Chapter 3.2: Fostering Job Creation, Innovation and Trade

Table of Contents![]() Previous

Previous

![]() Next

Next

Highlights

Keeping Taxes Low for Job-Creating Businesses

- Maintaining a low tax burden on businesses with no new taxes.

- Reducing the tax compliance burden for small and medium-sized businesses and other tax filers.

- Maintaining the freeze on Employment Insurance premium rates to help provide certainty and flexibility for employers, especially small businesses.

Fostering Trade and Canadian Entrepreneurship

- Continuing to ensure that Canadian businesses and investors have the market access they need to succeed in the global economy.

- Modernizing Canada’s intellectual property framework to better align it with international practices and reduce the administrative burden for innovative Canadian businesses.

- Consulting on a “Made-in-Canada” branding campaign to raise consumer awareness of the quality and range of Canadian-made products both domestically and internationally.

- Taking steps to strengthen internal trade, including the development of an Internal Trade Barriers Index to identify measures currently restricting trade, and help all jurisdictions in focusing reforms and negotiation efforts on priority areas.

- Moving forward with the planning for and construction of a new Windsor-Detroit International Crossing to improve the flow of people and goods between Canada and the United States.

Supporting Advanced Research and Innovation

- Creating the new Canada First Research Excellence Fund with $1.5 billion in funding over the next decade to help Canadian post-secondary institutions excel globally in research areas that create long-term economic advantages for Canada.

- Providing new funding of $46 million per year for the granting councils to support advanced research and scientific discoveries, including the indirect costs of research.

- Providing an additional $500 million over two years to the Automotive Innovation Fund, to support significant new strategic research and development projects and long-term investments in the Canadian automotive sector.

Promoting Canada’s Financial Sector Advantage

- Implementing measures to increase market discipline in residential lending and reduce taxpayer exposure to the housing sector.

- Taking action to encourage competitive financial services while preserving the safety and soundness of the financial sector.

- Modernizing regulation to better protect investors, enhance Canada’s financial services sector, support efficient capital markets and manage systemic risk.

Fostering Job Creation, Innovation and Trade

Since 2006, the Government has worked to foster an environment in which businesses can grow and succeed in the global economy. The Government has taken action to promote economic growth by increasing Canada’s openness to trade and investment, providing tax relief, improving the regulatory environment, promoting business competitiveness and strengthening the financial sector. Economic Action Plan 2014 builds on this foundation by investing in initiatives that will:

- Keep taxes low for all businesses.

- Further reduce barriers to the international and domestic flow of goods and services.

- Support advanced research and innovation.

- Continue to advance Canada’s robust financial sector.

These actions, taken together with Economic Action Plan 2014 initiatives to connect Canadians with available jobs, ensure safe, responsible resource development and strengthen infrastructure and transportation, will help ensure the continued success of Canadian businesses and promote the creation of high-quality jobs.

Keeping Taxes Low for Job-Creating Businesses

A Competitive Business Tax System

Actions taken by the Government have positioned Canada as an increasingly attractive place to invest and grow a business. A healthy and competitive business environment, in turn, helps the economy grow, creates new jobs and raises our standard of living.

The Government has delivered tax reductions totalling more than $60 billion to job-creating businesses from 2008–09 through 2013–14.

- To increase business investment and improve productivity, the federal general corporate income tax rate was reduced to 15 per cent in 2012 from 22.12 per cent in 2007, including the elimination of the corporate surtax in 2008 for all corporations.

- In recognition of the particularly harmful effect that capital taxes have on business investment, the federal capital tax was eliminated in 2006. The Government also provided a temporary financial incentive to encourage the provinces to eliminate their general capital taxes. The last provincial general capital tax was eliminated in 2012.

- To encourage the growth of small businesses by leaving them with tax savings that can be retained and reinvested in the business, the small business tax rate was reduced to 11 per cent in 2008, and the amount of income eligible for this lower rate was increased to $400,000 in 2007 and to $500,000 in 2009.

- To increase the potential rewards of investing in small businesses, the Lifetime Capital Gains Exemption on qualified small business shares has been increased to $800,000, and this new limit is now indexed to inflation.

- To help the manufacturing and processing sector accelerate and undertake additional investment and increase productivity, a temporary accelerated capital cost allowance for investment in manufacturing or processing machinery and equipment was introduced in 2007 and then extended through 2015. Economic Action Plan 2013 announced a two-year extension of this measure to provide projected support of $140 million in 2014–15 and a total of $1.4 billion over the 2014–15 to 2017–18 period.

Canada Is Ranked as One of the World’s Most Attractive Countries for Business

Bloomberg Rankings recently issued the results of an analysis of the world’s most attractive countries for business in which Canada leapt to second place, behind only Hong Kong.

—Bloomberg

Best Countries for Business 2014

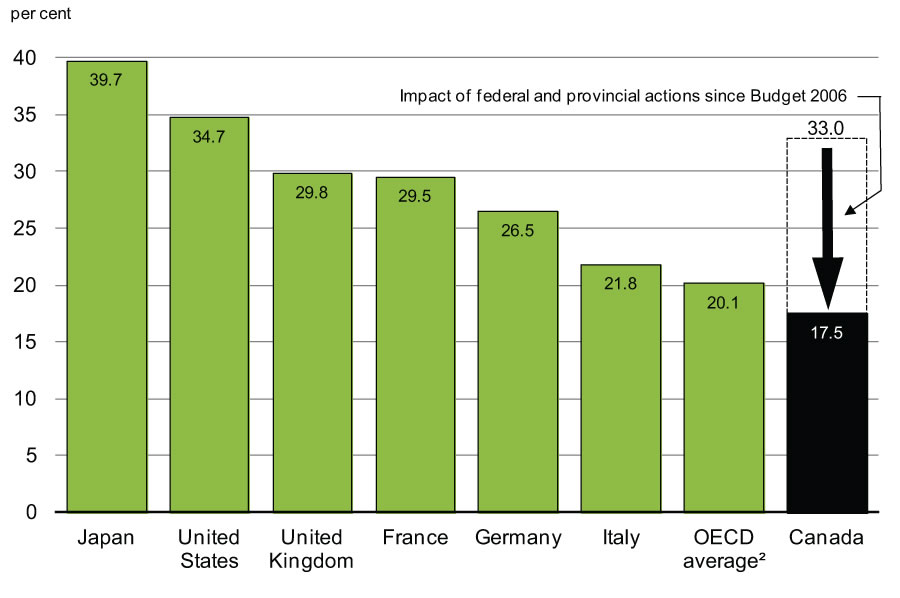

Canada’s tax competitiveness and overall business environment have been significantly improved, with the result that Canada now offers the lowest overall tax rate on new business investment in the Group of Seven (G-7) (Chart 3.2.1).

2 OECD (Organisation for Economic Co-operation and Development) average excludes Canada.

Source: Department of Finance.

The competitiveness of Canada’s business tax system is supported by third-party analysis. The KPMG publication Competitive Alternatives 2012 rigorously analyzed the impact of federal, state, provincial and municipal taxes on business operations. KPMG concluded that Canada’s total business tax costs are the lowest in the G-7 and more than 40 per cent lower than those in the United States.

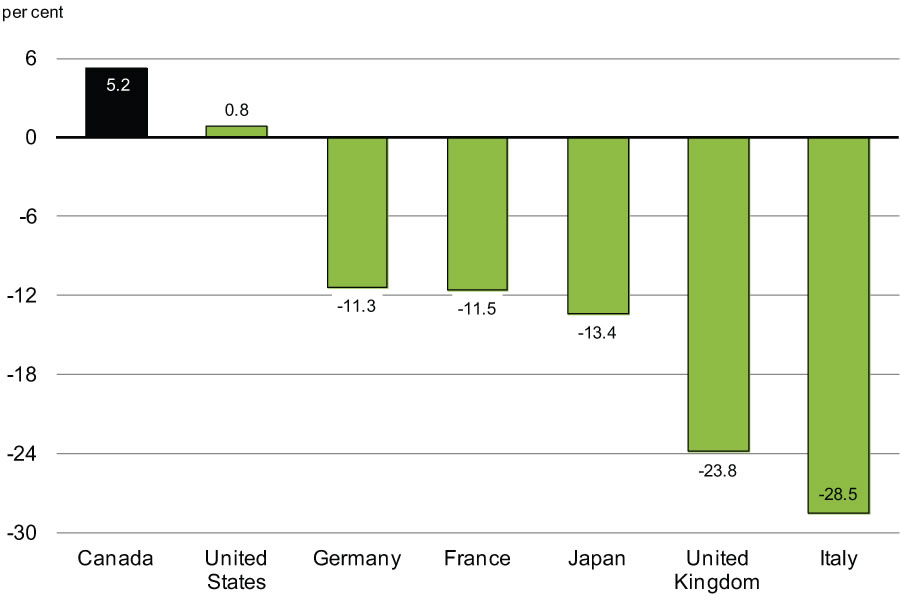

The Government’s low-tax plan is giving businesses strong incentives to invest in Canada. Real business investment in Canada is now 5.2 per cent higher than its pre-recession peak, and Canada leads the G-7 with the strongest growth in business investment over the global recession and the subsequent recovery (Chart 3.2.2). Investment by manufacturers in machinery and equipment has been particularly strong, outpacing that in the United States over the recovery, after lagging in prior years. Modern and up-to-date capital equipment increases the productivity and competitiveness of Canadian companies, which enables them to create jobs and raise living standards.

Solid business investment has been accompanied by a resilient Canadian labour market, with over 1 million net new jobs created since the recovery began in July 2009. This represents the strongest labour market performance in the G-7.

Note: The pre-recession peak in real gross domestic product was 2007Q3 for Italy; 2007Q4 for the United States; 2008Q1 for the United Kingdom, France, Germany and Japan; and 2008Q3 for Canada. The last data point is 2013Q3 for all countries except the United States, for which it is 2013Q4. Data for Italy include public non-residential investment.

Sources: Statistics Canada; United Kingdom Office for National Statistics; German Federal Statistical Office; Haver Analytics; Department of Finance calculations.

The Government’s focus on improving business tax competitiveness is part of a growth-oriented policy framework that has helped Canada to achieve one of the strongest fiscal positions and the lowest business tax costs in the G-7. Low taxes encourage capital investment, which in turn spurs job creation.

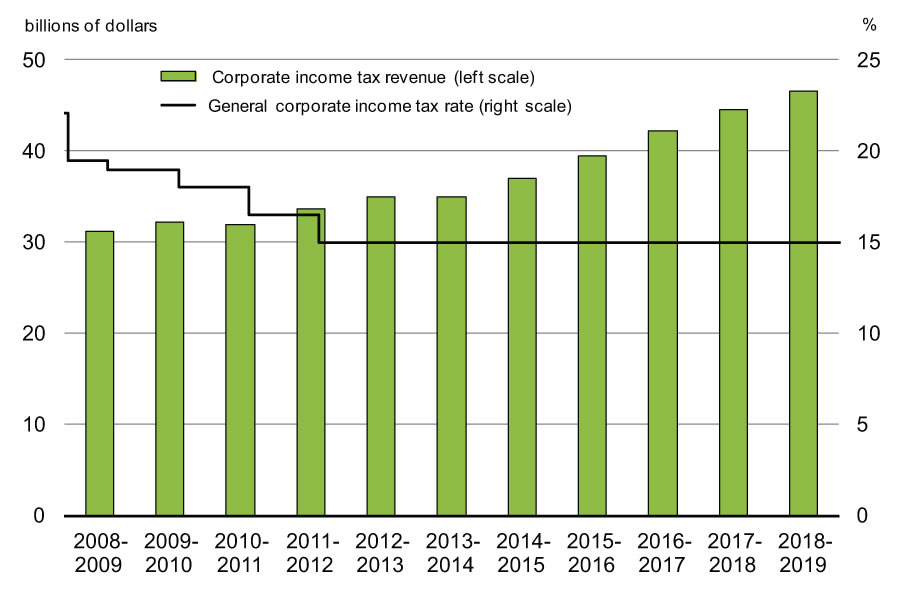

Reductions in the federal corporate tax rate to 15 per cent have contributed to growth in the reported amount of corporate taxable income. Corporate income tax revenues have risen by 12 per cent since the recession. Corporate taxes are expected to contribute $35 billion in revenues in 2013–14 (Chart 3.2.3) and grow at an annual rate of 5.9 per cent over the remainder of the projection period.

Improving the Canadian tax system to help Canadian businesses compete globally in this period of economic uncertainty requires collaboration among all levels of government. While provinces and territories have taken important actions to enhance Canada’s business tax advantage, some recent actions have diminished that advantage, jeopardizing a strong foundation for future growth.

Certainly, the recent [corporate tax rate] increases at the provincial level, including Ontario’s reversal of the legislated corporate tax rate reductions in 2011, are beginning to undermine the gains we have achieved in attracting capital investments to Canada.…Canada’s top ranking with the lowest METR among the G7 countries for business tax competitiveness is a hard-won accomplishment over the past decade. This accomplishment is noteworthy because it is firmly based on sound economic judgment: keeping a competitive corporate tax rate on a broad tax base is critical to encouraging capital investment and promoting economic growth, and also because it is shared and pursued by our governments under different political parties.

—Duanjie Chen and Jack Mintz

2013 Annual Global Tax Competitiveness Ranking:

Corporate Tax Policy at a Crossroads

Supporting Small Businesses

Small businesses are crucial to Canada’s long-term prosperity. Canadians depend on the jobs they create and the services they provide. That is why the Government continues to invest significantly in small businesses:

- Cutting Taxes—The Government has delivered substantial ongoing tax relief to small businesses and small business owners. Reductions in the small business tax rate and increases in the small business income limit are providing small businesses with an estimated $2.2 billion in tax relief in 2014.

- Cutting Red Tape—The Government understands that time spent navigating bureaucratic red tape is time small business owners could otherwise use to grow their business and create jobs. Reducing the administrative burden on small business is a key priority.

- Returning to Balanced Budgets—The Government’s sustained approach to responsible fiscal management responds directly to the priorities of small business owners, as they recognize that a sound fiscal position safeguards Canada’s low-tax plan and thereby ensures sustained economic growth.

Working closely with small businesses, including the Canadian Federation of Independent Business, Economic Action Plan 2014 builds on this record.

This Government has delivered substantial ongoing tax relief to small businesses and small business owners.

- Reductions in the small business tax rate to 11 per cent and increases in the small business income limit to $500,000 are providing small businesses with an estimated $2.2 billion in tax relief in 2014 and an estimated $10.8 billion in tax relief over the 2008–09 to 2013–14 period.

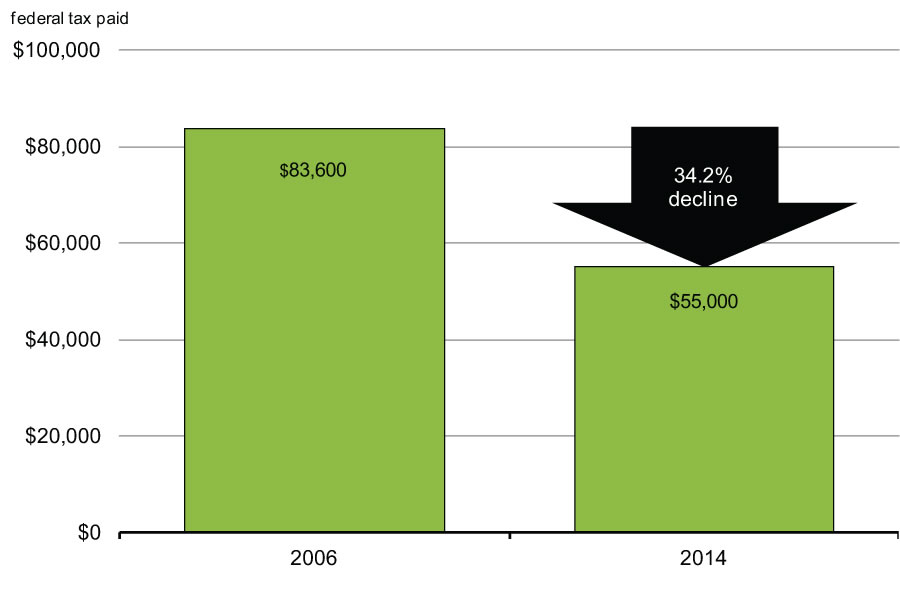

- For example, the amount of tax paid by a small business with $500,000 of taxable income has declined by 34.2 per cent as a result of actions taken by the Government, a tax savings of $28,600 that can be reinvested in the business to fuel the growth and expansion that can create new jobs.

- Small businesses can also benefit from the Government’s general corporate income tax rate cuts when their income exceeds $500,000. In 2012, small businesses represented more than 40 per cent of the corporations that benefited from cuts in the federal general corporate income tax rate to 15 per cent in 2012 from 22.12 per cent in 2007.

- In addition, the Lifetime Capital Gains Exemption (LCGE) on qualified small business shares was increased to $750,000 from $500,000 in 2007. The Government further increased the LCGE limit to $800,000 for 2014, and this new limit is now indexed to inflation. The LCGE is estimated to be delivering over $1 billion of federal tax relief annually to small business owners, farmers and fishermen.

This Government has also protected small businesses from substantial rate increases in Employment Insurance (EI) premiums and Canada Pension Plan (CPP) contributions that would have hit their bottom line.

- Freezing the EI premium rate for employees at the 2013 level of $1.88 per $100 of insurable earnings for 2014, and committing to set the rate no higher than $1.88 for 2015 and 2016, is leaving $660 million in the pockets of job creators and their employees in 2014 alone and will provide the certainty and flexibility that small businesses need to keep growing.

- Implementing the new EI premium rate-setting process in 2017 and subsequent years will ensure that small businesses continue to benefit from stable and predictable EI premium rates that are no higher than needed to pay for the EI program. This is expected to result in a significant reduction in the EI premium rate in 2017 and affordable rates thereafter, savings that small businesses will be able to use to hire, improve wages or help grow their business.

- There will be no change to the CPP contribution rate this year. Expanding the CPP would require an increase in contributions, which would impose a burden on employers and employees. For example, doubling the CPP replacement rate would result in an estimated increase in annual CPP contributions of up to $2,600 per worker, shared equally by employers and employees. Self-employed individuals would need to contribute the entire amount. The Government heard the concerns of small businesses and believes that now is not the time to consider an expansion of the CPP given the fragility of the global economic recovery and the importance of small businesses in supporting the recovery domestically.

Entrepreneurs need a framework of low taxes and minimal red tape in order to focus on growing their businesses. Indeed, the Government recognizes that taxes absorb dollars that would otherwise be used by business owners to seize opportunities for growth and create new jobs. To this end, further tax relief for small businesses will be a priority for the Government following the return to balanced budgets. This Government is firmly committed to delivering both lower taxes and less red tape.

Reducing the Regulatory Burden Faced by Businesses

Economic Action Plan 2014 announces progress in reducing regulatory irritants to business through the Red Tape Reduction Action Plan.

Economic Action Plan 2013 confirmed the Government’s ongoing commitment to eliminating unnecessary red tape from Canada’s regulatory system, while maintaining high standards for safety and protection. The One-for-One Rule and other Red Tape Reduction Action Plan reforms are bringing a new level of discipline to how the Government regulates and creates a more predictable environment for businesses.

The 2012–2013 Scorecard Report: Implementing the Red Tape Reduction Action Plan confirms the Government has made tangible progress in cutting red tape for Canadians and businesses. For example:

- The One-for-One Rule controls the administrative burden on business. Under the Rule, regulators must remove a regulation each time they introduce a new regulation that imposes administrative burden on business.

- As of December 2013, under the Rule, the Government had reduced the administrative burden by almost $20 million and achieved a net reduction of 19 regulations. This represents 98,000 hours in time saved for business annually.

- Service standards for 24 high-volume regulatory authorizations have been created, covering more than 60,000 transactions with businesses each year.

- The Government has also made the regulatory system more predictable, with 32 forward regulatory plans now posted on the Web, containing more than 400 regulatory changes.

Over the next year, the Government will continue its ambitious approach to reducing red tape through a combination of system-wide reforms and targeted action on issues that frustrate businesses, stifle innovation and restrict investment. This includes completing the Administrative Burden Baseline Initiative to count the number of federal regulatory requirements on business. The Government is also following through on its commitment to legislate the One-for-One Rule; Canada has become the first country to introduce legislation for such a rule.

Reducing the Tax Compliance Burden

Reducing the tax compliance burden has been a significant pillar of the Government’s broader initiative to eliminate unnecessary red tape. A PricewaterhouseCoopers study analyzing the ease of paying taxes in 189 countries, Paying Taxes 2014, found that a business in Canada takes 25 per cent less time than a business in the United States to prepare, file and pay its taxes each year. Indeed, according to the study, Canada is the only G-7 country to rank among the top 10 countries based on the overall ease of complying with tax obligations.

- The Canada-Ontario Tax Collection Agreement has been amended to provide for federal administration of Ontario’s corporate taxes for taxation years that end after 2008. PricewaterhouseCoopers estimates that this change is reducing compliance costs by more than $135 million annually for Ontario businesses, by allowing for a single annual tax form, a single tax collector and one set of income tax rules.

- The frequency of tax remittances and filings for small businesses in the areas of income taxes, source deductions and sales taxes has been reduced by measures introduced in Budget 2007. These measures continue to reduce the paperwork burden, with roughly 900,000 small employers and businesses no longer required to make an estimated 7.6 million filings and remittances annually.

The Government is continuing to reduce the tax compliance burden through new actions in Economic Action Plan 2014.

Revising Remittance Thresholds for Employer Source Deductions

Economic Action Plan 2014 proposes to reduce the maximum number of required payments on account of source deductions for more than 50,000 employers.

Throughout the taxation year, businesses are required to withhold from employee wages amounts in respect of personal income tax, and the employee portions of Canada Pension Plan (CPP) contributions and Employment Insurance (EI) premiums; businesses then remit these withholdings to the Government, along with the employer portion of CPP contributions and EI premiums.

The frequency of remittances can be onerous for small business owners, especially those that have to remit on a frequent basis.

In order to make it easier for businesses to prepare, file and pay taxes, Economic Action Plan 2014 proposes to reduce the maximum number of payments that businesses have to prepare and submit to the Canada Revenue Agency. The following changes in the frequency of employers’ remittance of source deductions are proposed:

- Increase to $25,000 from $15,000 the threshold level of average monthly withholdings at which employers are required to remit up to two times per month.

- Increase to $100,000 from $50,000 the threshold level of average monthly withholdings at which employers are required to remit up to four times per month.

The proposed changes will mean that over 50,000 small and medium-sized employers will see their maximum number of required payments on account of source deductions cut in half, eliminating the requirement for more than 800,000 payments.

While these changes to thresholds will not affect the overall amount of tax revenues, it is estimated that changes in the timing of remittances will increase public debt charges by $20 million over the 2014–15 to 2015–16 period. These changes will apply in respect of amounts withheld after December 31, 2014.

Creating a New Capital Cost Allowance Class for Eligible Capital Property

Economic Action Plan 2014 announces a public consultation on a measure that would simplify tax compliance for more than 60,000 businesses by replacing the complex eligible capital property rules with a new class of depreciable property.

Eligible capital property for income tax purposes includes intangible property such as goodwill and licences, franchises and quotas of indeterminate duration, as well as certain other rights. The tax rules for the depreciation and recognition of gains on eligible capital property are similar to but separate from the rules for depreciable property.

Over the years, many stakeholders have commented on the unnecessary complexity of the eligible capital property rules. Some stakeholders, including the Chartered Professional Accountants of Canada, have recommended that the Income Tax Act be simplified by replacing the eligible capital property rules with a new class of depreciable property.

As part of the Government’s ongoing tax simplification initiatives to reduce the tax compliance costs of businesses, the Government will be consulting on a measure that would replace the eligible capital property rules with a new class of depreciable property. The Government is interested in receiving feedback on the impact of the current rules on small businesses and how the transition could be implemented with the least complexity for small businesses. Detailed legislation and explanatory notes will be released for public consultation. The replacement of the eligible capital property rules with a new class of depreciable property would simplify tax compliance for the more than 60,000 businesses that invest in these types of assets each year.

Streamlining the Application and Notice Process for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) Credit

Economic Action Plan 2014 proposes to simplify tax filing for individuals by eliminating the requirement to apply for the GST/HST Credit.

A simplified, streamlined tax system helps reduce the tax filing burden for taxpayers and helps minimize costs for the Canada Revenue Agency (CRA) as the administrator of Canada’s tax system. The Government is proposing to eliminate the need for individuals to apply for the GST/HST Credit, and to allow the CRA to automatically determine if an individual is eligible to receive the credit. In addition to simplifying tax filing for individuals, this measure will eliminate the need for the CRA to issue notices each year to about 2 million applicants who do not qualify for the credit.

Additional Measures to Reduce the Tax Compliance Burden

Economic Action Plan 2014 also includes the following actions to reduce the tax compliance burden on businesses and charities:

- Joint Ventures—To provide more joint venture participants with access to the GST/HST joint venture election, which simplifies tax compliance, the Government proposes to consult with stakeholders on measures to allow joint venture participants who are engaged exclusively in commercial activities to make the election.

- Corporate Reorganizations—To facilitate corporate reorganizations, the Government proposes to simplify compliance in terms of accounting and reporting of GST/HST for transfers of business assets by one member of a closely related group of corporations and/or partnerships to a new member of that group.

- Charities—To reduce the administrative burden on charities, the Government will modernize the CRA’s information technology systems to permit electronic filing. Enabling charities to apply for registration and file their annual information returns electronically will reduce the time it takes charities to meet their compliance obligations under the Income Tax Act and allow them to spend more time on their charitable activities. Additional details are set out in Chapter 3.4.

- Farming and Fishing Businesses—To simplify the tax rules relating to the Lifetime Capital Gains Exemption and the intergenerational rollover for taxpayers who carry on farming and fishing businesses in combination, the Government proposes to generally treat a taxpayer’s combined farming and fishing business the same as separate farming and fishing businesses conducted by the same taxpayer. This will ensure consistent treatment for taxpayers who conduct farming and fishing activities in different legal forms.

Canada Revenue Agency (CRA) Actions That Reduce Red Tape and Improve Services for Businesses

The CRA is committed to easing the administrative and compliance burden for small business. In response to irritants that businesses identified during the Red Tape Reduction Commission’s consultations in 2011, the CRA made a number of commitments, which form the basis of its action plans.

- Provide effective, timely and clear information.

- Improve the online registration process for obtaining a Business Number and enhance identity authentication for secure online services.

- Make the CRA accountable for the written information it provides.

- Improve auditors’ knowledge, training and professionalism.

- Adopt a “Tell us once” approach and improve coordination and collaboration among regulators to eliminate the collection of redundant information.

- Improve timeliness for decisions related to appeals and rulings.

- Address numerous reporting and filing frequency requirements.

- Ensure that business perspectives are fully understood and appreciated in the policy development stage.

In October 2013, the CRA posted its action plans, which form part of the Government of Canada’s Red Tape Reduction Action Plan, on its website.

The CRA has committed to national consultations every two years with small businesses on improving services and reducing red tape. The next consultations will be in the Fall of 2014.

The CRA is moving forward with administrative and service improvements that deliver tangible simplification that tax filers appreciate. As many as 1.1 million small and medium-sized businesses are in a position to take advantage of these new services and improvements.

- Submitting Documents Electronically—In April 2014 the electronic filing service will be expanded to allow the filing of amended T2 corporate returns, and in October 2014 businesses will be able to update their banking and direct deposit information online.

- Authorized Representatives—In April 2014 the ease and timeliness of authorizations will be further improved, as representatives will be able to transmit an electronic authorization request to the CRA, instead of having to submit paper forms.

- Electronic Pre-Authorized Debit Service for Business—In October 2014 business owners registered with My Business Account will be provided with a free online option for paying their taxes. In addition, the CRA will be providing businesses with a detailed payment history for all of their accounts, in one secure and convenient place.

- Business Number—The CRA continues to build partnerships with provincial and municipal governments as the CRA’s Business Number rapidly becomes the common identifier for interactions between all levels of government and businesses. The CRA will be working to improve its online business registration service by removing some restrictions, enhancing authentication and improving the registration process.

- Liaison Officer Initiative—This recently announced pilot project will be focused on improving compliance by providing small and medium-sized enterprises with the information and the support they need, when they most need it. This will help small businesses avoid costly and time-consuming interactions with the CRA—such as requests for additional information, reviews, audits, and reassessments—so that small business owners can focus on growing their businesses.

- Registration of Tax Preparers Program—On January 17, 2014, the Minister of National Revenue launched consultations on a proposal to register tax preparers as part of a CRA initiative to improve voluntary compliance among small and medium-sized businesses. By promoting the filing of complete and accurate returns, the need for time-consuming and costly exchanges of information can be minimized.

Greater Transparency for Taxpayers

Economic Action Plan 2014 announces that legislation will be introduced to require the Minister of Finance to table in Parliament annually a list of the Government’s outstanding tax measures.

The Government is committed to maintaining a modern and efficient tax system. Part of doing so means frequently updating tax legislation. To make it easier for taxpayers to know the status of proposed tax measures, Economic Action Plan 2014 announces that legislation will be introduced to require the Minister of Finance to table in Parliament annually a list of the Government’s outstanding tax measures. To ensure that the list reflects any current government’s legislative agenda, the first report of each new government would be tabled in the second year of its mandate.

This measure is consistent with the objectives of Bill C-549, which was introduced in the House of Commons on November 13, 2013 by the Member of Parliament for Tobique-Mactaquac, Mike Allen. The Government thanks Mr. Allen for championing this initiative in support of greater transparency in the tax system.

Fostering Trade and Canadian Entrepreneurship

International trade and investment are important contributors to Canadian prosperity. Canadian firms access foreign markets to increase sales, and rely on global supply chains to maintain their competitiveness. Canadian consumers benefit from international trade through increased choice and lower prices. Consumers and businesses also benefit from a strong and integrated domestic market, where goods and services move freely across provincial and territorial boundaries. The Government is committed to making continued progress in all of these areas, including through new actions in Economic Action Plan 2014.

Canada’s Trade Agenda

The Government is focused on creating new jobs and new opportunities for Canadians. That is why the Government has worked to strengthen and expand Canada’s trade relationships abroad, foster a business environment that attracts foreign investment, and diversify our trade portfolio to include large and fast growing economies. In short, ensuring Canadian businesses and investors have the market access they need is a Government priority

Canada recently achieved one of its most ambitious commercial initiatives in our country’s history. On October 18, 2013, Prime Minister Stephen Harper announced that Canada and the European Union had reached an agreement in principle on a Comprehensive Economic and Trade Agreement. The agreement will unlock opportunities across all manufacturing, agriculture and service sectors in a market of 500 million consumers with a gross domestic product (GDP) of almost $17 trillion. Once in force, it will make Canada one of only a few advanced countries to have preferential access to the world’s two largest markets—the European Union and the United States.

Also in 2013, Canada brought into force the Canada-Panama Free Trade Agreement and signed a free trade agreement with Honduras. Canada also concluded, signed or brought into force 10 foreign investment promotion and protection agreements in 2013, more than any other year. These agreements will provide a more transparent and predictable climate for Canadian investors.

On November 27, 2013, the Government released its new Global Markets Action Plan, a refreshed strategy for creating jobs and opportunities for Canadians through trade and investment. The Plan is based on extensive, cross-country consultations with stakeholders in the business community, academia and other levels of government. It reflects the changing global economic landscape, focuses on core Canadian strengths and aligns Canada’s diplomatic resources to advance the country’s commercial interests in key foreign markets. The Plan will target emerging and established markets with broad Canadian interests, as well as emerging markets with specific opportunities for Canadian businesses. Three-year market access plans for each of these priority markets will be developed, implemented and updated regularly, mobilizing partnerships across governments and the private sector to make the pursuit of Canada’s commercial interests a truly coordinated national effort.

The Asia-Pacific region includes many of the world’s fastest growing economies. Looking forward, the Government is working on major new bilateral free trade deals with Korea, Japan and India, and is working to conclude negotiations on the Trans-Pacific Partnership (TPP), a market with nearly 800 million people and a combined GDP of $27.8 trillion. The TPP is an ambitious plurilateral trade agreement involving 12 countries in the Asia-Pacific region, which would link American and Asian markets and value chains and generate significant, broad-based benefits across all sectors and regions of Canada. The TPP would be Canada’s first agreement that includes its North American Free Trade Agreement partners, the United States and Mexico, and is critical to enhancing North American production linkages and growing Canada’s trade with Asia, both directly and indirectly.

Canada will also benefit from successful negotiations on the World Trade Organization (WTO) “Bali Package.” This package includes the WTO Trade Facilitation Agreement, the first multilateral trade agreement concluded since the establishment of the WTO in 1995, and will reduce customs-related red tape around the globe for Canadian businesses.

Canada-United States Beyond the Border Action Plan and Regulatory Cooperation Council Action Plan

Canada and the United States have the largest bilateral trading relationship in the world, with annual two-way trade in goods and services of over $700 billion. The Beyond the Border Action Plan and the Regulatory Cooperation Council Action Planannounced by Prime Minister Stephen Harper and U.S. President Barack Obama promote a joint approach to perimeter security, regulatory alignment and economic competitiveness.

Beyond the Border Action Plan

Over the past year, significant progress has been made across all areas of work under the Beyond the Border Action Plan. Benefits are emerging for citizens, travellers and businesses in both countries as we work together. Among the key accomplishments, Canada and the U.S.:

- Increased membership in the NEXUS trusted traveller program to more than 917,000, a 50-per-cent increase since the Beyond the Border Action Plan was announced, and provided members with additional time-saving benefits, including eight additional NEXUS lanes at land border crossings.

- Successfully implemented Phase I of the truck cargo pre-inspection pilot at Pacific Highway, British Columbia, in which U.S. officials pre-inspected approximately 3,500 U.S.-bound commercial trucks.

- Increased and harmonized the threshold value for low-value commercial shipments, providing access to expedited customs clearance for 1.5 million additional shipments annually into Canada, and reducing transaction costs for industry.

- Launched Phase II of the joint Entry/Exit program at the common land border whereby the record of entry into one country is securely shared and becomes the record of exit from the other country for all travellers who are neither citizens of Canada nor of the United States, thereby enhancing the integrity of our immigration systems.

- Released the first joint Border Infrastructure Investment Plan and confirmed Canadian border expansion projects at North Portal, Saskatchewan ($10 million); Emerson, Manitoba ($10 million); Lansdowne, Ontario ($60 million); and Lacolle, Quebec ($47 million).

Both countries remain committed to implementing this long-term initiative, which will further strengthen the Canada-U.S. partnership, and will continue to work closely with stakeholders to allow for regular and extensive consultations as implementation continues.

Regulatory Cooperation Council Action Plan

Broad progress has been made in implementing commitments from the Canada-U.S. 2011 Regulatory Cooperation Council Action Plan, with initiatives addressing four main regulated sectors: agriculture and food, transportation, health and personal care products, and the environment. Examples of progress include alignment of a number of vehicle safety standards, joint reviews of pesticides and veterinary drugs, use of the Globally Harmonized System of Classification and Labelling of Chemicals and the development of a common electronic submission gateway for pharmaceutical products. The benefits of regulatory alignment are increasingly clear, both for regulated industries (through synchronous product approvals and the elimination of duplicative requirements) and consumers (though greater product availability, lower cost and a more effective regulatory system).

A Canada-U.S. public consultation was undertaken in late 2013, seeking input on the next phase of regulatory cooperation between our two countries. The Government will continue to take action to deepen bilateral cooperation between Canadian and U.S. regulators to reduce duplication, streamline operations and eliminate the burden of unnecessary requirements on stakeholders. This will include changes to Canada’s regulatory processes to help synchronize the adoption of technical regulations in areas where Canada and the U.S. have similar policy objectives.

With strong support from industry stakeholders in the chemical, petroleum and mining sectors, Economic Action Plan 2014 will introduce amendments to the Hazardous Products Act and other consequential amendments to align and synchronize implementation of common classification and labelling requirements for workplace hazardous chemicals. This measure will facilitate international trade, reduce costs to businesses and consumers and enhance worker health and safety through improved and consistent hazard identification, which will provide a net benefit for Canadians of nearly $400 million in increased productivity and decreased health and safety costs.

Windsor-Detroit International Crossing

Economic Action Plan 2014 proposes to provide $470 million over two years on a cash basis for a new Windsor-Detroit International Crossing.

The Windsor-Detroit trade corridor is the most important international land crossing in North America, handling 30 per cent of Canada-U.S. trade carried by truck. In 2012, approximately 2.5 million trucks carrying over $100 billion in trade used this corridor. The Government has been working towards building a new international crossing between Windsor, Ontario and Detroit, Michigan, in recognition that an efficient and secure corridor is essential to the competitiveness of the manufacturing sector, and Canada’s economy more broadly.

The Government has made progress in advancing the construction of the new bridge, including concluding a governance agreement with the State of Michigan and obtaining a Presidential Permit from the United States Government to proceed with construction on the American side of the crossing.

The Government is providing $631 million over two years on a cash basis to advance the construction of the new crossing, of which Economic Action Plan 2014 proposes to provide $470 million over two years on a cash basis to support necessary procurement and project delivery activities.

This project will be undertaken as a public-private partnership, to allow the Government to leverage the expertise and innovation of the private sector to deliver this complex project on time and on budget.

Extension of the Softwood Lumber Agreement

The Canada-U.S. Softwood Lumber Agreement has ensured stable and fair market access to the United States for Canadian softwood lumber producers. The Agreement protects the ability of provinces to manage their forest resources and provides for independent and impartial rulings on matters relating to softwood lumber trade. In 2012, the Government announced an extension of the Agreement until October 2015, in order to continue to minimize trade disruptions for Canadian producers. The Agreement will be supported by a federal-provincial administrative arrangement that is aligned with the mutually agreed objective of cost recovery for services provided.

Strengthening Canada’s Intellectual Property Regime

Economic Action Plan 2014 proposes to modernize Canada’s intellectual property framework to better align it with international practices.

Canada’s existing framework for protecting intellectual property is not aligned with international practices, creating unnecessary costs for our innovative businesses. Harmonizing Canada’s intellectual property regime with international norms will help Canada’s innovative businesses access international markets, lower costs and draw foreign investment to Canada by reducing the regulatory burden and red tape faced by businesses.

Economic Action Plan 2014 proposes to modernize Canada’s intellectual property framework by ratifying or acceding to the following widely recognized international treaties: the Madrid Protocol, the Singapore Treaty, the Nice Agreement, the Patent Law Treaty and the Hague Agreement. The Government has tabled these treaties in Parliament and will propose the required legislative amendments to the Patent Act, the Trade-marks Act and the Industrial Design Act. The benefits expected for Canadian businesses from these reforms are significant. For example, accession to the trade-mark treaties will make it possible for a company to obtain protection for trade-marks in a number of countries through a single international application filed in one language, in one currency, with the International Bureau of the World Intellectual Property Organization, reducing paperwork and business costs.

Amendments will also be introduced to the Trade-marks Act to establish that the responsibilities of the Commissioner of Patents and Registrar of Trade-marks reside with a single individual.

Enhancing Consumer Awareness of Canadian-Made Products

Economic Action Plan 2014 announces that a private sector steering committee will be established to lead the development of a “Made-in-Canada” consumer awareness campaign.

The quality of Canadian products is recognized across the country and around the world. Branding products “Made in Canada” is a potentially powerful tool to encourage consumers—both in Canada and internationally —to choose such products. While other countries such as Australia have capitalized on their national brand as a competitive advantage, no widely recognized Canadian branding exists.

To help address the interests of consumers and highlight the quality and range of Canadian products, as we compete in more diverse export markets, the Government will undertake consultations with the private sector to develop a “Made-in-Canada” branding campaign. A private sector steering committee will be established to lead this initiative. Additional details will be announced in the coming months.

The Australian Made campaign was launched in 1986 and is currently overseen by the Australian Made Campaign Limited (AMCL). In addition to managing the Australian Made logo, the AMCL hosts a website that markets participating products and presents Australian companies’ profiles. Approximately 1,700 Australian companies currently use the logo on over 10,000 products.

Reducing Barriers to Internal Trade

Economic Action Plan 2014 makes a number of commitments to strengthen the Canadian economic union to the benefit of consumers and businesses.

The Government has made significant progress opening international markets to Canadian businesses, but more must be done within our own borders to ensure the free movement of goods and services across provincial and territorial boundaries. It should not be more difficult to conduct trade within Canada than it is to trade with other countries. These unnecessary barriers cost jobs, impede growth and inconvenience Canadians. For example, small business registration requirements vary from province to province. This creates a hurdle for firms to grow beyond their home province and seize opportunities in other parts of Canada. The need for small business to respond to these inconsistencies costs our economy and hurts job creation.

In June 2013, the Government convened a conference on the Agreement on Internal Trade involving over 100 leaders from the public, private, labour and academic sectors to explore the obstacles to internal trade and potential solutions. Key findings and recommendations emerging from this conference were presented by Canada’s Public Policy Forum in Canada’s Evolving Internal Market—An Agenda for a More Cohesive Economic Union, released in January 2014.

Engagement With Provinces and Territories

The New West Partnership Trade Agreement, an agreement among British Columbia, Alberta and Saskatchewan, has proved that cooperation among jurisdictions can result in the elimination of growth-limiting barriers. The Government fully supports the use of such agreements among willing partners to make improvements within the domestic economy and applauds those provincial governments for their leadership in this area.

The Minister of Industry has challenged his provincial and territorial colleagues to come together this Spring to discuss ambitious approaches to advance internal trade, and to each bring forward three specific actions they could enact to advance internal trade in Canada.

In January 2014, Canada’s Public Policy Forum released a report highlighting the key findings of the Symposium on the Agreement on Internal Trade (AIT), a multi-stakeholder conference convened by the Government of Canada in June 2013 to explore opportunities to advance internal trade. Overall, the Forum noted significant challenges and limited progress, and made the following recommendations:

- A key challenge in strengthening internal trade is that governments and stakeholders are unable to gauge the economic impact of barriers due to a lack of data and research. It was recommended that understanding of internal trade barriers be increased by developing a knowledge base of existing trade barriers in order to assess their economic impacts and plan for their removal.

- Engage all AIT parties in the pursuit of an ambitious and inclusive work plan outlining a common approach to improving internal trade and ensuring that Ministers responsible for internal trade remain proactive and commit to this important priority.

- Implement changes to the governance of the AIT to increase its scope to all economic sectors unless explicitly excluded by parties, strengthen the ability of parties to advance ambitious initiatives, and become more inclusive of non-government stakeholders.

- Advance regulatory alignment initiatives and reduce the reporting burden associated with regulation and corporate registration.

Identifying Priority Areas for Action on Internal Trade

To better identify measures currently restricting trade and enhance the understanding of their impact, the Government will work to develop an Internal Trade Barriers Index, modelled on the Services Trade Restrictiveness Index of the Organisation for Economic Co-operation and Development. The Index will play a key role in identifying measures that currently restrict trade and in helping all jurisdictions focus reforms and negotiation efforts on priority areas.

In addition, the Government will explore opportunities to work with willing jurisdictions through initiatives such as BizPaL, the online portal for federal, provincial, territorial and municipal permits and licences, to make it easier for Canadian businesses to operate anywhere across the country.

Removing Barriers to the Movement of Goods Within Canada

As indicated in the 2013 Speech from the Throne, the Government will also take action within its jurisdiction to strengthen internal trade by introducing further amendments to the Importation of Intoxicating Liquors Act to allow Canadians to take beer and spirits, in addition to wine, across provincial boundaries for their personal use.

These amendments will build on the work of the Member of Parliament for Okanagan–Coquihalla Dan Albas and his Private Member’s Bill (Bill C-311), recently adopted by Parliament, which removes the federal restrictions prohibiting individuals from moving wine from one province to another for personal use.

The Government will continue to pursue opportunities to revitalize the Agreement on Internal Trade in collaboration with provinces and territories, in order to strengthen the internal market for the benefit of Canadian businesses and consumers.

Since 2006, the Government has advanced a number of initiatives to enable the seamless movement of people, goods, services and investment across Canada. For example the Government has:

- Enhanced the mobility of apprentices by working with provinces to harmonize requirements for and examine the use of practical tests as a method of assessment.

- Streamlined and harmonized permit and licence requirements, through the expansion and upgrade of BizPaL.

- Streamlined the regulatory review process for major natural resource projects by creating the Major Projects Management Office and the Northern Projects Management Office, and by addressing the complexity and regulatory overlap that have caused delays and uncertainty in the development of resource projects.

- Advanced initiatives to improve the seamlessness of Canadian financial markets and services including the work towards establishing a cooperative capital markets regulatory system with willing provinces and territories.

Supporting Advanced Research and Innovation

The development of new ideas and new products is key to Canada’s future prosperity—it fuels the growth of small and large businesses and drives productivity improvements that raise the standard of living of Canadians. Canada remains the G-7 leader in research and development (R&D) expenditures in the higher education sector as a share of the economy.

The Government plays an important role in Canada’s science, technology and innovation system. Since 2006, the Government has provided more than $11 billion in new resources to support basic and applied research, talent development, research infrastructure, and innovative activities in the private sector, including more effectively aligning federal support for research with business needs.

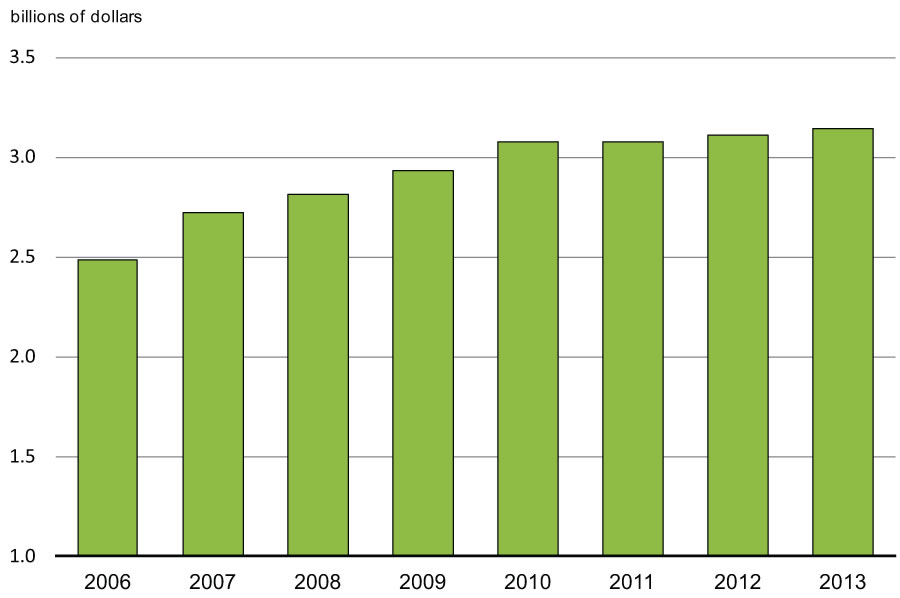

To be successful in the highly competitive global economy, Canada must continue to improve its approach for developing high-quality, talented people, performing world-leading research and generating new breakthrough ideas. The Government has increased support for these activities in each year since 2006, including through the recession, as illustrated in Chart 3.2.5. In 2013, this support exceeded $3 billion for research in the post-secondary education sector alone.

Canadian businesses will also need to better harness innovation and translate knowledge into marketable products and services to make competitive gains and create high-quality, value-added jobs. To sharpen the focus and improve the impact of federal investments in Canada’s science, technology and innovation system, the Government has recently completed consultations on an updated Science, Technology and Innovation Strategy, and will release the updated Strategy later this year.

Economic Action Plan 2014 reinforces Canada’s economic strength with new support for research and innovation totalling more than $1.6 billion over the next five years. This includes the largest annual increase in research support through the granting councils in over a decade when fully phased in, providing stable and predictable funding for leading-edge research, including discovery research funded through core granting council programming. Economic Action Plan 2014 also takes steps to foster social innovation through projects at colleges and polytechnics, and support the translation of knowledge into new business opportunities that benefit Canadians. The Government is also taking action to ensure that its defence spending supports high-quality jobs and business opportunities in Canada.

Securing International Leadership in Science and Innovation

Economic Action Plan 2014 proposes to create the Canada First Research Excellence Fund with $1.5 billion in funding over the next decade to help Canadian post-secondary institutions excel globally in research areas that create long-term economic advantages for Canada.

Federal investments in research and development have contributed significantly to Canada’s strong performance in the fields of science and technology. But Canada cannot be complacent, as Canadian post-secondary institutions face significant competition from their counterparts in other countries for the best minds, partnership opportunities and breakthrough discoveries. Canada’s ability to attract top research talent, innovators and enterprises requires its world-class institutions to be able to seize emerging opportunities and strategically advance their greatest strengths on the global stage.

Economic Action Plan 2014 proposes to create the Canada First Research Excellence Fund, which will help Canadian post-secondary research institutions leverage their key strengths into world-leading capabilities that will generate benefits for Canadians. Economic Action Plan 2014 proposes to provide the Canada First Research Excellence Fund with $50 million in 2015–16, growing to $100 million in 2016–17, $150 million in 2017–18, and reaching a steady-state level of $200 million annually in 2018–19 and beyond. Within the next decade, the Canada First Research Excellence Fund will provide an additional $1.5 billion to advance the global research leadership of Canadian institutions.

The Canada First Research Excellence Fund will position Canada’s post-secondary institutions to compete with the best in the world for talent and breakthrough discoveries, creating long-term economic advantages for Canada. The Canada First Research Excellence Fund, administered by the Social Sciences and Humanities Research Council on behalf of all the granting councils, will be available to all post-secondary institutions on a competitive, peer-reviewed basis. Further details on this initiative will be made available later this year.

Supporting Leading-Edge Research Through the Granting Councils

Economic Action Plan 2014 proposes to provide an additional $46 million per year on an ongoing basis to the granting councils in support of advanced research and scientific discoveries, including the indirect costs of research.

Research undertaken at Canadian universities, colleges and other institutions has advanced scientific and social understanding. The creation of knowledge, application of scientific discoveries and development of highly qualified people bring social and economic benefits to all Canadians.

Economic Action Plan 2014 proposes to provide an additional $46 million per year, starting in 2014–15 and on an ongoing basis, to the granting councils in support of advanced research and scientific discoveries. The new resources are allocated as follows:

- $15 million per year to the Canadian Institutes of Health Research, for the expansion of the Strategy for Patient-Oriented Research, the creation of the Canadian Consortium on Neurodegeneration in Aging and other health research priorities.

- $15 million per year to the Natural Sciences and Engineering Research Council, to support advanced research in the natural sciences and engineering.

- $7 million per year for the Social Sciences and Humanities Research Council, to support advanced research in the social sciences and humanities.

- $9 million per year for the Indirect Costs Program.

Funding for the creation of the Canadian Consortium on Neurodegeneration in Aging in Economic Action Plan 2014 implements the 2013 Speech from the Throne commitment to renew investments in health research to tackle the growing onset of dementia and related illnesses. With this initiative, Canada is joining forces with its G-8 counterparts to support additional research with a view to finding a cure for dementia by 2025.

The impacts of dementia on individuals, care-givers, families, and national economies are significant, and are only expected to intensify. By 2031, it's estimated that 1.4 million Canadians will have dementia, costing the Canadian economy nearly $300 billion. The Government of Canada is concerned about rising rates of dementia and is taking action.

—The Honourable Rona Ambrose, Minister of Health

G-8 London Summit, December 11, 2013

The new resources for the Indirect Costs Program will build on its current $332-million annual budget, which supports indirect costs associated with federally sponsored research such as the renovation and maintenance of research facilities, resources for libraries, information technology, management of intellectual property and knowledge transfer activities. Since 2006, the Government has increased support for the indirect costs of research by over 25 per cent. The Government will continue to work with the post-secondary sector, including the Association of Universities and Colleges of Canada, to improve the results, awareness and performance measurement of these vital investments.

These measures will augment the granting councils’ current combined base budgets of about $2.7 billion per year. The granting councils have received new support in every year since 2006.

Enhancing Industry-Relevant Research Training

Economic Action Plan 2014 proposes to provide $8 million over two years to Mitacs to expand its support for industrial research and training of postdoctoral fellows.

Mitacs is a leader in facilitating industry-academic research collaborations that help to prepare talented graduate students and postdoctoral fellows to become the next generation of innovators and research and development (R&D) managers. Mitacs’ programming includes the Elevate initiative, which provides postdoctoral fellows with industry-relevant research experience and training. This type of training helps ensure that Canadian businesses have a highly qualified pool of managers to lead R&D activities and increase productivity. This kind of investment in training is key to job creation and economic growth and will help address an acute shortage of skills challenging the growth of Canadian businesses.

Economic Action Plan 2014 proposes to provide $8 million over two years to Mitacs in order to expand its Elevate program. Going forward, Mitacs will become the single delivery agent of federal support for postdoctoral industrial R&D fellowships, as the Natural Sciences and Engineering Research Council’s Industrial R&D Fellowships program will be wound down with its resources redeployed to other priorities within the Council, including basic discovery research. This consolidation of offerings is consistent with the Government’s intent to streamline programs with similar objectives in order to reduce duplication and scale up the most successful approaches, in line with the recommendations of the Expert Panel Review of Federal Support to Research and Development.

Federal funding for Mitacs programs will also be made available to eligible not-for-profit organizations with an economic orientation, in addition to currently eligible industrial partners.

Mitacs is a leader in creating linkages between industry and talented graduate students and postdoctoral fellows, helping to develop the pool of innovators and managers needed by Canada’s innovative companies. Its success stories include:

- Enhanced data analytics in support of better logistics—BMI Technologies manufactures onboard sensor systems tracking the usage of forklifts. The company has involved a multidisciplinary team of five Mitacs interns to help improve the technology allowing for automatic data analysis across a large fleet of vehicles, which would link to a centralized monitoring system. Advances are helping the company create more efficient maintenance schedules, minimizing downtime for its vehicles.

- Assessing the cognitive processes involved in gaming—In partnership with Ubisoft Québec, a postdoctoral fellow in psychology at Université Laval has examined whether the analysis of eye movements during videogames can assess cognitive processes in the game and augment usual testing methods. The pattern of results showed a relationship between game outcome and the player’s eye movement.

Fostering Social Innovation Through Research at Colleges and Polytechnics

Economic Action Plan 2014 proposes to provide $10 million over two years in support of social innovation research projects at colleges and polytechnics.

Canadians benefit when community organizations are equipped with better tools and approaches for addressing society’s needs in areas such as education, integration of vulnerable populations and community development. Colleges and polytechnics play an important role in this regard, given their strong linkages with communities across Canada. Economic Action Plan 2014 proposes to provide $10 million over two years, starting in 2014–15, for a pilot initiative to connect the talent, facilities and capabilities of Canada’s colleges and polytechnics with the research needs of local community organizations. This funding will be administered by the Social Sciences and Humanities Research Council.

Enabling World-Class Physics Research

Economic Action Plan 2014 proposes to provide $222 million over five years, starting in 2015–16, to the TRIUMF physics laboratory to support the facility’s world-leading research and international partnership activities.

The TRIUMF facility in British Columbia is Canada’s premier physics laboratory and is home to the world’s largest cyclotron particle accelerator. The facility brings together leading scientists, postdoctoral fellows and graduate students from across Canada through a unique 18-member university alliance, and connects these talented individuals with leading counterparts from around the world to explore the fundamental structure and origins of matter. Through TRIUMF’s ambitious international partnerships, Canadian researchers have been at the centre of some of the most important international research projects, most recently making critical contributions to the discovery of the Higgs boson particle at the Large Hadron Collider at the European Organization for Nuclear Research.

TRIUMF has also forged highly successful partnerships with industry leaders in order to commercialize its scientific breakthroughs, and is recognized globally for its innovative work in the production of medical isotopes used for treating thyroid, breast and other cancers. It has helped to launch several spin-off companies and accelerate the growth of existing firms by sharing expertise, laboratory and research space, and jointly developing leading-edge research equipment.

Economic Action Plan 2014 proposes to provide $126 million over five years, beginning in 2015–16, to further support the world-leading research taking place at TRIUMF. Combined with an additional $96 million from the existing resources of the National Research Council, federal support for TRIUMF’s core operations will total $222 million over this five-year period.

TRIUMF works with industry partners to commercialize its scientific breakthroughs and has helped to launch spin-off companies and accelerate the growth of existing businesses. Its partners include:

- Particle accelerator equipment developer IKOMED Technologies, which has recently demonstrated its patented technology and secured private sector financing to expand its product offerings. The company has signed an agreement with GE Healthcare to manufacture a product that is expected to result in the creation of new high-value jobs.

- D-Pace, a provider of state-of-the-art engineering products and services for the particle accelerator industry, which has doubled its revenues in each of the past four years, increased its employment base and expanded its customer portfolio internationally as a result of its research and licensing partnerships with TRIUMF.

Supporting Atomic Energy of Canada Limited

Economic Action Plan 2014 proposes to provide $117 million over two years for Atomic Energy of Canada Limited to maintain safe and reliable operations at the Chalk River Laboratories, ensure a secure supply of medical isotopes and prepare for the expected transition of the laboratories to a Government-Owned, Contractor-Operated model.

Atomic Energy of Canada Limited (AECL) is a federal Crown corporation that operates Canada’s largest nuclear science and technology laboratories. AECL develops innovative applications of nuclear technology, with applications ranging from research and development to waste management and decommissioning nuclear facilities. The Government has announced that it is moving forward with the restructuring of AECL’s nuclear laboratories to ensure that their operations are efficient and continue to meet the needs of Canadians. Economic Action Plan 2014 proposes to provide $117 million over two years to AECL to maintain safe and reliable operations at the Chalk River Laboratories, ensure a secure supply of medical isotopes and prepare for the expected transition of the laboratories to a Government-Owned, Contractor-Operated model.

Fostering Canadian Leadership in Quantum Research and Technologies

Economic Action Plan 2014 proposes to provide $15 million over three years, starting in 2014–15, to support the Institute for Quantum Computing’s strategic plan to carry out and commercialize leading-edge research in quantum technologies.

The Institute for Quantum Computing, based at the University of Waterloo, is a leading Canadian research facility that contributes to breakthrough science at the outer limits of knowledge. Quantum computing involves harnessing the laws of quantum mechanics to process information. This capability could bring tremendous opportunity, including in areas such as cryptography and medical diagnostics. Quantum computing could launch new technologies that transform traditional markets, create new industries and generate a wave of leading-edge jobs in the Kitchener-Waterloo Region’s “Quantum Valley.”

To sustain Canada’s leadership position in quantum information research, Economic Action Plan 2014 proposes to provide $15 million over three years, starting in 2014–15, to support the Institute’s strategic plan to carry out and commercialize leading-edge research in quantum technologies. This funding will help the Institute continue to attract world-leading research talent, and increasingly translate new knowledge into innovative quantum technologies for the benefit of all Canadians.

Seizing the Opportunities of Open Data

Economic Action Plan 2014 proposes to provide $3 million over three years to the Canadian Digital Media Network for the creation of the Open Data Institute, through the Federal Economic Development Agency for Southern Ontario.

Data are the 21st century’s new natural resource. A rapidly increasing amount of data is being generated from a multiplicity of sources. Datasets are becoming so vast and diverse that a typical database would be insufficient to capture, store, manage and analyze them. With the rapid advancement of technology, it is now possible to work through such data to identify opportunities for new products and services, or new ways to operate more effectively and efficiently.

The release of information by governments for free use by citizens and businesses, known as Open Data, creates jobs by fuelling creativity, entrepreneurship and innovation. Open Data is a growing international movement. More than 40 countries, from every region of the world and at every stage of development, have established Open Data initiatives. These nations are opening up datasets that can promote economic development, spark innovation and help to find ways to make governments work better.

In Canada, the Government is committed to leading Open Data initiatives focused on stimulating the digital economy with the free flow of useful and usable data. The Government is delivering on its Open Data commitments, outlined in Canada’s Action Plan on Open Government, by:

- Ensuring the continued release of high-value datasets.

- Stimulating the “app” economy by supporting Open Data “appathons.”

- Encouraging the use of Open Data to raise productivity and create new products and services to benefit Canadians.

To help ensure that Canada captures the commercial opportunities presented by Open Data, Economic Action Plan 2014 proposes to provide $3 million over three years, from the existing resources of the Federal Economic Development Agency for Southern Ontario, for the creation of the Open Data Institute, to be based in Waterloo, Ontario. The new Institute will play a role in aggregating large datasets, informing the development of interoperability standards, and catalyzing the development and commercialization of new data-driven apps.

This initiative will be spearheaded by the Canadian Digital Media Network, a federally funded Centre of Excellence for Commercialization and Research, which provides support to Canadian companies and entrepreneurs in the information and communications technology sector and facilitates their collaboration with research institutes, governments and other organizations. The Government’s support will lever additional contributions from the Institute’s other partners, including Desire2Learn, OpenText Corporation, Communitech and the University of Waterloo.

Supporting Innovation in Atlantic Canada

Economic Action Plan 2014 announces the Government’s intention to refocus its Atlantic Canada-based innovation programs.

Encouraging innovation is essential to economic growth and increased productivity in Atlantic Canada. The Government remains committed to supporting innovation and commercialization throughout the region and building on the success of the Atlantic Canada Opportunities Agency’s work with businesses, universities and colleges. Over the next five years, the Atlantic Canada Opportunities Agency will provide approximately $450 million to support innovation and commercialization under its current suite of programs, including the Atlantic Innovation Fund and the Business Development Program.

Over the coming year, the Government will refocus its innovation programs delivered through the Atlantic Canada Opportunities Agency to ensure that they are responsive to the needs of business, including small and medium-sized enterprises, and that they effectively support the development and commercialization of new ideas, technologies, products and services that lead to strong economic growth.

Securing a Competitive and Innovative Automotive Sector

Economic Action Plan 2014 proposes to provide an additional $500 million over two years to the Automotive Innovation Fund, to support significant new strategic research and development projects and long-term investments in the Canadian automotive sector.

The automotive industry is among Canada’s leading employers and exporters, and is a key contributor to our economy. It represented 10 per cent of manufacturing GDP and 14 per cent of total merchandise exports in 2012. The sector also directly employs more than 115,000 Canadians in Southern Ontario and across Canada from automotive assembly to parts production.

The Automotive Innovation Fund (AIF) provides repayable contributions to automotive firms that are undertaking strategic, large-scale research and development projects focused on new vehicle technologies. Established in Budget 2008, the AIF has provided commitments totalling up to $316 million to six projects involving automotive assemblers and parts makers. This funding has leveraged commitments of up to $2.3 billion in private sector investments.

In order to attract major investment projects, such as new global platforms, and secure Canada’s automotive footprint, Economic Action Plan 2014 proposes to provide an additional $500 million over two years to the AIF. This new funding will support private sector investment in the long-term competitiveness of the Canadian automotive sector and create and sustain jobs and economic growth.

Defence Procurement Strategy

The Government is implementing the Defence Procurement Strategy to ensure defence procurement generates economic benefits and jobs for Canadians.

The Government recognizes the importance of building a stronger and more competitive defence sector that is better able to develop innovative products and solutions, deliver high-value exports and create high-paying jobs for Canadians.

The Defence Procurement Strategy has three key objectives: delivering the right equipment to the Canadian Armed Forces in a timely manner; improving the economic outcomes of defence procurement in terms of high-quality jobs for Canadians and exports for Canadian firms; and streamlining decision-making processes.

The Defence Procurement Strategy will ensure early and continuous engagement with industry in the procurement process, including through the publication of an annual Defence Acquisitions Guide that outlines Canada’s defence procurement priorities. The Strategy will also require a value proposition for each major procurement that will specify how it will support key industrial capabilities and increase the competitiveness of Canadian firms in the global marketplace.

The Defence Procurement Strategy is based on the 2013 report by Mr. Tom Jenkins, Canada First: Leveraging Defence Procurement Through Key Industrial Capabilities, and was developed in collaboration with the Canadian Association of Defence and Security Industries and the Aerospace Industries Association of Canada. The Government’s new approach to defence procurement will help create jobs, build industrial capacity, encourage innovation, promote export opportunities and drive economic growth in Canada.

Promoting Canada’s Financial Sector Advantage

Canadians benefit from a strong and healthy financial sector. The sector plays a fundamental role transforming savings into productive investment in the economy, facilitating the efficient management of risk, and providing the payments infrastructure necessary for the exchange of goods, services and financial assets. Canada’s financial system is widely considered one of the most resilient and best regulated in the world. For the sixth year in a row, the World Economic Forum has recognized our banking system as the soundest in the world. Moreover, 5 Canadian financial institutions were among the top 20 in Bloomberg’s most recent list of the world’s strongest financial institutions (more than any other country).

Since the start of the global financial crisis, the Government has implemented a number of measures to maintain Canada’s financial sector advantage. These measures are designed to reinforce the stability of the sector and encourage competition. Economic Action Plan 2014 proposes new initiatives that will build on Canada’s financial sector advantage.

Reinforcing the Housing Finance Framework

The Government continues to implement measures to increase market discipline in residential lending and reduce taxpayer exposure to the housing sector.

The Government provides taxpayer-backed mortgage insurance and mortgage securitization to ensure that mortgages are readily available to creditworthy Canadians at a reasonable cost. This approach has been working well, largely because the Government has made a number of adjustments in recent years to support the stability of the housing market and the financial system.

The Government continues to adjust the housing finance framework to restrain the growth of taxpayer-backed mortgage insurance and securitization. These measures will support the stability of the housing sector and the financial system by increasing market discipline in mortgage lending. They will also reduce taxpayer exposure to the housing sector without compromising the availability of reasonably priced mortgages.

The measures taken by the Government include:

- The Government has adjusted the rules for government-backed mortgage insurance four times since 2008, including requiring a minimum down payment of 5 per cent and establishing a maximum amortization period of 25 years for mortgages with a down payment of less than 20 per cent.

- For 2014, Canada Mortgage and Housing Corporation (CMHC) will pay guarantee fees to the Receiver General to compensate the Government for mortgage insurance risks. This will align CMHC with guarantee fees paid by private mortgage insurers.

- For 2014, CMHC is reducing its annual issuance of portfolio insurance from $11 billion to $9 billion.

- The Minister of Finance has reduced the amount of new guarantees that CMHC is authorized to provide under its 2014 securitization programs to $80 billion for market National Housing Act Mortgage Backed Securities and to $40 billion for Canada Mortgage Bonds.

- A new legislative framework for covered bonds is now in effect. This framework has created a fully private source of funding using only uninsured mortgages as collateral. It has been recognized internationally for its high standards. Since July 2013, Canadian lenders have successfully issued more than $14 billion in covered bonds in three different currencies.

- The Government has consulted stakeholders and will bring forward measures to implement Economic Action Plan 2013 initiatives to tie portfolio insurance to the use of CMHC securitization vehicles and prohibit the use of government-backed insured mortgages as collateral in securitization vehicles that are not sponsored by CMHC.