Chapter 3.4: Supporting Families and Communities

Table of Contents ![]() Previous

Previous

![]() Next

Next

Highlights

Consumers First

- Encouraging competition and lower prices by introducing legislation to cap wholesale domestic wireless roaming rates and provide telecommunications regulatory bodies with the power to impose monetary penalties on companies that violate regulatory requirements such as the Wireless Code.

- $305 million over five years to extend and enhance broadband internet service for Canadians in rural and Northern communities.

- Introducing legislation to prohibit unjustified cross-border price discrimination to reduce the gap between consumer prices in Canada and the United States.

- $390 million over five years to strengthen Canada’s food safety system.

- Developing a comprehensive financial consumer code.

- Eliminating the practice of pay-to-pay billing.

- Expanding access to basic banking services.

- Launching a review of the Canadian deposit insurance framework to ensure continued protection for the savings of Canadians.

Investing in Families

- $44.9 million over five years to expand the focus of the National Anti-Drug Strategy from illicit drugs to also address prescription drug abuse in Canada.

- Expanding health-related tax relief under the Goods and Services Tax/Harmonized Sales Tax (GST/HST) and income tax systems to better reflect the health care needs of Canadians.

- Enhancing access to Employment Insurance sickness benefits for claimants who receive Parents of Critically Ill Children and Compassionate Care benefits.

- Increasing the maximum amount of the Adoption Expense Tax Credit to help make adoption more affordable for Canadian families.

- An additional $5 million per year for the New Horizons for Seniors Program to support additional community projects that benefit seniors.

- Restoring the effectiveness of the excise duty on tobacco products in support of the Government’s commitment to reducing tobacco consumption.

- $91.7 million over five years to enhance the RCMP’s ability to combat contraband tobacco.

Investing in Stronger Communities

- Introducing measures that will further reduce the administrative burden on charities, encourage charitable giving and allow charities to use modern electronic tools.

- $105 million per year in support of culture-related programs, $9 million per year for the Canada Book Fund and $8.8 million per year for the Canada Music Fund.

- $10.8 million over four years to support the efforts of Special Olympics Canada.

- Proposing changes to the Public Service Employment Act and the Public Service Employment Regulations to enhance employment opportunities in the federal public service for veterans.

- Supporting the implementation of the Canadian Victims Bill of Rights.

- Committing $8.1 million to create a DNA-based Missing Persons Index to match DNA from missing persons and unidentified remains to the National DNA Data Bank.

- $25 million over five years to continue efforts to reduce violence against Aboriginal women and girls.

- Introducing a Search and Rescue Volunteers Tax Credit for search and rescue volunteers who perform at least 200 hours of service during the year.

- $200 million over five years to establish a National Disaster Mitigation Program; $40 million over five years for disaster mitigation in First Nations communities; and $11.4 million over five years on a cash basis to upgrade the earthquake monitoring system to incorporate more advanced technologies that provide timely public alerts in high-risk and urban areas.

- $323.4 million over two years to continue the First Nations Water and Wastewater Action Plan.

Supporting Families and Communities

Economic Action Plan 2014 builds on previous actions by the Government to support families and communities, improving the quality of life for hard-working Canadian families.

Economic Action Plan 2014 supports Canadian families by advancing the Government’s Consumers First Agenda, supporting competition in the wireless sector, better protecting financial consumers, keeping taxes low, encouraging inclusive communities, and providing further tax recognition of the costs of adopting a child and health-related expenses.

In addition, Economic Action Plan 2014 helps communities by taking additional steps to support the charitable sector, improve the health of Canadians, support our artists and cultural communities, and support and honour our veterans. It also takes action for Canadians in need, for example by helping Canadians prepare for and recover from natural disasters. Economic Action Plan 2014 also introduces a Search and Rescue Volunteers Tax Credit in recognition of the important role played by these volunteers. It proposes measures to improve the health and safety of Aboriginal communities including investments in water infrastructure and efforts to reduce violence against Aboriginal women and girls. In addition, Economic Action Plan 2014 supports Canadians’ safety and security and continues to provide development and humanitarian assistance to people in other countries.

Consumers First

When Canadians make decisions about how to spend their money, they must be assured of a voice, a choice and fair treatment. They are tired of hidden fees. They should not be charged more in Canada for identical goods that sell for less in the United States, unless that price difference reflects legitimate higher costs.

Since 2006, the Government has taken significant action to support and protect all Canadian consumers by reducing taxes and tariffs, ensuring marketplace fairness, promoting competition in a number of industries (including financial services, telecommunications and air services), and improving product and food safety.

The 2013 Speech from the Throne signalled that the Government would continue its strong commitment to protect Canadians and their families while encouraging healthy competition and lower consumer prices. Economic Action Plan 2014 will expand on the Government’s consumer-focused measures to improve the bottom line for Canadian families and ensure that they are getting value for their hard-earned dollars. Additional actions will support fair prices for consumers in the marketplace, enhance food safety and eliminate the practice of pay-to-pay billing.

Since 2006, the Government has taken concrete measures to protect Canadians while encouraging healthy competition and lower prices, including:

- Reducing taxes to leave more money in the pockets of consumers.

- Removing tariffs on baby clothing and sports and athletic equipment to help reduce the cost of those goods for Canadian consumers.

- Strengthening the position of credit card users through sweeping reforms to require summary boxes for credit card statements, impose a mandatory 21-day interest-free grace period on credit cards, ban unsolicited credit card cheques and require consent for credit limit increases.

- Increasing access to funds by reducing cheque hold periods, banning negative option billing, and strengthening disclosure by introducing a mortgage prepayment code of conduct and regulations for pre-paid cards.

- Adopting a wireless policy focused on stimulating greater competition, which has helped to reduce wireless rates by 20 per cent since 2008 and led to more choice and better service for consumers.

- Requiring all-inclusive airfare advertising to ensure that consumers can clearly see the total price of an airline ticket, with no hidden fees.

- Modernizing Canada’s consumer product safety system through the Canada Consumer Product Safety Act, which allows the Government to take action on consumer products when serious safety issues are identified.

- Strengthening Canada’s food safety system by providing over $500 million since 2006 to support the hiring of new inspectors, an improved inspection approach, enhanced oversight of imported foods, increased scientific capacity, and better training and more modern tools for inspectors.

- Protecting Canadian families and children from unsafe medicine through the introduction of the Protecting Canadians from Unsafe Drugs Act (Vanessa’s Law), which will give the Government the power to recall unsafe drugs and will impose increased fines and penalties for those who contravene the Act.

Improving Competition in the Telecommunications Market

Economic Action Plan 2014 proposes a number of measures to strengthen competition in the telecommunications market, including legislation to reduce wholesale roaming rates and to enhance consumer protection and regulatory compliance.

The Government has a strong record of responding to the needs and concerns of Canadian consumers, including by taking steps to achieve greater competition in the wireless market so that Canadians benefit from more choice, lower prices and better service. The 2013 Speech from the Throne highlighted the importance of protecting Canadians and their families while encouraging healthy competition and lower consumer prices. Since the last auction of wireless spectrum in 2008, prices have fallen by almost 20 per cent and jobs in the wireless industry have increased by 25 per cent.

The Government will build on this record by proposing to amend the Telecommunications Act to cap wholesale domestic wireless roaming rates to prevent wireless providers from charging other companies more than they charge their own customers for mobile voice, data and text services. This measure will be in place until the Canadian Radio-television and Telecommunications Commission (CRTC), which is now investigating this issue, makes a decision on roaming rates. With wholesale domestic roaming rates on networks capped, Canadian consumers will benefit from more competition in the wireless market.

The Competition Bureau's January 29, 2014 submission to the CRTC proceedings on wireless roaming rates indicates that "Canada's largest wireless companies have an incentive to use high mobile wireless roaming rates to ensure that new entrants are not, and do not become, fully effective competitors. As a result, new entrants are likely limited in their ability to bring attractive product offerings to market." The Competition Bureau's submission draws linkages between this practice and reduced product choice, higher prices for consumers and less innovation in the Canadian mobile wireless market.

The Government will also propose amendments to the Telecommunications Act and the Radiocommunication Act to provide the CRTC and Industry Canada with the power to impose administrative monetary penalties on companies that violate established rules such as the Wireless Code and rules related to the deployment of spectrum, services to rural areas and tower sharing. Legislative amendments will be proposed to:

- Enhance information sharing by the CRTC and Industry Canada to enable greater cooperation with organizations such as the Competition Bureau, which will benefit consumers;

- Provide the CRTC with the authority to impose conditions pertaining to social requirements on telecommunications service providers that are not carriers (i.e. “re-sellers” of services) to help ensure that all consumers can benefit, no matter which provider they choose;

- Clarify the prohibitions against violating Industry Canada’s spectrum auction rules, to ensure fair and competitive bidding that achieves the greatest benefit for Canadians from this public resource; and

- Clarify the prohibitions against the manufacture, sale or use of jamming devices (e.g. devices that block cell phone transmissions by creating interference), to better protect Canadians.

In addition, amendments will be introduced to streamline the process for certifying telecommunications equipment for use by consumers and businesses.

The CRTC commenced hearings last Fall on telecommunications service providers’ practice of charging customers to receive paper bills. The Government is following these proceeding with great interest.

Improving Access to Broadband in Rural and Northern Communities

Economic Action Plan 2014 proposes to provide $305 million over five years to extend and enhance access to high-speed broadband networks to a target speed of 5 megabits per second for up to an additional 280,000 Canadian households.

For most Canadians, access to affordable and reliable broadband networks is an important part of everyday life. The rapid evolution of technology, continuously changing user needs and the wide use of the internet require broader access to faster network speeds. Households in communities outside of urban centres commonly face challenges in accessing equivalent internet service levels due to factors such as remote location and challenging terrain. In the 2013 Speech from the Throne, the Government committed to continue working to make high-speed broadband networks available for rural Canadians. Enhancing and extending access will create jobs, growth and prosperity for rural and Northern Canadians by increasing their ability to participate in the digital economy. Additionally, small and medium-sized businesses will benefit by having increased access to information and markets.

Working with other partners, the Government is supporting such access in a number of ways, including by making broadband projects eligible under the new Building Canada plan announced in Economic Action Plan 2013. In the Fall of 2013, the Minister of Industry also announced that the Government will only renew those wireless spectrum licenses intended to be used to provide high-speed internet access to rural Canadians if the companies holding the licenses are using them for that purpose. Those companies that have not used the spectrum will lose it and the Government will ensure Canadians benefit from additional quality spectrum being deployed across the country for high-speed internet services.

To keep pace with the needs of Canadians in rural and Northern communities, Economic Action Plan 2014 proposes to provide $305 million over five years to extend and enhance broadband service to a target speed of 5 megabits per second for up to an additional 280,000 Canadian households, which represents near universal access. The Government will announce further details about the new program in the coming months.

Telecommunications infrastructure is important to Canada's rural, northern and remote communities. Broadband networks contribute to economic growth by improving productivity, providing new products and services, supporting innovation in all sectors of the economy, and improving access to new markets in Canada and abroad.

—Federation of Canadian Municipalities

Legislating Against Unjustified Cross-Border Price Discrimination

Economic Action Plan 2014 announces a plan to introduce legislation to prohibit unjustified cross-border price discrimination.

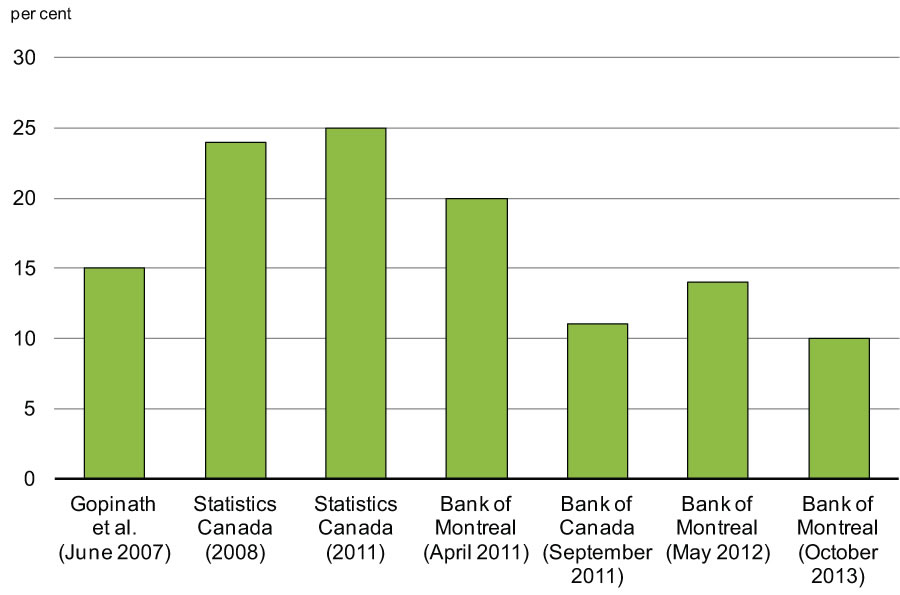

It is well documented that Canadians pay more than Americans for many identical goods. Estimates from Statistics Canada suggest that Canadians were paying about 25 per cent more than U.S. consumers for goods in 2011 after adjusting for the exchange rate and sales taxes, slightly up from 24 per cent in 2008. Estimates for more recent years by private sector organizations suggest that price differences remain high (Chart 3.4.1). Canadians work hard and should not be gouged with higher prices simply because of where they live.

“Canada/U.S. Price Gap & Cross-Border Shopping,” May 2012; “Raging Loonie: What It Can and Can Not Do,” April 2011. Sampled 20-60 products.

Mark Carney, Governor of the Bank of Canada, testifying before the Standing Senate Committee on National Finance, November 2, 2012. Sample of around 150 products.

Statistics Canada, “New Evidence on Exchange-rate-adjusted Prices in Canada,” Economic Insights, No. 2, Catalogue no. 11-626-X, January 2012, updated as announced in The Daily, January 20, 2014. This estimate excludes alcohol and tobacco and goods that are subject to marketing boards or supply management. Statistics Canada’s price gap estimate has been adjusted downward based on internal Department of Finance calculations to account for higher point-of-sale tax rates in Canada than in the United States. Sample of around 1,000 products.

Gopinath, Gita, Pierre-Oliver Gourinchas, Chang-Tai Hsieh, and Nicholas Li. (2011), “International Prices, Costs, and Markup Differences,” American Economic Review, Vol. 101, No. 6. Study based on around 4,000 products, as described in text box below.

In October 2011, at the request of the Minister of Finance, the Standing Senate Committee on National Finance studied the reasons for the price differences. The Committee report suggested the following potential causes: remaining import tariffs; the relatively small size of the Canadian market; different product safety standards in Canada; other higher underlying costs of doing business in Canada; insufficient competition in the Canadian retail market; and manufacturers engaging in country pricing strategies.

Economic Action Plan 2013 provided $79 million in annual tariff relief, through the elimination of tariffs on baby clothing and certain sports and athletic equipment. This initiative will allow the Government to assess whether tariff elimination can help narrow the price gap for consumers in Canada. As such, the Government, through a third party, is monitoring the tariff savings to ensure that they are being passed through to consumers in the form of lower retail prices. The Government expects to have a full assessment of the impact of these tariff reductions by the end of 2014, which will guide future decisions on tariff reductions.

Economic Action Plan 2014 proposes to address another source of the price gap identified by the Senate Committee: country pricing strategies—that is, when companies use their market power to charge higher prices in Canada that are not reflective of legitimate higher costs. Evidence suggests that some companies charge higher prices in Canada than in the U.S. for the same goods, beyond what could be justified by higher operating costs. Higher prices brought on by excessive market power hurt Canadian consumers.

The Government intends to introduce legislation to address price discrimination that is not justified by higher operating costs in Canada, and to empower the Commissioner of Competition to enforce the new framework. Details will be announced in the coming months.

The American Economic Review recently published a study1 that analyzed 4,000 product-level prices and wholesale costs of a large grocery store chain that operates in both Canada and the United States.2 It found that movements in the Canada-U.S. retail price gap are mostly driven by changes in what retailers pay at the wholesale level, rather than changes in retailers’ profits. In particular, the study found that:

- Retail price differences between Canada and U.S. regions located within 200 kilometres of the border were, on average, 15 per cent in June 2007.

- Product prices do not vary greatly between stores in the same country, but large price differences can be observed between stores located on different sides of the border.

Based on these findings, the authors of the study conducted a statistical analysis to examine the factors contributing to the movements in retail prices and wholesale costs. From this analysis, they concluded that distributors or wholesalers are “pricing to market” (practising country pricing strategies). They suggest this could be because “corporate agreements specifically prohibit retail stores from arbitraging prices across borders. That is, Canadian retail stores have to buy from Canadian distributors while U.S. retail stores have to buy from U.S. distributors.”

These findings are consistent with the Retail Council of Canada’s submission to and testimony before the Senate Committee explaining survey findings that “for retailers who have stores in both Canada and the United States, they are charged anywhere between 10 per cent and 50 per cent more for identical products by some suppliers”3 and that “country pricing is one of the largest contributors to the difference in pricing [between Canada and the U.S.]”4

1 Gopinath, Gita, Pierre-Oliver Gourinchas, Chang-Tai Hsieh and Nicholas Li. (2011). “International Prices, Costs, and Markup Differences,” American Economic Review, Vol. 101, No.6.

2 Their dataset contains information on approximately 4,000 products including ethnic and gourmet food, beverages, housekeeping supplies, books and magazines, and personal care products at 250 stores in the United States and 75 in Canada operated by a single large grocery store chain. Produce, flowers and dairy products were removed from their dataset because of their high-local content. The authors also tested the sensitivity of their results to the exclusion of books and magazines and found that their results were broadly unchanged.

3 Retail Council of Canada, “Submission to: Senate Committee on National Finance: Study on the Potential Reasons for Price Discrepancies Between Canada and the United States,” April 2012.

4 Diane J. Brisebois, President and Chief Executive Officer (Retail Council of Canada), testifying before the Standing Senate Committee on National Finance, April 24, 2012.

Strengthening Canada’s Food Safety System

The Government of Canada is committed to ensuring that Canadian families have confidence in the food they buy and eat.

Since 2006, the Government has invested over $500 million in Canada’s food safety system to hire inspectors, improve inspection practices, increase training for front-line inspectors and increase scientific capacity, resulting in a net increase of over 750 inspectors at the Canadian Food Inspection Agency. These investments have enhanced the Government’s ability to respond proactively to food safety issues and improved market access for Canadian agriculture and agri-food products.

Economic Action Plan 2014 proposes to invest an additional $390 million over five years to strengthen Canada’s food safety system. Funding will support the hiring of over 200 additional inspectors and other staff; establish a national information system to enable authorities to move quickly to detect and respond to food safety risks; and continue core bovine spongiform encephalopathy-related programming aimed at safeguarding human and animal health. In addition, the Government will pursue legislative amendments as needed to facilitate the implementation of food safety program improvements.

Enhancing the Inspection of Food in Canada

Economic Action Plan 2014 proposes to provide $153.6 million over five years to strengthen the Canadian Food Inspection Agency’s food safety programs.

The Government is taking action to further strengthen Canada's world-class food safety system. The volume of global trade in agriculture and agri-food products has increased significantly over the last decade and is projected to continue to grow. To respond to this changing environment and to continue protecting the health and safety of Canadians, the Government is making a significant investment to continue strengthening our food safety system.

Economic Action Plan 2014 proposes to provide $153.6 million over the next five years to enhance the Canadian Food Inspection Agency’s food safety programs that target high-risk foods. Funding will support the hiring of over 200 new inspectors and other staff, the development of programs to minimize food safety risks and an enhanced capacity to prevent unsafe food imports from entering Canada, offering better protection for consumers.

Modernizing the Food Safety Information System

Economic Action Plan 2014 proposes to provide $30.7 million over five years to establish a national Food Safety Information Network.

A key component of a modern food safety system is the ability to share standardized food safety data and analysis among all food safety authorities. Economic Action Plan 2014 proposes to provide $30.7 million over five years to establish a Food Safety Information Network to link federal and provincial food safety authorities and private food testing laboratories across Canada. The network will allow food safety data to be compiled, analyzed and shared in real time, allowing for more rapid detection of and response to food safety hazards.

Protecting Canadians and Supporting Animal Health

Economic Action Plan 2014 proposes to provide $205.5 million over five years to continue bovine spongiform encephalopathy programming.

Canada has implemented a comprehensive suite of internationally recognized, science-based, routine measures to effectively minimize the likelihood of exposure and spread of bovine spongiform encephalopathy (BSE) within the cattle population and to protect consumers from the associated human health risks. Economic Action Plan 2014 proposes to provide $205.5 million over five years to the Canadian Food Inspection Agency, Health Canada and the Public Health Agency of Canada to continue routine BSE-related programming aimed at safeguarding human and animal health, maintaining consumer confidence in Canadian products and enhancing market access.

Putting Consumers First in the Financial Sector

Consumers should be confident that they are protected by a high-quality regulatory framework that puts their interests first. Canadians must be able to make informed decisions about financial products and services and be assured of fair treatment.

Since 2006, the Government has set and delivered on an ambitious agenda to improve Canada’s financial consumer protection framework, resulting in one of the most advanced frameworks in the world. The Government has introduced credit card reforms, improved rules for disclosure, stronger complaint handling requirements, strengthened supervisory tools and new standards for prepaid payment products. Economic Action Plan 2014 continues to support financial consumers through new initiatives to ensure consumer protection, increase awareness and encourage financial literacy, enhance access to basic banking services and promote fairness and transparency.

Reviewing Canada’s Deposit Insurance Framework

Economic Action Plan 2014 announces the launch of a comprehensive review of Canada’s deposit insurance framework.

Deposit insurance protects Canadians’ savings of up to $100,000 in the event that a federally regulated deposit-taking institution fails. At the federal level, the Canada Deposit Insurance Corporation (CDIC) administers deposit insurance for CDIC members, including banks and other financial institutions.

The Government is launching a comprehensive review of Canada’s deposit insurance framework. This review will ensure that deposit insurance provides adequate protection for the savings of Canadians, taking into account lessons from the recent financial crisis and significant shifts in the global banking landscape.

Promoting Fairness and Transparency in the Credit Card Market

The Government will improve fairness and transparency in the credit card market.

Merchants pay fees each time they accept credit card payments from consumers. As with any other input cost, merchants pass some or all of these costs to consumers in the form of higher retail prices. Canada has among the highest credit card acceptance costs in the world.

In 2013, the Competition Tribunal found that certain of Visa’s and MasterCard’s network rules have an adverse affect on competition, which results in higher costs to merchants. In light of this finding, the Government will work with stakeholders to promote fair and transparent practices and to help lower credit card acceptance costs for merchants, while encouraging merchants to lower prices to consumers.

The Code of Conduct for the Credit and Debit Card Industry in Canada was created in 2010 to promote merchant choice, transparency and disclosure, and fairness in the credit card market. To further improve business practices, the Government intends to strengthen the Code of Conduct, in consultation with stakeholders.

Merchants pay fees ranging from approximately 1.5 per cent to 4 per cent of the value of credit card payment transactions. The fees that merchants pay to accept credit card payments are distinct from the annual fees and any interest charges paid by consumers who use credit cards, and merchants pass some or all of these costs to consumers in the form of higher retail prices.

| Consumer purchase | $100.00 |

| Interchange fee | $1.69 |

| Processing fee | $0.67 |

| Total acceptance fee | $2.36 |

| Merchant receives | $97.64 |

Raising Financial Consumer Awareness

The Government will continue to raise public awareness about the costs of and alternatives to payday lending and other high interest rate lending products, collateral charge mortgages, and bank powers of attorney and joint accounts.

Payday Lending

Payday lending and other high-cost loans are an extremely expensive way for consumers to access short-term lending. Payday lenders typically target vulnerable populations, including low-income workers and families, persons with disabilities and the elderly.

In 2007, at the request of the provinces, the Government amended the Criminal Code to allow provinces with designated licensing regimes to regulate payday lenders and payday loans. The Government is committed to working with the provinces to maintain the integrity of the framework and to support provincial efforts to regulate appropriately all payday lending-type high interest rate products. The Financial Literacy Leader will also work with stakeholders to raise public awareness about the costs of and alternatives to these products.

Collateral Charge Mortgage

While many consumers continue to choose a traditional mortgage to secure their home loans, many are increasingly choosing collateral charge mortgages. The impacts of having a collateral charge mortgage may differ from traditional mortgages. For instance, switching between lenders may be more difficult. To make an informed choice, consumers need sufficient information to clearly understand the costs and consequences of collateral charge mortgages relative to traditional mortgages. The Government will require enhanced disclosure, better equipping borrowers to understand these impacts.

Powers of Attorney

Some seniors may ask for help in managing their banking affairs and put arrangements in place for a power of attorney or joint account. In relying on others, seniors are more vulnerable to financial abuse if the power of attorney or joint account is not set up with care. As banks are often seen by seniors as a trusted authority, it is important to ensure that banks have appropriate and adequate processes and procedures for advising on these matters. The Government will require enhanced disclosure by banks on the costs and benefits of using powers of attorney or joint accounts and more robust bank processes and staff training.

Continuing to Develop a Comprehensive Financial Consumer Code

The Government will continue to engage with Canadians on the development of a comprehensive financial consumer code to better protect consumers of financial products and services and ensure they have the necessary tools to make responsible financial decisions.

In Economic Action Plan 2013, the Government proposed to develop a comprehensive financial consumer code. In December 2013, the Government launched a national discussion to seek the views of Canadians on how to better protect consumers of financial products. The code will create a framework that protects consumers more effectively in a rapidly evolving financial industry and addresses the unique challenges faced by vulnerable Canadians. The Minister of State (Finance) will conduct national consultations and Canadians’ views will be invaluable in developing the code.

Enhancing Access to Basic Banking Services

Universal access to basic banking services is a cornerstone of Canada’s strong and vibrant financial services sector. The Government will act to enhance access to basic banking services.

Universal access to basic banking is a cornerstone of Canada’s financial sector in which Canadians can take pride. Indeed, 96 per cent of Canadians currently have access to banking services. The Government is committing to ensuring that basic banking needs of Canadians are met by our banks.

Hundreds of thousands of Canadians benefit from low-cost accounts across Canada, and the Government will work to bring these low-cost accounts up to date to meet consumers’ current banking needs. As well, acting on the 2013 Speech from the Throne commitment, the Government will work with financial institutions to expand no-cost basic banking services for youths, students and vulnerable groups (e.g. beneficiaries of a Registered Disability Savings Plan and at-risk seniors). The Government will also proactively ensure pay-to-pay policies for monthly printed credit card statements provided by banks are prohibited.

The Government will build Canadians’ awareness of their right to cash Government of Canada cheques free of charge at any bank in Canada, following up on the commitment in Economic Action Plan 2013. New standard language has been added to the back of government cheques informing Canadians of this right.

Investing in Families

Families are the building blocks of our society. Canada succeeds when our families thrive. Every day, Canadian families work hard to make ends meet and provide for their children’s future. Since 2006, the Government has introduced several measures to help families succeed while recognizing that they are better placed to make household spending decisions than governments.

These measures include the introduction of the Universal Child Care Benefit, which provides parents up to $1,200 per year per child to help with the costs of raising young children, the reduction in the GST rate to 5 per cent from 7 per cent, the introduction of the Tax-Free Savings Account, and the introduction of the Registered Disability Savings Plan to help individuals with disabilities—and their families—save for their long-term financial security.

Economic Action Plan 2014 builds on the Government’s record of support for Canadian families by keeping taxes low, helping to address prescription drug abuse, encouraging the inclusion of all Canadians in our communities, and providing further tax recognition of the costs of adopting a child and health-related expenses.

Economic Action Plan 2014 also delivers on the Government’s commitment to reducing tobacco consumption by restoring the effectiveness of the excise duty on tobacco products, while also combating contraband tobacco, and supports efforts to reduce the incidence of tuberculosis among vulnerable populations.

Keeping Taxes Low for Canadian Families and Individuals

Since 2006, the Government has provided significant tax relief for Canadian families and individuals. For an average family of four, taxes have been cut by close to $3,400. These tax reductions give individuals and families greater flexibility to make the choices that are right for them and help build a solid foundation for future economic growth, more jobs and higher living standards for Canadians.

Action to Reduce Taxes

Since 2006, the Government has:

- Introduced more than 160 tax relief measures.

- Provided almost $160 billion in tax relief for Canadian families and individuals over a six-year period ending in 2013–14.

- Cut taxes for an average family of four by close to $3,400.

Dollars as a Result of the Government’s Actions

to Reduce the Tax Burden

Tax Relief for a Family of Four—Example

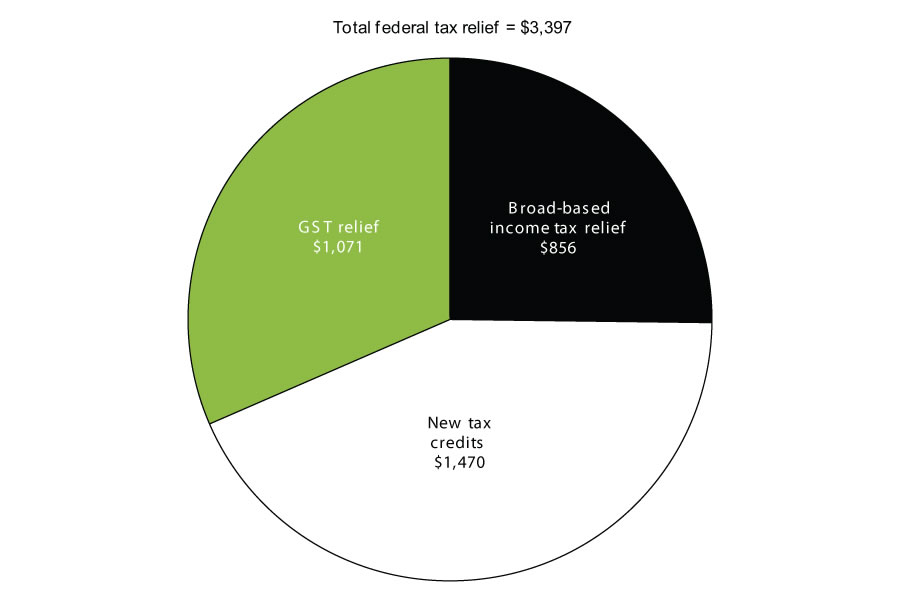

Blake and Laurie are a couple with two children. Blake earns $48,000 and Laurie earns $72,000. As a result of actions taken by the Government since 2006, their family will pay $3,400 less in taxes, allowing Blake and Laurie to invest their hard-earned money where they see fit. Specifically, they will pay $2,326 less in personal income tax, including $856 from broad-based income tax relief such as the reduction in the lowest personal income tax rate, and $1,470 as a result of the introduction of new credits such as the Child Tax Credit, the Children’s Arts Tax Credit and the Children’s Fitness Tax Credit.

Blake and Laurie will also pay $1,071 less in GST because of the Government’s reduction of the GST rate from 7 per cent to 5 per cent. Combined with personal income tax relief, this family will benefit from a total of about $3,400 in tax relief for 2014, allowing Blake and Laurie to invest that money in important family priorities (Chart 3.4.2).

Chart 3.4.2 Total Federal Tax Relief for a Family of Four, 2014

Under the Government’s long-term agenda to keep taxes low, significant broad-based action has been taken to reduce taxes on savings, and to reduce taxes for all Canadians. For instance, the Government has:

- Fulfilled its commitment to reduce the GST to 5 per cent from 7 per cent, benefiting all Canadians—even those who do not earn enough to pay personal income tax.

- Increased the amount that all Canadians can earn without paying federal income tax.

- Reduced the lowest personal income tax rate to 15 per cent from 16 per cent, and increased the amount of income that individuals can earn before facing higher tax rates by increasing the upper limit of the two lowest personal income tax brackets.

- Introduced the Tax-Free Savings Account (TFSA)—a flexible, registered, general-purpose savings vehicle—that allows Canadians to earn tax-free investment income to more easily meet their lifetime savings needs. As of 2013, Canadians can contribute up to $5,500 annually to a TFSA. This is an increase from the annual contribution limit of $5,000 for 2009 through to 2012 and reflects indexation to inflation. At the end of 2012, more than 9 million Canadians had opened a TFSA. As the TFSA matures, it is estimated that, by 2030, in combination with other registered plans, it will permit over 90 per cent of Canadians to hold all their financial assets in tax-efficient savings vehicles.

The Government has also introduced a number of targeted tax reduction measures. For example, the Government has:

- Helped families with children by introducing the Child Tax Credit, the Children’s Fitness Tax Credit and the Children’s Arts Tax Credit.

- Introduced the Registered Disability Savings Plan, a tax-assisted savings plan that helps individuals with severe disabilities—and their families—save for their long-term financial security.

- Enhanced support to caregivers of infirm dependent family members by introducing the new Family Caregiver Tax Credit, and by removing the $10,000 limit on eligible expenses that caregivers can claim under the Medical Expense Tax Credit in respect of a dependent relative.

- Provided additional support to adoptive parents by enhancing the Adoption Expense Tax Credit to better recognize the costs of adopting a child.

- Provided about $2.8 billion in additional annual targeted tax relief for seniors and pensioners by increasing the Age Credit amount by $2,000, doubling the Pension Income Credit amount to $2,000, raising from 69 to 71 the age limit for maturing savings in Registered Pension Plans and Registered Retirement Savings Plans (RRSPs) and introducing pension income splitting.

- Enhanced support for workers by introducing the Canada Employment Credit, which recognizes employees’ work expenses for things such as safety gear, uniforms and supplies.

- Provided further support to students and their families by exempting scholarship income from taxation, introducing the Textbook Tax Credit, making Registered Education Savings Plans more responsive to changing needs, and lowering the program duration requirements of the Tuition, Education and Textbook Tax Credits applying to foreign university programs.

- Enhanced support for students and apprentices by extending the Tuition Tax Credit to all occupational, trade and professional examination fees.

- Introduced the Public Transit Tax Credit to encourage public transit use and the Volunteer Firefighters Tax Credit to better support communities.

- Assisted first-time home buyers by introducing the First-Time Home Buyers’ Tax Credit and increasing the RRSP withdrawal limit under the Home Buyers’ Plan.

Benefits for Canadian families and individuals delivered through the personal income tax system, as well as support for families with children, have also been increased and enhanced. The Government has:

- Introduced the Universal Child Care Benefit, which provides $100 per month to families for each child under the age of six.

- Introduced and enhanced the Working Income Tax Benefit, lowering the “welfare wall” and strengthening work incentives for low-income Canadians already working, while encouraging other low-income Canadians to enter the workforce.

- Increased the amount of income that families can earn before the National Child Benefit supplement is fully phased out and before the Canada Child Tax Benefit base benefit begins to be phased out.

- Maintained the GST Credit level while reducing the GST rate by 2 percentage points, translating into about $1.2 billion in GST Credit benefits annually for low- and modest-income Canadians.

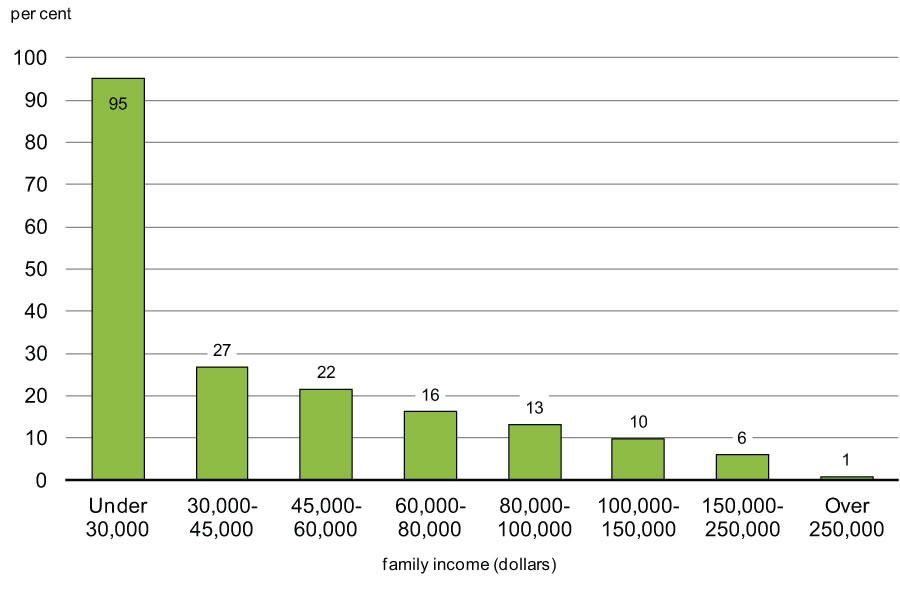

In total, the Government has provided almost $160 billion in tax relief for Canadian families and individuals over a six-year period ending in 2013–14. Canadians at all income levels are benefiting from tax relief introduced by the Government, with low- and middle-income Canadians receiving proportionately greater relief (Chart 3.4.3). Overall, personal income taxes are now 10 per cent lower with the tax relief provided by the Government, and more than 1 million low-income Canadians have been removed from the tax rolls.

Since 2006, the Government has introduced more than 160 tax relief measures. The federal tax burden is now the lowest it has been in more than 50 years. Going forward, the Government remains committed to keeping taxes low and examining ways to provide further tax relief for Canadians.

As a result of actions taken to date by the Government, seniors and pensioners are receiving about $2.8 billion in additional annual targeted tax relief. In particular, since 2006 the Government has:

- Increased the Age Credit amount by $2,000—$1,000 in 2006 and $1,000 in 2009.

- Doubled the maximum amount of income eligible for the Pension Income Credit to $2,000.

- Increased the age limit for maturing pensions and Registered Retirement Savings Plans to 71 from 69 years of age.

- Introduced pension income splitting.

In 2014, a single senior can earn at least $20,054 and a senior couple at least $40,108 before paying federal income tax.

Tax Relief for a Senior Couple—Example

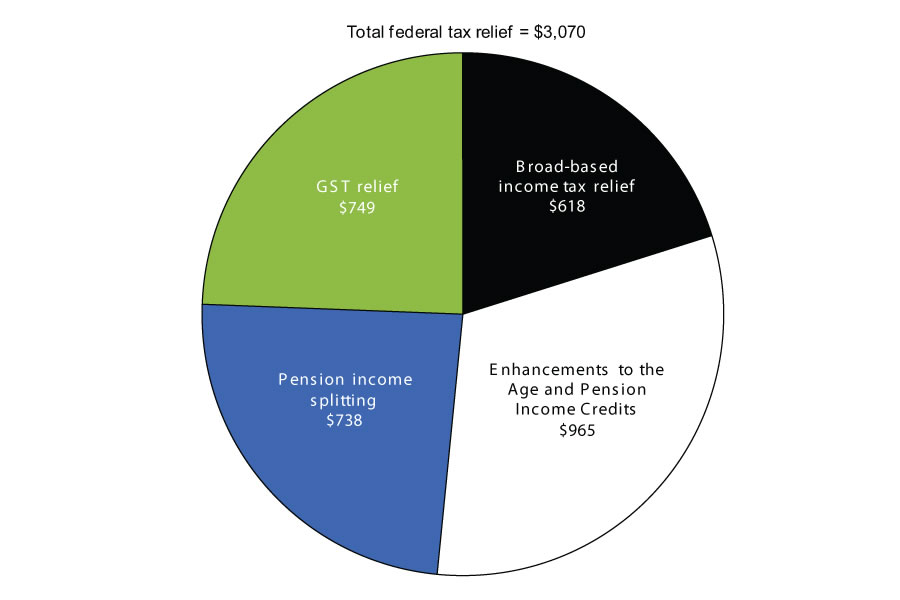

Dylan and Gisele are a senior couple receiving $55,000 and $27,000 respectively in pension income. As a result of actions taken by the Government since 2006, they will pay $2,321 less in personal income tax, including $618 from broad-based income tax relief, $738 they have saved by taking advantage of pension income splitting, and $965 from the doubling of the Pension Income Credit amount and the increases in the Age Credit amount.

Dylan and Gisele will also pay $749 less in GST because of the Government’s reduction of the GST rate from 7 per cent to 5 per cent. This adds up to a total of $3,070 in tax relief for 2014, allowing Dylan and Gisele to keep more of their pension income for everyday expenses.

Chart 3.4.4 Total Federal Tax Relief for a Senior Couple With Pension Income, 2014

Addressing Prescription Drug Abuse in Canada

Economic Action Plan 2014 proposes to invest $44.9 million over five years to expand the focus of the National Anti-Drug Strategy from illicit drugs to also address prescription drug abuse in Canada.

Prescription drug abuse has emerged as a leading consumer health and safety concern in Canada, including addiction and death due to overdose.

Canadian consumption of prescribed opioids has risen by over 200 per cent since 2000. Closely tied to this increase in usage is an increasing rate of prescription drug abuse, which doubled among Canadians aged 15 and older between 2011 and 2012.

Economic Action Plan 2014 expands the focus of the National Anti-Drug Strategy from illicit drugs to also address prescription drug abuse in Canada, and proposes to invest $44.9 million over five years to support new actions for that purpose. This funding will be used to educate Canadian consumers on the safe use, storage and disposal of prescription medications, enhance prevention and treatment services in First Nations communities, increase inspections to minimize the diversion of prescription drugs from pharmacies for illegal sale, and improve surveillance data on prescription drug abuse in Canada.

Health-Related Tax Measures

Economic Action Plan 2014 proposes to expand health-related tax relief under the GST/HST and income tax systems to better reflect the health care needs of Canadians.

The Government is committed to ensuring that the tax system reflects the evolving nature of the health care system and the health care needs of Canadians. Economic Action Plan 2014 proposes measures that will expand health-related tax relief by:

- Expanding the list of eligible expenses under the Medical Expense Tax Credit to include costs associated with service animals specially trained to assist individuals with severe diabetes, such as diabetes alert dogs.

- Providing further tax recognition for costs associated with eligible specially designed medical therapies and training by:

- Expanding the current GST/HST exemption for training that is specially designed to help individuals cope with a disorder or disability to also exempt services of designing such training, such as developing a training plan.

- Including amounts paid for the design of an individualized therapy plan as an eligible expense for income tax purposes under the Medical Expense Tax Credit.

- Exempting acupuncturists’ and naturopathic doctors’ professional services from the GST/HST.

- Adding eyewear specially designed to electronically enhance the vision of individuals with vision impairment that is supplied on the order of a physician or other specified health professional to the list of GST/HST-free (zero-rated) medical and assistive devices.

Changes to the Medical Expense Tax Credit will apply to expenses incurred after 2013, and are estimated to reduce federal revenues by a small amount in each of 2013–14, 2014–15 and 2015–16.

Changes to the GST/HST health-related measures will apply to supplies made after Budget Day and are estimated to reduce federal revenues by a small amount in 2013–14 and by $10 million in each of 2014–15 and 2015–16.

Diabetes alert dogs are service dogs that assist people who have severe diabetes and experience hypoglycaemic unawareness (a condition that occurs when an individual is unable to feel or recognize the symptoms of low blood glucose levels).

These dogs are trained to detect sudden drops in their handler’s blood glucose levels through scent and alert them to the need for treatment. Diabetes alert dogs can also be trained to seek help from others, activate an emergency call system and fetch equipment (such as food, medication or an insulin kit).

Employment Insurance: Enhancing Access to Sickness Benefits

Economic Action Plan 2014 proposes to enhance access to sickness benefits for claimants who receive Parents of Critically Ill Children and Compassionate Care benefits.

When Canadians fall sick, they may not be able to care for family members who are seriously ill or injured. The Government is committed to maintaining fairness in the Employment Insurance (EI) program and to making sure that it continues to help Canadians when they need it most. Building on the recent enhancements to EI sickness benefits for parental benefit claimants, Economic Action Plan 2014 proposes to commit $2.4 million over two years and $1.2 million per year ongoing to enhance access to sickness benefits for claimants who receive Parents of Critically Ill Children and Compassionate Care benefits. The proposed enhancements will allow claimants who are away from work temporarily to take care of a critically ill or injured child or gravely ill family member at significant risk of death to temporarily suspend their claims in order to access sickness benefits, should they themselves fall sick or become injured.

Paul and Julie have a seven-year-old son who has been diagnosed with leukemia. A specialist medical doctor has certified that the child is critically ill and that he would have to undertake treatments for several months. Although Paul and Julie are both eligible to receive Employment Insurance benefits for Parents of Critically Ill Children, they agreed that Julie would claim the full 35 weeks of Parents of Critically Ill Children benefits for which they are eligible.

The child goes through his treatments and Julie collects Parents of Critically Ill Children benefits as expected. However, at week 10 of her claim, Julie has an accident and is expected to be hospitalized for five weeks. As she is not able to care for her son, Julie switches to sickness benefits for five weeks and transfers five weeks of Parents of Critically Ill Children benefits to Paul.

When Julie recovers from her injury, she reverts to Parents of Critically Ill Children benefits and resumes collecting the remaining benefits entitlement.

The proposed change will allow Julie to temporarily suspend her claim in order to access sickness benefits. As a result, Julie and Paul will together collect 40 weeks of benefits including 5 weeks of sickness benefits and 35 weeks of benefits for Parents of Critically Ill Children.

Increasing the Adoption Expense Tax Credit

Economic Action Plan 2014 proposes to increase the maximum amount of the Adoption Expense Tax Credit to $15,000 to provide further tax relief in recognition of the costs unique to adopting a child.

The adoption process can be costly for prospective parents. The Adoption Expense Tax Credit recognizes the costs unique to adopting a child by providing a tax credit on up to a maximum of $11,774 in expenses per child for 2014. To provide further tax recognition of adoption-related expenses such as adoption agency fees and legal fees, Economic Action Plan 2014 proposes to increase the maximum amount of the credit to $15,000. This change will apply to adoptions finalized after 2013. Normal indexation will apply to the new maximum amount for taxation years after 2014.

It is estimated that this change will reduce federal revenues by a small amount in 2013–14 and by $2 million in each of 2014–15 and 2015–16.

Extending Changes to the Pension Transfer Limits

Economic Action Plan 2014 proposes to extend changes to the pension transfer limits to help individuals who are leaving an underfunded pension plan.

Individuals leaving a defined benefit Registered Pension Plan may receive a cash-out payment from the plan reflecting the lump-sum value of their pension benefits. The income tax rules limit the amount of such payments that may be transferred tax-free to a Registered Retirement Savings Plan, Registered Retirement Income Fund or other defined contribution retirement savings vehicle. In 2011, the Government introduced relieving changes to these limits for individuals leaving an underfunded plan that is being wound up due to an employer’s insolvency. Economic Action Plan 2014 proposes to extend these changes to additional situations to ensure the appropriate application of these rules to individuals leaving an underfunded plan. This measure will apply in respect of cash-out payments made after 2012.

It is estimated that these changes will reduce federal revenues by $3 million in 2013–14 and by $5 million in each of 2014–15 and 2015–16.

Registered Disability Savings Plans—Legal Representation

The Registered Disability Savings Plan (RDSP) is a tax-assisted savings vehicle, introduced in Budget 2007, that is widely regarded as a major policy innovation and positive development in helping to ensure the long-term financial security of Canadians with severe disabilities. Since RDSPs became available in 2008, more than 78,000 accounts have been opened.

However, a number of adults with disabilities have experienced problems in establishing an RDSP because their capacity to enter into a contract is in doubt. In many provinces and territories, the only way an RDSP can be opened in these cases is for the individual to be declared legally incompetent and have someone named as their legal guardian. This process can involve a considerable amount of time and expense on the part of concerned family members, and may have significant repercussions for the individual.

To address this issue, Economic Action Plan 2012 allowed, on a temporary basis, certain family members to become the plan holder of the RDSP for an adult individual who might not be able to enter into a contract.

While the temporary measure has facilitated greater access to RDSPs, it does not represent a complete solution, because only those potential RDSP beneficiaries who have parents or spouses can benefit. In addition, under provincial and territorial trust law, withdrawals from RDSPs must be paid to the beneficiary of the plan or his or her legal representative.

Some provinces and territories have already instituted streamlined processes to allow for the appointment of a trusted person to manage resources on behalf of an adult who lacks contractual capacity, or have indicated that their system already provides sufficient flexibility to address these concerns. In this regard, the Government of Canada recognizes the leadership shown by the Governments of British Columbia, Alberta, Saskatchewan, Manitoba, Newfoundland and Labrador, and Yukon.

Other provinces have taken significant steps to identify a solution in their respective jurisdictions. The Government of Canada appreciates the recent efforts that the Government of Ontario has made in tasking the Law Commission of Ontario to recommend a streamlined alternative process and the recent indication from the Government of the Northwest Territories that it will address this issue on a case-by-case basis.

The Government of Canada urges the governments of Quebec, Nova Scotia, New Brunswick, Prince Edward Island and Nunavut to take prompt action.

The federal tax system helps support Canadians with disabilities and those who care for them in many ways.

Disability and Health

- The Disability Tax Credit (DTC) provides general tax relief of $1,165 to eligible individuals with a severe and prolonged disability.

- The Medical Expense Tax Credit provides tax relief to individuals, including family caregivers, for an unlimited amount of eligible above-average medical and disability-related expenses.

- Under the GST/HST, relief is provided for basic health care services, including home care services, as well as prescription drugs, certain medical devices, and hospital parking for patients and visitors.

Children

- The Child Disability Benefit provides $2,650 (for the 2014–15 benefit year) in tax-free support to parents of DTC-eligible children.

- A supplement to the DTC provides additional tax relief of $680 for DTC-eligible children.

- The Children’s Fitness Tax Credit and Children’s Arts Tax Credit each provide a supplement of $75 in tax relief for DTC-eligible children, effectively doubling the maximum general relief provided by these credits.

Caregivers

- The Caregiver Tax Credit ($680), the Infirm Dependant Credit ($680) and the Eligible Dependant Credit ($1,671) can provide tax relief to recognize the additional costs incurred by caregivers.

- The Family Caregiver Tax Credit provides enhanced tax relief of $309 to caregivers of infirm dependent relatives, including spouses, common-law partners and minor children.

Savings and Retirement

- The Registered Disability Savings Plan (RDSP) helps DTC-eligible individuals—and their families—save for their long-term financial security. Up to $90,000 in total Canada Disability Savings Grants and Canada Disability Savings Bonds are available for each eligible beneficiary.

- Special rules are available under the Registered Education Savings Plan for DTC-eligible beneficiaries and for rollovers of a deceased individual’s Registered Retirement Savings Plan (RRSP) proceeds to the RRSP or RDSP of a financially dependent infirm child or grandchild.

Employment and Education

- The Working Income Tax Benefit provides a disability supplement of up to $556, in addition to the base amount, for low-income working Canadians who are DTC-eligible.

- The Refundable Medical Expense Supplement of up to $1,152 helps offset the loss of provincial and territorial disability-related support upon entering the labour force.

- The Child Care Expense Deduction allows parents of DTC-eligible children to deduct $10,000 in child care costs incurred to work or study.

- The Disability Supports Deduction allows individuals with disabilities to deduct costs for disability supports that enable them to work or study.

- Certain disability-related employment benefits are not included in the taxable income of certain DTC-eligible employees.

- Special eligibility rules under the Education Tax Credit, the Textbook Tax Credit, the tax exemption for income from scholarships, fellowships and bursaries, and the Lifelong Learning Plan apply to DTC-eligible part-time students.

Housing

- Special eligibility rules under the First-Time Home Buyers’ Tax Credit ($750) and the Home Buyers’ Plan apply to DTC-eligible individuals.

- Certain disability-related home renovation, construction and moving expenses may be claimed under the Medical Expense Tax Credit.

Notes: Amounts presented are the maximum tax relief or benefit for 2014, unless otherwise specified. Details of these measures are available on the Canada Revenue Agency website.

Support available through the tax system for persons with disabilities and their families is illustrated in three examples below. Amounts in parentheses after a measure represent the total federal income tax relief for 2014, or other benefits received, due to that measure. Tax relief and other benefits available from provincial and territorial governments are not considered.

A Family Caring for a Child With a Disability: Frank and Marilyn’s Story

Frank and Marilyn are a couple with one child, nine-year-old son Jacob. Like last year, Frank and Marilyn each earn $40,000 in 2014. Jacob has severe autism, and has been determined, based on certification of the effects of his condition by a qualified medical practitioner, to be eligible for the Disability Tax Credit, including the supplement for children ($1,845).

Since Jacob’s autism results in his needing significant assistance from his parents to attend to his personal needs, Frank or Marilyn can claim the Family Caregiver Tax Credit ($309) in addition to the Child Tax Credit ($338).

Frank and Marilyn can also claim more for Jacob’s music lessons and swim classes by virtue of his eligibility for the Disability Tax Credit under the Children’s Arts Tax Credit ($150) and Children’s Fitness Tax Credit ($150).

Due to high medical expenses, including for therapy, tutoring and a service dog for Jacob (which amount to $10,000 in eligible medical expenses in excess of 3 per cent of one of their net incomes in 2014), Frank and Marilyn can claim the Medical Expense Tax Credit ($1,500).

Frank and Marilyn are also eligible to receive the Child Disability Benefit ($1,929) in addition to the Canada Child Tax Benefit base benefit ($725) and, like last year, intend to contribute these amounts to their son’s Registered Disability Savings Plan, to attract the maximum annual Canada Disability Savings Grant ($3,500).

As a result, Frank and Marilyn expect to receive a total of $4,292 in tax relief for 2014, and $2,654 in child benefits, in addition to $3,500 in Canada Disability Savings Grants for Jacob, for a total of $10,446 to support them in caring for their son and saving for his long-term financial security.

A Student Entering the Labour Force: Amrita’s Story

Amrita is studying part time to become a medical assistant and recently began working in a clinic where she expects to earn $16,000 in 2014. As a blind person, Amrita is eligible for the Disability Tax Credit ($1,165). Although she cannot study full time due to her condition, she can claim the Education and Textbook Tax Credits ($558 for eight months of study) equivalent to the credits available for full-time study.

Amrita incurs $4,700 in eligible disability-related expenses in order to work in 2014, which she can deduct from her income under the Disability Supports Deduction ($422), as well as claim under the Refundable Medical Expense Supplement ($1,152).

Amrita is also eligible for the Working Income Tax Benefit including the disability supplement ($1,497) for a single person and the maximum annual Canada Disability Savings Bond ($1,000) in her Registered Disability Savings Plan. In future years, when Amrita can make contributions to her Registered Disability Savings Plan, she could be eligible for Canada Disability Savings Grants for which she has unused entitlements from the past 10 years (for years after 2007).

As a result, Amrita is entitled to $2,145 in tax relief for 2014 and $3,649 in other benefits for a total of $5,794 in recognition of her additional living expenses and the additional costs she incurs to work and study. She will pay no income tax, carry forward her education and textbook amounts to future years, and transfer the Disability Tax Credit to her aunt who has been supporting her.

A Couple Adapting to Disability: Henry and Martha’s Story

Henry has reduced his work hours to spend more time taking care of his wife Martha, who is mobility-impaired due to progressive multiple sclerosis. Due to the effects of Martha’s condition, which were certified by a qualified medical practitioner, Martha has been determined to be eligible for the Disability Tax Credit ($1,165).

Henry earns $60,000 in 2014 and is eligible to claim the Family Caregiver Tax Credit ($309) in addition to the Spouse or Common-Law Partner Credit ($1,671). Because Martha has no taxable income, Henry can claim Martha’s Disability Tax Credit.

The couple buys a new home to better accommodate Martha’s wheelchair. Even though neither Henry nor Martha is a first-time home buyer, Henry can claim the First-Time Home Buyers’ Tax Credit ($750) for this purchase and both he and Martha can withdraw up to $25,000 each from their Registered Retirement Savings Plans under the Home Buyers’ Plan without immediate tax consequences. Henry can also claim moving expenses (to the maximum of $2,000), fees for part-time attendant care (to the maximum of $10,000) and incremental construction costs for a wheelchair-accessible home (he incurs $9,800 in eligible construction costs), totalling $20,000 in eligible expenses in excess of 3 per cent of his net income in 2014 under the Medical Expense Tax Credit ($3,000).

As a result, Henry is expected to receive about $6,895 in tax relief for 2014 for the needs and care of his wife.

Enhancing the New Horizons for Seniors Program

Economic Action Plan 2014 proposes to increase funding for the New Horizons for Seniors Program by an additional $5 million per year.

The Government of Canada recognizes the important role community partners play in supporting seniors and building age-friendly communities. Through the New Horizons for Seniors Program, the Government provides funding to organizations that raise awareness of elder abuse and help ensure seniors can benefit from, and contribute to, the quality of life in their communities through active living and participation in social activities. For example, seniors in Scarborough, Ontario, now have greater awareness about how to protect themselves from fraud and financial abuse thanks to the Debt-Free Management Education (Seniors for Seniors) project, developed by the Canadian Centre for Women’s Education and Development. In Vancouver, the Association of Neighbourhood Houses of British Columbia has initiated the Elders Financial Abuse Awareness Dialogue Project. This multicultural project was developed for seniors to raise awareness of elder abuse, determine the root causes of elder financial abuse and reduce its incidence in ethnic communities across British Columbia.

Economic Action Plan 2014 proposes to provide an additional $5 million annually to the New Horizons for Seniors Program. This funding can support municipalities, not-for-profits, social enterprises and other community partners to address the needs of seniors.

Supporting Caregivers as Labour Force Participants

The Government is announcing that it will launch a Canadian Employers for Caregivers Plan to help maximize caregivers’ labour market participation.

The Government of Canada understands the sacrifice many Canadians make to care for their family members and the impact this has on both working caregivers and their employers. The Government will launch a Canadian Employers for Caregivers Plan to engage with employers on cost-effective workplace solutions to help maximize caregivers’ labour market participation. The Plan will include the creation of an employer panel that would identify promising workplace practices that support caregivers. Details will be announced by the Minister of State (Seniors) over the coming months.

Federal Programs Supporting Affordable Housing

The Government is committed to ensuring low-income families and vulnerable Canadians have access to quality affordable housing.

Some households face financial constraints or have distinct housing needs that impede their participation in the housing market. The Government will continue to work with provincial and territorial governments, municipalities, the Federation of Canadian Municipalities, and other stakeholders at the community level to ensure the accessibility and sustainability of housing, including social housing, for those most in need.

In Economic Action Plan 2013, the Government announced funding of $1.25 billion over five years to renew the Investment in Affordable Housing beginning in April 2014. Under the Investment in Affordable Housing, provinces and territories match federal investments and design and deliver programs to address local needs and priorities. Initiatives can include new construction, renovation, home ownership assistance, rent supplements, shelter allowances, and accommodations for victims of family violence.

Since 2006, the Government has provided significant support for affordable housing, including:

- $1.7 billion annually through Canada Mortgage and Housing Corporation (CMHC) for close to 600,000 households on and off reserves across Canada living in existing social housing.

- $1 billion in 2012 through CMHC’s Direct Lending initiative for the refinancing of existing commitments both on and off reserves, and financing of new commitments on reserves.

- $1.9 billion for housing and homelessness, including the Investment in Affordable Housing and the Homelessness Partnering Strategy. Over 147,000 households benefited from the Investment in Affordable Housing between April 2011 and September 2013.

- $303 million annually in support of First Nations housing needs on reserves through CMHC and Aboriginal Affairs and Northern Development Canada. Over the past five years, this funding has supported the construction of approximately 1,750 new units, renovations to about 3,100 existing units, capacity development and other housing initiatives.

The Government has also played a key role in addressing the recent economic downturn through housing-related measures in Canada’s Economic Action Plan 2009, including:

- $2 billion to create new and renovate existing social housing, resulting in more than 16,500 social housing and First Nations housing projects across Canada.

- $2 billion for the Municipal Infrastructure Lending Program, through which CMHC provided 272 low-cost loans to municipalities for housing-related infrastructure projects in towns and cities across the country.

Homelessness Partnering Strategy and Housing First

The Government has renewed the Homelessness Partnering Strategy as announced in Economic Action Plan 2013, and continues to work with communities, provinces and territories and the private and not-for-profit sectors to implement a Housing First approach to homelessness.

The Government is committed to ensuring that vulnerable Canadians who experience extended or repeated periods of homelessness have access to quality housing. Economic Action Plan 2013 announced nearly $600 million over five years starting April 2014 to renew and refocus the Homelessness Partnering Strategy using a Housing First approach. The Housing First approach involves giving people who are homeless a place to live, and then providing necessary supports to help them stabilize their lives and recover. As demonstrated by the Mental Health Commission of Canada’s At Home/Chez Soi project, the Housing First approach is an effective method to reduce homelessness and help those with mental illness. Through the Homelessness Partnering Strategy, the Government is implementing the Economic Action Plan 2013 commitment, and continues to work with communities, provinces and territories and the private and not-for-profit sectors to find flexible and effective ways to respond to homelessness.

Restoring the Effectiveness of the Excise Duty on Tobacco Products

Economic Action Plan 2014 proposes to restore the effectiveness of the excise duty on tobacco products by adjusting the domestic rate of excise duty on such products to account for inflation and eliminating the preferential excise duty treatment of tobacco products available through duty free markets.

Reducing tobacco consumption is an important health objective, and a key tool in achieving this objective is the excise duty on tobacco products.

The general domestic rate of excise duty on cigarettes has not effectively changed since 2002, meaning that the real rate of the excise duty has deteriorated by 23.7 per cent. To restore the effectiveness of the excise duty in reducing tobacco consumption, Economic Action Plan 2014 proposes to adjust the rate of excise duty on cigarettes, effective after Budget Day, to account for inflation since 2002. This measure will increase the rate of excise duty on cigarettes from $0.425 per 5 cigarettes or fraction thereof to $0.52575 per 5 cigarettes or fraction thereof (e.g. from $17.00 to $21.03 per carton of 200 cigarettes). This measure also includes corresponding increases in the rates of excise duty on other tobacco products (e.g. fine-cut tobacco for use in roll-your-own cigarettes, chewing tobacco and cigars), reflecting the inflationary adjustment in the rate for cigarettes.

In addition, to eliminate the preferential excise duty treatment of tobacco products available through duty free markets (e.g. duty free shops), Economic Action Plan 2014 proposes to increase the excise “duty free” rates on these products, effective after Budget Day, to be consistent with the rates of excise duty on the same tobacco products available in the domestic market (e.g. the excise “duty free” rate for cigarettes will increase from $15.00 to $21.03 per carton of 200 cigarettes).

It is estimated that these measures will increase federal tax revenues by $96 million in 2013–14, $685 million in 2014–15 and $660 million in 2015–16.

Going forward, to ensure that tobacco tax rates retain their real value in the future, the rates will be indexed to the Consumer Price Index and automatically adjusted accordingly every five years.

Tobacco use remains the leading preventable cause of disease and death in Canada, killing more than 37,000 Canadians each year. Cigarettes are highly addictive and cause cancer, heart disease and stroke, emphysema, and many other diseases. The overwhelming majority of new smokers are adolescents. A sustained, comprehensive response to the tobacco epidemic is essential, and tobacco taxation is a key component of that response.

—Excerpt from a May 3, 2013 submission to the Minister of Finance and Minister of Health, “A Win-Win: Recommendation for an Inflation Adjustment to Federal Cigarette Tax Rates,” endorsed by the Canadian Cancer Society and 12 other health organizations

Our evidence suggests that, even in Canada a big increase in the federal excise tax could get about one million smokers to quit and save about 5,000 lives a year.

—Dr. Prabhat Jha, Founding Director, Centre for Global Health Research, St. Michael’s Hospital and Professor, Dalla Lana School of Public Health, University of Toronto

Since 2006 the Government has taken a number of important steps to control contraband tobacco including:

- Providing funding for 71 new RCMP customs and excise officers to combat tobacco smuggling.

- Renewing the Federal Tobacco Control Strategy with an investment of $368.5 million over five years with a focus on contraband tobacco.

- Establishing the Task Force on Illicit Tobacco Products and the RCMP Contraband Tobacco Enforcement Strategy.

- Restricting the possession and importation of tobacco manufacturing equipment.

- Enhancing the tobacco stamping regime to deter contraband tobacco.

- Establishing the RCMP Anti-Contraband Tobacco Force of 50 officers and raising minimum penalties for trafficking in illicit tobacco.

- Adding 10 additional police officers in First Nations communities focused on contraband tobacco.

- Introducing the Tackling Contraband Tobacco Act to create a new offence of trafficking in contraband and to provide for minimum penalties of imprisonment for repeat offenders.

- Launching the “Break It Off” Campaign—a tobacco cessation program aimed at young Canadians. This is part of a multi-year $4.8-million investment to help young people quit smoking and stay smoke-free.

Enhancing Support to Combat Contraband Tobacco

Economic Action Plan 2014 proposes to allocate $91.7 million over five years to enhance the RCMP’s ability to combat contraband tobacco.

Contraband tobacco remains a serious threat to the public safety of Canadians. The illegal manufacture and distribution of this commodity fuels the growth of organized criminal networks. Building on recent investments, Economic Action Plan 2014 proposes to allocate $91.7 million over five years to enhance the RCMP’s ability to combat contraband tobacco.

The new funding to enhance the RCMP’s ability to combat contraband tobacco will be used to increase intelligence-led policing efforts, including the creation of a Geospatial Intelligence and Automated Dispatch Centre and the deployment of a range of sensor devices to detect movement on the border in high-risk areas, from the Maine-Quebec border to Oakville, Ontario.

Specifically, these enhancements would involve the deployment of high-end sensor devices including radar, sonar and unmanned ground sensors; mobile workstations; and long-range thermal video cameras to enable RCMP officers to respond in real time to high-risk alerts.

Investing in Stronger Communities

The Government continues to take concrete action to maintain strong and healthy Canadian communities. Economic Action Plan 2014 supports communities by taking additional steps to support the charitable sector. It proposes to maintain its investments in Canada’s vibrant arts and culture communities and to further recognize and support Canada’s veterans and their families. Economic Action Plan 2014 also provides additional support for Canadians in need and to help Canadians prepare for and recover from natural disasters. In addition, Economic Action Plan 2014 supports Canadians’ safety and security, supports the delivery of justice to victims of crime and their families, and continues to provide development and humanitarian assistance to people in other countries.

Charities

The Government of Canada recognizes that the charitable sector plays an essential and irreplaceable role in our society by providing valuable services to Canadians, including to those most in need. Economic Action Plan 2014 further responds to the report of the House of Commons Standing Committee on Finance on charitable donation tax incentives by proposing investments to reduce the administrative burden on charities and measures to enhance public awareness and tax incentives for charitable giving. It also proposes to amend the Criminal Code to remove an antiquated restriction and allow charities to conduct their lotteries through the use of modern technology.

Further Response to the Report of the House of Commons Standing Committee on Finance on Charitable Donation Tax Incentives

To encourage Canadians to donate to registered charities, the Government of Canada provides individuals and businesses with tax incentives that have been described as among the most generous in the world. In fact, federal tax assistance for the charitable sector amounts to approximately $3 billion annually. Provinces and territories also provide significant tax assistance.

In February 2013, the House of Commons Standing Committee on Finance completed an extensive review of charitable donation tax incentives and related issues. Economic Action Plan 2013 responded to the Committee’s February 11, 2013 report Tax Incentives for Charitable Giving in Canada by introducing the First-Time Donor’s Super Credit, which is being promoted by charities across Canada. In Economic Action Plan 2013, the Government also committed to work with the charitable sector and redouble its ongoing efforts in several areas identified by the Committee. Economic Action Plan 2014 introduces several measures that deliver on this commitment.

Investing to Reduce the Administrative Burden on Charities and Enhancing Public Awareness

Economic Action Plan 2014 further responds to the recommendations in the report of the House of Commons Standing Committee on Finance on charitable donation tax incentives by proposing to reduce the administrative burden on charities and enhance public awareness.