Archived - Chapter 2:

A Strong, Growing, and Resilient Economy

The global economy is changing. Technology, globalization, and an historic effort to fight climate change are creating new industries and new jobs.

We can be leaders in the economy of today and tomorrow and Canadians can benefit from the good jobs and economic growth that will come with it. But to be leaders in tomorrow’s economy, we need to make smart decisions today.

We need to attract more investment in the industries that are creating good middle class jobs for Canadians. We need to make our economy more resilient by strengthening our supply chains, ensuring our businesses can get their goods to market, and making sure Canadians are able to buy the products they need from around the world.

We need to make our economy more innovative and more productive and we need to make it easier for businesses, big and small, to invest, grow, and create jobs in Canada.

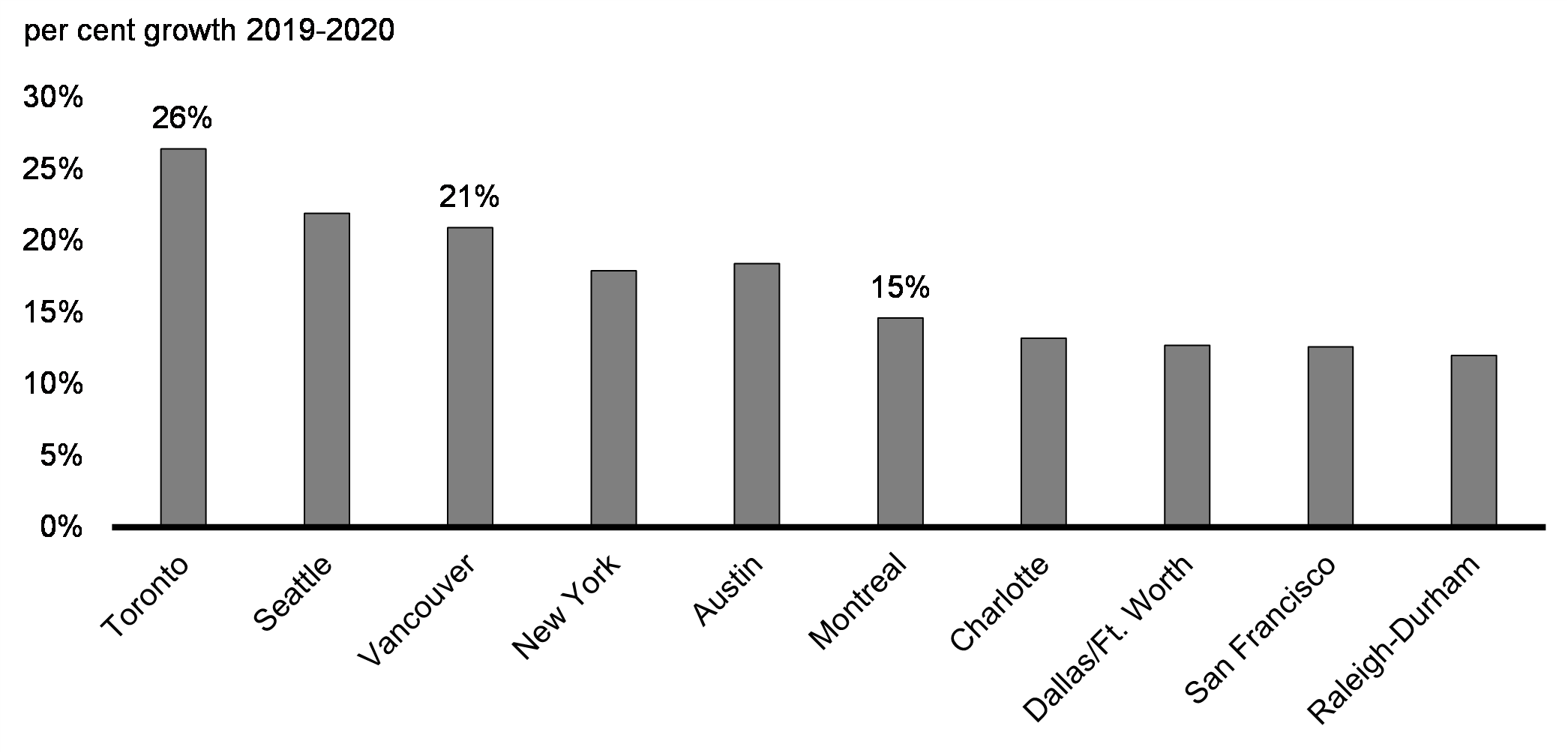

Canada is already home to some of the fastest growing markets for high-tech jobs in North America. Toronto—not Silicon Valley—led high-tech job growth from 2019 into 2020, and Vancouver outpaced New York City.

High Tech Job Growth

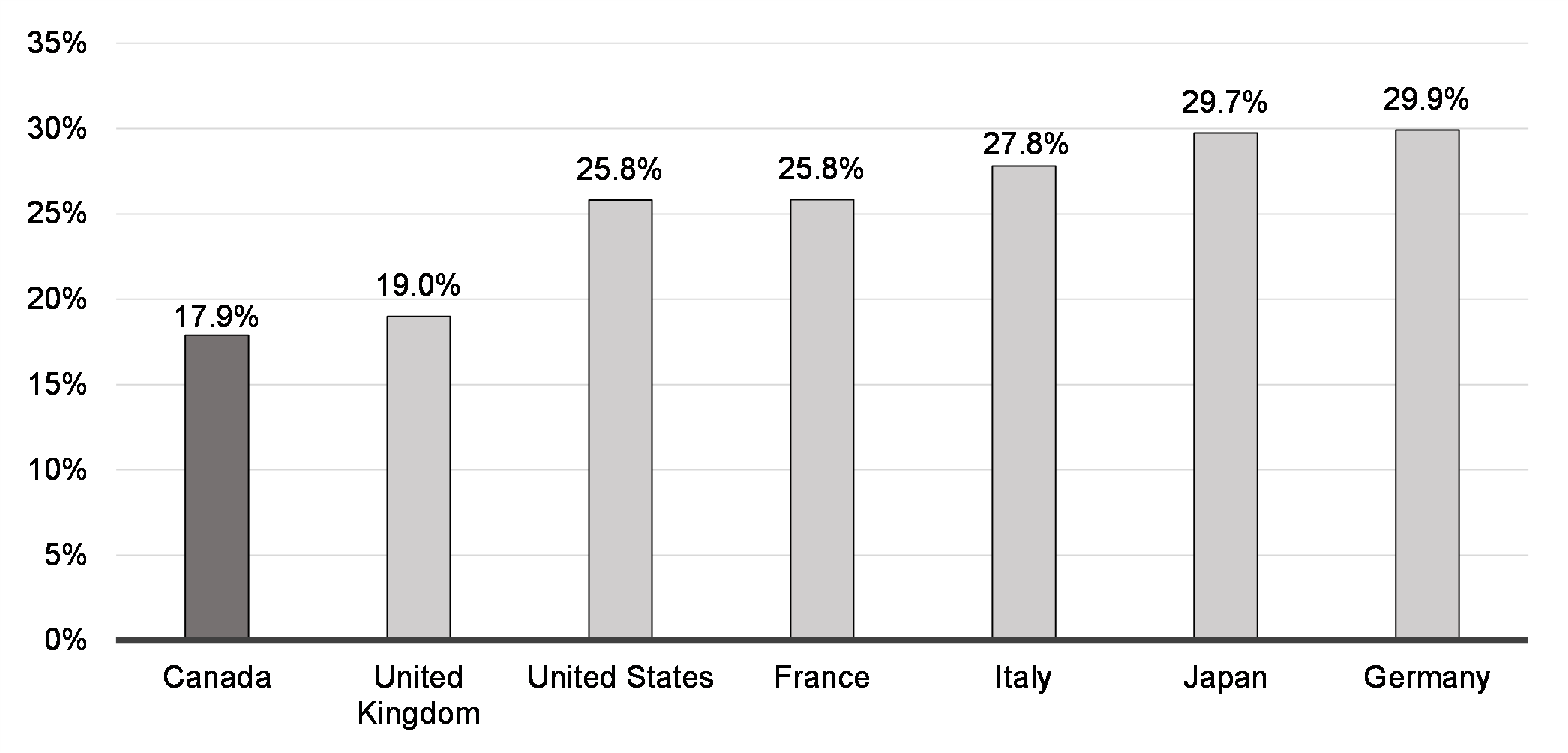

The corporate income tax rate reductions proposed in Budget 2021 for businesses that manufacture zero-emission technologies will give Canada the lowest combined federal-provincial-territorial average tax rate in the G7. This makes us an attractive destination for business investment in the clean technology sector—a sector that is getting larger and more valuable every day.

Statutory Corporate Income Tax Rates for Zero-Emission Technology Manufacturing and Processing, G7 Countries

As the global economy changes, Canada has everything we need to thrive. Our workforce is one of the most educated in the world. We have world- class research institutions and abundant sources of clean energy. We are the only country in the world with free trade access to the entire G7 and European Union.

