Chapter 2 - Results for Middle Class Canadians

Introduction

Canadians across the country are seeing the results of investments in people and communities in real and tangible ways. From the over 450,000 jobs created since 2015, to a more secure retirement for millions of seniors and workers, to a reduction in the small business tax rate to 9 per cent, to the nine out of 10 families who have more money in their pockets as a result of the Canada Child Benefit, this chapter highlights important accomplishments made over the last two years—and the progress made on an ambitious plan for the middle class and those working hard to join it.

- Canada now the fastest growing economy in the G7

- Over 450,000 jobs created since 2015, and unemployment rate at lowest level since 2008

- Lowest youth unemployment rate on record at 10.3 per cent

- Labour market participation of working-age women

at an all-time high

- Nine out of 10 Canadian families are receiving more money with the new Canada Child Benefit

- Employment Insurance benefits have improved to support unemployed and underemployed Canadians and families

- Canada Pension Plan maximum retirement benefit will increase by about 50 per cent for workers today and for the next generation

- Restored the eligibility age for Old Age Security and Guaranteed Income Supplement benefits to 65, putting thousands of dollars back in the pockets of Canadians as they become seniors

- Increased Guaranteed Income Supplement payments of up to $947 per year are helping nearly 900,000 low-income seniors, of which 70 per cent are women

- Eligible veterans are now receiving 90 per cent of their pre-release salary and will soon qualify for up to $80,000 in financial support to pursue education and training after release

- Over $11 billion in new investments, working towards a new fiscal relationship

- Over 50 new Self Determination Tables have been established to date to advance Indigenous rights, needs and interests

- Since November 2015, 26 long-term drinking water advisories have been lifted

- Lower taxes for middle class Canadians and small business

- A tax system better targeted to promote fairness, investment and growth

- Investments in the Canada Revenue Agency to better enforce the rules so that everyone pays their fair share

- Up to $1,000 more per year for low- and middle-income post-secondary students through Canada Student Grants

- A bold and inclusive Innovation and Skills Plan that builds on Canada's strengths

- Historically high levels of immigration and a Global Skills Strategy will ensure that Canada attracts top talent and investment from around the world

- Long-term infrastructure investments will strengthen communities and support sustainable economic growth by helping move goods and people more easily, and by creating jobs for today and tomorrow

- Pan-Canadian Framework on Clean Growth and Climate Change adopted on December 9, 2016

Opportunities for the Middle Class

The Government's plan for the middle class is creating jobs, improving lives, strengthening communities and growing the economy.

Supporting Children and Families

In the first year of its mandate, the Government acted on two of its cornerstone commitments:

- Middle class tax cut for 9 million Canadians: Single Canadians who benefit are saving an average of $330 each year, and couples who benefit are saving an average of $540 each year. The Government raised taxes on the wealthiest one per cent in order to give the middle class a break.

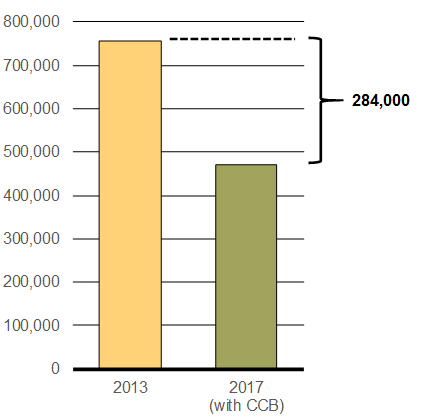

- Canada Child Benefit (CCB): Compared to the previous system of child benefits, the CCB is simpler, more generous and better targeted to those who need it most. During the first benefit year, over 3.3 million families received more than $23 billion in CCB payments, and the nine out of 10 families who are better off under the CCB received on average almost $2,300 more in benefits, tax-free. The CCB has helped lift hundreds of thousands of children out of poverty.

The net result of these two measures has been more money in the pockets of middle class people and their families, contributing significantly to economic growth, creating jobs and bringing renewed confidence for the future for millions of Canadians.

