Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Ottawa, March 29, 2012

Backgrounder: Withdrawing the Penny from Circulation

1. Introduction

The Government of Canada has announced its intention to withdraw the Canadian penny from circulation due to its low purchasing power, its rising cost of production relative to face value, the increased accumulation of pennies by Canadians in their households, environmental considerations, and the significant handling costs the penny imposes on retailers, financial institutions, and the economy more generally. The penny will retain its value indefinitely and can continue to be used in payments. However, as pennies are gradually withdrawn from circulation, price rounding on cash transactions will be required. In removing its lowest-denomination coin, Canada will follow on the successful experiences of many other countries.

Summary of Initiative

The Royal Canadian Mint (the Mint) will cease distribution of pennies to financial institutions effective fall 2012. The cent will continue to be Canada's smallest unit of currency for pricing goods and services, and pennies may continue to be used in cash transactions to make exact payment or change after the fall of 2012.

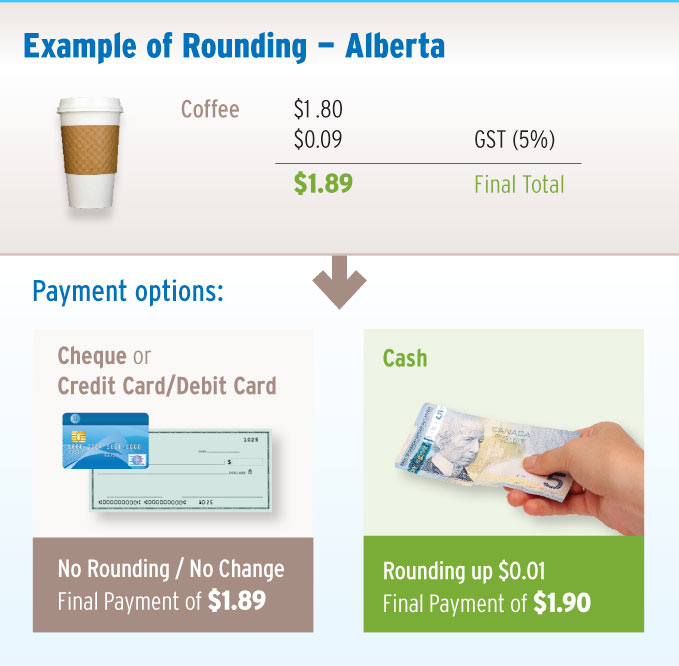

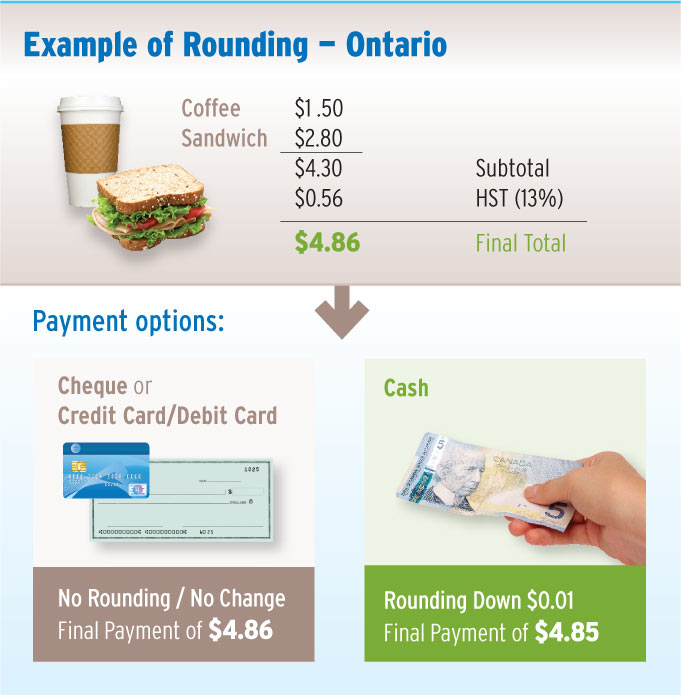

Where pennies are not available, cash transactions should generally be rounded up or down to the nearest five-cent increment in a fair and transparent manner, after calculation of Goods and Services Tax (GST)/Harmonized Sales Tax (HST), where applicable.

