Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Annex 3 - Supporting a Strong Manufacturing Sector

Overview

Canada’s manufacturing sector is a cornerstone of the economy. It employs close to 1.7 million Canadians and drives a high-tech, high-skill economic engine. Manufacturing sales have rebounded and are up by about 20 per cent since 2009.

Since 2006, the Government has introduced a number of broad-based and targeted measures to:

- Create a low-tax environment for manufacturers.

- Expand access to foreign markets.

- Support business innovation and world-class research.

- Train a highly skilled workforce.

- Create business opportunities through government procurement.

Actions to advance these priorities, together with new initiatives in Economic Action Plan 2015 and unprecedented levels of investment in Canada’s public infrastructure, will help manufacturers to succeed in the global economy and continue to create jobs, growth and long-term prosperity across Canada.

In recent years, the federal government has introduced a number of important fiscal measures that are already making a significant positive contribution to business investment, innovation, and job growth. Reductions in the business tax rate, the extension of the two-year write-off for investments in manufacturing and processing machinery and equipment, the elimination of import duties on materials and equipment used in manufacturing, and the signing of key international trade agreements will set the framework for growth in the future.

Context

The manufacturing sector is a significant part of Canada’s economy, accounting for more than 10 per cent of Canada’s gross domestic product (GDP) and 61 per cent of total merchandise exports, and employing 1.7 million people across the country. Its performance is central to the overall health of the economy.

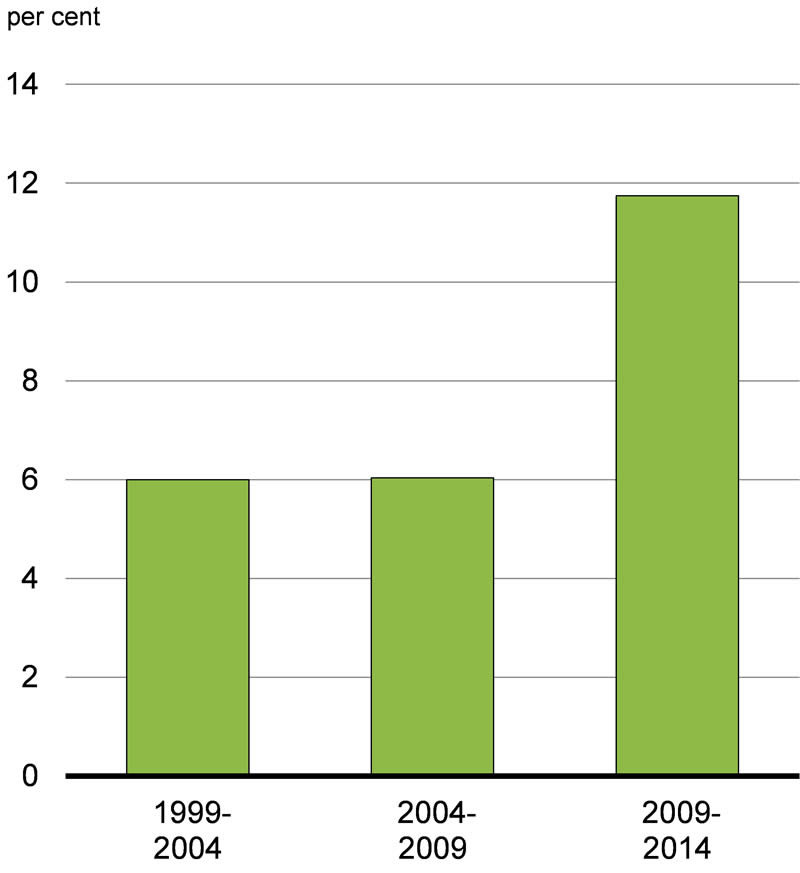

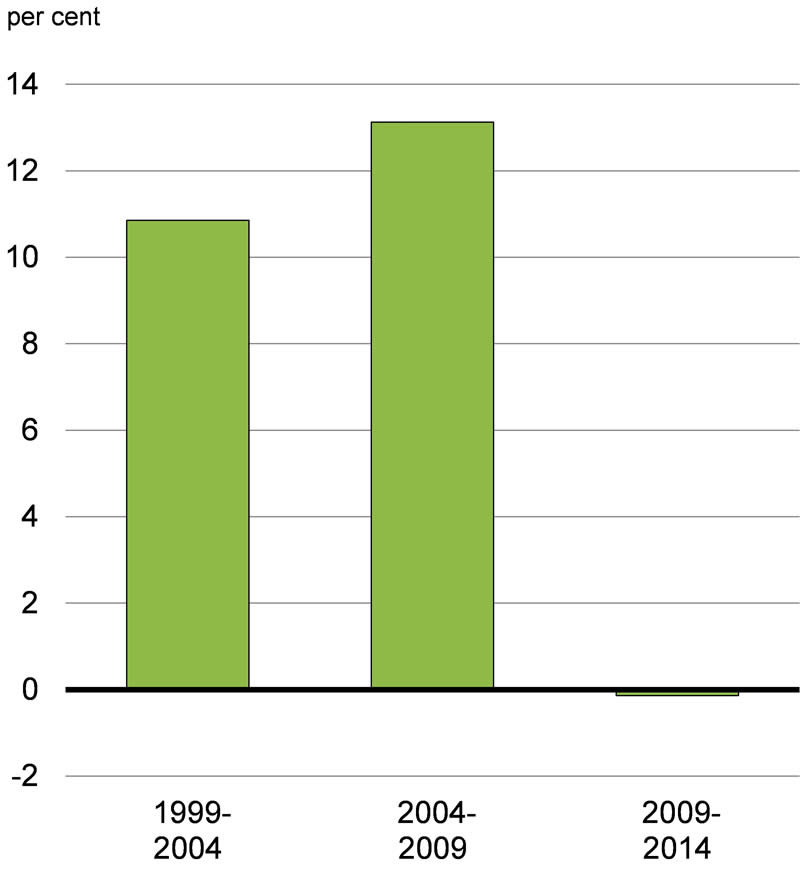

The sector has responded to the structural challenges of the last decade by keeping costs low and improving productivity. Unit labour costs have remained stable over the past five years following steady growth over the 2000s. Manufacturing sector productivity grew steadily over the 2000s and has accelerated over the past five years (Chart A3.1).

Labour Productivity Growth and Growth in Unit Labour Costs

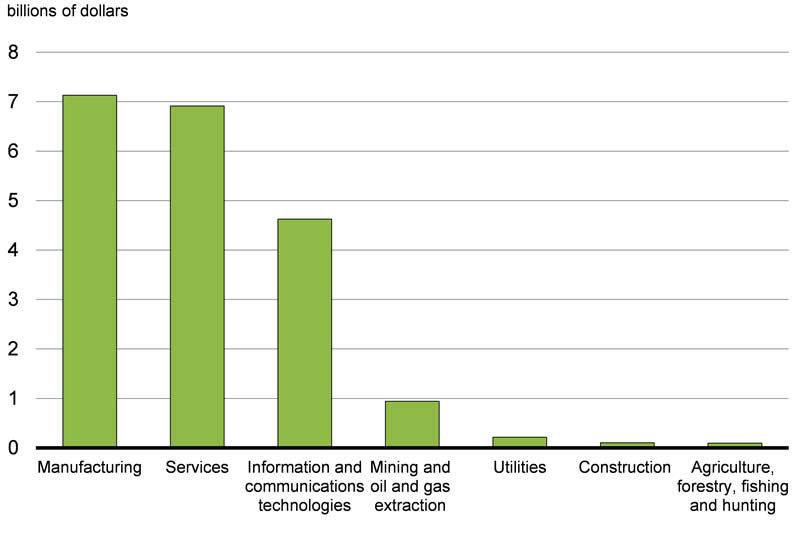

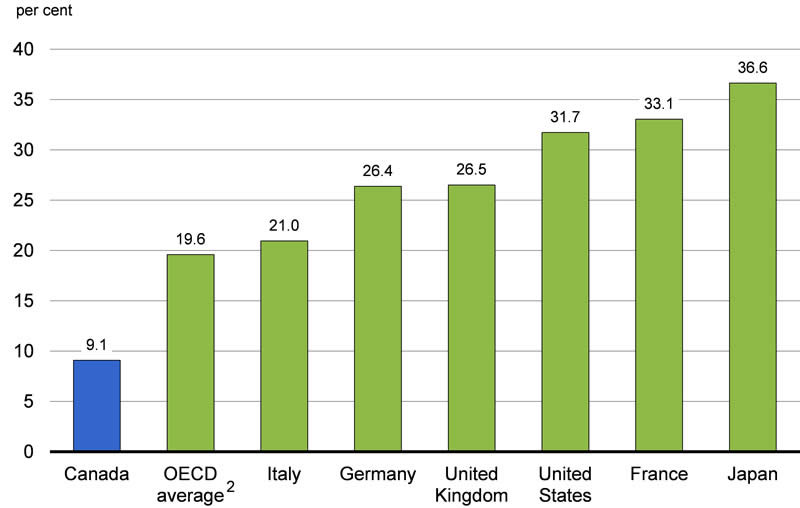

Manufacturers have long been leaders in investing in research and development, accounting for almost half of all business sector expenditure in research and development in 2014 (Chart A3.2). Continued investment by manufacturers in innovation and other drivers of productivity, such as investment in advanced machinery and equipment and skilled labour, is crucial to the sector’s long-term success. This continued investment is also necessary to improve Canada’s overall business productivity performance, a critical determinant of our long-term prosperity.

Source: Statistics Canada.

Economic Action Plan 2015 builds on the Government’s strong record of support for manufacturers and other businesses with new initiatives in key areas to help them innovate and compete in the global economy.

Creating a Low-Tax Environment for Manufacturers

Improving business tax competitiveness has been a key element of the Government’s approach to establishing a framework in which businesses can thrive and compete in the global economy.

Since 2006, the Government has taken significant action to reduce taxes for businesses in all sectors, including manufacturing. The federal general corporate income tax rate has been reduced to 15 per cent as of 2012 from 22.12 per cent in 2007. The Government also eliminated the federal capital tax and helped to secure the elimination of provincial general capital taxes through a financial incentive.

The Government has also introduced tax measures that support the competitiveness of the manufacturing sector by encouraging productivity-enhancing investment in machinery and equipment. Economic Action Plan 2015 proposes to provide manufacturers with an accelerated capital cost allowance at a rate of 50 per cent on a declining-balance basis for assets acquired after 2015 and before 2026 (see Chapter 3.1).

By allowing a substantially faster write-off of eligible investments than the usual 30-per-cent declining-balance rate, this measure will defer taxes and allow businesses to recover the cost of capital investments more quickly. This incentive will provide concrete, long-term support, enabling Canadian manufacturers to plan the investments that are needed to compete in a global economy. New investment will help position them to meet both present and future economic challenges, while creating jobs and growth.

2 OECD (Organisation for Economic Co-operation and Development) average excludes Canada.

Source: Department of Finance.

Small businesses are critical to the health of the Canadian economy, and many firms in the manufacturing sector are small businesses. To help small businesses grow and create jobs, the Government has reduced taxes substantially for small businesses and their owners. This includes both a reduction in the corporate income tax rate for small businesses to 11 per cent and increases in the amount of annual income eligible for this lower rate to $500,000. Small business owners are also benefitting from increases to the Lifetime Capital Gains Exemption.

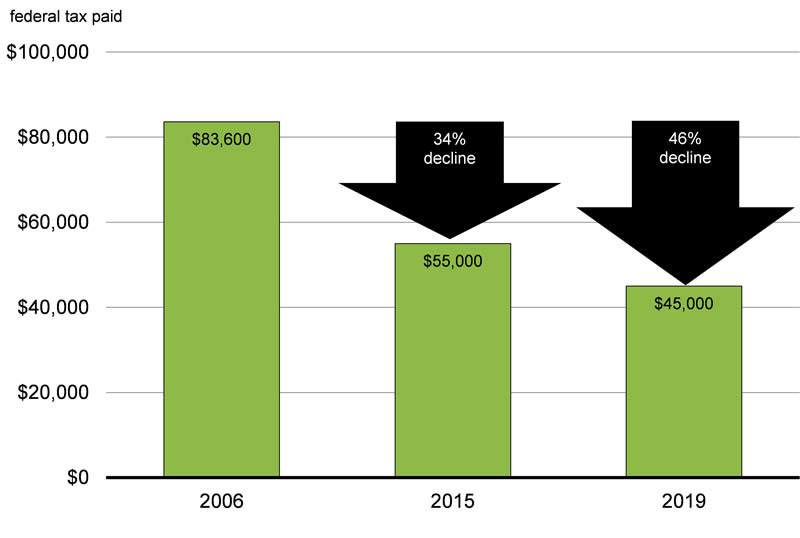

Economic Action Plan 2015 builds on this strong foundation by proposing to further reduce the small business tax rate to 9 per cent by 2019 (see Chapter 3.2). This significant tax reduction will further encourage job creation and economic growth.

For example, as a result of actions taken by the Government to reduce the small business tax rate (including this new proposed measure) and increase the amount of income eligible for that rate, the amount of federal corporate income tax paid by a small business with $500,000 of taxable income will be 46 per cent lower in 2019 than in 2006. This represents an annual tax reduction of up to $38,600 that can be reinvested in the business to fuel its growth.

In recognition of the important contribution that small businesses across the country make to job creation and economic growth, in September 2014 the Government announced the Small Business Job Credit:

- The credit will provide relief to small businesses for Employment Insurance (EI) premiums paid in 2015 and 2016. The credit will be available to any firm paying employer EI premiums equal to or less than $15,000 in those years.

- The credit will effectively reduce small businesses’ EI premium rate by 28 cents from the legislated $1.88 rate to $1.60 per $100 of insurable earnings. The credit is calculated as the difference between premiums paid at the legislated rate and the reduced small business rate.

- The credit is expected to provide savings of more than $550 million over the next two years for small businesses. Almost 90 per cent of all EI premium-paying businesses in Canada will receive the credit, reducing their EI payroll taxes by nearly 15 per cent.

Expanding Access to Foreign Markets

Access to foreign markets is crucial for Canada’s manufacturing sector, which accounts for 61 per cent of Canada’s total merchandise exports. Since 2006, the Government has concluded free trade agreements with 38 countries, bringing Canada’s total to 43. The past year has been particularly successful with a number of new trade agreements completed, including the Canada-European Union Comprehensive Economic and Trade Agreement and the entry into force of the landmark Canada-Korea Free Trade Agreement (see Chapter 3.5).

The Government is taking steps to speed up legitimate trade and travel and align regulatory approaches between Canada and the U.S., which accounts for nearly 80 per cent of all domestic manufacturing exports, by launching the Canada-U.S. Action Plan on Perimeter Security and Economic Competitiveness and the Action Plan on Regulatory Cooperation in 2011 (see Chapter 3.5).

The Government also recognizes that domestic trade barriers can undermine business productivity and competitiveness. Since 2009, Canada has unilaterally eliminated more than 1,800 tariffs, providing more than $450 million in annual tariff relief to Canadian manufacturers. This includes the elimination of all remaining tariffs on imported machinery and equipment and manufacturing inputs, making Canada a tariff-free zone for industrial manufacturers (see Chapter 3.1).

In addition, the Government is providing an unprecedented level of investment in public infrastructure that facilitates trade and supports the competitiveness of Canadian businesses, including through the $33 billion 2007 Building Canada Plan and the $53 billion New Building Canada Plan, as well as projects such as the replacement of the Champlain Bridge in Montreal and the construction of the Detroit River International Crossing (see Chapter 4.4).

Economic Action Plan 2015 proposes new initiatives to help Canadian businesses fully capitalize on emerging global opportunities (see Chapter 3.5), including:

- Providing $50 million over five years, starting in 2015–16, for a program to share the cost of exploring new export opportunities with small and

medium-sized enterprises. - Providing $42 million over five years, starting in 2015–16, to expand the footprint and resources of the Trade Commissioner Service.

Supporting Business Innovation and World-Class Research

Innovation is becoming increasingly crucial to the success of manufacturers, and requires a continuous supply of new knowledge and top talent.

The Government has acted to support innovation across the economy by doubling the National Research Council’s Industrial Research Assistance Program, with a further $110 million per year, to better support research and development by small and medium-sized client firms—about half of which are in the manufacturing and information and communications technology sectors. It has also improved assistance through the regional development agencies by refocusing the Atlantic Innovation Fund and launching the Western Innovation Initiative.

The Government has nurtured the strategic interactions between research institutions, researchers and enterprises by enhancing support for business-driven granting council programs focused on industry-academic collaboration. This is in addition to continuing to provide stable, long-term funding for post-secondary research through the granting councils’ core discovery programs, the Canada Foundation for Innovation and leading not-for-profit organizations such as Genome Canada.

The Government has also taken targeted steps to support business innovation in the manufacturing sector, including:

- Allocating $1 billion to the Automotive Innovation Fund since its creation in 2008, to support significant new research and development projects and

long-term investments. - Announcing stable funding of close to $1 billion over five years (starting in 2013–14) for the Strategic Aerospace and Defence Initiative, and launching a new Technology Demonstration Program for the aerospace sector in 2013.

- Establishing the Pulp and Paper Green Transformation Program in 2009, with $1 billion over three years to support capital projects in the pulp and paper sector that offer demonstrable environmental benefits.

- Providing over $190 million to the Investments in Forest Industry Transformation program.

- Establishing a new Advanced Manufacturing Fund, with funding of $200 million over five years, as part of the renewal of the Federal Economic Development Agency for Southern Ontario. The first recipient under the program, announced in March 2015, is Fibracast (Hamilton, Ontario), a manufacturer of advanced membrane technologies used in water and wastewater treatment.

Economic Action Plan 2015 is taking further actions to foster innovation by manufacturers, including in the automotive, aerospace and space, and forest sectors. It also includes support for advanced research and commitments to key international science and technology initiatives that create significant business opportunities for innovative Canadian firms (see Chapter 3.1), including:

- Providing up to $100 million over five years, starting in 2015–16, to support product development and technology demonstration by Canadian automotive parts suppliers through the new Automotive Supplier Innovation Program.

- Developing a national aerospace supplier development initiative modelled on the successful MACH program pioneered by Aéro Montréal.

- Providing an additional $30 million over four years, starting in 2016–17, to support cutting-edge research and technology development in Canada’s satellite communications sector.

- Continuing to support the transformation of the forest sector by providing $86 million over two years, starting in 2016–17, to extend the Forest Innovation Program and the Expanding Market Opportunities Program (see Chapter 3.5).

- Providing $119.2 million over two years, starting in 2015–16, to the National Research Council’s industry-partnered research and development activities, helping Canadian businesses increase their competitiveness and develop new, cutting-edge products.

- Providing an additional $1.33 billion over six years, starting in 2017–18, to the Canada Foundation for Innovation to support advanced research infrastructure at universities, colleges and research hospitals.

- Dedicating an additional $46 million per year to the granting councils, starting in 2016–17, focused in areas that will fuel economic growth and respond to important challenges and opportunities.

The federal granting councils offer a variety of programs that support the development of knowledge and talent at universities and colleges across Canada, which together are vital for a growing economy.

This includes the Natural Sciences and Engineering Research Council’s Strategy for Partnerships and Innovation. Over the 2009–2014 period, the Council funded more than 13,400 projects connecting businesses and researchers, with industry contributions increasing from $108 million to $195 million per year. During this time the number of industry partners doubled from 1,500 to more than 3,000 annually, of which 75 per cent are small and medium-sized enterprises.

The Strategy for Partnerships and Innovation has demonstrated success in helping more businesses extend their research and development capabilities, showing that Canadian businesses and academic institutions can help move Canada ahead in the global innovation race by working together.

Training a Highly Skilled Workforce

In recent years, the Government has taken important steps to reform the skills training system to better help Canadians acquire the skills that will get them hired or help them get better jobs. This includes creating the Canada Job Grant, an innovative, employer-driven approach to help Canadians gain the skills and training they need to fill available jobs, with up to $15,000 per person for training costs in partnership with employers.

The Government has also announced the intention to renegotiate the $1.95‑billion‑per-year Labour Market Development Agreements with provinces and territories to reorient training towards labour market demand.

To help more Canadians become apprentices and complete their training, the Government created the Canada Apprentice Loan to provide apprentices registered in Red Seal trades with interest-free loans for training. It is also providing significant financial support to apprentices through the introduction of the Apprenticeship Incentive Grant and the Apprenticeship Completion Grant.

Economic Action Plan 2015 proposes to build on these actions by:

- Providing a one-time investment of $65 million to business and industry associations to allow them to work with willing post-secondary institutions to better align curricula with the needs of employers (see Chapter 3.3).

- Helping to develop the next generation of research and development leaders by providing $56.4 million over four years, starting in 2016–17, to Mitacs in support of graduate-level industrial research and development internships (see Chapter 3.1).

- Through its Accelerate program, Mitacs is helping Bombardier Aerospace, Bell Helicopter Textron Canada Limited and Pratt & Whitney Canada with projects on additive manufacturing processes (also known as 3D printing). The objective of the research initiative is to advance the development of selected parts for aircraft and helicopter structures as well as aircraft engines, and pave the way for usage of additive manufacturing techniques in the production of parts for repair, retrofit or new product development.

- Nuance Communications, a multinational leader in voice and language solutions, collaborated with Mitacs Accelerate interns at McGill University on a long-term research project related to speech recognition technologies for mobile applications. The interns each worked on different aspects of the project, such as adapting applications to a user’s voice in dictation, and natural language understanding.

Creating Business Opportunities Through Government Procurement

Federal procurement represents a huge market for businesses large and small. The Government is strategically using procurement to contribute to the viability and growth of innovative Canadian businesses.

The Government pursued this approach through its $35 billion National Shipbuilding Procurement Strategy, a long-term commitment to generate high-value jobs through the manufacturing of new vessels for the Royal Canadian Navy and the Canadian Coast Guard at Canadian shipyards in Halifax and Vancouver. More broadly, the Government announced in February 2014 the implementation of the Defence Procurement Strategy to ensure that defence procurement delivers the right equipment to the Canadian Armed Forces and generates economic benefits and jobs for Canadians. In addition, the Government made permanent the Build in Canada Innovation Program and added a military component to provide small and medium-sized businesses an opportunity to showcase their innovative goods and services within federal departments before taking them to market.

Economic Action Plan 2015 proposes to build upon this foundation by:

- Providing $2.5 million per year, starting in 2016–17, to Industry Canada to increase the analytical capacity needed to support the Defence Procurement Strategy, by providing expert data analysis and research on the key industrial capabilities within Canada’s defence industrial base (see Chapter 3.1).

- In 2015, construction will begin at Irving Shipbuilding Inc. in Halifax, Nova Scotia, on the first of six Arctic Offshore Patrol Ships for the Royal Canadian Navy. Construction of the ships will sustain approximately 1,000 jobs at Irving Shipbuilding Inc. as well as many jobs at suppliers across Canada. For example, the majority of the steel plate for the first ship will be produced at the Essar Steel Algoma rolling mill in Sault Ste. Marie, Ontario.

- Vancouver Shipyards has completed investments to modernize its shipyard for building non-combat ships under the National Shipbuilding Procurement Strategy, and construction of the two initial blocks for the Canadian Coast Guard’s Offshore Fisheries Science Vessels began in October 2014. Vancouver Shipyards has awarded over $120 million in contracts to Canadian suppliers, and more than 100 companies have been engaged.

Conclusion

The Government’s commitment to support the competitiveness of Canadian manufacturers is longstanding and strong, reflecting the importance of the manufacturing sector to a vibrant and innovative economy. Actions to date, supplemented by significant new tax relief and investments in Economic Action Plan 2015, will help to fuel the success of manufacturing firms in global markets both today and in the years to come.