Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Chapter 6: Fiscal Outlook

Highlights

- The Government’s plan for returning to balanced budgets over the medium term is on track.

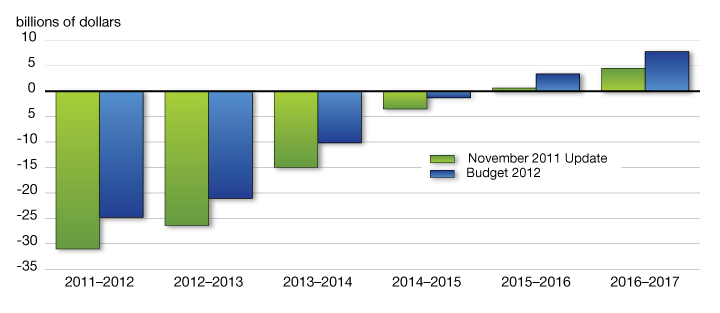

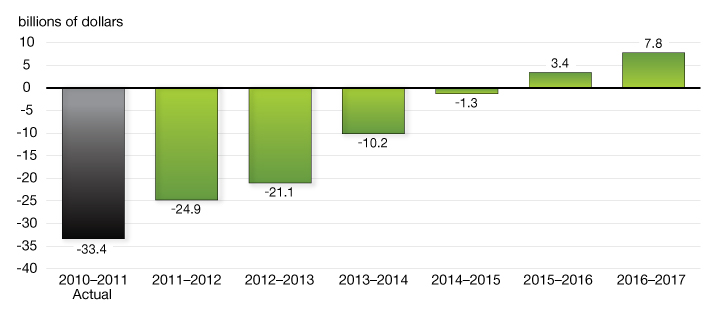

- The deficit in 2011–12 is projected to be $8.5 billion lower than it was in 2010–11, and it is projected to decrease by an additional $3.8 billion in 2012–13. The deficit is projected to continue to decline to $1.3 billion in 2014–15.

- Over the forecast period, the budgetary balance is projected to improve by a total of $39.6 billion compared to the November 2011 Update of Economic and Fiscal Projections, reflecting both the improved economic outlook and the Government’s strong fiscal management.

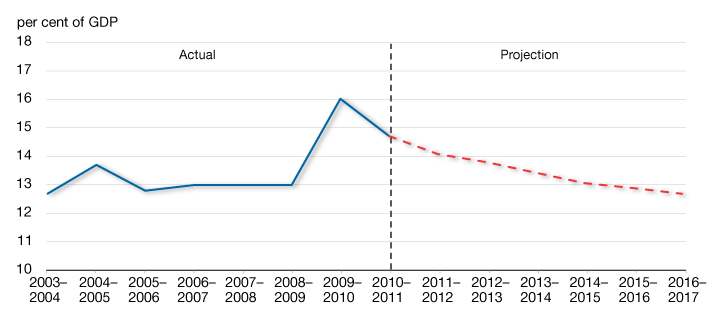

- As a share of gross domestic product (GDP), program expenses are projected to decline from 14.7 per cent in 2010–11 to 12.7 per cent in 2016–17, which represents a return to pre-recession spending ratios.

- The federal debt is projected to decline to 28.5 per cent of GDP in 2016–17, in line with its pre-recession level.

- Canada expects to achieve, well ahead of schedule, its Group of Twenty (G-20) commitments to halve deficits by 2013 and stabilize or reduce total government debt-to-GDP ratios by 2016, as agreed to by G-20 leaders at their summit in Toronto in June 2010.

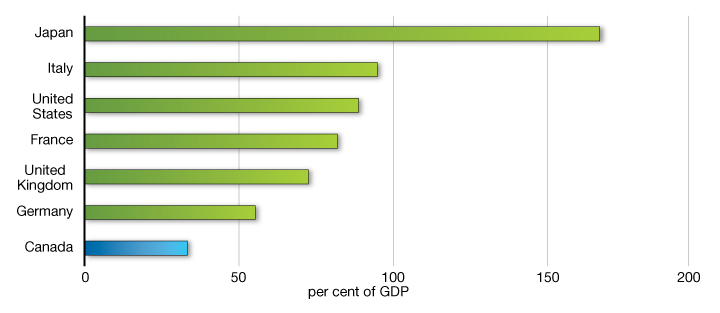

- Canada continues to hold a significant fiscal advantage over other G-7 countries. The International Monetary Fund projects that by 2016, Canada’s total government net debt-to-GDP ratio will remain at about one-third of the G-7 average and more than 20 percentage points of GDP below that of Germany, the G-7 country with the next-lowest ratio.

Introduction

The economy is the Government’s top priority. Responsible and sustainable fiscal management is a key element of the Government’s plan to create jobs and growth over the long term. Economic Action Plan 2012 reaffirms the Government’s commitment to returning to balanced budgets over the medium term and putting the debt-to-GDP ratio on a downward track.

Chart 6.1 indicates that the projected budgetary balance has improved over the entire forecast horizon, reflecting both the improved economic outlook and the Government’s strong fiscal management. Over the current year and the next five years, the projected budgetary balance has improved by a total of $39.6 billion compared to the projection at the time of the November 2011 Update of Economic and Fiscal Projections. The Government projects that it will return to balanced budgets over the medium term.

Government remains on track to return to balanced budgets over the medium term

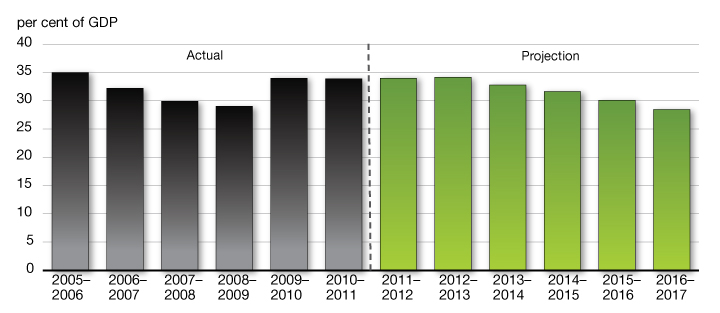

An important measure of fiscal sustainability is the debt-to-GDP ratio. Before the global financial crisis, the Government reduced its debt by over $37 billion between 2006 and 2008. The resulting reductions in the debt-to-GDP ratio provided Canada with the flexibility to implement measures to support the economy as part of the stimulus phase of Canada’s Economic Action Plan without jeopardizing Canada’s fiscal sustainability. Returning to balanced budgets over the medium term will ensure that the federal debt, measured in relation to the size of the economy, resumes its downward track (Chart 6.2). Canada’s federal debt in relation to the economy is expected to decline to 28.5 per cent of GDP by 2016–17, in line with its pre-recession level.

