Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Do you already receive Old Age Security? Then these changes don't affect you.

![]() Archived - PDF Version [271 Kb]

Archived - PDF Version [271 Kb]

To access a Portable Document Format (PDF) file you must have a PDF reader installed. If you do not already have such a reader, there are numerous PDF readers available for free download or for purchase on the Internet.

Ensuring a sustainable Old Age Security program (OAS): What it means for you

Why are changes to the OAS program necessary?

Canadians are living longer and healthier lives. In 1970 life expectancy was age 69 for men and 76 for women. Today it is 79 for men and 83 for women. The baby boom generation (born between 1946 and 1964) is also the largest age cohort in history. As Canadians are living longer and healthier lives, many may prefer to work longer.

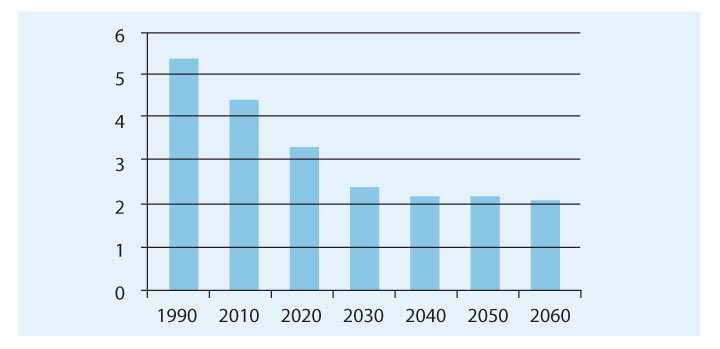

The OAS program is the single, largest program of the Government of Canada. It was put in place at a time when Canadians were not living the longer, healthier lives that they are now. Consequently, the cost of the program will grow from $38 billion in 2011 to $108 billion in 2030. The same period will see the number of working-age Canadians per senior fall from 4 today to 2 in 2030. This compares to a ratio of 5 working Canadians per senior in 1990.

The changes announced in Economic Action Plan 2012 are necessary to ensure that the OAS program remains on a sustainable path. They will ensure OAS remains strong and is there for future generations when they need it, as it is for all seniors who currently receive these benefits.

Ratio of Working-Age People to Seniors

Source: 9th Actuarial Report on the Old Age Security Program.

What is OAS?

- OAS is financed from general government revenues and provides benefits to most Canadians 65 years of age and over. The maximum annual OAS pension is currently $6,481.

- Additional support for low-income seniors is provided through the Guaranteed Income Supplement (GIS). The maximum annual GIS benefit is $8,788 for single seniors and $11,654 for couples.

- Support is also provided to low-income spouses or common-law partners of GIS recipients and low-income survivors, through the Allowance and the Allowance for the Survivor.

- The OAS program provides approximately $38 billion per year in benefits to 4.9 million individuals.

What will this mean for you?

Starting on April 1, 2023, the age of eligibility for OAS and GIS benefits will be gradually increased from 65 to 67, with full implementation by January 2029.

In line with the increase in age of OAS/GIS eligibility, the ages at which the Allowance and the Allowance for the Survivor are provided will also gradually increase from 60-64 today to 62-66, starting in April 2023.

| Month of Birth | 1958 | 1959 | 1960 | 1961 | 1962 |

|---|---|---|---|---|---|

|

|

|||||

| OAS/GIS Eligibility Age | |||||

| Jan. | 65 | 65 + 5 mo | 65 + 11 mo | 66 + 5 mo | 66 + 11 mo |

| Feb. – Mar. | 65 | 65 + 6 mo | 66 | 66 + 6 mo | 67 |

| Apr. – May | 65 + 1 mo | 65 + 7 mo | 66 + 1 mo | 66 + 7 mo | 67 |

| June – July | 65 + 2 mo | 65 + 8 mo | 66 + 2 mo | 66 + 8 mo | 67 |

| Aug. – Sept. | 65 + 3 mo | 65 + 9 mo | 66 + 3 mo | 66 + 9 mo | 67 |

| Oct. – Nov. | 65 + 4 mo | 65 + 10 mo | 66 + 4 mo | 66 + 10 mo | 67 |

| Dec. | 65 + 5 mo | 65 + 11 mo | 66 + 5 mo | 66 + 11 mo | 67 |

| Note: mo = months. | |||||

The eleven-year advance notification and the subsequent six-year phase-in period will allow those affected by these changes ample time to make adjustments to their retirement plans.

Many countries are increasing the age of eligibility of their public pension programs. Of the 34 Organisation for Economic Co-operation and Development countries, the following have recently increased or announced plans to increase the eligibility ages:

Australia, Austria, Belgium, the Czech Republic, Denmark, Estonia, France, Germany, Greece, Hungary, Ireland, Israel, Italy, Japan, Korea, the Netherlands, the Slovak Republic, Slovenia, Spain, Turkey, the United Kingdom and the United States.

Who will not be affected by the proposed changes to the age of eligibility?

The proposed changes to the age of eligibility for the OAS program would not affect anyone who is currently receiving benefits.

OAS pension and the GIS:

- Anyone who is 54 years of age or older as of March 31, 2012 (born on or before March 31, 1958) will not be affected.

Allowance and the Allowance for the Survivor:

- Anyone who is 49 years of age or older as of March 31, 2012 (born on or before March 31, 1963) will not be affected.

Who will be affected by the proposed changes to the age of eligibility?

OAS and the GIS benefits:

- People born between April 1, 1958, and January 31, 1962, will become eligible to receive their OAS benefits and GIS between the age of 65 and 67, depending on their birth date.

- People born on or after February 1, 1962, will be eligible for their OAS and GIS benefits at the age of 67.

Allowance and the Allowance for the Survivor:

- People born between April 1, 1963, and January 31, 1967, will be eligible to receive their Allowance or Allowance for the Survivor between the age of 60 and 62, depending on their birth date.

- People born on or after February 1, 1967, will be eligible for their Allowance or Allowance for the Survivor at the age of 62.

Voluntary deferral of OAS pension

To improve flexibility and choice in the OAS program, for example for those wishing to work longer, the Government will allow for the voluntary deferral of the OAS pension, for up to five years, starting on July 1, 2013.This will give individuals the option to defer take-up of their OAS pension to a later time and subsequently receive a higher, actuarially adjusted pension. For example, individuals could continue to work longer and defer taking up their OAS pension beyond age 65, resulting in a higher annual pension starting in a subsequent year. The adjusted pension would be calculated on an actuarially neutral basis, as is done with the Canada Pension Plan. This means that, on average, individuals will receive the same lifetime OAS pension whether they choose to take it up at the earliest age of eligibility or defer it to a later year.

The annual pension will be higher if they choose to defer. GIS benefits, which provide additional support to the lowest-income seniors, will not be provided on an actuarially adjusted basis.

Example of One-Year OAS Deferral

Michael will be turning 65 in September 2013.

Instead of taking up his OAS pension at age 65, he plans to continue working a year longer and defer the pension until age 66.

When he takes up his OAS pension at age 66, his annual pension will be $6,948 instead of $6,481 (in 2012 dollars).

Example of Five-Year

Rita will be turning 65 in December 2013.

She plans to continue working as long as she can. She prefers to forgo her OAS pension for the maximum deferral period of five years so that she can have a substantially higher annual pension amount, starting at age 70.

When she takes up her OAS pension at age 70, her annual pension will be $8,814 instead of $6,481 (in 2012 dollars).

Proactive enrolment for OAS benefits

The Government will improve services for seniors by putting in place a proactive enrolment regime that will eliminate the need for many seniors to apply for the OAS pension and the GIS. This measure will reduce the burden on seniors of completing application processes and will reduce the Government's administrative costs. Proactive enrolment will be implemented in a phased-in approach from 2013 to 2016.

Changes to other federal programs

The Government will ensure that certain federal programs, including programs provided by Veterans Affairs Canada and Aboriginal Affairs and Northern Development Canada, currently providing income support benefits until age 65, are aligned with changes to the OAS program.

This will ensure that individuals receiving benefits from these programs do not face a gap in income at ages 65 and 66.

The Government will discuss the impact of the changes to the OAS program on Canada Pension Plan (CPP) disability and survivor benefits with provinces and territories, who are joint stewards of the CPP, in the course of the next triennial review.

For more information, visit

www.servicecanada.gc.ca/retirement

or call 1 800 O-Canada.

Budget measures are subject to parliamentary approval.