Archived - Chapter 1:

Making Housing More Affordable

Everyone should have a safe and affordable place to call home.

But that goal—one that was taken as a given for previous generations—is increasingly out of reach for far too many Canadians. Young people cannot imagine being able to afford the house they grew up in. Foreign investors and speculators are buying up homes that should be for Canadians to own. Rents in our major cities continue to climb, pushing people further and further away from where they work.

All of this has an impact on our economy, too. In cities and communities across the country, a lack of affordable housing makes it more difficult to attract the workers that businesses need. Increasing our housing supply will make Canada more competitive in the global race for talent and investment. It will help make sure that our economy can continue to grow in the years to come.

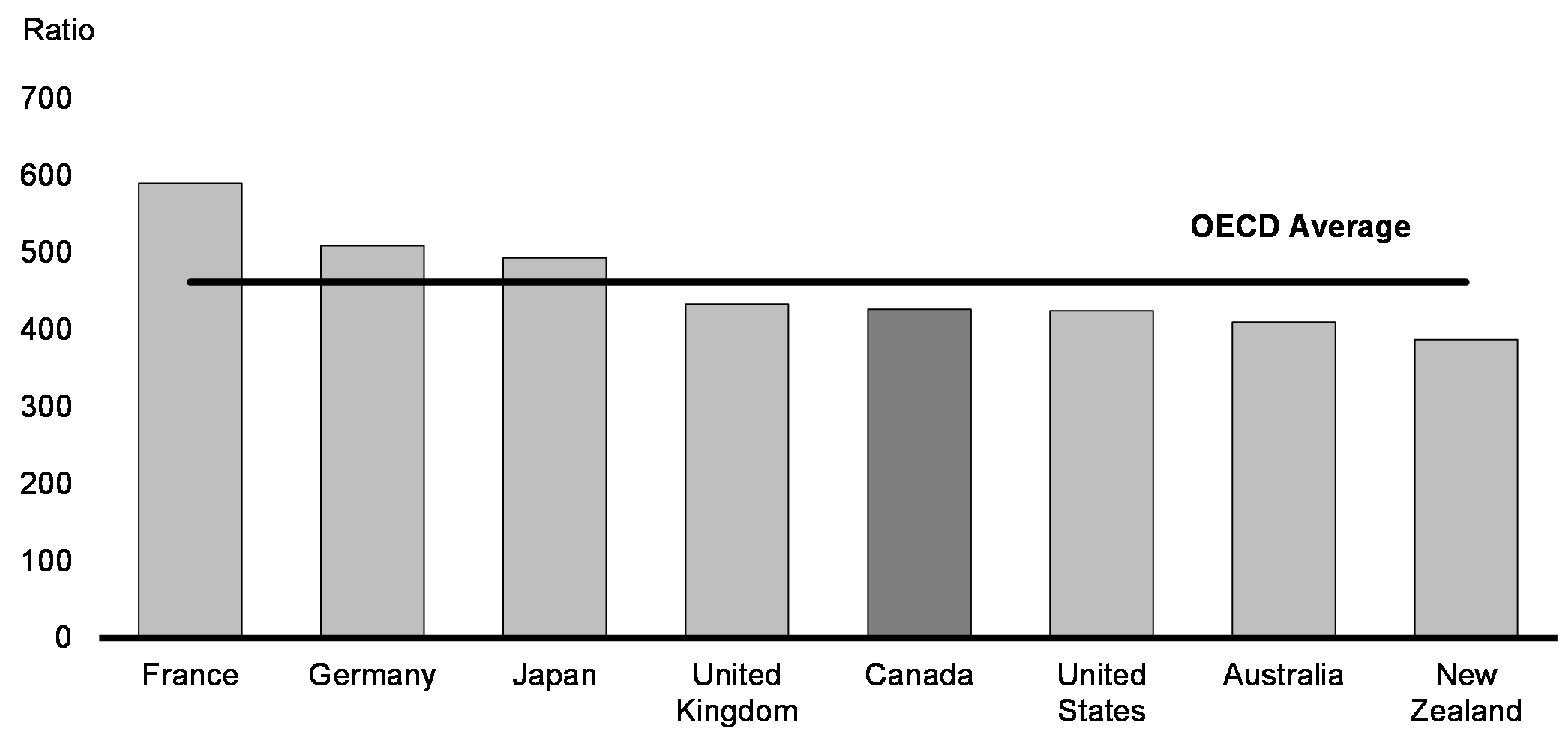

Number of Homes per 1,000 Persons, Selected OECD Countries

There are a number of factors that are making housing more expensive, but the biggest issue is supply. Put simply, Canada is facing a housing shortage—we have a lower number of homes per person than many OECD countries. Increasing our housing supply will be key to making housing more affordable for everyone.

To fill the gap that already exists—and to keep up with our growing population over the next decade—Finance Canada and the Canada Mortgage and Housing Corporation estimate that Canada will need to build at least 3.5 million new homes by 2031. To reach that number, significant steps have to be taken today.

In a given year, Canada constructs about 200,000 new housing units—standalone houses, individual condos, and other types of homes alike. While annual construction has increased in recent years, it is not enough to address affordability challenges and keep up with the housing demands of a growing population. To meet these housing needs, Canada will need to double our current rate of new construction over the next decade.

Neither the federal government nor developers can solve this issue alone—provincial, territorial, and municipal governments also have a significant role to play.

Budget 2022 proposes measures that—in partnership with steps that must be taken by other orders of government—will put Canada on the path to double our construction of new housing and meet Canada’s housing needs over the next decade.

Federal Housing Investments

Budget 2022 measures that will build more homes and make housing more affordable across the country include:

- Putting Canada on the path to double our housing construction over the next decade;

- Helping Canadians buy their first home;

- Protecting buyers and renters;

- Curbing unfair practices that drive up the price of housing; and,

- Continuing to fight homelessness and support housing affordability, particularly for the most vulnerable.

