Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Chapter 4.1: Plan to Return to Budget Balance

Introduction

Canadians understand the importance of living within their means and expect the Government to do the same. That is why the Government is committed to managing public finances in a sustainable and responsible manner—a commitment that underpins our plan to return to budgetary balance. The Government's responsible financial management put Canada in a position of strength when it came time to combat the global recession. From 2006 to 2008, the Government paid down over $37 billion in debt, which significantly contributed to Canada's low net debt position, and enabled the Government to implement the stimulus phase of Canada's Economic Action Plan without leaving the country in a vulnerable fiscal position like many other countries.

Responsible fiscal management—balancing the budget and reducing debt—does far more than provide room to manoeuvre if the economy is affected by developments outside our borders. Responsible fiscal management helps to spur economic growth and job creation over the long term. Reducing debt:

- Frees up taxpayer dollars otherwise absorbed by interest costs, which can be reinvested in other priorities, such as public services and health care, or left in the pockets of Canadians by reducing taxes.

- Keeps interest rates low, encouraging businesses to invest for the future and to create jobs.

- Signals that public services are sustainable over the long run.

- Strengthens the country's ability to respond to long-term challenges such as population aging.

- Preserves Canada's low-tax plan, fostering the long-term growth that generates high-quality jobs for all Canadians.

- Ensures fairness and equity toward future generations by avoiding future tax increases or reductions in services.

As discussed in Chapter 2, the global economic environment remains fragile. The euro area is still in recession and uncertainty regarding U.S. fiscal policy continues to weigh on growth prospects. Although the Canadian economy is expected to continue growing at a modest pace, we are not immune to external developments.

In these uncertain times, the most important contribution a government can make to bolster confidence and growth is to maintain a sound fiscal position. The Government recognizes that it cannot control the impact that external economic shocks could have on the domestic economy or the revenue outlook. It can, however, support a return to balanced budgets by maintaining its focus on controlling the growth of direct program spending by federal departments. This includes a continuous examination of departmental spending to ensure that the operations of government are managed as efficiently as possible, without compromising the quality of services to Canadians.

Economic Action Plan 2013 builds on previous actions and confirms the Government's objective to return to balanced budgets by 2015–16.

The Plan to Return to Balance

In order to avoid long-term deficits, the Government ensured that critical stimulus spending introduced in Budget 2009 was paired with a concrete plan to return to budgetary balance. The following year, in Budget 2010, targeted actions were taken to control the growth in direct program spending, including capping the International Assistance Envelope, restraining the growth in National Defence spending, and implementing a departmental operating budget freeze from 2010–11 to 2012–13.

Budget 2011 continued to build on the Government's plan with the announcement of results from the final year of Strategic Reviews and the launch of a major review of departmental spending. Departmental operations were scrutinized to ensure that programming was being delivered in an efficient manner and was aligned with the priorities of Canadians. The result was over $5.2 billion in ongoing departmental savings announced in Economic Action Plan 2012.

Economic Action Plan 2012 also indicated the Government's intention to take steps to ensure that the pension plans available to federal employees and Parliamentarians were financially sustainable, broadly consistent with other jurisdictions, and fair relative to the pension benefits available in the private sector. Following consultations with stakeholders, the 2012 Fall Update confirmed that these actions would result in annual savings of over $900 million once higher contribution rates are fully phased in. The 2012 Fall Update also confirmed the Government's intention to eliminate severance benefits available to employees upon voluntary departure, which will yield a further $500 million in ongoing savings.

The Government has also taken numerous actions to close tax loopholes that allow a select few businesses and individuals to avoid paying their fair share, and to improve the overall fairness of the tax system. These measures protect the Government's revenue base, which helps to keep taxes low for hard-working Canadian families.

Progress in Achieving Economic Action Plan 2012 Reductions

Following the Budget 2011 commitment to identify at least $4 billion in annual savings by 2014–15, the Government launched a major review of departmental spending. Approximately $75 billion in direct program spending by departments and agencies was assessed according to its relevance, effectiveness and value for taxpayer money.

Economic Action Plan 2012 announced the results of this review, with roughly $5.2 billion in ongoing savings identified, representing 6.9 per cent of the review base, and a reduction in federal employment of 19,200, or 4.8 per cent.

The reductions in departmental budgets were focused on making government operations leaner, while preserving fundamental programs and services for Canadians. These spending reductions are contributing to a more productive, efficient and responsive government by:

- Refocusing government programs to better align spending with the priorities of Canadians.

- Making it easier for Canadians and businesses to deal with their government.

- Modernizing and streamlining back office administrative functions.

The Government is on track to achieve the savings announced in Economic Action Plan 2012. As of December 31, 2012, 16,220 public service positions had been eliminated since Economic Action Plan 2012, of which 9,390 were achieved through attrition. The second year of departmental spending reductions has been reflected in the 2013–14 Main Estimates.

New Measures to Return to Balanced Budgets and to Make Government More Efficient

In Economic Action Plan 2012, the Government told Canadians that in the coming year, it would continue to standardize, consolidate and transform the way it does business by examining government-wide solutions to improve services and achieve efficiencies. In the Fall of 2012, the Government created the Priorities and Planning Sub-Committee on Government Administration with the aim of identifying opportunities that would generate operational savings while improving services and transforming the public service.

Economic Action Plan 2013 announces a number of common sense improvements to government administration and service delivery identified to date. Together, these whole-of-government initiatives are a clear signal that there has been real progress made towards the goal of modernizing government administration. Going forward, the Government will continue its efforts to transform the public service into the public service of tomorrow.

Reducing Travel Costs Through the Use of Technology

Economic Action Plan 2013 implements measures to cut departmental travel costs by $42.7 million or 5 per cent, and to boost productivity by using modern alternatives to travel.

The Government is committed to controlling administrative costs, including costs related to travel. In recent years, travel expenses have been declining as a result of cost containment measures in earlier budgets. In addition to those measures, the Directive on the Management of Expenditures on Travel, Hospitality and Conferences was introduced on January 1, 2011 to ensure that travel expenditures are managed in a more effective and economical manner. The Directive was strengthened in October 2012 by requiring increased oversight of all department-related events where total planned costs exceed $25,000.

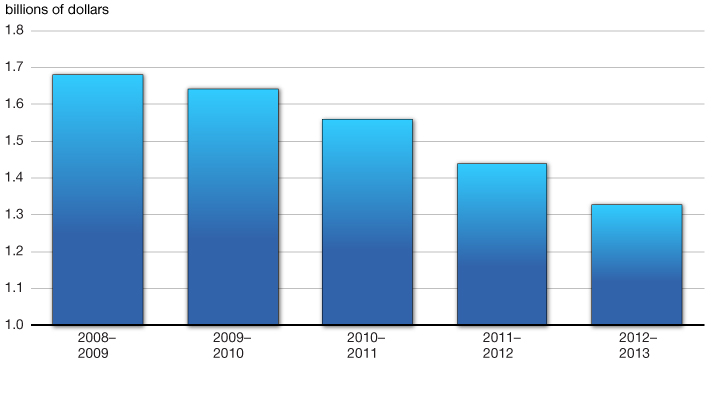

Economic Action Plan 2013 will further strengthen the Directive by requiring additional oversight of travel authorization and promoting alternatives to travel. To complement these efforts, departmental spending on public service travel will be reduced by 5 per cent, or $42.7 million, on an ongoing basis, beginning in fiscal year 2013–14. These changes will ensure that the downward trend in total travel expenses will continue (Chart 4.1.1).

Government travel costs have been declining

Federal departments will increasingly replace travel by using remote meeting alternatives such as telepresence, which is similar to videoconferencing but enables participants to see life-size, full-motion video with high-quality sound. These alternatives are more cost-effective than travel and will increase productivity, as public servants will spend less time in transit. In particular, Economic Action Plan 2012 announced that the Government would develop a strategy to expand the use of telepresence and other remote meeting solutions. Further to this commitment, the Government will dedicate $20 million of existing Shared Services Canada funding to improve the Government’s telepresence capacity and other comparable technologies. Shared Services Canada will monitor the use of the Government’s videoconferencing facilities and will work with the Treasury Board Secretariat to ensure that these facilities are used to the fullest extent possible.

Standardizing and Modernizing Government Information Technology

Economic Action Plan 2013 takes concrete action to reduce duplication in government information technology (IT) by standardizing and consolidating the procurement of end-user devices and transitioning to a single platform for federal email systems.

Federal departments are currently individually responsible for procuring end-user IT devices for their employees—including computers, operating software, and peripherals such as printers—as well as providing the associated IT support services. Duplication of effort in these activities has resulted in the Government spending significantly more than the private sector.

By moving away from each department independently managing these activities, there are opportunities to drive economies of scale, achieve savings for taxpayers and improve service. Therefore, Economic Action Plan 2013 announces the consolidation and standardization of software procurement for end-user devices for federal employees, resulting in annual savings of $8.7 million beginning in 2014–15. Moving forward, the Government will explore further whole-of-government approaches to reduce costs in the area of procurement of end-user devices and associated support services.

The Government will also build on the efficiencies achieved through the creation of Shared Services Canada and shift from 63 email systems managed by separate departments and agencies into a single, secure, reliable and cost-effective email platform. This work builds on Shared Services Canada’s efforts to consolidate the number of data centres from over 300 to less than 20 and to streamline electronic networks.

Transforming How Canadians Obtain Government Services and Information

Economic Action Plan 2013 improves access to government services and information by shifting to electronic publishing and examining opportunities to streamline the Government’s web presence.

The Government is also working to make it easier for citizens and businesses to obtain information and transact with government:

- Recognizing that more and more Canadians access information online, the Government will take steps to modernize the production and distribution of government publications by shifting to electronic publishing and making print publications the exception. The President of the Treasury Board will develop and implement new procedures that will require all publications to be available electronically and will allow printing only under specific circumstances, for instance, to meet statutory obligations, to inform Canadians about health, safety or security issues, or to meet the needs of specific target audiences.

- The Government is also examining opportunities to streamline its web presence by making it easier for Canadians to find and access Government information on the web through a single entry point.

More Efficient Government Operations

Economic Action Plan 2013 announces targeted savings identified at the Canada Revenue Agency and Fisheries and Oceans Canada, improvements to the Canada Revenue Agency compliance programs, and puts forward a plan to control overall employee compensation expenses.

The Priorities and Planning Sub-Committee on Government Administration also led a detailed review of the administrative functions of two federal departments:

- An examination of internal operations at the Canada Revenue Agency identified ongoing savings of $60.6 million per year by 2015–16 at the Agency’s headquarters operations. The Agency will streamline its internal services, reduce management administrative support, and leverage increased public use of automated tools to reduce spending on information technology. In addition, the Agency will further integrate workloads and broaden management oversight. These savings will not impact services to Canadians, government revenues or the security of taxpayer information.

- Fisheries and Oceans Canada identified internal departmental efficiencies rising to $33 million per year by 2015–16. The Department will modernize the organizational structure of its headquarters in order to provide cost-effective services to Canadians. For example, it will reduce administrative overhead and will pursue organizational changes to reduce duplication and improve decision-making processes. To complement these savings, Fisheries and Oceans Canada will also improve regional program efficiency by reducing management overhead and consolidating decision-making authority. Organizational changes required to generate these savings will not impact front line staff or services to Canadians.

In addition, Economic Action Plan 2013 confirms that the Canada Revenue Agency will implement transformational changes to its compliance programs that will improve effectiveness and help to preserve the integrity of the tax system through targeting non-compliance in the highest-risk areas. The Agency will make greater use of advanced data analysis to improve identification of incidences of non-compliance and will deploy teams of specialists to pursue tax evaders. These changes are expected to result in the collection of additional revenues amounting to $550 million per year by 2014–15.

The Government remains committed to ensuring that it is delivering the programs and services that Canadians want and need efficiently and effectively. The Government will continue to examine ways to streamline its operations by ensuring that programs and services are delivered by those best positioned to do so. The Government will introduce legislation as needed to consolidate operations and eliminate redundant organizations.

Economic Action Plan 2013 also confirms the Government’s ongoing commitment to ensure that overall employee compensation is reasonable and affordable, as well as aligned with what is offered by other public and private sector employers. As part of this commitment, the Government has already announced changes to employee and Parliamentarian pensions and is eliminating severance benefits available to employees upon voluntary departure.

As world events evolve rapidly, governments and private sector organizations around the globe are examining new ways to become more effective and efficient. Canada’s public service has contributed much to Canada’s success. As with all institutions, its systems and processes must be reviewed and updated periodically to ensure they are modernized to better serve Canada and Canadians.

Going forward, the Government will continue to ensure that the public service is affordable, modern and high-performing. To help do this, it will examine overall employee compensation and pensioner benefits and will propose changes to the labour relations regime. The Government will work with its employees, bargaining agents and others to identify and implement improved practices and approaches following the lead of other public and private sector organizations. It will also explore other opportunities to further transform and modernize the public service to address the demands of the modern world and respond to the evolving needs of Canadians. These improvements will benefit both public servants and all Canadians.

In addition, the Government will be examining its human resources management practices and institutions in a number of areas, including disability and sick leave management, with a view to ensuring that public servants receive appropriate services that support a timely return to work.

The Government will be consulting with key stakeholders on these objectives over the coming months.

Crown Corporations

Economic Action Plan 2013 takes steps to align employee compensation offered by Crown corporations with what is available to federal employees.

In Economic Action Plan 2012, the Government indicated that it would work with Crown corporations to ensure that their pension plans are broadly aligned with those available to federal employees. The Government will continue to work with Crown corporations with a view to moving to a 50:50 cost sharing between the employer and employees by 2017 and aligning the age at which retirement benefits become available with those announced in Economic Action Plan 2012 for post-2012 hires under the Public Service Pension Plan. The Government will also look at options to improve the financial viability of Crown corporations, including compensation levels.

Corporate Asset Management Review

Economic Action Plan 2013 confirms the Government’s ongoing commitment to review its corporate assets to ensure value for taxpayers.

The Corporate Asset Management Review is a systematic review of corporate assets as a normal part of good governance. The review assesses selected federal assets, with a view to improve their efficiency and effectiveness, ensuring the Government’s resources are employed in ways that focus on the priorities of Canadians and maximize benefits to taxpayers. There is a broad range of potential outcomes in respect of Crown assets or Crown corporations associated with this process, including but not limited to: preserving status quo operations and management; changes to current mandates, governance and operations; and divestiture where appropriate. In some cases, implementation of an outcome may involve the introduction of new legislative authorities. The Government will continue to review its corporate assets to ensure value for taxpayers.

As a result of this systematic review, the Government intends to proceed with a sale of Ridley Terminals Inc., a bulk coal terminal in British Columbia. As announced in December 2012, the Government is seeking a buyer that will operate the terminal on a long-term, sustainable basis and with open access. The decision to sell Ridley Terminals is consistent with the Government’s commitment to the efficient use of public resources. Private ownership of the terminal could allow it to reach its full potential and maximize its contribution to economic growth, jobs and new investments in Prince Rupert and surrounding communities.

Closing Tax Loopholes and Improving the Fairness and Integrity of the Tax System

Economic Action Plan 2013 announces a number of measures to close tax loopholes and improve the fairness and integrity of the tax system, helping to keep Canadian taxes low.

As part of the Government’s continuing commitment to keep taxes low for Canadian families and ensure the integrity of the tax system, Economic Action Plan 2013 proposes a number of measures to close tax loopholes, address aggressive tax planning, clarify tax rules, and reduce international tax evasion and aggressive tax avoidance.

The Government is committed to closing tax loopholes that allow a select few businesses and individuals to avoid paying their fair share. Broadening and protecting the tax base supports the Government’s effort to return to balanced budgets, responds to provincial governments’ concerns about protecting provincial revenues on our shared tax bases, and helps give Canadians confidence that the tax system is fair. Ensuring that everyone pays their fair share also helps to keep taxes low for Canadian families and businesses, thereby improving incentives to work, save and invest in Canada.

Since 2006, and including measures proposed in Economic Action Plan 2013, the Government has introduced over 75 measures to improve the integrity of the tax system.

The Government is taking steps in Economic Action Plan 2013 to improve the integrity of the tax system by:

- Further extending the application of Canada’s thin capitalization rules—which limit the amount of Canadian profits that can be distributed to certain non-resident shareholders as deductible interest payments—to Canadian resident trusts and non-resident entities.

- Ensuring that the loss pools of trusts cannot be inappropriately traded among arm’s length persons.

- Enhancing corporate anti-loss trading rules to address planning that avoids these rules.

- Ensuring that the tax consequences of disposing of a property, such as capital gains tax, cannot be avoided by a taxpayer by entering into transactions that are economically equivalent to a disposition of the property, but where legal ownership of the property is retained by the taxpayer.

- Ensuring that derivative transactions cannot be used to convert fully taxable ordinary income into capital gains taxed at a lower rate.

- Eliminating unintended tax benefits relating to leveraged insured annuities.

- Eliminating unintended tax benefits relating to leveraged life insurance arrangements, commonly known as 10/8 arrangements.

- Clarifying that the income reserve for future services cannot be used by taxpayers for amounts received for the purpose of funding future reclamation costs (e.g., the costs of reclaiming land previously used for waste disposal purposes, or for addressing pipeline abandonment).

- Responding to the recent Federal Court of Appeal decision in the Sommerer case to restore the intended tax policy result in relation to non-resident trusts.

- Providing the Minister of National Revenue the authority to withhold Goods and Services Tax/Harmonized Sales Tax (GST/HST) refunds claimed by a business where the business has failed to provide the Canada Revenue Agency (CRA) with all of the information required as part of the GST/HST registration process.

- Introducing new administrative monetary penalties and criminal offences to deter the use, possession, sale and development of electronic suppression of sales software that is designed to falsify records for the purpose of tax evasion.

- Clarifying that reports, examinations and other services that are performed for a non-health-care-related purpose do not qualify for the GST/HST exemption for basic health care services.

- Clarifying that commercial paid parking is subject to GST/HST when supplied by a municipality, hospital, university, public college, school or any entity established by one of these bodies.

- Extending the reassessment period for reportable tax avoidance transactions and tax shelters when information returns are not filed properly and on time.

- Permitting the CRA to collect up to 50 per cent of amounts in dispute in respect of tax shelter claims that involve a charitable donation.

- Revising Scientific Research and Experimental Development (SR&ED) program claim forms to require more detailed information that will facilitate the identification of claims with a higher risk of non-compliance, as well as imposing a new penalty of $1,000 in respect of each SR&ED claim for which the required information is missing, incomplete or inaccurate.

- Clarifying the restricted farm loss rules to ensure that, in order for a farmer to be able to fully deduct farming losses against other sources of income, the other sources of income must be subordinate to farming.

- Consulting members of the tax community and other Canadians on access to graduated personal tax rates for certain trusts.

- Consulting members of the tax community and other Canadians on the issue of “treaty shopping,” where payments are made from Canada to an entity that resides in a Canadian treaty partner country in order to benefit from preferential Canadian treaty provisions.

Legislative proposals in Economic Action Plan 2013 to improve tax integrity are estimated to raise $100 million in revenues in 2013–14, rising to over $270 million in 2017–18, for a total of close to $1 billion over the next five years.

In addition, Economic Action Plan 2013 will provide the CRA with new tools to enforce the tax rules to reduce international tax evasion and aggressive tax avoidance, specifically by:

- Extending the normal reassessment period by three years for taxpayers who have failed to report income from a specified foreign property on their annual income tax return and failed to properly file the Foreign Income Verification Statement (Form T1135).

- Revising Form T1135 to require reporting of more detailed information.

- Streamlining the process for the CRA to obtain information concerning unnamed persons from third parties such as banks.

- Requiring certain financial intermediaries, including banks, to report to the CRA their clients’ international electronic funds transfers of $10,000 or more.

- Announcing that the CRA will introduce a new Stop International Tax Evasion Program through which it will be able to pay rewards to individuals with knowledge of major international tax non-compliance. The reward will be a percentage of tax collected as a result of information provided.

Economic Action Plan 2013 also introduces tax fairness and neutrality measures that will yield $215 million in savings in 2013–14, rising to $965 million in 2017–18, for a total of $3.4 billion over the next five years. Further details are provided in Annex 2.

In total, actions in Economic Action Plan 2013 to close tax loopholes and improve the fairness and integrity of the tax system will provide about $315 million in savings in 2013–14, rising to over $1.2 billion in 2017–18, for a total of $4.4 billion over the next five years.

In addition, the modernization of the General Preferential Tariff regime discussed in Chapter 3.2 will result in annual savings of $83 million in 2014–15, rising to $333 million in 2015–16 and ongoing, for a total of $1.1 billion over the next five years.

Improving the Integrity of Canada’s Tax System: A Track Record of Success

Examples of measures introduced by the Government prior to Economic Action Plan 2013 include:

- Improving the thin capitalization rules, which restrict the amount of interest that businesses may deduct in cross-border contexts, by extending the rules to certain partnerships and by aligning the debt-to-equity ratio with current industry norms.

- Addressing “foreign affiliate dumping” transactions that foreign-controlled Canadian corporations used to shift profits out of Canada.

- Addressing the use of partnerships in corporate tax avoidance or deferral (e.g., the bump denial rules and the anti-deferral rules).

- Ensuring the charitable sector uses its resources appropriately through enhanced transparency and accountability measures.

- Addressing self-dealing arrangements involving Retirement Compensation Arrangements, Registered Retirement Savings Plans and Tax-Free Savings Accounts.

- Introducing hybrid surplus rules to prevent foreign affiliates from deferring tax by repatriating only the non-taxable portion of certain capital gains.

- Introducing upstream loan rules to prevent foreign affiliates from deferring tax by repatriating otherwise taxable surplus in the form of loans.

- Introducing an information reporting regime for tax avoidance transactions and improving the tax shelter reporting rules.

- Improving the specified leasing property rules to prevent tax-exempt entities from gaining the benefit of income tax recognition of depreciation.

- Reducing unintended tax benefits relating to employee stock options.

- Addressing “foreign tax credit generator” transactions which artificially create foreign taxes (where no net foreign tax is actually paid) that are claimed by the Canadian corporation as foreign tax credits in order to offset Canadian tax otherwise payable.

- Moving forward with targeted and simplified proposals to prevent the reduction in Canadian tax through the use of non-resident trusts and foreign investment entities.

- Introducing a tax on the income of specified investment flow-through entities (SIFTs, commonly known as “income trusts”); subsequently, ensuring that corporate anti-loss trading rules apply on SIFT conversions to corporate form, and also ensuring that stapled securities cannot be used to frustrate the SIFT regime.

| 2012– 2013 |

2013–2014 | 2014–2015 | 2015–2016 | 2016–2017 | 2017–2018 | 6-Year Total | |

|---|---|---|---|---|---|---|---|

| Reducing travel costs | -43 | -43 | -43 | -43 | -43 | -214 | |

| Expanding the use of telepresence | 20 | 20 | |||||

| Standardizing and consolidating procurement of end-user devices |

-2 | -9 | -9 | -9 | -9 | -37 | |

| Targeted review: Canada Revenue Agency operations |

-19 | -58 | -61 | -61 | -61 | -259 | |

| Targeted review: Fisheries and Oceans Canada operations | -4 | -5 | -33 | -33 | -33 | -108 | |

| Canada Revenue Agency: compliance programs |

-30 | -125 | -550 | -550 | -550 | -550 | -2,355 |

| Closing tax loopholes and improving the fairness of the tax system |

-2 | -316 | -806 | -946 | -1,082 | -1,237 | -4,389 |

| General Preferential Tariff | -83 | -333 | -333 | -333 | -1,082 | ||

| Total | -32 | -489 | -1,554 | -1,974 | -2,110 | -2,265 | -8,423 |

| Less internal reallocations | -20 | -20 | |||||

| Total measures to return to budget balance |

-32 | -509 | -1,554 | -1,974 | -2,110 | -2,265 | -8,443 |

| Note: Totals may not add due to rounding. | |||||||

The Government’s Plan for Returning to Balanced Budgets Is on Track

Economic Action Plan 2013 builds on actions taken by the Government since Budget 2010 with an additional $500 million in savings in 2013–14, rising to $2.3 billion in 2017–18, for a total of $8.4 billion over the next five years.

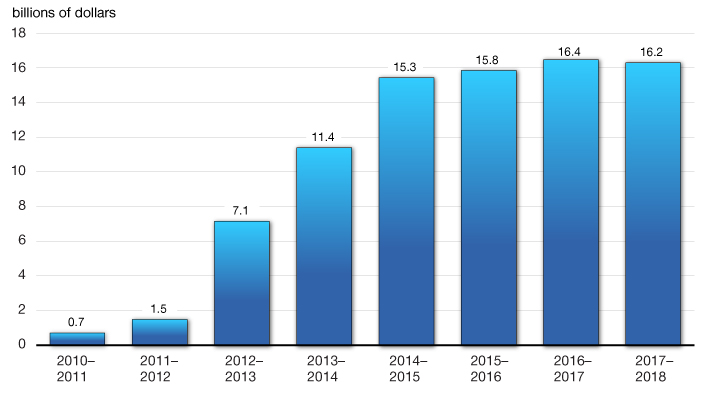

Together with measures taken since Budget 2010, this means the Government has announced savings that will reduce the deficit by more than $15 billion in 2014–15 and beyond, resulting in cumulative savings of more than $84 billion over the 2010–11 to 2017–18 period (Chart 4.1.2). Over 75 per cent of these savings will result from measures to restrain the growth in direct program spending.

Actions taken since Budget 2010 have resulted in over $16 billion in ongoing savings

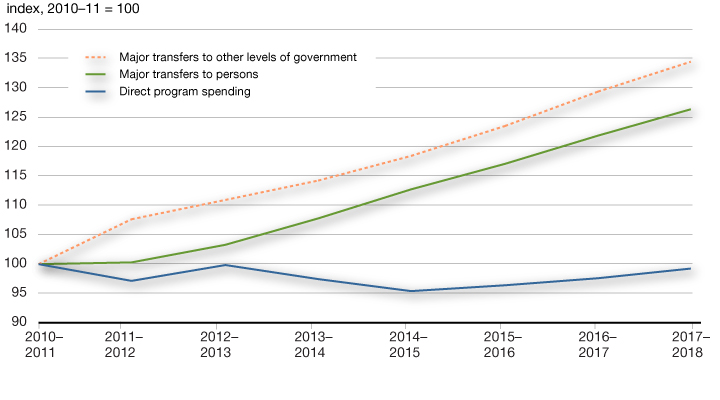

The Government's focus on controlling direct program spending by federal departments is demonstrated in Chart 4.1.3. Taking into account all measures in this budget, direct program spending is projected to remain roughly at or below its 2010–11 level over the forecast horizon. In contrast, federal transfers to individuals that provide important income support, such as Old Age Security and Employment Insurance, and major transfers to other levels of government for social programs and health care will continue to grow over the forecast horizon.

The Government is controlling direct program spending

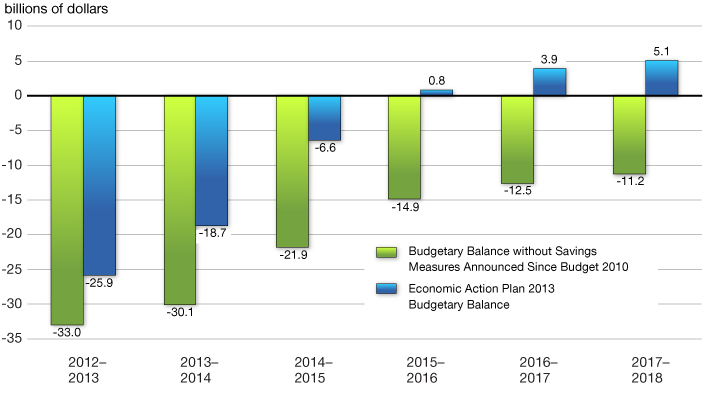

By focusing on controlling what it can control, the Government is on track to balance the budget by 2015–16 (Chart 4.1.4). The Government's actions since Budget 2010 have constrained growth in discretionary spending and have been part of a clear plan to eliminate the deficit over the medium term.

The Government’s restraint measures since Budget 2010 ensure a return to balanced budgets

on the Budgetary Balance

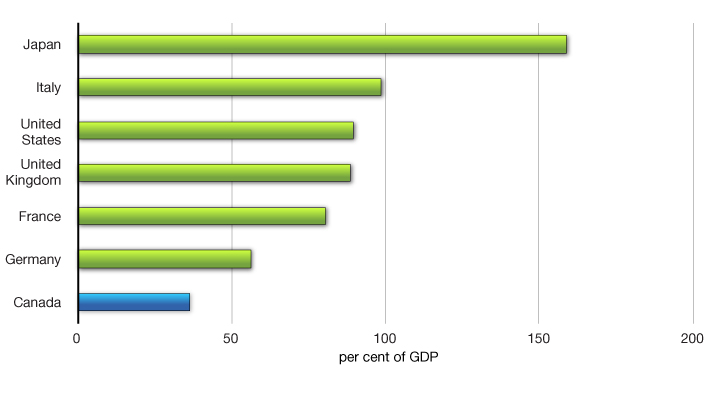

As a result of this sound management, Canada's fiscal position remains the envy of the world and is expected to allow Canada to maintain by far the lowest net debt burden among G-7 countries (Chart 4.1.5).

Canada will maintain a significant fiscal advantage over other G-7 countries

Source: International Monetary Fund, Fiscal Monitor, October 2012.