Chapter 3.1: Connecting Canadians With Available Jobs

Table of Contents ![]() Previous

Previous

![]() Next

Next

Highlights

Ensuring Training Reflects Labour Market Needs

- Aligning training with labour market needs through the Canada Job Grant.

- Introducing a new generation of Labour Market Agreements for Persons with Disabilities to better meet the needs of persons with disabilities and employers.

- $15 million over three years to connect persons with developmental disabilities with jobs through the Ready, Willing & Able initiative of the Canadian Association for Community Living.

- $11.4 million over four years to support the expansion of vocational training programs for persons with Autism Spectrum Disorders.

Training the Workforce of Tomorrow

- Creating the Canada Apprentice Loan by expanding the Canada Student Loans Program to help apprentices registered in Red Seal trades with the cost of training.

- Providing an additional $40 million to the Canada Accelerator and Incubator Program to help entrepreneurs create new companies and realize the potential of their ideas through intensive mentoring and other resources to develop their business.

- Introducing the Flexibility and Innovation in Apprenticeship Technical Training pilot project to expand the use of innovative approaches for apprentice technical training.

- Focusing federal investments in youth employment to provide real-life work experience in high-demand fields.

- Eliminating the value of student-owned vehicles from the Canada Student Loans Program assessment process to better reflect the needs of students who commute or work while studying.

- Investing to reform the on-reserve education system, in partnership with First Nations, through the First Nations Control of First Nations Education Act.

- Renewing the Computers for Schools Program to provide students and interns with access to information and communications technology equipment and skills training.

Strengthening Canada’s Labour Market

- Investing $75 million over three years to assist unemployed older workers by renewing and expanding the Targeted Initiative for Older Workers program.

- Investing $11.8 million over two years and $3.3 million per year ongoing to launch an enhanced Job Matching Service to help connect Canadians with available jobs.

- Investing $11.0 million over two years and $3.5 million per year ongoing to reform the Temporary Foreign Worker Program to ensure that Canadians are given the first chance at available jobs.

- Investing $14.0 million over two years and $4.7 million per year ongoing towards the successful implementation of an Expression of Interest economic immigration system to support Canada’s labour market needs.

Introduction

Canada has had a remarkable job creation record in recent years. The fundamental strength of the Canadian labour market has been particularly evident after the global recession. Despite the weak global economic environment, the Canadian economy has experienced one of the best performances among the Group of Seven (G-7) economies in terms of output growth and job creation, with over 1 million net new jobs created since the recovery began in July 2009. Moreover, high-wage, full-time, private-sector employment has been the main source of job creation over the recovery.

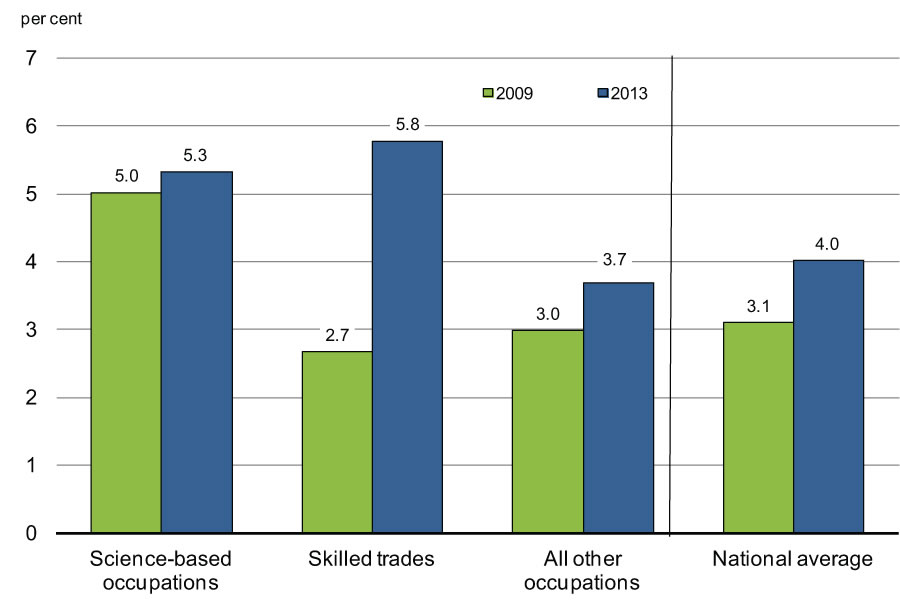

However, challenges remain, as highlighted in the accompanying Jobs Report: The State of the Canadian Labour Market. Too many Canadians are still out of work or underutilized at a time when skills and labour shortages are re-emerging in certain sectors and regions. Despite significant labour mobility in Canada, imbalances between unemployment and job vacancies persist in certain regions and occupation groups and Canadian firms are having more difficulty in hiring than the unemployment situation would normally warrant. Canada’s unemployment rate was 7 per cent in January 2014, about 1 percentage point above its pre-recession level, whereas the job vacancy rate (the share of jobs available that are unfilled) reached 4.2 per cent in January 2014, a level similar to its pre-recession level (Chart 3.1.1).

Sources: Number of online job postings: WANTED Analytics. Employment: Statistics Canada (Labour Force Survey); Department of Finance calculations.

Indeed, employers continue to identify the shortage of skilled labour as an impediment to growth.

- The Canadian Chamber of Commerce lists skills shortages as the number one barrier to Canada’s competitiveness.

- A third of senior Canadian executives surveyed by Workopolis reported that a shortage of skilled workers is the greatest challenge facing Canadian businesses, on par with concerns about the general state of the economy.

- The Canadian Federation of Independent Business reports that about a third of businesses surveyed reported having experienced skills shortages limiting their expansion, a rate that is double that seen in early 2010.

- The Canadian Manufacturing Coalition states that nearly one half of companies surveyed face “immediate labour and/or skills shortages.”

- ManpowerGroup Canada says that labour shortages are at a six-year high in Canada, with vacancies in the skilled trades among the most difficult to fill.

- Hays Specialist Recruitment Canada indicates that the shortage of skilled workers is increasing in Canada.

- The Canadian Restaurant and Foodservices Association states that 36 per cent of restaurants in Canada report that a shortage of skilled labour is having a negative effect on their business.

- The Canadian Association of Petroleum Producers reports that “member companies are facing new and emerging challenges resulting from the growing shortage of skilled workers.”

- The Information Technology Association of Canada and the Information and Communications Technology Council state that “the skills shortage in the ICT sector is a reality today” and note that, by 2016, some 106,000 ICT workers will be needed.

- Engineers Canada projects that Canada will face a skills shortage of professional engineers because the workforce cannot be replaced fast enough.

- The Forest Products Association of Canada states that the forest products industry has set a goal to recruit at least 60,000 workers by the end of the decade, which it believes will be “an ongoing challenge for the sector at all skill levels.”

In addition, a number of groups are not being used to their full potential in the labour market, including less-skilled individuals, recent immigrants, Aboriginal peoples, persons with disabilities and older Canadians.

In response, the Government has put in place concrete measures to directly support the development of a skilled, mobile and productive workforce. Economic Action Plan 2014 proposes further steps in this direction.

Ensuring Training Reflects Labour Market Needs

The Government invests over $13.5 billion each year in skills training. Despite this significant investment, the national job vacancy rate indicates misalignment between the skills of the unemployed and those required by employers.

In 2013–14, the Government transferred $2.7 billion to support labour market programming through:

- $1.95 billion to provinces and territories through Labour Market Development Agreements.

- $500 million to provinces and territories through Labour Market Agreements, introduced in Budget 2007.

- $218 million to provinces through Labour Market Agreements for Persons with Disabilities.

Over $10 billion annually is invested by the Government in support of post-secondary education, which includes providing students with financial assistance such as Canada Student Loans and Canada Student Grants, and specific programming targeted to First Nations and Inuit students.

Since 2006, the Government has provided support for skills training for:

- Youth through the Youth Employment Strategy, with investments of over $330 million per year.

- Persons with disabilities through the Opportunities Fund, with annual investments of about $40 million per year.

- Aboriginal peoples through annual investments of $438 million, including:

- $12 million over two years to support post-secondary education of Aboriginal students through Indspire and the Purdy Crawford Chair in Aboriginal Business Studies.

- $241 million over five years announced in Economic Action Plan 2013 to help ensure young, on-reserve First Nations Income Assistance recipients who can work have the incentives and training necessary to gain employment.

- $210 million over five years through the Skills and Partnership Fund, announced in 2010, to provide Aboriginal peoples with project-specific training that responds to the demands of the Canadian labour market.

- $350 million per year provided through the Aboriginal Skills and Employment Training Strategy to Aboriginal organizations to provide training and employment services to Aboriginal peoples.

The Government has also taken actions to support the labour market participation of older Canadians who wish to remain in the workforce:

- Budget 2011 extended the Targeted Initiative for Older Workers, a federal-provincial-territorial employment program providing employment assistance and offering activities to improve the employability of unemployed workers aged 55 to 64.

- Economic Action Plan 2012 provided $6 million over three years to extend and expand the ThirdQuarter project, an initiative that has helped approximately 1,200 experienced workers who are over 50 find a job that matches their skills.

Economic Action Plan 2013 announced that the Government would transform skills training in Canada, ensuring that federal funding responds to the hiring needs of employers. Most notably, Economic Action Plan 2013 announced the introduction of the Canada Job Grant, which will ensure that employers participate meaningfully as partners in the skills training system, sharing the associated costs.

Labour Market Agreements and the Canada Job Grant

The new Canada Job Grant will be launched to better align training with labour market needs.

The Canada Job Grant will encourage greater employer participation in skills training decisions and ensure that training is better aligned with job opportunities, particularly in sectors facing skills mismatches and labour shortages.

The Government has consulted broadly with employers and employer associations, educational institutions and labour organizations on the design of the Canada Job Grant. It has heard that employers welcome an increased role in training decisions and want the Government to support skills training in a way that is simple for businesses to access, with minimal red tape. Employers are also seeking skills training support that is responsive to diverse business needs, with special consideration given to the needs of small businesses.

The design of the Canada Job Grant reflects the outcomes of these consultations. The Grant will require matching from employers, but in recognition of the particular challenges they face, small businesses will benefit from greater flexibility in their cost-matching arrangements.

The Canada Job Grant Will Be Launched in 2014

Who is eligible?

Businesses with a plan to train unemployed and underemployed Canadians for a new or a better job will be eligible to apply for a Canada Job Grant. All Canadians seeking training can, in partnership with an employer, benefit from the Canada Job Grant.

How much funding is available?

The Canada Job Grant could provide up to $15,000 per person for training costs, including tuition and training materials, which includes up to $10,000 in federal contributions. Employers would be required to contribute on average one-third of the total costs of training. Small businesses will benefit from flexible arrangements under the Canada Job Grant, such as the potential to count wages as part of the employer contribution.

Where can the Canada Job Grant be used?

The Grant will be for short-duration training provided by an eligible third-party trainer, such as community colleges, career colleges, trade union centres and private trainers. Training can be provided in a classroom, on site at a workplace or online.

The Government is continuing to work closely with provinces and territories toward the implementation of the Canada Job Grant and the renewal of the Labour Market Agreements. In jurisdictions where Agreements are not secured, the Government of Canada will deliver the Canada Job Grant starting April 1, 2014 directly through Service Canada, engaging employer networks through the Regional Development Agencies, so that employers and Canadians in all jurisdictions have the opportunity to benefit from the Grant.

As announced in Economic Action Plan 2013, the Government will also renegotiate the $1.95-billion-per-year Labour Market Development Agreements to reorient training toward labour market demand.

Labour Market Agreements for Persons With Disabilities

As announced in Economic Action Plan 2013, the Government will provide $222 million annually, matched by the provinces and territories, over the next four years, through a new generation of Labour Market Agreements for Persons with Disabilities.

Economic Action Plan 2013 announced that the Government would introduce a new generation of Labour Market Agreements for Persons with Disabilities to ensure federal funding supports programming that better helps Canadians with disabilities to obtain the skills they need to fill available jobs.

In its January 2013 report, the Panel on Labour Market Opportunities for Persons with Disabilities highlighted that there are approximately 800,000 working-age Canadians with a disability who are not working even though their disability does not prevent them from doing so.

Released in January 2013, Rethinking DisAbility in the Private Sector, the report of the Panel on Labour Market Opportunities for Persons with Disabilities, offered key findings to guide and support the actions of employers seeking to accommodate persons with disabilities in their workplace. The Panel heard from many businesses and found that:

- Many employers have recognized that hiring and accommodating persons with disabilities is good for business. Of note, in 57 per cent of cases, no workplace accommodation is required for people with disabilities. In the 37 per cent of cases reporting a one-time cost to accommodate an employee with a disability, the average amount spent is $500.

- Many employers show a genuine desire to hire persons with disabilities; however, education and training are required to overcome barriers, dispel myths and put theory into practice.

- The keys to success are leadership and effective community partnerships with organizations that fully understand the talent needs of business.

The Government recognizes the contributions that persons with disabilities can and do make to the economy, and that employment provides all individuals with a sense of dignity and independence. It also recognizes, as highlighted by the Panel, that there is a good business case for hiring persons with disabilities.

To ensure employment opportunities for persons with disabilities improve and the employment needs of Canadian businesses are better met, the new Agreements will engage employers and disability community organizations to help establish program priorities.

Overall, the needs of persons with disabilities will be better served by these new, collaborative Agreements through strengthened governance and accountability frameworks that focus on tangible employment outcomes and demand-driven programming. For example, eligible programming could include job coaching and employment counselling, workplace accommodations and work experiences such as youth internships.

Canadian Business SenseAbility

The Government is also supporting the creation of a Canadian Employers Disability Forum, announced in Economic Action Plan 2013. In order to help drive employment for persons with disabilities, the forum, established by Canadian business leaders under the name Canadian Business SenseAbility, will facilitate education, training and the sharing of resources and best practices among Canadian businesses. Over the last year, the Canadian Business SenseAbility has formed its Board of Directors, chaired by Kathy Martin, former Senior Vice President of Human Resources at Loblaw Companies, hired an Executive Director, and begun developing its strategic plan with the objective of increasing the labour market participation of Canadians with disabilities.

In addition, the Government is proposing to support two complementary initiatives—Ready, Willing & Able and CommunityWorks—that align with the findings and recommendations of the Panel on Labour Market Opportunities for Persons with Disabilities.

Ready, Willing & Able

Economic Action Plan 2014 proposes to connect persons with developmental disabilities with jobs by providing $15 million over three years to the Ready, Willing & Able initiative of the Canadian Association for Community Living.

The Government encourages the inclusion of all working-age Canadians in the labour force. Persons with intellectual disabilities and persons with Autism Spectrum Disorders face unique barriers to employment despite being willing to participate and capable of participating in a competitive labour market.

Economic Action Plan 2014 proposes to invest $15 million over three years to expand the Ready, Willing & Able initiative, through which the Canadian Association for Community Living engages employers to hire and support youth and working-age adults with developmental disabilities—including persons with intellectual disabilities and persons with Autism Spectrum Disorders. With the proposed Government support, the Association will expand existing activities to 20 community-based locations across Canada and host 40 employer forums, which will support up to 1,200 new jobs for persons with developmental disabilities.

The Ready, Willing & Able initiative is designed to increase labour force participation of people with developmental disabilities by identifying best practices and expanding these activities to communities across Canada. Ready, Willing & Able is working with employers to help them develop their capacity and confidence in hiring people with developmental disabilities as valuable employees.

The Canadian Association for Community Living and Community Living Ontario have recently formed a partnership with Costco Wholesale for the Ready, Willing & Able initiative. Community Living Ontario and local Associations for Community Living are working with individual Costco warehouse managers to determine how best to ensure that companies’ regular hiring includes persons with developmental disabilities.

Employment support services are being provided to candidates and Costco management and employees throughout the hiring process, including initial contacts, interviews, offers of employment, and transitions to new jobs at Costco. The pilot project is demonstrating success with the hiring of persons with developmental disabilities in 20 participating Costco stores.

I’m very happy about getting this job, and that I’m getting paid an equal wage—and a good one at that. I look forward to being part of a team and not being treated any differently—now I can tell my brother, my friends and my mom that I work at Costco!

—New Costco employee, Peterborough store

It is simply the right thing to do, something that we have always tried to do, and so we are very excited about being able to formalize this commitment to diversity and through this do an even better job of reaching out to this potential labour pool.

—David Skinner, Vice President of Operations,

Eastern Canada, Costco Wholesale

CommunityWorks—A Vocational Training Program for Individuals With Autism Spectrum Disorders

Economic Action Plan 2014 proposes to provide $11.4 million over four years to support the expansion of vocational training programs for persons with Autism Spectrum Disorders.

The Government recognizes the importance of supporting the economic and social inclusion of persons with disabilities. This can be achieved by capitalizing on the expertise and partnerships of community-based organizations to provide a full continuum of supports to individuals, their families and employers.

Economic Action Plan 2014 proposes to invest $11.4 million over four years to support the Sinneave Family Foundation and Autism Speaks Canada as they move to expand a network of vocational training programs in centres across Canada that will help to create employment opportunities for individuals with Autism Spectrum Disorders. The Sinneave Family Foundation estimates that once fully implemented, approximately 1,200 youth with Autism Spectrum Disorders will benefit each year.

In addition to measures proposed in Economic Action Plan 2014, the Government is taking action to improve the knowledge base around Autism Spectrum Disorders, while also raising awareness of this condition. For example:

- In 2012–13, the Canadian Institutes of Health Research’s Institute of Neurosciences, Mental Health and Addiction provided funding of nearly $105 million for approximately 1,062 research projects, including in the area of Autism Spectrum Disorders.

- In March 2012, the Government of Canada and its partners committed $1 million over five years to support a Chair in Autism Spectrum Disorders Treatment and Care Research Program.

- Budget 2011 provided $100 million for the Canada Brain Research Fund, administered by Brain Canada, to support world-leading neuroscience research, foster collaborative research initiatives and accelerate the pace of discovery, in order to improve the health and quality of life of Canadians who suffer from brain disorders, including Autism Spectrum Disorders.

- The Public Health Agency of Canada continues to develop a national system of surveillance of developmental disorders, with an initial emphasis on Autism Spectrum Disorders in children—a system that will collect and track over time information on the number and characteristics of people who develop such a disorder, the risk and protective factors, and treatments and services.

- The Government would like to acknowledge the work of Member of Parliament for Edmonton–Mill Woods–Beaumont Mike Lake in advocating for persons with Autism Spectrum Disorders and spreading awareness of the challenges these Canadians—and the families that support them—face.

The Government is proposing to provide new funding in support of social innovation research projects at colleges and polytechnics (see Chapter 3.2). This new initiative will support projects such as an Ottawa-based project to improve work opportunities for youth with Asperger’s Syndrome.

Individuals with a cognitive disability like Asperger’s Syndrome are extremely intelligent but can display behaviours which could lead to poor employability and job retention. In Ottawa, a local co-operative centre is working to help alleviate this problem for youth and young adults entering the world of post-secondary education and work, including by providing programs that promote and enhance the employability of individuals with Asperger’s Syndrome. With the aid of the local college's School of Community Studies and its students, the centre is aiming to augment its services to individuals with Asperger’s Syndrome, including by developing training materials for individuals with Asperger’s Syndrome, as well as potential employers in the community.

Training the Workforce of Tomorrow

Students participating in Canada’s education system are the largest source of new labour market supply, and providing them with the right skills is essential to further Canada’s economic prospects.

In recognition of the importance of post-secondary education, over $10 billion annually is invested by the Government in support of post-secondary education, which includes providing students with financial assistance such as Canada Student Loans and Canada Student Grants. In 2011–12, more than half a million Canadians received direct financial support from the Canada Student Loans Program to help them pursue their post-secondary education. Over $2.4 billion in loans were provided and over 336,000 students obtained a total of $647 million in Canada Student Grants. Canada places at the top of the rankings of the Organisation for Economic Co-operation and Development (OECD) in terms of post-secondary educational attainment, thanks in part to these federal supports for students.

Canada also has one of the highest youth employment rates among its OECD peers, ranking ahead of countries such as Germany, the United States, Sweden and Spain. However, more can be done to ensure young Canadians are receiving the training they need to realize their full potential.

Economic Action Plan 2014 announces measures to support the training and employment of Canada’s next generation by helping them get the skills and experience they need to get quality jobs, and by confirming significant new investments to support the implementation of a First Nations Control of First Nations Education Act, which will reform the on-reserveeducation system, in partnership with First Nations, to achieve better outcomes for First Nations students.

Supporting Apprenticeship Training

Apprenticeship training plays an important role in Canada’s post-secondary education system and is a key provider of vital skills and knowledge necessary to power and grow the Canadian economy. Supporting the take-up and completion of apprenticeships, followed by certification, contributes to increasing the supply of skilled labour.

Employers and various organizations have identified an acute need for skilled tradespeople. Employer surveys indicate that skilled trades are among the most difficult jobs to fill. Job vacancy rates in the skilled trades (e.g. construction workers, mechanics and machine operators) have risen sharply since 2009, and unfilled demand for this type of skilled labour has been most acute in Alberta and Saskatchewan (as highlighted in the accompanying Jobs Report: The State of the Canadian Labour Market).

Since 2006, the Government has recognized the importance of apprentices to Canada’s economy and to this end has committed substantial financial support to apprentices and the employers that hire them.

David is registered in a four-year apprenticeship program at his local community college in Ontario to become a Heavy Duty Equipment Technician, which is a Red Seal trade. The apprenticeship program consists of a combination of workplace-based training and two months of in-class technical training per year over three years. David’s expenses for this year include $400 in tuition and $2,500 in tools. David’s workplace-based training allows him to earn $25,000 annually.

In recognition of the costs he incurs as an apprentice, David is able to receive $444 in federal tax relief in 2014, including:

- $60 under the Tuition Tax Credit for his annual tuition of $400.

- $120 under the Education Tax Credit (based on a credit amount of $400 per month for the in-class portion of his training).

- $20 under the Textbook Tax Credit (based on a credit amount of $65 per month for the in-class portion of his training).

- $169 from the Canada Employment Credit, which provides a non-refundable tax credit based on an amount of $1,127.

- $75 from the Tradesperson’s Tools Deduction, which allows tradespersons to deduct from their income up to $500 of the total cost of eligible tools acquired in a taxation year that exceeds the amount of the Canada Employment Credit.

In addition to the personal income tax relief that David receives, his employer is eligible for a tax reduction of $2,000 per year, the maximum credit under the Apprenticeship Job Creation Tax Credit, during the first two years of David’s apprenticeship program.

David may also claim the Apprenticeship Incentive Grant of $1,000 during each of the first two years of his apprenticeship program, and when he successfully completes his apprenticeship program and obtains his provincial/territorial journeyperson certification, he can apply for the Apprenticeship Completion Grant of $2,000.

Because he has paid premiums and meets all the Employment Insurance (EI) program eligibility requirements, David can receive EI regular benefits when he begins his in-class technical training. Although there is a normal two-week waiting period as an apprentice, the waiting period would be waived for David’s subsequent in-class technical training sessions.

David could also be eligible for EI Part II support delivered in partnership with the province under the Labour Market Development Agreement. EI Part II support could cover training-related expenditures such as basic living expenses, relocation/commuting costs, training materials and child care expenses.

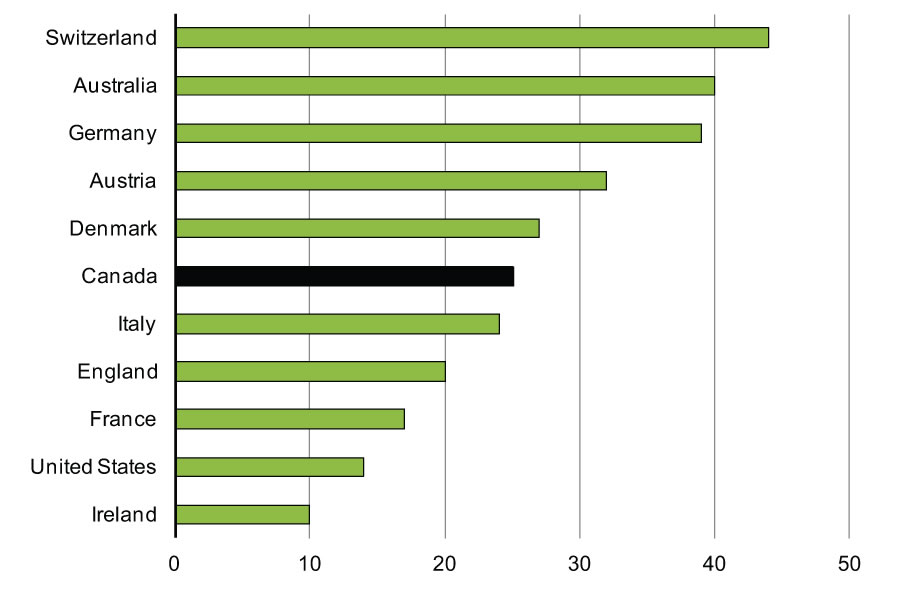

As discussed in more detail in the accompanying Jobs Report: The State the Canadian Labour Market, the number of apprentices completing training and obtaining certification has doubled from 2000 to 2011. However, apprenticeship completion rates have averaged only 50 per cent over the same period, which is low compared to other countries, and substantially lower than that of community college and university students.

Sources: London School of Economics and Political Science,Centre for Economic Performance, The State of Apprenticeship (2010); International Labour Organization (ILO), Overview of Apprenticeship Systems and Issues, ILO Contribution to the G-20 Task Force on Employment, September 2012.

Canada Apprentice Loan

Economic Action Plan 2014 proposes to create the Canada Apprentice Loan by expanding the Canada Student Loans Program to provide apprentices registered in Red Seal trades with access to over $100 million in interest-free loans each year.

Apprentices in skilled trades do most (80 to 85 per cent) of their learning during on-the-job paid employment. They are also required to participate in technical training for short periods of time ranging from six to eight weeks each year. Apprentices can face significant costs to complete these periods of technical training required by their program, including educational fees, tools and equipment, living expenses and forgone wages. These costs can be particularly acute for apprentices who intend to complete their training after a number of years on the job, while supporting their families.

Economic Action Plan 2014 proposes to create the Canada Apprentice Loan, which will offer interest-free loans to help registered apprentices with the cost of their training. The Canada Apprentice Loan will assist more apprentices in completing their training and encourage more Canadians to consider a career in the skilled trades.

Apprentices registered in their first Red Seal trade apprenticeship will be able to apply for interest-free loans of up to $4,000 per period of technical training. Interest charges and repayment of Canada Apprentice Loans will not begin until after loan recipients complete or terminate their apprenticeship training program. At least 26,000 apprentices per year are expected to apply for over $100 million in loans. The estimated net cost of these loans to the Government would be $25.2 million over two years and $15.2 million per year ongoing.

Further details will be announced by the Minister of Employment and Social Development in the coming months.

Supporting Entrepreneurs Through Intensive Mentoring

Economic Action Plan 2014 proposes to provide an additional $40 million over four years to the Canada Accelerator and Incubator Program to help entrepreneurs create new companies and realize the potential of their ideas through intensive mentoring and other resources to develop their business.

Business accelerators and incubators play an important role in the development of innovative businesses by providing them with hands-on advice from experienced entrepreneurs and other resources. This is why, in September 2013, the Government launched the Canada Accelerator and Incubator Program (CAIP) as part of the Venture Capital Action Plan. CAIP aims to establish a critical mass of outstanding accelerator and incubator organizations across Canada. It will enable leading organizations to expand their intensive mentoring and business development services to high-potential companies and entrepreneurs, including young Canadians, so that they can develop their ideas into globally competitive businesses.

The Request for Proposals under CAIP, launched in September 2013, attracted a significant number of high-quality applications from organizations across the country. To increase the impact of CAIP in helping entrepreneurs realize the business potential of their ideas, Economic Action Plan 2014 proposes to provide the program with an additional $40 million over four years, starting in 2015–16, increasing its total funding to $100 million. Recipient organizations under this initiative will be announced in the coming months.

Accelerators are typically for-profit organizations owned and operated by venture capital investors. Accelerators provide a range of services to early-stage firms, including financial support, mentorship, business advice, office and development space, and complementary services offered by partner organizations.

Incubators are typically not-for-profit organizations that offer similar services as accelerators but tend to provide longer tenure for participating firms and a broader suite of services in terms of physical space and mentorship. Incubators are often sponsored by universities, colleges or economic development corporations.

Flexibility and Innovation in Apprenticeship Technical Training

Economic Action Plan 2014 proposes to introduce the Flexibility and Innovation in Apprenticeship Technical Training pilot project to expand the use of innovative approaches to apprentice technical training.

The Government recognizes that the skilled trades are critical to Canada’s economic prosperity. It is continuing to work with provinces and territories to harmonize apprenticeship systems and reduce barriers to certification in the skilled trades so that apprentices can more easily work and train where the jobs are.

In order to improve the apprenticeship system, Economic Action Plan 2014 proposes to introduce the Flexibility and Innovation in Apprenticeship Technical Training (FIATT) pilot project to expand innovative approaches to the delivery of apprentice technical training aimed at reducing non-financial barriers to completing training and obtaining certification.

Examples could include using in-class simulators, e-learning modules, remote learning sites and video conferencing in place of, or in addition to, traditional in-class training. The project will test alternatives to the block training approach that exists across most of the country in order to allow apprentices to continue working and earning while fulfilling the technical training requirements of their programs. It is anticipated that the FIATT pilot project could support up to 12 multi-year projects across the country through a reallocation of $13 million over four years starting in 2014–15.

Employment Insurance Awareness Initiative for Apprentices

Economic Action Plan 2014 proposes to take steps to increase awareness of the financial supports available to support apprenticeship training.

The Government will also take steps to ensure that apprentices are aware of the existing financial supports available to them while they are on technical training through the Employment Insurance (EI) program. Increased awareness will benefit apprentices, as they will start to receive EI benefits more quickly.

The Government also allows employers to invest more in apprenticeship training by supplementing an employee’s EI benefits during periods of training. Currently, the basic EI benefit rate is set at 55 per cent of the employee’s weekly insurable earnings up to a maximum payment of $485 per week. Employers can choose to top up an apprentice’s EI benefits up to 95 per cent of their normal wage through the use of a Supplemental Unemployment Benefit plan that is approved and registered through Service Canada.

Focusing Federal Investments in Youth Employment

Economic Action Plan 2014 proposes to review the Youth Employment Strategy to better align it with the evolving realities of the job market.

The Government invests over $330 million annually in programming for youth through the Youth Employment Strategy, which provides skills development and work experience for youth at risk, summer students and recent post-secondary graduates.

Economic Action Plan 2014 announces that the Government will improve the Youth Employment Strategy to align it with the evolving realities of the job market and to ensure federal investments in youth employment provide young Canadians with real-life work experience in high-demand fields such as science, technology, engineering, mathematics and the skilled trades.

Supporting Internships in High-Demand Fields

Economic Action Plan 2014 proposes to dedicate $40 million towards supporting up to 3,000 internships in high-demand fields.

Although Canada boasts high levels of post-secondary achievement, the transition to a first job can be challenging. Young graduates often lack opportunities to gain the workplace experience and skills necessary to find and retain jobs. In addition, too many Canadians graduate and find themselves unemployed or underemployed, while employers are searching for workers.

Recognizing these challenges, the Government proposes to strengthen youth programming by dedicating $40 million toward supporting up to 3,000 full-time internships for post-secondary graduates in high-demand fields for 2014–15 and 2015–16. Of this amount, up to $30 million would be provided to the National Research Council’s Industrial Research Assistance Program to support youth internships in small and medium-sized enterprises undertaking technical research and development projects. The remaining $10 million will be delivered by Employment and Social Development Canada under the Youth Employment Strategy.

Supporting Internships in Small and Medium-Sized Enterprises

Economic Action Plan 2014 proposes to reallocate $15 million annually towards supporting up to 1,000 internships in small and medium-sized enterprises.

Small and medium-sized enterprises are key drivers of Canada’s economic growth. While they are in need of skilled workers, they often lack the capacity that many large companies have to recruit new employees.

To facilitate the linkages between small and medium-sized employers and youth, Economic Action Plan 2014 also proposes a reallocation of $15 million annually within the Youth Employment Strategy to support up to 1,000 full-time internships for recent post-secondary graduates in small and medium-sized enterprises.

Eliminating Vehicles From Canada Student Loans Assessments

Economic Action Plan 2014 proposes to eliminate the value of student-owned vehicles from the Canada Student Loans Program assessment process to better reflect the needs of students who commute or work while studying.

Since 2006, the Government has made significant investments in post-secondary education to remove financial barriers and to streamline and modernize the Canada Student Loans Program and the Canada Student Grants Program.

Many students, especially those who live in rural and suburban communities, often require a vehicle for travel between their residence, classes and their jobs as public transit is not an option for them. The current $5,000 exemption limit for vehicles, implemented in 1995, has not been adjusted or revised in nearly two decades.

Economic Action Plan 2014 proposes to simplify the Canada Student Loans Program by eliminating the value of student-owned vehicles from the need assessment process to better reflect current realities.

More than 19,000 student loan borrowers who own vehicles will benefit from higher loan disbursements each year as a result of this initiative, at a projected net cost of $14.8 million over two years and $7.8 million per year ongoing.

The Government invests over $10 billion annually to support post-secondary education, which includes providing students with financial assistance such as Canada Student Loans and Canada Student Grants, and specific programming targeted to First Nations and Inuit students.

Since 2006, the Government has taken significant action that helps students obtain education and skills, including:

- $800 million added to the Canada Social Transfer (CST) in 2008–09 to enhance the quality and competitiveness of Canada’s post-secondary education system, bringing the total investment in post-secondary education within the CST to $3.2 billion. This amount has increased annually by the 3 per cent CST escalator to total $3.9 billion in 2014–15.

- $1 billion for the Post-Secondary Education Infrastructure Trust.

- $2 billion in economic stimulus funding for the Knowledge Infrastructure Program to support infrastructure enhancements at universities and colleges.

- More than $1.8 billion in new funding committed to the Canada Foundation for Innovation to support research infrastructure at universities, colleges, research hospitals and other not-for-profit research institutions across Canada.

- More than $260 million for new Canada Graduate Scholarships to support graduate-level students who have demonstrated a high standard of achievement.

- $125 million for Vanier Canada Graduate Scholarships to attract and retain world-class doctoral students.

- $35 million for Banting Postdoctoral Fellowships to support the very best postdoctoral researchers who will positively contribute to the country’s growth.

- $123 million to streamline and modernize the Canada Student Loans Program.

- Allowing full-time students to earn more money by doubling the in-study income exemption under the Canada Student Loans Program from $50 per week to $100 per week, benefiting approximately 100,000 students each year.

- Reducing the in-study interest rate for part-time students from prime plus 2.5 per cent to zero, bringing them in line with full-time students and saving them approximately $5.6 million per year.

- Introducing Canada Student Loan forgiveness for family physicians, nurses and nurse practitioners practising in underserved rural and remote communities.

- Increasing the family income thresholds for part-time students such that Canada Student Loans are available to more young Canadians.

- Consolidating and integrating all federal grants into one program—the Canada Student Grant Program. The program is providing monthly grants of $250 for low-income students and $100 for middle-income students.

- Increasing the income eligibility threshold for part-time students used to determine eligibility for the Canada Student Grant.

Reforming First Nations K-12 Education

Economic Action Plan 2014 confirms significant new investments to support the implementation of a First Nations Control of First Nations Education Act.

Education is fundamental to ensuring full equality of opportunity and a share in Canada’s prosperous future. The Government will work with its partners so that young First Nations people will have access to education systems on reserves comparable to provincial and territorial school systems. For this young and fast-growing population, this is a game-changer.

The First Nations Control of First Nations Education Act will establish the structures and standards necessary to ensure stronger, more accountable education systems on reserves and will result in better outcomes for First Nations students.

Economic Action Plan 2014 confirms core funding of $1.25 billion from 2016–17 to 2018–19 in support of the First Nations Control of First Nations Education Act. When implemented, the legislation will provide stable and predictable statutory funding consistent with provincial education funding models.

In addition, Economic Action Plan 2014 confirms a new Enhanced Education Fund that will provide funding of $160 million over four years starting in 2015–16. This funding will help to develop the partnerships and institutional structures required to implement the proposed legislation, including support for new First Nations education authorities.

New funding to build and renovate schools is also confirmed, with $500 million over seven years beginning in 2015–16 for a new Education Infrastructure Fund. This represents a continuation of the investments in school infrastructure announced in Economic Action Plan 2012.

Taken together, these investments totalling over $1.9 billion will support legislation to reform the on-reserve education system, providing First Nations children with access to a modern and accountable education regime that aligns with provincial education systems off reserve.

Supporting Women Entrepreneurs

Economic Action Plan 2014 proposes to provide $150,000 to increase mentorship among women entrepreneurs.

Successful entrepreneurs create high-paying jobs by developing new goods and services and developing innovative business models. Women are significantly under-represented as a proportion of small business owners. Economic Action Plan 2014 proposes to provide $150,000 to Status of Women Canada in 2014–15 to increase mentorship among women entrepreneurs.

Over the coming year, the Minister of Status of Women will consult on how to increase the numbers of women entering into, and succeeding in, business.

Renewing the Computers for Schools Program

Economic Action Plan 2014 proposes to provide $36 million over four years to renew the Computers for Schools Program, providing students and interns with access to information and communications technology equipment and skills training.

A vibrant economy requires that students have access to the equipment they need to acquire the skills that will prepare them to fully participate in the digital economy. The Government of Canada’s Computers for Schools Program plays a key role in this effort by supporting the refurbishment of surplus government computer equipment, and allowing it to be reused in schools and other learning organizations across the country. Since its inception in 1993, the program has made over 1.2 million computers accessible to Canadian learners. The Computers for Schools Program also provides students and recent graduates with market-relevant skills and experience in information and communications technology fields. Over 250 young Canadians per year benefit from internships offered through the program.

Recognizing the important social and environmental benefits of this successful program, Economic Action Plan 2014 proposes to provide $17.6 million over four years, starting in 2014–15, to renew the Computers for Schools Program. Combined with an additional $18.4 million from the existing resources of Industry Canada and the Youth Employment Strategy, federal support for Computers for Schools will total $36 million over this four-year period.

Strengthening Canada’s Labour Market

Canada’s long-term prosperity depends on the labour market participation of all its citizens. But even with the appropriate set of qualifications, it may take time for job seekers to connect with employers. That is why the Government has taken important steps to help unemployed people connect with jobs that match their skills in their local area. In particular, it has introduced changes to the Employment Insurance program to quickly alert unemployed Canadians to job opportunities through daily job postings, reformed the Temporary Foreign Worker Program to ensure that Canadians have first access to Canadian jobs, and launched the Sectoral Initiatives Program in 2012 to address skills shortages in key sectors of Canada’s economy.

Economic Action Plan 2014 proposes new investments to make it easier for Canadians to connect with available jobs and to ensure that Canadians are given the first chance at those jobs. It also proposes measures to make the immigration system more efficient, flexible and responsive, and to ensure that it supports the needs of Canada’s labour market.

Targeted Initiative for Older Workers

Economic Action Plan 2014 proposes to renew the Targeted Initiative for Older Workers program for a three-year period, representing a federal investment of $75 million.

Encouraging the labour market participation of under-represented groups in the labour market continues to be an important priority of the Government. Demographic changes and an aging population mean that older workers are becoming a larger portion of the labour force. They also represent a source of experienced talent that is sought after by employers. While older workers are faring relatively well, economic uncertainty can create unique challenges, particularly in communities where traditional industries have reduced their presence and workforce.

In 2006, the Targeted Initiative for Older Workers program was created to assist unemployed older workers in smaller, vulnerable communities affected by significant downsizing or closures and/or high unemployment by supporting the reintegration of participants into the workforce. All provinces and territories participate in this cost-shared initiative alongside the federal government.

Through Economic Action Plan 2014, the Government proposes to renew the Targeted Initiative for Older Workers program for a three-year period, representing a federal investment of $75 million. Eligibility for the Initiative will also be expanded to communities experiencing unfulfilled employer demand and/or skills mismatches, so that communities with tighter labour markets that may not have met the previous criteria can participate in the Initiative, if they have vacant jobs that unemployed older workers could fill.

Enhanced Job Matching Service and Modernized National Job Bank

Economic Action Plan 2014 proposes to invest $11.8 million over two years and $3.3 million per year ongoing to launch an enhanced Job Matching Service to ensure that Canadians are given the first chance at available jobs that match their skills in their local area.

The Government of Canada is committed to helping unemployed Canadians get back to work and ensuring that Canadians are given the first chance at available jobs. The enhanced Job Matching Service will provide job seekers with modern and reliable tools to find jobs that match their skills, and provide employers with better tools to look for qualified Canadians. Through a secure, authenticated process, registered job seekers and employers will be automatically matched on the basis of skills, knowledge and experience.

The proposed enhanced Job Matching Service will build on the launch of a modernized and easy-to-use consolidated National Job Bank, providing job seekers and employers with timely access to job postings and consolidated labour market information.

These initiatives complement recent and ongoing investments to provide better and timely labour market information. They inform young people about fields of study that are relevant to existing and forecasted demand for labour in particular occupations to help students make better choices about their education. Altogether, these initiatives are part of an ongoing strategy to leverage technology to better connect unemployed Canadians with available jobs.

Ensuring the Temporary Foreign Worker Program’s Labour Market Opinion Process Operates in the National Interest

Economic Action Plan 2014 proposes to invest $11.0 million over two years and $3.5 million per year ongoing to strengthen the Labour Market Opinion process to ensure Canadians are given the first chance at available jobs.

The Government of Canada is committed to reforming the Temporary Foreign Worker Program to ensure that Canadians are given the first chance at available jobs. During 2013, the Government implemented several important reforms, including:

- Introducing a moratorium on accelerated Labour Market Opinions.

- Requiring employers to pay temporary foreign workers the prevailing wage.

- Allowing the Government to suspend, revoke or refuse to process Temporary Foreign Worker applications in order to better protect the Canadian labour market.

- Restricting the use of non-official languages as job requirements.

- Increasing the length and reach of advertising required by employers to ensure no Canadians are available before they can turn to foreign workers.

The Government also committed that the costs of the Labour Market Opinion process will no longer be absorbed by taxpayers and imposed a user fee of $275 per position to fully recover the cost of processing a temporary foreign worker application under the Labour Market Opinion process.

Economic Action Plan 2014 proposes to invest $11.0 million over two years and $3.5 million per year ongoing to further strengthen the Labour Market Opinion process by realigning the application streams to better identify vulnerable temporary foreign workers and improve processing times for certain applications; limiting the use of the program in high-unemployment regions; and ensuring that employers transition to a Canadian workforce through better prevention, detection and response to employer non-compliance. In addition, the Government will introduce reforms to the Temporary Foreign Worker Program for those workers who are exempt from the Labour Market Opinion process to ensure the program continues to promote Canada’s economic and labour market interests.

Immigrant Investor Program

Economic Action Plan 2014 proposes to replace the ineffective Immigrant Investor and Entrepreneur programs with an Immigrant Investor Venture Capital Fund pilot project.

The Government of Canada is committed to immigration that contributes to job creation and economic growth. In recent years, significant progress has been made to better align the immigration system with Canada’s economic needs.

The current Immigrant Investor Program stands out as an exception to this success. For decades, it has significantly undervalued Canadian permanent residence, providing a pathway to Canadian citizenship in exchange for a guaranteed loan that is significantly less than our peer countries require. There is also little evidence that immigrant investors as a class are maintaining ties to Canada or making a positive economic contribution to the country. Overall, immigrant investors report employment and investment income below Canadian averages and pay significantly lower taxes over a lifetime than other categories of economic immigrants. For these reasons, the Immigrant Investor Program has been paused since July 2012 and the Entrepreneur Program since July 2011.

Economic Action Plan 2014 proposes to end these underperforming programs.

To eliminate the existing backlog, which is diverting resources away from better performing economic immigration streams, the Government intends to return applications and refund associated fees paid by certain federal Immigrant Investor Program and Entrepreneur Program applicants who applied on or before Budget Day.

In place of the current Immigrant Investor Program, the Government will introduce a new Immigrant Investor Venture Capital Fund pilot project, which will require immigrants to make a real and significant investment in the Canadian economy. The Government will also undertake consultations on a potential Business Skills pilot program. Together, these pilots will test new and innovative approaches to business immigration that will better fuel the continued growth of the Canadian economy.

Expression of Interest System

Economic Action Plan 2014 proposes to provide $14.0 million over two years and $4.7 million per year ongoing to Citizenship and Immigration Canada to support the successful implementation of an Expression of Interest economic immigration system.

The Government is transforming the immigration system into one that is fast, flexible and focused on meeting Canada’s economic and labour market needs. To that end, Economic Action Plan 2014 proposes to provide $14.0 million over two years and $4.7 million per year ongoing to launch a new recruitment model—the Expression of Interest system—in January 2015.

The Expression of Interest system would allow the Government of Canada, provinces and territories, and employers to actively target highly skilled immigrants under key economic immigration programs, including the Federal Skilled Worker Program, the Federal Skilled Trades Program and the Canadian Experience Class. Under the Expression of Interest system, candidates would make an online submission to express interest in coming to Canada and provide information about their skills and experience. This information would then be ranked and sorted relative to other applicants, and provinces and territories as well as employers may consider these candidates based on their immigration and labour market needs. The Government would only invite the most highly ranked candidates to submit an application for permanent residence.

| 2013–14 | 2014–15 | 2015–16 | Total | |

|---|---|---|---|---|

| Ensuring Training Reflects Labour Market Needs | ||||

| Ready, Willing & Able | 5 | 5 | 10 | |

| Community Works—A Vocational Training Program for Individuals With Autism Spectrum Disorders | 3 | 3 | 5 | |

| Subtotal—Ensuring Training Reflects Labour Market Needs | 7 | 8 | 15 | |

| Training the Workforce of Tomorrow | ||||

| Supporting Apprenticeship Training | ||||

| Canada Apprentice Loan | 13 | 12 | 25 | |

| Supporting Entrepreneurs Through Intensive Mentoring | 6 | 6 | ||

| Flexibility and Innovation in Apprenticeship Technical Training | 1 | 4 | 5 | |

| Focusing Federal Investments in Youth Employment | ||||

| Supporting Internships in High-Demand Fields | 20 | 20 | 40 | |

| Supporting Internships in Small and Medium-Sized Enterprises | 15 | 15 | 30 | |

| Eliminating Vehicles From Canada Student Loans Assessments | 7 | 7 | 15 | |

| Reforming First Nations K-12 Education | 120 | 120 | ||

| Supporting Women Entrepreneurs | – | – | ||

| Renewing the Computers for Schools Program | 9 | 9 | 18 | |

| Subtotal—Training the Workforce of Tomorrow | 66 | 194 | 259 | |

| Strengthening Canada’s Labour Market | ||||

| Targeted Initiative for Older Workers | 25 | 25 | 50 | |

| Enhanced Job-Matching Service and Modernized National Job Bank |

6 | 6 | 12 | |

| Ensuring the Temporary Foreign Worker Program’s Labour Market Opinion Process Operates in the National Interest | 5 | 6 | 11 | |

| Immigrant Investor Program | 2 | 2 | ||

| Expression of Interest System | 7 | 7 | 14 | |

| Subtotal—Strengthening Canada’s Labour Market | 2 | 43 | 43 | 89 |

| Total—Connecting Canadians With Available Jobs | 2 | 116 | 245 | 363 |

| Less funds existing in the fiscal framework | 25 | 25 | 50 | |

| Less funds sourced from internal reallocations | 41 | 44 | 84 | |

| Net fiscal cost | 2 | 51 | 176 | 229 |

| Notes: A dash indicates an amount of less than $500,000. Totals may not add due to rounding. | ||||