Chapter 4.1: Plan to Return to Budget Balance

Table of Contents ![]() Previous

Previous

![]() Next

Next

Introduction

The Government is committed to return to balanced budgets in 2015.

Balanced budgets ensure low taxes, support the sustainability of the services and programs Canadians depend on, and inspire confidence in investors and consumers, which is critical to job creation and economic growth. Indeed, the commitment to achieve balanced budgets, and the significant progress made towards achieving this goal, has made Canada a recognized leader on the world economic stage for prudent fiscal management.

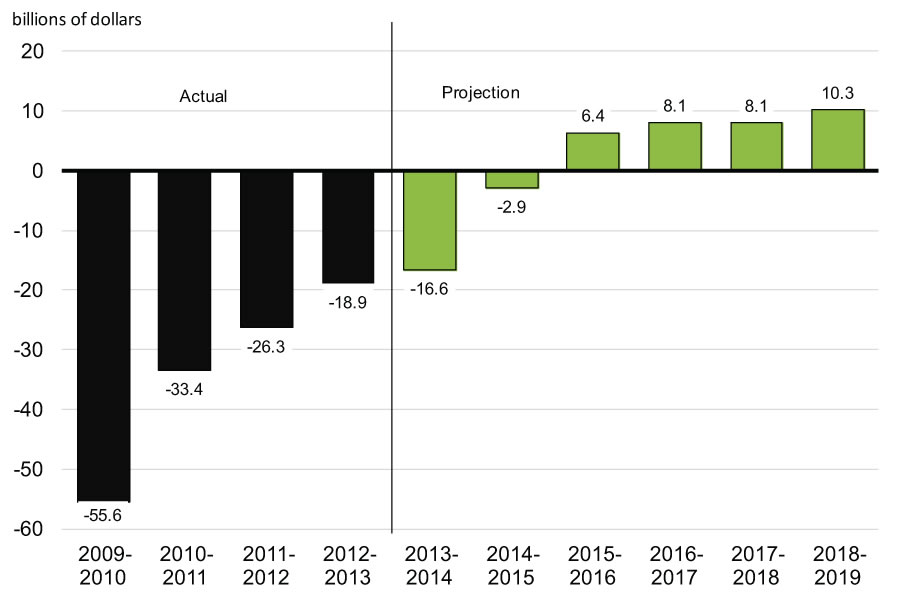

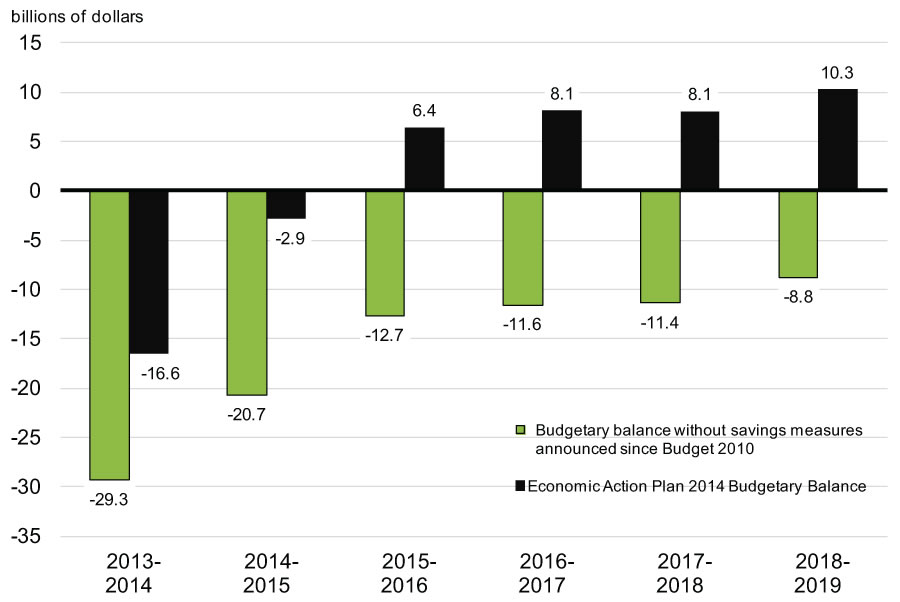

The Government is on track to return to balanced budgets in 2015. The deficit has been reduced by almost two-thirds since the height of the global economic and financial crisis, from $55.6 billion in 2009–10 to $18.9 billion in 2012–13. Looking forward, including the measures announced in Economic Action Plan 2014, the deficit is projected to fall to $2.9 billion by 2014–15. A surplus of $6.4 billion is projected for 2015–16, after taking into account the $3.0-billion annual adjustment for risk.

Paying off the deficit is a priority for small business owners. As they are unable to accumulate substantial deficits themselves, small business owners are very supportive of paying down debt.

—Canadian Federation of Independent Business

Fiscal policy must also focus on reducing government debt, as savings realized from lower interest payments would make room for budget initiatives that can improve Canadians’ standard of living and quality of life.

—Canadian Chamber of Commerce

Responsible fiscal management is central to the Government’s approach to the economy. For example, the Government paid down over $37 billion in debt before the Great Recession, contributing significantly to the low net debt position that allowed Canada to navigate through the economic and financial storm that arrived from outside our borders.