Non-cash payments, such as cheques, credit cards and debit cards, will continue to be settled to the nearest cent.

After the Mint ceases distribution in the fall of 2012, businesses will be asked to return pennies through their financial institutions to the Mint for melting and recycling of the metal content. The Government will work closely with financial institutions to coordinate this penny redemption program. Charities are welcome to take advantage of the penny's withdrawal to increase their fundraising through penny drives.

2. Why Withdraw the Penny?

Due to inflation, the penny's purchasing power has eroded over the years. Today it retains only about one-twentieth of its original purchasing power. Given its declining purchasing value, some Canadians consider the penny more of a nuisance than a useful coin. We often store them in jars, throw them away in water fountains, or refuse them as change. Retailers often provide a "take a penny, leave a penny" dish or a charitable collection box at the cash register to reduce the handling of pennies. Financial institutions face increasing costs for handling, storing and transporting pennies. Over time, the penny's burden to the economy has grown relative to its value as a means of payment.

In 2010, the Senate Committee on National Finance undertook a broad consultation on the penny. In its final report, The Costs and Benefits of Canada's One-Cent Coin to Canadian Taxpayers and the Overall Canadian Economy, the Committee recommended the removal of the penny and the introduction of a voluntary rounding regime.

Savings to Taxpayers with the Withdrawal of the Penny

The Government uses taxpayers' money to pay for the costs of producing and distributing circulation coinage. Generally, the Government earns more from the sale of coins at face value than it pays to the Mint for their production. In 2010–11, the Government paid the Mint $120 million for coins and earned $131 million on the subsequent sale of these coins to financial institutions at face value.

However, in contrast to other coin denominations, the Government loses money on every new penny produced by the Mint. The cost to produce a new penny exceeds its face value by about 0.6 cents, so the estimated cost to the Government of supplying pennies to the economy is about $11 million per year.

Withdrawing pennies from circulation is expected to increase slightly the demand for higher-denomination coins such as the nickel, dime and quarter. While such a shift in demand is difficult to estimate, this would increase net coinage revenues as these coins are worth more than they cost to produce.

Other Economic Impacts

Withdrawing the penny will bring economic and financial savings to financial institutions, retailers and consumers. A private sector study estimated that the economic costs of maintaining the penny, including direct production costs and indirect costs to financial institutions, retailers and consumers, amounted to $150 million in 2006.[1]

Environmental Benefits

Over the past five years, some 7,000 tonnes of pennies were produced and distributed annually from the Mint's plant in Winnipeg to the rest of the country.

Ceasing production of the penny and withdrawing existing pennies from circulation will have significant environmental benefits. First, it will reduce the annual use of base metals by the Mint in the production process. Second, metals from existing pennies will be recycled for use in other products. Finally, ceasing the production of pennies will save energy that is currently used in the production, transportation and distribution of pennies.

3. Impact on Canadians

What It Will Mean for Consumers

Canadians will be able to easily adapt to the elimination of the penny.

Pennies that are still in circulation or are held by Canadians will retain their value, and consumers can continue to use them indefinitely to make payments. Canadians can also redeem rolled pennies at their financial institutions. Canadians who have saved a substantial amount of pennies over the years can also consider donating these to charities.

The cent will remain the basic unit for all payments. Price rounding will only affect cash transactions (i.e., using coins and bank notes). Non-cash payments such as cheques, credit and debit cards will continue to be settled to the cent.

Price rounding will only be used for cash transactions after the calculation of the GST/HST. There should be no net gains or losses for either consumers or retailers. A 2005 Bank of Canada study[2] concluded that the inflationary effect of eliminating the penny would be small or non-existent.

What It Will Mean for Businesses

As the penny will continue to remain the basic unit in the Canadian currency system, retailers and other businesses can continue to price goods and services in one-cent increments and there will be no need to reprogram cash registers.

When settling transactions in cash where pennies are not available, businesses are expected to round prices in a fair, consistent, and transparent manner.

The calculation of the GST or HST on purchases, whether for cash or non-cash transactions, will continue to be calculated to the penny and added to the price. It is only the total cash payment for the transaction that will be rounded. If businesses round cash transactions to the nearest five-cent increment, any gains or losses relating to cash transactions (a maximum of two cents per transaction) will balance out over time.

What It Will Mean for Financial Institutions

Given the large volume and weight of pennies, the handling, storage and transportation of these coins are costly for financial institutions. The Desjardins Group estimated that in 2006 Canadian financial institutions together handled more than nine billion pennies per year, which translated into an annual cost of at least $20 million.[3] Following the elimination of the penny, they will realize significant cost savings in no longer handling pennies.

How Charitable Organizations Can Benefit

The redemption of pennies presents a fundraising opportunity for charities. As noted in the Desjardins Group study, Canadians could be hoarding several billion pennies, along with other coins.

Experience elsewhere has shown that charities can benefit by getting involved in the process of withdrawing low-denomination coins from circulation. In New Zealand, when the five-cent coin was removed from circulation, non-profit organizations ran successful fundraising campaigns. During the changeover to the euro in 2002, charities in many eurozone countries successfully encouraged people to donate their local-currency coins.

The Government of Canada and the Mint will work in collaboration with Imagine Canada to reach out to institutions and charitable organizations who may wish to organize fundraising activities around the elimination of the penny.

4. Experience of Other Countries

Many countries have removed their lowest-denomination coins from circulation as they became less used for transactions and more costly to produce (see Box 4). For example, New Zealand stopped issuing its one-cent and two-cent coins in 1989. After the production ceased, while some retailers chose the symmetric rounding system, some larger retail chains opted to consistently round down the final price on cash transactions.

Overall, New Zealand's removal of one-cent and two-cent coins was very successful. Consistent with a recent Bank of Canada study,[4] there was no noticeable effect on inflation and it was widely accepted by the public. Charities benefited from the withdrawal of the coins.

Countries That Have Ceased to Produce or Removed Low-Denomination Coins

Australia: removed its one-cent and two-cent coins from circulation in 1992.

Brazil: stopped issuing one-real coins in 2005.

Finland: does not issue one-cent and two-cent euro coins since the euro was introduced in 2002.

Israel: stopped issuing the one-agora coin in 1991 and the five-agorot coin in 2008.

Netherlands: stopped issuing one-cent and two-cent euro coins in 2004.

New Zealand: removed its one-cent and two-cent coins from circulation in 1989 and its five-cent coin in 2006.

Norway: removed its one-øre and two-øre coins in 1972; by 1991, it had also removed its five, ten and twenty-five øre coins.

Sweden: removed its one-öre and two-öre coins in 1971; by 1992, it had also removed its five, ten and twenty-five öre coins. In 2009, it repealed the fifty-öre coins from circulation.

Switzerland: officially withdrew its one-centime coin from circulation in 2006, while the two-centime coin lost its legal tender status in 1978.

United Kingdom: removed the legal tender status of the half-penny in 1984.

5. Public Comment

The Government welcomes public comment.

Public comments should be e-mailed to 1cent@fin.gc.ca, or mailed to the address below by May 31, 2012. In your submission, please provide:

- Your full name.

- The name of the organization for which you speak, if applicable.

- Your full mailing address, including postal code.

- Your telephone number, including area code.

- Your e-mail address and fax number, if applicable.

You should indicate by which method you would prefer to be contacted and also state whether any communication with you should be in French or English.

Please address your comments to:

Department of Finance

L'Esplanade Laurier

20th Floor, East Tower

140 O'Connor Street

Ottawa, Ontario

Canada

K1A 0G5

[1] Id. at 2.

[2] Id. at 1.

[3] Aubry, J.-P., F. Dupuis, and H. Vachon 2008. "100th Anniversary of the Canadian Penny," Desjardins Economic Studies, April 9, 2008.

[4] Lauer, B., K. McPhail, and M. Urwin. 2005. "Would Elimination of the Penny be Inflationary?" Bank of Canada