In addition to these measures, Budget 2022 proposes additional funding to address housing needs of Indigenous peoples, as detailed in Chapter 7.

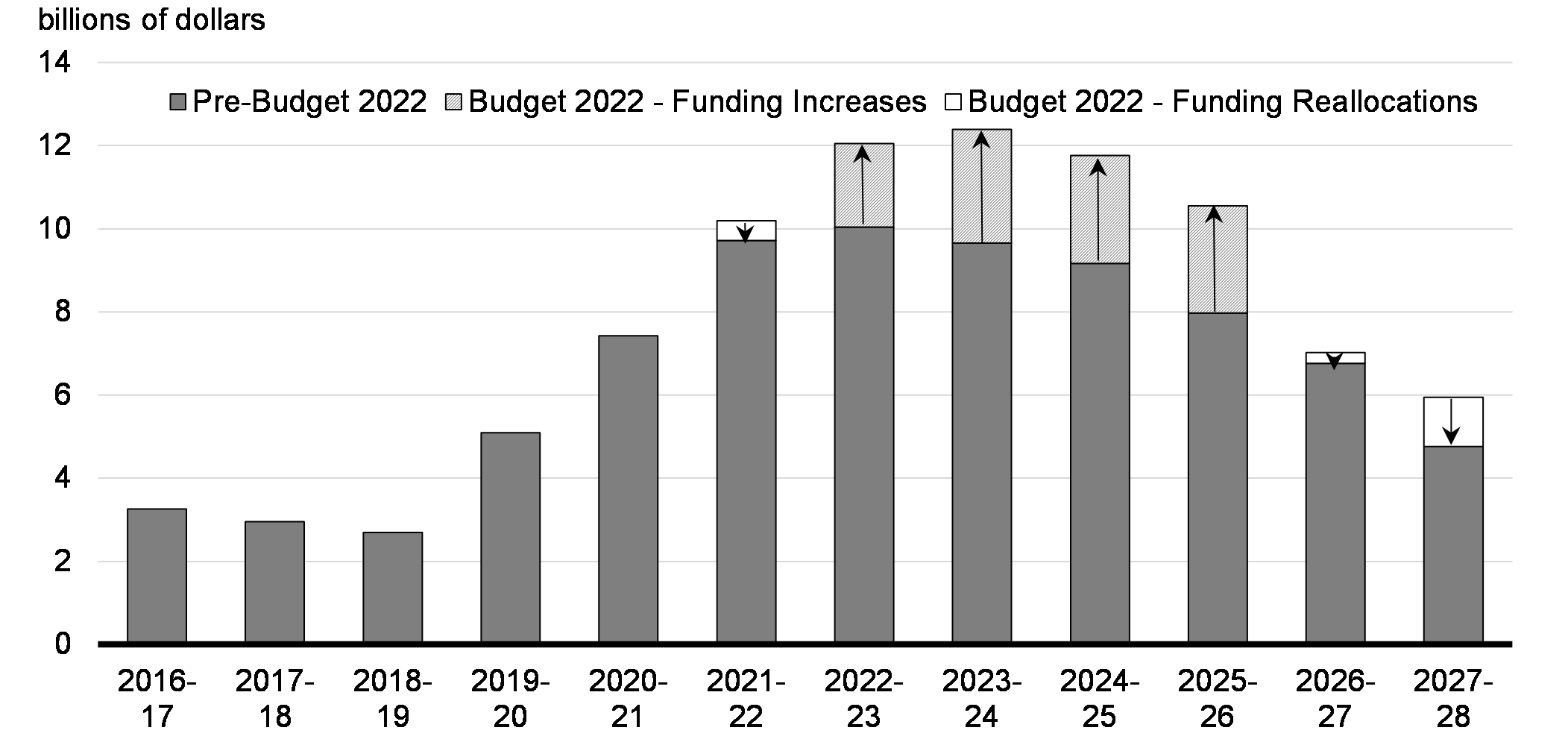

Key Ongoing Actions

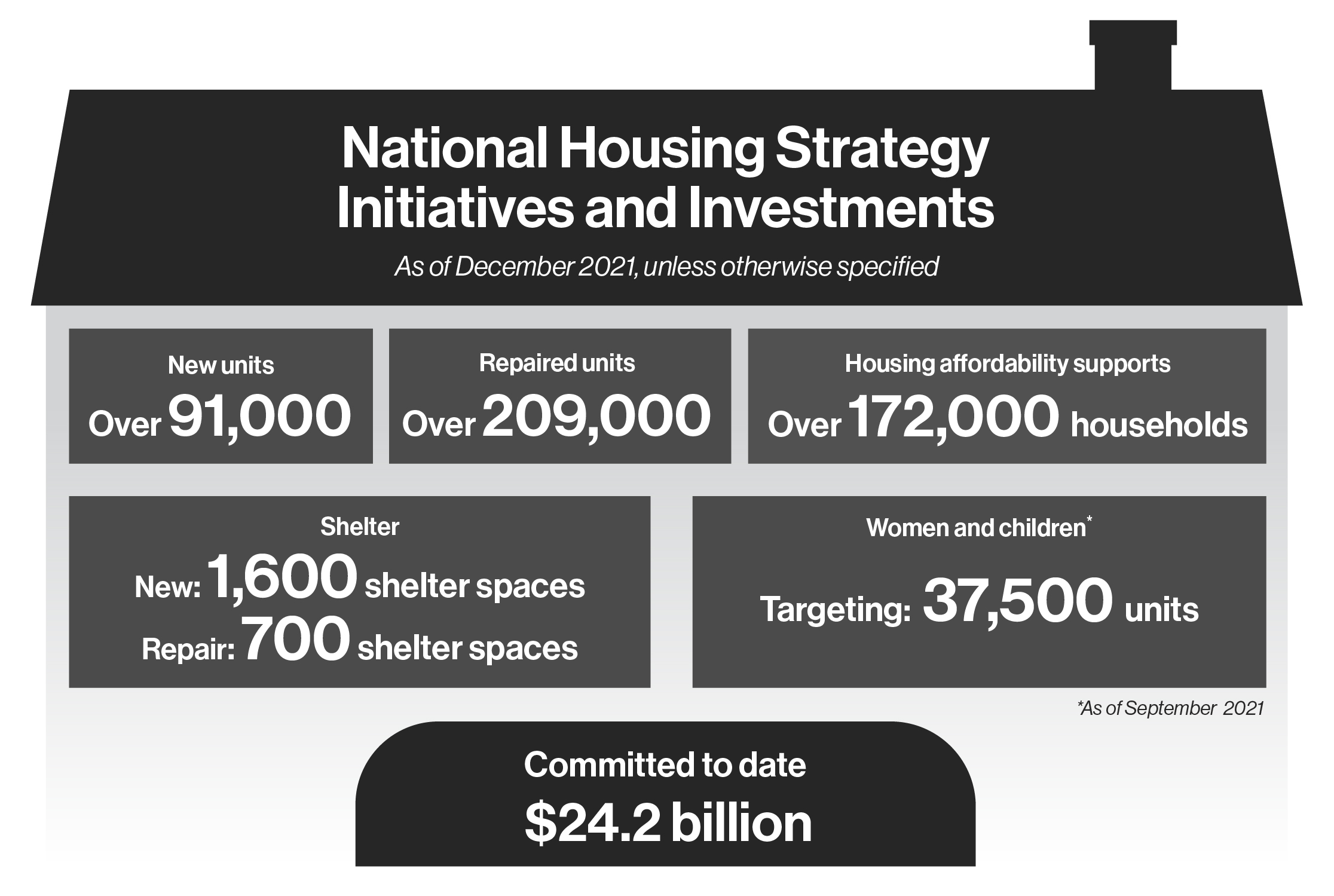

The federal government is already on track by 2027-28 to deliver more than $72 billion in financial support through the National Housing Strategy, in addition to other measures that will make housing more affordable. Actions underway since 2015 include:

-

More than $42 billion in federal support for the construction and repair of rental housing, affordable housing, and shelters;

-

More than $15 billion in joint funding with provinces and territories, including for the Canada Housing Benefit to provide direct rent assistance;

-

More than $11 billion in support for community and social housing;

-

More than $2.7 billion in distinctions-based support for housing in Indigenous communities;

-

More than $3 billion for Reaching Home: Canada’s Homelessness Strategy, and a commitment to eliminate chronic homelessness by 2030; and,

-

Tabling legislation that would implement Canada's first national vacant housing tax on non-Canadian, non-resident owners.

National Housing Strategy Initiatives and Investments Committed

1.1 Building Affordable Homes

Every order of government has a role to play in building more homes and making housing more affordable for Canadians. Provinces and territories oversee the frameworks guiding land use, planning, and their targets for increasing the number of new homes. Municipalities implement policies in a manner best suited to their communities.

To help double our rate of construction over the next ten years, make our housing and building stock more environmentally friendly, and address homelessness, the federal government is proposing a range of measures that will:

- Incentivize cities to build more homes and create denser, more sustainable neighbourhoods to increase housing supply;

- Support those in need of affordable housing by building new affordable units faster;

- Create a new generation of co-op housing through the largest investment in new co-op housing in more than 30 years;

- Accelerate retrofits and build more net-zero homes in communities across Canada so that people can save on energy bills; and,

- Support those experiencing or at risk of homelessness by continuing to provide doubled annual funding for Reaching Home; building new affordable units for the most vulnerable; continuing work to end chronic homelessness; and introducing a new program to combat veteran homelessness.

Launching a New Housing Accelerator Fund

