Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Chapter 3.2: Improving Conditions for Business Investment

Highlights

Responsible Resource Development

The Government is committed to improving the review process for major economic projects to accelerate investment and job creation. Economic Action Plan 2012 proposes:

- System-wide legislative improvements to the review process for major economic projects to achieve the goal of “one project, one review” in a clearly defined time period for major economic projects.

- $165 million over two years for responsible resource development that creates jobs while protecting the environment.

Investing in Our Natural Resources

The Government is supporting the development of Canada’s natural resource industries. Economic Action Plan 2012 proposes:

- Support for junior mineral exploration by extending the temporary 15-per-cent Mineral Exploration Tax Credit for flow-through share investors for an additional year.

- Actions to improve access to modern, reliable seismic data for offshore resource development.

- $12.3 million over two years to continue to assess diamonds in the North.

Expanding Trade and Opening New Markets for Canadian Businesses

The Government is taking action to improve Canadians’ standard of living by growing international trade and creating export opportunities for Canadian businesses. Economic Action Plan 2012 proposes:

- Intensifying Canada’s pursuit of new and deeper international trade and investment relationships, including updating the Government’s Global Commerce Strategy.

- Implementing the Action Plan on Perimeter Security and Economic Competitiveness and the Action Plan on Regulatory Cooperation, which will facilitate trade and investment flows with the United States.

- Providing support to Canadian businesses through tariff and tax measures, along with the extended provision of domestic financing by Export Development Canada.

- Increasing travellers’ exemptions to modernize existing rules and facilitate border processes for Canadians bringing goods home from abroad.

Keeping Taxes Low for Job-Creating Businesses

The Government has reduced business taxes and is committed to keeping taxes low. The Government has also taken action to enhance the neutrality of the tax system to support growth and encourage investment to flow to its most productive uses. Economic Action Plan 2012 proposes:

- Enhancing the neutrality of the tax system and further rationalizing inefficient fossil fuel subsidies by phasing out tax preferences for resource industries.

Improving Economic Conditions for Farmers and Fishermen

The Government is improving economic conditions for farmers and fishermen. Economic Action Plan 2012 proposes:

- $44 million over two years to transition the Canadian Grain Commission to a sustainable funding model.

- $10.5 million in 2012–13 to support key fisheries science activities.

Strengthening Business Competitiveness

The Government is taking action to improve the competitive position of job-creating Canadian businesses. Economic Action Plan 2012 proposes:

- Reducing red tape through the “One-for-One” Rule and implementing the Canada-United States Action Plan on Regulatory Cooperation.

- Reducing the tax compliance burden for businesses.

- Eliminating foreign investment restrictions for certain telecommunications companies.

Further Developing Canada’s Financial Sector Advantage

The Government is proposing new initiatives that will further ensure that our financial system remains strong and that it benefits all Canadians. Economic Action Plan 2012 proposes:

- Introducing legislative amendments to support central clearing of standardized over-the-counter derivative transactions, and to reinforce Canada’s financial stability framework.

- The Government will introduce enhancements to the governance and oversight framework for Canada Mortgage and Housing Corporation, and is moving forward with a legislative framework for covered bonds.

Improving Conditions for Business Investment

In a competitive global economy, Canadian entrepreneurs and businesses need a competitive and efficient tax system, a modern regulatory system, a well-functioning financial system and access to international markets. This solid foundation allows Canadian firms to create jobs and growth by exploiting opportunities at home and abroad.

The Government has a proven record of support for entrepreneurship, investment and growth. Since 2006, the Government has worked to promote investment and reduce regulatory impediments to business growth. As well, the stimulus phase of Canada’s Economic Action Plan provided unprecedented levels of funding to support the renewal of economically vital public infrastructure across the country. It is no surprise that Forbes magazine ranked Canada as the number one country in the world for doing business in 2011, citing our strong economic recovery and competitive tax system, among other factors.

Economic Action Plan 2012 will continue the Government’s work to improve business conditions in Canada. To this end, the Government will:

- Support responsible resource development.

- Invest in our natural resources.

- Expand trade and open new markets for Canadian businesses.

- Keep taxes low for job-creating businesses.

- Improve economic conditions for farmers and fishermen.

- Strengthen business competitiveness.

- Further develop Canada’s financial sector advantage.

Responsible Resource Development

Major economic projects create jobs and spur development across Canada. In 2010, natural resource sectors employed over 760,000 workers in communities throughout the country. In the next 10 years, more than 500 major economic projects representing $500 billion in new investments are planned across Canada. A significant element of this economic boost is represented by Canada’s unique oil sands industry, which employs over 130,000 people while generating wealth that benefits all Canadians. This contribution is increasing: a recent study by the Canadian Energy Research Institute estimates that in the next 25 years, oil sands growth will support, on average, 480,000 jobs per year in Canada and will add $2.3 trillion to our gross domestic product. Increasing global demand for resources, particularly from emerging economies, will create new economic and job opportunities from which all Canadians will benefit.

Canadians will only reap the benefits that come from our natural resources if investments are made by the private sector to bring the resources to market. Yet those who wish to invest in our resources have been facing an increasingly complicated web of rules and bureaucratic reviews that have grown over time, adding costs and delays that can deter investors and undermine the economic viability of major projects.

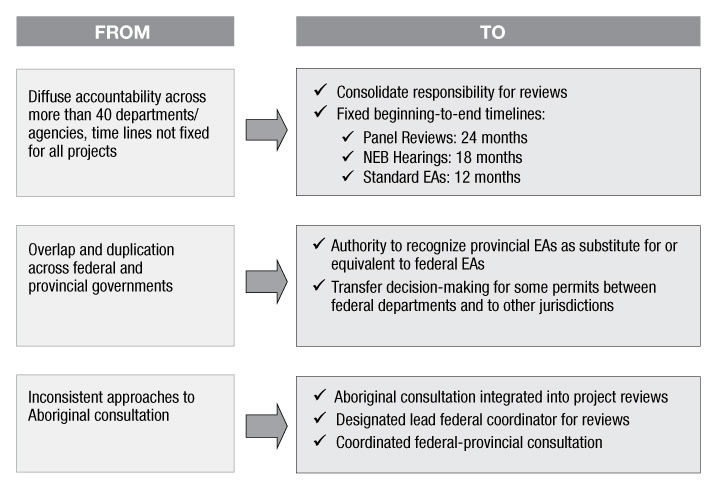

To maximize the value that Canada draws from our natural resources, we need a regulatory system that reviews projects in a timely and transparent manner, while effectively protecting the environment. The Government recognizes that the existing system needs comprehensive reform. The Government will bring forward legislation to implement system-wide improvements to achieve the goal of “one project, one review” in a clearly defined time period. Economic Action Plan 2012 proposes to streamline the review process for major economic projects, support consultation with Aboriginal peoples, and strengthen pipeline and marine safety.

Modernizing the Regulatory System for Project Reviews

The Government will propose legislation to streamline the review process for major economic projects.

Since 2006, the Government has been working to streamline the review process for major economic projects so that projects proceed in a timely fashion while protecting the environment. For example, in 2010 the Government amended the Canadian Environmental Assessment Act to allow assessments to start sooner and reduce duplication, and created participant funding programs to ensure meaningful public engagement in the review process.

These steps have made a difference, but more needs to be done. Currently, companies undertaking major economic projects must navigate a complex maze of regulatory requirements and processes. Approval processes can be long and unpredictable. Delays and red tape often plague projects with few environmental risks. Under the current system, thousands of smaller projects with little or no risk to the environment are caught up in the federal environmental review process. The types of small projects that can be needlessly subjected to lengthy reviews include construction of a new pumping house for the expansion of a maple syrup plant, and the replacement of an existing culvert under a causeway. By forcing these thousands of low-risk projects to go through the review process, the current system draws resources away from projects that have the greatest impact on the environment. This approach is not economically sound or environmentally beneficial.

In the federal government alone, accountability for assessments rests with dozens of departments and agencies, each with its own mandate, processes, information needs and timelines. This leads to duplication and a needless waste of time and resources. For example:

- Enbridge proposed a new $2-billion pipeline connecting Hardisty, Alberta to Gretna, Manitoba. Due to multiple approval processes, federal departments made their decisions on the project two years after the National Energy Board’s approval of the project.

- Areva Resources Canada has proposed the construction and operation of a uranium mine and mining facilities in northern Saskatchewan, with capital investment of up to $400 million and up to 200 construction jobs. There was a 19-month delay in starting the environmental assessment. The federal lead department changed midway through the environmental review, which added unnecessary complexity.

- The NaiKun Wind Energy Group is proposing to develop a 396-megawatt offshore wind energy project in Hecate Strait off the northeast shores of Haida Gwaii in British Columbia. The company estimates that the project would have a capital investment of $1.6 billion and would create up to 200 construction jobs. The federal decision to approve the process came 16 months after the provincial decision.

The starting point of federal environmental assessments can also be unpredictable, which can cause lengthy delays. The Rabaska Partnership, for instance, is proposing to construct and operate a liquefied natural gas terminal near Beaumont and Lévis, Quebec, including a marine jetty to receive tankers, on-shore facilities, and a new 50-kilometre pipeline to connect to existing natural gas transmission networks. It took almost two years before the federal panel began its review. Similarly, the federal environmental assessment for the project began 10 months after Canpotex Terminals Limited and Prince Rupert Port Authority submitted a project description proposing to construct a 13-million-tonnes-per-year potash export terminal with a deepwater marine wharf in Prince Rupert, British Columbia. The proponents estimate that the project would have a capital investment of $750 million and would create up to 800 jobs during construction.

A further complication is overlapping federal and provincial regulatory requirements and processes that require a high degree of coordination. For example, an application for the Joslyn North Mine Project, an oil sands mine located in northern Alberta, was submitted to the Province of Alberta in 2006. A federal environmental assessment did not begin until 2008 and a decision to approve the project was issued by the responsible federal department in December 2011. The Lower Churchill Generation Project includes two hydroelectric power generating facilities on the lower section of the Churchill River in Labrador. A description of the project was submitted to the federal and provincial governments in 2006, an environmental assessment began in 2007 and the responsible federal departments approved the project in March 2012. Under a modernized regulatory review system, defined timelines will apply to environmental assessments, including for panel reviews of projects such as the Lower Churchill Generation Project.

Both levels of government have recognized an urgent need to reduce duplication.

[Federal, provincial and territorial ministers] reaffirmed their commitment to working toward the shared objective of one-project/one-review for our environmental assessments and associated regulatory processes to position Canada for long-term growth and job creation while maintaining the highest standard of environmental protection.

— Annual Energy and Mines Conference Communiqué, July 2011

Currently, over $3 billion in provincially approved projects are stranded in the mire of federal process and delay. This is unacceptable. Time is money. Duplication is waste. Tax dollars are limited. We cannot afford to hold investment and jobs hostage. Byzantine bureaucratic practices have no place in the 21s Century.

— British Columbia Speech from the Throne, February 2010

A positive area of cooperation between the federal government and provinces was the conclusion in 2011 of the Canada-Quebec Accord for the shared management of offshore petroleum resources. By clarifying the roles and responsibilities of each level of government, this Accord will allow for the development of oil and gas resources in the Gulf of St. Lawrence, creating jobs and economic development while protecting fisheries and the environment.

A modern regulatory system should support progress on economically viable major economic projects and sustain Canada’s reputation as an attractive place to invest, while contributing to better environmental outcomes.

Increased resource development activities can also offer new opportunities for Aboriginal businesses and can generate well-paying jobs for Aboriginal peoples near their communities. There are steps the Government can take to improve consultations with Aboriginal peoples when it contemplates conduct that might affect potential or established Aboriginal or Treaty rights.

The Government will focus on four major areas to streamline the review process for major economic projects:

- Making the review process for major projects more predictable and timely.

- Reducing duplication and regulatory burden.

- Strengthening environmental protection.

- Enhancing consultations with Aboriginal peoples.

The Government will propose legislation to modernize the federal regulatory system that will establish clear timelines, reduce duplication and regulatory burdens, and focus resources on large projects where the potential environmental impacts are the greatest.

Summary of Key Improvements

These measures will accelerate project development and directly lead to the creation of high-paying, high-quality jobs including for engineers, tradespeople and other skilled workers. The resulting economic activity will stimulate additional job creation across the country.

Major Projects Management Office Initiative

Economic Action Plan 2012 proposes $54 million over two years to renew the Major Projects Management Office initiative.

The Major Projects Management Office initiative has helped to transform the approvals process for major natural resource projects by shortening the average review times from 4 years to just 22 months, and improving accountability by monitoring the performance of federal regulatory departments. More than 70 major projects are currently benefitting from the system-wide improvements made possible by the initiative (see map). To continue to support effective project approvals through the Major Projects Management Office initiative, Economic Action Plan 2012 proposes $54 million over two years.

Major Projects Management Office Initiative: Current Projects

Major Economic Projects Benefitting From the Major Projects Management Office Initiative

Horn River Natural Gas Pipeline (British Columbia)

The Horn River Natural Gas Pipeline project connects natural gas supply from northeastern British Columbia to an existing pipeline infrastructure. The Major Projects Management Office initiative coordinated the federal review of the project and approval was granted in February 2011, 17 months after receiving the description of the project.

Groundbirch Natural Gas Pipeline (Alberta and British Columbia)

The federal review of the Groundbirch Natural Gas Pipeline project was coordinated by the Major Projects Management Office initiative. A description of the pipeline, which would cross from Alberta into British Columbia, was submitted to the Office in November 2008 and the project was approved within 17 months in April 2010.

Bakken Oil Pipeline (Manitoba and Saskatchewan)

The Bakken Oil Pipeline, which will transport oil from Saskatchewan to Manitoba, was approved by the federal government within 17 months in March 2012. The review of the project, which was expected to trigger statutory and regulatory obligations for several departments, was coordinated by the Major Projects Management Office after receiving a project description in October 2010.

Detour Lake Gold Mine (Ontario)

Approval for the Detour Lake Gold Mine project was granted by the Minister of the Environment in December 2011. A description of the open-pit mine project, which would be located in northeastern Ontario, was submitted in October 2009. The Major Projects Management Office coordinated the review of the project, which was expected to trigger statutory and regulatory obligations for Fisheries and Oceans Canada, Natural Resources Canada and Transport Canada, and the review of the project was completed in 14 months.

Hebron Offshore Oil Development (Newfoundland and Labrador)

ExxonMobil Canada Properties’ Hebron Offshore Oil Development project is a 19,000 to 28,000 cubic metres per day offshore oil production proposal located in the Jeanne d'Arc basin, approximately 340 kilometres offshore of St. John's. The proposal consists of an offshore oil production system and associated facilities. A project description was submitted in March 2009 and the review was completed in January 2012.

Matoush Uranium Exploration (Quebec)

The Matoush Uranium Exploration Ramp Access project involves the excavation of an exploration ramp to determine the possibility of a uranium mine within the James Bay and Northern Quebec Agreement territory located approximately 260 kilometres north of Chibougamau in Quebec. The project consists of a 2,405-metre ramp, at a maximum depth of 300 metres. Temporary structures will be built at the surface to support the underground exploration. The project description was submitted in September 2008 and the review was completed February 2012.

Consultation Under the Canadian Environmental Assessment Act

Economic Action Plan 2012 proposes $13.6 million over two years to support consultations with Aboriginal peoples.

The Government is committed to consulting with Aboriginal peoples in the review of projects to ensure that their rights and interests are respected. Consultations can also facilitate discussions on how Aboriginal peoples can benefit from the economic development opportunities associated with these projects. To support consultations with Aboriginal peoples related to projects assessed under the Canadian Environmental Assessment Act, Economic Action Plan 2012 proposes $13.6 million over two years to the Canadian Environmental Assessment Agency.

Supporting Responsible Energy Development

Economic Action Plan 2012 proposes $35.7 million over two years to support responsible energy development.

Safe navigation of oil tankers is very important to our Government. Oil tankers have been moving safely and regularly along Canada’s West Coast since the 1930s. For example, 82 oil tankers arrived at Port Metro Vancouver in 2011. Nearly 200 oil or chemical tankers visited the Ports of Prince Rupert and Kitimat over the past five years. They all did so safely.

Oil tankers in Canada must comply with the safety and environmental protection requirements of international conventions and, while in Canadian waters, with Canada’s marine safety regulatory regime. These requirements include double hulling of ships, mandatory pilotage, regular inspections and aerial surveillance.

Any tanker built after July 6, 1993, must be double hulled to operate in Canadian waters. A double hull is a type of hull where the bottom and sides of a vessel have two complete layers of watertight hull surface. Tankers that are not double hulled are being gradually phased out. And, for large crude oil tankers, the phase-out date for single hulled vessels—like the Exxon Valdez—was 2010, which means that all large crude tankers operating in our waters today are double hulled.

In compulsory pilotage areas, the Pacific Pilotage Authority requires tanker operators to take a marine pilot with local knowledge onboard before entering a harbour or busy waterway. In special circumstances, more stringent measures may be taken, including: requiring two pilots onboard oil tankers; escort tugs; additional training standards; and navigational procedures, restrictions and routing measures.

Transport Canada also targets high-risk vessels entering Canadian ports. The department’s ship inspectors board and inspect foreign vessels, including oil tankers, entering Canadian ports to ensure they comply with all of our rules. In 2011, almost 1,100 inspections were carried out across Canada, 147 of them on oil tankers.

Economic Action Plan 2012 proposes further measures to support responsible energy development, including:

- New regulations which will enhance the existing tanker inspection regime by strengthening vessel inspection requirements.

- Appropriate legislative and regulatory frameworks related to oil spills, and emergency preparedness and response.

- A review of handling processes for oil products by an independent international panel of tanker safety experts.

- Improved navigational products, such as updated charts for shipping routes.

- Research to improve our scientific knowledge and understanding of marine pollution risks, and to manage the impacts on marine resources, habitats and users in the event of a marine pollution incident.

These measures will ensure that pipelines in Canada are carefully monitored, environmental consequences are understood and emergency response is improved. Economic Action Plan 2012 proposes $35.7 million over two year to further strengthen Canada’s tanker safety regime and support responsible development.

Strengthening Pipeline Safety

Economic Action Plan 2012 proposes $13.5 million over two years to strengthen pipeline safety.

The National Energy Board is an independent federal agency established to regulate international and interprovincial aspects of the oil, gas and electric utility industries, including international and interprovincial pipelines. To increase the number of inspections of oil & gas pipelines from about 100 to 150 inspections per year, and double from 3 to 6 the number of annual comprehensive audits to identify issues before incidents occur, Economic Action Plan 2012 proposes $13.5 million over two years to the National Energy Board. Funding for these activities will be fully cost-recovered from industry.

The Northern Pipeline Agency

Economic Action Plan 2012 proposes $47 million over two years to the Northern Pipeline Agency.

The Northern Pipeline Agency was created as a single window regulatory body to oversee the planning and construction of a major pipeline—the Alaska Pipeline—to transport natural gas from Alaska through Canada to the lower 48 U.S. states. To carry out federal regulatory responsibilities related to the Alaska Pipeline Project, Economic Action Plan 2012 proposes $47 million over two years to the Northern Pipeline Agency. This funding will be fully cost-recovered from industry.

Amending Mining Regulations

Economic Action Plan 2012 proposes $1 million over two years to amend metal mining regulations.

Environment Canada is responsible for administering the key pollution prevention provisions under the Fisheries Act, including the associated Metal Mining Effluent Regulations. These regulations prescribe controls on the effluents and waste rock that can be deposited into certain bodies of water.

To address an existing regulatory gap and provide greater certainty for the mining industry in Canada, Economic Action Plan 2012 proposes $1 million over two years to Environment Canada to expand Metal Mining Effluent Regulations to non-metal diamond and coal mines.

Investing in Our Natural Resources

Canada’s rich natural resources contribute to jobs and growth in communities across the country. The energy and mining sectors accounted for nearly 10 per cent of Canada’s gross domestic product (GDP) in 2010, and employed nearly 580,000 workers. Economic Action Plan 2012 announces new and renewed measures in support of energy and mineral exploration.

Supporting Junior Mineral Exploration

Economic Action Plan 2012 proposes to extend the temporary 15-per-cent Mineral Exploration Tax Credit for flow-through share investors for an additional year.

The temporary 15-per-cent Mineral Exploration Tax Credit for flow-through share investors helps junior exploration companies raise capital by providing an incentive to individuals who invest in flow-through shares issued to finance mineral exploration. This credit is in addition to the regular deduction provided for the exploration expenses “flowed through” from the issuing company.

The credit is scheduled to expire on March 31, 2012. However, given ongoing global uncertainty and in support of the exploration efforts of junior exploration companies, Economic Action Plan 2012 proposes to extend the credit for an additional year, until March 31, 2013.

It is estimated that the extension of this measure will result in a net reduction of federal revenues of $100 million over the 2012–13 to 2013–14 period.

Supporting Offshore Oil & Gas Exploration

Economic Action Plan 2012 proposes to amend the Coasting Trade Act to improve access to modern, reliable seismic data for offshore resource development.

Offshore oil & gas developments create jobs and support economic growth in Canada’s communities. Continued exploration activity is required to bring new projects to communities and sustain these economic benefits over the long term and depends on modern, reliable seismic technology and data. To advance exploration for new developments, Economic Action Plan 2012 proposes to amend the Coasting Trade Act to improve access to modern, reliable seismic data for offshore resource development. This will ensure private sector companies have the information they require to identify potential resource development opportunities.

Assessing Diamonds in the North

Economic Action Plan 2012 proposes $12.3 million over two years to continue to assess diamonds in the North.

The natural resource sector in Canada’s North provides significant employment and business opportunities for Aboriginal peoples and communities. The Diamond Valuation and Royalty Assessment Program, operated by Aboriginal Affairs and Northern Development Canada, ensures that Canadians and Northerners benefit from the royalties associated with diamond production in the region. To renew the Diamond Valuation and Royalty Assessment Program, Economic Action Plan 2012 proposes $12.3 million over two years to Aboriginal Affairs and Northern Development Canada.

Expanding Trade and Opening New Markets for Canadian Businesses

Our country’s prosperity is linked to reaching beyond our borders for economic opportunities that serve to grow Canada’s trade and investment. Open trade has long been a powerful engine for Canada’s economy. It is even more so in these globally challenging economic times.

Our Government understands the importance of market openness to the global economy and has shown continued leadership on the world stage by opposing protectionism and trade-restrictive measures. Canada believes open markets create jobs and economic growth for people around the world.

Canada’s Leadership on Trade

Deepening Canada’s trade and investment relationships in large and fast-growing export markets around the world is key to jobs and growth. In less than six years, Canada has concluded new free trade agreements with nine countries: Colombia, Jordan, Panama, Peru, the European Free Trade Association (Iceland, Liechtenstein, Norway and Switzerland), and most recently with Honduras. Canadian businesses and workers now have preferred export access and a real competitive edge in key markets around the world.

Since 2007, Canada has concluded or brought into force foreign investment promotion and protection agreements with 10 countries (China, Peru, Latvia, the Czech and Slovak Republics, Romania, Madagascar, Jordan, Bahrain and Kuwait) and is in active negotiations with 10 others, including India.

Our Government recognizes that restrictions on imports and investment stifle our exporters and undermine competitiveness. Over the past three years, the Government has removed many of Canada’s self-imposed trade costs to help businesses be more competitive. For example, since 2009, the Government has eliminated all tariffs on imported machinery and equipment, and manufacturing inputs to make Canada a tariff-free zone for industrial manufacturers, the first in the G-20. These actions are providing more than $410 million in annual tariff relief to Canadian businesses. Such made-in-Canada measures have helped—and will continue to help—create jobs for Canadians, increase investment and innovation, and improve productivity.

Canada’s Trade Plan for Jobs and Growth

Economic Action Plan 2012 proposes to intensify Canada’s pursuit of new and deeper trading relationships. Our Government understands that Canadians’ standard of living and future prosperity depend on growing trade and investment.

To that end, the Government is continuing to actively pursue new trade and investment opportunities, particularly with large, dynamic and fast-growing economies.

Canada-U. S. Border and Regulatory Action Plans

In December 2011, Canada and the United States took the biggest step forward in bilateral cooperation since the signing of the North American Free Trade Agreement with the launch of the Action Plan on Perimeter Security and Economic Competitiveness and the Action Plan on Regulatory Cooperation. These agreements create a new, modern border for a new century.

The Action Plan on Perimeter Security and Economic Competitiveness provides a practical road map for speeding up legitimate trade and travel across the Canada-U.S. border, while enhancing security. In a typical year, more than $500 billion worth of two-way trade takes place between Canada and the U. S. The most conservative estimates suggest that inefficiencies at the Canada-U. S. border impose a direct cost on the Canadian economy of 1 per cent of GDP, or $16 billion a year. Even a modest improvement in border efficiency will result in significant and lasting economic gains.

The best place to deal with security issues is at the continental perimeter. Smarter systems can reduce the needless inconvenience posed to manufacturers and travellers by multiple inspections of freight and baggage, i.e. goods should be once screened, twice accepted. Pilot projects at Prince Rupert and Montréal will begin soon. In addition to these pilot projects, the Government will take other measures to implement action plan commitments and other border improvements over the next two years.

Deeper Canada-China Ties

In order to benefit Canadian workers and businesses, our Government continues to strengthen its ties with China, now Canada’s second largest trading partner.

In February 2012, Canada announced that after 18 years of negotiation Canada and China had concluded a Foreign Investment Promotion and Protection Agreement. This landmark agreement will facilitate investment flows between Canada and China by providing a more stable and secure environment for investors on both sides of the Pacific. The potential for increased Canadian investment in China is significant given that China is expected to become the world’s largest economy by 2020.

Our Government will continue to actively engage with China to explore how to best enhance our growing bilateral trade and economic relations.

Canada-EU Trade Agreement

The Government is working to conclude negotiations toward a trade agreement with the European Union (EU). This agreement will improve access for Canadian businesses to the EU’s $18-trillion economy and 500 million consumers. The potential to Canadian workers and their families from a Canada-EU free trade agreement include:

- A 20-per-cent boost in bilateral trade.

- A $12-billion annual boost to Canada’s economy.

Canada-India Trade Agreement

Our Government is committed to building on our strong ties with India to create new opportunities and strengthen the economies of both countries.

In November 2010, the Prime Minister announced the start of trade negotiations. This initiative underscores the dedication of both countries to meeting a mutual goal of tripling bilateral trade to $15 billion annually by 2015.

A Joint Study Report concluded that a new Canada-India trade agreement could boost Canada’s economy by at least $6 billion, and directly benefit Canadian businesses and workers in sectors ranging from primary agricultural, resource-related and chemical products to transportation, machinery and equipment, and services.

Trans-Pacific Partnership

In November 2011, the Prime Minister formally indicated Canada’s interest in joining the Trans-Pacific Partnership (TPP) negotiations. The current TPP members represent an export market of 505 million people and a GDP of almost $17 trillion (2010).

Active and Ongoing Engagement in the Asia-Pacific Region

In the past few years, our Government has been aggressively expanding commercial relations with the Asia-Pacific region to create jobs and economic benefits. The opportunities in this dynamic region are impressive. Asia-Pacific markets have an economic growth rate that is two to three times the global average.

Canada is maximizing opportunities for entrepreneurs through innovative trade, investment, air transport, and science and technology agreements.

Other initiatives in the region include:

- Advancing the just-launched free trade agreement negotiations with Japan.

- Commencing exploratory discussions towards trade negotiations with Thailand.

- Adopting the Joint Declaration on Trade and Investment with the Association of Southeast Asian Nations to increase Canada’s trade and investment ties in the region.

- Signing air transport agreements with six Asia-Pacific countries.

Canada recently approved the issuance of a 20-year licence to export liquefied natural gas from Kitimat, British Columbia to the Asia-Pacific region. This initiative will allow Canada to diversify its energy exports to growing markets in the Asia-Pacific region, further strengthening its trading partnerships with Asian economies.

Canada in the Americas

In the Americas region, Canada has concluded trade agreements with the United States, Mexico, Honduras, Panama, Costa Rica, Chile, Colombia and Peru. Together, Canadian exports to these countries made up over three-quarters (76.6 per cent) of Canada’s worldwide exports in 2010.

In June 2011, the Government announced that Canada is moving ahead with exploratory discussions to enhance its trade relationship with South America’s largest common market, Mercosur, whose members are Argentina, Brazil, Paraguay and Uruguay. Mercosur countries represent an export market of nearly 250 million consumers and account for almost three-quarters of all economic activity in South America.

Deeper Canada-Africa Ties

Canada wants to deepen its commercial presence in Africa to create opportunities for Canadian businesses and workers arising from Africa’s present and future economic growth.

Opportunities in Africa for Canadian companies exist in sectors such as telecommunications, agriculture, energy, transportation, infrastructure, natural resources and education.

In October 2011, Canada began negotiations towards a free trade agreement with Morocco, Canada’s first with an African country.

Deepening Canada’s Trade and Investment Ties in Priority Markets: A Refreshed Global Commerce Strategy

Economic Action Plan 2012 proposes to refresh the Global Commerce Strategy through extensive consultations with Canada’s business community.

In 2007, the Government launched the Global Commerce Strategy to respond to changes in the global economy and position Canada for long-term prosperity. The Global Commerce Strategy identified 13 priority markets around the world where Canadian opportunities and interests had the greatest potential for growth. This led to five years of Canadian leadership on the world stage in support of open trade, job creation, economic growth and prosperity for Canadians.

Economic Action Plan 2012 proposes to refresh the Global Commerce Strategy through extensive consultations with Canada’s business community, including the very critical small and medium-sized businesses. An updated Global Commerce Strategy will align Canada’s trade and investment objectives with specific high-growth priority markets with an eye to ensuring that Canada is branded to its greatest advantage within each of those markets. In what remains a fragile global economic climate, the new Global Commerce Strategy will be announced in 2013, and guide Canada’s trade plan in priority markets going forward.

| Economic Growth (per cent) |

||||

|---|---|---|---|---|

| Trading Partner | Population (millions, 2010) |

Gross Domestic Product (billions of US dollars, 2011) |

2010 | 2011 |

| European Union | 494 | 17,960 | 1.8 | 1.7 |

| India | 1,191 | 1,843 | 10.1 | 7.8 |

| Japan | 128 | 5,855 | 4.0 | -0.5 |

| TPP | 505 | 17,804 | 3.5 | 1.9 |

| Mercosur | 244 | 3,025 | 8.0 | 4.8 |

| Notes: Values for 2011 are estimates. Economic growth for the TPP and Mercosur is weighted by share of world output at purchasing power parity, as per convention. TPP = Australia, Brunei, Chile, Malaysia, New Zealand, Peru, Singapore, United States and Vietnam. Mercosur = Argentina, Brazil, Paraguay and Uruguay. Sources: International Monetary Fund; Organisation for Economic Co-operation and Development (OECD). |

||||

Trade Measures to Support the Energy Industry

Economic Action Plan 2012 proposes to restore the duty-free status of certain imported fuels used as manufacturing inputs in energy and electricity production.

Canada’s energy sector is a vital component of the Canadian economy. Recently, certain imported fuels used as manufacturing inputs in energy and electricity production became subject to a 5-per-cent tariff as a result of a Canada Border Services Agency ruling. Economic Action Plan 2012 proposes to restore the duty-free status of these inputs. Eliminating this tariff will lower business costs by $30 million annually, improve the competitiveness of the energy industry, including electricity generation in Newfoundland and Labrador, and maintain the Government’s commitment to make Canada a tariff-free zone for industrial manufacturers.

Export Development Canada

Economic Action Plan 2012 extends the temporary domestic powers provided to Export Development Canada for an additional year.

Since 2009, Export Development Canada (EDC) has provided additional financing support to Canadian exporters who were facing difficulties in meeting their financing needs due to the financial crisis. While credit conditions have continued to improve, credit availability remains limited in some areas, in part due to the impact of developments outside Canada on foreign banks. Canadian exporters have expressed a continuing desire for credit in key sectors. Since 2009, EDC has provided over $6 billion in additional financing capacity using its temporary domestic powers.

On March 8, 2012, the Government extended the temporary domestic powers provided to EDC under Canada’s Economic Action Plan for an additional year (until March 12, 2013) to help meet the financing needs of Canadian exporters. The extension of EDC’s temporary domestic powers until March 2013 will support further assessment and consultation with stakeholders on EDC’s role in the domestic market. EDC will continue to focus its domestic lending activities on filling gaps in a manner that is coordinated with the Business Development Bank of Canada and complements the activity of private sector financial institutions.

Streamlining Canada’s Trade Remedy System

Economic Action Plan 2012 proposes to consolidate Canada’s trade remedy investigation functions into one organization, under the Canadian International Trade Tribunal.

Canada’s continued support for trade liberalization is complemented by a strong and effective trade remedy system, which acts as an important safety valve for Canadian manufacturers harmed by unfairly traded imports. Canada’s trade remedy system is currently jointly administered by the Canada Border Services Agency and the Canadian International Trade Tribunal (CITT).

In Budget 2011, the Government committed to proposing initiatives to ensure Canada operates an efficient trade remedy system. To deliver on this commitment, the Government will introduce legislation to consolidate Canada’s trade remedy investigation functions into one organization, under the CITT. This restructuring will create efficiencies that will help the Government maintain and sustain an effective trade remedy system. This initiative will also cut red tape, making it less cumbersome for Canadian businesses to take action against unfair trade, and will result in cost savings.

Foreign Trade Zone Programming

In Budget 2011, the Government committed to review Canada’s foreign trade zone (FTZ)-like policies and programs to ensure that they are competitive, well marketed and efficiently administered. Consultations concluded in February 2012.

The Government is carefully reviewing submissions to identify opportunities to reduce red tape and costs, facilitate access to existing programs, and improve efforts to promote our FTZ-like policies and programs as an integral part of Canada’s tax and tariff advantages. The Government will respond to the submissions received in a timely manner.

Increasing Travellers’ Exemptions

Economic Action Plan 2012 proposes to increase the value of goods that may be imported duty- and tax-free by Canadian residents returning from abroad after a 24-hour and 48-hour absence to $200 and $800, respectively.

Every year, Canadians take some 30 million overnight trips outside of Canada, often returning with goods purchased abroad. Modernization of the rules applied to these purchases is long overdue. Economic Action Plan 2012 proposes the most significant increase in the duty- and tax-free travellers’ exemptions in decades. The travellers’ exemption allows Canadians to bring back goods up to a specified dollar limit without having to pay duties or taxes, including customs duty, Goods and Services Tax/Harmonized Sales Tax, federal excise levies and provincial sales and product taxes.

The Government proposes to increase the value of goods that may be imported duty- and tax-free by Canadian residents returning from abroad after a 24-hour and 48-hour absence to $200 and $800, harmonizing them with U.S. levels. This measure will facilitate cross-border travel by streamlining the processing of returning Canadian travellers who have made purchases while outside Canada. This change will be effective beginning on June 1, 2012. It is estimated that this measure will reduce federal revenues by $13 million in 2012–13 and by $17 million in 2013–14.

| Length of Absence | Current Limits | Limits as of June 1, 2012 |

|---|---|---|

| More than 24 hours | $50 | $200 |

| More than 48 hours | $400 | $800 |

| More than 7 days | $750 | $800 |

Tax Relief for Foreign-Based Rental Vehicles

Economic Action Plan 2012 proposes tax relief for Canadian residents temporarily importing foreign-based rental vehicles to facilitate access to Canadian tourism destinations.

To facilitate access to Canadian tourism destinations, Economic Action Plan 2012 proposes to eliminate or reduce taxes on foreign-based rental vehicles temporarily imported by Canadian residents, consistent with the Government’s commitment under the Federal Tourism Strategy. These changes will make it easier for Canadians who have been travelling abroad to return to Canada to continue their touring and travelling activities with a foreign-based rental vehicle. For example, a Canadian who takes a cruise from British Columbia to Alaska and has been outside Canada for at least 48 hours would be able to rent a vehicle in Alaska and then enter the Yukon for touring purposes without having to pay taxes on that vehicle at the border. These changes will be effective starting June 1, 2012.

International Taxation

Economic Action Plan 2012 proposes improvements to Canada’s system of international taxation.

Canada’s system of international taxation plays a key role in providing the right environment for cross-border trade and investment. In 2007, the Government established the Advisory Panel on Canada’s System of International Taxation, chaired by Mr. Peter Godsoe, with a mandate to provide recommendations to improve the fairness and competitiveness of Canada’s international tax rules.

The Panel’s December 2008 report concluded that Canada’s system of international taxation is a good one that has served Canada well.

At the same time, given that the competitiveness landscape is continually shifting, Canada’s international tax rules must constantly adapt to maintain an appropriate balance of competitiveness, simplicity, fairness, efficiency and protection of the tax base.

The Government has acted on a number of the Panel’s recommendations and made other incremental improvements to the system of international taxation. These past actions include:

- Repealing section 18.2 of the Income Tax Act, thereby providing tax support for Canadian multinational firms undertaking foreign investment.

- Narrowing the definition of taxable Canadian property, thereby improving the ability of Canadian businesses, including innovative high-growth companies that contribute to job creation and economic growth, to attract foreign venture capital.

- Ensuring that taxpayers have an opportunity to apply for refunds of tax withheld under section 105 of the Income Tax Regulations and section 116 of the Income Tax Act after a reassessment by the Canada Revenue Agency.

- Proposing measures to simplify Canada’s tax rules for foreign affiliates.

- Proposing simplified and more targeted rules for foreign investment entities and non-resident trusts.

- Proposing measures to counter schemes, often referred to as “foreign tax credit generators,” that were designed to shelter tax otherwise payable by artificially increasing foreign tax credits.

Economic Action Plan 2012 introduces several additional improvements to respond to the report of the Panel. Details of these measures can be found in Annex 4. Going forward, the Government will continue to evaluate the report of the Panel and consider additional improvements to Canada’s international taxation rules.

Tax Treaties and Tax Information Exchange Agreements

The Government is actively negotiating and concluding tax treaties to reduce tax barriers to international trade and investment, strengthen Canada’s bilateral economic relationships, and create enhanced opportunities for Canadian businesses abroad. Since 2007:

- New tax treaties with Gabon, Greece and Turkey have come into force.

- Updated tax treaties and protocols with Finland, Italy, Korea, Mexico, Switzerland and the United States have come into force.

- New tax treaties with Colombia and Namibia have been signed.

- New protocols to update tax treaties with Austria, Barbados, France, and Singapore have been signed.

- Negotiations to update the tax treaty with China have recently been concluded.

- Negotiations for a new tax treaty with Hong Kong have begun.

- Negotiations to update tax treaties with Israel, the Netherlands, New Zealand, Poland, Spain and the United Kingdom have begun.

Canada now has 89 tax treaties in force, 7 tax treaties and protocols signed but not yet in force, and 11 tax treaties under negotiation.

The Government is committed to combating international tax evasion and to ensuring tax fairness by implementing the standard developed by the Organisation for Economic Co-operation and Development for the effective exchange of tax information. The Government, in its 2007 budget, extended the exemption for dividends received out of active business income earned by foreign affiliates resident in tax treaty countries to also include active business income earned by foreign affiliates established in a jurisdiction that has agreed to a tax information exchange agreement (TIEA) with Canada. This provided non-tax treaty jurisdictions an incentive to enter into TIEAs with Canada. Since 2007, the Government has brought into force 13 TIEAs, signed 3 other TIEAs, and is actively negotiating TIEAs with 14 other jurisdictions, including negotiations recently launched with Panama.

Fostering Sustainable Global Growth

Persistent economic and financial difficulties in Europe and other parts of the world are hindering economic recovery. Canada is playing a leadership role in formulating global policy responses through institutions such as the G-20 and the International Monetary Fund (IMF), and through its leadership of the Financial Stability Board, which is chaired by Bank of Canada Governor Mark Carney. Canada is also helping address development challenges through focused programs and initiatives that meet the needs of the developing world.

Providing Stewardship in the G-20

In September 2009, as part of its response to the global economic crisis, the G-20 created the Framework for Strong, Sustainable and Balanced Growth. The G-20 Framework is a forum where members identify and assess global economic risks and vulnerabilities, and coordinate policies designed to foster stronger, more sustainable and balanced economic growth. Canada and India have co-chaired the Framework Working Group since its launch at the 2009 Pittsburgh Summit. In its capacity as co-chair, Canada has led the development of action plans that deal with pressing global economic concerns, and promote growth and prosperity across the globe.

The considerable progress achieved through this process culminated in the Action Plan for Growth and Jobs agreed by Leaders in Cannes, France in November 2011, which set out a broad range of reforms covering the key policy areas across G-20 members. Looking ahead in 2012, Canada will continue to provide leadership in developing an action plan for Leaders at the upcoming G-20 Summit in Los Cabos, Mexico. The plan will monitor progress in meeting past commitments and develop new commitments as appropriate to address current global economic risks and vulnerabilities.

Strengthening the Legitimacy and Effectiveness of the International Monetary Fund

The IMF is a key global institution in assisting the international community through economic crises. In order to support its continuing role, the Government of Canada is delivering on its commitment to ratify a historic quota and governance reform agreement reached in 2010, which enhances the IMF’s capacity to provide support to the global economy. These actions should continue to strengthen the legitimacy and effectiveness of the IMF.

To support accountability to Canadians, the Government is enhancing the timeliness of its reporting on Canadian priorities and activities of the IMF and World Bank by aligning the timing of its annual report to Parliament and the public with the annual report on development assistance tabled annually in the Fall.

Increasing the Impact of Canadian Development Assistance

Canadians want to help the world’s poor, but they want assurances that their tax dollars are making a real difference in the lives of the people they are intended to help. In Budget 2007, the Government committed to an ambitious agenda to maximize the effectiveness of Canada’s international assistance efforts. Considerable progress has been made in delivering on our promise to make Canada’s aid more effective, particularly in the areas of accountability for resources and results, transparency, and the use of innovation to maximize the impact of aid.

Last year, Canada was the first to meet its G-8 commitment to double investments in sustainable agricultural development. Currently, we are leading global efforts on maternal, newborn and child health, as agreed at the G-8 meeting in Muskoka in 2010. The Canadian International Development Agency now delivers over 80 per cent of its bilateral assistance in a more focused set of countries, which allows Canada to play a more influential role in achieving enduring impacts in these countries. The Government has also taken significant steps to improve the transparency of our spending to Canadians and other countries, for example by joining the Open Government Partnership and the International Aid Transparency Initiative.

In addition, Canada has supported development innovation, pioneering new approaches to maximize impact and leverage private sector capital to address global development challenges. Canada’s strategic investments over the past several years are showing promising results including the accelerated introduction of pneumococcal vaccines to protect the lives of the world’s poorest children through the Advanced Market Commitment; progress by Grand Challenges Canada in tackling critical barriers to solving some of the most pressing global health challenges; and enhanced support for applied research that demonstrates sustained and measurable impacts on food security in developing countries through the Canadian International Food Security Research Fund.

Refocusing Canada’s Tariff Regime for Developing Countries

Economic Action Plan 2012 proposes to review Canada’s preferential tariff regime for developing countries.

Since 1974, Canada has granted preferential market access to imports from developing countries as a means to promote their economic growth and export diversification. The global economic landscape has changed considerably since then, including significant shifts in the income levels and trade competitiveness of certain developing countries. To respond to these developments and ensure that this form of development assistance is appropriately aligned with our development policy objectives, the Government will undertake a comprehensive review of Canada’s General Preferential Tariff regime.

Keeping Taxes Low for Job-Creating Businesses

A Competitive Business Tax System

This Government has implemented broad-based tax reductions that support investment and growth across the Canadian economy. The Government is delivering more than $60 billion of tax relief to job-creating businesses over 2008–09 and the following five fiscal years. Key actions include the following:

- To spur business investment and improve productivity, the Government reduced the federal general corporate income tax rate to 15 per cent on January 1, 2012, from 22.12 per cent in 2007. These tax reductions include the elimination of the corporate surtax in 2008 for all corporations.

- To help small businesses retain more of their earnings for investment, expansion and job creation, the Government cut the small business tax rate to 11 per cent in 2008 and increased the amount of income eligible for this lower rate to $500,000 in 2009.

- To further spur investment in small businesses, the Government increased the Lifetime Capital Gains Exemption on qualified small business shares to $750,000 from $500,000 in Budget 2007, the first increase in the exemption since 1988.

- To remove a disincentive for business investment, the Government eliminated the federal capital tax in 2006. The Government also provided the provinces with a temporary financial incentive to encourage them to eliminate their general capital taxes and to eliminate or replace their capital taxes on financial institutions with a minimum tax. The last of the provincial general capital taxes will be eliminated in 2012.

- To better support cross-border trade and investment and Canada’s participation in the global economy, the Government has improved Canada’s system of international taxation.

- To encourage investment to flow to its most productive uses and reduce the tax burden on capital investment, the Government improved the neutrality of the tax system by better aligning capital cost allowance rates with the useful life of assets. For example, in 2007, the capital cost allowance rate for manufacturing and processing buildings was increased to 10 per cent from 4 per cent, and the rate for computers was increased to 55 per cent from 45 per cent.

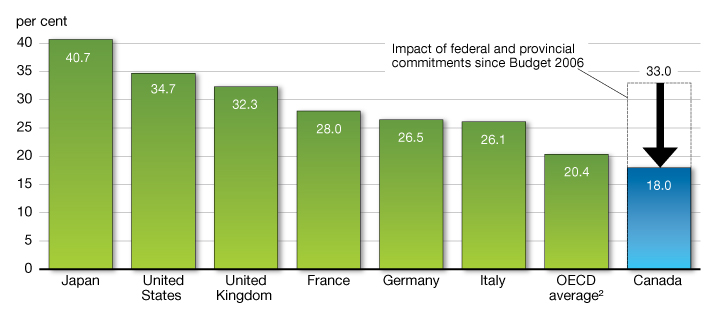

Lower general corporate income tax rates and other tax changes have increased the expected rate of return on investment and reduced the cost of capital (Chart 3.2.1), giving businesses strong incentives to invest and hire in Canada.

Canada leads the G-7 with the lowest overall tax rate on new business investment

It excludes the resource and financial sectors and tax provisions related to research and development.

2 OECD average excludes Canada.

Source: Department of Finance.

The competitiveness of Canada’s business tax system is supported by third-party analysis.

- KPMG’s publication Competitive Alternatives 2010 rigorously analyzed the impact of federal, state, provincial and municipal taxes on business operations, concluding that business tax costs in the United States are more than 55 per cent higher than in Canada.

- According to the 2011 Forbes magazine feature, “The Best Countries for Business,” Canada is the number one jurisdiction for doing business among 134 countries studied.

- Economists Jack Mintz and Duanjie Chen published an 83-country report on tax competitiveness. Their most recent report shows that Canada went from being the least tax competitive G-7 country in 2005 to the most tax competitive country in the G-7 in 2011.

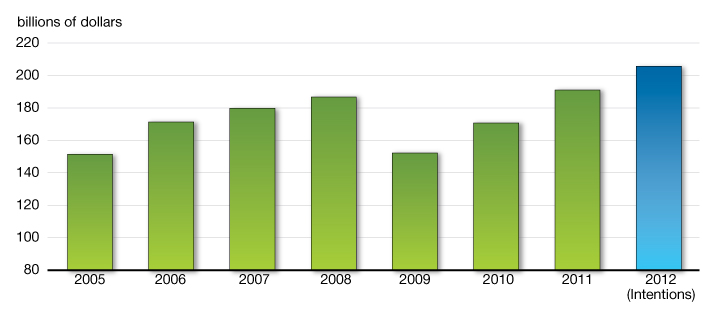

As shown in Chart 3.2.2, overall business investment in non-residential construction and machinery and equipment in 2011 exceeded the pre-downturn peak of 2008, and investment intentions for 2012 are even stronger. This business investment increases the amount of machinery, equipment, information technology and other physical capital in the economy. A larger stock of capital, in turn, increases Canada’s productive capacity, creates jobs and raises living standards.

Low taxes are supporting record-high business investment intentions

Source: Statistics Canada, Public and Private Investment Intentions.

Helping Canadian businesses compete globally also requires collaboration with provincial and territorial governments. A number of provinces have taken important actions to enhance Canada’s tax competitiveness and contribute to a strong foundation for future growth. In addition, the Government of Canada has a number of tax agreements with its provincial and territorial partners that result in greater efficiency and simplicity of the tax system, and work is ongoing to improve and enhance the application and administration of these agreements.

Keeping taxes low for Canadian businesses is a cornerstone of this Government’s long-term plan for jobs, growth and prosperity.

Enhancing the Neutrality of the Tax System

In 2009, along with other members of the G-20, the Government committed to “rationalize and phase out over the medium term inefficient fossil fuel subsidies.” This builds on the Government’s 2006 commitment to examine opportunities to make the tax system more neutral across sectors, in order to help ensure that investment is directed towards its most productive uses. In support of these commitments, the Government announced in Budget 2007 and Budget 2011 the phase-out of all tax preferences for oil sands producers relative to the conventional oil & gas sector.

Economic Action Plan 2012 proposes to further Canada’s efforts toward rationalizing fossil fuel subsidies, reducing tax distortions and improving the allocation of investment and capital within the Canadian economy by phasing out tax preferences for resource industries.

Phasing Out the Atlantic Investment Tax Credit—Oil & Gas and Mining

Economic Action Plan 2012 proposes to phase out the Atlantic Investment Tax Credit for investments in the oil & gas and mining sectors.

The Atlantic Investment Tax Credit is a 10-per-cent credit available for certain investments in new buildings, machinery and equipment used in the Atlantic region and the Gaspé Peninsula. Currently, the credit supports investments in farming, fishing, logging, manufacturing and processing, oil & gas, and mining.

The Canadian oil & gas and mining sectors have generally been performing well, and investment by these industries in the Atlantic region is robust and growing. Recognizing this, Economic Action Plan 2012 proposes to phase out the Atlantic Investment Tax Credit for investments in the oil & gas, and mining sectors.

The change will help improve the neutrality of the tax system for the oil & gas, and mining sectors across Canada and constitutes further action by Canada in support of the commitment by G-20 Leaders to rationalize and phase out inefficient fossil fuel subsidies over the medium term.

Phasing Out the Corporate Mineral Exploration and Development Tax Credit

Economic Action Plan 2012 proposes to phase out the Corporate Mineral Exploration and Development Tax Credit.

The mining sector has historically benefited from a number of targeted income tax preferences. As a first step in meeting the objective of making the tax system more neutral across mining and other industries, Economic Action Plan 2012 proposes to phase out the 10-per-cent Corporate Mineral Exploration and Development Tax Credit.

Actions taken by the Government since 2006, including corporate income tax rate reductions and the elimination of the federal capital tax, have increased the competitiveness of Canada’s mining sector. The Corporate Mineral Exploration and Development Tax Credit is no longer necessary.

This change is expected to increase federal revenues by approximately $10 million over the 2012–13 to 2013–14 period.

Improving Economic Conditions for Farmers and Fishermen

Strengthening Agricultural Institutions

Economic Action Plan 2012 proposes $44 million over two years to transition the Canadian Grain Commission to a sustainable funding model.

The agriculture sector was one of the most resilient through the economic downturn. The near- and medium-term outlook for agricultural commodity prices and farm income is strong. In 2009, the agriculture and agri-food sector accounted for approximately 2 million jobs and 8 per cent of total GDP. With nearly $35.5 billion in exports, Canada is the world’s fifth-largest exporter of agriculture and food products.

The coming year will see a focus on setting the right conditions for farmers and businesses in the agriculture and agri-food sector to compete and adapt. The Government will work with its provincial and territorial partners, and with industry, to develop a new federal-provincial-territorial agricultural policy framework to replace the current Growing Forward agreement in 2013. The new five-year framework agreement will set out policies and programs to support a modern, innovative and market-oriented sector. This will include a refocused suite of Business Risk Management programs.

The Government is delivering on its long-standing promise to give Western Canadian farmers the freedom to market their own wheat and barley on the open market. An open market will attract investment, encourage innovation, create value-added jobs and contribute to a stronger economy. The monopoly on the sale of Western Canadian wheat and barley for export and domestic human consumption will end as of August 1, 2012. The Government is committed to a smooth transition for farmers, which includes a viable, voluntary Canadian Wheat Board as part of an open and competitive Canadian grain market.

Efforts continue to modernize key institutions within the grain sector. To support its transition to a sustainable funding model, Economic Action Plan 2012 proposes $44 million over two years to the Canadian Grain Commission as it updates its fee structure.

Supporting Canada’s Fisheries

Economic Action Plan 2012 proposes $10.5 million in 2012–13 to support key fisheries science activities.

Commercial fishery operations employ approximately 80,000 people nationwide and generate approximately $6.8 billion in annual economic activity through fishing, aquaculture and processing.

Scientific monitoring activities of key commercial stocks support conservation and sustainability objectives while increasing economic opportunity for fishermen by allowing higher catch levels to be set with greater confidence. To support scientific activities of importance to industry, Economic Action Plan 2012 proposes $10.5 million in 2012–13 for the Department of Fisheries and Oceans. The Government will also take steps to allow the use of fishery resources to help generate revenues to pay for scientific activities.

Strengthening Business Competitiveness

Fostering Foreign Investment

The Government will introduce targeted improvements to the foreign ownership review process and be introducing legislative amendments to lift foreign investment restrictions in the telecommunications sector for companies that hold less than a 10 per cent share of the total Canadian telecommunications market.

Foreign investment provides significant benefits to Canada through knowledge, capital, access to new markets and the creation of high-value jobs across the country. The Government is committed to an open investment framework that encourages foreign investment in Canada as well as Canadian business investment abroad, while safeguarding Canada’s interests. The Investment Canada Act requires the review of significant foreign investments in Canada in order to ensure that the investments bring a net benefit to our country. To help strengthen investor confidence, the Government will introduce targeted improvements to the administration of the Act in the interests of greater transparency while preserving investor confidentiality.

With respect to the telecommunications sector in particular, the Government consulted with industry and consumer stakeholders on how to increase foreign investment in a way that would maximize economic and social benefits for Canadians.

The Government heard that liberalization of foreign investment in the telecommunications sector can encourage greater competition by strengthening the position of new entrants, improving access to capital and enabling closer strategic partnerships. Liberalization could also increase choice and lower costs for consumers, encourage innovation and improve productivity.

The Government will be introducing amendments to the Telecommunications Act to lift the foreign investment restrictions in that Act for telecommunications companies that hold less than a 10 per cent share of the total Canadian telecommunications market.

This targeted action will remove a barrier to investment for the companies that need it most, a key consideration as the upcoming wireless auction planned for 2013 is expected to be highly competitive and capital-intensive.

Reducing Red Tape

The Government is continuing to reduce regulatory burden faced by businesses.

Red tape hampers economic growth and erodes trust between government and citizens. The Government is committed to removing bureaucratic obstacles to businesses’ efforts to create jobs and growth.

In January 2011, the Government created the Red Tape Reduction Commission, fulfilling a Budget 2010 commitment. After a year of extensive Canada-wide consultations, the Commission brought forward recommendations to reduce irritants to business that impede growth, competitiveness and innovation.

The Government responded earlier this year by implementing the “One-for-One” Rule. Under this rule, every time the Government adopts a new regulation, it must eliminate an existing one. When a new or amended regulation increases administrative burden on business, the Government will offset—from existing regulations—an equal amount of administrative burden costs on business.

The President of the Treasury Board will develop an Action Plan to address the Commission’s Recommendations Report in the coming months to deliver better regulations that reduce frustration and lower costs for Canadian business.

Red Tape Reduction Commission Membership

The Red Tape Reduction Commission was composed of Parliamentarians and members of the private sector:

- The Honourable Tony Clement, President of the Treasury Board, Lead Minister

- The Honourable Maxime Bernier, Minister of State (Small Business and Tourism), Chair of the Commission

- William Aho, Central Mechanical Systems, Ltd.

- Dean Allison, Member of Parliament (Niagara West–Glanbrook)

- Bernard Bélanger, Premier Tech

- Lois Brown, Member of Parliament (Newmarket–Aurora)

- Stirling MacLean, WearWell Garments, Ltd.

- Cathy McLeod, Member of Parliament (Kamloops–Thompson–Cariboo)

- The Honourable Rob Moore, Member of Parliament (Fundy Royal)

- Gord Peters, Cando Contracting, Ltd.

- Denis Prud’homme, former owner of Prud’homme Trucking

- Catherine Swift, Canadian Federation of Independent Business

- Chris Warkentin, Member of Parliament (Peace River)

The Government is also committed to implementing the Canada-United States Action Plan on Regulatory Cooperation, announced on December 7, 2011, by Prime Minister Harper and President Obama. The Action Plan contains 29 initiatives to align the regulatory approaches between Canada and the United States in areas of agriculture and food, transportation, health and personal care products, chemical management, the environment, and other cross-sectoral areas, without compromising health, safety or environmental protection standards. The Action Plan will help reduce barriers to trade, lower costs for consumers and business, and create economic opportunities on both sides of the border.

Reducing the Tax Compliance Burden for Businesses

Economic Action Plan 2012 proposes measures to reduce the tax compliance burden for small businesses and announces a number of administrative improvements by the Canada Revenue Agency.

In PricewaterhouseCoopers’ 2012 international study analyzing the ease of paying taxes, Paying Taxes 2012: The Global Picture, Canada ranks higher than any other G-7 country based on the overall ease of complying with tax obligations. PricewaterhouseCoopers also identified Canada as a potential model for other countries’ tax systems from the perspective of a company filing and paying taxes.

Reducing the Tax Compliance Burden Has Positive Results

- The Canada-Ontario Tax Collection Agreement was amended to provide for federal administration of Ontario’s corporate taxes for taxation years that end after 2008. PricewaterhouseCoopers estimated that this change reduces compliance costs by more than $135 million annually for Ontario businesses, by allowing for a single annual tax form, a single tax collector and one set of income tax rules.

- The frequency of tax remittance and filing requirements for small businesses in the areas of income taxes, source deductions and sales taxes was reduced by measures introduced in Budget 2007. More than 600,000 small businesses are able to benefit from these changes, with the total number of filings and remittances for small businesses reduced by more than one-third.

- The definition of taxable Canadian property was narrowed in Budget 2010, thereby eliminating the need for tax reporting under section 116 of the Income Tax Act for many investments. This improves the ability of Canadian businesses, including innovative high-growth companies that contribute to job creation and economic growth, to attract foreign venture capital.

Through ongoing review and revision of the tax system and its administration, the Government is continuing to reduce the tax compliance burden, including the following actions proposed or announced in Economic Action Plan 2012.

A Doubling of the Goods and Services Tax/Harmonized Sales Tax (GST/HST) Streamlined Accounting Thresholds

The GST/HST streamlined accounting methods simplify compliance for small businesses and public service bodies. Economic Action Plan 2012 proposes to double the thresholds for eligibility to use these methods so that more small businesses and public service bodies have access to these simplified approaches.

Simplified Administration for Partnerships

In order to reduce the workload for partnerships that want to file waivers, Economic Action Plan 2012 proposes to amend the Income Tax Act to provide the authority for a single designated partner to sign a waiver on behalf of all partners.

Improvements to the Rules for Paying Eligible Dividends

Under existing rules, if a corporation wishes to pay dividends, and only a portion of those dividends would be eligible for an enhanced dividend tax credit, that portion must be paid as a separate dividend in order for investors to be eligible to claim the enhanced dividend tax credit. Economic Action Plan 2012 proposes amendments, for dividends paid on or after Budget Day, to allow a corporation to pay a single dividend and designate a portion of it as an eligible dividend.

Administrative Improvements That Enhance the Predictability of the Scientific Research and Experimental Development (SR&ED) Tax Incentive Program

Economic Action Plan 2012 announces administrative changes to the SR&ED tax incentive program that will improve its predictability and reduce the tax compliance burden. These initiatives will complement the SR&ED Policy Review Project currently underway, which will consolidate and clarify the administrative policies that are contained in about 70 documents pertaining to the SR&ED tax incentive program.

Written Responses to Business Enquiries

As of April 16, 2012, businesses will be able to submit questions and receive answers to their specific business enquiries electronically using the Canada Revenue Agency’s (CRA’s) secure My Business Account portal. These written responses will provide businesses with increased confidence in the information provided by the CRA and thus greater certainty in their tax affairs.

Expansion of Web Forms for Information Returns

The CRA’s Web Forms electronic filing application for information returns is an online service enabling the creation and secure filing of encrypted returns over the Internet, including the filing of original, additional, amended and cancelled slips. The CRA’s Web Forms service also validates data in real time, prompts the user to correct errors before filing slips, automatically calculates totals for the summary, and prints slips for recipients. Web Forms now accepts 11 additional types of returns, and the limit on the number of each type of form (e.g. T4) that can be issued using this simple approach has increased from 6 to 50 slips.

Enhancements to the CRA’s Secure My Business Account Portal

The CRA’s My Business Account portal is a secure and convenient way to access business accounts online and perform certain transactions. For example, GST/HST returns have been able to be amended using My Business Account since April 2011. As of April 16, 2012, business owners will have the option to input an address change online, and balances such as Non-Capital Losses and Refundable Dividend Tax on Hand from the last five tax year-ends will be automatically displayed.

An Improved Business Section on the CRA’s Website

Modifications to the CRA’s website provide a “one-stop shop” for businesses and a clear path to available electronic services with a new task-based web page. By improving the ability of businesses to find and use information and services on the CRA’s website, this initiative responds to concerns raised during consultations held by the Red Tape Reduction Commission.

Graduated Penalties for Late Filing

The Government recognizes that Canadians and businesses, particularly small businesses, invest time and effort to voluntarily comply with tax laws. Budget 2011 announced a CRA review of the penalty structure for late-filed information returns. After working with the Canadian Federation of Independent Business and other organizations representing small businesses, the CRA has instituted a new administrative policy to ensure that these penalties are charged in a manner that is both fair and reasonable. Where a business is unable to comply in a timely manner with a reporting obligation related to certain information returns, such as T4s, reduced penalties will be applied when the number of late-filed returns is small.

Continued CRA Progress on Tax Fairness

Information on complaints and disputes is now easier to access on the CRA website through revised web pages that are simpler to use and were put in place in December 2011. Visibility will be further improved by adding information on recourse mechanisms to notices of assessment and reassessment. The CRA is also updating publications related to tax fairness and developing new content and new types of content, such as webinars on redress mechanisms.

Taxation of Corporate Groups