The Government’s long-standing commitment to responsible fiscal management is founded on the recognition that a sound fiscal position is key to ensuring ongoing economic growth and job creation over the longer term. The Government’s plan to return to balanced budgets will secure Canada’s future prosperity, creating job opportunities for Canadians and raising our standard of living. It is for this reason that the Government has made returning to budget balance the cornerstone of its Economic Action Plan.

Balancing the budget and reducing debt will:

- Ensure taxpayer dollars are used to support important social

services—such as health care—rather than paying interest costs. - Preserve Canada’s low-tax plan and allow for further tax reductions, fostering growth and the creation of jobs for the benefit of all Canadians.

- Help to keep interest rates low, instilling confidence in consumers and investors, whose dollars spur economic growth and job creation.

- Strengthen the country’s ability to respond to longer-term challenges, such as population aging and unexpected global economic shocks.

- Signal that public services are sustainable over the long run and ensure fairness and equity for future generations by avoiding future tax increases or reductions in services.

Note: Totals may not add due to rounding.

Sources: Public Accounts of Canada; Department of Finance.

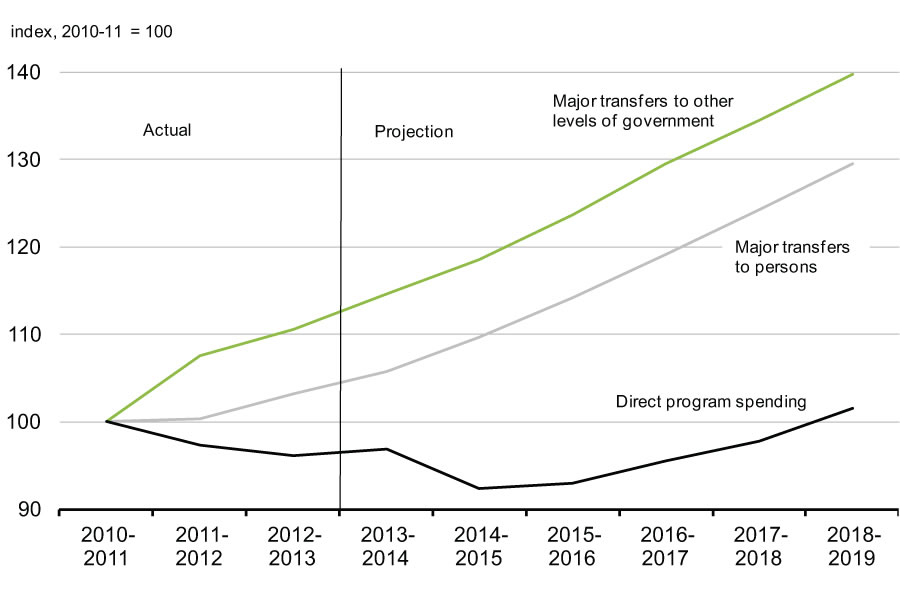

Careful management of direct program spending―specifically, government administration―reflects the Government’s fundamental belief that the private sector, not government, is the engine of growth and wealth creation.

In keeping with commitments made at the beginning of the economic recovery, the Government’s plan to return to balanced budgets has focused on controlling direct program spending by federal departments, rather than raising taxes that are harmful to job creation and economic growth. Indeed, strict fiscal discipline on the part of federal departments will allow the Government to return to balanced budgets, while maintaining the lowest federal tax burden on Canadians in half a century.

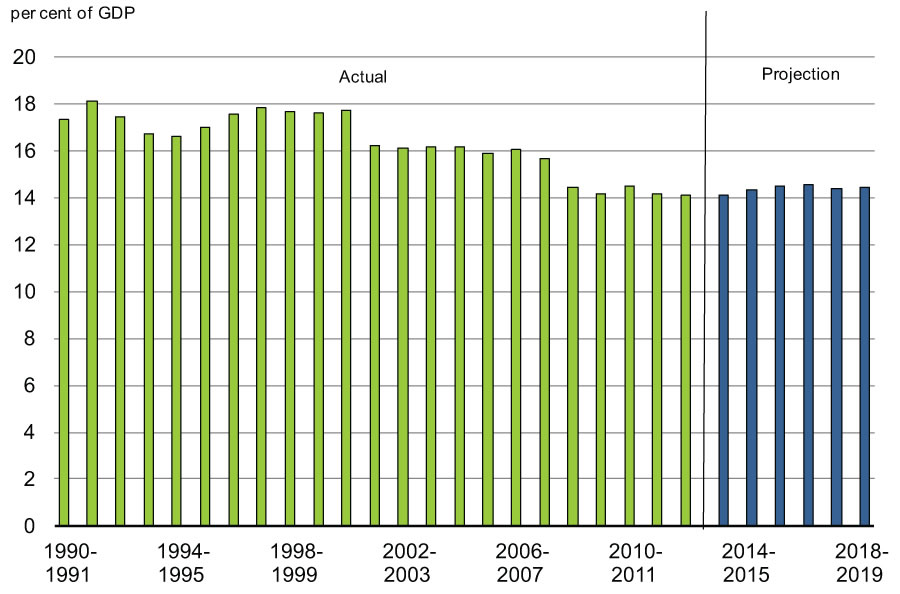

Sources: Public Accounts of Canada; Department of Finance.