As a result, Canada expects to achieve, well ahead of schedule, its G-20 commitments to halve deficits by 2013 and stabilize or reduce total government debt-to-GDP ratios by 2016, as agreed to by G-20 Leaders at their summit in Toronto in June 2010.

The federal debt-to-GDP ratio is projected to resume its downward track

Sources: Department of Finance; Statistics Canada.

Canada continues to maintain a fiscal advantage over other G-7 economies. The International Monetary Fund projects that Canada’s total government net debt-to-GDP ratio (which includes federal, provincial and territorial debt, as well as the Canada Pension Plan and Québec Pension Plan) will remain the lowest among the G-7 countries, falling to 33.3 per cent in 2016 (Chart 6.3). This ratio would be about one-third of the G-7 average (92.9 per cent of GDP), and significantly lower than Germany, which would have the second-lowest net debt-to-GDP ratio in the G-7 (55.3 per cent of GDP).

Canada will maintain a significant fiscal advantage over other G-7 countries

Source: International Monetary Fund, Fiscal Monitor, September 2011.

Fiscal Planning Framework

Approach to Budget Planning

To ensure objectivity and transparency, the economic forecast underlying the Government’s fiscal projections is based on an average of private sector economic forecasts. This process has been followed for nearly two decades. This budget maintains that approach.

However, as described in Chapter 2, although the March 2012 private sector survey is considered to be a reasonable basis for fiscal planning purposes, the global economic outlook remains uncertain and, as a result, the Government has judged it appropriate to maintain a downward adjustment to the private sector forecast for nominal GDP. With this adjustment for risk, the revenue projections are reduced by $3.0 billion in each year from 2012–13 to 2016–17 (Table 6.1).

| 2012–13 | 2013–14 | 2014–15 | 2015–16 | 2016–17 | |

|---|---|---|---|---|---|

| Adjustment for risk to revenues1 | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 |

| 1 A negative number implies a deterioration in the budgetary balance. A positive number implies an improvement in the budgetary balance. | |||||

Fiscal Outlook Before the Measures Announced in Budget 2012

Table 6.2 provides a summary of the changes in the fiscal projections between the November 2011 Update and this budget. The $24.4 billion deficit projected for 2011–12, before measures announced in this budget, is $6.6 billion lower than the $31.0-billion deficit projected in the 2011 Update, which reflects in part the removal of the adjustment for risk since the fiscal year has essentially ended and the risks have not materialized. In addition, revenues are expected to be $1.6 billion higher than forecast in the Update, while the projections for program expenses and public debt charges are lower by $1.6 billion and $0.5 billion, respectively.

The budgetary balance over the remainder of the projection period has also improved since the Update, as higher revenues and lower public debt charges are expected to more than offset an increase in projected program expenses.

| 2011–12 | 2012–13 | 2013–14 | 2014–15 | 2015–16 | 2016–17 | |

|---|---|---|---|---|---|---|

| November 2011 Update budgetary balance | -31.0 | -27.4 | -17.0 | -7.5 | -3.4 | 0.5 |

| Revenue effect of adjustment for risk | -3.0 | -4.5 | -3.0 | -1.5 | -1.5 | -1.5 |

| November 2011 Update budgetary balance before adjustment for risk | -28.0 | -22.9 | -14.0 | -6.0 | -1.9 | 2.0 |

| Impact of economic and fiscal developments | ||||||

| Decisions since the November Update | -0.1 | -0.7 | 0.0 | 0.0 | 0.0 | 0.0 |

| Budgetary revenues | 1.6 | 2.1 | 2.0 | 2.2 | 2.3 | 2.3 |

| Budgetary expenses1 | 1.6 | 1.3 | -0.8 | -1.6 | -1.3 | -1.0 |

| Public debt charges1 | 0.5 | 1.0 | 2.1 | 2.1 | 1.6 | 1.6 |

| Total economic and fiscal developments | 3.6 | 3.7 | 3.4 | 2.6 | 2.5 | 2.9 |

| Revenue effect of adjustment for risk | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | |

| Revised status quo budgetary balance (before budget measures) | -24.4 | -22.2 | -13.7 | -6.3 | -2.4 | 1.9 |

| Note: Totals may not add due to rounding. 1 A negative number implies an increase in spending and a deterioration in the budgetary balance. A positive number implies a decrease in spending and an improvement in the budgetary balance. |

||||||

Decisions taken since the November Update include the Government’s commitment to provide transfer protection payments to provinces in 2012–13 to ensure that no province experiences a decline in its combined entitlements under the Canada Health Transfer, Canada Social Transfer and Equalization and additional funding for Atomic Energy of Canada Limited to support its ongoing operations.

Budgetary revenues have been revised upward over the entire projection period from the November Update, primarily reflecting better-than-expected year-to-date results and the improvement in the economic outlook.

Budgetary expenses are projected to be below the level projected in the November Update in 2011–12 and 2012–13, but higher from 2013–14 onward. Lower projected spending in 2011–12 and 2012–13 is a result of lower year-to-date Employment Insurance benefits, lower offshore resource revenue being transferred to the provinces, and lower infrastructure spending as funding is being shifted to future years. Higher projected spending from 2013–14 onward reflects higher elderly and children’s benefits due to higher projected population growth and inflation, as well as the realignment of funding for infrastructure and the reassessment of government liabilities.

The decrease in public debt charges over the forecast horizon reflects a downward revision to projected interest rates, as well as the decrease in debt associated with an improved budgetary balance.

Fiscal Impact of Measures Announced in Budget 2012

Table 6.3 sets out the impact of the measures introduced in this budget.

| 2011– 2012 |

2012– 2013 |

2013– 2014 |

2014– 2015 |

2015– 2016 |

2016– 2017 |

|

|---|---|---|---|---|---|---|

| November 2011 Update budgetary balance | -31.0 | -27.4 | -17.0 | -7.5 | -3.4 | 0.5 |

| Economic and fiscal developments (including decisions since the Update and change to adjustment for risk) | 6.6 | 5.2 | 3.4 | 1.1 | 1.0 | 1.4 |

| Revised status quo budgetary balance (before budget measures) |

-24.4 | -22.2 | -13.7 | -6.3 | -2.4 | 1.9 |

| Budget measures | ||||||

| Revenue measures | ||||||

| Closing tax loopholes | 0.0 | 0.1 | 0.3 | 0.4 | 0.4 | 0.5 |

| Phasing out/eliminating tax preferences | 0.0 | 0.0 | 0.1 | 0.2 | 0.2 | 0.3 |

| Employment Insurance changes | -0.1 | -0.3 | -0.8 | -1.1 | -0.2 | -0.2 |

| Other measures | 0.0 | -0.2 | 0.0 | 0.2 | 0.4 | 0.4 |

| Total revenue measures | -0.1 | -0.4 | -0.4 | -0.2 | 0.9 | 1.1 |

| Expense measures1 | ||||||

| Supporting jobs and growth | 0.0 | -0.8 | -0.9 | -0.8 | -0.6 | -0.6 |

| Reductions in departmental spending | -0.9 | 1.8 | 3.5 | 5.3 | 5.2 | 5.2 |

| Updating defence capital funding | 0.4 | 0.5 | 1.3 | 0.7 | 0.3 | 0.1 |

| Total expense measures | -0.5 | 1.4 | 3.9 | 5.3 | 4.9 | 4.8 |

| Total budget measures | -0.5 | 1.1 | 3.5 | 5.0 | 5.8 | 5.9 |

| Budgetary balance (after budget measures) | -24.9 | -21.1 | -10.2 | -1.3 | 3.4 | 7.8 |

| Note: Totals may not add due to rounding. 1 A negative number implies an increase in spending and a deterioration in the budgetary balance. A positive number implies a decrease in spending and an improvement in the budgetary balance. |

||||||

The new policy measures in this budget have a negative impact on the budgetary balance of $0.5 billion in 2011–12, largely due to the recording of a liability for estimated workforce adjustment costs associated with the departmental spending reductions announced in this budget. For the remainder of the forecast horizon, budget measures have a positive impact on the budgetary balance, rising from $1.1 billion in 2012–13 to $5.9 billion in 2016–17.

Revenue measures announced in this budget will lower revenues by $0.1 billion in 2011–12, by $0.4 billion in 2012–13 and 2013–14, and by $0.2 billion in 2014–15. They will raise revenues by $0.9 billion in 2015–16 and by $1.1 billion in 2016–17. Revenues are raised in all years by actions to close tax loopholes and phase out or eliminate tax preferences. The higher revenues from these actions are more than offset over the 2011–12 to 2014–15 period by the impact of Employment Insurance (EI) measures on EI premium revenues. EI premium revenues are lowered by the extension of the EI Hiring Credit for Small Business and limiting increases in the premium rate to 5 cents per year until the EI Operating Account is balanced.

The budget also announces actions to support jobs and growth. These measures cost a total of $3.6 billion over the next five years. At the same time, the budget will reduce departmental spending by $20.1 billion between 2011–12 and 2016–17 after taking into account workforce adjustment costs, which departments are expected to fund internally. Program expenses are also reduced by the alignment of defence funding with expected requirements. Overall, on a net basis, budget measures will reduce spending by $20.8 billion over 2011–12 and the next five years.

The fiscal projections in Chart 6.4 show that the Government remains on track to eliminate the deficit over the medium term.

The Government is on track to return to balanced budgets over the medium term

Summary of Statement of Transactions

Table 6.4 summarizes the Government’s financial position, including measures announced in this budget.

| Projection | |||||||

|---|---|---|---|---|---|---|---|

| 2010– 2011 |

2011– 2012 |

2012– 2013 |

2013– 2014 |

2014– 2015 |

2015– 2016 |

2016– 2017 |

|

| Budgetary revenues | 237.1 | 248.0 | 255.0 | 270.4 | 285.5 | 300.0 | 312.5 |

| Program expenses | 239.6 | 241.9 | 245.3 | 249.4 | 253.9 | 261.7 | 268.6 |

| Public debt charges | 30.9 | 31.0 | 30.8 | 31.1 | 33.0 | 34.9 | 36.1 |

| Total expenses | 270.5 | 272.9 | 276.1 | 280.6 | 286.9 | 296.6 | 304.7 |

| Budgetary balance | -33.4 | -24.9 | -21.1 | -10.2 | -1.3 | 3.4 | 7.8 |

| Federal debt1 | 550.3 | 581.3 | 602.4 | 612.5 | 613.9 | 610.4 | 602.6 |

| Per cent of GDP | |||||||

| Budgetary revenues | 14.6 | 14.4 | 14.3 | 14.6 | 14.7 | 14.8 | 14.8 |

| Program expenses | 14.7 | 14.1 | 13.8 | 13.4 | 13.1 | 12.9 | 12.7 |

| Public debt charges | 1.9 | 1.8 | 1.7 | 1.7 | 1.7 | 1.7 | 1.7 |

| Budgetary balance | -2.1 | -1.4 | -1.2 | -0.5 | -0.1 | 0.2 | 0.4 |

| Federal debt | 33.9 | 33.8 | 33.9 | 33.0 | 31.6 | 30.1 | 28.5 |

| Note: Totals may not add due to rounding. 1 The projected level of federal debt for 2011–12 includes an estimate of other comprehensive income, as well as estimated transitional adjustments related to enterprise Crown corporations’ adoption of International Financial Reporting Standards. |

|||||||

The numbers in blue italics in Table 6.4 above and in the paragraph below were updated from the print version of the Budget Plan released on March 29, 2012.

As a result of the improved economic outlook and actions taken in this budget to support jobs and growth and to return to balanced budgets over the medium term, the budgetary balance is projected to improve from a $24.9-billion deficit in 2011–12 to a surplus of $7.8 billion in 2016–17. As a percentage of GDP, the budgetary balance is projected to improve from a deficit of 1.4 per cent in 2011–12 to a surplus of 0.4 per cent in 2016–17.