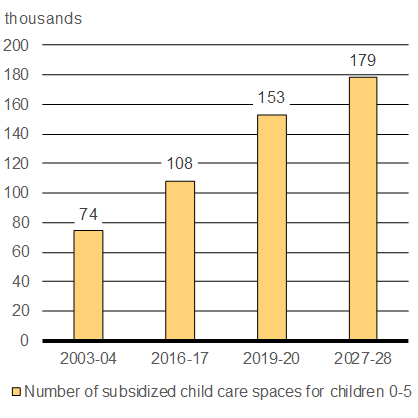

To further help families, in June 2017, federal-provincial-territorial Ministers Responsible for Early Learning and Child Care announced a new agreement on a Multilateral Early Learning and Child Care Framework to make enhancements to provincial and territorial early learning and child care systems. Governments have committed to increase the quality, accessibility, affordability, flexibility and inclusivity in early learning and child care, with consideration for families that need it most. To implement this initiative, the Government of Canada is providing $7.5 billion over 11 years to support and create more high-quality, affordable child care across the country, and is working with provinces and territories to enter into three-year bilateral agreements that will outline their unique early learning and child care needs and the funding allocation for each jurisdiction.

Source: 2013 data from Statistics Canada’s Canadian Income Survey, 2013 edition, based on after-tax low-income cut-offs. 2017 data is an Employment and Social Development Canada projection.

A distinction-based Indigenous Early Learning and Child Care Framework will be developed between partners that will reflect the unique cultural needs of First Nations, Inuit and Métis children across Canada.

A Stronger, More Inclusive Canada

The Government is taking steps to ensure that all Canadians have a real and fair chance at success, and can benefit from a growing economy. This includes making sure all Canadians can look forward to a secure and dignified retirement, fulfilling Canada's solemn promise to our veterans and ensuring that the most vulnerable in our society have a safe place to call home.

- Seniors are more financially secure today, as a result of increases to the maximum Guaranteed Income Supplement top-up benefit—more than doubling top-up benefits for our most vulnerable single seniors.

How Low- Income Single Seniors Benefit

Lynn is a 74-year-old resident of Montréal, Quebec, who lives alone. With no income apart from Old Age Security and Guaranteed Income Supplement benefits, she struggles to make ends meet. The increase in the Guaranteed Income Supplement top-up benefit for single seniors introduced in Budget 2016 provides Lynn with an additional $947 per year.

Charles is a 68-year-old widower residing in Edmonton, Alberta. Charles receives annual Canada Pension Plan benefits of $5,000 along with Old Age Security and Guaranteed Income Supplement benefits. The increase in the Guaranteed Income Supplement top-up benefit for single seniors introduced in Budget 2016 provides Charles with an additional annual benefit of $848 per year.

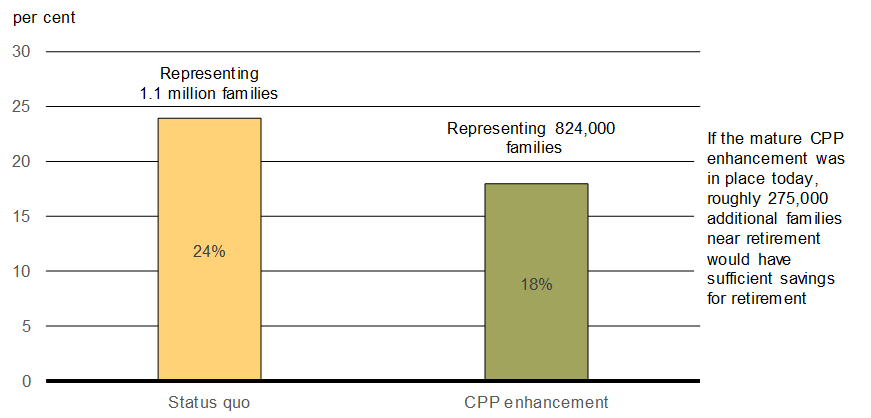

- Future retirees have more peace of mind—as enhancements to the Canada Pension Plan will increase the maximum retirement benefit by about 50 per cent for workers today and for the next generation.

Note: Figures represent the share of families near retirement at risk of not saving adequately (when considering income from the three pillars of the retirement income system and savings from other financial assets) if the CPP enhancement had been in place throughout their working lives. The number of families under-saving is calculated by applying the share of families under-saving to the number of economic families in 2016 with a major income earner age 45-59. The number of families represents families from all provinces.

Source: Department of Finance Canada.

- Veterans who qualify for disability benefits are now receiving 90 per cent of their pre-release salary as well as more compensation for their pain and suffering. Starting in April 2018, eligible veterans will begin receiving up to $80,000 to go to college, university or a technical school after they complete their service. Further measures will increase financial support for caregivers and expand access to Military Family Resource Centres for the families of veterans living with mental and physical health issues as a result of their service. The total investment in improved veterans' benefits and services exceeds $6.7 billion over seven years. The Government will continue to work with the veterans' community to examine the best way to streamline and simplify the system of financial support programs currently offered to veterans. In addition, the Government will be moving forward with its commitment to re-establish lifelong pensions as an option for ill and injured veterans. Details are expected to be announced in advance of Budget 2018.

David is a 32-year-old Canadian Armed Forces member who will be released in the summer of 2018 after 12 years of service in the Regular Force as an ammunition technician. He is planning on going back to school full-time for a three-year college course to become a civil engineering technician. He will receive an education benefit of $20,000 per year for each of those three years. Depending on his family income, David could also be eligible to receive student grants and loans through the Canada Student Loans Program. In addition, David can access employment services such as career counselling and job-search training under the Career Transition Services Program to assist him in re-entering the labour force following the completion of his studies.

Low-income Canadians will have improved access to adequate and affordable housing—a cornerstone of sustainable, inclusive communities and a Canadian economy where we can prosper and thrive. The Government is renewing federal leadership in housing with significant new long-term investments. The launch of the National Housing Strategy—a long-term investment of more than $11.2 billion over 11 years—will take place later this fall. One-third of social housing tenants in Canada are seniors. It is expected that the Strategy will have a more pronounced impact on senior women living alone, female-headed lone-parent families, and women with disabilities who currently experience high levels of housing need.

In April, the Government announced the launch of the Rental Construction Financing Initiative to help increase the supply of rental housing. Over the next four years, this initiative will offer more than $2.5 billion in low-cost loans to support the construction of new rental housing. These funds will be provided to municipalities, non-profit organizations and housing developers. Low-cost loans will help with the earliest, and most challenging, phases of development, including construction, lease-up and the early stages of property operations. These loans are expected to spur the construction of more than 10,000 new rental housing units across Canada.

In exchange for these favourable loans, borrowers will be required to build housing projects that:

- are more energy-efficient;

- are accessible to Canadians with disabilities; and

- have 20 per cent of their units set aside as affordable housing for moderate-income families.

- Newcomers to Canada will continue to play an important role in supplying Canada's knowledge economy with innovative, highly skilled and specialized talent, as new permanent and temporary residents are welcomed to Canada to help drive our economic and shared growth.

Since Budget 2017, the Government has continued to pursue policies and investments that support gender equality and inclusiveness.

- The new Multilateral Early Learning and Child Care Framework will support access to child care for children of all backgrounds, and allow greater participation in work, education or training, particularly by mothers.

- Canada's new defence policy will promote diversity and inclusion as core institutional values across the Defence team. Gender-based Analysis Plus will be integrated in all Defence activities across the Canadian Armed Forces and the Department of National Defence. A new focus will be placed on recruiting and retaining under-represented populations within the Canadian Armed Forces, including, but not limited to, women, Indigenous Peoples and members of visible minorities, with a target to increase the representation of women to 25 per cent of the overall force.

- The new Feminist International Assistance Policy will aim to reduce extreme poverty and build a more peaceful, inclusive and prosperous world—recognizing that promoting gender equality and empowering women and girls is the most effective approach to achieving this goal.

- Stronger capacity at Status of Women Canada will support national and international engagement to help advance the Government's gender equality objectives.

The Government continues to work with civil society and international partners to improve how it includes Gender-based Analysis Plus as part of policy development and budget decision-making—and will build on Budget 2017's Gender Statement to promote greater gender equality and inclusiveness as part of Budget 2018.

A Renewed Relationship With Indigenous Peoples

The Government is taking concrete steps to achieve reconciliation with First Nations, Inuit and the Métis Nation. To support the renewal of the relationship, the Government announced the creation of two new departments: a Department of Crown-Indigenous Relations and Northern Affairs, and a Department of Indigenous Services. These changes mark an important shift away from historic colonial structures. The Government is also working with First Nations, Inuit and Métis to co-develop policy proposals that respond to their priorities. While significant work remains, progress is being made:

- Budgets 2016 and 2017 invested $11.8 billion to improve quality of life and economic opportunities for Indigenous Peoples.

- The Canada-Métis Nation Accord was signed by the Prime Minister and the leaders of the Métis Nation. The Accord identifies a wide range of areas for collaboration including education, poverty, housing, health, and fiscal funding mechanisms.

- The Inuit-Crown Partnership Committee has developed a joint work plan to advance the socio-economic, cultural, and conditions of success for Inuit.

- The implementation of the United Nations Declaration on the Rights of Indigenous Peoplesrequires transformative change in the Government's relationship with Indigenous Peoples. To this end, the Government has released 10 Principles that will guide the renewal of the relationship including through the ongoing work of the Working Group of Ministers on the Review of Laws and Policies Related to Indigenous Peoples.

- On August 16, 2017, the Government of Canada and 23 Anishinabek Nation First Nations signed an historic self-government agreement on education. Under the agreement, participating First Nations will create the Anishinabek Education System—an education system by Anishinabek First Nations for Anishinabek students. The Manitoba First Nations School System, the result of an Education Governance Agreement between the Government of Canada and the Manitoba First Nations Education Resource Centre, assumed responsibility in July 2017 for administering and managing elementary and secondary education programs and services for 10 participating First Nations. Strong, culturally rooted First Nations-led education will strengthen communities and open opportunities for First Nations students.

- In August 2017, the Government announced an investment of up to $60.2 million for Wataynikaneyap Power to construct a 117-kilometre power line from Red Lake, Ontario, into the local distribution systems at Pikangikum First Nation. The project will provide clean energy while making an important contribution to the health and safety of community members and boosting the First Nation's economic development opportunities.

- Progress continues to be made in addressing long-term drinking water advisories. Since Budget 2016, $733.2 million has been provided to support 348 water and wastewater projects in 275 communities serving approximately 275,000 people. Since November 2015, 26 long-term drinking water advisories have been lifted.

Combatting International Tax Evasion and Avoidance

To keep taxes low and ensure everyone pays their fair share, the Government of Canada is actively engaged with international partners to ensure that Canada's tax system is functioning as intended and contributing to the objective of an economy that works for the middle class.

Canada has worked together with the other members of the Group of 20 (G20) and the Organisation for Economic Co-operation and Development (OECD) to develop recommendations that will address base erosion and profit shifting (BEPS). BEPS refers to international tax planning arrangements used by multinational enterprises to unfairly minimize their taxes. For example, some enterprises will shift their taxable profits away from the jurisdiction where the underlying economic activity has taken place in order to avoid paying their fair share.

The Government remains firmly committed to protecting Canada's tax system, and has implemented—or is in the process of implementing—the measures agreed to as minimum standards under the BEPS project:

- Legislation was enacted in December 2016 that requires large multinational enterprises to file country-by-country reports. This information will give tax authorities in each country a clearer picture of where the operations of the group in their particular jurisdiction fit into the group's global operations and assist in high-level risk assessments.

- Canada participated in the development of a multilateral instrument to streamline the implementation of tax treaty-related BEPS recommendations. On June 7, 2017, Canada, along with 67 other countries, signed the multilateral instrument. The Government is now undertaking the necessary domestic processes for ratification.

- Canada has committed to the effective and timely resolution of tax treaty-related disputes by improving the mutual agreement procedure in Canada's tax treaties.

- The Canada Revenue Agency (CRA) has begun the spontaneous exchange with other tax administrations of tax rulings.

With respect to other BEPS recommendations:

- Canada has robust "controlled foreign corporation" rules in the form of our foreign accrual property income regime, which helps prevent taxpayers from avoiding Canadian income tax by shifting income into foreign subsidiaries.

- Canada has implemented requirements for the disclosure of specified tax avoidance transactions to the CRA.

- The CRA is applying revised international guidance on transfer pricing by multinational enterprises.

The Government will continue to work with its international partners to ensure a coherent and consistent response to fight tax avoidance through BEPS.

The Government is also strengthening its efforts to combat international tax evasion through enhanced sharing of information between tax authorities. The automatic exchange of information with respect to financial accounts held by non-residents—under the framework of the Common Reporting Standard developed by the OECD—is an important tool to promote compliance, combat international tax evasion, and ensure that taxpayers are reporting their income from all sources. To date, more than 100 jurisdictions have committed to implement the new standard.

Strengthening Corporate and Beneficial Ownership Transparency

The Government of Canada is committed to implementing strong standards for corporate and beneficial ownership transparency that provide safeguards against money laundering, terrorist financing, tax evasion and tax avoidance, while continuing to facilitate the ease of doing business in Canada. Understanding the ownership and control of corporations is vital for good corporate governance and to protect the integrity of the tax and financial systems.

As announced in Budget 2017, the Government is working with the provinces and territories to strengthen the transparency of legal persons and arrangements in order to address blind spots in the availability of beneficial ownership information.

The Government also announced in Budget 2017 that it will examine ways to enhance the tax reporting requirements for trusts in order to improve the collection of beneficial ownership information.

These actions will ensure that law enforcement and other authorities have timely access to the information needed to crack down on money laundering, terrorist financing and tax evasion and to combat aggressive tax avoidance.

An Innovative, Inclusive and Sustainable Economy

Recognizing the unique opportunities and challenges that a rapidly changing economy presents, the Government took definitive steps to foster innovation, equip Canadians with the skills they need to succeed, and introduce transformational investments in infrastructure.

Skills for the New Economy

The Government is making targeted investments to expand access to the education, work experiences and employment supports that Canadians need to get high-quality, well-paying jobs. Combining work experience with education ensures that recent graduates have the skills and knowledge employers need. Youth will be better-prepared as they enter the workforce and all workers will have the skills and supports to advance their career throughout their working lives.

Today, these investments are already translating into greater opportunities for students and workers.

More work-ready students supported through work-integrated learning

- 347,000 more students from low- and middle-income families and 16,000 more part-time students receive financial assistance each year

- More students will be eligible for grants from expanded income thresholds starting in September 2017

- 10,000 new placements over four years for post-secondary students in business and in science, technology, engineering and mathematics through the Student Work-Integrated Learning Program

- Increasing the annual number of research internships offered by Mitacs from 3,750 to10,000 over the next five years, providing more job-relevant experiences for students and helping businesses become more innovative

- 65,800 Canada Summer Jobs, effectively doubling the program in 2016

- New green jobs are helping young Canadians learn about our natural environment and contribute to economic growth

- Additional heritage sector jobs supported the lead-up to Canada's 150th anniversary

- Lowest youth unemployment rate on record, at 10.3 per cent

- More than 50,000 additional new entrants and re-entrants now have access to Employment Insurance regular benefits

In addition, Labour Market Transfer Agreements are being reformed and consolidated in partnership with provincial and territorial governments. Employment and training programs currently supported by nearly $3 billion in annual federal investments will become more flexible, more client-focused and driven by results and innovation.

The Government is also boosting student financial assistance for low- and middle-income adult learners by providing additional funding through Canada Student Grants, and is currently working with provinces and territories to make Canada Students Grants more accessible to adult learners.

Additional investments of $2.7 billion over six years were announced in Budget 2017 and the Employment Insurance Acthas been amended to expand eligibility for the Agreements funded through the Employment Insurance program as of April 1, 2018.

| Current Labour Market Development Agreements | Expanded Labour Market Development Agreements | |

|---|---|---|

| Employment benefits (e.g., skills development, wage subsidies) | Individuals currently receiving or having received Employment Insurance benefits in the past five years | Expanded to include unemployed individuals who have made minimum Employment Insurance premium contributions above the premium refund threshold (i.e. $2,000) in at least five of the last 10 years |

| Employment assistance services under support measures (e.g., employment counselling, job search assistance) | Unemployed Canadians | Expanded to include employed Canadians |

| Employer-sponsored training under support measures (Labour Market Partnerships) | Assistance to employers to support approved training activities for employees facing a loss of employment | Expanded to include assistance to employers to support approved training activities for employees in order to maintain their employment. This may include employees impacted by technological or structural changes in the economy |

A More Skilled And Innovative Canada

The Government's Innovation and Skills Plan is helping Canada realize its potential as a global leader in innovation. Since Budget 2017, the Government has taken steps to advance the Plan's key measures:

- Innovation Superclusters Initiative: Clusters are dense areas of business activity that bring together a critical mass of large and small companies and post-secondary and other research institutions. Superclusters build on the advantages of clusters, and comparatively these innovation hotbeds have stronger connections, a long-term competitive advantage, global brand recognition, and an outsized positive impact on jobs and growth. Launched in May 2017, this initiative will provide up to $950 million over five years in support of up to five business-led superclusters, on a competitive basis. The Government announced in October 2017 a shortlist of nine applicants invited to submit detailed supercluster proposals by November 24, 2017. These geographically diverse proposals focus on the highly innovative industries identified in Budget 2017, namely advanced manufacturing, agri-food, clean technology, digital technology, health/bio-sciences and clean resources, as well as infrastructure and transportation. It is expected that successful proposals will be announced by early 2018.

- Strategic Innovation Fund (SIF): Launched in July 2017, this new five-year $1.26 billion fund will attract and support high-quality business investments across all sectors of the economy. SIF projects are currently being assessed with the first announcements to occur imminently.

- Pan Canadian Artificial Intelligence Strategy: Artificial intelligence (AI) helps create and put to use knowledge that can improve the lives of Canadians through advances such as facilitating medical diagnosis and allowing farmers to maximize crop yields through precision farming. Announced in March 2017, the Government is providing $125 million over five years for an ambitious AI strategy to retain and attract top academic talent and to position Canada as a world-leading destination for companies seeking to invest in AI and innovation. Delivered through the Canadian Institute for Advanced Research (CIFAR), the strategy includes the launch of the Vector Institute, a new independent AI research facility affiliated with the University of Toronto. CIFAR will work with the Vector Institute to support its core activities, including the Canada CIFAR Chairs in AI Science, graduate training, and the participation of the Chairs and trainees in national AI activities.

Clean Growth and Climate Change

The Pan-Canadian Framework on Clean Growth and Climate Change was adopted by First Ministers on December 9, 2016 to grow Canada's economy while reducing emissions and building resilience to adapt to a changing climate. The Government has made significant progress in implementing the Framework:

- Clean Technology Financing: The Government is moving ahead to implement the Budget 2017 commitment to make available nearly $1.4 billion in new financing to accelerate the growth of promising clean technology firms, positioning Canada as a leader in the global clean economy. New equity financing, working capital and project financing are being made available through the Business Development Bank of Canada and Export Development Canada, further expanding their business growth and export financing support to Canadian clean technology companies and building on their client-centric collaboration in the sector. Further details will be available later this fall.

- Oceans Protection Plan: In November 2016, the Government announced $1.5 billion for the Oceans Protection Plan—the most significant investment ever made to protect our oceans and coastlines while growing our economy. Since then, the Government has made progress on a series of measures that will protect the marine environment and coastal communities, such as supporting safer and more efficient Arctic resupply operations, and expanding the Community Participation Funding Program to help Indigenous and local communities take part in improving Canada's marine transportation system.

- Low Carbon Economy Fund: In June 2017, the Government announced that this $2 billion fund will be divided into two parts. The Low Carbon Economy Leadership Fund will provide $1.4 billion to provinces and territories that have adopted the Pan-Canadian Framework to help them deliver on their commitments to reduce greenhouse gas emissions, including those that they identified in the Framework. The remainder will be allocated to the Low Carbon Economy Challenge to support projects and to implement the Pan-Canadian Framework. Following the review of proposals by the Government, funding agreements will be finalized and signed with provinces and territories in the coming months. The Low Carbon Economy Challenge is expected to be launched in the coming months to support ambitious projects that can be submitted by all provinces and territories, as well as municipalities, Indigenous governments and organizations, businesses and both not-for-profit and for-profit organizations.

- Carbon Pricing Backstop: On May 18, 2017, the Government released a technical paper on the proposed federal carbon pricing backstop for comment. The proposed backstop is comprised of a carbon levy on fossil fuels and an output-based pricing system for certain industrial facilities, and will apply in provinces and territories that do not implement their own carbon pricing systems that meet the federal benchmark. The Government is considering comments received as it develops legislation to implement the federal backstop.

Infrastructure Investments for Communities

Investing in Canada, the Government's plan to renew Canada's infrastructure for a generation (over $180 billion over 12 years), has already achieved important results—investing in projects that matter to communities, and that will create jobs and keep Canada's economy growing now and in the future. The results speak for themselves:

- Ottawa Light Rail Stage 2 Project will become a reality: When construction of this project is completed in 2023, 70 per cent of Ottawa residents will live within five kilometres of light rail transit, helping mom and dad get home faster at the end of a long day. Along with support from the Province of Ontario and the City of Ottawa's participation in the project, federal investments of $1.09 billion are helping build close to 40 kilometres of track and 23 new transit stations.

- New and improved YMCA community and recreation centre for Halifax: Serving as both a recreation facility and a community centre, the new building will include an aquatic centre, a gymnasium and indoor track, child care facilities, and a community resource centre for leadership, child and family development. The Government of Canada and the Government of Nova Scotia announced $10 million in joint federal-provincial funding for the construction of this YMCA facility in the Greater Halifax/Dartmouth region.

- Communities across Nunavut will benefit from faster Internet: Canadians in all 25 Nunavut communities will be able to do business online and participate in distance education because of investments in high-speed Internet. A nearly $50 million federal contribution through the Connect to Innovate program will improve high-speed coverage from Kugluktuk to Pangnirtung in Nunavut. As a result, all Nunavut communities will have access to Internet download speeds of 5 to 15 megabits per second.

- Brandon Airport Passenger Terminal Redevelopment Project: Thanks to funding from the Government of Canada, the Government of Manitoba and the City of Brandon, the passenger terminal at Brandon Municipal Airport was recently renovated and expanded to three times its former size. This redevelopment project will make travel more comfortable for passengers, allow airport services to be expanded in the future, and provide upgrades to support airport operations, including the installation of a fiber optic cable for fast and reliable broadband connectivity.

- Support for Montréal's Réseau électrique métropolitain (REM): Investing in Canada will provide $1.283 billion to support the REM light rail network, subject to necessary due diligence. For the metropolitan area of Montréal, REM will be the largest public transportation project since the completion of the Montréal metro inaugurated in 1966, and one of the most ambitious public transit projects in the nation's history.

- Improved service for the Expo, Millennium and Canada Lines: The Government is contributing $149 million through the Public Transit Infrastructure Fund announced in Budget 2016 for the purchase of new SkyTrain vehicles for the Expo, Millennium and Canada Lines. These new vehicles will help reduce wait times and crowding and improve overall customer experience for commuters in the Metro Vancouver area.

The Government is working with its partners to deploy the initiatives announced in Budget 2017, including the launch of the Canada Infrastructure Bank, the Smart Cities Challenge, and bilateral agreements with provinces and territories. Budget 2017 investments include $25.3 billion for public transit, $21.9 billion for green infrastructure, $21.9 billion for social infrastructure, $10.1 billion for trade and transportation, and $2 billion dedicated to rural and northern communities.

The Government is establishing the Canada Infrastructure Bank (CIB), an arm's-length organization that will work with provincial, territorial, municipal, Indigenous and private sector investment partners to transform the way infrastructure is planned, funded and delivered in Canada. The CIB will be responsible for investing at least $35 billion in revenue-generating infrastructure projects that are in the public interest, and attracting private sector capital to those projects so that more infrastructure can be built across Canada.

The implementation of the CIB is advancing on track. The Canada Infrastructure Bank Act is now in place. Earlier this year, the Government announced the appointment of the inaugural Chairperson, Janice Fukakusa, a highly qualified leader with extensive experience in finance and banking. The search process for the CIB's board directors and its Chief Executive Officer is also well-advanced. The CIB's headquarters are being established in Toronto, to take advantage of its status as a global financial hub with a vast network and critical mass of financial, legal and construction firms.

By the end of this year, the CIB will begin work with its partners to bring new investment and transformative new ideas to Canada's infrastructure landscape.

- Date modified: