Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Annex 1: Debt Management Strategy for 2013–14

Purpose

The Debt Management Strategy sets out the Government of Canada's objectives, strategy and plans for the management of its domestic and foreign debt, other financial liabilities and related assets. Borrowing activities support the ongoing refinancing of government debt coming to maturity, the execution of the budget plan and other financial operations of the Government, including investing in financial assets needed to establish a prudent liquidity position and borrowing on behalf of some Crown corporations.

The Financial Administration Act requires that the Government table in Parliament, prior to the start of the fiscal year, a report on the anticipated borrowing to be undertaken in the year ahead, including the purposes for which the money will be borrowed.

Highlights of the Federal Debt Management Strategy

- For 2013–14, net issuance of domestic marketable bonds is planned to be approximately $87 billion, down from $94 billion in 2012–13. At the end of 2013–14, the stock of marketable bonds is projected to be about $477 billion.

- With long-term interest rates remaining near historic lows, the debt strategy for 2013–14 extends the temporary increase in 10 and 30-year bond issuance announced on September 27, 2012. Additionally, the Government is assessing the potential benefits of issuing bonds with a maturity of 40 years or longer.

- The stock of treasury bills is projected to decline from $181 billion at the start of 2013–14 to about $149 billion by the end of 2013–14. This will accommodate the maturing of about $41 billion of mortgage-backed securities purchased under the Insured Mortgage Purchase Program in 2008 and 2009.

- The extension of the temporary increase in long-term bond issuance, combined with the projected drop in the stock of treasury bills in 2013–14, will lead to a substantial reduction in refinancing risk.

- The Government will achieve its target for prudential liquidity holdings of domestic and foreign assets by the Summer of 2013, well in advance of the original target date of March 2014. As a result, total prudential liquidity holdings will grow to more than $75 billion, an increase of $35 billion since March 2011. Going forward, the foreign exchange reserves portion of prudential liquidity holdings will be maintained at a level at or above 3 per cent of nominal gross domestic product.

Context

Strong Demand for Government of Canada Debt Securities

Alone among the Group of Seven (G-7) countries, Canada continues to receive the highest possible credit ratings, with a stable outlook, from all the major credit rating agencies. Among global investors, Canada has a well-earned reputation for responsible fiscal, economic and financial sector management. This has supported a continuing strong demand for Government of Canada securities, making them among the world's most sought-after investments.

Medium-Term Debt Strategy

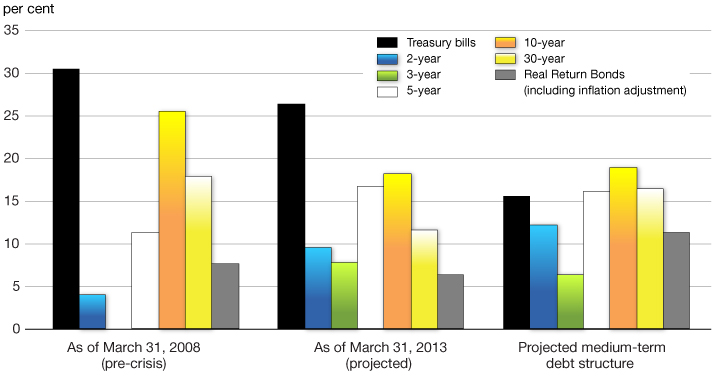

The Government's medium-term debt management strategy is informed by modelling analysis that reflects a wide range of economic and interest rate scenarios drawn from historical experience. The medium-term debt strategy is aimed at gradually transitioning the debt structure towards a more even distribution across instruments (Chart A1.1), while improving cost-risk characteristics and reducing exposure to debt rollover risk.

With long-term interest rates remaining near historic lows and the slope of yield curve relatively shallow, the debt strategy for 2013–14 extends the temporary increase in 10 and 30-year bond issuance announced on September 27, 2012.

The share of bonds with original terms of 30 years is expected to increase from about 19 per cent to 29 per cent of the stock of market debt over the next decade. At that time, the share of longer-term debt is expected to start stabilizing as long bonds issued in the 1990s begin to mature. Similarly, over the coming decade, the share of bonds with original terms of 10 years or more is projected to increase from about 37 per cent to around 48 per cent.

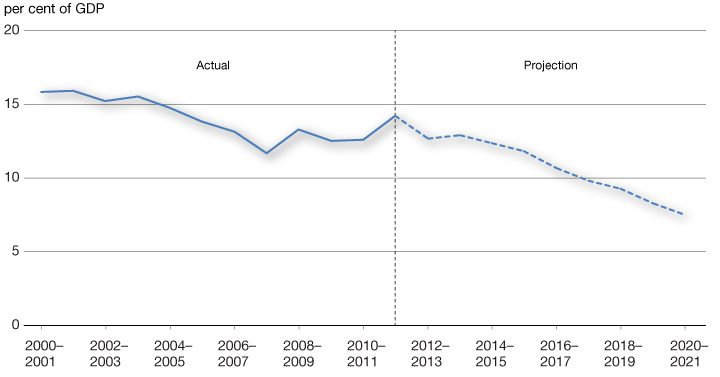

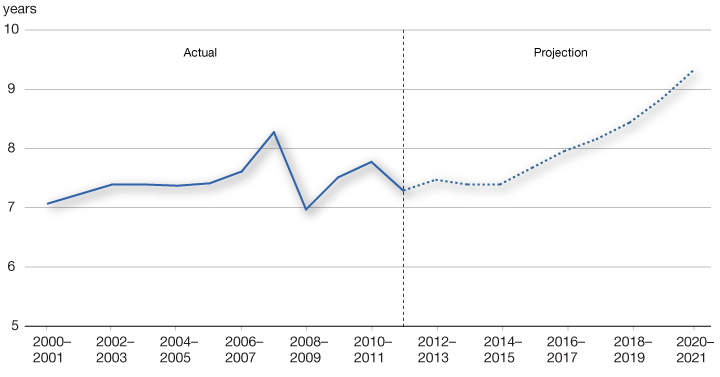

The level of refinancing risk will continue to decline. It is projected that the net annual refixing amount of interest-bearing debt as a percentage of gross domestic product (GDP), which measures the amount of all interest-bearing debt net of financial assets that matures or needs to be repriced within one year relative to Canada's GDP, will decline from about 13 per cent in 2013–14 to approximately 7 per cent over the coming decade (Chart A1.2).

Consistent with this, the average term to maturity of the market debt net of financial assets will gradually increase (Chart A1.3).

Prudential Liquidity Management

The Government holds liquid financial assets in the form of domestic cash deposits and foreign exchange reserves to safeguard its ability to meet payment obligations in situations where normal access to funding markets may be disrupted or delayed. This also supports investor confidence in Canadian government debt.

In Budget 2011, the Government announced its intention to increase its prudential liquidity position by $35 billion over a three-year period. As part of this plan, liquid foreign reserves have increased by $10 billion and government deposits held with financial institutions and the Bank of Canada have increased by $15 billion. Given strong and continuing demand for Government of Canada securities, the Government announced on February 14, 2013 that the remaining $10 billion of prudential liquidity, which will be held with the Bank of Canada, will be fully funded by the Summer of 2013, nine months ahead of schedule.

Once the prudential liquidity plan is fully implemented, the Government's overall liquidity levels will cover one month of net projected cash flows, including coupon payments and debt refinancing needs.

Information on cash balances and foreign exchange assets is available in The Fiscal Monitor. Information on the management of Canada's reserves held in the Exchange Fund Account is available in the Report on the Management of Canada's Official International Reserves.

Planned Borrowing Activities for 2013–14

Borrowing Authority

For 2013–14, the aggregate borrowing limit requested from the Governor in Council to meet Economic Action Plan 2013 financial requirements and provide a margin for prudence is $300 billion, $15 billion lower than in 2012–13.

Actual borrowing and uses of funds compared with those forecast will be reported in the 2013–14 Debt Management Report, and detailed information on outcomes will be provided in the 2014 Public Accounts of Canada. Both documents will be tabled in Parliament in the Fall of 2014.

Sources of Borrowing

The aggregate principal amount of money required to be borrowed by the Government from financial markets in 2013–14 to finance Economic Action Plan 2013 refinancing needs and other financial requirements is projected to be $242 billion.

Uses of Borrowing

Refinancing Needs

In 2013–14, refinancing needs are projected to be approximately $259 billion. The main source of refinancing needs during the year stems from the treasury bills, which have a term to maturity of one year or less, and bonds that will mature in 2013–14. Other lesser amounts include retail debt (Canada Savings Bonds and Canada Premium Bonds) that will mature in 2013–14.

Financial Source/Requirement

The other main determinant of borrowing needs is the Government's financial source or requirement. If the Government has a financial source, it can use the source for some of its refinancing needs. If it has a financial requirement, then it must meet that requirement along with its refinancing needs.

The financial source/requirement measures the difference between cash coming into the Government and cash going out. This measure is affected not only by the budgetary balance but also by the Government's non-budgetary transactions.

The budgetary balance is presented on a full accrual basis of accounting, recording government revenues and expenses when they are earned or incurred, regardless of when the cash is received or paid.

Non-budgetary transactions include changes in federal employee pension accounts; changes in non-financial assets; investing activities through loans, investments and advances (including loans to three Crown corporations—the Business Development Bank of Canada, Farm Credit Canada and Canada Mortgage and Housing Corporation); and other transactions (e.g., changes in other financial assets and liabilities, and foreign exchange activities).

For 2013–14, a budgetary deficit of about $19 billion and a financial source of approximately $22 billion are projected. As the amount the Government plans to borrow is higher than the planned uses of borrowings, the year-end cash position is projected to increase by about $5 billion (Table A1.1).

Actual borrowing for the year may differ from the forecast due to uncertainty associated with economic and fiscal projections, the timing of cash transactions and other factors, such as changes in foreign reserve needs and Crown borrowings. Thus, the aggregate borrowing limit of $300 billion requested for 2013–14 includes a margin for prudence, enabling debt management operations to respond to changing circumstances without the need for frequent resubmissions to the Governor in Council.

| Sources of Borrowings | |

| Payable in Canadian currency | |

| Treasury bills1 | 149 |

| Bonds | 88 |

| Retail debt | 2 |

| Total payable in Canadian currency | 238 |

| Payable in foreign currencies | 4 |

| Total cash raised through borrowing activities | 242 |

| Uses of Borrowings | |

| Refinancing needs | |

| Payable in Canadian currency | |

| Treasury bills | 181 |

| Bonds | 75 |

| Of which: | |

| Regular bond buybacks | 1 |

| Retail debt | 3 |

| Canada Pension Plan (CPP) bonds and notes | 0 |

| Total payable in Canadian currency | 259 |

| Payable in foreign currencies | 0 |

| Total refinancing needs | 259 |

| Financial source/requirement | |

| Budgetary balance | 19 |

| Non-budgetary transactions | |

| Pension and other accounts | -7 |

| Non-financial assets | 2 |

| Loans, investments and advances | |

| Enterprise Crown corporations | 4 |

| Insured Mortgage Purchase Program (net of redemptions) | -41 |

| Other | 0 |

| Total loans, investments and advances | -37 |

| Other transactions2 | 1 |

| Total non-budgetary transactions | -41 |

| Total financial source/requirement | -22 |

| Total uses of borrowings | 237 |

| Other unmatured debt transactions3 | 0 |

| Net Increase or Decrease (-) in Cash | 5 |

| Notes: Numbers may not add due to rounding. A negative sign denotes a financial source. 1 These securities are rolled over, or refinanced, a number of times during the year. This results in a larger number ofnewissues per year than the stock outstanding at the end of the fiscal year, which is presented in the table. 2 Other transactions primarily comprise the conversion of accrual adjustments into cash, such as tax and other account receivables, provincial and territorial tax collection agreements, tax payables and other liabilities, and changes in foreign exchange accounts. 3 These transactions comprise cross-currency swap revaluation, unamortized discounts on debt issues and obligations related to capital leases and other unmatured debt. |

|

Debt Management Strategy for 2013–14

Objectives

The fundamental objective of debt management is to raise stable and low-cost funding to meet the financial needs of the Government of Canada. An associated objective is to maintain a well-functioning market in Government of Canada securities, which helps to keep debt costs low and stable.

Achieving Stable Low-Cost Funding

Achieving stable low-cost funding involves striking a balance between the cost and the risk associated with the debt structure.

Over the medium term, debt management decisions will be taken with a view to keeping debt costs low and maintaining refinancing risks at prudent levels, while reserving sufficient flexibility to adapt to changing circumstances.

Maintaining a Well-Functioning Government Securities Market

Having access to a well-functioning government securities market ensures that funding can be raised efficiently to meet the Government's needs regardless of economic conditions. To support a liquid and well-functioning Government of Canada securities market, the Government strives to maintain transparent, regular and diversified borrowing programs.

Market Consultations

As in previous years, market participants were consulted periodically in 2012–13. The most recent set of consultations were held in December and were focused on obtaining feedback on a broad range of topics, including the marketable bond and treasury bill programs, the impact of increased international participation on domestic fixed-income markets, the effectiveness of bond buyback operations, and the impact of upcoming changes to the regulatory environment. Additionally, market participants' views were sought on the demand for Canadian-dollar-denominated longer-term bonds.

Further details on the subjects of discussion and the views expressed during the consultations can be found on the Bank of Canada website.

Continued Low Historic Interest Rates

As long-term interest rates remain near historic lows, it remains advantageous and prudent for the Government to continue to lock in additional long-term funding. Consistent with this strategy, on September 27, 2012, the Government announced an extension of the plan outlined in the Debt Management Strategy for 2012–13 to reallocate short-term bond issuance towards long-term bonds.

In 2013–14, the Government plans to continue the temporary increase in the issuance of 10 and 30-year bonds. Notably, there will be five 10-year bond operations (the additional auction will be conducted in the first quarter of 2013–14), and three 30-year nominal bond operations (no 30-year auction will be conducted in the second quarter of 2013–14).

Overall, the additional long-term issuance will contribute to a reduction in refinancing risk at a low cost, which is consistent with the key objectives of the medium-term debt strategy.

Additionally, informed by market consultations and recent issuances by provinces, which suggest there is appreciable domestic investor interest in ultra-long nominal bonds, the Government is assessing the potential benefits of issuing bonds with a maturity of 40 years or longer. Any decision to issue an ultra-long bond would be subject to market conditions and would be communicated by the Government to market participants during the course of the fiscal year.

Composition of Market Debt

The stock of market debt has increased since the financial crisis, reaching a peak of $665 billion in 2012–13. This trend will reverse starting in 2013–14, when the stock of market debt is projected to decline by approximately $17 billion due to a financial source in 2013–14 (Table A1.2).

The stock of treasury bills is projected to decline from about $181 billion at the start of the fiscal year to approximately $149 billion by the end of 2013–14, mainly as a result of about $41 billion of mortgage-backed securities purchased under the Insured Mortgage Purchase Program (IMPP) maturing in the latter half of 2013–14.[1]

| 2009–10 Actual |

2010–11 Actual |

2011–12 Actual |

2012–13 Projected |

2013–14 Planned |

|

|---|---|---|---|---|---|

| Treasury bills | 176 | 163 | 163 | 181 | 149 |

| Marketable bonds | 368 | 416 | 448 | 466 | 477 |

| Retail debt | 12 | 10 | 9 | 8 | 7 |

| Foreign debt | 8 | 8 | 11 | 11 | 15 |

| CPP bonds | 0.5 | 0 | 0 | 0 | 0 |

| Total market debt | 564 | 597 | 631 | 665 | 648 |

| Note: Numbers may not add due to rounding. | |||||

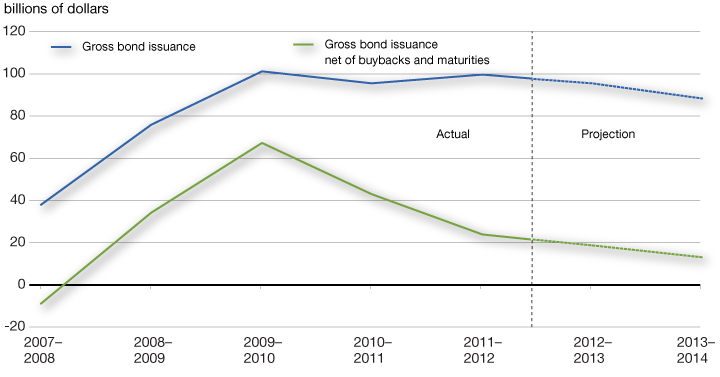

Bond Program

In 2013–14, the level of net bond issuance is planned to be about $87 billion, about $7 billion less than the amount issued in 2012–13 (Table A1.3).

| 2009–10 Actual |

2010–11 Actual |

2011–12 Actual |

2012–13 Projected |

2013–14 Planned |

|

|---|---|---|---|---|---|

| Gross bond issuance | 102 | 96 | 100 | 96 | 88 |

| Buybacks | -2 | -4 | -6 | -2 | -1 |

| Net issuance | 100 | 92 | 94 | 94 | 87 |

| Maturing bonds and adjustments1 | -27 | -44 | -62 | -76 | -75 |

| Change in bond stock | 73 | 48 | 32 | 18 | 11 |

| Note: Numbers may not add due to rounding. 1 Includes cash management bond buybacks and the inflation adjustment for Real Return Bonds. |

|||||

Gross bond issuance planned for 2013–14, while still fairly high on a historical basis, will be lower than it has been in recent years due to reduced financial requirements. Gross bond issuance net of buybacks and maturities will continue to trend downward (Chart A1.4).

Maturity Dates and Benchmark Bond Target Range Sizes

As part of the medium-term debt strategy, four new maturity dates were implemented in 2011–12 to help smooth the cash flow profile of upcoming maturities by reducing the size of June 1 and December 1 maturities and related coupon payments. The move to eight maturity dates also gives the debt program additional capacity to absorb potential upward changes in funding requirements.

For 2013–14, no changes to the bond maturity pattern and benchmark target range sizes are planned (Table A1.4). These amounts do not include coupon payments.

| Feb. | Mar. | May | June | Aug. | Sept. | Nov. | Dec. | |

|---|---|---|---|---|---|---|---|---|

| 2-year | 8-12 | 8-12 | 8-12 | 8-12 | ||||

| 3-year | 8-12 | 8-12 | ||||||

| 5-year | 10-13 | 10-13 | ||||||

| 10-year | 10-14 | |||||||

| 30-year | 12-15 | |||||||

| Real Return Bond1 | 10-16 | |||||||

| Total | 16-24 | 10-13 | 8-12 | 10-14 | 16-24 | 10-13 | 8-12 | 10-16 |

| 1 Includes estimate for inflation adjustment. The 30-year nominal bond and Real Return Bond do not mature in thesameyear. | ||||||||

Bond Auction Schedule

In 2013–14, there will be quarterly auctions of 2, 3, 5 and 10-year bonds and Real Return Bonds.

Five 10-year bond auctions will occur, with the additional 10-year auction being held in the first quarter of 2013–14. Three 30-year nominal bond auctions will occur—one in each of the first, third and fourth quarters of 2013–14. The order of bond auctions within each quarter may be adjusted to support the borrowing program, and there may be multiple auctions of the same bonds in some quarters. The dates of each auction will continue to be announced through the Quarterly Bond Schedule that is published on the Bank of Canada website prior to the start of each quarter.

Bond Buyback Programs

Two types of bond buyback operations will be conducted in 2013–14: regular bond buybacks on a switch basis and cash management bond buybacks.

Regular Bond Buyback Operations

In 2012–13, regular bond buyback operations on a switch basis were used in the 30-year sector to support liquidity in long bonds. Buyback operations on a switch basis in the 30-year sector will continue to be used and will be conducted in the second and fourth quarters of 2013–14. No regular buyback operations on a cash basis are planned for 2013–14.

Cash Management Bond Buyback Operations

The cash management bond buyback program helps manage government cash requirements by reducing the high levels of cash balances needed ahead of large bond maturities. In light of the success of these operations in 2012–13 and taking into account feedback received during market consultations, weekly cash management bond buyback operations will be continued in 2013–14.

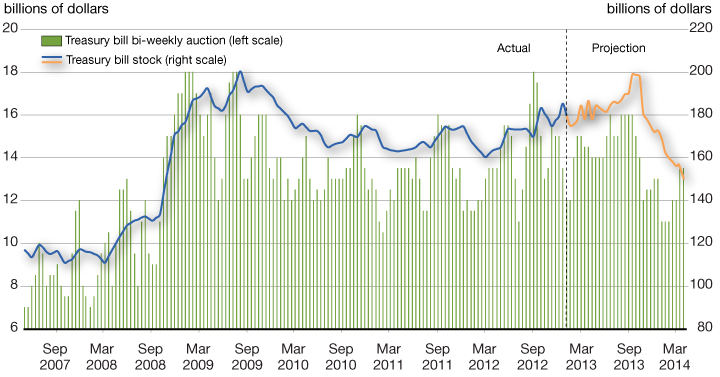

Treasury Bill Program

The stock of treasury bills is projected to decline from $181 billion[2] at the start of the fiscal year to approximately $149 billion by the end of 2013–14, mainly as a result of about $41 billion of IMPP assets maturing in the latter half of 2013–14.

Over the medium term, the stock of treasury bills will be managed down to eventually represent about 16 per cent of total market debt. In 2013–14, the share of treasury bills is projected to fall from about 27 per cent to about 23 per cent to absorb the maturing IMPP assets. It is projected to fall further to about 22 per cent in 2014–15 to absorb the remaining maturing IMPP assets. This is consistent with the medium-term debt strategy and maintains issuance stability in the bond program. During the debt strategy consultations conducted in December, market participants were of the view that the Canadian treasury bill market would be able to handle these adjustments.

Bi-weekly issuance of 3, 6 and 12-month maturities will be continued in 2013–14, and bi-weekly auction sizes for the first two quarters are projected to be within the $14 billion to $16 billion range. The size of the bi-weekly treasury bill auctions may temporarily drop to $11 billion in the second half of 2013–14 due to the inflows related to the maturing IMPP assets, before stabilizing around the $13 billion range (Chart A1.5).

Cash management bills (i.e., short-dated treasury bills) help manage government cash requirements in an efficient manner. These instruments will also continue to be used in 2013–14.

Retail Debt Program

More than 2.5 million Canadians hold Canada Savings Bonds (CSBs) or Canada Premium Bonds (CPBs). CSBs are offered exclusively through the Payroll Savings Program while CPBs are available for sale through financial institutions and dealers. Investors repeatedly cite the safety and security of CSBs and CPBs as key attributes, with payroll deduction providing a convenient, simple and free automatic savings option.

In 2012–13, a number of changes were made to the Retail Debt Program to improve its efficiency and better align product offerings to the current needs of Canadians.

Further information on the Retail Debt Program is available on the Canada Savings Bonds website.

Foreign Currency Funding

The purpose of the Exchange Fund Account (EFA) is to aid in the control and protection of the external value of the Canadian dollar. Assets held in the EFA are managed to provide foreign currency liquidity, support market confidence, and promote orderly conditions for the Canadian dollar in the foreign exchange markets, if required. The prudential liquidity plan instituted in Budget 2011 calls for liquid foreign exchange reserves to be maintained at a level at or above 3 per cent of nominal GDP.

The Government has access to a range of direct sources of funding for its foreign currency assets. These include a short-term US-dollar paper program, medium-term note issuance in various markets, international bond issues, purchases and sales of Canadian dollars in foreign exchange markets, and cross-currency swaps involving the exchange of domestic liabilities for foreign-currency-denominated liabilities.

The debt management strategy for 2013–14 assumes that all foreign liabilities maturing during the year will be refinanced. The actual amount of gross foreign currency funding may vary from this assumption, depending on market conditions and the Government's foreign currency needs. The mix of funding sources used to finance the reserves in 2013–14 will depend on a number of considerations, including relative cost, market conditions, and the objective of maintaining a prudent foreign-currency-denominated debt maturity structure.

Further information on managing foreign currency reserves and funding objectives is provided in the Report on the Management of Canada's Official International Reserves, which is available on the Department of Finance website.

1 These mortgage-backed assets were purchased from financial institutions in 2008 and 2009 under the IMPP, which formed part of the Government of Canada's response to the financial crisis. About $41 billion of these assets will mature in 2013–14, with the remaining $11 billion maturing in 2014–15.

2 While the Debt Management Strategy for 2012–13 projected a treasury bill stock of $159 billion at 2012–13 year-end, it is now expected to be $22 billion higher primarily because of a higher-than-forecast amount of bonds repurchased at cash management bond buyback operations.