But other countries are moving fast in the international competition for investment and innovation. We need to do more to ensure Canadian businesses—of all sizes—are able to succeed.

Budget 2022 outlines the additional steps that need to be taken—the steps that will create new, good-paying jobs for Canadians; help more people join the middle class; and set Canada up to be an economic leader for decades to come.

Key Ongoing Actions

In Budget 2021, the federal government announced a range of important programs and initiatives that will help foster economic growth, including:

-

$8 billion to transform and decarbonize industry and invest in clean technologies and batteries;

-

$4 billion for the Canada Digital Adoption Program, which launched in March 2022 to help businesses move online, boost their e-commerce presence, and digitalize their businesses;

-

$1.2 billion to support life sciences and bio-manufacturing in Canada, including investments in clinical trials, bio-medical research, and research infrastructure;

-

$8 billion to transform and decarbonize industry and invest in clean technologies and batteries;

-

$1 billion to the Strategic Innovation Fund to support life sciences and bio-manufacturing firms in Canada and develop more resilient supply chains. This builds on investments made throughout the pandemic with manufacturers of vaccines and therapeutics like Sanofi, Medicago, and Moderna;

-

$1.9 billion for the National Trade Corridors Fund to make Canada’s transportation infrastructure more efficient and more effective, like twinning parts of the Trans-Canada Highway in Nova Scotia and road and rail improvements at the Port of Vancouver;

-

$1.5 billion for regional development agencies to support the country’s economic recovery through programs like the Jobs and Growth Fund and the Canada Community Revitalization Fund;

-

$1 billion for the Universal Broadband Fund (UBF), bringing the total available through the UBF to $2.75 billion, to improve high-speed Internet access and support economic development in rural and remote areas of Canada;

-

Enhancing the Canada Small Business Financing Program, increasing annual financing to small businesses by an estimated $560 million;

-

$1.2 billion to launch the National Quantum Strategy, Pan-Canadian Genomics Strategy, and the next phase of Canada’s Pan-Canadian Artificial Intelligence Strategy to capitalize on emerging technologies of the future;

-

$1 billion to revitalize the tourism sector;

-

Helping small and medium-sized businesses to invest in new technologies and capital projects by allowing for the immediate expensing of up to $1.5 million of eligible investments beginning in 2021;

-

Continuing to work with partners to support the revitalization of East Montreal, including projects that promote innovation, development, and a green and inclusive transition of the area; and

-

Cutting tax rates in half for businesses that manufacture zero-emission technologies.

2.1 Leading Economic Growth and Innovation

Budget 2022 comes at a critical time for Canada. We need to take significant and transformative steps to put our economy on the path to reach net-zero by 2050. We need to make it easier for Canadian businesses to innovate and become global leaders in the industries that will grow our economy and create new jobs.

While Budget 2022 proposes dozens of measures that will help to do these things, there are two steps, in particular, that will have a significant impact in making Canada’s economy stronger and more innovative: the launch of a world-leading Canada Growth Fund; and the creation of a new Canadian Innovation and Investment Agency.

Launching a World-Leading Canada Growth Fund

The value of economic growth is that it delivers higher and better standards of living for Canadians. Facing the challenges of climate change, technological change, and a changing global economy, Canada’s economic success is not guaranteed. It requires focused and concerted action.

Governments cannot do this alone. To prosper in the face of challenges of such great scale, we must find new ways of pooling our capabilities across the public sector, the private sector, and across industries from coast-to-coast-to-coast.

On the fight against climate change alone—to build a net-zero economy by 2050—Canada will need between $125 billion and $140 billion of investment every year over that period. Today, annual investment in the climate transition is between $15 billion and $25 billion. No one government can close that gap.

Today, other countries are moving to positon themselves in the international competition for capital and investment. Canada’s peers have begun to launch growth funds to attract the trillions of dollars in private capital that are waiting to be invested in the good jobs and new industries of today and tomorrow. Canada must keep pace.

-

Budget 2022 proposes to establish the Canada Growth Fund to attract substantial private sector investment to help meet important national economic policy goals:

- To reduce emissions and contribute to achieving Canada’s climate goals;

- To diversify our economy and bolster our exports by investing in the growth of low-carbon industries and new technologies across new and traditional sectors of Canada’s industrial base; and

- To support the restructuring of critical supply chains in areas important to Canada’s future prosperity—including our natural resources sector.

The Canada Growth Fund will be a new public investment vehicle that will operate at arms-length from the federal government. It will invest using a broad suite of financial instruments including all forms of debt, equity, guarantees, and specialized contracts. The fund will be initially capitalized at $15 billion over the next five years. It will invest on a concessionary basis, with the goal that for every dollar invested by the fund, it will aim to attract at least three dollars of private capital.

In standing up the Canada Growth Fund, the government intends to seek expert advice from within Canada and abroad. Following these consultations, details about the launch of the fund will be included in the 2022 fall economic and fiscal update. Funding for the Canada Growth Fund will be sourced from the existing fiscal framework.

Creating a Canadian Innovation and Investment Agency

Canadians are a talented, creative, and inventive people. Our country has never been short on good ideas.

But to grow our economy, invention is not enough. Canadians and Canadian companies need to take their new ideas and new technologies and turn them into new products, services, and growing businesses.

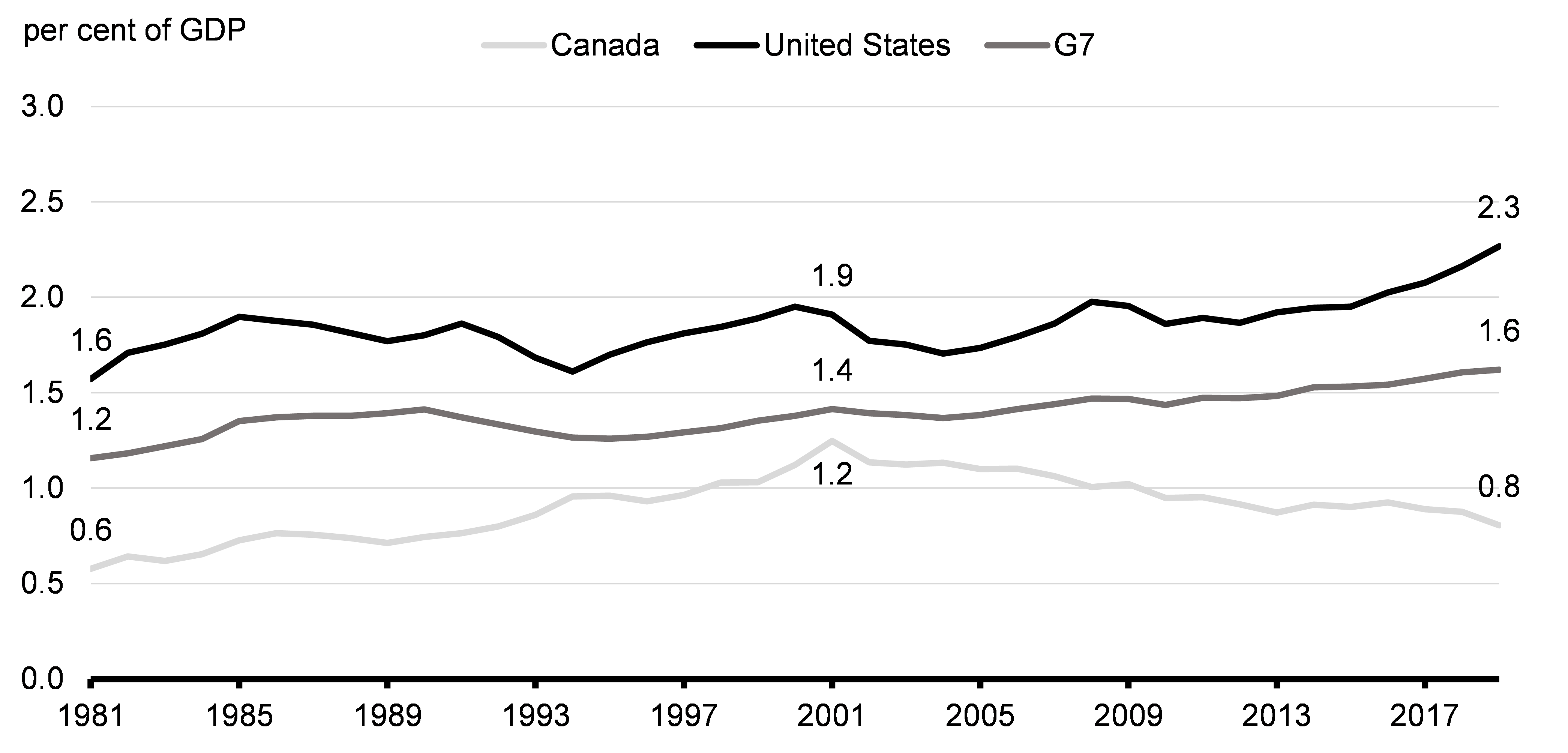

However, Canada currently ranks last in the G7 in R&D spending by businesses. This trend has to change.