To make housing more affordable, more housing needs to be built. Building more housing will require investments, but it will also require changes to the systems that are preventing more housing from being built.

The federal government’s goal is to incentivize the cities and towns that are stepping up to get more housing built, while also ensuring that municipalities are able to get the support they need to modernize and build new homes.

-

Budget 2022 proposes to provide $4 billion over five years, starting in 2022-23, to the Canada Mortgage and Housing Corporation to launch a new Housing Accelerator Fund. The fund will be designed to be flexible to the needs and realities of cities and communities, and could include support such as an annual per-door incentive for municipalities, or up- front funding for investments in municipal housing planning and delivery processes that will speed up housing development. Its focus will be on increasing supply, but government supports will be targeted to ensure a balanced supply that includes a needed increase to the supply of affordable housing.

This new fund will target the creation of 100,000 net new housing units over the next five years.

The Housing Accelerator Fund will have a flexible single application system, and will still allow municipalities to access other related programs. The federal government will ensure that the program also takes into account smaller and rural communities that are growing quickly, like those in Atlantic Canada and northern Ontario.

Using Infrastructure Funding to Encourage More Home Construction

Every year, the federal government provides significant amounts of funding to provinces, territories, and municipalities to help them deliver important public infrastructure projects. At the same time, there is not enough housing being built to keep up with the needs of Canadians.

A coordinated approach, involving all orders of government, is required to ensure public spending is working to build more of the homes Canadians need.

-

To this end, Budget 2022 signals the government’s intention to create flexibility within federal infrastructure programs to tie access to infrastructure funding to actions by provinces, territories, and municipalities to increase housing supply where it makes sense to do so. This flexibility would be included within the Canada Community-Building Fund, when its current administrative agreements with provinces and territories are renewed; and other future infrastructure programs.

Together with the new Housing Accelerator Fund, this represents nearly $43 billion in new and existing federal funding over the next ten years that will be leveraged to encourage the construction of more homes for Canadians across the country.

Leveraging Transit Funding to Build More Homes

The pandemic has had an extraordinary impact on public transit ridership and the revenues that municipalities count on. On March 25, 2022, the government tabled a bill to authorize up to $750 million in 2021-22 to support municipalities as they address their public transit shortfalls.

To increase the impact of this investment, the proposed funding will be conditional on provincial and territorial governments committing to match the federal contribution and to accelerate their work with their municipalities to build more homes for Canadians.

Rapidly Building New Affordable Housing View the impact assessment

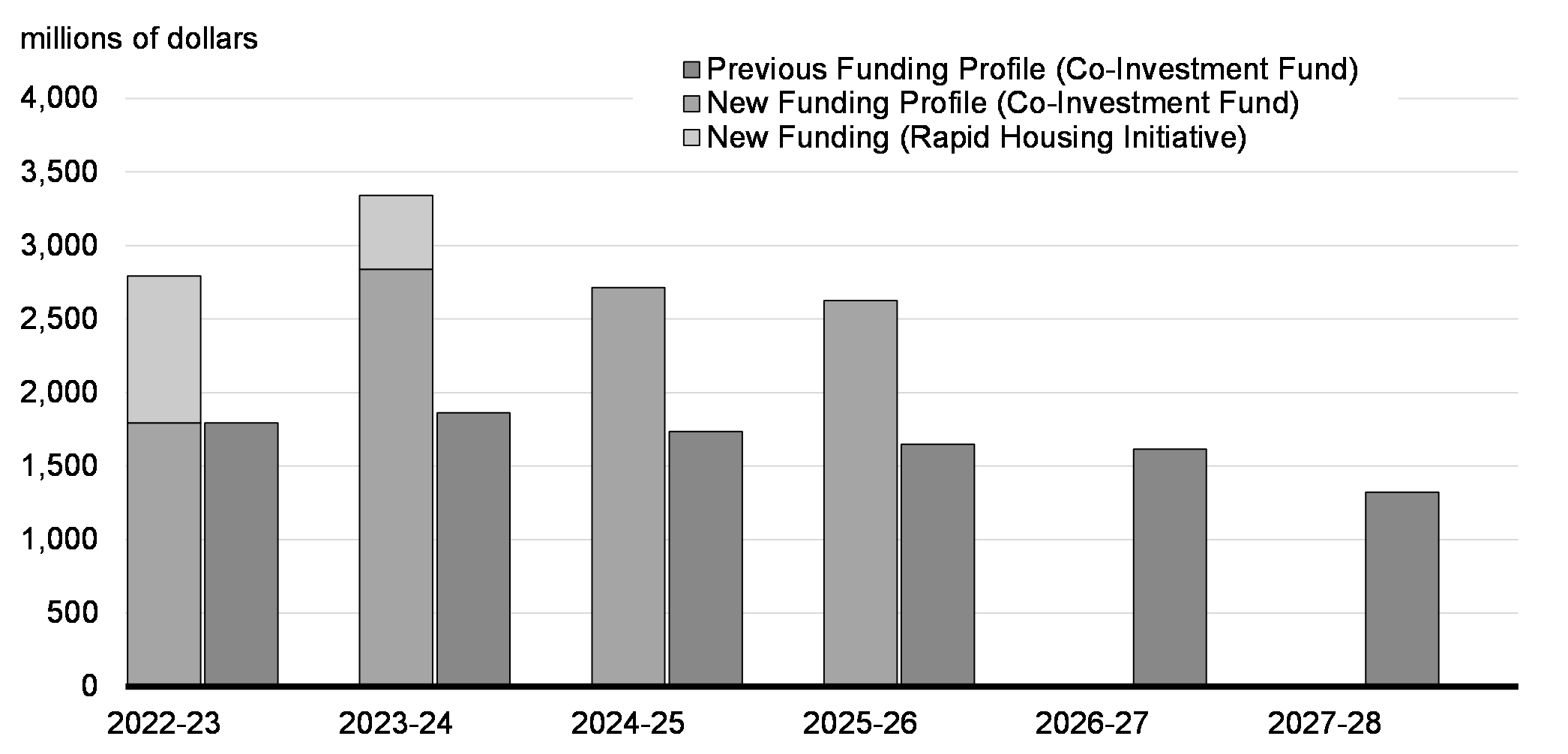

Additional affordable housing units are urgently needed, particularly for those experiencing or at risk of homelessness. To ensure that more affordable housing can be built quickly, the government is proposing to extend the Rapid Housing Initiative for a third round.

-

Budget 2022 proposes to provide $1.5 billion over two years, starting in 2022-23, to the Canada Mortgage and Housing Corporation to extend the Rapid Housing Initiative. This new funding is expected to create at least 6,000 new affordable housing units, with at least 25 per cent of funding going towards women-focused housing projects.

Speeding Up Housing Construction and Repairs for Vulnerable Canadians View the impact assessment

Over the last five years, the National Housing Co-Investment Fund has supported the construction and repair of 108,000 housing units for the most vulnerable Canadians. Projects like shelters, homes for seniors and persons with disabilities, and supportive housing account for 75 per cent of units committed to so far, with demand for those units exceeding supply. To protect housing affordability tomorrow, the government is accelerating its investments today.

-

Budget 2022 proposes to advance $2.9 billion in funding, on a cash basis, under the National Housing Co-Investment Fund, so that all remaining funds will be spent by 2025-26. This will accelerate the creation of up to 4,300 new units and the repair of up to 17,800 units for the Canadians who need them most.

Taking lessons from the Rapid Housing Initiative, the National Housing Co-Investment Fund will be made both more flexible and easier to access, including with more generous contributions and faster approvals.

