Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Annex 2: The Stimulus Phase of Canada’s Economic Action Plan: A Final Report to Canadians

Highlights

- The stimulus phase of Canada’s Economic Action Plan steered the economy through the deepest global recession since the 1930s and has positioned Canada to succeed in a highly competitive global economy.

- Over 30,000 projects were completed under the stimulus phase of the Economic Action Plan. These projects have contributed to a strong labour market recovery, with over 610,000 net new jobs created since July 2009.

- This performance reflects the Government’s commitment to create jobs and opportunities for Canadians. Since January 2006, employment in Canada has increased by over 1.1 million, the strongest performance of any Group of Seven (G-7) country over this period.

- The Government was flexible in responding to the needs of Canadians during the economic recovery:

- The Government strengthened Employment Insurance (EI) benefits and froze EI premium rates in 2010. In 2011 and 2012, EI premium increases were limited to 5 cents per $100 of insurable earnings.

- The Government extended the deadline for infrastructure projects under four Economic Action Plan funds from March 31, 2011 to October 31, 2011.

- This additional flexibility gave the Government’s partners more time to complete infrastructure projects funded during the stimulus phase of the Economic Action Plan. It is estimated that almost $3.5 billion was spent in the 2011–12 fiscal year as a result of the Government’s prudent management.

- The stimulus phase of Canada’s Economic Action Plan was successful in securing the recovery by protecting jobs and families, while making important investments to contribute to Canada’s long-term economic prosperity.

- The next phase of Canada’s Economic Action Plan builds on the momentum created in the stimulus phase by continuing to focus on jobs and growth, while solidifying Canada’s long-term fiscal sustainability.

The Stimulus Phase of Canada’s Economic Action Plan

By providing over $63 billion in timely fiscal stimulus, Canada’s Economic Action Plan made important investments that will contribute to Canada’s long-term economic prosperity while supporting those most affected by the global recession. Taxes have been reduced for Canadian families and job-creating businesses; EI benefits were enhanced for the unemployed; thousands of infrastructure projects were completed across the country; significant support was provided for science and technology, industries and communities; and extraordinary actions were taken to improve access to financing.

The implementation of the stimulus phase of the Economic Action Plan was timely and completed as planned. The Government carefully designed and managed the stimulus to ensure the sound stewardship of taxpayer funds.

We found that the programs we examined were designed in a manner to allow for timely implementation while maintaining suitable controls.

— Fall 2010 Report of the Auditor General of Canada

to the House of Commons

The Government reported regularly to Canadians on the implementation of the stimulus phase of Canada’s Economic Action Plan. To date, the Government has released seven reports focusing on substantive milestones—dollars spent and outcomes achieved—and provided an additional update to Canadians as part of Budget 2011.

| Reports to Canadians | Date |

|---|---|

| Stimulus phase of Canada’s Economic Action Plan launch | January 2009 |

| First Report to Canadians | March 2009 |

| Second Report to Canadians | June 2009 |

| Third Report to Canadians | September 2009 |

| Fourth Report to Canadians | December 2009 |

| Fifth Report to Canadians (Budget 2010) | March 2010 |

| Sixth Report to Canadians | September 2010 |

| Seventh Report to Canadians | January 2011 |

| Final Report to Canadians (Budget 2012) | March 2012 |

Temporary stimulus has now been wound down, and the Government is reporting to Canadians for a final time. As the Government moves forward with the next phase of Canada’s Economic Action Plan, this annex provides details on overall results achieved since the launch of the stimulus phase in January 2009.

The stimulus phase of the Action Plan stimulated economic growth by:

- Reducing the Tax Burden for Canadians: Providing Canadians with significant, permanent personal income tax relief and encouraging businesses to make the type of productivity-enhancing investments that result in sustained economic growth.

- Helping the Unemployed: Providing more resources for EI benefits to support those who lost their jobs and supporting training and skills development programs to help Canadians get the additional skills they need for the jobs of tomorrow. This included offering additional benefits to long-tenured workers. It also included providing support to Canadian workers participating in work-sharing agreements.

- Building Infrastructure to Create Jobs: Investing in new infrastructure and stimulating housing construction to create jobs and help ensure that Canada emerged from the global economic downturn with a modern and greener infrastructure and more affordable and safe housing for lower-income Canadians. The stimulus phase of the Economic Action Plan also provided additional support to the housing sector through the Home Renovation Tax Credit.

- Advancing Canada’s Knowledge Economy and Creating Better Jobs: Improving infrastructure at colleges, universities, federal laboratories and research facilities; introducing additional support for graduate students and internships; commercializing new ideas; and strengthening research and technology leadership in Canada.

- Supporting Industries and Communities: Supporting local economies and protecting jobs in regions, communities and sectors that were most affected by the global economic downturn.

- Improving Access to Financing and Strengthening Canada’s Financial System: Ensuring the continued stability of the Canadian financial system and improving access to financing for Canadian households and businesses.

Overall, more than $60 billion in stimulus and tax reductions were delivered to the economy in 2009–10 and 2010–11, and it is estimated that almost $3.5 billion was delivered in 2011–12 (Table A2.2).

| 2009–10 | 2010–11 | 2011–12 | Total | |

|---|---|---|---|---|

| Reducing the Tax Burden for Canadians | 3,020 | 3,180 | 6,200 | |

| Helping the Unemployed | 3,348 | 5,005 | 8,353 | |

| Building Infrastructure to Create Jobs | 6,021 | 7,462 | 1,051 | 14,534 |

| Advancing Canada’s Knowledge Economy and Creating Better Jobs | 1,550 | 1,469 | 250 | 3,269 |

| Supporting Industries and Communities | 10,979 | 2,023 | 13,003 | |

| Total federal stimulus measures | 24,918 | 19,140 | 1,301 | 45,359 |

| Leveraged provincial and territorial actions | 8,553 | 7,679 | 2,164 | 18,395 |

| Total Economic Action Plan stimulus | 33,471 | 26,819 | 3,465 | 63,755 |

| Notes: Totals may not add due to rounding. Amounts for 2009–10 and 2010–11 are actual cash expenditures, while amounts for 2011–12 reflect estimated expenditures only for the four extended infrastructure programs. As a result of the extension of these programs, some funds originally planned for 2010–11 will be recorded in 2011–12. Final numbers will be released in the Public Accounts of Canada in Fall 2012. | ||||

At the federal level, it is estimated that over $45 billion was delivered through the stimulus phase of the Economic Action Plan, generating a significant boost to jobs and growth.

From the outset of the stimulus phase of the Economic Action Plan in early 2009, the Government worked closely with partners in provinces and territories to identify priority and shovel-ready infrastructure projects. For many stimulus programs, the Government required that federal contributions be matched by equal or greater contributions from provinces territories and municipalities, thereby ensuring maximum impact from the Economic Action Plan.

In many cases, provinces, territories and municipalities chose to contribute more than the amounts required under program contribution agreements, thereby allowing larger and more ambitious infrastructure projects to be funded through the Plan. Taking into account these additional contributions, it is estimated that over $63 billion in stimulus and tax reductions were delivered to the economy between 2009–10 and 2011–12.

Canada has emerged from the recession of 2008-2009 as a leader in the pack of industrialized nations. And while it is important not to rest on our laurels, Canadian economic and fiscal fundamentals are a rightful source of pride for our business and political leaders. (The Finance Minister) has guided the economy through the recession with a deft hand, and is now set to return his government to the important path of fiscal sustainability.

—Richard Gauthier, CEO, Canadian Automobile Dealers Association

March 9, 2011, Globe and Mail

Prudent and Flexible Management

In order for the stimulus to be effective, it had to deliver important economic and job-creating results when Canada needed it the most. The Government worked with provincial, territorial and municipal partners to ensure that stimulus funds were spent effectively and in a timely manner so that communities benefited from the economic recovery.

While the majority of infrastructure projects were completed by March 31, 2011, consultations with provinces, territories and municipalities in Fall 2010 revealed that a number of infrastructure projects were at risk of not being completed by the March 31st deadline. In response to these concerns, the Government extended the project completion deadline to October 31, 2011 under four cost-shared infrastructure programs, providing additional flexibility to its partners and extending stimulus benefits by an additional construction season. While this extension had some impact on the timing of expenditures between fiscal years 2010–11 and 2011–12, it did not impose any additional costs on the Government, as it entailed a change in the profile of budgeted funds and not new allocations of funding.

This additional flexibility gave the Government’s partners more time to complete infrastructure projects funded during the stimulus phase of the Economic Action Plan. It is estimated that 2,270 projects were completed as a result of the extension.

Over 30,000 Projects Have Been Completed

In total, based on the most recent reports received, 30,200 projects have been completed with support from Canada’s Economic Action Plan, since January 2009. These included:

- Roughly 7,500 provincial, territorial and municipal infrastructure projects, including almost 4,000 Infrastructure Stimulus Fund projects and over 1,900 Recreational Infrastructure Canada projects.

- Over 500 projects to improve infrastructure at colleges and universities across the country.

- 258 projects to improve small craft harbours.

- Over 1,850 projects to assist communities hardest hit by the recession through the Community Adjustment Fund.

- 147 cultural infrastructure projects.

- Over 200 projects to upgrade facilities at National Parks and National Historic Sites.

- 249 projects to modernize federal laboratories.

- Roughly 1,800 projects to renovate and repair federal buildings.

- Over 300 projects to enhance the accessibility of Crown-owned buildings for persons with disabilities.

- 97 First Nations infrastructure projects.

- An estimated 16,500 social housing and First Nations housing projects.

The Economic Action Plan was a partnership between governments to protect Canadians during a global crisis—and that partnership has delivered results. Municipalities are co-funding $10 billion worth of stimulus projects that will keep 100,000 Canadians on the job and supporting their families.

— Hans Cunningham, Past President of the Federation

of Canadian Municipalities, December 2010

The Stimulus Phase of Canada’s Economic Action Plan Protected Canadian Jobs

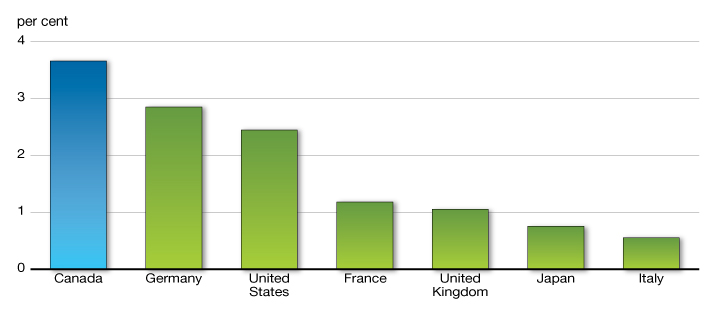

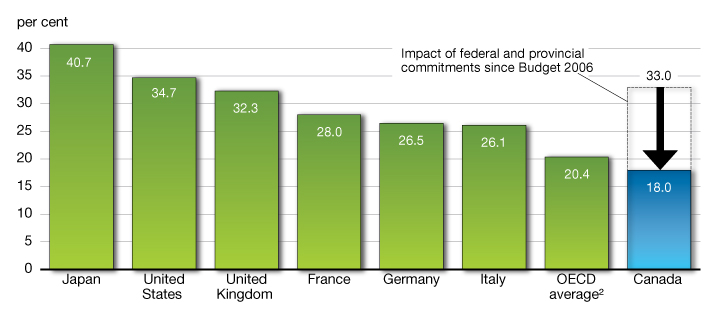

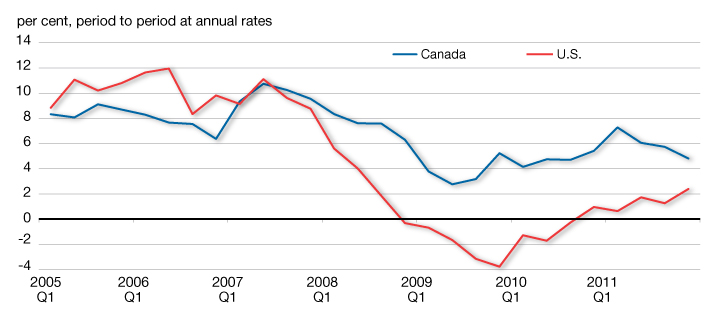

Economic developments since the introduction of the stimulus phase of Canada’s Economic Action Plan underscore its success in protecting Canadian jobs through strong support to the domestic economy. As a result, there are more than 610,000 Canadians working today than in July 2009, and Canada has posted the strongest growth in employment among G-7 countries (Chart A2.1).

Canada has experienced the strongest growth in employment among G-7 countries during the recovery

Sources: Haver Analytics; Department of Finance calculations.

This performance was remarkable given that the global recession posed a particularly significant challenge for the Canadian economy. We faced losses in the value of our exports not only from weaker demand from our trading partners, but also from sharply lower commodity prices. These factors, along with the negative impact of the global financial market crisis on Canadian credit and equity markets, resulted in sharp declines in consumer and business confidence during the early stages of the global recession.

With the implementation of the stimulus phase of the Economic Action Plan in early 2009, however, Canada’s economic situation stabilized, and output and jobs began to grow again. This resulted in a rebound in consumer and business confidence, despite ongoing external weakness in the global economy. Stronger confidence, in turn, was reflected in:

- A solid rebound in consumer spending growth, which averaged close to 3 per cent per quarter over the stimulus phase of the Economic Action Plan, reflecting in part the positive impacts of tax relief and stimulus spending, as well as support for the unemployed through enhanced EI benefits and training programs.

- Strong growth in residential investment, bolstered by temporary measures introduced to support the housing market. In particular, with support from the Home Renovation Tax Credit, which provided Canadian homeowners with approximately $2.3 billion in tax relief, home renovation spending growth averaged over 18 per cent per quarter from the second quarter of 2009 through the first quarter of 2010.

- A resurgence in private business investment growth, which returned to positive territory in early 2010 and averaged over 16 per cent per quarter over the remainder of the stimulus phase of the Economic Action Plan.

- Finally, government investments in infrastructure were key to the success of the Economic Action Plan, with average government investment growth of almost 15 per cent per quarter during the stimulus phase of the Economic Action Plan.

The Government’s Policies Are Supporting

a Strong Job Market

The Government’s sound policies and prudent management have contributed to significant job growth in Canada. Since January 2006, employment in Canada has increased by over 1.1 million, the strongest performance of any G-7 country over this period.

- Over 610,000 jobs have been created since July 2009, more than offsetting all of the jobs lost during the recession.

- About 90 per cent of the jobs created since July 2009 have been full-time jobs and over 75 per cent have been high-quality jobs in high-wage industries and in the private sector.

Canada’s labour market has performed better than its G-7 peers, with Canada posting the strongest employment growth among G-7 countries over the recovery (Chart A2.1).

In the last few years, Canada has got every major decision right. Look at the facts. Not a single Canadian bank fell or faltered during the global banking crisis. Canada got to grips with its deficit and was running surpluses and paying down debt before the recession, fixing the roof while the sun was shining. Your economic leadership has helped the Canadian economy to weather the global storms far better than many of your international competitors.

— David Cameron, Prime Minister, United Kingdom,

September 22, 2011

Results Achieved

The following section reports on key overall results achieved under the stimulus phase of Canada’s Economic Action Plan. Actions taken during the stimulus phase are divided into six themes:

- Reducing the Tax Burden for Canadians

- Helping the Unemployed

- Building Infrastructure to Create Jobs

- Advancing Canada’s Knowledge Economy and Creating Better Jobs

- Supporting Industries and Communities

- Improving Access to Financing and Strengthening Canada’s Financial System

Reducing the Tax Burden for Canadians

The tax reductions provided during the stimulus phase of Canada’s Economic Action Plan were an essential part of the Government’s effort to boost economic growth and establish a competitive business environment, which helps create more and better-paying jobs and increase living standards for Canadians. The tax reductions built on actions taken since 2006 and reinforced the Government’s ambitious agenda of creating a tax system that fuels investment and job creation in Canada.

Actions taken by the Government since 2006, including those in the stimulus phase of the Economic Action Plan, will reduce taxes on individuals, families and businesses by an estimated $220 billion over 2008–09 and the following five fiscal years. In total, the Government has introduced more than 140 tax relief measures since 2006.

Tax relief for Canadian families and individuals (not including housing-related tax relief) provided under the stimulus phase of the Economic Action Plan from 2008–09 to 2010–11 totalled $6.9 billion. These permanent measures provide tax relief on an ongoing basis.

| 2008–09 | 2009–10 | 2010–11 | Total | |

|---|---|---|---|---|

| Personal income tax relief for all taxpayers | 470 | 1,885 | 1,950 | 4,305 |

| Increases to the National Child Benefit supplement and the Canada Child Tax Benefit | 230 | 310 | 540 | |

| Enhancing the Working Income Tax Benefit | 145 | 580 | 580 | 1,305 |

| Targeted relief for seniors | 80 | 325 | 340 | 745 |

| Total–Reducing the Tax Burden for Canadians | 695 | 3,020 | 3,180 | 6,895 |

| Notes: Totals may not add due to rounding. The Canada Child Tax Benefit and the National Child Benefit supplement are considered expenditures for budgetary purposes and thus should not be included in calculations of total tax relief. | ||||

Tax Relief for Individuals and Families

The stimulus phase of the Economic Action Plan introduced significant new personal income tax reductions that have provided relief, particularly for low- and middle-income Canadians, as well as measures to help Canadians purchase or improve their homes. These tax reductions allow individuals and families to keep more of their hard-earned money and improve incentives to work, save and invest, while also contributing to the Government’s long-term economic agenda. For example, the Government:

- Increased the amount of income that Canadians can earn before paying federal income tax, and increased the top of the two lowest income tax brackets so that Canadians can earn more income before being subject to higher tax rates.

- Introduced the Working Income Tax Benefit in Budget 2007, and effectively doubled it in the stimulus phase of Canada’s Economic Action Plan. This enhancement lowered the “welfare wall,” further strengthening work incentives for low-income Canadians already in the workforce and encouraging other low-income Canadians to enter the workforce. Canadians have been able to receive enhanced benefits since filing their 2009 tax return.

- Raised the level at which the National Child Benefit supplement for low-income families is fully phased out and the level at which the Canada Child Tax Benefit begins to be phased out, which is providing a benefit of up to $443 per year (in the 2011–12 benefit year) for a family with two children. Additional monthly benefits under these programs began to be paid to families with children in July 2009.

- Increased the Age Credit amount by $1,000 in 2009 to provide tax relief to low- and middle-income seniors. With indexation, this means additional tax savings of up to $157 for low-income seniors in 2012.

- Introduced a new tax credit of up to $750 to assist first-time home buyers and provided them with additional access to their Registered Retirement Savings Plan savings to purchase or build a home.

Tax Relief for Families Since 2006: Example

Michael and Kate are a couple with two children. Michael earns $40,000 and Kate earns $60,000. As a result of actions taken by the Government since 2006, they are expected to pay $2,145 less in personal income tax and $960 less in GST, for a total of $3,105 in tax relief in 2012. Michael and Kate also receive an additional $81 in child benefits.

Supporting Families With Children

Since 2006, the Government has significantly increased support for families to better assist them with the costs of raising children:

- The Universal Child Care Benefit, available since July 2006, gives families with young children more choice in child care by providing $100 per month for each child under age 6.

- The Child Tax Credit, available since 2007, recognizes the expenses associated with raising children by providing personal income tax relief of up to $329 in 2012 for each child under age 18.

- The Children’s Fitness Tax Credit, available since 2007, promotes physical fitness among children through a 15-per-cent credit on up to $500 in eligible fees for the enrolment of a child under age 16 in an eligible program of physical activity.

- The Children’s Arts Tax Credit, available since 2011, promotes children’s participation in artistic, cultural, recreational or developmental activities through a 15-per-cent credit on up to $500 in eligible fees for the enrolment of a child under age 16 in an eligible program.

- The amount that families can earn before the National Child Benefit supplement is fully phased out—or before the base benefit under the Canada Child Tax Benefit begins to be phased out—was increased starting in July 2009. As a result, a low-income family with two children receives an additional benefit of up to $443 in the 2011–12 benefit year.

- The spousal and other related amounts were increased to equal the basic personal amount so that single-earner families, including single parents, receive the same tax treatment as two-earner families, effective 2007.

- To help families with children with disabilities, the Government introduced the Registered Disability Savings Plan (RDSP) starting in 2008, and increased the Child Disability Benefit component of the Canada Child Tax Benefit as of July 2006. Families with infirm children may also claim the new Family Caregiver Tax Credit, a 15-per-cent credit on an amount of $2,000 available starting in 2012. Budget 2012 introduces several measures to improve the RDSP. These measures will give RDSP beneficiaries and their families increased flexibility to establish, contribute to and access savings from their plans.

- To help families with education costs, the Government took several actions to strengthen Registered Education Savings Plans and expand and enhance the Canada Student Loans Program, and launched the new consolidated Canada Student Grants Program. The Government also exempted scholarship and bursary income from tax and introduced the Textbook Tax Credit.

- Families are major beneficiaries of the substantial tax relief the Government has provided to all Canadians, such as the 2-percentage-point reduction in the Goods and Services Tax, broad-based personal income tax reductions, and the introduction of the Tax-Free Savings Account, which helps Canadians meet lifetime savings needs.

- In addition, many families are benefiting from other more targeted tax measures introduced since 2006, such as the Working Income Tax Benefit, the Canada Employment Credit, the Public Transit Tax Credit and the First-Time Home Buyers’ Tax Credit.

- The average family of four is now saving more than $3,100 per year in taxes, and more than 1 million low-income Canadians have been removed from the tax rolls in 2012.

- Altogether, actions taken since 2006 will provide about $160 billion of tax relief for individuals and families over 2008–09 and the following five fiscal years.

Supporting Low-Income Working Canadians

Canada’s tax system ensures that people with lower incomes contribute a smaller proportion of their income in taxes. Indeed, more than 40 per cent of all taxpayers pay no net tax; that is, their tax liabilities are either nil or offset by income-tested benefits such as the Canada Child Tax Benefit and the GST Credit. In addition, low-income Canadians now pay significantly less tax and receive more benefits due to actions taken by the Government since 2006. In fact, in 2012, one third of the personal income tax relief provided by the Government will go to Canadians with incomes under $41,544, even though they pay about 13 per cent of taxes.

Since it was introduced in 2007, the Working Income Tax Benefit (WITB) has lowered the welfare wall, so that low-income individuals may keep more of their earnings. In 2012, if the WITB had not been introduced, a typical low-income single parent in Nova Scotia would have only kept about 28 cents of each additional dollar earned between $3,000 and $10,000, due to reduced benefits from federal and provincial income-tested programs and taxes. As a result of the enhanced WITB, the same family will keep about 53 cents of each additional dollar earned.

Other tax relief provided by the Government has also helped low-income working Canadians. For example, the amount that a single parent with one child can earn in 2012 before paying taxes has increased by $5,324 to $26,557 as a result of the introduction of the Canada Employment Credit, the Child Tax Credit and legislated increases to the basic personal amount, and the Eligible Dependant Credit.

Tax Relief for Job-Creating Businesses

A competitive business tax system is essential for creating an environment that encourages new investment, growth and job creation in Canada. In 2007, Parliament passed a bold tax reduction plan that lowered the federal general corporate income tax rate from 22.12 per cent in 2007 (including the corporate surtax that was eliminated in 2008) to 15 per cent in 2012. The stimulus phase of the Economic Action Plan built on these corporate income tax reductions to help position businesses to weather the effects of global economic challenges, invest in Canada, and spur innovation and growth—thereby creating more and better-paying jobs for Canadian workers. Stimulus measures included:

- Help for businesses to adopt newer technology at a faster pace: a temporary 100-per-cent capital cost allowance (CCA) rate was introduced for computers acquired after January 27, 2009 and before February 1, 2011.

- Help for businesses in manufacturing and processing industries to restructure and retool to position themselves for long-term success: the temporary 50-per-cent straight-line accelerated CCA rate for investments in manufacturing or processing machinery and equipment was extended to include investments undertaken in 2010 and 2011. This measure was first introduced in Budget 2007 and was extended, most recently in Budget 2011, to include investments undertaken before 2014.

- Support for small businesses: the amount of small business income eligible for the reduced federal income tax rate was further increased to $500,000 effective January 1, 2009, following a previous increase to $400,000 from $300,000 as of January 1, 2007.

- Support for mineral exploration activity across Canada: the temporary Mineral Exploration Tax Credit was extended.

These measures provided immediate economic stimulus, while also encouraging the type of productivity-enhancing investments that result in sustained growth.

Including measures in the stimulus phase of the Economic Action Plan, the Government has introduced business tax relief totalling roughly $60 billion over 2008–09 and the following five fiscal years.

Business tax cuts are benefiting Canadians in very important ways … If governments had not provided tax relief for Canadian businesses, the recession would have been deeper and unemployment would have certainly been higher … (now) we have a corporate sector that is better poised to take advantage of new market opportunities, which will, in turn, continue to generate job growth.

— Jayson Myers, President & CEO,

Canadian Manufacturers and Exporters

January 25, 2012 press release

Supporting Small Businesses

The tax system provides considerable support to small businesses through a lower corporate income tax rate, incentives for investors, enriched financial support for research and development (R&D) and simplified compliance.

Since 2006, the Government has introduced a large number of tax measures to support investment, innovation and growth by small businesses, including:

- To help small businesses retain more of their earnings for investment, expansion and job creation, the lower small business tax rate was reduced to 11 per cent from 12 per cent in 2008. The amount of income eligible for this lower rate was increased from $300,000 to $400,000 in 2007, and then to $500,000 in 2009.

- To spur investment in small businesses, Budget 2007 increased the Lifetime Capital Gains Exemption on qualified small business shares to $750,000 from $500,000, the first increase in the exemption since 1988.

- To enhance support for R&D through the Scientific Research and Experimental Development tax incentive program, Budget 2008 increased the amount of expenditures eligible for the higher, refundable tax credit to $3 million and extended eligibility to medium-sized companies by increasing the taxable capital and income limits.

- To help innovative companies attract venture capital, Budget 2010 narrowed the definition of taxable Canadian property, thereby eliminating the need for tax reporting under section 116 of the Income Tax Act for many investments. This improves the ability of Canadian businesses, including innovative high-growth companies that contribute to job creation and economic growth, to attract foreign venture capital.

- To encourage hiring in the small businesses sector, Budget 2011 announced a temporary Hiring Credit for Small Business of up to $1,000 against a small employer’s increase in its 2011 EI premiums over those paid in 2010. This temporary credit was available to approximately 525,000 employers whose total EI premiums were at or below $10,000 in 2010, reducing their 2011 payroll costs by about $165 million.

- To assist employers facing challenges, Budget 2011 also made available an extension of up to 16 weeks for active or recently terminated EI work-sharing agreements.

Budget 2012 further supports small businesses by announcing:

- An extension of the Hiring Credit for Small Business for one year, which will provide a credit of up to $1,000 against a small employer’s increase in its 2012 EI premiums over those paid in 2011.

- A new approach to setting EI premium rates that will ensure predictability and stability by limiting rate increases to 5 cents per year until the EI Operating Account is balanced, after which the Canada Employment Insurance Financing Board will be mandated to set a seven-year break-even rate to be recalculated every year.

- Actions to reduce the tax compliance burden for small businesses. This includes doubling the thresholds for eligibility to use the GST/HST streamlined accounting methods, simplifying administration for partnerships, and improving the rules for paying eligible dividends.

As a result of federal and provincial business tax changes, Canada has an overall tax rate on new business investment that is lower than that in any other G-7 country and below the average of the member countries of the Organisation for Economic Co-operation and Development (OECD) (Chart A2.2).

Canada leads the G-7 with the lowest overall tax rate on new business investment

1 The marginal effective tax rate (METR) on new business investment takes into account federal, provincial and territorial statutory corporate income tax rates, deductions and credits available in the corporate tax system and other taxes paid by corporations, including provincial capital taxes and retail sales taxes on business inputs. The methodology for calculating METRs is described in the 2005 edition of Tax Expenditures and Evaluations (Department of Finance).The METR includes measures announced as of January 1, 2012.

It excludes resource and financial sectors and tax provisions related to research and development.

2 OECD average excludes Canada.

Source: Department of Finance.

The government's commitment to reducing the general corporate income tax rate to 15% by 2012 is important to our ongoing economic recovery and should be applauded.

— Gabe Hayos, Canadian Institute of Chartered Accountants

House of Commons Standing Committee on Finance

October 18, 2011

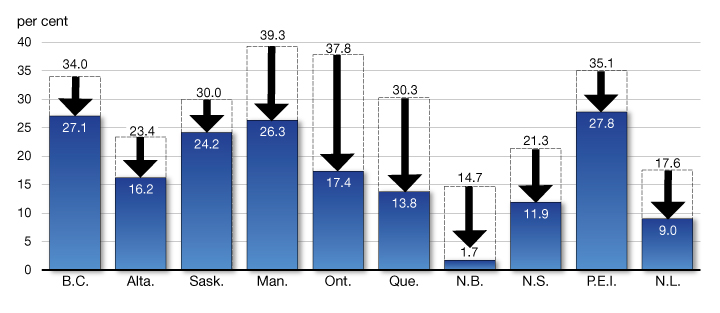

Improving the competitiveness of the Canadian tax system requires collaboration among all governments to help Canadian businesses compete globally. Provinces and territories have also taken action to enhance Canada’s business tax advantage (Chart A2.3.). These actions are helping Canada build a strong foundation for future economic growth, job creation and higher living standards for Canadians.

Combined, federal and provincial tax changes have improved Canada’s tax competitiveness

Source: Department of Finance.

| 2008–09 | 2009–10 | 2010–11 | Total | |

|---|---|---|---|---|

| Personal income tax relief for all taxpayers | 470 | 1,885 | 1,950 | 4,305 |

| Increases to the National Child Benefit supplement and the Canada Child Tax Benefit | 230 | 310 | 540 | |

| Enhancing the Working Income Tax Benefit | 145 | 580 | 580 | 1,305 |

| Targeted relief for seniors | 80 | 325 | 340 | 745 |

| Total–Reducing the Tax Burden for Canadians | 695 | 3,020 | 3,180 | 6,895 |

| Reference: | ||||

| Tax and Tariff Measures to Support Housing and Business | ||||

| Home Renovation Tax Credit | 2,265 | 2,265 | ||

| Increasing withdrawal limits under the Home Buyers’ Plan | 15 | 15 | 30 | |

| First Time Home Buyers’ Tax Credit | 130 | 115 | 245 | |

| Mineral Exploration Tax Credit for flow-through share investors | 70 | -15 | 55 | |

| Increasing the income limit for the small business tax rate | 45 | 80 | 125 | |

| Temporary 100-per-cent capital cost allowance rate for computers | 340 | 355 | 695 | |

| Tariff relief on machinery and equipment | 76 | 81 | 157 | |

| Temporary acceleration of the capital cost allowance rate for manufacturing or processing machinery and equipment | ||||

| Notes: Totals may not add due to rounding. The Canada Child Tax Benefit and the National Child Benefit supplement are considered expenditures for budgetary purposes and thus should not be included in calculations of total tax relief. | ||||

Helping the Unemployed

The stimulus phase of Canada’s Economic Action Plan included $8.4 billion over two years to support workers most affected by the global recession. Because of the quick and decisive measures taken by the Government, Canada’s economy has more than recovered all of the jobs lost during the downturn. As temporary stimulus measures began to wind down, the Government took additional steps to secure the recovery by limiting Employment Insurance (EI) premium rate increases to 5 cents per $100 of insurable earnings for 2011 and 2012 and 10 cents for subsequent years.

| 2009–10 | 2010–11 | Total | |

|---|---|---|---|

| Strengthening benefits for Canadian workers | 1,259 | 1,680 | 2,938 |

| Enhancing the availability of training | 896 | 948 | 1,844 |

| Keeping EI rates frozen for 2010 | 1,193 | 2,378 | 3,571 |

| Total–Helping the Unemployed | 3,348 | 5,005 | 8,353 |

| Note: Totals may not add due to rounding. | |||

Over the course of the downturn, the EI program provided Canadians with needed temporary support. In 2009–10, the Government spent approximately $5.3 billion more in EI benefits than during the previous year.

Supporting Workers

The Government of Canada provides significant support to Canadian workers, including programs and services for those looking to first enter the labour market, those looking to upgrade their skills and training, and those in need of support during periods of unemployment.

Since 2006, the Government has introduced important measures aimed at ensuring a more skilled and inclusive workforce. Investments have included:

- Putting in place the Targeted Initiative for Older Workers in 2006 to support a range of employment activities for unemployed older workers in vulnerable communities. Canada’s Economic Action Plan provided an additional $60 million over three years for the Targeted Initiative for Older Workers to help older workers remain active and productive participants in the labour market. Budget 2011 then provided $50 million over two years to extend the Initiative until 2013–14.

- Introducing a new labour market training architecture in Budget 2007, making available $3 billion over six years to provinces and territories for the design and delivery of labour market programs with a focus on assisting groups under-represented in the labour force, including persons with disabilities, Aboriginal peoples, recent immigrants and older workers.

- Providing $7 billion over two years, under the Economic Action Plan, for direct support to workers most affected by the recession. The Canada Skills and Transition Strategy included investments to: strengthen EI benefits, work-sharing and wage protection benefits; significantly expand the availability of training opportunities, including for older workers, youth and Aboriginal peoples; encourage completion of apprenticeships; facilitate the recognition of foreign credentials; and freeze EI premium rates for two years.

Budget 2010 announced additional, targeted actions to protect Canadian workers and their jobs from the effects of the global economic recession by:

- Temporarily extending the maximum length of work-sharing agreements to protect jobs, allowing more workers to keep their jobs while employers retained skilled employees with years of experience.

- Providing $108 million over three years to assist young people looking to gain skills and experience. This included a one-year $30-million increase in funding for the Career Focus component of the Youth Employment Strategy as well as $20 million in support of Pathways to Education Canada’s work to support disadvantaged youth.

- Budget 2011 provided additional support by extending for up to 16 weeks active or recently terminated work-sharing agreements, further protecting workers’ jobs.

The Government has also introduced a number of tax measures to support Canadian workers, including:

- The Canada Employment Credit, introduced in Budget 2006, provides tax recognition for work-related expenditures such as home computers, uniforms and supplies.

- The Tradesperson’s Tools Deduction, introduced in Budget 2006, allows tradespersons to deduct from their income part of the cost of tools they must acquire as a condition of employment.

- The Apprenticeship Job Creation Tax Credit, introduced in Budget 2006, encourages employers to hire new apprentices in eligible trades.

- The Working Income Tax Benefit, introduced in Budget 2007, strengthens work incentives for low-income Canadians already in the workforce and encourages low-income Canadians to enter the workforce. The Economic Action Plan effectively doubled the tax relief provided by the Working Income Tax Benefit for 2009 and future years.

- This tax relief builds on the support provided to apprentices through the Apprentice Incentive Grant provided in Budget 2006 and the Apprenticeship Completion Grant, which was introduced in Budget 2009.

In addition, Budget 2012 provides:

- $50 million over two years to enable the Youth Employment Strategy to help more young Canadians get the information and gain the skills, work experience and abilities they need to make a successful transition to the workplace.

- $21.3 million over two years to help unemployed Canadians get back to work more quickly by enhancing the content and timeliness of labour market information that is provided to them. The Government will also clarify what is expected of Canadians with respect to their job search activities while they are receiving regular EI benefits.

- $74.0 million over two years to introduce a new, national three-year EI pilot project that will allow claimants to earn more money while receiving EI benefits. This new pilot project will mean those working while on EI claim will see their benefits reduced by only 50 per cent of earnings. This change means that claimants will be able to earn more and have a higher total income while they are on claim.

- An improved way to calculate EI benefits that will reduce disincentives to taking all available work. Beginning April 2013, claimants will have their EI benefits calculated based on the highest weeks of earnings over the year preceding a claim. The number of weeks will vary from 14 to 22, depending on the unemployment rate in the claimant’s EI region.

- A commitment to protect long-term disability benefits of employees in the federally regulated private sector by requiring employers to insure, on a go-forward basis, any long-term disability plans they offer to their employees.

In addition to much-needed temporary assistance, the stimulus phase of the Economic Action Plan invested in training for Canadian workers so they can take advantage of new opportunities as the economy recovers. The Plan’s support for the unemployed included:

- An extra five weeks of EI benefits were provided to more than 1.2 million EI claimants.

- EI premium rates in 2010 were frozen at $1.73 per $100 of insurable earnings—their lowest level since 1982.

- Nearly 12,000 long-tenured unemployed workers have received additional assistance through the Career Transition Assistance program in order to participate in long-term training.

- To date, almost 225,000 long-tenured workers have received 5 to 20 weeks of additional EI benefits.

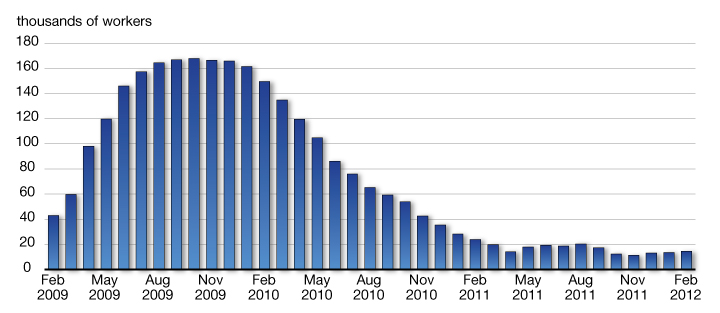

- In December 2011, over 13,000 Canadians were participating in more than 550 work-sharing agreements. At its peak in October 2009, over 165,000 Canadians were participating in work-sharing agreements. In order to support a continued recovery for Canadian businesses and workers, the Government announced, as part of the November 2011 Update of Economic and Fiscal Projections, an additional extension of up to 16 weeks for active, recently terminated or new work-sharing agreements. The extension will be phased out by October 2012.

- Since April 1, 2009, payments have been made to more than 40,600 claimants under the Wage Earner Protection Program.

- The Government provided $750 million per year to the provinces and territories in 2009–10 and 2010–11 in support of training and skills development programs, which has benefited more than 200,000 Canadians annually.

- Projects under the enhanced Targeted Initiative for Older Workers provided support to over 12,000 older workers. Due to the success of the initiative, Budget 2011 provided $50 million over two years to extend the program.

- Training and skills development was provided to close to 19,800 Aboriginal people through the Aboriginal Skills and Employment Partnership program and the Aboriginal Skills and Training Strategic Investment Fund.

- Support is being provided to implement the Pan-Canadian Framework for the Assessment and Recognition of Foreign Qualifications. To date, funding has supported 67 contribution agreements, including projects with seven provincial and territorial governments and 21 different professions, to assist with the implementation of the Framework.

- Funding has supported 1,008 youth internships in not-for-profit and community service organizations through the YMCA and YWCA, 91 per cent of which have an environmental focus.

The number of Canadian workers benefiting from work-sharing has fallen as the recovery takes hold

Work-Sharing Agreements

Canada’s Economic Action Plan:

Working for Canadians

Aboriginal Skills and Employment Partnership Program

Edmonton, Alta.—Sean Mangal got a solid foothold in the pipes trade through Trade Winds to Success, an 18-week pre-apprenticeship training program that ensures Aboriginal peoples are positioned to benefit from Alberta’s construction industry in occupations such as boilermakers, ironworkers, carpenters and pipe/steamfitters. Trade Winds to Success enabled Sean to obtain a job in his chosen field as a pipefitter with Arpi’s North Inc., working on projects such as the Edmonton International Airport expansion.

Enhanced Work Sharing

Mississauga, Ont.—Since being founded in 1936, the Mascot Truck Parts company has become one of the largest heavy-duty specialists in North America, applying its expertise to rebuilding all makes of transmissions, differentials and steering gears. The economic downturn hit the manufacturing and automotive industry hard and Mascot felt the impact. To avoid layoffs, the company signed a work-sharing agreement that allowed it to keep 107 employees and the business running.

Apprenticeship Grants

Vancouver, B.C.—Ross Redeker’s love for working with his hands has led him to become a successful and well-paid plumber. His previous job as a warehouse manager was not giving him the sort of job satisfaction he had been looking for, and he wanted to make a change. He left the warehouse job to become a plumber apprentice. Currently employed at Bridge Mechanical, the company that hired him four years ago, Ross is grateful to the Government of Canada for providing the apprenticeship grants. “I want to thank you for making these programs available. It has not only given me financial assistance to obtain a job that I enjoy, but it has given me a sense of pride. When people ask what I do for a living, I can say ‘I am a certified plumber.’”

| 2009–10 | 2010–11 | Total | |

|---|---|---|---|

| Strengthening Benefits | |||

| An extra 5 weeks of EI benefits | 796 | 796 | 1,592 |

| EI—long-tenured workers (Career Transition Assistance program) | 15 | 83 | 98 |

| EI—long tenured workers (extension of regular benefits) | 215 | 731 | 946 |

| EI—work sharing | 211 | 49 | 260 |

| Wage Earner Protection Program | 22 | 21 | 43 |

| Subtotal—Strengthening Benefits | 1,259 | 1,680 | 2,938 |

| Enhancing the Availability of Training | |||

| EI training programs | 500 | 500 | 1,000 |

| Strategic Training and Transition Fund | 250 | 250 | 500 |

| Canada Summer Jobs Program | 10 | 10 | 20 |

| Federal public service student employment program | 10 | 10 | 20 |

| YMCA/YWCA | 15 | 15 | |

| Targeted Initiative for Older Workers | 5 | 21 | 26 |

| Apprenticeship Completion Grant | 39 | 40 | 79 |

| Foreign Credential Recognition program | 12 | 22 | 35 |

| Aboriginal Skills and Employment Partnership program | 7 | 48 | 56 |

| Aboriginal Skills and Training Strategic Investment Fund | 24 | 46 | 70 |

| Aboriginal Human Resource Development Strategy | 23 | 23 | |

| Subtotal—Enhancing the Availability of Training | 896 | 948 | 1,844 |

| Keeping EI rates frozen for 2010 | 1,193 | 2,378 | 3,571 |

| Total—Helping the Unemployed | 3,348 | 5,005 | 8,353 |

| Notes: Totals may not add due to rounding. Spending figures exclude employee benefit plan and accommodation costs. | |||

Building Infrastructure to Create Jobs

State-of-the-art transportation infrastructure helps move people and goods to markets, and improves business competitiveness, allowing the economy to grow and prosper. Other types of public infrastructure, such as clean drinking water systems and cultural and recreational facilities, improve public health and enhance the quality of life for Canadian families.

| 2009–10 | 2010–11 | 2011–12 | Total | |

|---|---|---|---|---|

| Building Infrastructure | ||||

| Investments in provincial, territorial and municipal infrastructure | 852 | 3,469 | 1,051 | 5,373 |

| Investments in First Nations infrastructure | 229 | 280 | 510 | |

| Federal infrastructure | 943 | 713 | 1,657 | |

| Subtotal—Building Infrastructure | 2,025 | 4,463 | 1,051 | 7,540 |

| Stimulating Housing Construction | ||||

| Support for home ownership and the housing industry | 2,596 | 321 | 2,917 | |

| Investments in social housing for Canadians | 1,399 | 2,678 | 4,077 | |

| Subtotal—Stimulating Housing Construction | 3,995 | 2,999 | 6,994 | |

| Total—Building Infrastructure to Create Jobs | 6,021 | 7,462 | 1,051 | 14,534 |

| Total—With provincial contributions | 8,019 | 13,934 | 2,816 | 24,769 |

| Notes: Totals may not add due to rounding. Spending figures exclude employee benefit plan and accommodation costs. Amounts for 2009–10 and 2010–11 are actual cash expenditures, while amounts for 2011–12 reflect estimated expenditures for the four extended infrastructure programs. As a result of the extension of these programs, some funds originally planned for 2010–11 will be recorded in 2011–12. Final numbers will be released in the Public Accounts of Canada in Fall 2012. The budgetary impact may be somewhat smaller because some of these expenditures relate to construction and renovation costs of federal assets (for which only depreciation is recorded on a budgetary basis) and loans to third parties (where there is a budgetary impact only in the event that there is a risk of loss). | ||||

In the shorter term, infrastructure and housing investments are widely recognized as an effective means to boost economic activity and put people to work. That is why the Government delivered about $14.5 billion during the stimulus phase of Canada’s Economic Action Plan to modernize a broad range of infrastructure including our roads, bridges, public transit, parks and water treatment facilities, and to support home ownership, help stimulate the housing sector, and improve housing across Canada. These investments, including those in new infrastructure and the rehabilitation of existing assets, helped to create and maintain jobs across Canada during the economic downturn, and will continue to benefit all Canadians for many years.

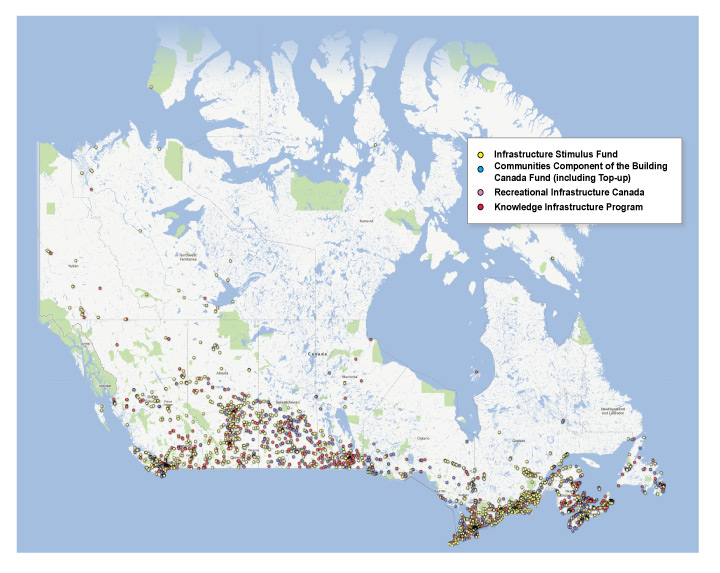

While the majority of projects announced as part of the stimulus phase of Canada’s Economic Action Plan were completed by March 31, 2011, a number of provincial/territorial, municipal and not-for-profit projects facing scheduling challenges benefited from a one-time seven-month extension to the deadline for completing infrastructure projects. This flexibility provided the Government’s partners with an additional construction season to complete projects under the following four programs: the Infrastructure Stimulus Fund, the Building Canada Fund Communities Component Top-Up, the Knowledge Infrastructure Program and the Recreational Infrastructure Canada program. As a result of the extension, almost $3.5 billion in stimulus was invested in the economy in 2011–12, and it is estimated that roughly 2,270 projects under the four extended programs were completed after March 31, 2011.

Investments in Provincial, Territorial and Municipal Infrastructure

As part of the stimulus phase of Canada’s Economic Action Plan, the Government launched a number of new initiatives to stimulate additional investment in provincial, territorial and municipal infrastructure. These new stimulus initiatives consisted of the Infrastructure Stimulus Fund, the Building Canada Fund Communities Component Top-Up, the Green Infrastructure Fund, the Recreational Infrastructure Canada program and funding for recreational trails.

By working closely with each province and territory to approve projects quickly, the Government allocated close to $5.4 billion in stimulus funding towards almost 7,000 projects across the country. Provinces, territories, municipalities and other partners also contributed to these projects, thereby generating a total investment in public infrastructure of about $14 billion at a critical time.

In addition to launching new stimulus initiatives, the Government took steps to accelerate funding under Building Canada initiatives that were announced in Budget 2007. These steps were designed to further increase investment when support for the economy was needed most.

Some of these projects, particularly larger-scale projects being funded under the Major Infrastructure Component of the Building Canada Fund, are ongoing and continue to support long-term economic growth.

In the last few years, federal investments have helped municipalities put police on the streets, repair social housing and rebuild the roads, bridges, water systems and public transit Canada needs to support families, businesses and long-term economic growth.

— Federation of Canadian Municipalities,

February 2012

Infrastructure Stimulus Fund: Through the Infrastructure Stimulus Fund, the Government made $4 billion in funding available for infrastructure projects that could get underway quickly and thus provide much-needed economic stimulus to the Canadian economy. Working with provinces, territories, municipalities and the private sector, more than 4,000 projects were completed under this program. In total, these projects represented an investment of about $10 billion in Canada’s public infrastructure.

Canada’s Economic Action Plan: Working for Canadians

Examples of Completed Infrastructure Stimulus Fund Projects

St. Lunaire-Griquet, N.L.—With the help of $1.25 million from the Infrastructure Stimulus Fund, Newfoundland and Labrador improved access to one of its prime tourist destinations, L’Anse aux Meadows. The Route 436 approach to this UNESCO World Heritage site, Canada’s earliest known Viking settlement, was resurfaced and widened. A culvert was also replaced. The benefits of this project include improved safety and traffic flow and lower maintenance costs, all of which contribute to the promotion of tourism and economic growth in the region.

Chatham, Ont.—The Chatham-Kent Women’s Centre provides shelter, counselling, education and housing support to victims of domestic abuse. To accommodate growing demand, the centre received $322,475 from the Infrastructure Stimulus Fund to expand the facility and make the building accessible to persons with disabilities. Now double its original size, the centre no longer has to rely on hotels or community partners to house their clients, freeing up the time and money to focus on programs to help women and children threatened by domestic abuse.

Spirit River, Alta.—Elevator and Cargill roads are important access routes that contribute to the Central Peace Region’s economic development. The roads support an average of 1,020 truckloads a year, translating into more than $120 million in annual regional revenues. Both roads were restored and repaved thanks to $336,761 from the Infrastructure Stimulus Fund. This project helped sustain jobs in the area, while also increasing road safety for truckers. It also improved access to the industrial and agricultural network to enhance the flow of goods crucial to the regional economy.

Carmacks, Y.T.—Running through the Town of Carmacks, Freegold Road is a primary supply route to and from many northern mining projects. A single-lane wooden bridge across the Nordenskiold River had been causing bottlenecks on this important local artery. With a $1-million contribution from the Infrastructure Stimulus Fund, a new steel bridge is now in place. It is large enough to handle two lanes of traffic as well as heavy vehicles and includes a sidewalk. The new bridge supports continued resource development in the region.

Bonus for Community Projects: The stimulus provided under Canada’s Economic Action Plan included $500 million to top up the more than $1 billion in initial funding that was made available under the Communities Component of the Building Canada Fund. More than 500 projects were completed as a result of this top-up, representing a total investment of approximately $1.5 billion in community infrastructure.

Green Infrastructure Fund: The Green Infrastructure Fund supports sustainable energy generation and transmission, modernized wastewater infrastructure and better management of solid waste. To date, the Government has committed $617 million towards 17 Green Infrastructure Fund projects. Provinces, territories, municipalities and the private sector are also contributing funding towards these projects, bringing the total investment to over $2 billion. Projects under the Green Infrastructure Fund are mainly long-term strategic initiatives that not only have been creating stimulus in the short term but will lead to a more sustainable economy in the coming years.

Canada’s Economic Action Plan: Working for Canadians

National Recreational Trails: The stimulus phase of the Economic Action Plan made $25 million in funding available in 2009–10 to the National Trails Coalition to help build and renew recreational trails for walking, running, cross-country skiing and biking, as well as snowmobile and all-terrain vehicle trails. The funding supported a total of 474 projects that were completed by March 31, 2010.

Recreational Infrastructure Canada: Hockey arenas, soccer fields, tennis courts and swimming pools provide Canadians and their families with the benefits of physical activity and community-based experience. The stimulus phase of Canada’s Economic Action Plan provided $500 million for the Recreational Infrastructure Canada program, supporting the construction of new facilities and upgrades to existing ones across the country. These funds were matched by contributions from other levels of government and recipients, thereby increasing the impact on local employment. In total, 1,919 projects were completed, creating significant new economic activity in all parts of Canada.

Canada’s Economic Action Plan: Working for Canadians

Examples of Community Projects

Arichat, N.S.—Thanks to $250,000 from the Building Canada Fund Communities Component Top-Up, the Village of Arichat replaced five aging and malfunctioning wastewater pumping stations that were installed in the 1970s and had become impossible to maintain. The work has made the community’s wastewater collection system more efficient and reliable. The work has also benefited the environment by preventing raw sewage from discharging into the Arichat harbour, as had occurred when the old sewage pumps malfunctioned.

Sayabec, Que.—For the Town of Sayabec’s residents, improving the community centre was a key goal. The centre is the hub of local activities and one of few in the region able to host events such as exhibitions, performances and conferences. With $593,630 from the Building Canada Fund Communities Component Top-Up, the centre renovated its storage and stage areas. The building’s roof and siding were also replaced, and more parking spaces were added to accommodate a growing clientele.

Langford, B.C.—The City of Langford was in need of a new arena for some time. With only two skating rinks to serve 66,000 residents, ice time was constantly booked. To solve this problem, the city received over $4.4 million from the Building Canada Fund Communities Component Top-Up to build a new recreational facility. The City Centre Park Sportsplex includes an ice rink and bowling alley. It also features a one-of-a-kind ”ice river” that connects the new 500-seat arena to an outdoor skating area that can be converted into a children’s splash park in Summer.

Lorette, Man.—Previously served by only three municipal wells and numerous private wells, Lorette residents had to put up with recurring boil-water orders. With the help of $600,000 from the Building Canada Fund Communities Component Top-Up, the town built a one-million-litre concrete reservoir and pumping station with filtration and disinfection capacity. The system also has sufficient capacity to accommodate future community growth. Thanks to the stimulus provided, everyone in the town is now linked to a modern potable water system that has improved drinking water quality and reliability.

First Nations Infrastructure

During the stimulus phase of Canada’s Economic Action Plan, the Government spent $510 million to support infrastructure projects in three priority areas: schools, water and wastewater projects, and health and police facilities in First Nations communities. In total, these funds supported 97 major projects, all of which were completed.

Investments, such as the following, spurred significant job creation and economic development in First Nations communities, many of which are rural:

- $173-million investment in 12 school projects.

- $188-million investment in 23 water and wastewater projects.

- $134-million investment in health service infrastructure, including 40 major projects and 135 minor projects.

- $15-million investment in 22 First Nations policing infrastructure projects.

Funding to Upgrade and Modernize Federal Infrastructure

Federal infrastructure stimulus projects under the Plan included investments in faster and more reliable passenger rail services, safer bridges and highways, refurbished harbours for small crafts and more efficient border crossings.

Reliable Passenger Rail Services: The stimulus phase of Canada’s Economic Action Plan provided funding for a wide range of projects designed to modernize rail passenger services through improvements to infrastructure, locomotives, passenger cars, stations and related facilities.

- VIA Rail was able to accelerate its capital projects as a result of investments made through the stimulus phase of Canada’s Economic Action Plan, including completing upgrades to rail car safety systems, tracks and stations.

- The stimulus phase of the Action Plan also supported two remote passenger rail services: Keewatin Railway, which operates between The Pas and Pukatawagan (northern Manitoba), and Tshiuetin Rail Transportation, which operates between Sept-Îles and Schefferville (northern Quebec) as well as in Labrador.

Federal Bridges: Through the stimulus phase of Canada’s Economic Action Plan, the Government invested more than $89 million over two years in the rehabilitation and repair of the following bridges:

- Blue Water Bridge in Sarnia.

- Peace Bridge in Fort Erie.

- Champlain Bridge in Montréal.

- Alexandra Bridge and the Chaudière Crossing in the National Capital Region.

- The LaSalle Causeway in Kingston and the Burlington Lift Bridge in Burlington.

The funding ensures that bridges and other transportation infrastructure continue to be safe and serve the needs of commuters.

Federal Buildings: The stimulus phase of the Plan delivered significant funds to repair and renovate the federal government’s building portfolio. About 2,000 repair and renovation projects were completed. In addition, funding was provided to over 300 projects to enhance the accessibility of Crown-owned buildings for persons with disabilities. During project selection, priority was given to facilities where services were provided directly to Canadians.

Canada’s Economic Action Plan: Working for Canadians

Examples of Federal Bridges

National Capital Region—The work done on the Alexandra Bridge in the National Capital Region exemplifies the positive outcomes of green-based approaches to asset rehabilitation. This rehabilitation project involved strengthening the steel structure and increasing its seismic capacity as well as replacing the deck, guardrail and wooden boardwalk. The work done on the century-old bridge was closely managed to maximize the recycling of all salvageable materials and, as a result, achieved over 88 per cent diversion from landfill. The pressure-treated wood previously used in the bridge’s boardwalk was replaced with planks made from non-treated durable wood species. Screw fasteners now hold the planks in place instead of traditional nails. The screws ensure fewer planks will need to be replaced each year.

Burlington, Ont.—The original, lead-based paint on the Burlington Lift Bridge, dating back to 1962, had begun to flake and peel off the bridge, producing an increased risk of contamination to the surrounding environment. There was also a need to paint the lift span in order to mitigate the structural deterioration resulting from its exposure to road salt, which had accelerated the rate of peeling and corrosion. In addition, structural deficiencies due to corrosion were repaired. All the repair work was completed within 20 months and the bridge was shut down only twice throughout the duration of the work.

Alaska Highway: On sections of the Alaska Highway from Summit Lake, British Columbia, to the Yukon border, deck repairs to eight bridges were completed, 28 kilometres of asphalt road surface were repaved, and an intersection was rebuilt to make it safer. These investments totalled $13 million and were all completed on budget during the short northern Summer construction period.

Twinning of the Trans-Canada Highway in Banff National Park: The project involved two separate design/build tenders, one for the Icefields Interchange and a second for the twinning of six kilometres of the Trans-Canada Highway between the Interchange and the Alberta-British Columbia border. Funding was provided over three years and construction is expected to be completed in Fall 2012.

Small Craft Harbours: The stimulus phase of Canada’s Economic Action Plan provided $200 million to Fisheries and Oceans Canada to undertake repairs of small craft harbours through 272 projects. To date, repair, maintenance and dredging has been completed for 258 projects. Projects that remain underway will be completed in the future with existing departmental funding.

Fisheries and Oceans Canada was also provided with $17 million to accelerate the construction of the Pangnirtung harbour in Nunavut. Stimulus funding spent totalled $11.2 million. The remaining $5.8 million was approved for spending in 2011–12.

Canada’s Economic Action Plan: Working for Canadians

Small Craft Harbours

Port Saunders, N.L.—A wharf reconstruction project at the commercial fishing harbour of Port Saunders has restored the capacity of the harbour to support the economic sustainability of this community. The harbour, which is used by 140 commercial fishing vessels, is important to the economic viability of the seafood industry in the Gulf of St. Lawrence. The Economic Action Plan’s $2.5-million project protected over 500 full-time seasonal jobs in the harvesting and processing sectors.

Berens River, Man.—Berens River is a remote Aboriginal community located 280 kilometres northeast of Winnipeg, Manitoba. It is an active fishing community with over 65 commercial fishers; fishing is the primary economic endeavour. Thanks to Canada’s Economic Action Plan, a contract for $185,000 was awarded to Lindell and Dymterko Ltd. for a new timber crib wharf. The community now has access to an improved vessel berthing for the commercial fishers and increased landing capacity.

Federal Contaminated Sites: Through the stimulus phase of Canada’s Economic Action Plan, the Government accelerated work to assess and remediate federal contaminated sites. Departments completed over 210 accelerated remediation projects and over 2,400 site assessments in 2009–10 and 2010–11.

Supporting Home Ownership and Jobs in Housing Construction

The housing industry is an important source of economic activity and job creation in Canada, as it promotes demand for building materials and other goods and services. For many Canadians, their homes are their most important investment. To protect and create jobs, the Government provided significant support for home ownership and renovations.

Canadians who undertook eligible renovations to their homes after January 27, 2009 and before February 1, 2010 were entitled to receive up to $1,350 in tax relief from the temporary Home Renovation Tax Credit (HRTC) introduced in the stimulus phase of Canada’s Economic Action Plan. The HRTC expired as planned on January 31, 2010.

The HRTC helped more than 3 million Canadians—about one out of every three owner-occupied households—improve their homes while boosting Canada’s economic growth.

The stimulus phase of Canada’s Economic Action Plan also provided additional tax support to first-time home buyers, who continue to benefit from greater access to their Registered Retirement Savings Plan savings to purchase or build a home, as well as up to $750 in tax relief from the First-Time Home Buyers’ Tax Credit.

Further, thanks to Canada’s Economic Action Plan, homeowners benefited from the enhanced ecoENERGY Retrofit – Homes program to make energy efficiency improvements to their homes. The program experienced strong demand during the stimulus phase of the Economic Action Plan and was renewed until March 31, 2012.

Investments in Social Housing

The stimulus phase of Canada’s Economic Action Plan included historic investments in social housing that contributed to supporting Canada’s housing construction and renovation industries. Federal support of roughly $2 billion helped Canadian families access suitable and affordable housing, while putting Canadians back to work.

In addition, provincial and territorial governments, which were responsible for program design and delivery, contributed over $1.5 billion toward this two-year investment. This joint investment in social housing allows for the construction and renovation of 16,500 housing units for low income families across the country. This includes 430 construction projects for low-income seniors and persons with disabilities, and over 11,350 existing social housing renovation projects administered by provinces and territories nationwide.

The Government of Canada also invested $150 million to renovate and retrofit federally administered social housing. In total, almost 1,310 projects were completed. These projects support some of the most vulnerable in our communities: single-parent families, recent immigrants, and Aboriginal peoples living off reserve.

Through the stimulus phase of the Economic Action Plan, the Government invested $400 million over two years to build and renovate housing in First Nations communities. Close to 500 communities benefited from more than 3,200 projects. A further $200 million was also invested in the North to address the territories’ housing needs, which supported 210 projects.

In addition to direct funding for social housing, municipalities undertook housing-related infrastructure projects supported by 272 low-cost loans totalling $2 billion.

Funds from the Affordable Housing Initiative were used by the Quebec government to fund subsidized housing through the provincial program AccèsLogis. These funds, coupled with money for housing provided through Canada’s Economic Action Plan, totalled $85.6 million last year, enough to build 1,223 social-housing units. These new homes were a lifeline for the increasing number of people who are forced to resort to food banks and who find themselves evicted from their apartments for being unable to pay their rent.

—Cathy Inouye, Project Genesis; Paula Kline,

Montreal City Mission; John Eric Feliciano,

Face à Face Listening and Intervention Centre.

June 2011

Canada’s Economic Action Plan:

Working for Canadians

Investments in Housing for Low-Income Seniors and Persons with Disabilities

Prince Albert, Sask.—The Prince Albert Community Housing Society (PACH) completed a project in Prince Albert that provides 18 much-needed affordable housing units for seniors, allowing them to stay in their community close to family and friends. PACH received $2.3 million in combined federal and provincial funding under Canada’s Economic Action Plan. This investment has helped provide residents with quality, affordable housing that meets their needs while contributing to the economic and social well-being of the entire community.

Prince Albert Community Housing was delighted when the proposal for these units was approved with $2.3 million in funding provided by the federal and provincial governments. It is now a beautiful home for seniors with extremely happy residents who have a place they can call home.

— Linda Boyer, Manager, Prince Albert Housing Society Inc.

Investments in First Nations and Northern Housing

Fort Smith, N.W.T.—A small community located along the banks of the Slave River in the Northwest Territories has benefited from new housing as a result of $600,000 in federal assistance through Canada’s Economic Action Plan. The Town of Fort Smith added four new affordable housing units for low-income families to the community’s housing stock thanks to the funding, which also contributed to the sustainability of the community.

The investments being made are an important part of our efforts to ensure the sustainability of our communities through the provision of affordable housing.

— Robert C. McLeod, Minister Responsible for

the Northwest Territories Housing Corporation

Renovation and Retrofit of Existing Social Housing (Federal)

Charlottetown, P.E.I.—Gateway Co-op, Charlottetown’s largest co-op, received new windows thanks to a federal investment through Canada’s Economic Action Plan. It received over $169,000 in federal funding to replace windows in the 28-unit building, improving its energy efficiency and creating local jobs.

Without this initiative, co-ops would not be as able to make many of the repairs they need. Government funding initiatives for affordable housing have helped to consolidate co-ops’ success in delivering affordable, mixed-income housing programs at a reasonable cost.

— Nicholas Gazzard, Executive Director,

Co-operative Housing Federation of Canada

| 2009–10 | 2010–11 | 2011–12 | Total | |

|---|---|---|---|---|

| Investments in Provincial, Territorial and Municipal Infrastructure | ||||

| Accelerating payments: Provincial/Territorial Base Funding Initiative | 179 | 158 | 337 | |

| Infrastructure Stimulus Fund | 525 | 2,635 | 807 | 3,967 |

| Bonus for Community Projects | 30 | 303 | 163 | 497 |

| Green Infrastructure Fund | 5 | 42 | 47 | |

| National recreation trails | 25 | 25 | ||

| Recreational Infrastructure Canada | 87 | 331 | 82 | 501 |

| Investments in First Nations Infrastructure | ||||

| School construction | 82 | 91 | 173 | |

| Water and wastewater projects | 69 | 119 | 188 | |

| Critical community services (health facilities) | 67 | 67 | 134 | |

| Critical community services (police facilities) | 12 | 3 | 15 | |

| Federal infrastructure | ||||

| An improved rail system | 138 | 213 | 352 | |

| Trans-Canada Highway | 16 | 29 | 45 | |

| Federal bridges | 39 | 50 | 89 | |

| Alaska Highway | 13 | 13 | ||

| Small craft harbours | 117 | 93 | 210 | |

| Repair and restoration of federal buildings | 171 | 151 | 322 | |

| Enhancing accessibility of federal buildings | 16 | 22 | 38 | |

| Manège Militaire in the City of Québec | 1 | 1 | 2 | |

| Accelerating action on federal contaminated sites | 88 | 127 | 216 | |

| Border facilities | 2 | 20 | 22 | |

| Aviation security | 343 | 7 | 350 | |

| Subtotal—Building Infrastructure | 2,025 | 4,463 | 1,051 | 7,540 |

| Support for Home Ownership and the Housing Industry | ||||

| Home Renovation Tax Credit | 2,265 | 2,265 | ||

| Home Buyers’ Plan withdrawal limit | 15 | 15 | 30 | |

| First-Time Home Buyers’ Tax Credit | 130 | 115 | 245 | |

| ecoENERGY Retrofit – Homes program | 186 | 191 | 377 | |

| Investments in Social Housing for Canadians | ||||

| Renovation and retrofit of social housing (provincial/territorial) | 433 | 417 | 850 | |

| Renovation and retrofit of social housing (federal)1 | 67 | 82 | 149 | |

| First Nations housing—Canada Mortgage and Housing Corporation1 | 123 | 126 | 249 | |

| First Nations housing—Aboriginal Affairs and Northern Development Canada | 75 | 79 | 154 | |

| Northern housing | 100 | 100 | 200 | |

| Housing for low-income seniors | 200 | 200 | 400 | |

| Housing for persons with disabilities | 25 | 50 | 75 | |

| Loans to municipalities: housing-related infrastructure | 376 | 1,624 | 2,000 | |

| Subtotal—Stimulating Housing Construction | 3,995 | 2,999 | 6,994 | |

| Total—Building Infrastructure to Create Jobs | 6,021 | 7,462 | 1,051 | 14,534 |

| Notes: Totals may not add due to rounding. Spending figures exclude employee benefit plan and accommodation costs. Amounts for 2009–10 and 2010–11 are actual cash expenditures, while amounts for 2011–12 reflect estimated expenditures for the four extended infrastructure programs. As a result of the extension of these programs, some funds originally planned for 2010–11 will be recorded in 2011–12. Final numbers will be released in the Public Accounts of Canada in Fall 2012. The budgetary impact may be somewhat smaller because some of these expenditures relate to construction and renovation costs of federal assets (for which only depreciation is recorded on a budgetary basis) and loans to third parties (where there is a budgetary impact only in the event that there is a risk of loss). 1 Approximately $1 million in spending was reprofiled to 2011–12. |

||||

Advancing Canada’s Knowledge Economy and Creating Better Jobs

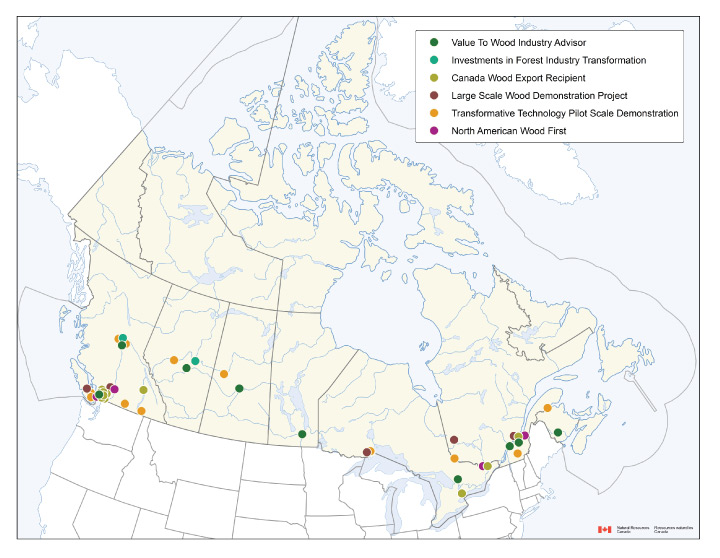

While providing stimulus across the country, Canada’s Economic Action Plan also contributed to long-term growth and prosperity by helping to build Canada’s capacity for innovation.