Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Chapter 5: Responsible Management to Return to Balanced Budgets

Highlights

- In Budget 2011, the Government reiterated its commitment to generate ongoing savings from operating efficiencies and improving productivity by announcing a review of departmental spending. The results of this review are presented in this budget.

- Canada’s economic and fiscal fundamentals are strong. The scale of Canada’s efforts to reduce the deficit is modest compared to the expenditure restraint efforts being pursued by many countries around the world and relative to that undertaken in Canada in the mid-1990s, which included reduced transfers to provinces for health care and education.

- The Government’s economic management strikes the right balance between supporting economic growth and job creation and returning to budget balance over the medium term.

- That is why the Government remains committed to returning to balanced budgets at an appropriate pace as the economy continues to recover from the global economic crisis.

- The Government’s plan to return to balanced budgets over the medium term is on track.

- Measures initiated in Budget 2010 and Budget 2011 to restrain growth in federal spending have proven to be highly successful, contributing to a projected return to budgetary balance over the medium term, while ensuring continued and growing funding for the programs and services that are a priority for Canadians.

- The Government is not reducing transfers to persons, including those for seniors, children and the unemployed, or transfers to other levels of government in support of health care and social services.

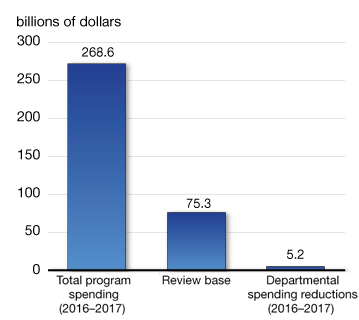

- The results of the Government’s review of departmental spending will yield savings of $5.2 billion on an ongoing basis. The planned reduction in spending represents less than 2.0 per cent of federal program spending in 2016–17, or 0.2 per cent of Canada’s gross domestic product (GDP) in that same year.

Responsible Management of Public Finances

Canadians know the importance of living within their means and expect the Government to do the same. That is why the Government is committed to managing public finances in a sustainable and responsible manner. The Government’s responsible financial management put Canada in a position of strength when it came time to combat the global recession. From 2006 to 2008, the Government paid down over $37 billion in debt, significantly contributing to Canada’s low net debt position. This enabled the Government to quickly implement the stimulus phase of Canada’s Economic Action Plan without leaving the country in a vulnerable fiscal position like many European countries.

But Canadians know that responsible fiscal management—balancing the budget and reducing debt—does far more than just provide room to manoeuvre when the economy is negatively affected by developments outside our borders. Responsible fiscal management contributes to strong economic growth and job creation over the long term. Reducing debt:

- Frees up tax dollars otherwise absorbed by interest costs, which can be reinvested in other priorities such as health care, public services or lower taxes.

- Keeps interest rates low, encouraging businesses to invest for the future.

- Signals that public services are sustainable over the long run.

- Strengthens the country’s ability to respond to challenges such as population aging.

- Preserves Canada’s low-tax plan, fostering the long-term growth that generates high-quality jobs for all Canadians.

The Plan to Return to Balance

The Government’s medium-term fiscal plan is founded on returning to balanced budgets. The means to achieve this goal have been well established, beginning in Budget 2009 with the launch of the stimulus phase of Canada’s Economic Action Plan, which was explicitly designed to be temporary. The plan was then augmented in Budget 2010, which announced targeted actions to control the growth in direct program spending, including: restraining the growth in defence spending; capping the International Assistance Envelope; freezing departmental operating budgets for two years; and freezing the salaries of the Prime Minister, Ministers, Members of Parliament and Senators until 2013.

Budget 2011 further augmented the plan. First, it delivered on the 2010 strategic review, which, combined with the results of the reviews of the previous three years, resulted in $2.8 billion in ongoing savings. Second, it launched a comprehensive review of departmental spending with the objective of achieving at least $4 billion in annual savings by 2014–15.

Over the past year, the Government assessed approximately $75 billion of direct program spending by departments and agencies. Federal organizations were asked to look at the efficiency and effectiveness of their programs and operations to ensure value for money, as well as to rethink business processes and service delivery platforms. Major transfers to persons and transfers to other levels of government were excluded from the scope of the review. In fact, transfers will continue to increase to record high levels in 2012–13 and going forward.

The following section provides an overview of the results of the review. It highlights key measures the Government is taking to find efficiencies in its operations and achieve greater relevance and effectiveness in government programs and services.

The [Canadian] authorities have appropriately shifted toward fiscal consolidation. The federal government is leading the initial fiscal effort, and regional governments are expected to follow suit.

[IMF] Staff supports the [Canadian] authorities' objective of returning to a stronger fiscal position in the medium term.

— International Monetary Fund, November 2011

Reductions in Departmental Spending

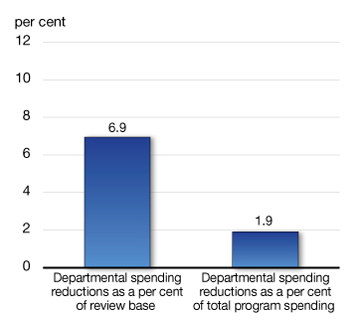

The results of the Government’s review of departmental spending amount to roughly $5.2 billion in ongoing savings, representing 6.9 per cent of an aggregate review base of $75.3 billion.

These measures represent modest and measured action on the part of the Government to help ensure a return to balanced budgets over the medium term. In fact, the reduction in spending represents less than 2.0 per cent of expected federal program spending in 2016–17, or about 0.2 per cent of Canada’s GDP that same year (Chart 5.1).

Relative to total program spending of over $250 billion, planned departmental spending reductions are modest

As Table 5.1 demonstrates, this was not an exercise in across-the-board spending reductions. The Government focused instead on finding savings that would reflect the primary goal of achieving efficiencies in operations and enhancing productivity, as well as those that would better align spending with the priorities of Canadians. As a result, the savings achieved relative to existing spending vary across portfolios. Further, almost 70 per cent of the total ongoing savings are due to operating efficiencies. An overview of savings for each participating government portfolio appears in Annex 1.

| Portfolio | 2012–13 | 2013–14 | 2014–15 | Ongoing | Review Base | Per Cent of Review Base1 |

Per Cent of Total Program Spending1 |

|---|---|---|---|---|---|---|---|

| Aboriginal Affairs and Northern Development | 26.9 | 60.1 | 165.6 | 165.6 | 6,223.2 | 2.7 | 0.06 |

| Agents of Parliament | 8.3 | 8.8 | 16.4 | 16.4 | – | – | 0.01 |

| Agriculture and Agri-Food | 17.1 | 168.5 | 309.7 | 309.7 | 3,092.3 | 10.0 | 0.12 |

| Canada Revenue Agency2 | 14.8 | 87.0 | 225.4 | 253.1 | 3,641.2 | 6.9 | 0.09 |

| Citizenship and Immigration | 29.8 | 65.2 | 84.3 | 84.3 | 1,581.5 | 5.3 | 0.03 |

| Environment | 19.5 | 56.4 | 88.2 | 88.2 | 1,062.2 | 8.3 | 0.03 |

| Finance2 | 20.6 | 32.6 | 34.6 | 38.6 | 229.4 | 16.8 | 0.01 |

| Fisheries and Oceans | 3.8 | 13.4 | 79.3 | 79.3 | 1,360.1 | 5.8 | 0.03 |

| Foreign Affairs and International Trade | 72.4 | 116.6 | 169.8 | 169.8 | 1,916.2 | 8.9 | 0.06 |

| Health | 111.7 | 218.5 | 309.9 | 309.9 | 4,811.7 | 6.4 | 0.12 |

| Heritage | 52.2 | 130.7 | 191.1 | 191.1 | 2,773.7 | 6.9 | 0.07 |

| Human Resources and Skills Development | 10.6 | 64.7 | 286.7 | 286.7 | 7,589.8 | 3.8 | 0.11 |

| Industry | 89.2 | 182.7 | 217.3 | 217.3 | 3,454.4 | 6.3 | 0.08 |

| International Assistance Envelope | 180.7 | 242.1 | 377.6 | 377.6 | 3,896.8 | 9.7 | 0.14 |

| Justice | 21.2 | 69.0 | 76.9 | 76.9 | 898.3 | 8.6 | 0.03 |

| National Defence | 326.8 | 706.1 | 1,119.8 | 1,119.8 | 15,069.0 | 7.4 | 0.42 |

| Natural Resources | 68.3 | 86.0 | 108.3 | 108.3 | 1,079.6 | 10.0 | 0.04 |

| Privy Council Office | 3.7 | 6.5 | 12.2 | 12.2 | 102.6 | 11.9 | 0.00 |

| Public Safety | 179.4 | 370.7 | 687.9 | 687.9 | 6,940.6 | 9.9 | 0.26 |

| Public Service Commission | 2.2 | 4.5 | 9.0 | 9.0 | 89.9 | 10.0 | 0.00 |

| Public Works and Government Services2 | 1.5 | 28.1 | 85.3 | 177.6 | 1,848.6 | 9.6 | 0.07 |

| Regional Development Agencies | 26.7 | 73.4 | 86.9 | 86.9 | 996.2 | 8.7 | 0.03 |

| Shared Services Canada | 74.7 | 104.5 | 150.0 | 150.0 | 1,493.4 | 10.0 | 0.06 |

| Transport | 63.4 | 97.2 | 152.6 | 152.6 | 1,428.8 | 10.7 | 0.06 |

| Treasury Board | 10.4 | 18.6 | 30.2 | 30.2 | 281.1 | 10.7 | 0.01 |

| Veterans Affairs2 | 36.1 | 49.3 | 66.7 | 36.9 | 3,487.6 | 1.1 | 0.01 |

| Total Portfolio Savings | 1,472.1 | 3,061.2 | 5,141.5 | 5,235.7 | 75,348.1 | 6.9 | 1.9 |

| Note: Totals may not add due to rounding. 1 Ongoing savings as a percentage of the review base and 2016–17 total program spending across the Government. 2 Savings associated with the Canada Revenue Agency’s and the Department of Finance Canada’s spending reduction measures will continue to grow in value beyond 2014–15. Given that a large portion of its spending is fixed over the short term (e.g. through lease agreements and contracts), Public Works and Government Services Canada has until 2018–19 to achieve its savings target. The lower ongoing savings for Veterans Affairs Canada reflects the accrual impact of some of its savings measures, which are fully amortized by 2015–16. |

|||||||

This modest approach reflects Canada’s sound fiscal and economic fundamentals, and is in stark contrast to more significant expenditure restraint measures that many other countries have had to put in place to stabilize their fiscal positions.

Countries such as the United Kingdom and euro-area members including Greece, Portugal, Italy and Spain, for example, are drastically reducing funding and services for their citizens. The planned measures in many of these countries represent the deepest spending reductions in decades, and are accompanied by hundreds of thousands of lost public sector jobs, tax increases and postponed infrastructure projects.

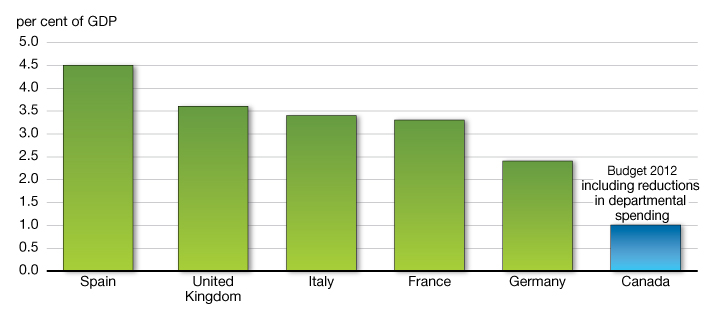

Chart 5.2 compares the spending track underlying the Government’s plan to return to balance over the medium term, including the reductions in departmental spending announced in this budget, with those being implemented in Spain, the U.K., Italy, France and Germany. Up to 2014–15, planned spending restraint is expected to result in a decline in program spending as a share of GDP of 1.0 percentage point.[1] This is significantly less than the expenditure restraint measures being taken in other countries, where program spending as a per cent of GDP is being reduced by between 2.4 percentage points, in the case of Germany, and 4.5 percentage points in the case of Spain.

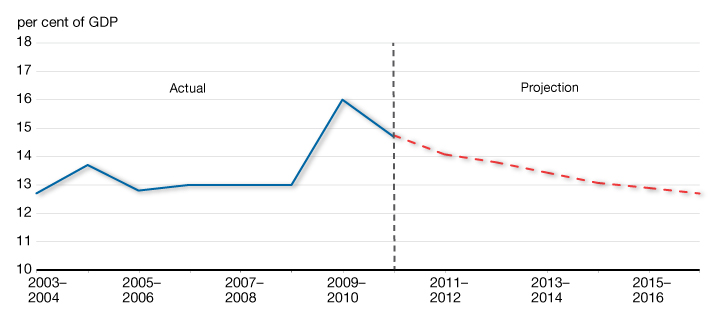

The actions the Government is currently undertaking to reduce the growth in spending are also modest compared to those implemented in the mid-1990s. Between 1993-94 and 1997-98, federal program spending was reduced by 3.8 percentage points of GDP, from 16.8 per cent to 13.0 per cent of GDP, and included reductions in Employment Insurance benefits and funding for the provinces and territories for health care and education.

Planned spending restraint is modest

(2011–12 to 2014–15)

Sources: National forecasts; European Commission; U.K. Office for Budget Responsibility; International Monetary Fund; Department of Finance calculations.

Unlike the significant fiscal consolidation exercise in the mid-1990s, major transfers to persons and other levels of government for health care and education and other social programs will not be cut. On the contrary, major transfers to provinces, territories and individuals will grow over the forecast period. In 2014–15, once the planned reductions in departmental spending have been fully implemented, federal program spending is projected to be roughly 6 per cent higher than in 2010–11. This will be fuelled by continued growth in transfers to provinces for the provision of health care, education and social services and to individuals for Old Age Security and children’s benefits.

However, growth in spending is expected to be less than that of the economy. As a consequence, total program spending as a per cent of GDP is expected broadly to return to pre-recession levels over the budget horizon (Chart 5.3).

Including the departmental spending reductions detailed in this budget, program spending is expected to broadly return to pre-recession levels

The planned reductions in departmental spending announced in this budget are modest and focused on making government operations leaner and more efficient, while preserving fundamental programs, services and transfers for Canadian individuals and families. Indeed, these spending reductions will result in a more productive, efficient and responsive government by:

- Refocusing government and programs.

- Making it easier for Canadians and businesses to deal with their government.

- Modernizing and reducing the back office.

This section provides some examples of the savings measures that will be implemented in these areas, and Annex 1 contains additional details. Once departments and agencies have had the opportunity to communicate cost savings measures contained in this budget to their employees and collective bargaining agents, they will begin to implement these measures and communicate accordingly.

Refocusing Government and Programs

The Government is committed to reducing unnecessary spending by focusing on providing programs that are consistent with federal roles and responsibilities, ensuring programs are delivered by those best positioned to do so, and refocusing program funding based on achievable objectives and the needs of Canadians. In particular, the Government’s review of departmental spending has identified opportunities to better align program funding with citizen and business demand.