New Rapid Housing Initiative Spending and National Housing Co-Investment Funding Profile

Building More Affordable and Energy Efficient Rental Units View the impact assessment

The Rental Construction Financing Initiative (RCFI) incentivizes the construction of new rental housing by offering low-interest loans and mortgage insurance to those building more rental housing in areas where it is needed most.

-

Budget 2022 announces the government’s intent to reform the Rental Construction Financing Initiative by strengthening its affordability and energy efficiency requirements. Developers who significantly exceed these requirements and build highly affordable and energy efficient units will be eligible to have a portion of their repayable loans converted to non- repayable loans.

Budget 2022 also announces that the RCFI will target a goal of having at least 40 per cent of the units it supports provide rent equal to or lower than 80 per cent of the average market rent in their local community. These new requirements and incentives under a more ambitious Rental Construction Financing Initiative will ensure that rental units built through this program are more affordable, that people can reduce pollution and save on energy bills, and that Canada continues to make progress towards meeting our climate projections.

Direct Support for those in Housing Need

The Canada Housing Benefit was co-developed with provinces and territories and launched in 2020 with joint funding of $4 billion over eight years. It provides direct financial support to Canadians who are experiencing housing need. However, as part of its broader efforts to make life more affordable for Canadians, the government recognizes that many are in need of additional assistance. To support those struggling with housing costs:

-

Budget 2022 proposes to provide $475 million in 2022-23 to provide a one-time $500 payment to those facing housing affordability challenges. The specifics and delivery method will be announced at a later date.

A New Generation of Co-Operative Housing Development View the impact assessment

For generations, co-ops have offered quality, affordable housing to Canadians, while empowering their members through inclusion, personal development, and security of tenure through their community-oriented model of housing. While co-ops are home to approximately a quarter of a million Canadians, not enough have been built in recent years.

-

Budget 2022 proposes to reallocate $500 million of funding on a cash basis from the National Housing Co-Investment Fund to launch a new Co-operative Housing Development Program aimed at expanding co-op housing in Canada. This new program will be co-designed with the Co-operative Housing Federation of Canada and the co-operative housing sector.

-

Budget 2022 also proposes an additional $1 billion in loans to be reallocated from the Rental Construction Financing Initiative to support co- op housing projects.

With the largest investment in building new co-op housing for more than 30 years, an estimated 6,000 units will be constructed.

Affordable Housing in the North View the impact assessment

Canada’s Northern communities face unique housing needs due to higher construction costs, shorter construction seasons, infrastructure gaps, and the effects of climate change that are increasing as the North has been warming at roughly three times the global warming rate. The federal government is continuing to work with partners across Yukon, the Northwest Territories, and Nunavut to address the issues of housing availability and quality that disproportionately affect Northerners.

-

Budget 2022 proposes to provide $150 million over two years, starting in 2022-23, to support affordable housing and related infrastructure in the North. Of this amount, $60 million would be provided to the Government of Nunavut; $60 million to the Government of the Northwest Territories; and $30 million to the Government of Yukon.

Multigenerational Home Renovation Tax Credit

Many Canadians have traditions of living together in multigenerational homes, with grandparents, parents, and children under one roof. For some families across the country, having different generations living together—an elderly grandparent with their daughter’s family or a son with a disability with their parents—can be an important way for them to care for each other.

-

To support these families, Budget 2022 proposes to introduce a Multigenerational Home Renovation Tax Credit, which would provide up to $7,500 in support for constructing a secondary suite for a senior or an adult with a disability.

Starting in 2023, this refundable credit would allow families to claim 15 per cent of up to $50,000 in eligible renovation and construction costs incurred in order to construct a secondary suite.

Greener Buildings and Homes

Buildings and homes are the third-largest source of greenhouse gas emissions in Canada, accounting for approximately 12 per cent of Canada’s emissions. Since 2016, the federal government has dedicated more than $10 billion towards decarbonizing homes and buildings, and incenting energy efficient retrofits. To achieve Canada’s goal of net-zero emissions by 2050, the scale and pace of retrofitting buildings in Canada must increase. To this end, the federal government will develop a national net-zero by 2050 buildings strategy, working with provinces, territories, and other partners to accelerate both retrofits of existing buildings, and the construction of buildings to the highest zero carbon standards.

-

Budget 2022 proposes to provide $150 million over five years, starting 2022-23, to Natural Resources Canada to develop the Canada Green Buildings Strategy. The strategy will include initiatives to further drive building code reform; to accelerate the adoption and implementation of performance-based national building codes; to promote the use of lower carbon construction materials; and to increase the climate resilience of existing buildings.

-

Budget 2022 proposes to provide $200 million over five years, starting in 2022-23, to Natural Resources Canada to create the Deep Retrofit Accelerator Initiative, which will provide support for retrofit audits and project management for large projects to accelerate the pace of deep retrofits in Canada, including a focus on low-income affordable housing.

Establishing a Greener Neighbourhood Pilot Program

More than two thirds of buildings that will be standing in Canada in 2050 have already been built today, and many of them need to be retrofitted to make them more sustainable.

The Energiesprong model, adopted by Netherlands, the United Kingdom, France, Germany, and the United States, accelerates the pace and scale of retrofits by aggregating homes and buildings in an entire neighbourhood and retrofitting them all at the same time. This support for community-level home retrofits aligns with the Net-Zero Advisory Body’s recommendation to seek out opportunities to decarbonize multiple buildings at once.

-

Budget 2022 proposes to provide $33.2 million over five years, starting 2022-23, to Natural Resources Canada, including $6 million from the Green Infrastructure – Energy Efficient Buildings Program to implement a Greener Neighbourhoods Pilot Program in up to six community housing neighbourhoods to pilot “Energiesprong” model in Canada.

Greener Construction in Housing and Buildings

Guidance, standards, and research are all needed to support innovations like the development of lower-carbon building materials and more energy efficient processes for retrofitting homes.

-

Budget 2022 proposes to provide $183.2 million over seven years, starting in 2022-23, with $8.5 million in remaining amortization, and $7.1 million ongoing to the National Research Council to conduct research and development on innovative construction materials and to revitalize national housing and building standards to encourage low-carbon construction solutions.

Greener Affordable Housing

Budget 2021 announced $4.4 billion on a cash basis to create the Canada Greener Homes Loan program, of which a portion will be used to make existing affordable housing more energy efficient, which will also help to lower energy bills.

-

Budget 2022 proposes to provide an additional $458.5 million over the program duration, starting in 2022-23, to the Canada Mortgage and Housing Corporation to provide low-interest loans and grants to low- income housing providers as part of the low-income stream of the Canada Greener Homes Loan program.

Long-Term Supports to End Homelessness View the impact assessment

Every Canadian should have a safe place to call home, but for too many, including Indigenous peoples, persons with disabilities, and veterans, that still isn’t a reality. Thousands of Canadians do not have a warm place to sleep at the end of the day, and during the pandemic, have had to choose between the cold of the streets and the crowding of shelters.

Through Reaching Home: Canada’s Homelessness Strategy, the federal government has committed more than $3 billion to address homelessness, including doubling annual funding for four years in response to the pandemic.

The government remains committed to ending chronic homelessness, and is proposing significant additional investments that will help make continued progress towards that goal.

-

Budget 2022 proposes to provide $562.2 million over two years, beginning in 2024-25, for Infrastructure Canada to continue providing doubled annual funding for Reaching Home. This funding will provide longer term certainty for the organizations doing vitally important work across the country and ensure that our communities have the support they need to continue to prevent and address homelessness.

Improving Community Responses to Homelessness View the impact assessment

Reaching Home provides vital support to community efforts to support those experiencing homelessness. However, no community or organization can prevent or end homelessness on its own. Making sure that everyone has a safe place to call home is a goal that different organizations and orders of governments share, and there is a need to ensure communities have access to all of the knowledge and tools they need to effect change.

-

Budget 2022 proposes to provide $18.1 million over three years, starting in 2022-23, to Infrastructure Canada to conduct research about what further measures could contribute to eliminating chronic homelessness.

A New Veteran Homelessness Program View the impact assessment

The government is also taking action to address the fact that thousands of veterans experience homelessness every year. They have served Canada with our flag on their shoulder, and they deserve a safe place to call home.

Budget 2021 announced $45 million for a pilot program aimed at reducing veteran homelessness. To ensure that long-term support is in place, the government now intends to move directly to the launch of a targeted program.

-

Budget 2022 proposes to provide $62.2 million over three years, beginning in 2024-25, for Infrastructure Canada, with support from Veterans Affairs Canada, to launch a new Veteran Homelessness Program that will provide services and rent supplements to veterans experiencing homelessness in partnership with community organizations.

1.2 Helping Canadians Buy Their First Home

From big cities to small towns, the cost of owning a home continues to rise. Young people are finding it more and more difficult to imagine buying a one- bedroom condo—to say nothing of a three-bedroom house. Many of those who’ve been saving for years are being pushed further and further away from where they work in order to find something they can afford.

To help address this, Budget 2022 is proposing a series of new measures to support first-time home buyers and help make the path to ownership a reality for renters.

A Tax-Free First Home Savings Account

As home prices climb, so too does the cost of a down payment. This represents a major barrier for many looking to own a home—especially young people. To help Canadians save for their first home:

-

Budget 2022 proposes to introduce the Tax-Free First Home Savings Account that would give prospective first-time home buyers the ability to save up to $40,000. Like an RRSP, contributions would be tax-deductible, and withdrawals to purchase a first home—including investment income— would be non-taxable, like a TFSA. Tax-free in, tax-free out.

The government intends to work with financial institutions to ensure that a Tax- Free First Home Savings Account could be opened and contributed to in 2023.

It is estimated that the Tax-Free First Home Savings Account would provide $725 million in support over five years.

Matthew and Taryn are aspiring homeowners living together. Starting in 2023, they each save $8,000 per year (the annual maximum) in their Tax-Free First Home Savings Account and are able to deduct this from their income. They both make between $50,000 and $100,000, and the Tax-Free First Home Savings Account allows them each to receive an annual federal tax refund of $1,640.

Matthew and Taryn have a combined $90,000 (including tax-free investment income) in their Tax-Free First Home Savings Account at the end of 2027, when they finally find their ideal first home.

By using the Tax-Free First Home Savings Account, Matthew and Taryn are finally able to afford a down payment to buy their first home. They can withdraw their down payment tax-free, saving thousands of dollars that can be put towards their new home. In addition, they will claim the doubled First- Time Home Buyers’ Tax Credit, providing an additional $1,500 in tax relief.

Doubling the First-Time Home Buyers’ Tax Credit

The government recognizes that the significant closing costs associated with purchasing a home can be a hurdle for first-time home buyers, and the First-Time Home Buyers’ Tax Credit is intended to provide support to Canadians buying their first home whether it be in a rural, suburban, or urban community.

-

Budget 2022 proposes to double the First-Time Home Buyers’ Tax Credit amount to $10,000. The enhanced credit would provide up to $1,500 in direct support to home buyers.

This measure would apply to homes purchased on or after January 1, 2022.

An Extended and More Flexible First-Time Home Buyer Incentive

To make it more affordable for people to buy their first home, the federal government introduced the First-Time Home Buyer Incentive, which allows eligible first-time home buyers to lower their borrowing costs by sharing the cost of buying a home with the government.

-

To help more Canadians purchase their first home, Budget 2022 announces an extension of the First-Time Home Buyer Incentive to March 31, 2025, and that the government is exploring options to make the program more flexible and responsive to the needs of first-time home buyers, including single-led households.

Supporting Rent-to-Own Projects

Many Canadians rent because they value the flexibility that comes with it. Others rent before they plan to buy their own home, but for those working towards ownership, rising home prices are pushing down payments further out of reach. Rent-to-own arrangements can help alleviate that barrier by providing more time and support to renters on the path to homeownership, and by allowing them to live and grow in their homes.

-

To help develop and scale up rent-to-own projects across Canada, Budget 2022 proposes to provide $200 million in dedicated support under the existing Affordable Housing Innovation Fund. This will include $100 million to support non-profits, co-ops, developers, and rent-to-own companies building new rent-to-own units.

This investment will provide opportunities for Canadians to get on the path to homeownership earlier, while also encouraging new housing supply that supports affordability for renters and prospective homeowners.

Examples of eligible projects, which must include safeguards and robust consumer protections, could include the repair and renewal of housing for rent- to-own purposes, innovative financing models, and programming that assists rent-to-own participants in preparing for homeownership.

1.3 Protecting Buyers and Renters

Buying a home is often the most significant financial decision that someone will make in their life. However, some real estate practices are putting even more pressure on home buyers and leaving them questioning whether or not they paid too much for their home.

Moving Forward on a Home Buyers’ Bill of Rights

Unfair practices like blind bidding or asking buyers to waive their right to a home inspection can make the process of buying a home even more stressful for too many Canadians. To help level the playing field for young and middle class Canadians, the government will take steps to make the process of buying a home more open, transparent, and fair.

-

Budget 2022 announces that the Minister of Housing and Diversity and Inclusion will engage with provinces and territories over the next year to develop and implement a Home Buyers’ Bill of Rights and bring forward a national plan to end blind bidding. Among other things, the Home Buyers Bill of Rights could also include ensuring a legal right to a home inspection and ensuring transparency on the history of sales prices on title searches.

-

To support these efforts, Budget 2022 proposes to provide $5 million over two years, starting in 2022-23, to the Canada Mortgage and Housing Corporation.

Housing for Canadians, Not for Big Corporations

Housing should be for Canadians to use as homes.

However, in recent years, the significant increase in housing prices has led to large investors acquiring a larger portfolio of residential housing. There is a concern that this concentration of ownership in residential housing can drive up rents and house prices, and undercut the important role that small, independent landlords play. Many believe that this trend has also led to a rise in “renovictions”, when a landlord pressures and persuades their tenants to leave, or is formally permitted to evict them to make extensive renovations in order to raise rents.

To address these concerns:

-

Budget 2022 announces a federal review of housing as an asset class, in order to better understand the role of large corporate players in the market and the impact on Canadian renters and homeowners. This will include the examination of a number of options and tools, including potential changes to the tax treatment of large corporate players that invest in residential real estate. Further details on the review will be released later this year, with potential early actions to be announced before the end of the year.

1.4 Curbing Foreign Investment and Speculation

Increasing our housing supply will help make housing more affordable, but it isn’t the only solution.

There is concern that foreign investment, property flipping and speculation, and illegal activity are driving up the cost of housing in Canada

Budget 2022 proposes new measures that will ban foreign investment in residential real estate, crack down on illegal activity in our housing market, and make sure that property flippers and speculators are paying their fair share of tax.

A Ban on Foreign Investment in Canadian Housing

For years, foreign money has been coming into Canada to buy residential real estate. This has fueled concerns about the impact on costs in cities like Vancouver and Toronto and worries about Canadians being priced out of the housing market in cities and towns across the country.

-

To make sure that housing is owned by Canadians instead of foreign investors, Budget 2022 announces the government’s intention to propose restrictions that would prohibit foreign commercial enterprises and people who are not Canadian citizens or permanent residents from acquiring non- recreational, residential property in Canada for a period of two years.

Refugees and people who have been authorized to come to Canada under emergency travel while fleeing international crises would be exempted. International students on the path to permanent residency would also be exempt in certain circumstances, as would individuals on work permits who are residing in Canada.

The government will continue to monitor the impact that foreign money is having on housing costs across Canada and may come forward with additional measures to strengthen the enforcement of the proposed ban if necessary. Non-resident, non-Canadians who own homes that are being underused or left vacant would be subject to the Underused Housing Tax once it is in effect.

Making Property Flippers Pay Their Fair Share

Property flipping—buying a house and selling it for much more than what was paid for it just a short time prior—can unfairly lead to higher housing prices, and some people who engage in property flipping may be improperly reporting their profits to pay less tax.

-

Budget 2022 proposes to introduce new rules to ensure profits from flipping properties are taxed fully and fairly. Specifically, any person who sells a property they have held for less than 12 months would be considered to be flipping properties and would be subject to full taxation on their profits as business income. Exemptions would apply for Canadians who sell their home due to certain life circumstances, such as a death, disability, the birth of a child, a new job, or a divorce. Exemptions will be set in forthcoming rules and Canadians will be consulted on the draft legislative proposals.

This new measure will ensure that investors who flip homes pay their fair share, while protecting the current, vitally important, principal residence exemption for Canadians who use their houses as homes.

The measure would apply to residential properties sold on or after January 1, 2023.

Taxing Assignment Sales

Homes should be for people to live in, not commodities to be traded and profited upon by housing speculators. Speculative trading in the Canadian housing market contributes to higher prices for Canadians. Speculative trading can include the resale of housing before it has even been constructed or lived in. This is called an “assignment sale.”

Currently, when a person makes a new home assignment sale, Goods and Services Tax/Harmonized Sales Tax (GST/HST) may or may not apply, depending on the reason for purchasing the home. For example, GST/HST does not apply if the buyer initially intended to live in the home.

This creates an opportunity for speculators to be dishonest about their original intentions, and uncertainty for everyone involved in an assignment sale as to whether GST/HST applies. The current rules also result in the uneven application of GST/HST to the full and final prices of new homes.

-

To address these issues, Budget 2022 proposes to make all assignment sales of newly constructed or substantially renovated residential housing taxable for GST/HST purposes, effective May 7, 2022.

Protecting Canadians From Money Laundering in the Mortgage Lending Sector

In recent years, there has been a growth in mortgages issued by lending businesses not regulated under the national anti-money laundering and anti- terrorist financing rules that apply to other financial institutions, such as banks. This puts many middle class Canadians, and their most important investment, at financial risk.

-

To help prevent financial crimes in the real estate sector, the federal government is announcing its intention to extend anti-money laundering and anti-terrorist financing requirements to all businesses conducting mortgage lending in Canada within the next year.

This will limit the exploitation of the real estate market by criminals, which can affect housing affordability across the country.

| 2021– 2022 |

2022- 2023 |

2023- 2024 |

2024- 2025 |

2025- 2026 |

2026- 2027 |

Total | |

|---|---|---|---|---|---|---|---|

| 1.1. Building Affordable Homes | 750 | 1,813 | 2,030 | 1,789 | 1,864 | 637 | 8,883 |

| Launching a New Housing Accelerator Fund | 0 | 150 | 925 | 925 | 1,000 | 1,000 | 4,000 |

| Leveraging Transit Funding to Build More Homes1 | 750 | 0 | 0 | 0 | 0 | 0 | 750 |

| Rapidly Building New Affordable Housing | 0 | 1,000 | 500 | 0 | 0 | 0 | 1,500 |

| Speeding Up Housing Construction and Repairs for Vulnerable Canadians2 | 0 | 801 | 1,059 | 978 | 893 | 0 | 3,730 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -801 | -675 | -595 | -510 | -576 | -3,157 |

| Building More Affordable and Energy Efficient Rental Units | 0 | 216 | 244 | 251 | 223 | 194 | 1,128 |

Less: Funds Previously Provisioned in the Fiscal Framework |

0 | -216 | -244 | -251 | -223 | -194 | -1,128 |

| Direct Support for those in Housing Need | 0 | 475 | 0 | 0 | 0 | 0 | 475 |

| A New Generation of Co-Operative Housing Development | 0 | 6 | 34 | 78 | 74 | 0 | 191 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -6 | -34 | -78 | -74 | 0 | -191 |

| Affordable Housing in the North | 0 | 75 | 75 | 0 | 0 | 0 | 150 |

| Multigenerational Home Renovation Tax Credit | 0 | 5 | 25 | 25 | 25 | 25 | 105 |

| Greener Buildings and Homes3 | 0 | 70 | 70 | 70 | 70 | 70 | 350 |

| Establishing a Greener Neighbourhood Pilot Program3 | 0 | 2 | 8 | 11 | 8 | 4 | 33 |

Less: Funds Sourced From Existing Departmental Resources |

0 | 0 | 0 | -4 | -2 | 0 | -6 |

| Greener Construction in Housing and Buildings3 | 0 | 17 | 24 | 28 | 31 | 28 | 127 |

| Greener Affordable Housing3 | 0 | 49 | 39 | 75 | 72 | 85 | 319 |

Less: Funds Previously Provisioned in the Fiscal Framework |

0 | -27 | -26 | -31 | -28 | -24 | -136 |

| Long-Term Supports to End Homelessness | 0 | 0 | 0 | 281 | 281 | 0 | 562 |

| Improving Community Responses to Homelessness | 0 | 8 | 8 | 2 | 0 | 0 | 18 |

| A New Veteran Homelessness Program | 0 | 0 | 0 | 13 | 24 | 24 | 62 |

Less: Year-Over- Year Reallocation of Funding |

0 | -11 | 0 | 11 | 0 | 0 | 0 |

| 1.2. Helping Canadians Buy Their First Home | -17 | 124 | 180 | 345 | 350 | 355 | 1,338 |

| A Tax-Free First Home Savings Account | 0 | 0 | 55 | 215 | 225 | 230 | 725 |

| Doubling the First-Time Home Buyers’ Tax Credit | 30 | 125 | 130 | 130 | 130 | 130 | 675 |

| An Extended and More Flexible First-Time Home Buyer Incentive | 9 | 38 | 43 | 51 | 52 | 50 | 242 |

Less: Funds Sourced From Existing Departmental Resources |

-55 | -38 | -48 | -51 | -57 | -56 | -305 |

| Supporting Rent-to-Own Projects | 0 | 22 | 24 | 24 | 25 | 26 | 121 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -22 | -24 | -24 | -25 | -26 | -121 |

| 1.3. Protecting Buyers and Renters | 0 | 3 | 3 | 0 | 0 | 0 | 5 |

| Moving Forward on a Home Buyers' Bill of Rights | 0 | 3 | 3 | 0 | 0 | 0 | 5 |

| 1.4. Curbing Foreign Investment and Speculation | 0 | -14 | -25 | -25 | -25 | -25 | -114 |

| Making Property Flippers Pay Their Fair Share | 0 | -4 | -15 | -15 | -15 | -15 | -64 |

| Taxing Assignment Sales | 0 | -10 | -10 | -10 | -10 | -10 | -50 |

| Additional Investments – Making Housing More Affordable |

0 | 26 | 0 | 0 | 0 | 0 | 26 |

| Assisting Homeowners Affected by Pyrrhotite | 0 | 26 | 0 | 0 | 0 | 0 | 26 |

| Additional funding proposed for the Canada Mortgage and Housing Corporation to support homeowners in Quebec whose homes require remediation from damages to foundations caused by the mineral pyrrhotite. | |||||||

| Chapter 1 - Net Fiscal Impact | 733 | 1,951 | 2,188 | 2,109 | 2,189 | 966 | 10,137 |

|

Note: Numbers may not add due to rounding.

|

|||||||

Report a problem on this page

- Date modified: