Common menu bar links

Archived - Budget 2011

Chapter 1: Introduction (June 6, 2011)

Table of Contents - Previous - Next

Introduction

The global economy is emerging from the deepest and most synchronized financial and economic crisis since the Great Depression.

Having learned from the mistakes of the 1930s, governments and central banks responded to the downturn with unprecedented fiscal and monetary stimulus. With a strong fiscal situation and a sound banking system, Canada was able to act boldly and effectively to protect jobs and to minimize the impact of the recession on Canadians.

Canada’s economic performance during the recovery stands out among advanced countries. Canada has posted the strongest employment growth in the Group of Seven (G–7) since mid–2009, and more Canadians are working today than before the recession. Moreover, Canada’s fiscal situation remains among the strongest in the industrialized world. As the global economy continues to improve, Canada stands poised for success.

However, as recent world events show, there remains considerable risk and uncertainty in the global economy, and at home too many Canadians still remain out of work. For these reasons, the Government remains focused on the economy.

The Government will build on the achievements of Canada’s Economic Action Plan with a new phase designed to secure the recovery and to improve the well-being of Canadians over the long term. To this end, Budget 2011 supports job creation and continues to lay the foundation for sustainable economic growth.

Delivering on Canada’s Economic Action Plan

Canada’s Economic Action Plan was designed to fight the effects of the global recession by providing significant stimulus to safeguard jobs and protect families, while making important productive investments to contribute to Canada’s long-term economic prosperity. By ensuring that stimulus spending was concentrated over a two‑year period, the Government was able to run short-term deficits without jeopardizing Canada’s long‑term fiscal advantage.

Canada’s Economic Action Plan is working. In the first year of implementation alone, almost $32 billion in stimulus spending and tax relief was delivered, and the Government remains on track to deliver a further $28 billion in support for the recovery.

These investments have been effective in shielding Canadians from the worst of the global recession. Over 28,500 projects have been completed or are underway, generating significant employment in local communities and contributing to the creation of about 540,000 jobs across Canada since July 2009.

Even though the vast majority of initiatives announced in Budget 2009 ended as planned on March 31, 2011, projects completed as part of the Economic Action Plan will continue to benefit Canadians. By supporting productive investments in infrastructure, a more highly skilled labour force and a competitive business environment, Canada’s Economic Action Plan will make lasting contributions to economic growth and prosperity.

While the Economic Action Plan has been successful in getting Canadians back to work, the global economic recovery remains fragile. For this reason, measures to foster long‑term growth and support job creation continue to be the Government’s top priority.

The Next Phase of Canada’s Economic Action Plan —

A Low-Tax Plan for Jobs and Growth

The Government will build on the success of the stimulus plan. As the private sector moves ahead as the engine of growth and job creation, the Government will return its focus toward sustainable actions that create the right conditions for long-term economic prosperity.

The Next Phase of Canada’s Economic Action Plan—A Low-Tax Plan for Jobs and Growth will invest in the key drivers of economic growth—innovation, investment, education and training—and will seek to foster an environment in which all Canadians contribute to and benefit from a stronger economy. In doing so, the Government will reinforce Canada’s comparative advantages.

The Government will build on the sustainable low-tax environment and growth-friendly policies put in place since 2006. The focus of the Next Phase of Canada’s Economic Action Plan will be supporting job creation, supporting families and communities, investing in innovation, education and training, and preserving Canada’s fiscal advantage.

Supporting Job Creation by helping businesses and entrepreneurs succeed, keeping taxes low, investing in projects of national importance, and maintaining Canada’s brand as one of the best places to invest. Budget 2011 advances these priorities by:

- Providing a temporary Hiring Credit for Small Business to encourage additional hiring by this vital sector.

- Extending the work-sharing program and the Targeted Initiative for Older Workers to help Canadians in some of the hardest hit areas stay in the workforce.

- Supporting the manufacturing and processing sector by extending the accelerated capital cost allowance treatment for investments in manufacturing and processing machinery and equipment for two years.

- Renewing the Best 14 Weeks and Working While on Claim EI pilot projects for

one year. - Extending the temporary 15-per-cent Mineral Exploration Tax Credit for an additional year (until March 31, 2012) to continue to help companies raise capital for mineral exploration.

- Providing renewed funding of almost $100 million over two years for research, development and demonstrations of clean energy and energy efficiency.

- Contributing $150 million toward the construction of an all-season road between Inuvik and Tuktoyaktuk that completes the Dempster Highway, connecting Canadians from coast to coast to coast.

Supporting Families and Communities so that all Canadians enjoy a high standard of living and our communities stay vibrant and safe. Budget 2011 invests in these goals by:

- Enhancing the Guaranteed Income Supplement (GIS) for those seniors who rely almost exclusively on their Old Age Security and the GIS and may therefore be at risk of experiencing financial difficulties. This measure will provide a new top-up benefit of up to $600 annually for single seniors and $840 for couples. This measure represents an investment of more than $300 million per year, and will improve the financial security of more than 680,000 seniors across Canada.

- Attracting more health care workers to underserved rural and remote communities by forgiving up to $40,000 of the federal component of Canada Student Loans for new family physicians and up to $20,000 for nurse practitioners and nurses.

- Introducing a Family Caregiver Tax Credit and Children’s Arts Tax Credit to support Canadian families.

- Introducing a Volunteer Firefighters Tax Credit for volunteer firefighters who perform at least 200 hours of service in their communities.

- Providing nearly $870 million over two years to address climate change and air quality, including the extension of the ecoENERGY Retrofit – Homes program that will help homeowners make their homes more energy efficient and reduce the burden of high energy costs.

Investing in Innovation, Education and Training to promote research in leading-edge technologies and to provide Canadians with the opportunity and incentives to acquire the skills needed for jobs in today’s labour market. Budget 2011 makes important progress on these priorities by:

- Providing $80 million in new funding over three years through the Industrial Research Assistance Program to help small and medium-sized businesses accelerate their adoption of key information and communications technologies through collaborative projects with colleges.

- Establishing 10 new Canada Excellence Research Chairs. Some of these new chairs will be active in fields relevant to Canada’s Digital Economy Strategy.

- Increasing the budgets of all three federal granting councils by $47 million annually, including support for indirect costs.

- Improving commercialization and supporting demonstration of new technologies in the marketplace by supporting research links between colleges, universities and businesses.

- Enhancing and expanding eligibility for the Canada Student Loan and Grant Program for part-time and full-time post-secondary students.

- Helping apprentices in the skilled trades and workers in regulated professions by making occupational, trade and professional examination fees eligible for the Tuition Tax Credit.

Preserving Canada’s Fiscal Advantage in order to be able to invest in the priorities of Canadians, to keep Canada’s economy growing strongly, and to maintain low interest rates. Budget 2011 advances these objectives by:

- Reaffirming the Government’s plan to return to balanced budgets without raising taxes, cutting transfers to persons, including those for seniors, children and the unemployed, or cutting transfers to other levels of government that support health care and social services, Equalization, and the gas tax transfer to municipalities.

- Identifying savings that reach over $500 million annually from the 2010 round of strategic reviews. Together with measures to restrain the growth of National Defence spending, the first cycle of strategic reviews has resulted in $11 billion in savings over seven years and more than $2.8 billion in ongoing savings.

- Protecting the integrity and fairness of the Canadian tax system by closing tax loopholes.

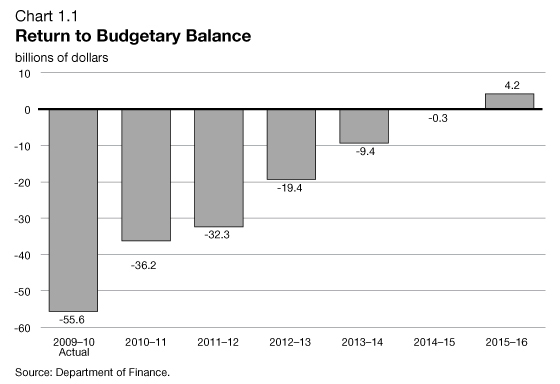

The deficit in 2012–13 is projected to be cut by almost two-thirds from its level in 2009–10. The deficit is projected to continue to decline to $0.3 billion in 2014–15. It is expected that there will be a surplus of $4.2 billion in 2015–16.

This chart from Budget 2011 has been updated to reflect the revised budgetary balance after accounting for all adjustments and new measures in this budget. The Strategic and Operating Review will support the return to balanced budgets by 2014–15.

This chart from Budget 2011 has been updated to reflect the revised budgetary balance after accounting for all adjustments and new measures in this budget. The Strategic and Operating Review will support the return to balanced budgets by 2014–15.

In addition, the Government is moving forward with a comprehensive review of direct program spending to be completed in 2011–12. The Strategic and Operating Review will build on the first cycle of strategic reviews to support the return to balanced budgets by 2014–15, and provide fiscal room to continue paying down debt and investing in the priorities of Canadians, including lowering taxes for families. The review will focus on improving the efficiency and effectiveness of government operations and programs to ensure value for taxpayer money.

As shown in Table 1.1, without including any targeted savings from the Strategic and Operating Review, the Government is projected to return to balanced budgets by 2015–16. The Government remains committed to balancing the budget one year earlier, by 2014–15. It will achieve this by reducing expenses through the Strategic and Operating Review. The budgetary savings associated with the Strategic and Operating Review will be reflected in the Government’s fiscal projections once these actions are determined and implemented in Budget 2012.

| 2010–2011 | 2011–2012 | 2012–2013 | 2013–2014 | 2014–2015 | 2015–2016 | |

|---|---|---|---|---|---|---|

| (billions of dollars) | ||||||

| Balance including measures in Budget 2011 |

-40.5 | -29.6 | -19.4 | -9.5 | -0.3 | 4.2 |

| Balance including measures in this update of Budget 2011 |

-36.2 | -32.3 | -19.4 | -9.4 | -0.3 | 4.2 |

| Difference | 4.3 | -2.7 | 0.0 | 0.1 | 0.0 | 0.0 |

| Reference | ||||||

| Strategic and Operating Review targeted savings |

1.0 | 2.0 | 4.0 | 4.0 | ||

| Balance including measures in this update of Budget 2011 and the expected savings from the Strategic and Operating Review |

-36.2 | -32.3 | -18.4 | -7.4 | 3.7 | 8.2 |

| Note: Totals may not add due to rounding. | ||||||

Going forward, the Government will maintain its focus on the priorities set out in the Next Phase of Canada’s Economic Action Plan. The cornerstone of this plan will be returning to balanced budgets.

By focusing on sustainable investments in Canada’s long-term prosperity, the Government will seek to increase the well-being of all Canadians, while preserving the public services and culture that define us as a nation.