- The Government will introduce legislation to modernize Canada’s currency set by eliminating the penny from Canada’s coinage system. The Government will no longer distribute pennies as of Fall 2012. However, the penny will retain its value indefinitely and can continue to be used in payments. The penny has weak purchasing power and costs the Government 1.6 cents to produce. Other countries, such as New Zealand, Australia, the Netherlands, Norway, Finland and Sweden, have made smooth transitions to a penny-free economy. The Government expects that businesses will apply rounding for cash transactions in a fair and transparent manner. Canadians will be able to redeem pennies for full value. The Government will work in collaboration with institutions and charitable organizations that may wish to organize fundraising activities around the elimination of the penny.

- Domestic coinage denominations have been shifting from metal alloys to plated steel cores. The $1 and $2 coins are the last of the denominations to be converted to the new plating technology. The Government will adjust the metal composition of these coins, significantly reducing their unit production costs.

- The Government is eliminating the Public Appointments Commission Secretariat as the Government has significantly strengthened the rigour and accessibility of the public appointments system over the past five years. Improvements put in place to strengthen the public appointments system include advertising public appointment opportunities on a dedicated website and conducting open selection processes for leadership and full-time positions.

- In recent years, the Government has made major, necessary investments in the country’s military capabilities. Going forward, defence contracting and internal processes will be streamlined to achieve savings. However, Canadian Forces regular and reserve force strength will be maintained at 68,000 and 27,000, respectively, preserving the balance across the four Canada First Defence Strategy pillars upon which military capabilities are built—personnel, equipment, readiness and infrastructure.

- The Government will update the terms and conditions of employment abroad to make them comparable to benefits provided in the private sector or by other public sector counterparts. Based on international standards, rent ceilings for leased accommodations will be lowered moderately. Extending some postings will help deepen Canadians’ contacts on the ground and will also reduce the administrative costs associated with frequent relocation.

- The Government will also sell some official residences abroad and move to smaller ones, generating capital revenue of $80 million. More modest quarters will not impact the ability of our diplomats to do their jobs and will reduce the number of required staff, resulting in further operating savings.

- While the National Round Table on the Environment and the Economy (NRTEE) filled an important need in the past, a mature and expanded community of environmental policy stakeholders has demonstrated the capacity to provide analysis and policy advice for the Government of Canada. As a result, the Government will introduce legislation to eliminate the NRTEE. Environment Canada will continue to offer effective programs to protect Canada’s natural environment.

- The Government will eliminate the Katimavik program. Our Government is committed to giving our young people the opportunities they deserve, and we will achieve that by funding programs that benefit large numbers of young people at a reasonable cost rather than concentrating available funding on a very small number of participants at an excessive per-person cost. Our Government is proud to continue to invest in affordable, effective programming that engages youth, including Encounters with Canada, Forum for Young Canadians, and organizations that support youth, like the YMCA. Canadian Heritage will continue to invest over $105 million in youth programming to allow almost 100,000 young people to learn about their country.

- The Government will eliminate the Advanced Leadership Program at the Canada School of Public Service. While the program has been successful in building senior leader capacity, it is no longer a cost-effective learning tool. The school will continue to offer other relevant, affordable and quality learning experiences to support capacity building.

- The Government will introduce legislation to wind down Assisted Human Reproduction Canada, with final closure of operations by March 31, 2013. The winding down of the Agency responds to the 2010 ruling of the Supreme Court of Canada that significantly reduced the federal role in assisted human reproduction. Health Canada will take over responsibility for any remaining federal functions such as compliance and enforcement, and outreach.

Making It Easier for Canadians and Businesses to Deal With Their Government

The Government is maintaining its commitment to reduce unnecessary red tape to allow businesses to focus on creating high-quality jobs and contribute to Canada’s economic growth. Specifically, the Government will expand electronic services available to Canadians and Canadian businesses and introduce regulatory changes that will cut unnecessary red tape for citizens and employers, placing greater flexibility and control in their hands.

- The Government will consolidate Agriculture and Agri-Food Canada’s grants and contribution programs across the Department and streamline management of the Farm Debt Mediation Service. Delivering all of its programs out of one branch will allow the Department to offer more efficient services with fewer people. Farmers and the industry will benefit from this change, which will simplify the application process and reduce paperwork and other redundancies, while reducing costs.

- The Government will change how the Canadian Food Inspection Agency (CFIA) monitors and enforces non-health and non-safety food labelling regulations. The CFIA will introduce a web-based label verification tool that encourages consumers to bring validated concerns directly to companies and associations for resolution. The Government will also repeal regulations related to container standards to enable industry to take advantage of new packaging formats and technologies, while removing an unnecessary barrier for the importation of new products from international markets.

- The Government will streamline and modernize Human Resources and Skills Development Canada’s administration and delivery of grants and contributions, which will improve services and reduce red tape. Ongoing savings will be achieved by consolidating, standardizing and automating administrative functions to reduce duplication and increase capacity to offer advanced services and transactions online.

- The Government will replace the existing contribution agreements for the housekeeping and grounds maintenance components of the Veterans Independence Program (VIP) with annual grants. This will simplify the process for more than 96,000 Veterans, primary caregivers and survivors, who will continue to receive the financial support they need for housekeeping and grounds maintenance services, but will no longer have to obtain, track and submit receipts to be reimbursed. As a result, almost 2.5 million transactions each year related to these reimbursements under VIP will be eliminated.

- The Government is taking action to more quickly give doctors and patients access to drugs that have already passed a rigorous safety review, including removing the requirement for regulatory amendments to declare prescription status for new drugs, or to switch their status from prescription to non-prescription. This measure is purely about reducing the red tape that blocks drugs shown to be safe from getting on the market and is consistent with the Government’s broader red tape reduction efforts.

Modernizing and Reducing the Back Office

The Government is committed to streamlining, consolidating and standardizing administrative functions and operations within and across organizations. The Government has identified opportunities to consolidate administrative functions including human resources and financial services, real property maintenance, information technology, communications and contracting within portfolios and across similar organizations. It has also identified ways to reduce travel expenses by using virtual tools such as teleconferencing, videoconferencing and virtual presence.

- Environment Canada and Natural Resources Canada will reduce travel activities and will reduce their fleets by a total of 160 vehicles.

- A number of departments and agencies with similar mandates and program and policy goals, such as the regional development agencies, Health Canada and the Public Health Agency of Canada, and Agriculture and Agri-Food Canada and the Canadian Food Inspection Agency, will achieve savings by merging their back office functions.

- Public Works and Government Services Canada will introduce new office space standards in Crown-owned and federal government occupied buildings. The new, more efficient and effective office accommodation standards are consistent with industry best practices.

- Shared Services Canada (SSC) will now deliver email, data centre and network services to 43 federal organizations. SSC will realize significant cost savings by moving to a single email system, consolidating data centres, and utilizing its collective purchasing power.

Workforce Impact

As the largest employer in Canada, the Government is managing the impact of these spending reductions on its workforce responsibly.

The planned reduction in departmental spending is expected to eliminate about 12,000 government positions over a three-year-period, with affected individuals qualifying for collectively bargained workforce adjustment measures. This number takes into account attrition—largely retirement or other voluntary departures. In total, federal employment will be reduced by about 19,200 or 4.8 per cent. To the largest extent possible, the Government will use these vacancies towards redeploying individuals whose jobs have been affected by the spending reduction.

The planned reduction in employment includes the elimination of about 600 executive positions, or 7.4 per cent of the executive workforce, bringing the level of management overhead more in line with private sector best practices.

To put the total planned reduction in employment in perspective, the 4.8 per cent, or 19,200, reduction is about one-third of that experienced during the 1990s Program Review, which saw a reduction in federal employment of about 14 per cent or about 50,000.

Further, the planned reduction in employment would reverse only about 20 per cent of the increase in federal public sector employment that has occurred since the late 1990s. Indeed, between 1998 and 2011, federal employment grew by approximately one-third, or 95,000, from just under 300,000 in 1998 to just under 400,000 in 2011.

A large proportion of full-time-equivalent reductions will occur in the National Capital Region. The regional distribution of employment in the federal public service will be largely unaffected by the implementation of the departmental spending reductions.

It is expected that the proposed reduction in employment, which represents only 0.1 per cent of all jobs in Canada, will be marginal compared to the expected job growth in the wider economy over the course of the three years in which the reductions will be implemented.

In addition, the Government is taking actions in this budget, as part of its plan for jobs and growth, that will offset some of the reduction in public service employment, while at the same time creating an environment for private sector job creation.

The Government will make every effort to manage the employment reductions resulting from the reduction in departmental spending in a manner that treats federal employees fairly and minimizes disruptions to Canadians. The collectively bargained Workforce Adjustment Directive for unionized employees and the Directive on Career Transition for Executives set out the options and benefits available to employees whose position will be affected by a workforce adjustment situation.

Where possible, the Government will use natural attrition and internal redeployments to mitigate the impact on permanent federal employees. The Government will strengthen workforce information sharing across federal departments to ensure that hiring managers can be easily linked with affected employees.

The overall cost of workforce adjustment measures resulting from the planned reduction in departmental spending is estimated to be $0.9 billion. Consistent with government accounting practices, which are based on independently set standards, these costs are accrued in the 2011–12 fiscal year.

Responsible Expenditure Management

In addition to the measures described above, and as part of its commitment to responsible and sustainable public finances, the Government is implementing several other initiatives that will improve the efficiency and reduce the costs of service delivery, streamline its reporting procedures by eliminating unnecessary and duplicative reports, as well as better align planned spending with expected needs.

Updating Defence Capital Funding

The Government of Canada has made significant progress towards the implementation of the Canada First Defence Strategy, which outlines a comprehensive, long-term plan to provide the Canadian Forces with the people, equipment and support they need to carry out their core missions in Canada and elsewhere in North America and abroad. The Government will continue to replace key equipment, including purchasing new ships built in Canada through the National Shipbuilding Procurement Strategy, as well as by acquiring an affordable replacement for Canada’s aging CF-18 fleet to better equip Canada’s men and women in uniform. In order to ensure that funding for major capital equipment procurements is available when it is needed, the Government is adjusting the National Defence funding profile to move $3.54 billion over seven years into the future period in which purchases will be made.

Modernizing the Government’s Information Technology: Shared Services Canada

Shared Services Canada was established on August 4, 2011, as a demonstration of the Government’s commitment to generating operational efficiencies and ensuring value for Canadian taxpayers. The new department’s mandate is to consolidate information technology (IT) infrastructure, including email, data centres and networks, across 43 departments and agencies. Through this initiative, the Government will produce savings and reduce the Government’s footprint, strengthen the security and safety of government data to ensure Canadians are protected, and make it more cost-effective to modernize IT services. The new organization has already identified upfront, ongoing savings. It will continue to generate savings for taxpayers as it carries out its mandate.

The Government will introduce legislation establishing Shared Services Canada with a mandate to deliver value for money for Canadian taxpayers and giving it the necessary authorities to maintain the integrity of its mission-critical operations and to realize the efficiencies for which it was created.

Administrative Services Review—Moving Forward

Building on the administrative services review from Budget 2010, the Government set out a direction in Budget 2011 to improve services and realize efficiencies by examining government-wide solutions that standardize, consolidate and re-engineer the way it does business. As discussed above, the Government is moving forward with the creation of Shared Services Canada, with a mandate to lower costs by streamlining information technology networks, data centres and email systems.

Moving forward, the Government will pursue additional standardization and consolidation opportunities, continuing to improve the way it delivers services to Canadians while generating operational savings. For example, as discussed in Chapter 4, the Government plans to improve services to seniors, while reducing its own administrative costs, by putting in place a proactive enrolment regime that would eliminate the need for many seniors to apply for Old Age Security and the Guaranteed Income Supplement if they meet the eligibility requirements.

Parliamentary Expenses

The House of Commons Board of Internal Economy and the Senate Board of Internal Economy, Budgets and Administration have undertaken reviews of Parliamentary spending in order to find efficiencies and provide better value for taxpayers. These boards have found efficiencies through new policies and process improvements, and submitted their results to the Government.

Public Sector Compensation

The Government is also taking specific action to bring federal public service compensation in line with that of other public and private sector employers. This includes eliminating the accumulation of severance benefits for voluntary resignation and retirement, which to date has been eliminated for about 230,000 unionized and non-unionized federal government employees, including members of the Royal Canadian Mounted Police, the Canadian Forces and all executives in the core public administration. Other federal public sector employers are pursuing similar approaches.

Starting on April 1, 2012 and on a go-forward basis, the prior years of service of former members of the Canadian Forces who join the public service will be recognized for the purpose of calculating vacation entitlements.

Pensions of Public Servants and Parliamentarians

In Budget 2010, the Government indicated that it would engage public sector bargaining agents and assess measures taken by other jurisdictions in Canada to ensure that the total costs of compensation are reasonable. Employee pension plans represent a significant element of the Government’s total compensation expenses.

The Government is committed to respecting its pension obligations. The Government will take steps to ensure that plans are sustainable, financially responsible and broadly consistent with the pension products offered by other jurisdictions as well as fair relative to those offered in the private sector.

The Government proposes to adjust the Public Service Pension Plan so that public service employee contributions equal, over time, those of the employer (50/50). Comparable changes to the contribution rates will be made to the pension plans for the Canadian Forces, the Royal Canadian Mounted Police and Parliamentarians.

In addition, it is proposed that, for those employees who join the federal public service starting in 2013, the normal age of retirement will be raised from 60 to 65.

Adjustments to the pension plan of Parliamentarians will take effect in the next Parliament.

The Government will also work with Crown corporations to ensure that their employee pension plans are financially sustainable and broadly aligned with those available to federal employees.

The Government will be consulting with key stakeholders on all of these changes in the coming months.

Corporate Asset Management Review

Since 2009, the Government has been undertaking a systematic review of corporate assets as a normal part of good governance, which can contribute to the ongoing reallocation of financial resources to high priorities in order to maximize benefits to taxpayers. The review assesses selected assets, with a view to improve their efficiency and effectiveness and to ensure that government resources are employed in ways that focus on the priorities of Canadians. There are a number of potential outcomes from this process that may be adopted or implemented, ranging from the status quo to amendments to current mandates or governance, and even possibly divestment. The Government will continue to review its corporate assets to ensure value for taxpayers.

Greater Use of Telepresence Technology

The Government will explore ways to increase its productivity by using telepresence and other remote conferencing technologies more extensively. Telepresence technology is similar to videoconferencing; however, it enables participants to see life-size, full-motion video with high-quality sound. The Government will develop a strategy to expand the use of telepresence technology and other remote meeting solutions. Investments in this technology will be financed by reductions in travel expenses.

Next Steps

The section above has described the numerous measures that the Government has taken to date to achieve its medium-term objective of returning to balanced budgets. Following a deliberate and measured review of departmental spending, the Government is taking action to refocus federal efforts on relevant and effective programs that are required to meet long-standing needs in the primary areas of federal responsibility. It will also ensure that all government operations are performed as efficiently as possible.

Over the coming year, the Government will continue to examine new ways to reduce costs, modernize how government works and ensure value for taxpayers’ money, including in the areas of service delivery, corporate asset management, travel and administrative systems.

[1] Includes the impact of measures undertaken in Budget 2010, Budget 2011 and Budget 2012 to restrain growth in program spending.