Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Chapter 5.1 - Balancing the Budget and Reducing the Debt Burden

Balancing the Budget

The Government is fulfilling its promise to balance the budget in 2015.

Our Government is fulfilling its promise to balance the federal budget. We are now in a position to fulfill our promise to help Canadian families balance theirs.

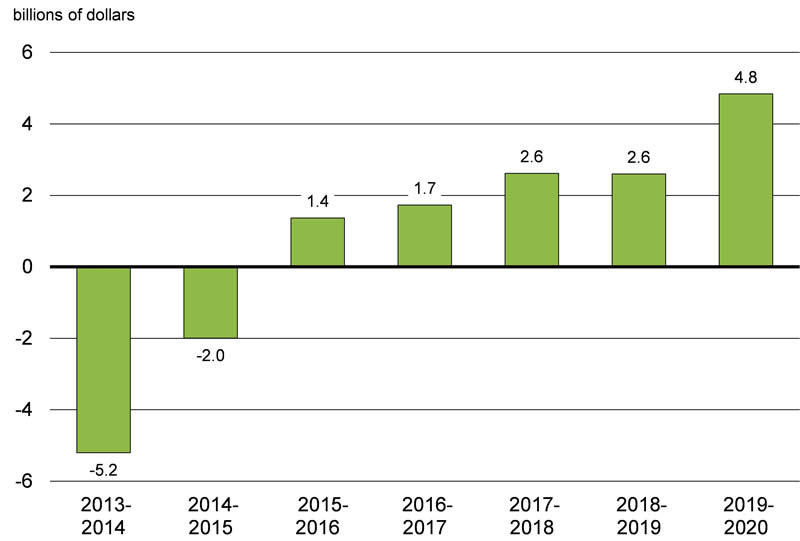

Under the Government’s Economic Action Plan, the deficit has been reduced from $55.6 billion at the height of the global economic and financial crisis to a projected surplus of $1.4 billion for 2015–16.

Sources: Public Accounts of Canada; Department of Finance.

Small business owners know that carrying a deficit for a prolonged period of time means they may be out of business…as such, small businesses are very supportive of the government’s effort to eliminate the deficit in 2015 and return to a balanced budget.

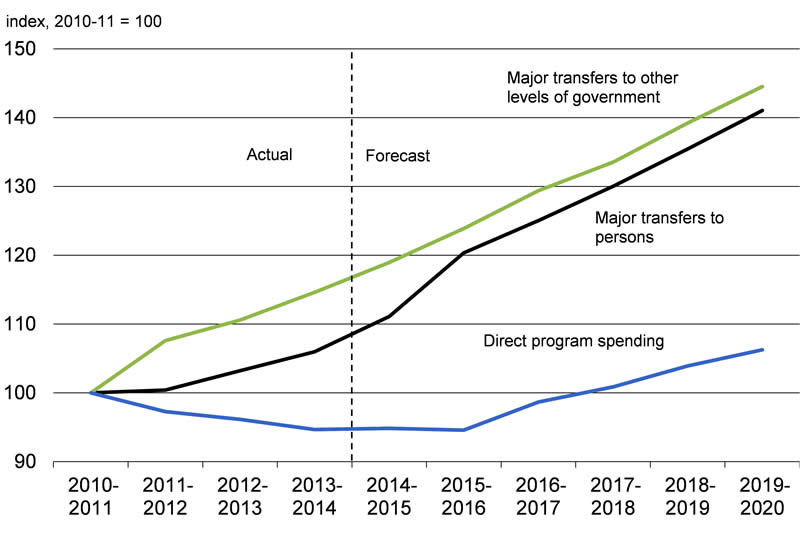

In the wake of one of the largest economic and financial crises of the past century, the Government initiated a plan to return to balanced budgets as the economy recovered. In keeping with commitments made at the beginning of the economic recovery, the Government’s plan to return to balanced budgets has focused on controlling operating expenses by federal departments rather than raising taxes that are harmful to job creation and economic growth or reducing transfers to individuals and other levels of government for social programs and health care. Departmental spending has been restrained through government-wide reviews of spending and operating budget freezes, which have improved the efficiency of government departments without compromising the delivery of priority services to Canadians.

In addition, the Government has undertaken a number of targeted measures to ensure that overall federal public service employee compensation is reasonable and aligned with that offered by other public and private sector employers. This has included increased pension plan contributions from federal public servants to 50 per cent of plan costs, an increase in the normal age of retirement for new federal public servants to 65, a move to equal cost-sharing for retired federal employees who choose to participate in the public service health care plan, and elimination of the severance benefit for voluntary resignation and retirement.

These efforts have resulted in direct program spending declining for four consecutive years, a trend that has not been observed in decades.

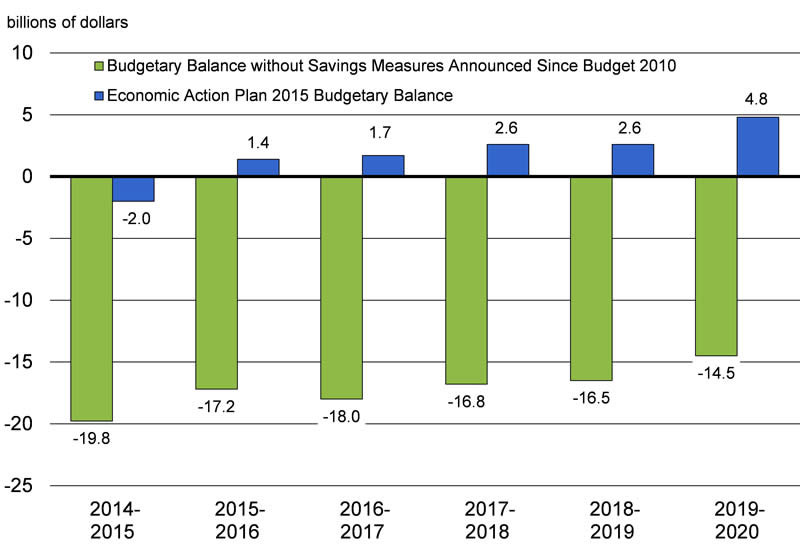

The Government’s actions since Budget 2010 have constrained growth in discretionary spending. In addition, the Government has introduced over 90 measures to close tax loopholes and make other improvements to the tax system since 2006, including measures introduced in Economic Action Plan 2015. These actions have allowed the Government to achieve a balanced budget.

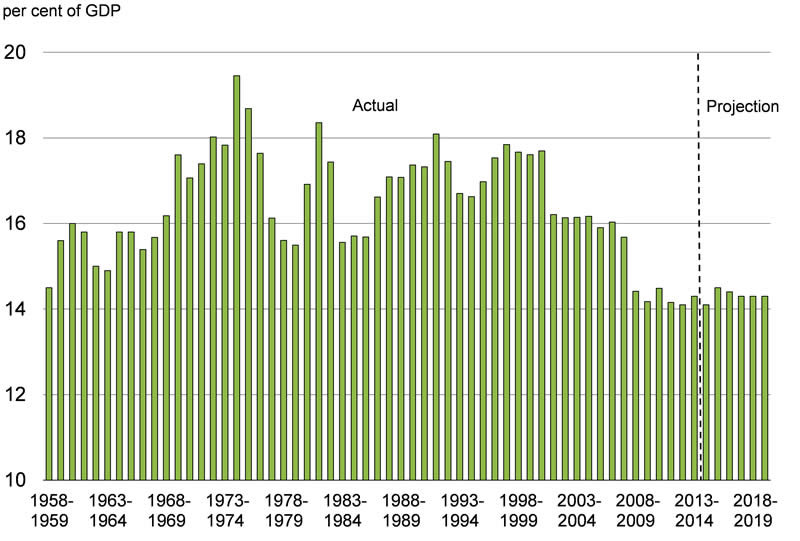

The Government’s prudent fiscal plan has achieved a balanced budget in the face of headwinds, such as the third-largest decline in world oil prices in the last 40 years. All the while, the Government has maintained its priority: to put money back in the pockets of hard-working Canadian families and businesses. Initiatives such as the Family Tax Cut and the Small Business Job Credit are examples of the Government giving back to Canadians. Indeed, the Government balances the budget while maintaining the lowest federal tax burden in half a century.

The Government’s long-standing commitment to responsible fiscal management is founded on the recognition that a sound fiscal position is key to ensuring ongoing economic growth and job creation over the longer term. Indeed, the commitment to balanced budgets, and the significant progress made towards achieving this goal, has made Canada a recognized leader on the world economic stage for sound fiscal management.

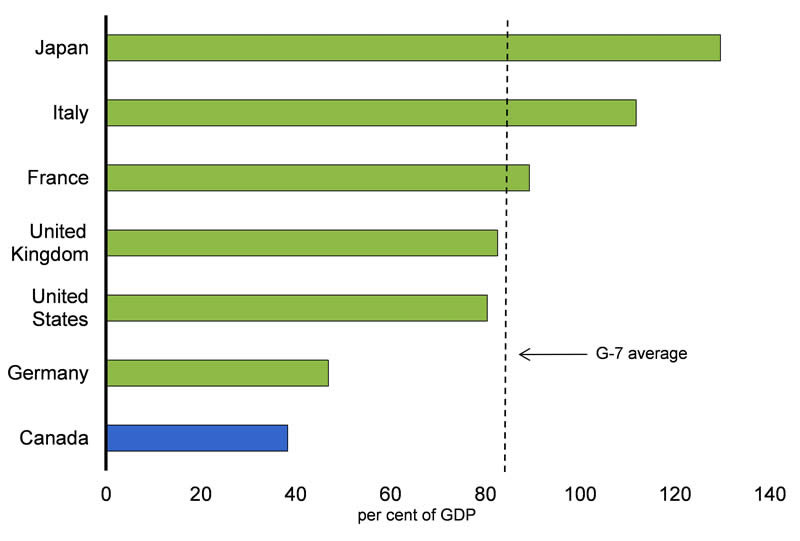

As a result of the Government’s responsible fiscal management, Canada’s total government net debt-to-GDP ratio (which includes that of the federal, provincial, territorial and local governments as well as the net assets of the Canada Pension Plan and the Québec Pension Plan) remains the lowest of any G-7 country and among the lowest of the advanced G-20 countries.

Net Debt-to-GDP Ratios, 2015

Source: International Monetary Fund, Fiscal Monitor, April 2015.

It should be noted that debt statistics published by international institutions such as the International Monetary Fund and the Organisation for Economic Co-operation and Development (OECD) currently overstate Canadian government debt levels relative to those of most other countries. This relative overstatement is largely the result of Canada’s international leadership in reporting its public sector employee pension liabilities and the steps that the federal and provincial governments have taken to fund their public sector pension obligations. These issues are further described in Annex 2.

Balanced Budget Legislation

The Government will introduce balanced budget legislation to enshrine in law its prudent approach to fiscal planning.

Balancing the budget takes hard work and tough choices. A balanced budget:

- Ensures taxpayer dollars are used to support the programs Canadians depend on—rather than paying interest costs.

- Preserves Canada’s low-tax plan and allows for further tax reductions, fostering growth and the creation of jobs for the benefit of all Canadians.

- Helps to instill confidence in consumers and investors, whose dollars spur economic growth and job creation.

- Strengthens the country’s ability to respond to longer-term challenges, such as population aging and unexpected global economic shocks.

- Signals that public services are sustainable, ensuring fairness for future generations by avoiding future tax increases or reductions in services.

It is legitimate for a government to run deficits to respond to a severe downturn in the economy. In 2009, the Government implemented the largest stimulus program in Canadian history to respond to the global financial crisis. In these situations, governments face tremendous pressure to introduce permanent new spending programs to respond to a temporary recession. The results are the structural deficits that Canada experienced in the 1970s, 1980s and 1990s. Structural deficits lead to higher taxes, increased debt and painful spending cuts to important social programs such as health care and education.

Balanced budget legislation will ensure that the only acceptable deficit would be one that responds to a recession or an extraordinary circumstance—such as a war or natural disaster. Within 30 days of a deficit published for any reason, the Finance Minister will be required to appear before the House of Commons Standing Committee on Finance and present a plan with concrete timelines to return to balanced budgets. If that deficit was due to a recession, that plan would include a freeze on operating spending and a wage freeze for Ministers and Deputy Ministers that would take effect as the recovery begins.

The Government’s approach to balanced budget legislation would ensure that any increase in Government spending to respond to a recession, war or natural disaster would be temporary, targeted and timely.

Deficits outside of a recession or an extraordinary circumstance are unacceptable and the need to return to balanced budgets is immediate. Reflecting this, if a Finance Minister posts a deficit outside of a recession or extraordinary circumstance, operating budgets would be automatically frozen, and the salaries of Ministers and Deputy Ministers would be reduced by 5 per cent soon after the reported deficit.

Balanced budget legislation will make it clear to Ministers and Deputy Ministers that there will be consequences for running a deficit in normal economic times.

Debt Reduction

The set-aside for contingencies will be used, if not required, to reduce the debt.

Balanced budgets lead to a declining debt burden, which helps to instill confidence in consumers and investors, keeps taxes low, strengthens the country’s ability to respond to longer-term fiscal and economic challenges, and preserves the sustainability of public services.

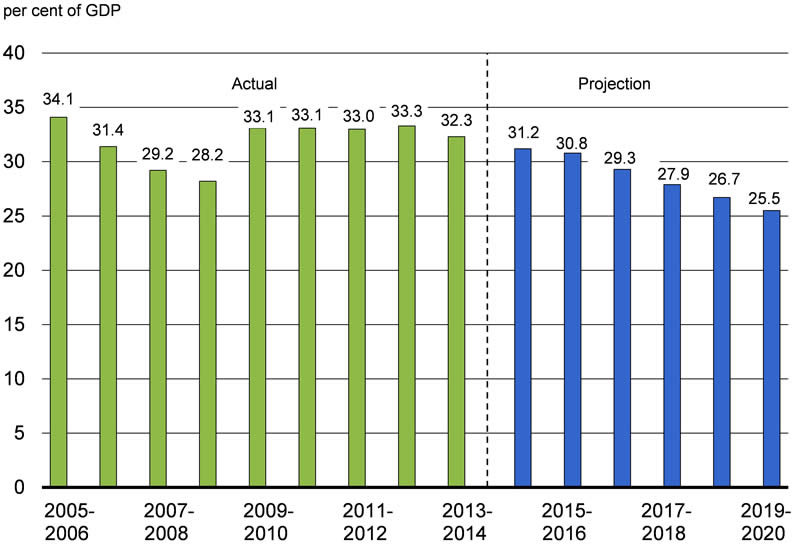

Since 2006, the Government’s approach to fiscal policy and its debt reduction strategy have been successful. The Government recorded balanced budgets between 2005–06 and 2007–08, reducing Canada’s debt by more than $37 billion and the federal debt-to-GDP ratio to 28.2 per cent.

As the global economy fell into recession, the reductions in the debt-to-GDP ratio allowed the Government to take action to reduce the impact of the global crisis, and positioned Canada to emerge from the recession faster and stronger than virtually any other major advanced economy.

In successive budgets, beginning with Budget 2010, the Government gradually wound down fiscal stimulus and controlled spending to engineer a return to balanced budgets. A key element of the Government’s fiscal planning has been the inclusion of an annual set-aside for contingencies, which has helped the Government fulfill its promise of balancing the budget by 2015.

Having balanced the budget, the set-aside for contingencies will continue to protect the fiscal outlook from global economic uncertainty, and will be used to reduce the level of federal debt, if it is not required. This responsible use of taxpayers’ money will help ensure that the Government meets its debt reduction commitments, while continuing to provide tax relief to hard-working Canadian families.

At the G-20 Leaders’ Summit in 2013, Prime Minister Stephen Harper announced Canada’s commitment to achieve a federal debt-to-GDP ratio of 25 per cent by 2021. In the 2013 Speech from the Throne, the Government committed to reduce the debt-to-GDP ratio to pre-recession levels by 2017. The Government remains on target to meet both commitments.

Modernizing Government

The Government remains committed to ensuring that it is delivering the policies, programs and services that Canadians want and need efficiently and effectively. The Government will introduce legislation as needed to streamline its operations and optimize the governance of Canada’s federal agencies, boards, commissions and Crown corporations.

For example, the Government will propose minor legislative amendments to:

- Allow taxpayer information to be shared between tax and non-tax debt collectors within the Canada Revenue Agency, in order to facilitate the collection of certain non-tax debts that are owed to the federal or provincial governments.

- Transition the Canada Border Services Agency, the Canada Revenue Agency and the Parks Canada Agency to standard one-year appropriations in 2016–17 in order to create a unified appropriations framework for federal departments and agencies.

- Clarify recent changes to the Parliamentarians’ pension plan.

- Provide the Minister responsible for Shared Services Canada with new procurement authorities to further facilitate the Economic Action Plan 2013 commitment to standardize and consolidate the procurement of end-user devices.

- Update outdated references in federal Acts and make technical changes to previously announced initiatives as required to ensure they function as intended.

Improving the Integrity of Federal Procurement

Economic Action Plan 2015 proposes to implement a new procurement integrity framework.

The Government is committed to an open, fair and transparent procurement process, while obtaining the best possible value for Canadian taxpayers. The Government will take action by introducing a new government-wide integrity regime for its procurement and real property transactions to ensure that it does business with ethical suppliers in Canada and abroad. The new regime will be transparent, rigorous and consistent with best practices in Canada and abroad. It will ensure that all suppliers are given due process and a whole-of-government perspective, which supports transparent competition and an ethical Canadian marketplace. It will also foster ethical business practices, ensure due process and uphold the public trust.

Strengthening Tax Compliance

The Canada Revenue Agency (CRA) has taken actions to strengthen tax compliance, including the following recent initiatives:

- Introducing an enhanced strategy to combat the underground economy, which entails the increased use of information and advanced analytics to better identify and detect areas of significant risk, expanded information sharing with third parties, including provincial and territorial partners, and enhanced underground economy audit efforts.

- Establishing a Ministerial Advisory Committee for key external stakeholders to collaborate with the Government and help inform the Government’s strategy for tackling the underground economy.

- Supporting the Canadian Home Builders’ Association’s Get it in Writing! campaign to raise awareness of the safety and financial risks of participating in the underground economy.

The Government is also committed to working with its international partners to improve compliance and address cross-border tax evasion. Thus, Canada is one of more than 90 jurisdictions that intend to implement the OECD/G-20 common reporting standard for the automatic exchange of financial account information. It is proposed that the standard be implemented in Canada as of July 1, 2017, allowing for a first exchange of information in 2018.

To support the CRA’s efforts to ensure taxpayer compliance, Economic Action Plan 2015 proposes to expand and enhance programs that target the underground economy, offshore non-compliance and aggressive tax avoidance by large complex entities.

Efforts to Combat the Underground Economy

Economic Action Plan 2015 proposes $118.2 million over five years for the Canada Revenue Agency to expand its Underground Economy Specialist Teams.

The underground economy results in a loss of federal and provincial tax revenue and diminishes the fairness and integrity of the tax system. Economic Action Plan 2015 proposes $118.2 million over five years for the CRA for enhanced underground economy audit efforts through the creation of additional Underground Economy Specialist Teams. These additional teams will adopt new approaches to identify and combat the underground economy, including advanced analytics and working with provincial colleagues to address local sectors participating in the underground economy.

Combatting International Tax Evasion and Aggressive Tax Avoidance

Economic Action Plan 2015 proposes $25.3 million over five years for the Canada Revenue Agency to expand its activities to combat international tax evasion and aggressive tax avoidance.

Economic Action Plan 2013 announced a number of measures to address international tax evasion and aggressive tax avoidance. These measures are proving successful and are producing a significant volume of high-quality information for the CRA. To make full use of this additional information, Economic Action Plan 2015 proposes $25.3 million over five years for the CRA. This will lead to an expansion of the CRA’s offshore compliance activities through the use of improved risk assessment systems and business intelligence as well as the hiring of additional auditors.

Combatting Tax Avoidance by the Largest and Most Complex Business Entities

Economic Action Plan 2015 proposes $58.2 million over five years for the Canada Revenue Agency to combat aggressive tax avoidance in Canada by the largest and most complex business entities.

Aggressive tax planning and tax avoidance by the largest and most complex business entities entails a fiscal cost to governments and taxpayers, and reduces the fairness and integrity of the tax system for businesses and individuals who pay their fair share.

The Canada Revenue Agency has, in recent years, implemented transformational changes to its compliance programs that have led to enhanced risk assessment and improved effectiveness through the targeting of non-compliance in the highest-risk areas.

Economic Action Plan 2015 proposes $58.2 million over five years for the CRA to address additional cases that have been identified through the enhanced risk assessment systems to further combat aggressive tax avoidance—domestically and internationally.

Economic Action Plan 2015 accounts for the expected revenue impact of these measures, including $68 million in 2015–16, rising to $191 million in 2019–20, for a total of $831 million over five years (Table 5.1.1). These amounts do not reflect the gain that will be realized by provinces and territories, which will receive additional tax revenues as a result of these initiatives.

| 2015–2016 | 2016–2017 | 2017–2018 | 2018–2019 | 2019–2020 | 5-Year Total | |

|---|---|---|---|---|---|---|

| Expected revenues | 68 | 191 | 191 | 191 | 191 | 831 |

| Funding for increased Canada Revenue Agency compliance activities | -26 | -45 | -44 | -44 | -44 | -202 |

| Revenue Impact | 42 | 146 | 147 | 147 | 147 | 629 |

Improving the Fairness and Integrity of the Tax System

An efficient tax system that provides fair outcomes is essential to keep Canada positioned as an attractive place to work, invest and do business. Ensuring that everyone pays their fair share also helps to keep taxes low for Canadian families and businesses, and helps maintain public confidence in the tax system.

The Government is committed to closing tax loopholes that allow a few businesses and individuals to avoid paying their fair share. Efforts to broaden and protect the tax base support the Government’s commitment to responsible fiscal management, and respond to provincial governments’ concerns about protecting provincial revenues from our shared tax bases.

Since 2006, including measures introduced in Economic Action Plan 2015, the Government has introduced over 90 measures to close tax loopholes, clarify tax rules, reduce aggressive international tax avoidance and improve the integrity of the tax system.

Internationally, Canada continues to participate in the OECD/G-20 project on Base Erosion and Profit Shifting, which aims to develop coordinated multilateral solutions to address international tax planning strategies used by multinational enterprises to inappropriately minimize their taxes.

Economic Action Plan 2015 proposes a number of measures to improve the fairness and integrity of the tax system:

- Ensuring that corporations do not realize unintended tax benefits on synthetic equity arrangements.

- Improving an existing anti-avoidance rule that is meant to prevent corporations from converting their taxable capital gains into tax-free dividends.

- Improving an existing anti-avoidance rule in Canada’s foreign accrual property income regime regarding captive insurance to help ensure that income of foreign affiliates of Canadian taxpayers from the ceding of insured Canadian risks remains taxable in Canada.

- Clarifying that the Canada Revenue Agency or the courts may increase or adjust an amount included in an assessment that is under objection or appeal, as long as the overall tax amount assessed does not increase.

Economic Action Plan 2015’s integrity measures are expected to generate tax revenues of $1.2 billion over four years (Table 5.1.2).

| 2015– 2016 |

2016– 2017 |

2017– 2018 |

2018– 2019 |

2019– 2020 |

5-Year Total |

|

|---|---|---|---|---|---|---|

| Improving the Fairness and Integrity of the Tax System | – | 365 | 310 | 280 | 280 | 1,235 |

| Revenue Impact | – | 365 | 310 | 280 | 280 | 1,235 |

| Projection | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2010–2011 | 2011–2012 | 2012–2013 | 2013–2014 | 2014–2015 | 2015–2016 | 2016–2017 | 2017–2018 | 2018–2019 | 2019–2020 | Total | |

| Economic Action Plan 2010 | |||||||||||

| Spending restraint | 452 | 1,586 | 3,481 | 4,425 | 5,130 | 5,130 | 5,130 | 5,130 | 5,130 | 5,130 | 40,724 |

| Closing tax loopholes | 260 | 350 | 420 | 455 | 475 | 505 | 515 | 530 | 535 | 555 | 4,600 |

| Total for Economic Action Plan 2010 | 712 | 1,936 | 3,901 | 4,880 | 5,605 | 5,635 | 5,645 | 5,660 | 5,665 | 5,685 | 45,324 |

| Economic Action Plan 2011 | |||||||||||

| Spending restraint | 194 | 271 | 569 | 525 | 534 | 534 | 534 | 534 | 534 | 4,229 | |

| Closing tax loopholes | 255 | 900 | 1,395 | 1,460 | 1,130 | 1,520 | 870 | 395 | 400 | 8,325 | |

| Total for Economic Action Plan 2011 | 449 | 1,171 | 1,964 | 1,985 | 1,664 | 2,054 | 1,404 | 929 | 934 | 12,554 | |

| Economic Action Plan 2012 | |||||||||||

| Spending restraint | -900 | 1,762 | 3,481 | 5,332 | 5,175 | 5,219 | 5,222 | 5,222 | 5,222 | 35,734 | |

| Closing tax loopholes | 100 | 281 | 376 | 426 | 476 | 551 | 661 | 786 | 3,657 | ||

| Total for Economic Action Plan 2012 | -900 | 1,862 | 3,762 | 5,708 | 5,601 | 5,695 | 5,773 | 5,883 | 6,008 | 39,391 | |

| 2012 Update of Economic and Fiscal Projections | 341 | 572 | 791 | 999 | 1,231 | 1,436 | 1,436 | 1,436 | 8,241 | ||

| Economic Action Plan 2013 | |||||||||||

| Spending restraint | 0 | 68 | 114 | 145 | 145 | 145 | 145 | 145 | 907 | ||

| Closing tax loopholes and strengthening compliance1 | 32 | 461 | 1,436 | 1,575 | 1,707 | 1,857 | 1,935 | 2,022 | 11,025 | ||

| Total for Economic Action Plan 2013 | 32 | 529 | 1,550 | 1,720 | 1,857 | 2,002 | 2,080 | 2,167 | 11,932 | ||

| 2013 Update of Economic and Fiscal Projections | 550 | 1,100 | 1,130 | 1,160 | 1,190 | 1,190 | 6,320 | ||||

| Economic Action Plan 2014 | |||||||||||

| Managing compensation costs | 1,109 | 1,537 | 1,390 | 1,221 | 1,113 | 1,005 | 1,005 | 8,380 | |||

| Closing tax loopholes and strengthening compliance2 | 10 | 44 | 384 | 439 | 424 | 449 | 474 | 2,224 | |||

| Total for Economic Action Plan 2014 | 1,119 | 1,581 | 1,774 | 1,660 | 1,537 | 1,454 | 1,479 | 10,604 | |||

| Economic Action Plan 2015 | |||||||||||

| Strengthening tax compliance | 42 | 146 | 147 | 147 | 147 | 629 | |||||

| Closing tax loopholes | 365 | 310 | 280 | 280 | 1,235 | ||||||

| Total for Economic Action Plan 2015 | 42 | 511 | 457 | 427 | 427 | 1,864 | |||||

| Grand Total | 712 | 1,485 | 7,307 | 12,826 | 17,770 | 18,535 | 19,778 | 19,428 | 19,063 | 19,325 | 136,230 |

| Of which: | |||||||||||

| Total spending restraint | 452 | 880 | 5,855 | 10,224 | 13,979 | 14,473 | 14,610 | 14,739 | 14,661 | 14,661 | 104,535 |

| Total revenue measures | 260 | 605 | 1,452 | 2,602 | 3,791 | 4,062 | 5,168 | 4,689 | 4,402 | 4,664 | 31,695 |

| Per cent of GDP | 0.0% | 0.1% | 0.4% | 0.7% | 0.9% | 0.9% | 0.9% | 0.9% | 0.8% | 0.8% | |