The Government has acted to maximize efficiency and ensure Canadians’ hard-earned tax dollars are spent only when necessary. Taking into account all measures in Economic Action Plan 2014, direct program spending is projected to remain broadly in line with the 2010–11 level over the forecast horizon. In fact, direct program spending has declined for three consecutive years, a trend that has not been observed in decades. Indeed, in 2012–13 it was over $5 billion lower than in 2009–10.

In contrast, federal transfers to individuals that provide important income support, such as Old Age Security, and major transfers to other levels of government, including those for social programs and health care, will continue to grow over the forecast horizon.

The Government has controlled direct program spending through the implementation of both targeted savings actions and broad-based reviews focused on reducing spending without compromising the delivery of priority services to Canadians. Among others, initiatives include targeted departmental spending reductions, a government-wide operating budget freeze, and better alignment of federal employee compensation with that offered by other public and private sector employers.

Departmental spending reduction measures have been augmented by initiatives designed to protect and improve the integrity, fairness and neutrality of the tax system. Ensuring that everyone plays by the same rules, and pays their fair share, helps to keep taxes low for hard-working Canadians.

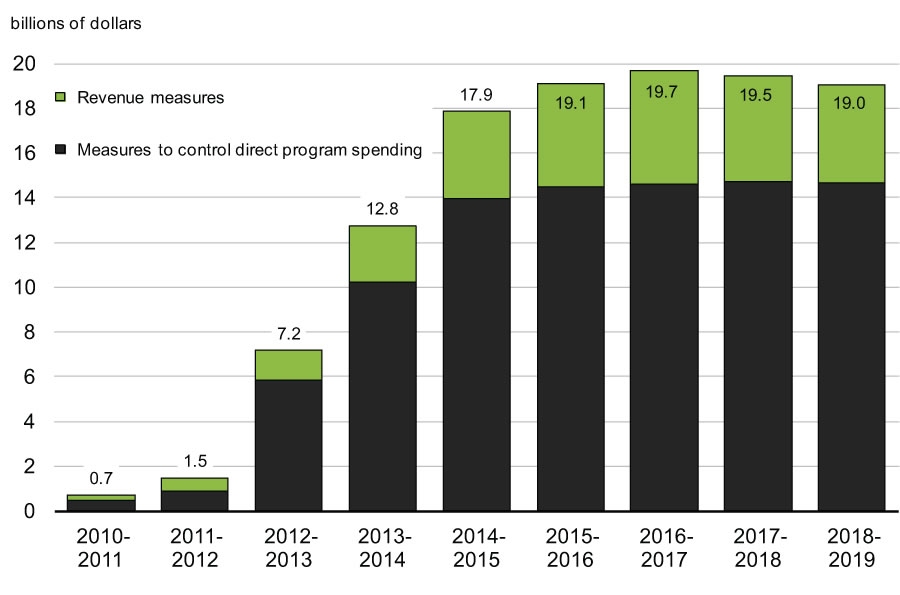

Chart 4.1.5 illustrates the total savings realized through measures that the Government has introduced since 2010, including those announced in Economic Action Plan 2014 (see also Table 4.1.2 at the end of this chapter). In total, annual savings are expected to rise to over $19 billion by 2015–16, with over three-quarters of this amount resulting from actions taken to control departmental spending.

The Government’s actions since Budget 2010 have constrained growth in discretionary spending and have allowed the Government to be on track to balance the budget by 2015 (Chart 4.1.6).

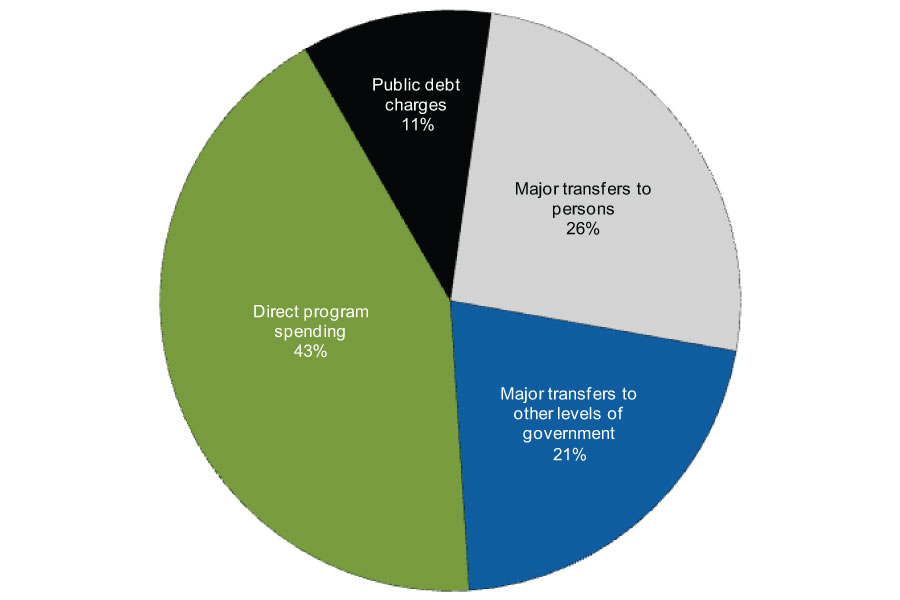

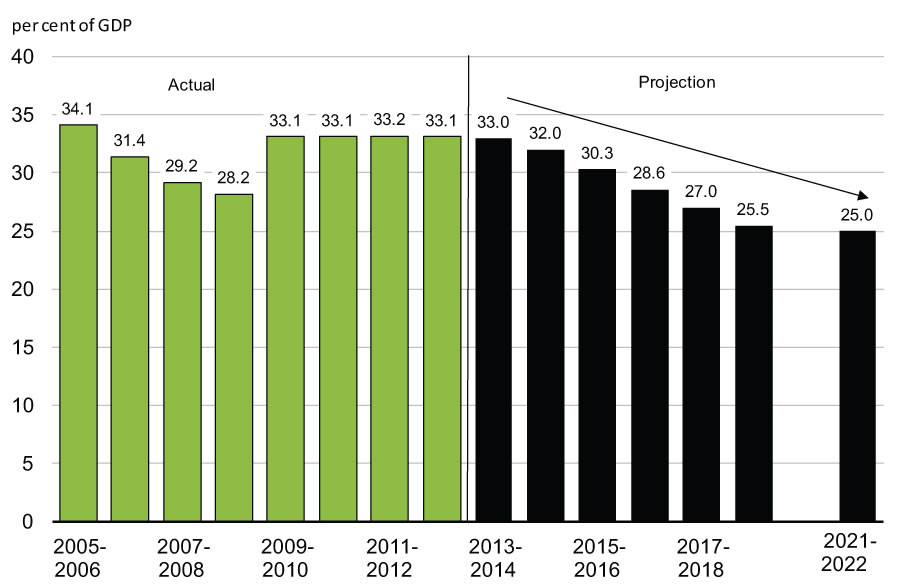

This responsible use of taxpayers’ money will help ensure that the federal debt-to-GDP (gross domestic product) ratio remains on a downward path. At the Group of Twenty (G-20) Leaders’ Summit in St. Petersburg, Russia, last September, Prime Minister Stephen Harper announced Canada’s commitment to achieve a federal debt-to-GDP ratio of 25 per cent by 2021. In the 2013 Speech from the Throne, the Government committed to reduce the debt-to-GDP ratio to pre-recession levels by 2017. Lower debt levels mean lower debt-servicing costs, which currently absorb 11 cents of every revenue dollar the Government collects, and will result in lower taxes for Canadians as well as a strong investment climate that supports job creation and economic growth.

The return to balanced budgets in 2015 will contribute to reducing Canada’s federal debt-to-GDP ratio to below its low, pre-recession level by 2017, putting the Government well on its way towards achieving its target of 25 per cent of GDP by 2021.

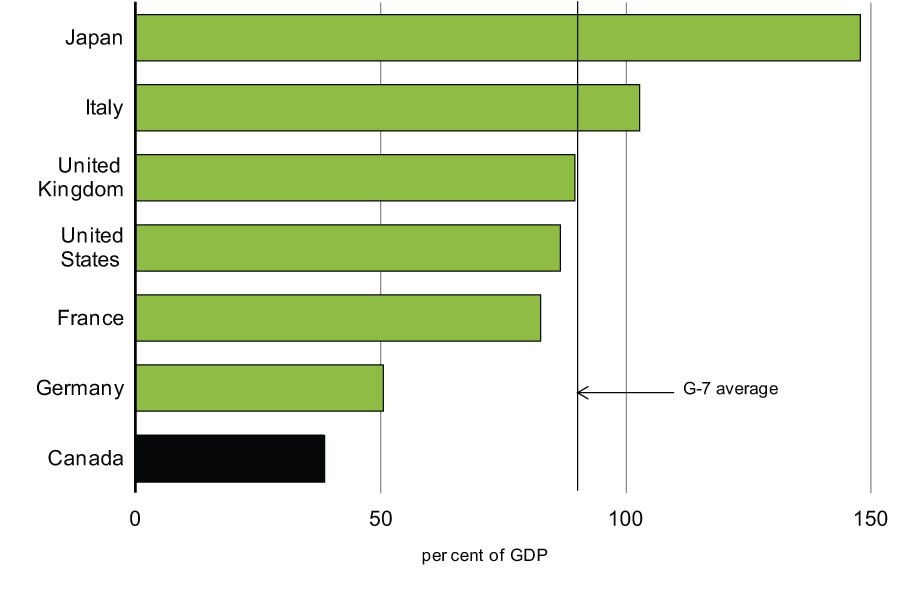

The planned reduction in federal debt will help to ensure that Canada’s total government net debt-to-GDP ratio (which includes that of the federal, provincial/territorial and local governments as well as the net assets of the Canada Pension Plan and the Québec Pension Plan) will remain the lowest, by far, of any G-7 country and among the lowest of the advanced G-20 countries.

The Government’s record on fiscal management has made Canada a recognized leader on the international economic stage.

Canada is now one of only a handful of countries in the world, alongside Australia, Denmark, Finland, Sweden, Norway, Switzerland and Singapore, that continues to receive a triple-A credit rating, with a stable outlook, from all the major credit rating agencies.

Note: Total government net debt-to-GDP ratio is the ratio of total liabilities net of financial assets of the central, state and local levels of government, as well as those in social security funds, to GDP. For Canada, total government includes the federal, provincial/territorial and local government sectors, as well as the Canada Pension Plan and the Québec Pension Plan. For international comparability, adjustments are made to unfunded public pension liabilities.

Source: International Monetary Fund, Fiscal Monitor, October 2013.

Plan for Returning to Balanced Budgets: Making Government More Efficient

Economic Action Plan 2014 reinforces the Government’s commitment to control the size and cost of government operations. As outlined in the November 2013 Update of Economic and Fiscal Projections, the Government has reintroduced a freeze on departmental operating budgets. This freeze will apply for two years beginning in 2014–15. Under this measure, departments and certain appropriation-dependent Crown corporations will place increased focus on improving the efficiency of their internal operations and administration. The operating budget freeze is expected to generate savings of roughly $550 million in 2014–15 and $1.1 billion in 2015–16.

The Government continues to seek out common-sense efficiencies to ensure value for taxpayer dollars. The newly established Treasury Board Sub-Committee on Government Administration (TBGA) will build on the success of previous transformational initiatives advanced since Budget 2010.

These initiatives have been designed to contain costs and increase efficiencies by re-engineering government processes and eliminating wasteful spending in order to save taxpayer money. The TBGA will consider new ways to exploit the potential for achieving operational efficiencies and enhance the delivery of programs and services to Canadians. Areas of focus will include:

- Streamlining departmental information technology applications.

- Simplifying processes and reducing administrative costs of the Government’s procurement system, while reducing administrative burden on suppliers.

- Modernizing federal office space management.

- Rationalizing the Government’s vehicle fleet.

In addition, the President of the Treasury Board will work to eliminate wasteful spending on late fees and interest charges for delinquent payments to suppliers, on which approximately $5 million was spent in 2012–13.

The Government remains committed to ensuring that it is delivering the programs and services that Canadians want and need efficiently and effectively. For example, the Government proposes to take steps to ensure that the Office of the Chief Actuary can efficiently and effectively deliver its services to key clients, which include government departments, agencies and Crown corporations. The Office of the Chief Actuary provides vital and independent actuarial advice with respect to the Canada Pension Plan, public sector pension arrangements, and other social programs for which the Canadian taxpayer is a stakeholder.

The Government will continue to examine ways to streamline its operations by ensuring that programs and services are delivered by those best positioned to do so. The Government will introduce legislation as needed to eliminate redundant organizations and consolidate operations, such as support and administrative services.

Managing Compensation Costs

The Government is committed to ensuring that overall public service employee compensation is reasonable and affordable, as well as aligned with that offered by other public and private employers.

Recognizing that personnel costs represent one of the largest operating expenditures for the Government of Canada, the Government will continue to work with public sector bargaining agents in upcoming negotiations to ensure that the public service is affordable, modern and high-performing. The Government will also propose minor legislative amendments to clarify recent changes to the labour relations regime.

The Government remains committed to ensuring that overall employee compensation is reasonable and affordable, as well as aligned with that offered by other public and private sector employers. As part of this commitment, the Government has already announced changes to employee pensions and is eliminating severance benefits available to employees upon voluntary departure.

2014 marks the beginning of a new round of collective bargaining between the Government of Canada and federal public service bargaining agents. The Government will work with these bargaining agents to renew all 27 of its collective agreements. The Government’s overarching goal in these negotiations is to reach agreements on total public service compensation that are fair and reasonable to employees and to taxpayers.

The Government of Canada’s specific policy priority in the 2014 round of negotiations is to implement a disability and sick leave management system that is modern, comprehensive, and responsive to the needs of all employees. Modernization of the Government’s disability and sick leave management system is long overdue:

- The Government is among the remaining few large employers that does not offer formal short-term disability coverage to its employees.

- 65 per cent of employees do not have enough accumulated sick days to cover the 13-week period before becoming eligible for long-term disability benefits.

- 25 per cent of employees have less than 10 days of banked sick leave.

- The Government lacks effective case management to support early return from illness, decreasing the overall productivity of the public service.

A modernized disability and sick leave management system, including the introduction of a formal short-term disability plan, will lead to a healthier and more productive federal workforce serving Canadians. The Government looks forward to working with bargaining agents to make it happen.

The Government will also take steps to ensure that the costs of the Public Service Health Care Plan (PSHCP) for retirees are shared fairly between them and the Government as employer.1 The Government intends to pursue changes that will make the Plan for retired federal employees more comparable with the plans of other large employers in the public and private sectors, and would ensure that the Plan is more affordable and sustainable in the future.

To this end, the Government intends to transition from currently paying 75 per cent of benefit costs to equal cost sharing for retired federal employees under the PSHCP, and increase from two to six the number of years of service required to be eligible to participate in the Plan in retirement, except for current pensioners. The Government also intends to ensure that current low-income pensioners are not adversely affected by the change in contributions. There will be no change to the health care contributions of public servants while they are employees.

It is estimated that phasing in equal cost sharing for retired employees and increasing the minimum years of service required to be eligible for the PSHCP to six years would result in fiscal savings of roughly $7.4 billion over six years under accrual accounting. Public sector accounting standards require that the liability for future pensioner health care expenses be revalued if a change is made to the cost-sharing arrangement. As such, significant fiscal savings would be recognized over the medium term from reducing the recorded pensioner health care liability. However, the annual dollar impact for current retirees would be modest. For a government employee opting for individual coverage in his/her retirement, a move to equal cost sharing would increase his/her annual payments to the Plan from $261 to roughly $550. This increase, when fully implemented, would represent less than 1 per cent of a gross federal public service pension of $30,000.

The expenditure outlook incorporates the estimated impact of these proposed changes and may need to be revised depending on the nature of final Plan changes.

The Government is continuing to engage with bargaining agents and key stakeholders towards a timely resolution on these proposals and is prepared to consider reasonable Plan improvements provided they are fair to taxpayers.

There is no case for taxpayers to cover 75 percent of the cost of the Public Service Health Care Plan, especially when such benefits are rare and becoming rarer in the private sector.

—C.D. Howe Institute

Alignment of Crown Corporations’ Pension Plans With the Public Service Pension Plan

The Government is working with Crown corporations to implement 50:50 employer-employee pension plan cost sharing and to increase the retirement age for new hires.

In Economic Action Plan 2012, the Government indicated that it would work with Crown corporations to ensure that their pension plans are broadly aligned with those available to other federal employees. Economic Action Plan 2013 reaffirmed this commitment. Broad alignment requires Crown corporations to move to a 50:50 cost-sharing ratio between the employer and employees by 2017. Furthermore, it requires raising the retirement age for new hires to 65 years as well as raising the age at which other retirement benefits are available to correspond with the age at which they are available under the Public Service Pension Plan. These reforms are expected to be implemented by all Crown corporations subject to the Pension Benefits Standards Act, 1985 by 2017.

These changes will ensure that there are consistent retirement standards across Crown corporations and the rest of the public service.

Integrity of Parliamentary Operations

The Government will introduce legislation to prohibit Members of the Senate and the House of Commons from accruing pensionable service as a result of having been suspended from Parliament through a majority vote by their peers.

Canadians expect that all Parliamentarians will be held to the highest standards of accountability and that the integrity of our public office and institutions will be protected. The actions of Parliamentarians should be based on integrity, trust and respect for taxpayers’ dollars. Accordingly, the Government will introduce legislation to prohibit Members of the Senate and the House of Commons from accruing pensionable service as a result of having been suspended from Parliament through a majority vote by their peers.

Responsible Management of National Defence Capital Funding

The Government is moving $3.1 billion in National Defence funding for major capital procurements to future years in which key purchases will be made.

The Government has made major investments in the Canadian Armed Forces since 2006, including the purchase of vital new equipment such as the strategic lift C-17 aircraft and Chinook helicopters. In addition, new ships for the Royal Canadian Navy and Canadian Coast Guard will be built at Canadian shipyards through the National Shipbuilding Procurement Strategy. To ensure that funding is available when needed for planned procurements, the Government is moving $3.1 billion in National Defence funding for major capital procurements from the 2013-14 to 2016-17 period to future years in which key purchases will be made.

Delivering Value to Taxpayers From Government Assets

Economic Action Plan 2014 maintains the Government’s ongoing commitment to review its corporate assets to ensure value for taxpayers.

Economic Action Plan 2014 maintains the Government’s commitment to maximizing the return generated by federal government assets. Through its review of federal corporate assets, the Government has identified certain assets that have the potential to generate more wealth and jobs for Canadians if they were owned by the private sector. The sale of these assets is anticipated to generate significant returns for Canadian taxpayers.

- The Government is continuing its preparations for the divestitures of Ridley Terminals Inc. and portions of the Dominion Coal Blocks. Any sales will be conducted in a manner that maximizes benefits for taxpayers and in consultation with appropriate key stakeholders, including First Nations.

- The Government plans to exit from its holdings in General Motors in an expeditious manner, while maximizing value for Canadian taxpayers.

Economic Action Plan 2014 continues to include a potential gain from the sale of assets in the forecast for other revenues of $500 million in 2014–15 and $1.5 billion in 2015–16. These amounts are conservative and do not reflect the full potential return from these sales.

Also resulting from the review of its corporate assets, Economic Action Plan 2014 proposes changes to the Royal Canadian Mint’s legislated mandate and governance to align its activities with the Government’s objective of ensuring a cost-effective supply of coins for Canadians.

Improving the Fairness and Integrity of the Tax System, and Strengthening Tax Compliance

Economic Action Plan 2014 announces a number of measures to address international aggressive tax avoidance, improve tax integrity and strengthen tax compliance, and enhance the fairness of the tax system.

Economic Action Plan 2014 proposes a number of measures that reflect the Government’s ongoing commitment to improving the fairness and integrity of the tax system and ensuring that everyone pays their fair share. These include a package of actions to address international aggressive tax avoidance by multinational enterprises. A well-functioning tax system is essential to keep Canada positioned as an attractive place to work, invest and do business. Efforts to ensure the integrity of the tax system also benefit provincial governments by protecting provincial revenues on our shared tax bases.

Since 2006, and including measures proposed in Economic Action Plan 2014, the Government has introduced over 85 measures to improve the integrity of the tax system.

Addressing International Aggressive Tax Avoidance by Multinational Enterprises

Canada’s tax rules must constantly be reviewed to ensure that they maintain an appropriate balance between the objectives of competitiveness, simplicity, fairness, efficiency and protection of the tax base.

In support of Canada’s low-tax plan, the Government has taken action in recent years to combat international tax evasion and aggressive tax avoidance. By protecting the tax base, these measures help to keep Canadian tax rates low and competitive, thereby improving incentives to work, save and invest in Canada.

Other countries share Canada’s recognition of the importance of an effective international tax system. In February 2013, the Organisation for Economic Co-operation and Development (OECD) launched a project on base erosion and profit shifting (BEPS). The project aims to address international tax planning strategies used by multinational enterprises to inappropriately minimize their taxes, for example, by shifting taxable profits away from the jurisdictions where the economic activity has taken place. The Leaders of the G-8 and the G-20 have endorsed the project. Work is underway to develop recommendations responding to the concerns raised in the Action Plan on BEPS, which the OECD released in July 2013.

These multilateral efforts are consistent with the Government’s ongoing commitment to protect the Canadian revenue base and ensure tax fairness. The Government has acted to protect the integrity of Canada’s international tax system in previous budgets. For example, Economic Action Plan 2012 introduced a measure to curtail foreign affiliate dumping transactions, and the thin capitalization rules were tightened and their application extended in Economic Action Plan 2012 and Economic Action Plan 2013.

Economic Action Plan 2014 proposes to continue efforts to address international aggressive tax avoidance by:

- Ensuring that financial institutions do not avoid paying Canadian tax on income associated with the insurance of Canadian risks through the use of derivative “insurance swap” arrangements between foreign affiliates of Canadian taxpayers and third parties.

- Ensuring that the offshore regulated bank provisions are not inappropriately used to circumvent the foreign accrual property income rules through foreign affiliates that are not part of a Canadian financial institution group.

- Ensuring that non-residents cannot avoid Canadian withholding tax or thin capitalization rules by entering into back-to-back loan arrangements with third-party financial intermediaries to effectively make indirect loans to their Canadian subsidiaries.

- Inviting comments from stakeholders on a proposed rule to prevent treaty shopping.

- Inviting input from the public on issues related to international tax planning by multinational enterprises and other cross-border tax integrity issues, such as ensuring the effective collection of sales tax on e-commerce sales to Canadians by foreign-based vendors.

Economic Action Plan 2013 introduced measures to strengthen the capacity of the Canada Revenue Agency (CRA) to combat international tax evasion and aggressive tax avoidance. The status of each measure is set out below:

- Legislation to streamline the process for the CRA to obtain information concerning unnamed persons from third parties, such as banks, was included in the Economic Action Plan 2013 Act, No. 1, which received Royal Assent on June 26, 2013.

- The CRA released a revised Foreign Income Verification Statement (Form T1135). The revised Form T1135 requires taxpayers to provide more detailed information, including the names of specific foreign institutions and countries where offshore assets are located and the foreign income earned on those assets. The CRA is also in the process of developing a system that will allow Form T1135 to be filed electronically.

- Legislation to extend the normal reassessment period by three years, for taxpayers who have failed to report income from a specified foreign property on their annual income tax return and who have failed to properly file Form T1135, was included in the Economic Action Plan 2013 Act, No. 2, which received Royal Assent on December 12, 2013.

- On January 15, 2014, the CRA announced the launch of the Offshore Tax Informant Program.

- Draft legislative proposals to implement the requirement for certain financial intermediaries, including banks, to report international electronic funds transfers of $10,000 or more to the CRA, beginning in 2015, were released for public comment on January 9, 2014.

Other Tax Actions to Improve Tax Integrity, Strengthen Compliance and Enhance Fairness

In addition to the international aggressive tax avoidance package outlined above, the Government is taking steps in Economic Action Plan 2014 to improve the integrity of the tax system and strengthen tax compliance by:

- Extending the tax on split income to income from a business or rental property that is paid or allocated to a minor child from certain partnerships and trusts.

- Deeming the value of a gift of certified cultural property to be no greater than the donor’s cost of the property, if it was acquired under a gifting arrangement that is a tax shelter.

- Ensuring the filing of accurate excise tax returns through the addition of a new administrative monetary penalty and an amended offence, for the making of false statements or omissions in excise tax returns, consistent with similar provisions in other tax statutes.

- Giving the Minister of National Revenue the discretionary authority to register and assign a Goods and Services Tax/Harmonized Sales Tax registration number where a person fails to comply with the requirement to register.

- Providing the Minister of National Revenue with more authority to prevent the potential abuse of registered charities by state supporters of terrorism.

- Announcing a public consultation on the income tax framework for non-profit organizations (NPOs) to ensure that the tax exemption for NPOs is appropriately targeted and not subject to abuse by organizations that claim the exemption but are not operating in the manner intended, and to ensure that reporting requirements for legitimate NPOs provide the public and the Canada Revenue Agency with sufficient information to evaluate their activities.

Measures in Economic Action Plan 2014 to improve the fairness of the tax system include:

- Eliminating the tax benefits that arise from taxing certain trusts and estates at graduated rates.

- Eliminating an exemption from the non-resident trust rules that benefits a small number of individuals during their first five years of Canadian residence.

In total, measures in Economic Action Plan 2014 to address international aggressive tax avoidance, improve tax integrity and strengthen tax compliance, and enhance the fairness of the tax system will provide savings of $44 million in 2014–15, rising to $454 million in 2018–19, for a total of $1.8 billion over 2013–14 and the following five years.

| 2013– 2014 |

2014– 2015 |

2015– 2016 |

2016– 2017 |

2017– 2018 |

2018– 2019 |

6-Year Total |

|

|---|---|---|---|---|---|---|---|

| Managing Compensation Costs | -1,109 | -1,537 | -1,390 | -1,221 | -1,113 | -1,005 | -7,375 |

| Improving the Fairness and Integrity of the Tax System, and Strengthening Tax Compliance |

-10 | -44 | -389 | -439 | -429 | -454 | -1,765 |

| Total savings measures | -1,119 | -1,581 | -1,779 | -1,660 | -1,542 | -1,459 | -9,140 |

| Responsible Management of National Defence Capital Funding | -592 | -575 | -900 | -1,075 | -3,142 | ||

| Total | -1,711 | -2,156 | -2,679 | -2,735 | -1,542 | -1,459 | -12,282 |

| Note: Totals may not add due to rounding. | |||||||

| Projection | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2010– 2011 |

2011– 2012 |

2012– 2013 |

2013– 2014 |

2014– 2015 |

2015– 2016 |

2016– 2017 |

2017– 2018 |

2018– 2019 |

Total | |

| Budget 2010 | ||||||||||

| Spending restraint | 452 | 1,586 | 3,481 | 4,425 | 5,130 | 5,130 | 5,130 | 5,130 | 5,130 | 35,594 |

| Closing tax loopholes | 260 | 350 | 420 | 455 | 475 | 505 | 515 | 530 | 535 | 4,045 |

| Total for Budget 2010 | 712 | 1,936 | 3,901 | 4,880 | 5,605 | 5,635 | 5,645 | 5,660 | 5,665 | 39,639 |

| Budget 2011 | ||||||||||

| Spending restraint | 194 | 271 | 569 | 525 | 534 | 534 | 534 | 534 | 3,695 | |

| Closing tax loopholes | 255 | 770 | 1,345 | 1,490 | 1,430 | 1,565 | 930 | 350 | 8,135 | |

| Total for Budget 2011 | 449 | 1,041 | 1,914 | 2,015 | 1,964 | 2,099 | 1,464 | 884 | 11,830 | |

| Economic Action Plan 2012 | ||||||||||

| Spending restraint | -900 | 1,762 | 3,481 | 5,332 | 5,175 | 5,219 | 5,222 | 5,222 | 30,512 | |

| Closing tax loopholes | 100 | 276 | 376 | 436 | 541 | 651 | 751 | 3,131 | ||

| Total for Economic Action Plan 2012 | -900 | 1,862 | 3,757 | 5,708 | 5,611 | 5,760 | 5,873 | 5,973 | 33,643 | |

| 2012 Update of Economic and Fiscal Projections | 341 | 572 | 791 | 999 | 1,231 | 1,436 | 1,436 | 6,806 | ||

| Economic Action Plan 2013 | ||||||||||

| Spending restraint | 68 | 114 | 145 | 145 | 145 | 145 | 762 | |||

| Revenue measures | 32 | 451 | 1,494 | 1,889 | 2,035 | 2,195 | 2,290 | 10,386 | ||

| Total for Economic Action Plan 2013 |

32 | 519 | 1,609 | 2,034 | 2,180 | 2,340 | 2,435 | 11,148 | ||

| 2013 Update of Economic and Fiscal Projections | 550 | 1,100 | 1,130 | 1,160 | 1,190 | 5,130 | ||||

| Subtotal: Savings announced prior to Economic Action Plan 2014 | 712 | 1,485 | 7,177 | 11,642 | 16,277 | 17,343 | 18,045 | 17,932 | 17,582 | 108,196 |

| Economic Action Plan 2014 | ||||||||||

| Managing Compensation Costs | 1,109 | 1,537 | 1,390 | 1,221 | 1,113 | 1,005 | 7,375 | |||

| Improving the Fairness and Integrity of the Tax System, and Strengthening Tax Compliance | 10 | 44 | 389 | 439 | 429 | 454 | 1,765 | |||

| Total for Economic Action Plan 2014 |

1,119 | 1,581 | 1,779 | 1,660 | 1,542 | 1,459 | 9,140 | |||

| Grand total | 712 | 1,485 | 7,177 | 12,761 | 17,858 | 19,122 | 19,705 | 19,474 | 19,041 | 117,336 |

| Of which: | ||||||||||

| Total spending restraint | 452 | 880 | 5,855 | 10,224 | 13,979 | 14,473 | 14,610 | 14,739 | 14,661 | 89,874 |

| Total revenue measures1 | 260 | 605 | 1,322 | 2,537 | 3,879 | 4,649 | 5,095 | 4,735 | 4,380 | 27,462 |

| % of GDP | 0.0% | 0.1% | 0.4% | 0.7% | 0.9% | 0.9% | 0.9% | 0.9% | 0.8% | |

| Note: Totals may not add due to rounding. 1 Includes measures to improve the fairness and neutrality of the tax and tariff systems as well as the Canada Revenue Agency’s compliance programs. |

||||||||||

1 The PSHCP provides supplemental health coverage for plan members beyond that provided under provincial and territorial health insurance plans. Participation in the plan is voluntary for pensioners.