Business R&D Relative to Peers

Solving Canada’s main innovation challenges—a low rate of private business investment in research, development, and the uptake of new technologies—is key to growing our economy and creating good jobs.

A market-oriented innovation and investment agency—one with private sector leadership and expertise—has helped countries like Finland and Israel transform themselves into global innovation leaders.

The Israel Innovation Authority has spurred the growth of R&D-intensive sectors, like the information and communications technology and autonomous vehicle sectors. The Finnish TEKES helped transform low-technology sectors like forestry and mining into high technology, prosperous, and globally competitive industries.

In Canada, a new innovation and investment agency will proactively work with new and established Canadian industries and businesses to help them make the investments they need to innovate, grow, create jobs, and be competitive in the changing global economy.

-

Budget 2022 announces the government’s intention to create an operationally independent federal innovation and investment agency, and proposes $1 billion over five years, starting in 2022-23, to support its initial operations. Final details on the agency’s operating budget are to be determined following further consultation later this year.

At a time when other countries are making significant investments in this area, the government intends to invest in innovation, research, and development at the scale required to make Canada a global leader.

Support delivered through the innovation and investment agency will also enable innovation and growth within the Canadian defence sector and boost investments in Canadian defence manufacturing.

The government will consult further with both Canadian and global experts in finalizing the design and mandate of the new agency, with details to be announced in the 2022 fall economic and fiscal update.

An Innovation and Investment Agency to Help Canadian Businesses Succeed

Shannon runs a small life science firm in London, Ontario, and has learned that a Canadian university researcher has discovered—through preliminary experiments—a new class of potentially life-saving cancer therapeutics. Shannon’s firm specializes in methods for quickly turning potential therapeutics into safe, market-ready pharmaceuticals through advanced drug development methods.

Her firm wants to partner with the researcher to initiate a new R&D program to develop these drugs, but does not have the capital it needs. Shannon sees a large global opportunity, but financial support is needed up front to help her company seize the opportunity.

Shannon’s firm could approach the Agency to seek guidance and support, and the Agency would quickly determine the feasibility of the project, the market potential of the technology, and could provide the firm with needed funding to capitalize on an exciting opportunity. If project milestones are achieved, Shannon’s firm could apply for additional funding as it works to sell its new product around the world and create jobs here in Canada.

Review of Tax Support to R&D and Intellectual Property

The Scientific Research and Experimental Development (SR&ED) program provides tax incentives to encourage Canadian businesses of all sizes and in all sectors to conduct R&D. The SR&ED program has been a cornerstone of Canada’s innovation strategy. The government intends to undertake a review of the program, first to ensure that it is effective in encouraging R&D that benefits Canada, and second to explore opportunities to modernize and simplify it. Specifically, the review will examine whether changes to eligibility criteria would be warranted to ensure adequacy of support and improve overall program efficiency.

As part of this review, the government will also consider whether the tax system can play a role in encouraging the development and retention of intellectual property stemming from R&D conducted in Canada. In particular, the government will consider, and seek views on, the suitability of adopting a patent box regime in order to meet these objectives.

Cutting Taxes for Canada’s Growing Small Businesses

The government provides a range of incentives to encourage investments in growing businesses.

Small businesses currently benefit from a reduced federal tax rate of 9 per cent on their first $500,000 of taxable income, compared to a general federal corporate tax rate of 15 per cent. A business no longer has access to this lower rate once its level of capital employed in Canada reaches $15 million. However, phasing out access to the lower tax rate too quickly—and then requiring a small business to pay more in tax—can discourage some businesses from continuing to grow and create jobs.

-

Budget 2022 proposes to phase out access to the small business tax rate more gradually, with access to be fully phased out when taxable capital reaches $50 million, rather than at $15 million.

This would allow more medium-sized businesses to benefit from the reduced rate, increase the amount of income that can be eligible for the reduced rate, and deliver an estimated $660 million in tax savings over the 2022-2023 to 2026-2027 period that can be reinvested towards growing and creating jobs.

This measure would apply to taxation years that begin on or after Budget Day.

The government is also undertaking a review to assess whether the tax system is providing adequate support to investments in growing businesses. The review will include an examination of the rollover for small business investments. This measure allows investors in small businesses to defer tax on capital gains.

Cutting Taxes for Canada’s Growing Small Businesses

MakerCo is a manufacturing business that currently has $10 million in taxable capital and earns $500,000 in income annually (corresponding to a 5 per cent rate of return on capital). Because the company’s taxable capital does not exceed $10 million, all of its income is eligible for the small business tax rate of 9 per cent.

The company has identified a promising opportunity to expand its operations and is considering a $2 million capital investment, which would bring its taxable capital to $12 million and increase its income to $600,000.

Under the current rules, the company’s income eligible for the small business tax rate would decrease to $300,000 and the remaining $300,000 would be taxed at the general corporate tax rate of 15 per cent.

With the more gradual phase-out proposed in this Budget, the company’s income eligible for the small business tax rate would be $475,000 and the remaining $125,000 would be taxed at the general corporate tax rate. As a result, the company would save $10,500 in taxes compared to the current rules, making it more attractive for MakerCo to grow its business.

2.2 Supporting Economic Growth and Stable Supply Chains

With our abundant resources, Canada has a unique opportunity to lead the way in sectors where supply chain challenges have impacted the global economy. Smart investments in areas like agriculture, critical minerals, and semiconductors will help make Canada a leader in the clean and digital technologies that the world counts on, and create thousands of good jobs for Canadians—many of them in rural areas.

Complementary investments to allow goods to move more efficiently—both within Canada and with our trading partners around the world—will also make our economy more resilient in the face of an ever-changing world.

Canada’s Critical Minerals and Clean Industrial Strategies

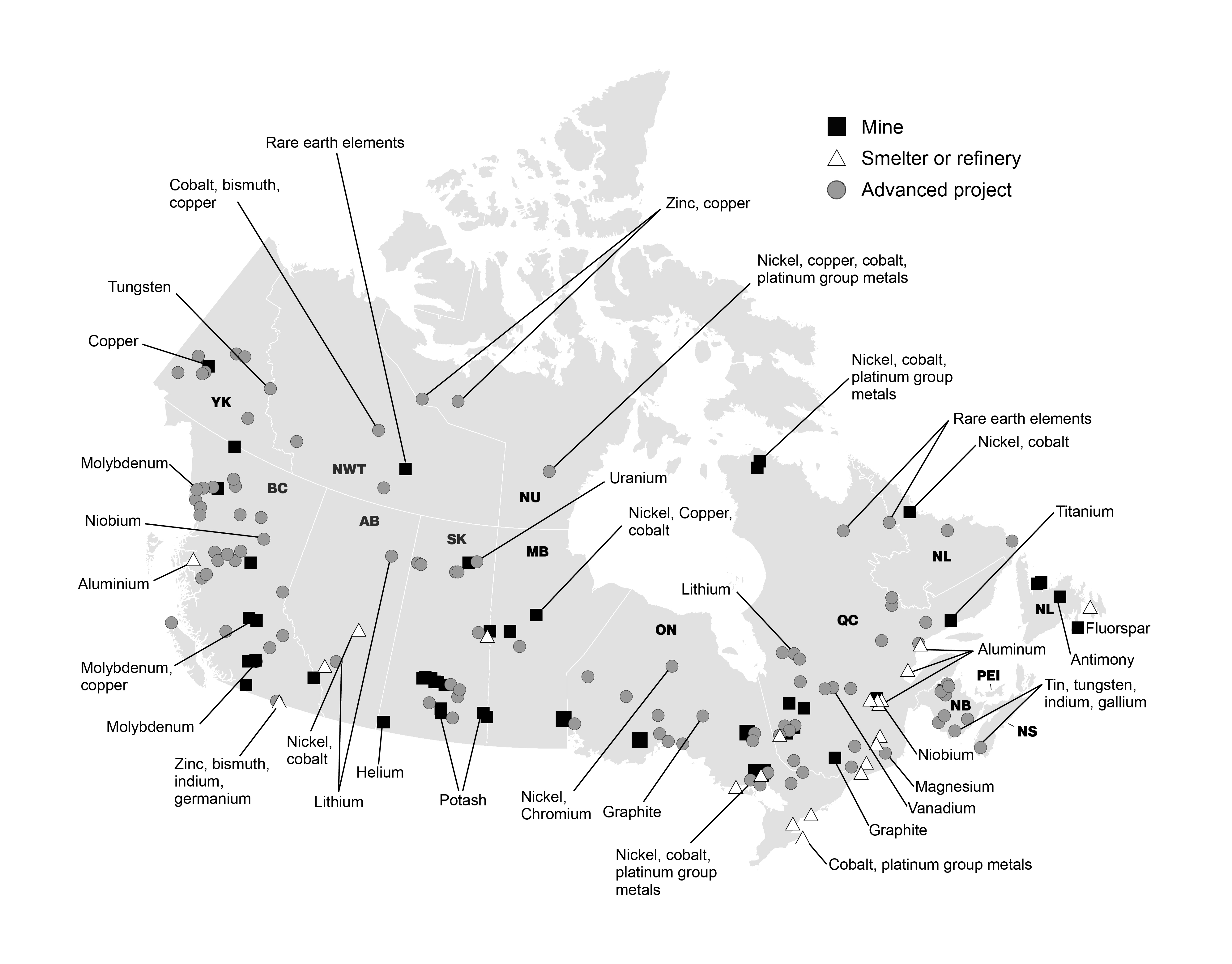

Critical Minerals Opportunities

Critical minerals are central to major global industries like clean technology, health care, aerospace, and computing. They are used in phones, computers, and in our cars. They are already essential to the global economy and will continue to be in even greater demand in the years to come.

Canada has an abundance of a number of valuable critical minerals, but we need to make significant investments to make the most of these resources.

In Budget 2022, the federal government intends to make significant investments that would focus on priority critical mineral deposits, while working closely with affected Indigenous groups and through established regulatory processes. These investments will contribute to the development of a domestic zero-emissions vehicle value chain, including batteries, permanent magnets, and other electric vehicle components. They will also secure Canada’s place in important supply chains with our allies and implement a just and sustainable Critical Minerals Strategy.

In total, Budget 2022 proposes to provide up to $3.8 billion in support over eight years, on a cash basis, starting in 2022-23, to implement Canada’s first Critical Minerals Strategy. This will create thousands of good jobs, grow our economy, and make Canada a vital part of the growing global critical minerals industry.

Supporting Critical Minerals Projects in Canada

Critical mineral mining projects are expensive and come with a unique set of challenges that can often include remote locations, changing prices, and lengthy regulatory processes. Making these projects a less risky undertaking for companies will help grow both Canada’s critical mineral industry and secure the good resource jobs of the future. Specific measures proposed in Budget 2022 to support critical mineral projects include:

-

Up to $1.5 billion over seven years, starting in 2023-24, for infrastructure investments that would support the development of the critical minerals supply chains, with a focus on priority deposits;

-

$79.2 million over five years on a cash basis, starting in 2022-23, for Natural Resources Canada to provide public access to integrated data sets to inform critical mineral exploration and development; and

-

The introduction of a new 30 per cent Critical Mineral Exploration Tax Credit for specified mineral exploration expenses incurred in Canada and renounced to flow-through share investors.

The tax credit would apply to certain exploration expenditures targeted at nickel, lithium, cobalt, graphite, copper, rare earths elements, vanadium, tellurium, gallium, scandium, titanium, magnesium, zinc, platinum group metals, or uranium, and renounced as part of a flow-through share agreement entered into after Budget Day and on or before March 31, 2027.

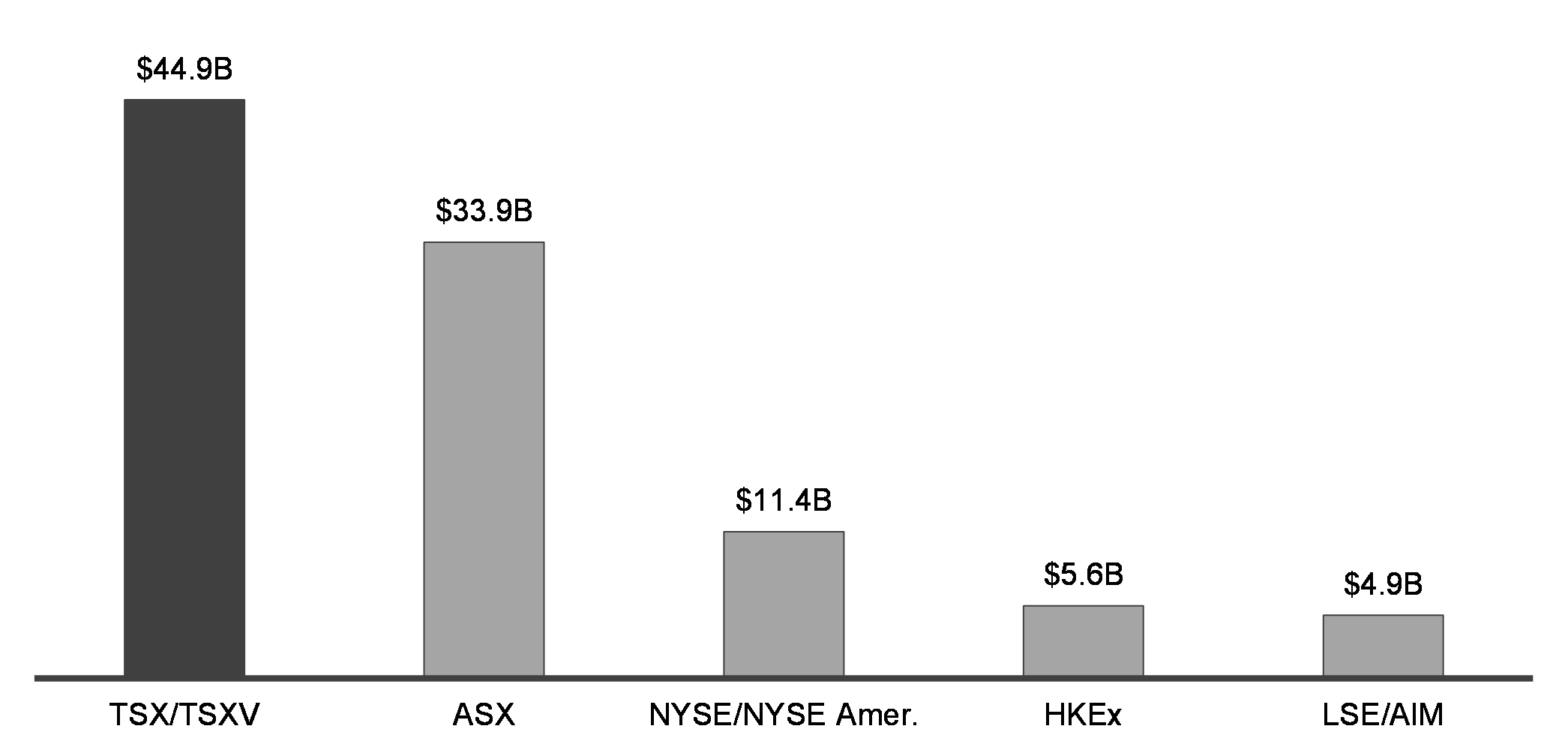

These measures will build upon Canada’s strong capital markets position for mining companies.

The Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV) are the world's primary listing venues for mining and mineral exploration companies, with more than 1,170 issuers in 2021. Between 2017 and 2021, almost $45 billion of the world's total equity capital for these mineral exploration and mining companies was raised by companies listed on the TSX or TSXV.

Global Mining Equity Capital Raised (5-Year Total = 101 Billion CAD)

Attracting Global Critical Minerals Supply Chains

Budget 2022 proposes significant funding to make Canada a more attractive destination for critical minerals investment and to secure valuable agreements that would increase production of goods like electric vehicles and batteries.

-

Budget 2022 proposes to provide up to $1 billion over six years on a cash basis, starting in 2024-25, to Innovation, Science and Economic Development Canada for the Strategic Innovation Fund. Combined with $500 million drawn from existing program funding, this will provide $1.5 billion in targeted support towards critical minerals projects, with prioritization given to manufacturing, processing, and recycling applications. Support for innovative projects through the Strategic Innovation Fund will complement other proposed investments in the sector, including a proposed $1.5 billion investment in infrastructure.

The government will also explore potential opportunities to support the growth of the solar panel industry through this envelope.

Promoting Sustainable Mining Extraction and Processing

With significant advantages like strong environmental protections, a well-educated workforce, experience in greening mining operations, and commitments to reconciliation and Indigenous participation, Canada has everything that leading companies look for when deciding where to invest in mining projects. These advantages will be vitally important as Canada seeks to develop the critical minerals supply chains.

Budget 2022 proposes new funding to build on those assets and continue to make Canada an attractive country for critical mining investment.

-

Budget 2022 proposes to provide up to $144.4 million over five years, starting in 2022-23, to Natural Resources Canada and the National Research Council to support research, development, and the deployment of technologies and materials to support critical mineral value chains.

- Additionally, as indicated in Chapter 7, Budget 2022 proposes to provide $103.4 million over five years, starting in 2022-23, to Natural Resources Canada for the development of a National Benefits-Sharing Framework for natural resources and the expansion of the Indigenous Partnership Office and the Indigenous Natural Resource Partnerships program. At least $25 million of this amount will be dedicated to early engagement and Indigenous communities' capacity building to support their participation in the critical minerals strategy. These investments will increase Indigenous capacity to benefit from all types of natural resources projects, including critical minerals, and are a key component of the Partnering with Indigenous Peoples in Natural Resource Projects proposal in Chapter 7.

Making the Critical Minerals Regulatory Processes Simpler

Companies seeking to invest look for a balanced and predictable regulatory environment and a collaborative approach between different orders of government. To help job-creating critical minerals projects move forward in Canada, Budget 2022 makes important investments in improving our regulatory processes.

-

Budget 2022 proposes to provide $10.6 million over three years, starting in 2024-25, to Natural Resources Canada to renew the Centre of Excellence on Critical Minerals, which works with provincial, territorial, and other partners, and that will provide direct assistance to help developers of critical minerals navigate regulatory processes and existing support measures.

-

Budget 2022 also proposes to provide up to $40 million over eight years, starting in 2022-23, to Crown-Indigenous Relations and Northern Affairs Canada to support northern regulatory processes.

To ensure an efficient and effective impact assessment regime, the federal government will consider the funding requirements for the Impact Assessment Agency of Canada and other relevant departments in the context of the fall 2022 economic and fiscal update. This will help support the assessment of major projects, such as critical mineral mines.

Working With Friends and Allies to Strengthen Global Supply Chains

Canada has the critical minerals the world needs and is uniquely positioned to be a trusted partner in the global critical minerals supply chain.

-

Budget 2022 proposes to provide $70 million over eight years, starting in 2022-23, to Natural Resources Canada to advance Canada’s global leadership on critical minerals, in particular to meet its responsibilities under the Extractive Sector Transparency Measures Act.

Better Supply Chain Infrastructure

The recent flooding in British Columbia—which cut off the flow of goods to and from the west coast—reinforced the importance of our highways, railways, and ports as the backbone of our transportation system. In January, the government hosted the National Supply Chain Summit to discuss the challenges facing Canada's supply chains and identify potential solutions. The recommendations of the Task Force will help inform the development of a National Supply Chain Strategy.

Continued investments in transportation infrastructure will help ensure Canada’s supply chains can meet the needs of our economy and withstand disruptions caused by climate change and global events. Well-functioning supply chains support good jobs and keep goods moving.

-

To help build more resilient and efficient supply chains, Budget 2022 proposes to provide $603.2 million over five years, starting in 2022-23, to Transport Canada, including:

- $450 million over five years, starting in 2022-23, to support supply chain projects through the National Trade Corridors Fund, which will help ease the movement of goods across Canada’s transportation networks. This is in addition to the $4.2 billion that has been allocated to the fund since 2017. The Minister of Transport will rename the fund to reflect the government’s focus on supply chains;

- $136.3 million over five years, starting in 2022-23, to develop industry- driven solutions to use data to make our supply chains more efficient, building on the success of initiatives like the West Coast Supply Chain Visibility Program. Of this amount, $19 million will be sourced from existing resources; and

- $16.9 million over five years, starting in 2022-23, to continue making Canada’s supply chains more competitive by cutting needless red tape, including working to ensure that regulations across various modes of cargo transportation (e.g., ship, rail) work effectively together.

These investments will help lower prices for Canadians; make our supply chains stronger; improve the ability of Canadian businesses to export their goods abroad; and deliver essential goods to our communities.

These investments will also complement work the government is doing through the newly established National Supply Chain Task Force, which will work with industry, associations and experts to examine key pressures and make recommendations regarding short- and long-term actions to strengthen the efficiency, fluidity, and resiliency of transportation infrastructure and the reliability of Canada’s supply chains.

Moving on Canada’s Infrastructure Investments

The Investing in Canada Infrastructure Program is providing $33.5 billion over 11 years for public infrastructure across Canada. Under this program, provinces and territories prioritize and submit projects to Infrastructure Canada for review. To date, the program has approved more than $20 billion for over 4,500 projects in communities across the country, including the Montreal Blue Line, Calgary Green Line, and Vancouver Millennium Line extensions, and the public transit expansion in Ontario.

However, many of the funded projects are reporting construction delays due to the pandemic. Despite significant progress, there is also a need for provinces to more quickly commit their remaining funding to projects that will deliver the infrastructure that our communities need.

-

Budget 2022 signals the government’s intention to accelerate the deadline for provinces to fully commit their remaining funding under the Investing in Canada Infrastructure Program to priority projects to March 31, 2023. As a measure of fiscal prudence, any uncommitted funds after this date will be reallocated to other priorities. The federal government will work closely with provinces to support them in expediting project submissions. The existing deadline of March 31, 2025 will remain unchanged for the territories.

-

Budget 2022 also proposes to extend the Investing in Canada Infrastructure Program’s construction deadline from October 2027 to October 2033. To support this extension, Budget 2022 proposes to adjust the program’s funding profile so that funding is available when needed. This extension recognizes delays caused by the pandemic, and will ensure that provinces and territories can fund priority projects.

These measures will help ensure that federal funding for infrastructure can continue to support transformative infrastructure projects in communities across Canada.

| Province | Remaining Project Funding | |

|---|---|---|

| $ (millions) | Percentage of total project funding envelope |

|

| Alberta | $60.3 | 2% |

| British Columbia | $1,312.6 | 34% |

| Manitoba | $13.6 | 1% |

| New Brunswick | $392.4 | 58% |

| Newfoundland and Labrador | $326.3 | 59% |

| Nova Scotia | $372.0 | 45% |

| Ontario | $1,056.8 | 10% |

| Prince Edward Island | $89.8 | 25% |

| Quebec | $3,299.0 | 44% |

| Saskatchewan | $375.2 | 42% |

|

Source: Infrastructure Canada

|

||

Strengthening Canada’s Semiconductor Industry

Semiconductors—often called microchips—are used every day in smartphones, computers, and cars.

In February, the federal government announced $150 million to support investments in the development and supply of semiconductors. This investment built on the $90 million allocated in Budget 2021 to retool and modernize the National Research Council’s Canadian Photonics Fabrication Centre, which supplies photonics research, testing, prototyping, and pilot-scale manufacturing services to academics and businesses in Canada.

-

In addition to these previous investments, Budget 2022 proposes to provide $45 million over four years, starting in 2022-23 on a cash basis, to Innovation, Science and Economic Development Canada to engage with stakeholders, conduct market analysis, and support projects that will strengthen Canada’s semiconductor industry.

Growing Canada’s Health-Focused Small and Medium-Sized Businesses

The Coordinated Accessible National Health Network (CAN Health Network) brings together hospital networks and health authorities in nine provinces to procure innovative health care solutions, including investing in made-in-Canada technologies. This model shows potential to help deliver better care to Canadians, help our health technology businesses grow and create good middle class jobs across the country.

-

Budget 2022 proposes to provide $30 million over four years, starting in 2022-23, to build upon the success of the CAN Health Network, and expand it nationally to Quebec, the territories, and Indigenous communities.

Making Canada’s Economy More Competitive

A competitive economy is a fair, growing, and innovative economy. In this regard, the government will consult broadly on the role and functioning of the Competition Act and its enforcement regime. However, there are also shortcomings in the Act that can easily be addressed and move Canada in line with international best practices.

-

Budget 2022 announces the government’s intention to introduce legislative amendments to the Competition Act as a preliminary phase in modernizing the competition regime. This will include fixing loopholes; tackling practices harmful to workers and consumers; modernizing access to justice and penalties; and adapting the law to today's digital reality.

Leadership on Internal Trade and Labour Mobility

Reducing barriers to interprovincial trade and labour mobility has been consistently identified by economists as among the top ways for Canada to increase our long-term economic prosperity. The International Monetary Fund recently found that Canada could increase our GDP per capita by four per cent through a complete liberalization of interprovincial trade in goods.

Since 2015, Canada has achieved meaningful progress, including signing the Canada Free Trade Agreement, the removal of federal restrictions on the interprovincial trade of liquor, and actions to harmonize regulations between jurisdictions.

The federal government is committed to providing continued leadership on reducing barriers to internal trade and labour mobility.Over the coming year the government will evaluate and, where appropriate, remove federal exemptions to the Canada Free Trade Agreement and take action to conclude outstanding internal trade negotiations.

Supporting Canada’s Innovation Clusters

Since they were launched in 2017, Canada’s innovation clusters have helped build successful and growing innovation ecosystems across the Canadian economy. These have included plant-based protein alternatives; ocean-based industries; advanced manufacturing; digital technologies; and artificial intelligence.

As of December 2021,Canada’s innovation clusters have already approved more than 415 projects with 1,840 partners, worth over $1.9 billion. These projects have been supported through co-investment by government and industry across 11 provinces and territories. Together they have also generated more than 850 new intellectual property rights.

There is an opportunity now to build on the success of this model to strengthen networks between the private sector, academia, and governments in ways that will promote innovation, help firms grow in Canada, and grow our economy.

-

Budget 2022 proposes to provide $750 million over six years, starting in 2022-23, to support the further growth and development of Canada’s Global Innovation Clusters. Building on their success to date, these clusters will expand their national presence and will collaborate to deepen their impact, including through joint missions aligned with key government priorities, such as fighting climate change and addressing supply chain disruptions. To maximize the impact of this funding and to ensure it corresponds with industry and government needs, it will be allocated between the five clusters on a competitive basis.

Renewing the Canadian Agricultural Partnership

For generations, the agriculture and agri-food sector has been a cornerstone of the Canadian economy. Canada’s farmers are counted upon to feed Canadians and the world—a task that is even more important today due to increasing food insecurity stemming from Russia’s illegal invasion of Ukraine.

The Canadian Agricultural Partnership is a comprehensive suite of support offered by the federal, provincial, and territorial governments. Each year, these programs provide $600 million to support agricultural innovation, sustainability, competitiveness, and market development. The framework also includes a comprehensive suite of business risk management programs to help Canadian farmers cope with volatile markets and disaster situations, with average spending of approximately $2 billion per year.

Federal, provincial, and territorial governments will work together over the coming year to renew the programs under the next agricultural policy framework that begins in 2023.

2.3 Investing in Intellectual Property and Research

Investing in and protecting intellectual property and research are vitally important pieces of building an innovative economy.

Answering the call from those looking to innovate, Budget 2022 helps to protect and expand intellectual property and research; attract leading researchers; advance critical research priorities; and strengthen the security of our research institutions.

Building a World-Class Intellectual Property Regime

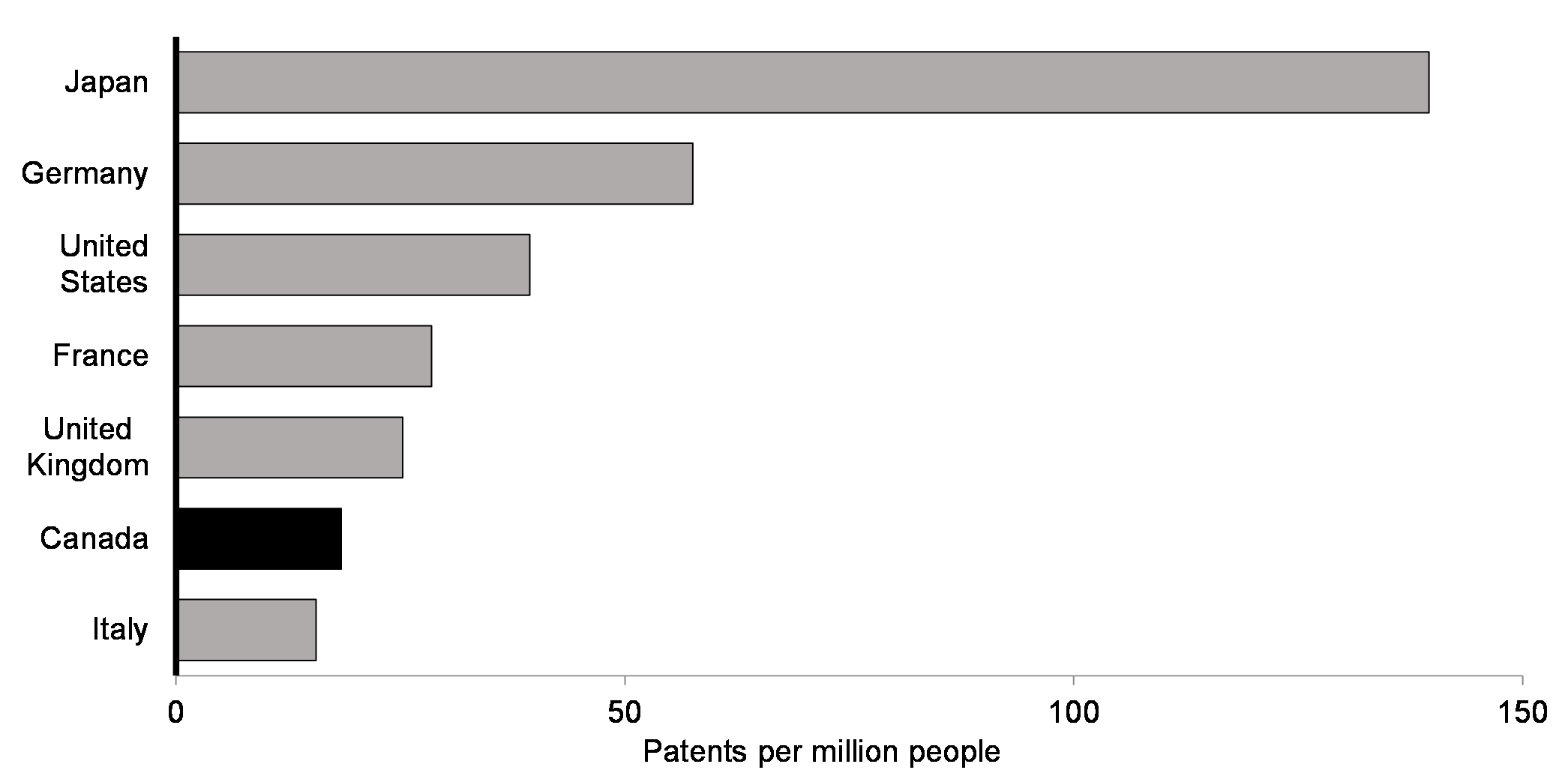

Patent-owning businesses grow faster and pay higher wages. However, on the number of patents held, Canada lags behind other countries we are competing with to attract investment and grow our economy.

Since 2015, the federal government has taken important steps to improve Canada’s intellectual property performance, including through the launch of the National Intellectual Property Strategy in 2018, and Elevate IP and IP Assist announced in Budget 2021.

Number of Patents per Capita, 2018

-

To build a world-class intellectual property regime, Budget 2022 proposes to build on previous investments and provide $96.6 million over five years, starting in 2022-23, and $22.9 million ongoing, as follows:

- $47.8 million over five years, starting in 2023-24, and $20.1 million ongoing to Innovation, Science and Economic Development Canada to launch a new national lab-to-market platform to help graduate students and researchers take their work to market;

- $35 million over five years, starting in 2022-23, to Global Affairs Canada for the CanExport program to help Canadian businesses secure their intellectual property in foreign markets;

- $10.6 million over five years, starting in 2022-23, and $2 million ongoing to Innovation, Science and Economic Development Canada to launch a survey to assess the government’s previous investments in science and research, and how knowledge created at post-secondary institutions generates commercial outcomes;

- $2.4 million over five years, starting in 2022-23, and $0.6 million ongoing to Innovation, Science and Economic Development Canada to expand use of ExploreIP, Canada’s intellectual property marketplace, so that more public sector intellectual property is put to use helping Canadian businesses; and,

- $0.8 million over five years, starting in 2022-23, and $0.2 million ongoing to Innovation, Science and Economic Development Canada to expand the Intellectual Property Legal Clinics Program, which will make it easier to access basic intellectual property services.

The Strategic Intellectual Property Program Review announced in Budget 2021 is underway. Where appropriate the federal government intends to strengthen intellectual property conditions to promote the growth of intellectual property and maintain it in Canada.

The government will also undertake a review of further ways to build innovative companies that support Canada’s competitiveness, keep intellectual property in Canada, and attract talent and investment from around the world. In particular, the government will consider and seek views on the suitability of adopting a patent box regime and other measures to promote the growth of intellectual property and maintain it in Canada.

Securing Canada’s Research from Foreign Threats

Canadian research and intellectual property can be an attractive target for foreign intelligence agencies looking to advance their own economic, military, or strategic interests. The National Security Guidelines for Research Partnerships, developed in collaboration with the Government of Canada– Universities Working Group in July 2021, help to protect federally funded research.

-

To implement these guidelines fully, Budget 2022 proposes to provide $159.6 million, starting in 2022-23, and $33.4 million ongoing, as follows:

- $125 million over five years, starting in 2022-23, and $25 million ongoing, for the Research Support Fund to build capacity within post- secondary institutions to identify, assess, and mitigate potential risks to research security; and

- $34.6 million over five years, starting in 2022-23, and $8.4 million ongoing, to enhance Canada’s ability to protect our research, and to establish a Research Security Centre that will provide advice and guidance directly to research institutions.

Hiring More Leading Researchers

The federal government created the Canada Research Chairs Program (CRCP) in 2000 to grow the number of world-class researchers in Canada. Today, there are more than 2,200 Canada Research Chairs helping our universities lead cutting- edge research. An extensive evaluation of the CRCP is currently underway and is expected to be completed in fall 2022. Future investments and modernization to the CRCP will be examined following the review.

To complement the CRCP, the Canada Excellence Research Chairs program attracts and retains top-tier global research faculty in science and technology.

-

Budget 2022 proposes to provide $38.3 million over four years, starting in 2023-24, and $12.7 million ongoing for the federal granting councils to add new, internationally recruited Canada Excellence Research Chairs in the fields of science, technology, engineering, and mathematics. This will support a further 12 to 25 new Canada Excellence Research Chairs— reinforcing Canada’s competitive advantage as a destination of choice for world-class researchers.

Expanding Canada’s Presence in Space

Budget 2019 announced an investment of $1.9 billion over 24 years to build and operate Canadarm3 for the NASA-led Lunar Gateway.

Canadarm3 is a smart robotic system that will use cutting-edge software and artificial intelligence to perform tasks on the Lunar Gateway station as it orbits the Moon.

A broad range of Canadian companies will also play a role in the Canadarm3 supply chain, which will create and maintain an estimated 630 high-quality jobs for Canadians over a 12-year period that began in 2019-20.

In December 2020, Canada signed a treaty with the United States that guaranteed Canada’s use of Lunar Gateway for scientific and innovation purposes and secured flights for Canadian astronauts to go to the Moon. This will include the participation of Canadian astronauts on Artemis II—the first crewed mission to the Moon’s vicinity since 1972—which will make Canada just the second country to send a human to deep space.

-

Budget 2022 announces the government’s intention to introduce legislative amendments and new legislation necessary to enable Canada’s participation in Lunar Gateway, including the ratification of the Canada-US Lunar Gateway Treaty and the construction of Canadarm3.

Leveraging the National Research Council

The National Research Council (NRC) provides a network of research and technical facilities across Canada, supporting business, government, and university collaborations.

Budget 2022 announces that the government will explore new ways to better integrate leading university researchers and business partners and further modernize the NRC to better invent, innovate, and prosper.

Additional information will be forthcoming alongside further details on the establishment of the new innovation and investment agency.

Funding for Black Researchers View the impact assessment

A diverse, inclusive, and equitable research community leads to better research and science. The scholarship and fellowship programs of the federal granting councils—the Natural Sciences and Engineering Research Council, Social Sciences and Humanities Research Council, and Canadian Institutes of Health Research—provide student researchers with the support they need to pursue research and science and to secure good jobs. However, Black researchers are underrepresented in the awarding of these grants, scholarships, and fellowships. To help increase opportunities for Black Canadian researchers:

-

Budget 2022 proposes to provide $40.9 million over five years, starting in 2022-23, and $9.7 million ongoing to the federal granting councils to support targeted scholarships and fellowships for promising Black student researchers.

Funding the Canadian High Arctic Research Station

As a hub for science and technology in Canada’s North, the Canadian High Arctic Research Station is designed to be a world-class scientific facility in the remote Arctic that strengthens Canadian leadership on Arctic issues.

-

Budget 2022 proposes to provide $14.5 million over five years, starting in 2022-23, with $8.4 million in remaining amortization and $2.5 million ongoing, to support the completion and operations of the Canadian High Arctic Research Station.

2.4 Driving Investment and Growth for Our Small Businesses

Canada’s small and medium-sized businesses are at the heart of our economy and our communities. They define our main streets and neighbourhoods, in cities and towns, both urban and rural. Helping them innovate and grow is good for Canada—now and for decades to come.

Budget 2022 will address the barriers that are preventing small businesses from growing. This includes reducing payment card fees for merchants.

Budget 2022 will also help Canadian businesses make the most of global trade opportunities, while better protecting Canadian businesses against unfair competition.

Reducing Credit Card Transaction Fees

Payment card transaction fees can increase the cost of doing business for our small businesses. As announced in Budget 2021, the federal government is committed to lowering the cost of credit card fees in a way that benefits small businesses and protects existing reward points for consumers. To this end, the government will continue current consultations with stakeholders on solutions to lower the cost of fees for merchants.

Strengthening Canada’s Trade Remedy and Revenue Systems

A strong and accessible trade remedy system protects Canadian workers and businesses, while effective revenue systems ensure that trade flows are effectively enforced.

-

Budget 2022 announces the government’s intention to introduce amendments to the Special Import Measures Act and the Canadian International Trade Tribunal Act to strengthen Canada’s trade remedy system by better ensuring unfairly traded goods are subject to duties, and increasing the participation of workers.

-

Budget 2022 proposes to provide $4.7 million over five years, starting in 2022-23, and $1.1 million ongoing, to the Canada Border Services Agency to create a Trade Remedy Counselling Unit that will assist companies, with a focus on small and medium-sized enterprises.

-

The government also proposes to introduce amendments to the Customs Act to implement electronic payments and clarify importer responsibility for duties and taxes.

Employee Ownership Trusts

Employee ownership trusts encourage employee ownership of a business, and facilitate the transition of privately owned businesses to employees. Budget 2021 announced that the government would engage with stakeholders to examine what barriers exist to the creation of these trusts in Canada.

These consultations revealed that the main barrier to the creation of employee ownership trusts in Canada was the lack of a dedicated trust vehicle under current tax legislation tailored to the requirements of these structures.

-

Budget 2022 proposes to create the Employee Ownership Trust—a new, dedicated type of trust under the Income Tax Act to support employee ownership.

The government will continue to engage with stakeholders to finalize the development of rules for the Employee Ownership Trust and to assess remaining barriers to the creation of these trusts.

Engaging the Cannabis Sector

As a relatively new sector of the Canada economy, it is important that the federal government and all stakeholders have a clear understanding of the challenges and opportunities that are facing Canada’s legal cannabis sector.

-

Budget 2022 proposes launching a new cannabis strategy table that will support an ongoing dialogue with businesses and stakeholders in the cannabis sector. This will be led by the Department of Innovation, Science and Economic Development, and will provide an opportunity for the government to hear from industry leaders and identify ways to work together to grow the legal cannabis sector in Canada.

This engagement is in addition to the proposed changes to the cannabis excise duty framework detailed in the Tax Supplementary Information.

2.5 Supporting Recovery and Growth in Affected Sectors

Changes in global trade, or other disruptions, can have significant consequences for Canadian businesses and the Canadian families that depend on them. This is particularly the case for sectors that depend on predictable market and border conditions, like agriculture and tourism.

The federal government has a role to play in minimizing the impacts of these challenges on businesses and industries when they arise, and to help them recover and grow afterwards.

Budget 2022 takes timely action to support the resiliency of important sectors, and to invest in their long-term success.

The Next Steps Towards High Frequency Rail

High frequency rail has the potential to offer climate-friendly transportation and faster, more regular, and more reliable passenger rail service between Toronto and Quebec City—Canada’s busiest travel corridor. The federal government is making use of the expertise of private sector companies for the potential project’s planning and design.

-

Budget 2022 proposes to provide $396.8 million over two years, starting in 2022-23, to Transport Canada and Infrastructure Canada for planning and design steps in support of high frequency rail between Toronto and Quebec City.

Investing in VIA Rail Stations and Maintenance Centres

In 2019, 4.8 million passengers rode VIA Rail trains in the Windsor to Quebec City corridor. Demand for passenger rail was significantly affected by the pandemic, but ridership on VIA trains is now rebounding and is expected to continue to rise as we come through the pandemic. However, many of VIA Rail’s maintenance centres and stations are decades-old and require significant investments to ensure they can provide the quality rail service that Canadians deserve.

-

Budget 2022 proposes to provide $42.8 million over four years, starting in 2023-24, with $169.4 million in remaining amortization, to VIA Rail Canada to construct, maintain, and upgrade stations and maintenance centres in the Windsor to Quebec City corridor.

Supporting the Prince Edward Island Potato Industry

The detection of potato wart on Prince Edward Island (PEI) has disrupted sales of potatoes to the United States and threatened the livelihoods of Islanders who count on being able to export their world-class potatoes. The federal government is making progress in getting PEI potatoes back to market in the United States. With that work ongoing, the government will continue to support the PEI potato industry, and the Canadian Food Inspection Agency will continue its efforts to prevent the spread of potato wart on PEI.

-

Budget 2022 proposes to provide a total of $16 million over two years, on a cash basis, starting in 2022-23 to the Atlantic Canada Opportunities Agency through the Jobs and Growth Fund to support long-term investments and assist in stabilizing the Prince Edward Island potato sector and supply chain.

-

Budget 2022 also proposes to provide $12 million over two years, starting in 2022-23, for the Canadian Food Inspection Agency to accelerate the investigation into the latest detection of potato wart to help prevent its spread and to allow for full trade to resume with the United States as soon as possible.

Full and Fair Compensation for Supply Managed Sectors

As a result of significant trade deals that the federal government has negotiated since 2015, Canada now has trade agreements with two-thirds of the world’s economies and is the only country with free trade access to the entire G7 and the European Union. Free trade creates good jobs for Canadians and will help our economy and businesses continue to grow for decades to come.

As part of these agreements, including the new NAFTA, Canada provided our trading partners with incremental market access for dairy, poultry, and eggs.

Since 2016, the federal government has provided $2.7 billion in compensation for farmers as a result of the Canada-European Union Comprehensive Economic and Trade Agreement and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. Processors of dairy, poultry, and eggs have also received $392.5 million in compensation.

Working with sector representatives, the government will announce full and fair compensation for the supply managed sector related to the new NAFTA in the 2022 fall economic and fiscal update.

Support for Canada’s Tourism Sector

After five consecutive years of growth, the pre-COVID visitor economy generated $105 billion in expenditures in Canada in 2019. The sector remains a key economic driver and job creator, especially for young and rural Canadians.

With the onset of the pandemic, workers and businesses in the tourism industry felt the full impact of public health measures and border closures.

To date, the tourism and hospitality sector received an estimated $23 billion in support through the federal government’s emergency programs.

The Tourism and Hospitality Recovery Program, which is available until May 2022, was introduced to provide support through wage and rent subsidies to organizations in the tourism and hospitality sectors. The Local Lockdown Program was also introduced to ensure organizations have the necessary support to weather the impacts of lockdowns and capacity restrictions.

Canada’s high vaccination rate and the lifting of travel restrictions are providing important relief as the sector begins to turn the corner. To continue supporting Canada’s tourism sector, the Minister of Tourism will work with the tourism industry, provincial and territorial counterparts, and Indigenous tourism operators to develop a new post-pandemic Federal Tourism Growth Strategy, which will plot a course for growth, investment, and stability.

As part of these efforts, and to ensure Indigenous businesses are part of the recovery, Budget 2022 proposes two important measures.

-

Budget 2022 proposes to provide $20 million over two years, starting in 2022-23, in support of a new Indigenous Tourism Fund to help the Indigenous tourism industry recover from the pandemic and position itself for long-term, sustainable growth.

-

Budget 2022 also proposes to provide $4.8 million over two years, starting in 2022-23, to the Indigenous Tourism Association of Canada to support its operations, which continue to help the Indigenous tourism industry rebuild and recover from the pandemic.

These measures build on other ongoing supports for the sector, including $1 billion in support provided through Budget 2021 programs such as the Tourism Relief Fund and the Major Festivals and Events Support Initiative. An estimated $750 million of these funds are expected to be used to support the sector in 2022-23. Destination Canada is also expected to spend more than $48 million for marketing campaigns in the United States, in order to draw in more visitors and increase economic activity.

Supporting Vibrant Rural Communities

Canada’s rural communities are a driver of economic growth, and home to a wide range of industries including agriculture, mining, and tourism. To support this growth, the federal government has announced a range of important programs and initiatives that are supporting Canadians living and working in rural communities, including:

- $2.75 billion for the Universal Broadband Fund to improve high-speed Internet access in rural and remote areas;

- $2 billion for the Regional Relief and Recovery Fund, which has supported local businesses through Regional Development Agencies during the pandemic;

- $2.7 billion in compensation to farmers since 2016 for the Canada-European Union Comprehensive Economic and Trade Agreement, and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership;

- $1 billion to revitalize the tourism industry;

- $392.5 million in compensation for dairy, poultry, and egg processors;

- $101 million to support Canada’s wine sector as it adapts to ongoing and emerging challenges; and

- Providing $100 million from the price on pollution directly to farmers in provinces where the federal system applies.

Budget 2022 also announces further action to support Canadians living in rural communities, including:

- $26.2 million to increase the forgivable amount of student loans for doctors and nurses who practice in rural and remote communities;

- $3.8 billion over eight years to launch Canada’s first Critical Minerals Strategy, which will create jobs in rural communities across Canada;

- $346.1 million to train 1,000 fire fighters and provide them with new equipment, and $169.9 million to create a new wildfire satellite monitoring system;

- $4 billion over five years for a new Housing Accelerator Fund to help municipalities—including smaller and rural communities—build 100,000 new homes;

- $29.3 million to create a Trusted Employer model and cut red tape for access to the Temporary Foreign Worker Program, and $48.2 million to create a new streamlined foreign worker program for agricultural and fish processing employers;

- $55 million to maintain and enhance the Trans Canada Trail;

- $470 million to help farmers reduce emissions by expanding the On-Farm Climate Action Fund; and

- Tripling the size of the Agricultural Clean Technology Program with a top-up of $329 million.

| 2021– 2022 |

2022- 2023 |

2023- 2024 |

2024- 2025 |

2025- 2026 |

2026- 2027 |

Total | |

|---|---|---|---|---|---|---|---|

| 2.1. Leading Economic Growth and Innovation | 0 | 11 | 364 | 410 | 435 | 440 | 1,660 |

| Launching a World-Leading Canada Growth Fund | 0 | 10 | 300 | 400 | 400 | 400 | 1,510 |

Less: Funds Sourced From the Fiscal Framework |

0 | -10 | -300 | -400 | -400 | -400 | -1,510 |

| Creating a Canadian Innovation and Investment Agency | 0 | 1 | 199 | 250 | 275 | 275 | 1000 |

| Cutting Taxes for Canada’s Growing Small Businesses | 0 | 10 | 165 | 160 | 160 | 165 | 660 |

| 2.2. Supporting Economic Growth and Stable Supply Chains | 0 | 187 | 644 | 734 | 737 | 726 | 3,029 |

| Canadian Critical Minerals Strategy – Infrastructure Investments |

0 | 0 | 214 | 214 | 214 | 214 | 857 |

| Critical Mineral Exploration Tax Credit | 0 | 65 | 45 | 110 | 90 | 90 | 400 |

| Canadian Critical Minerals Strategy – Integrated Data |

0 | 8 | 15 | 18 | 18 | 18 | 77 |

| Canadian Critical Minerals Strategy – Strategic Innovation Fund |

0 | 0 | 0 | 17 | 44 | 101 | 162 |

| Canadian Critical Minerals Strategy – Technology Research, Development, and Deployment | 0 | 20 | 20 | 35 | 35 | 35 | 144 |

| Canadian Critical Minerals Strategy – Centre of Excellence on Critical Minerals |

0 | 0 | 0 | 4 | 4 | 4 | 11 |

| Canadian Critical Minerals Strategy – Support for Northern Regulatory Processes |

0 | 5 | 5 | 5 | 5 | 5 | 25 |

| Canadian Critical Minerals Strategy – Global Leadership on Critical Minerals |

0 | 8 | 13 | 13 | 13 | 13 | 62 |

| Better Supply Chain Infrastructure | 0 | 63 | 161 | 138 | 134 | 109 | 603 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -2 | -4 | -4 | -4 | -4 | -19 |

| Strengthening Canada's Semiconductor Industry | 0 | 3 | 3 | 18 | 18 | 0 | 40 |

| Growing Canada’s Health- Focused Small and Medium-Sized Businesses | 0 | 10 | 10 | 5 | 5 | 0 | 30 |

| Supporting Canada's Innovation Clusters | 0 | 8 | 162 | 162 | 163 | 142 | 637 |

| 2.3. Investing in Intellectual Property and Research | 0 | 45 | 56 | 77 | 83 | 89 | 350 |

| Building a World-Class Intellectual Property Regime | 0 | 9 | 13 | 20 | 25 | 30 | 97 |

| Securing Canada’s Research from Foreign Threats | 0 | 29 | 31 | 32 | 33 | 34 | 160 |

| Hiring More Leading Researchers | 0 | 0 | 0 | 13 | 13 | 13 | 38 |

| Funding for Black Researchers | 0 | 4 | 8 | 9 | 10 | 10 | 41 |

| Funding the Canadian High Arctic Research Station | 0 | 3 | 3 | 2 | 3 | 3 | 14 |

| 2.4. Driving Investment and Growth for Our Small Businesses | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

| Strengthening Canada’s Trade Remedy and Revenue Systems - Trade Remedy Counselling Unit | 0 | 1 | 1 | 1 | 1 | 1 | 5 |

| Strengthening Canada’s Trade Remedy and Revenue Systems - Clarifying Liability for Amounts Owing on Imports | 0 | 0 | -1 | -1 | -1 | -1 | -4 |

| 2.5. Supporting Recovery and Growth in Affected Sectors |

0 | 95 | 348 | 10 | 14 | 14 | 482 |

| The Next Steps Towards High Frequency Rail | 0 | 74 | 323 | 0 | 0 | 0 | 397 |

| Investing in VIA Rail Stations and Maintenance Centres | 0 | 0 | 4 | 10 | 14 | 14 | 43 |

| Supporting the Prince Edward Island Potato Industry | 0 | 10 | 10 | 0 | 0 | 0 | 20 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -1 | -1 | 0 | 0 | 0 | -2 |

| Support for Canada's Tourism Sector | 0 | 13 | 12 | 0 | 0 | 0 | 25 |

| Chapter 2 - Fiscal Impact | 0 | 339 | 1,412 | 1,232 | 1,270 | 1,270 | 5,522 |

| Moving on Canada's Infrastructure Investments – Investing in Canada Infrastructure Program Reprofile |

-127 | -201 | -761 | -1,226 | -1,956 | -2,072 | -6,342 |

|

Note: Numbers may not add due to rounding. |

|||||||

Report a problem on this page

- Date modified: