Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Chapter 3.4: Investing in World-Class Research and Innovation

Highlights

Supporting Advanced Research

- $37 million in new annual support for research partnerships with industry through the granting councils, including $12 million to enhance the College and Community Innovation Program.

- $165 million in multi-year support for genomics research through Genome Canada, including new large-scale research competitions and participation by Canadian researchers in national and international partnership initiatives.

- $225 million to be used by the Canada Foundation for Innovation to support advanced research infrastructure priorities and sustain the long-term operations of the Foundation.

Pursuing a New Approach to Supporting Business Innovation

- $121 million over two years to invest in the strategic focus of the National Research Council to help the growth of innovative businesses in Canada.

- $20 million over three years to help small and medium-sized enterprises access research and business development services at universities, colleges and other non-profit research institutions of their choice.

- $325 million over eight years to Sustainable Development Technology Canada to continue support for the development and demonstration of new, clean technologies.

- $20 million over two years to the Canada Revenue Agency to improve the predictability and enhance enforcement of the Scientific Research and Experimental Development tax incentive program.

Enhancing Canada’s Venture Capital System

- $60 million over five years to help outstanding and high-potential incubator and accelerator organizations expand their services to entrepreneurs.

- $100 million through the Business Development Bank of Canada to invest in firms graduating from business accelerators.

- Promoting an entrepreneurial culture in Canada through new Entrepreneurship Awards.

- $18 million over two years to the Canadian Youth Business Foundation to help young entrepreneurs grow their firms.

Investing in World-Class Research and Innovation

The global economy is changing. As other mature economies are striving to become more innovative and productive, Canada is also facing more intense competition from emerging countries that are seeking to move up the value chain. Canada must continue to generate the highly qualified individuals and breakthrough new ideas that our businesses require to become more competitive and create and sustain high-paying, value-added jobs.

The Government of Canada is taking action to ensure Canada has the necessary conditions in place to foster innovation. By consistently supporting advanced research and technology, the Government is choosing to invest in the current and future prosperity of Canadians. Since 2006 the Government has provided more than $9 billion in new resources to support science, technology, and the growth of innovative firms—bringing support to an all-time high and helping to foster a world-class research and innovation system that supports Canadian businesses and economic growth. Economic Action Plan 2013 proposes to build on this strong foundation, helping to position Canada for sustainable, long-term economic prosperity and a higher quality of life for Canadians.

Supporting Advanced Research

Since 2006, the Government has provided significant new resources to support advanced research in Canada, including new funding for:

- Basic and industry-partnered research through the federal research granting councils.

- Applied industry-relevant research at colleges and polytechnics.

- Leading-edge research infrastructure through the Canada Foundation for Innovation and the $2-billion Knowledge Infrastructure Program.

- The development and attraction of highly qualified personnel through new initiatives such as the Vanier Canada Graduate Scholarships for doctoral students and the Banting Postdoctoral Fellowships.

- Enhanced global leadership of key research institutions through the Canada Excellence Research Chairs program.

- The advancement of Canada’s capacity for research in genomics through Genome Canada.

- Knowledge transfer and commercialization through initiatives such as the Centres of Excellence for Commercialization and Research, the Business-led Networks of Centres of Excellence and the Industrial Research and Development Internships.

The Government also supports research and innovation in tackling global challenges via its Development Innovation Fund. Through its contribution of $225 million to Grand Challenges Canada (GCC), announced in Budget 2008 and supporting activity through 2016, the Government brings science, technology, social and business innovation together in the field of global health. The Government will be strengthening its commitment to GCC with the recently announced strategic partnership intended to drive financial innovation in international development.

Federal Support for Research and Development is Benefitting Canadians

Since 2006 the Government has invested more than $9 billion in new funding for science, technology and innovation, activities that enhance business competitiveness and lead to a higher quality of life for Canadians. Examples of success stories driven by federal support for research and development include:

- Cangene Corporation, a biopharmaceutical company, has licensed a technology platform developed by a researcher at the University of British Columbia to treat Alzheimer’s disease. The discovery will allow the company to advance an immune therapeutic treatment to directly impact the disease’s progression. In time, the discovery could lead to a preventative vaccine.

- A research team at St-Boniface Hospital and the University of Manitoba found that eating flaxseed was associated with reduced blood pressure in people with hypertension. With an anti-hypertensive effect among the most potent ever observed, this discovery could result in dramatic reductions in strokes and heart attacks.

- A team of neuroscientists at the University of Waterloo have created the largest functioning model of the brain. Described in Science magazine, this model is the first to explain how brains can perform a wide variety of tasks in a flexible manner and how the brain coordinates the flow of information between different areas to exhibit complex behaviour.

- Researchers at the University of Toronto have created the Wind-Earthquake Coupling Damper, a construction technology to cost-effectively reduce wind and earthquake vibrations in high-rise buildings. Developed in partnership with leading architects and designers, the technology can absorb vibrations without reducing leasable building space. The commercialization of this technology is being undertaken by the University of Toronto’s spin-off company Kinetica Dynamics.

- Researchers at Dalhousie University have developed new programs to help prevent and treat disruptive behaviour among children with attention deficit and hyperactivity disorders. The new approach focuses on a child’s environment, such as at school or the playground, rather than delivering treatment in an isolated office setting.

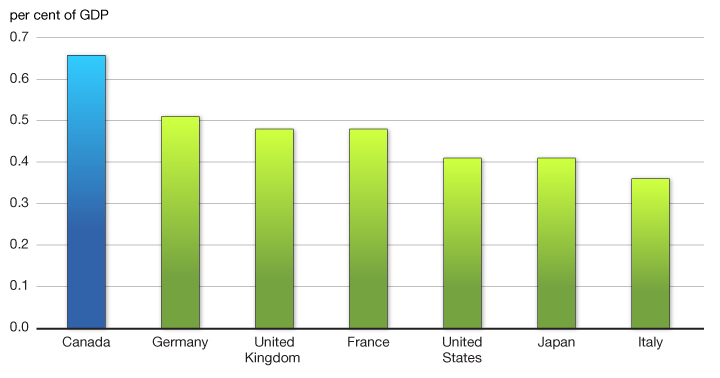

As a result of these actions, Canada continues to be a world leader in post-secondary research. As illustrated in Chart 3.4.1, Canada ranks first among Group of Seven (G-7) countries in higher education research and development spending as a share of the economy. In its September 2012 report The State of Science and Technology in Canada, the Council of Canadian Academies noted that Canada is internationally renowned for excellence in a wide range of disciplines, including clinical medicine, information and communication technologies, physics and astronomy, psychology and cognitive sciences. Further, the report notes that Canada does well in terms of international science and technology collaboration and human capital, indicating a net migration of researchers into the country in the past decade. The Council affirms that Canada has world-class researchers and institutions.

Canada ranks first among G-7 countries in higher education research and development spending as a share of the economy

Source: Organisation for Economic Co-operation and Development, Main Science and Technology Indicators.

The Government recognizes that Canada must build on this position of strength by continuing to invest in research and technology development, even in this time of fiscal restraint. Economic Action Plan 2013 proposes the following new measures to support world-class research and innovation.

Strengthening Research Partnerships Between Post-Secondary Institutions and Industry

Economic Action Plan 2013 proposes to provide $37 million annually to support research partnerships with industry through the granting councils.

Scientific discovery and its deployment through new technologies, products and services into the marketplace provide economic and social benefits for all Canadians. Our country’s world-leading public research also contributes to the strength of our communities and to the competitiveness of Canadian businesses.

The Government has taken a number of steps to strengthen research partnerships with industry, including through the granting councils. Economic Action Plan 2013 proposes to provide further support for partnerships between businesses and academic researchers, including an additional $37 million in 2013-14 and ongoing to the federal research granting councils for partnered research. This funding consists of three elements:

- $15 million per year to the Natural Sciences and Engineering Research Council, including $12 million to enhance the College and Community Innovation Program (see below).

- $15 million per year for the Canadian Institutes of Health Research’s Strategy for Patient-Oriented Research.

- $7 million per year for the Social Sciences and Humanities Research Council. This funding will in part support research related to the labour market participation of persons with disabilities (see Chapter 3.1 under “Strengthening Federal Programming for Persons With Disabilities”).

Colleges and polytechnics play an important role in helping small and medium-sized enterprises bring new technologies, products and processes to the marketplace. As indicated above, Economic Action Plan 2013 includes an additional $12 million annually for the College and Community Innovation Program (CCIP) starting in 2013-14, increasing its budget to $50 million per year. CCIP supports collaboration between colleges and industry on research and development projects that focus on company needs, helping firms to become more innovative and productive.

To further encourage the contribution of colleges to the innovation system, the granting councils will also extend eligibility for their undergraduate industrial internships and scholarships to students enrolled in bachelor degree programs in colleges and polytechnics.

Through these new initiatives, the Government will be fully reinvesting the savings from the granting councils’ efficiencies identified in last year’s budget to take effect in 2013-14 and later years in priority research areas.

Economic Action Plan 2013 also proposes increased support for initiatives to attract highly promising students from around the world to Canadian universities and to allow Canadian students to take advantage of training opportunities abroad through the Mitacs Globalink Program (see Chapter 3.1 under “International Education Strategy”).

The Government recognizes that federally sponsored research undertaken at post-secondary institutions entails associated indirect costs, and provides support for these through the Indirect Costs Program. In the coming year, the Government will examine the Indirect Costs Program in consultation with the post-secondary sector, including the Association of Universities and Colleges of Canada, to ensure that the program is meeting its objective of reinforcing excellence in post-secondary research.

College and Community Innovation Program Success Stories

The College and Community Innovation Program helps firms to become more innovative and productive by supporting collaboration between colleges and industry on research and development projects that focus on company needs. Examples of the program’s successes to date include:

- In partnership with SAIT Polytechnic in Calgary, Alberta, Get Mobility Solutions Inc. has designed a new prototype of a multifunctional wheelchair able to overcome challenging obstacles such as ascending and descending staircases. This project has allowed the company to build and assemble a second-generation prototype of this innovative wheelchair.

- Yukon College, the University of Saskatchewan and industry partners are developing biochar, a type of charcoal resulting from heating biological elements otherwise considered as waste, for the remediation of soil contaminated by oil spills and gas leaks.

- Fleming College has increased the capacity of its Centre for Alternative Wastewater Treatment in Lindsay, Ontario, to develop, apply and commercialize new technologies. The applied research capacity of the college will be integrated in student curricula to involve students in research, learning and training. In 2011-12 the Centre pursued research activities with over 15 firms in the natural resources, instrumentation, clean technology and consulting sectors.

- TransBIOTech, a centre for technology transfer associated with CEGEP Lévis-Lauzon in Lévis, Quebec, has developed a model in partnership with Bio-K Plus International to determine whether the probiotics developed by the firm could positively influence the immune system, in addition to the benefits already known for the digestive system. The research findings could be used in applications relating to inflammatory intestinal diseases such as Crohn’s disease.

- Canada’s Smartest Kitchen at Holland College in Prince Edward Island is supporting the development of new food products in Atlantic Canada. The Smartest Kitchen provides industry access to the expertise of chefs, product development and market research services, and specialized equipment.

Reinforcing Canadian Research Capacity in Genomics

Economic Action Plan 2013 proposes to provide multi-year funding of $165 million to support genomics research.

Genome Canada is a not-for-profit corporation dedicated to accelerating the development of Canadian research capacity in genomics. Genomics research helps unlock new opportunities in diverse areas such as health, fisheries, forestry, agriculture and the environment. Past research supported by Genome Canada has led to the implantation of defibrillators in the chests of individuals who had tested positive for a fatal gene responsible for sudden cardiac death, saving many lives. Research supported by Genome Canada on the bovine genome has provided the cattle and dairy industry with the tools to undertake genome selection for desirable traits such as meat quality and milk production, providing significant benefits to the industry. Genome Canada has had a transformative impact on the state of genomics research, helping Canada become a world leader in this critical research area.

To date, the Government has provided over $1 billion to Genome Canada, including $60 million through Economic Action Plan 2012 for the launch of a new applied research competition in the area of human health, expected to take place later this year. Genome Canada has matched this significant federal commitment with an additional $1 billion raised from other partners.

To build on Genome Canada’s achievements to date, Economic Action Plan 2013 proposes to provide $165 million in 2014-15 to support Genome Canada’s multi-year strategic plan. This funding will enable Genome Canada to launch new large-scale research competitions over the next three years, support continued participation by Canadian genomics researchers in national and international partnership initiatives, and maintain Genome Canada’s operations and the operations of the regional Genome Centres and the Science and Technology Innovation Centres until the end of 2016-17.

Combined with an additional $280 million in matching contributions from Genome Canada’s research partners, support for genomics research through Genome Canada will total approximately $2.5 billion by the end of 2016-17.

Supporting Leading-Edge Research Infrastructure

Economic Action Plan 2013 announces that $225 million of unallocated interest income of the Canada Foundation for Innovation will be committed to advanced research infrastructure priorities and sustaining the long-term operations of the Foundation.

The Canada Foundation for Innovation (CFI) is a not-for-profit corporation that supports the modernization of research infrastructure at Canadian universities, colleges, research hospitals and other not-for-profit research institutions across Canada. It has supported over 7,800 projects at 130 research institutions across the country. The CFI plays a vital role in attracting and retaining the world’s top researchers, and training the next generation of researchers and highly skilled workers.

To date, the Government has provided close to $5.5 billion to the CFI, including $500 million through Economic Action Plan 2012 to sustain its core investment activities in advanced research infrastructure.

Building on these resources, Economic Action Plan 2013 announces that a further $225 million will be allocated to enrich the next Leading Edge/New Initiatives Fund competition, sustain the CFI’s operations, support cyber-infrastructure, and respond to evolving priorities approved by the Minister of Industry. This funding is sourced from interest income accrued with respect to funding the CFI previously received from the federal government.

In addition, infrastructure at post-secondary institutions that supports advanced research and teaching will be eligible for funding under the Provincial-Territorial Infrastructure Component of the new Building Canada Fund (see Chapter 3.3 under “Building Canada Fund”).

Supporting Atomic Energy of Canada Limited

Economic Action Plan 2013 proposes to provide $141 million over two years to ensure a secure supply of medical isotopes and maintain safe and reliable operations at Atomic Energy of Canada Limited’s Chalk River Laboratories.

Atomic Energy of Canada Limited (AECL) is a federal Crown corporation that specializes in a range of nuclear products and services. To continue to ensure a secure supply of medical isotopes and maintain safe and reliable operations at the Chalk River Laboratories, Economic Action Plan 2013 proposes to provide $141 million over two years for AECL’s laboratory operations.

Pursuing a New Approach to Supporting Business Innovation

The Government of Canada understands that federal support for business innovation must respond to the needs of the private sector. In 2010 the Government established the Expert Review Panel on Research and Development, chaired by Mr. Tom Jenkins, Executive Chairman and Chief Strategy Officer of OpenText Corporation, to provide advice and recommendations on maximizing the effectiveness of federal programs that contribute to innovation and support business investment in research and development. The Panel’s October 2011 report, Innovation Canada: A Call to Action, noted that Canada has a solid foundation on which to build leadership in the knowledge economy. The Report contained a number of wide-ranging recommendations for improving the federal government’s support in this area, including a shift to more direct support for business innovation, simplifying program delivery and enhancing access to risk capital for high-growth innovative firms.

Starting with Economic Action Plan 2012, the Government has made significant progress in implementing the recommendations of the Expert Panel, based on a new approach focused on active business-led initiatives. This included doubling support for the National Research Council’s Industrial Research Assistance Program, which provides advice, information and assistance to innovative small and medium-sized companies. The Government has also announced resources to revitalize Canada’s venture capital industry, including $400 million to help increase private sector investments in early-stage risk capital, and to support the creation of large-scale venture capital funds led by the private sector.

Economic Action Plan 2013 continues to respond to the important directions provided by the Expert Panel to ensure that Canadian businesses derive the highest benefit possible from federal support for innovation, in order to become more competitive and create high-paying jobs in Canada.

Fostering Business Innovation

Transforming the National Research Council

Economic Action Plan 2013 proposes to provide $121 million over two years to invest in the National Research Council’s strategic focus to help the growth of innovative businesses in Canada.

The National Research Council (NRC) is currently undergoing a fundamental transformation in how it does business. Work is well underway to better position the NRC to provide businesses with technical services, support for applied research and development projects, access to sector-specialized laboratories and testing facilities, and connections to leading applied research organizations around the world. This new approach will allow innovative firms to benefit from the NRC’s world-class capabilities, consistent with the recommendations of the Expert Panel, and was developed in consultation with businesses, universities and colleges.

Economic Action Plan 2013 continues the momentum, providing $121 million over two years to invest in the NRC’s strategic focus to help the growth of innovative businesses in Canada. The Government will announce further details about the evolution of the new NRC in the coming year.

Supporting the Commercialization of Research by Small and Medium-Sized Enterprises

Economic Action Plan 2013 proposes to provide $20 million over three years to help small and medium-sized enterprises access research and business development services at universities, colleges and other non-profit research institutions of their choice through a new pilot program to be delivered through NRC-IRAP.

The National Research Council’s Industrial Research Assistance Program (NRC-IRAP) provides advisory and financial assistance to help small and medium-sized companies build their innovation capacity and create high-paying jobs. Economic Action Plan 2012 provided new resources to double the program’s support for companies.

To fully take advantage of Canada’s investments in research and development, businesses must be able to bridge the innovation gap by forging stronger linkages with post-secondary institutions to access new knowledge and skills, and transform them into a competitive advantage.

Consistent with the recommendation of the Jenkins Panel, Economic Action Plan 2013 proposes to provide $20 million over three years for a new pilot program to be delivered through NRC-IRAP. The pilot program will enable hundreds of small and medium-sized enterprises to commercialize their products or services more quickly and effectively by providing them with credit notes to help pay for research, technology and business development services at universities, colleges and other non-profit research institutions of their choice. Similar initiatives have been implemented in other countries such as the Netherlands and Ireland, as well as at the provincial level in Alberta and Nova Scotia. Evidence suggests that these initiatives can be effective in promoting more collaborative projects involving businesses and research institutions. More details about this new approach for supporting innovative businesses will be made available in the coming months.

Sustainable Development Technology Canada

Economic Action Plan 2013 proposes to provide $325 million over eight years to Sustainable Development Technology Canada to continue support for the development and demonstration of new, clean technologies that create efficiencies for businesses and contribute to sustainable economic development.

Sustainable Development Technology Canada (SDTC) is an arm’s-length foundation established by the Government of Canada to assist entrepreneurs in the development and demonstration of clean technologies on a not-for-profit basis. Clean technology and efficient practices can save businesses money, create high-paying jobs, drive innovation and improve the productivity of Canada’s natural resource and manufacturing sectors, while also delivering social and environmental benefits.

SDTC has a proven track record for selecting and cultivating promising small and medium-sized enterprises in the clean technology sector. To date, the Foundation has provided support to over 210 companies to develop technologies that offer a wide range of benefits from reduced water usage in the oil sands to reducing emissions from natural gas (examples of the technologies that have been advanced with SDTC’s support are highlighted below). To continue supporting the development and demonstration of new clean technologies that promote sustainable development, Economic Action Plan 2013 proposes to provide $325 million over eight years to Sustainable Development Technology Canada.

SDTC Is Supporting Innovative Clean Technologies

Sustainable Development Technology Canada was established in 2001 and supports a broad range of technologies that increase productivity, efficiency and ultimately the competitiveness of Canadian industry. Some of the companies supported by SDTC include:

Ostara Nutrient Recovery Technologies (Vancouver, British Columbia)—Ostara has developed a new process that retrieves phosphate and ammonia from waste water facilities resulting in improved treatment, reduced maintenance and the recovery of a commercial by-product, slow release fertilizer.

Titanium Corporation (Calgary, Alberta)—Titanium’s oil sands technology creates value from tailings waste by recovering bitumen and high-value minerals and solvents for resale, and reducing water use from oil sands mining operations.

Electrovaya (Mississauga, Ontario)—Electrovaya, in partnership with industry leaders like Chrysler, develops batteries and related systems and products for clean electric transportation, utility-scale energy storage and smart grid power, as well as for the consumer and healthcare markets.

Atlantic Hydrogen (Fredericton, New Brunswick)—Atlantic Hydrogen is helping to make natural gas burn cleaner with its cost-effective technology, which significantly cuts back on the release of greenhouse gas and particulate matter emissions.

N-Solv Corporation (Calgary, Alberta)—Through this project, N-Solv will demonstrate its Bitumen Extraction Solvent Technology (BEST), a low-temperature in-situ production technology for bitumen reserves using a pure, condensing solvent. The N-Solv technology is targeted to produce 85 per cent fewer greenhouse gas emissions than current in-situ processes and will reduce the consumption of process water to zero.

Strengthening the Impact of the Scientific Research and Experimental Development Tax Incentive Program

The Scientific Research and Experimental Development (SR&ED) tax incentive program is one of the most generous systems in the industrialized world for research and development (R&D). It is the single largest federal program supporting business R&D in Canada, providing more than $3.6 billion in tax assistance in 2012.

In Economic Action Plan 2012, the Government noted its concern that high contingency fees charged by SR&ED tax preparers reduce the effectiveness of the SR&ED tax incentive program. The Government announced that it would consult on contingency fees charged by SR&ED tax preparers to find out whether these fees diminish the benefits of the SR&ED program to Canadian businesses and the economy. To that end, a discussion paper was released inviting submissions, and consultations were undertaken in 2012.

The submissions received by the Government during the consultations indicated that intervention to regulate contingency fees directly is not required: the market for SR&ED tax preparers is competitive, contingency fee rates have declined over time and there is no evidence that this type of billing arrangement results in higher compliance costs for businesses.

Instead, many stakeholders recommended that the Government enhance the predictability of the SR&ED tax incentive program, and take action to address aggressive positions being taken by some tax preparers and claimants. In line with that feedback, Economic Action Plan 2013 proposes a number of measures:

- New funding of $5 million over two years will be provided to the Canada Revenue Agency to conduct more direct outreach with first-time SR&ED program claimants. A new in-person service will be implemented to ensure that new claimants have access to information about the SR&ED program’s eligibility requirements, the required supporting documentation, and any other information needed to facilitate the filing of their SR&ED program claim. This new in-person service will help new claimants to better understand the SR&ED program parameters, and contribute to reducing taxpayers’ reliance on third-party tax preparers. The Canada Revenue Agency will also develop new web-based seminars that will be available to the SR&ED community at no cost.

- The Canada Revenue Agency will also receive new funding of $15 million over two years to focus more resources on reviews of SR&ED program claims where the risk of non-compliance is perceived to be high and eligibility for the SR&ED program unlikely. The Canada Revenue Agency will also more frequently apply penalties for false statements or omissions, where appropriate. In addition, in order to enable better risk assessment, SR&ED program claim forms will be revised to require more detailed information. To enforce this new requirement, Economic Action Plan 2013 proposes that a new penalty be applied in instances where the new required information is missing, incomplete or inaccurate. These new initiatives will help protect the integrity of the SR&ED tax incentive program.

Actions Taken by the Canada Revenue Agency to Enhance Predictability of the Scientific Research and Experimental Development Tax Incentive Program

The measures announced today complement initiatives announced in Economic Action Plan 2012 to enhance the predictability of the SR&ED tax incentive program. The Canada Revenue Agency has taken the following steps to implement these measures:

- A pilot project to determine the feasibility of a Formal Pre-Approval Process for SR&ED program claims was just launched.

- Improvements to the review process for Notices of Objection related to SR&ED program claims have been implemented.

- In consultation with SR&ED stakeholders, the existing online Eligibility Self-Assessment Tool is being enhanced to educate businesses on SR&ED program eligibility requirements and to assist them in preparing their SR&ED program claims.

- In 2012, meetings were held with industry representatives to discuss and address emerging SR&ED program issues. These discussions will continue to be held regularly.

- The first SR&ED Program Tax Tip was released in 2013.

Enhancing Canada’s Venture Capital System

Venture capital plays an important role in promoting a more innovative economy by providing the investment and resources needed for high-potential small and medium-sized business to grow. Some of Canada’s top innovative businesses—such as Blackberry, OpenText, and Sierra Wireless—benefitted from venture capital investments at key stages of their growth. Canada requires a strong, sustainable venture capital industry to support high-potential young businesses, to ensure that they are able to grow into globally competitive firms that drive job-creation, innovation and economic growth.

As noted by the 2011 Expert Review Panel on Research and Development, Canada’s venture capital industry has been challenged on a number of fronts. In recent years, persistent poor returns have led to low fundraising and have limited the amount of capital available to fuel the growth of Canadian start-up businesses.

Recognizing the importance of the venture capital industry to Canada’s future productivity growth, Economic Action Plan 2012 announced resources to support Canada’s venture capital industry, including $400 million to help increase private sector investments in early-stage risk capital, and to support the creation of large-scale venture capital funds led by the private sector.

Over the Summer and Fall, the Government conducted extensive consultations with key stakeholders to determine how to structure this support to best contribute to the creation of a sustainable, private sector-led venture capital sector in Canada. During the consultations, stakeholders emphasized the need to implement private sector-led initiatives that demonstrate the return potential of the Canadian venture capital market to investors.

Based on the results of the consultations, the Prime Minister announced in January 2013 the Venture Capital Action Plan, a comprehensive strategy for deploying the $400 million in new capital over the next 7 to 10 years, which is expected to attract close to $1 billion in new private sector investments in funds of funds. The Plan recognizes the need to demonstrate that Canada’s innovative firms represent superior return opportunities, and that private sector investment and decision-making is central to long-term success. In particular, the Venture Capital Action Plan is making available:

- $250 million to establish new, large private sector-led national funds of funds (a funds of funds portfolio consists of investments in several venture capital funds) in partnership with institutional and corporate strategic investors, as well as interested provinces.

- Up to $100 million to recapitalize existing large private sector-led funds of funds, in partnership with willing provinces.

- An aggregate investment of up to $50 million in three to five existing high-performing venture capital funds in Canada.

- Additional resources to continue developing a robust venture capital system and a strong entrepreneurial culture in Canada.

The availability of venture capital financing is just one driver of a successful private sector-led venture capital sector. It is equally important to foster a strong entrepreneurial culture and well-established networks that link investors to innovative companies. These complementary elements help entrepreneurs and young firms to develop their innovative ideas into strong business plans and access new markets and customers.

To support the Government’s efforts to strengthen venture capital in Canada, Economic Action Plan 2013 announces new initiatives to complement the Venture Capital Action Plan and promote the broader venture capital system.

Enhancing Innovation Hubs That Foster Entrepreneurial Talent and Ideas

Economic Action Plan 2013 proposes to provide $60 million over five years to help outstanding and high-potential incubator and accelerator organizations in Canada expand their services to entrepreneurs, and to make available a further $100 million through the Business Development Bank of Canada to invest in firms graduating from business accelerators.

Business incubators and accelerators are organizations that provide entrepreneurs with the resources, facilities and expertise needed to develop their business plan and seek follow-on financing. Incubators and accelerators play an important role in the venture capital system, serving as invaluable “classrooms” for entrepreneurs, providing them with hands-on advice and mentoring from successful innovators, and helping them gain strategic advantage in a competitive international marketplace.

In order to better support Canadian business accelerators and incubators, Economic Action Plan 2013 proposes to:

- Provide $60 million over five years to help outstanding and high-potential incubator and accelerator organizations in Canada expand their services to entrepreneurs.

- Make available $100 million through the Business Development Bank of Canada for strategic partnerships with business accelerators and co-investments in graduate firms.

Additional details on these new initiatives will be made available in the coming months.

Promoting an Entrepreneurial Culture in Canada

Economic Action Plan 2013 proposes to create new Entrepreneurship Awards that celebrate the achievements, mentorship, risk-taking and resilience of Canadian entrepreneurs.

Entrepreneurs are the driving force behind the new businesses that bring innovations to market, launch novel industries and create high-paying jobs. Canada has a wealth of talented and successful entrepreneurs. These dynamic business owners can inspire others to start exciting new ventures and offer valuable advice to the next generation of Canadian entrepreneurs.

To highlight Canada’s entrepreneurial culture, Economic Action Plan 2013 proposes to create new awards that celebrate the achievements, mentorship, risk-taking and resilience of Canadian entrepreneurs. Building upon the successful Young Entrepreneur of the Year award supported by the Business Development Bank of Canada, the new awards will recognize:

- The achievements of outstanding Canadian entrepreneurs who have created and grown many successful businesses.

- Business mentors credited by their peers for having provided valuable advice that has led to the creation and growth of Canadian firms.

- Innovative start-up companies that could reshape their industry in exciting and previously unforeseen ways.

- Spectacular turnarounds of businesses or entrepreneurs that demonstrate recovery from failure in a way that is bold and inspiring.

The nomination process for these new awards will be announced in the coming months.

Supporting Youth Entrepreneurship

Economic Action Plan 2013 proposes to provide $18 million over two years to the Canadian Youth Business Foundation.

The Canadian Youth Business Foundation is a national not-for-profit organization that works with young entrepreneurs to help them become the business leaders of tomorrow through mentorship, expert advice, learning resources and start-up financing. Since 2002, the Foundation has worked with 5,600 new entrepreneurs, helping to create 22,100 new jobs across Canadian communities.

Economic Action Plan 2013 proposes to provide $18 million over two years to enable the Canadian Youth Business Foundation to continue supporting young entrepreneurs between the ages of 18 and 34, conditional on the Foundation raising $15 million in matching funding from non-federal sources. This funding will support the Foundation’s efforts to become self-sustainable.

Promoting Linkages With International Investors

Innovative and high-growth firms can realize significant benefits through connections with venture capitalists and entrepreneurial services abroad. Canada supports such connections through programs such as the Canadian Technology Accelerator initiative, with hubs in New York City, Boston and Silicon Valley. The Government will continue to look for ways to foster these types of opportunities for Canadian innovative, high-growth firms and to promote Canada as a leading jurisdiction for innovation and investment opportunity.

Phasing Out the Labour-Sponsored Venture Capital Corporations Tax Credit

Economic Action Plan 2013 proposes to phase out the federal Labour-Sponsored Venture Capital Corporations tax credit by 2017.

The federal Labour-Sponsored Venture Capital Corporations (LSVCC) tax credit was introduced in the 1980s when access to venture capital for small and medium-sized businesses was limited. However, the economic environment and the structure of the venture capital market have changed significantly since that time.

The LSVCC tax credit has been criticized by academics, international organizations as well as venture capital industry stakeholders as being an ineffective means of stimulating a healthy venture capital sector. Recently, several commentators, including the Organisation for Economic Co-operation and Development (OECD), have called for the elimination of the tax credit.

All things considered, labour-sponsored funds are financial instruments that fulfill neither their economic objectives, namely to make venture capital available to help Quebec businesses, nor their financial objectives of offering a good return to contributors, their performance being interesting only by taking into account the additional tax credit.

—Louis Fortin, Youri Chassin, Michel Kelly-Gagnon

Montreal Economic Institute Research Paper, October 2011As part of their recommendations for enhancing innovation outcomes, the OECD recommends to phase out tax credits to labour sponsored venture capital corporations (LSVCCs).

—Organisation for Economic Co-operation and Development

OECD Economic Surveys: Canada 2012These credits have not only been ineffective in generating more venture capital, but they have also helped finance poor projects that should have never been funded in the first place.

—Jack M. Mintz

National Post, March 15, 2012Providing tax relief to LSIFs [LSVCCs] has been, overall, a disappointing use of taxpayers’ money. Such funds have been shown in multiple studies, including this one, to do a poor job of achieving public policy aims.

—Tariq Fancy

C.D. Howe Institute E-Brief, September 19, 2012LSVCCs have generated poor returns, displaced more effective private funds, and in net have impoverished, rather than enhanced, the Canadian venture capital industry.

—Jeffrey G. MacIntosh

National Post, March 20, 2012

The Government heard the same message during the consultations on increasing the availability of venture capital in Canada held over the Summer and Fall of 2012. Several venture capital industry stakeholders called for an end to the LSVCC tax credit program.

Ontario has already taken action and completed the phase-out of its tax credit for investors in Labour Sponsored Investment Funds in 2012.

Economic Action Plan 2013 therefore proposes to phase out the federal LSVCC tax credit by 2017. The phase-out of the tax credit aligns with the increase in venture capital investments resulting from the implementation of the $400-million Venture Capital Action Plan. The Government’s new approach will better target resources to the venture capital industry in order to create a sustainable and efficient private sector-led venture capital sector.

The Government will consult with stakeholders on potential changes to the tax rules governing LSVCCs in order to assist with an orderly phase-out of the federal LSVCC tax credit.

| 2013-14 | 2014-15 | Total | |

|---|---|---|---|

| Supporting Advanced Research | |||

| Strengthening Research Partnerships Between Post-Secondary Institutions and Industry |

37 | 37 | 74 |

| Reinforcing Canadian Research Capacity in Genomics | 165 | 165 | |

| Supporting Atomic Energy of Canada Limited | 137 | 4 | 141 |

| Subtotal—Supporting Advanced Research | 174 | 206 | 380 |

| Pursuing a New Approach to Supporting Business Innovation | |||

| Fostering Business Innovation | |||

| Transforming the National Research Council | 61 | 60 | 121 |

| Supporting the Commercialization of Research by Small and Medium-Sized Enterprises |

3 | 8 | 10 |

| Sustainable Development Technology Canada | 1 | 12 | 13 |

| Strengthening the Impact of the Scientific Research and Experimental Development Tax Incentive Program |

10 | 9 | 20 |

| Subtotal—Pursuing a New Approach to Supporting Business Innovation |

75 | 88 | 163 |

| Enhancing Canada's Venture Capital System | |||

| Enhancing Innovation Hubs That Foster Entrepreneurial Talent andIdeas |

9 | 17 | 26 |

| Supporting Youth Entrepreneurship | 9 | 9 | 18 |

| Subtotal—Enhancing Canadas Venture Capital System | 18 | 26 | 44 |

| Total—Investing in World-Class Research and Innovation | 267 | 320 | 587 |

| Less funds existing in the fiscal framework | 61 | 72 | 133 |

| Net fiscal cost | 205 | 249 | 454 |

| Note: Totals may not add due to rounding. | |||