The federal debt-to-GDP ratio (accumulated deficit) stood at 33.9 per cent in 2010–11, less than half of its peak of 68.4 per cent in 1995–96. The debt ratio is projected to fall to 28.5 per cent in 2016–17, in line with its pre-recession level.

Outlook for Budgetary Revenues

| Projection | |||||||

|---|---|---|---|---|---|---|---|

| 2010– 2011 |

2011– 2012 |

2012– 2013 |

2013– 2014 |

2014– 2015 |

2015– 2016 |

2016– 2017 |

|

| Income taxes | |||||||

| Personal income tax | 113.5 | 120.9 | 125.4 | 133.9 | 142.0 | 149.8 | 157.0 |

| Corporate income tax | 30.0 | 32.6 | 32.4 | 34.3 | 36.5 | 37.9 | 39.9 |

| Non-resident income tax | 5.1 | 5.2 | 5.5 | 6.0 | 6.5 | 7.0 | 7.4 |

| Total income tax | 148.6 | 158.6 | 163.3 | 174.2 | 184.9 | 194.7 | 204.3 |

| Excise taxes/duties | |||||||

| Goods and Services Tax | 28.4 | 29.1 | 30.9 | 32.4 | 34.0 | 35.6 | 37.3 |

| Customs import duties | 3.5 | 4.0 | 4.1 | 4.3 | 4.5 | 4.7 | 4.9 |

| Other excise taxes/duties | 11.0 | 10.9 | 10.9 | 10.9 | 11.0 | 10.9 | 10.7 |

| Total excise taxes/duties | 42.9 | 44.1 | 45.9 | 47.6 | 49.5 | 51.2 | 52.9 |

| Total tax revenues | 191.5 | 202.7 | 209.2 | 221.8 | 234.4 | 245.9 | 257.2 |

| Employment Insurance premium revenues | 17.5 | 18.7 | 20.1 | 21.5 | 23.0 | 24.2 | 23.6 |

| Other revenues | 28.1 | 26.6 | 25.7 | 27.0 | 28.2 | 30.0 | 31.6 |

| Total budgetary revenues | 237.1 | 248.0 | 255.0 | 270.4 | 285.5 | 300.0 | 312.5 |

| Per cent of GDP | |||||||

| Personal income tax | 7.0 | 7.0 | 7.1 | 7.2 | 7.3 | 7.4 | 7.4 |

| Corporate income tax | 1.8 | 1.9 | 1.8 | 1.8 | 1.9 | 1.9 | 1.9 |

| Goods and Services Tax | 1.7 | 1.7 | 1.7 | 1.7 | 1.8 | 1.8 | 1.8 |

| Total tax revenues | 11.8 | 11.8 | 11.8 | 11.9 | 12.1 | 12.1 | 12.2 |

| Employment Insurance premium revenues | 1.1 | 1.1 | 1.1 | 1.2 | 1.2 | 1.2 | 1.1 |

| Other revenues | 1.7 | 1.5 | 1.4 | 1.5 | 1.4 | 1.5 | 1.5 |

| Total | 14.6 | 14.4 | 14.3 | 14.6 | 14.7 | 14.8 | 14.8 |

| Note: Totals may not add due to rounding. | |||||||

Table 6.5 sets out the Government’s projection for budgetary revenues reflecting both Budget 2012 measures and the adjustment for risk, which for planning purposes is applied to tax revenues and other revenues. Revenues are expected to increase by 4.6 per cent in 2011–12 based on year-to-date results and the economic projections. Over the remainder of the forecast horizon, revenues are projected to grow at an average annual rate of 4.7 per cent.

Personal income tax revenues—the largest component of budgetary revenues—are projected to increase by $7.4 billion, or 6.5 per cent, to $120.9 billion in 2011–12. Over the remainder of the projection period, personal income tax revenues increase somewhat faster than growth in GDP, averaging 5.4 per cent annual growth, reflecting the progressive nature of the income tax system combined with real income gains.

Corporate income tax revenues are projected to increase by 8.8 per cent to $32.6 billion in 2011–12. Over the remainder of the projection period, corporate income tax revenues are projected to grow at an average annual rate of 4.1 per cent, based on projected profit growth and measures announced in this budget.

Non-resident income tax revenues are projected to grow at an average rate of 6.3 per cent over the forecast horizon, reflecting projected growth in dividend and interest payments.

Goods and Services Tax (GST) revenues are projected to grow by 2.7 per cent in 2011–12 based on projected growth in taxable consumption and year-to-date results. Annual growth in GST revenues is projected to average 5.1 per cent over the remainder of the projection period, in line with growth in taxable consumption.

Customs import duties are projected to increase by $0.5 billion, or 14.9 per cent, in 2011–12, reflecting year-to-date results and lower customs import duties in 2010–11 due to the duty remission framework for certain imported ships announced on October 1, 2010. Over the remainder of the projection period, annual growth in customs import duties is projected to average 4.1 per cent, based on projected growth in imports and the tariff relief for manufacturers announced on November 27, 2011.

Based on year-to-date results, other excise taxes and duties are projected to be $10.9 billion in 2011–12 and remain close to that level over the remainder of the projection period.

EI premium revenues are projected to grow by 6.8 per cent in 2011–12. Based on the economic outlook and measures announced in this budget, including the new EI rate-setting mechanism, it is projected that the annual growth in EI revenues will average 4.8 per cent over the remainder of the forecast horizon and that the EI Operating Account will return to cumulative balance by 2016.

Employment Insurance Operating Account

| 2011– 2012 |

2012– 2013 |

2013– 2014 |

2014– 2015 |

2015– 2016 |

2016– 2017 |

|

|---|---|---|---|---|---|---|

| EI premium revenues | 18.7 | 20.1 | 21.5 | 23.0 | 24.2 | 23.6 |

| EI benefits1 | 17.5 | 18.7 | 19.3 | 19.3 | 19.5 | 19.8 |

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |

| EI Operating Account annual balance2 | -0.6 | -0.3 | 0.3 | 1.9 | 3.2 | 3.4 |

| EI Operating Account cumulative balance2 | -8.5 | -8.8 | -8.4 | -6.6 | -3.4 | 0.0 |

| Reference: | ||||||

| Projected premium rate (per $100 of insurable earnings) | 1.78 | 1.83 | 1.88 | 1.93 | 1.98 | 1.95 |

| Projected premium rate without the changes to the premium rate-setting mechanism announced in this budget (per $100 of insurable earnings) | 1.78 | 1.83 | 1.93 | 2.03 | 2.10 | 2.00 |

| 1 EI benefits include regular EI benefits, sickness, maternity, parental, compassionate care, fishing and work-sharing benefits, and employment benefits and support measures. These represent 90 per cent of total EI program expenses. The remaining EI costs relate mainly to administration and are included in direct program spending. 2 The EI Operating Account annual and cumulative balances are on a calendar-year basis since the EI premium rate is set on a calendar-year basis. |

||||||

In this budget, the Government is taking steps to respond to employers’ and employees’ concerns by ensuring the stability and predictability of EI premiums and limiting increases to 5 cents per year until the EI Operating Account is balanced. Further, the Government is pursuing a number of reforms to the EI program that will provide support for job creation, help unemployed Canadians find work and remove disincentives to work.

The global recession increased total benefit expenditures over a relatively short period of time, resulting in a projected cumulative deficit in the EI Operating Account of $8.5 billion in 2011. Over the next few years, the Canada Employment Insurance Financing Board will continue to set the rate, but the Government will limit rate increases to 5 cents each year until the EI Operating Account is balanced. Under the proposed new EI rate-setting mechanism, the EI Operating Account is projected to return to balance in 2016. To achieve this, the premium rate is projected to increase by 5 cents per year until 2015 to reach $1.98 per $100 of insurable earnings and then decrease to $1.95 in 2016. Without the changes to the premium rate-setting mechanism announced in this budget, the premium rate would have been higher in every year of the forecast horizon. Canada will continue to have one of the lowest payroll contribution rates in the OECD.

Other revenues include those of consolidated Crown corporations, net income from enterprise Crown corporations, foreign exchange revenues, returns on investments and proceeds from the sales of goods and services. Other revenues are projected to fall by $1.5 billion, or 5.4 per cent, to $26.6 billion in 2011–12, as a number of one-time factors which raised

2010–11 revenues are not expected to reoccur in 2011–12. These include lower provisions for credit losses, unrealized gains on derivatives held under the Insured Mortgage Purchase Program, gains realized on the Government’s sale of common shares in General Motors, and foreign exchange gains. Growth in other revenues is expected to average 3.5 per cent per year over the remainder of the projection period.

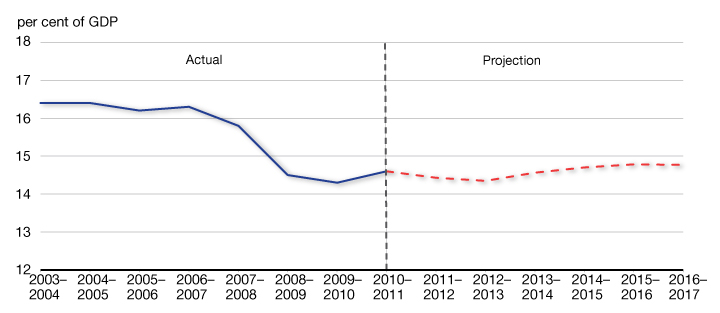

Chart 6.5 shows that the revenue-to-GDP ratio decreased sharply from 16.3 per cent in 2006–07 to 14.3 per cent in 2009–10 due to the impact of the global recession and tax reductions. Revenues as a share of GDP rose to 14.6 per cent in 2010–11. Over the remainder of the forecast period, the revenue-to-GDP ratio is projected to remain relatively stable at that level.

Revenue-to-GDP ratio steady over the projection period

Outlook for Program Expenses

| Projection | |||||||

|---|---|---|---|---|---|---|---|

| 2010– 2011 |

2011– 2012 |

2012– 2013 |

2013– 2014 |

2014– 2015 |

2015– 2016 |

2016– 2017 |

|

| Major transfers to persons | |||||||

| Elderly benefits | 35.6 | 38.1 | 40.4 | 42.6 | 45.0 | 47.5 | 50.1 |

| Employment Insurance (EI) benefits1 | 19.9 | 17.5 | 18.7 | 19.3 | 19.3 | 19.5 | 19.8 |

| Children’s benefits | 12.7 | 12.8 | 13.2 | 13.5 | 13.8 | 14.0 | 14.1 |

| Total | 68.1 | 68.5 | 72.2 | 75.5 | 78.1 | 81.0 | 84.0 |

| Major transfers to other levels of government |

|||||||

| Canada Health Transfer | 25.4 | 27.0 | 28.6 | 30.3 | 32.1 | 34.0 | 36.1 |

| Canada Social Transfer | 11.2 | 11.5 | 11.9 | 12.2 | 12.6 | 13.0 | 13.3 |

| Other health and social transfers2 | 0.6 | 0.2 | 0.3 | 0.3 | |||

| Fiscal arrangements3 | 16.4 | 16.9 | 17.8 | 18.7 | 19.5 | 20.3 | 21.1 |

| Canada’s cities and communities | 1.8 | 2.3 | 2.0 | 2.0 | 2.0 | 2.0 | 2.0 |

| Other transfers4 | 0.7 | 2.3 | 1.1 | 0.4 | 0.3 | 0.3 | 0.2 |

| Alternative Payments for Standing Programs | -3.1 | -3.2 | -3.4 | -3.6 | -3.8 | -4.0 | -4.2 |

| Total | 53.0 | 56.9 | 58.4 | 60.3 | 62.8 | 65.6 | 68.5 |

| Direct program expenses | |||||||

| Operating expenses subject to freeze | 54.7 | 54.9 | 53.6 | 53.3 | 53.3 | 54.8 | 55.6 |

| Other operating expenses | 22.5 | 22.7 | 23.2 | 23.2 | 23.4 | 24.4 | 24.4 |

| Transfer payments | 36.8 | 34.0 | 32.5 | 31.6 | 30.4 | 30.0 | 29.8 |

| Capital amortization | 4.4 | 4.9 | 5.3 | 5.5 | 5.8 | 6.0 | 6.1 |

| Total | 118.5 | 116.5 | 114.7 | 113.7 | 113.0 | 115.1 | 116.1 |

| Total program expenses | 239.6 | 241.9 | 245.3 | 249.4 | 253.9 | 261.7 | 268.6 |

| Major transfers to persons | 4.2 | 4.0 | 4.1 | 4.1 | 4.0 | 4.0 | 4.0 |

| Major transfers to other levels of government | 3.3 | 3.3 | 3.3 | 3.2 | 3.2 | 3.2 | 3.2 |

| Direct program expenses | 7.3 | 6.8 | 6.5 | 6.1 | 5.8 | 5.7 | 5.5 |

| Total program expenses | 14.7 | 14.1 | 13.8 | 13.4 | 13.1 | 12.9 | 12.7 |

| Note: Totals may not add due to rounding. 1 EI benefits include regular EI benefits, sickness, maternity, parental, compassionate care, fishing and work-sharing benefits, and employment benefits and support measures. These represent 90 per cent of total EI program expenses. The remaining EI costs relate mainly to administration and are included in direct program spending. 2 Other health and social transfers include the Wait Time Reduction Transfer and other health-related transfers. 3 Fiscal arrangements include Equalization, Territorial Formula Financing, the Youth Allowances Recovery and statutory subsidies. 4 Other major transfers to other levels of government include transitional payments; transfer protection payments in 2010–11, 2011–12 and 2012–13; payments under the 2005 Offshore Accords; the recognition of repayment by British Columbia of the transitional assistance it received from the Government of Canada for sales tax harmonization; and a provision in 2011–12 in support of the Memorandum of Agreement between the Government of Canada and the Government of Quebec regarding sales tax harmonization. |

|||||||

Table 6.6 provides an overview of the projections for program expenses by major component, including the measures announced in this budget. Program expenses consist of major transfers to persons, major transfers to other levels of government and direct program expenses.

Major transfers to persons consist of elderly, EI and children’s benefits.

Elderly benefits are comprised of Old Age Security, Guaranteed Income Supplement and Spousal Allowance payments to qualifying seniors, with Old Age Security payments representing approximately 80 per cent of these expenditures. Elderly benefits are projected to grow from $38.1 billion to $50.1 billion over the planning period, or approximately 5.6 per cent per year—significantly faster than nominal GDP, which averages 4.4 per cent growth per year. This increase is due to consumer price inflation, to which benefits are fully indexed, and a projected increase in the seniors’ population from 4.8 million to 6.0 million over the planning period, or an average increase of 3.6 per cent per year.

EI benefits are projected to decrease by 11.6 per cent to $17.5 billion in 2011–12, based in large part on year-to-date results. EI benefits are projected to grow modestly over the remainder of the planning period, averaging 2.4 per cent per year, as the fiscal cost of new measures and higher average weekly benefits are offset by lower projected unemployment rates.

Children’s benefits, including the Canada Child Tax Benefit and the Universal Child Care Benefit, are projected to increase moderately over the forecast horizon, reflecting population growth and adjustments for inflation.

Major transfers to other levels of government include transfers in support of health and social programs, Equalization and Territorial Formula Financing. Legislation will be introduced to ensure the current 6-per-cent annual escalator for the Canada Health Transfer (CHT) will continue for five more years. Starting in 2017–18, the CHT will grow in line with a three-year moving average of nominal GDP growth, with funding guaranteed to increase by at least 3 per cent per year. The Government will introduce legislation to continue the 3-per-cent escalator for the Canada Social Transfer for 2014–15 and subsequent years.

Other major transfers to other levels of government in 2011–12 include recognition of the repayment by British Columbia of the transitional assistance it received from the Government of Canada for sales tax harmonization, as well as a provision in support of the Memorandum of Agreement between the Government of Canada and the Government of Quebec regarding sales tax harmonization. Additionally, other major transfers to other levels of government include total transfer protection payments to provinces in 2010–11, 2011–12 and 2012–13.

Direct program expenses include operating expenses of National Defence and other departments, expenses of Crown Corporations, transfers administered by departments for farm income support, natural resource royalties paid to provinces, and student financial assistance.

Some of these expenses are subject to the operating freeze announced in Budget 2010. These include the wages and salaries of federal employees, professional services contracts, telecommunications, leases, utilities (heat and hydro), materials and supplies. These expenses are projected to decline from 2011–12 to 2013–14 due to the cost containment measures introduced in previous budgets and reductions to departmental spending announced in this budget.

Other operating expenses include costs for employee pensions and other benefits, non-wage expenses of National Defence and amounts for items such as the allowance for bad debt. The projections for this expense item reflect the reallocation of resources to better align funding that will support the Canada First Defence Strategy. They also reflect departmental spending reductions announced in this budget.

Transfers are projected to decline over the projection period, reflecting the wind-down of the stimulus phase of Canada’s Economic Action Plan, a reduction in activity under the Building Canada Fund and departmental spending reductions announced in this budget.

Amounts for capital expenses are presented on an accrual basis. The amount of capital amortization is expected to increase over the next five years as a result of new investments and upgrades to existing capital.

| 2010– 2011 |

2011– 2012 |

2012– 2013 |

2013– 2014 |

2014– 2015 |

2015– 2016 |

2016– 2017 |

Total | |

|---|---|---|---|---|---|---|---|---|

| Budget 2010 | ||||||||

| Spending restraint | 452 | 1,586 | 3,481 | 4,425 | 5,130 | 5,130 | 5,130 | 25,334 |

| Tax fairness—closing tax loopholes | 355 | 440 | 500 | 565 | 625 | 625 | 625 | 3,735 |

| Total for Budget 2010 | 807 | 2,026 | 3,981 | 4,990 | 5,755 | 5,755 | 5,755 | 29,069 |

| Budget 2011 | ||||||||

| Spending restraint | 194 | 271 | 569 | 525 | 534 | 534 | 2,627 | |

| Tax fairness—closing tax loopholes | 240 | 730 | 1,095 | 1,040 | 990 | 990 | 5,085 | |

| Total for Budget 2011 | 434 | 1,001 | 1,664 | 1,565 | 1,524 | 1,524 | 7,712 | |

| Budget 2012 | ||||||||

| Reductions in departmental spending | -900 | 1,762 | 3,481 | 5,332 | 5,175 | 5,219 | 20,069 | |

| Tax fairness—closing tax loopholes | 120 | 320 | 415 | 440 | 490 | 1,785 | ||

| Total for Budget 2012 | -900 | 1,882 | 3,801 | 5,747 | 5,615 | 5,709 | 21,854 | |

| Total savings | 807 | 1,560 | 6,864 | 10,455 | 13,067 | 12,894 | 12,988 | 58,635 |

| Note: Totals may not add due to rounding. | ||||||||

Chart 6.6 shows program expenses as a share of GDP. The stimulus phase of Canada’s Economic Action Plan, which strengthened Canada’s economy and supported Canadians during the global recession, resulted in a temporary increase in the program expenses-to-GDP ratio. However, as a result of the targeted savings measures announced since Budget 2010, program expenses as a share of GDP decline in all years of the forecast horizon. As a share of GDP, program expenses are projected to decline from 14.7 per cent in 2010–11 to 12.7 per cent in 2016–17, which represents a return to pre-recession spending ratios.

Program expenses-to-GDP ratio to return to its pre-recession level

Financial Source/Requirement

The budgetary balance is presented on a full accrual basis of accounting, recording government liabilities and assets when they are incurred or acquired, regardless of when the cash is paid or received.

In contrast, the financial source/requirement measures the difference between cash coming in to the Government and cash going out. This measure is affected not only by the budgetary balance but also by the Government’s non-budgetary transactions. These include changes in federal employee pension accounts; changes in non-financial assets; investing activities through loans, investments and advances; changes in other financial assets and liabilities; and foreign exchange activities.

| Projection | |||||||

|---|---|---|---|---|---|---|---|

| 2010– 2011 |

2011– 2012 |

2012– 2013 |

2013– 2014 |

2014– 2015 |

2015– 2016 |

2016– 2017 |

|

| Budgetary balance | -33.4 | -24.9 | -21.1 | -10.2 | -1.3 | 3.4 | 7.8 |

| Non-budgetary transactions | |||||||

| Pensions and other accounts | 7.0 | 4.8 | 6.2 | 5.3 | 4.0 | 2.9 | 2.9 |

| Non-financial assets | -3.2 | -2.3 | -1.0 | -1.1 | -0.7 | -0.5 | -0.3 |

| Loans, investments and advances | |||||||

| Enterprise Crown corporations | -9.2 | -4.5 | -4.3 | -4.7 | -4.3 | -5.6 | -4.3 |

| Insured Mortgage Purchase Program | 5.2 | 3.4 | 2.4 | 41.9 | 10.6 | 0.0 | 0.0 |

| Other | 0.3 | 1.2 | -0.4 | -0.3 | -0.3 | -0.2 | -0.2 |

| Total | -3.7 | 0.1 | -2.2 | 36.8 | 5.9 | -5.9 | -4.5 |

| Other transactions | -12.9 | -7.7 | -5.2 | -0.6 | 1.2 | 1.4 | 1.2 |

| Total | -12.8 | -5.1 | -2.2 | 40.4 | 10.4 | -2.1 | -0.7 |

| Financial source/requirement | -46.2 | -30.0 | -23.3 | 30.2 | 9.1 | 1.3 | 7.1 |

| Note: Totals may not add due to rounding. | |||||||

As shown in Table 6.8, significant financial requirements are projected in 2011–12 and 2012–13 ($30.0 billion in 2011–12 and $23.3 billion in

2012–13), followed by financial sources of $30.2 billion in 2013–14, $9.1 billion in 2014–15, $1.3 billion in 2015–16 and $7.1 billion in 2016–17. The requirements in 2011–12 and 2012–13 mainly reflect the budgetary balance, whereas the financial sources expected over the 2013–14 to 2016–17 period mainly reflect the improvement of the budgetary balance and the repayment of principal on assets maturing under the Insured Mortgage Purchase Program.

The financial source associated with pensions and other accounts is expected to be $6.2 billion in 2012–13. Pensions and other accounts include the activities of the Government of Canada’s employee superannuation plans, as well as those of federally appointed judges and Members of Parliament. Since April 2000, the net amount of contributions less benefit payments related to post-March 2000 service has been invested in capital markets. Contributions and payments pertaining to pre-April 2000 service are recorded in the pension accounts. The Government also sponsors a variety of future benefit plans, such as health care and dental plans and disability and other benefits for war veterans and others.

Financial requirements for non-financial assets mainly reflect the difference between cash outlays for the acquisition of new tangible capital assets and the amortization of capital assets that are included in the budgetary balance. They also include the proceeds from the net losses or gains of tangible capital assets, losses on the disposal of tangible capital assets, the change in inventories, and prepaid expenses. A net cash requirement of $1.0 billion is estimated for 2012–13.

Loans, investments and advances include the Government’s investments in enterprise Crown corporations, such as Canada Mortgage and Housing Corporation (CMHC), Canada Post Corporation, Export Development Canada and the Business Development Bank of Canada (BDC). They also include loans, investments and advances to national and provincial governments and international organizations, and for government programs. The requirements for enterprise Crown corporations projected from

2011–12 to 2016–17 reflect the Government’s decision in Budget 2007 to meet all the borrowing needs of CMHC, BDC and Farm Credit Canada through its own domestic debt issuance. The financial source in the projection period under the Insured Mortgage Purchase Program is due to the winding down in March 2010 of purchases of insured mortgage pools under the plan and the subsequent repayments of principal as the assets under the plan mature.

Other transactions include the payment of tax refunds and other accounts payable, the collection of taxes and other accounts receivable, the conversion of other accrual adjustments included in the budgetary balance into cash, as well as foreign exchange activities. A portion of the $5.2-billion net cash requirement in 2012–13 reflects borrowings to improve prudential liquidity management, announced as part of the prudential liquidity plan in Budget 2011.

Risks to the Fiscal Projections

Risks to the economic outlook are the greatest source of uncertainty to the fiscal projections. Private sector economists consider global economic uncertainty as the principal economic risk—in particular the potential for wider contagion of the sovereign debt and banking crisis in Europe. To help illustrate how the fiscal outlook could be affected by changes in the economic outlook, tables illustrating the sensitivity of the budgetary balance to a number of economic shocks are provided below.

Beyond the economic outlook, there remain upside and downside risks associated with the fiscal projections, as several key drivers of the fiscal outlook are not directly linked to economic variables (such as the relationship between personal income taxes and personal income or the extent to which departments and agencies do not fully use all of the resources appropriated by Parliament).

Sensitivity of the Budgetary Balance to Economic Shocks

Changes in economic assumptions affect the projections for revenues and expenses. The following tables illustrate the sensitivity of the budgetary balance to a number of economic shocks:

- A one-year, 1-percentage-point decrease in real GDP growth driven equally by lower productivity and employment growth.

- A decrease in nominal GDP growth resulting solely from a one-year, 1-percentage-point decrease in the rate of GDP inflation.

- A sustained 100-basis-point increase in all interest rates.

These sensitivities are generalized rules of thumb that assume any decrease in economic activity is proportional across income and expenditure components.

| Year 1 | Year 2 | Year 5 | |

|---|---|---|---|

| Federal revenues | |||

| Tax revenues | |||

| Personal income tax | -1.8 | -1.9 | -2.2 |

| Corporate income tax | -0.4 | -0.4 | -0.4 |

| Goods and Services Tax | -0.3 | -0.3 | -0.4 |

| Other | -0.2 | -0.2 | -0.3 |

| Total tax revenues | -2.7 | -2.9 | -3.3 |

| Employment Insurance premium revenues | -0.1 | -0.1 | 1.0 |

| Other revenues | 0.0 | 0.0 | 0.0 |

| Total budgetary revenues | -2.9 | -3.0 | -2.3 |

| Federal expenses | |||

| Major transfers to persons | |||

| Elderly benefits | 0.0 | 0.0 | 0.0 |

| Employment Insurance benefits | 0.8 | 0.9 | 0.9 |

| Children’s benefits | 0.0 | 0.0 | 0.0 |

| Total | 0.8 | 0.9 | 0.9 |

| Other program expenses | -0.1 | 0.0 | -0.3 |

| Public debt charges | 0.0 | 0.1 | 0.4 |

| Total expenses | 0.7 | 0.9 | 1.0 |

| Budgetary balance | -3.6 | -3.9 | -3.4 |

| Note: Totals may not add due to rounding. | |||

A 1-percentage-point decrease in real GDP growth reduces the budgetary balance by $3.6 billion in the first year, $3.9 billion in the second year and $3.4 billion in the fifth year (Table 6.9).

- Tax revenues from all sources fall by a total of $2.7 billion in the first year and by $2.9 billion in the second year. Personal income tax revenues decrease as employment and wages and salaries fall. Corporate income tax revenues fall as output and profits decrease. GST revenues decrease as a result of lower consumer spending associated with the fall in employment and personal income.

- EI premium revenues decrease in the early years as employment and wages and salaries fall before increasing in Year 5, when the premium rate is raised to recoup the cost of higher benefit payments and return the EI Operating Account to balance. This also reflects the rate-setting mechanism announced in this budget.

- Expenses rise, mainly reflecting higher EI benefits (due to an increase in the number of unemployed) and higher public debt charges (reflecting a higher stock of debt due to the lower budgetary balance).

| Year 1 | Year 2 | Year 5 | |

|---|---|---|---|

| Federal revenues | |||

| Tax revenues | |||

| Personal income tax | -1.8 | -1.4 | -1.5 |

| Corporate income tax | -0.4 | -0.4 | -0.4 |

| Goods and Services Tax | -0.3 | -0.3 | -0.4 |

| Other | -0.2 | -0.2 | -0.3 |

| Total tax revenues | -2.7 | -2.4 | -2.6 |

| Employment Insurance premium revenues | -0.2 | -0.3 | 0.4 |

| Other revenues | -0.1 | -0.1 | -0.1 |

| Total budgetary revenues | -3.0 | -2.8 | -2.3 |

| Federal expenses | |||

| Major transfers to persons | |||

| Elderly benefits | -0.2 | -0.4 | -0.5 |

| Employment Insurance benefits | -0.1 | -0.1 | -0.2 |

| Children’s benefits | -0.1 | -0.1 | -0.1 |

| Total | -0.5 | -0.7 | -0.8 |

| Other program expenses | -0.4 | -0.4 | -0.8 |

| Public debt charges | -0.4 | 0.0 | 0.2 |

| Total expenses | -1.2 | -1.0 | -1.4 |

| Budgetary balance | -1.8 | -1.8 | -0.9 |

| Note: Totals may not add due to rounding. | |||

A 1-percentage-point decrease in nominal GDP growth resulting solely from lower GDP inflation (assuming that the Consumer Price Index moves in line with GDP inflation) lowers the budgetary balance by $1.8 billion in the first year, $1.8 billion in the second year and $0.9 billion in the fifth year (Table 6.10).

- Lower prices result in lower nominal income and, as a result, personal income tax, corporate income tax and GST revenues all decrease, reflecting declines in the underlying nominal tax bases. For the other sources of tax revenue, the negative impacts are similar under the real and nominal GDP shocks.

- EI premium revenues decrease marginally in the early years in response to lower earnings, but are higher in Year 5, consistent with the principle of breaking even over time and the new rate-setting mechanism announced in this budget, the EI premium rate adjusts to return the EI Operating Account to balance. Unlike the real GDP shock, EI benefits do not rise since unemployment is unaffected by price changes.

- Partly offsetting lower revenues are the declines in the cost of statutory programs that are indexed to inflation, such as elderly benefit payments and the Canada Child Tax Benefit, as well as declines in federal wage and non-wage expenses that are indirectly linked to inflation. Payments under these programs are smaller if inflation is lower. Public debt charges decline in the first year due to lower costs associated with Real Return Bonds, then rise due to the higher stock of debt.

| Year 1 | Year 2 | Year 5 | |

|---|---|---|---|

| Federal revenues | 1.1 | 1.5 | 2.0 |

| Federal expenses | 1.7 | 2.8 | 3.9 |

| Budgetary balance | -0.6 | -1.3 | -1.9 |

An increase in interest rates decreases the budgetary balance by $0.6 billion in the first year, $1.3 billion in the second year and $1.9 billion in the fifth year (Table 6.11). The decline stems entirely from increased expenses associated with public debt charges. The impact on debt charges rises through time as longer-term debt matures and is refinanced at higher rates. Moderating the