Archived - Annex 2

Update on the 2021-22 Debt Management Strategy

Introduction

The government released, as part of Budget 2021, the 2021-22 Debt Management Strategy, which set out the government’s objectives, strategy, and borrowing plans for its domestic debt program and the management of its official international reserves.

As first outlined in the July 2020 Economic and Fiscal Snapshot, the government issued long-term debt to finance the emergency support to Canadians and Canadian businesses through the COVID-19 pandemic.

The government announced, in Budget 2021, that it would consult with market participants to assess the market’s capacity to absorb long-term debt issuance, and would make any necessary adjustments to maintain stability in Canada’s financial markets.

In October 2021, the Department of Finance and the Bank of Canada held over 30 bilateral virtual meetings and received written comments from market participants. These consultations, which are an integral part of the debt management process, sought views on issues related to the design and operation of the Government of Canada’s domestic debt program. A detailed summary of the fall 2021 consultations can be found online.

Adjustments to the 2021-22 Borrowing Plan

Consistent with the direction laid out in the 2021-22 Debt Management Strategy, this year’s strategy continues to maximize the financing of COVID-19-related debt through long-term issuance. This approach provides security by lowering debt rollover and providing more predictable public debt charges over the long-term. This will ensure that Canada’s debt is sustainable and will not weigh on future generations.

The fiscal outlook for 2021-22 has improved since Budget 2021, with a 2021-22 financial requirement that is projected to be $35 billion lower than the spring estimate.

Reflecting these lower financial requirements, the expected bond program issuance for 2021-22 has been reduced by $31 billion and treasury bills stock has been reduced by $28 billion from the levels outlined in the 2021-22 Debt Management Strategy. The updated projection for gross issuance of bonds and treasury bills is set out in Table A2.1.

|

2020-21 Actual1 |

2021-22 Budget 2021 |

2021-22 Update |

Change from Budget 2021 |

|

|---|---|---|---|---|

| Treasury bills | 219 | 226 | 198 | -28 |

2-year |

129 | 76 | 67 | -9 |

3-year |

57 | 36 | 29 | -7 |

5-year |

82 | 48 | 40 | -8 |

10-year |

74 | 84 | 79 | -5 |

30-year |

32 | 32 | 30 | -2 |

Real Return Bonds (RRB) |

1 | 1 | 1 | 0 |

Ultra-long |

- | 4 | 4 | 0 |

Green bonds |

- | 52 | 52 | 0 |

| Total bonds | 374 | 286 | 255 | -31 |

| Total gross issuance | 593 | 512 | 453 | -59 |

|

Sources: Bank of Canada; Department of Finance Canada calculations. Note: Numbers may not add due to rounding 1 Includes a 5-year auction conducted in March 2021 with a settlement date in the 2021-22 fiscal year. 2 Target issuance, subject to market conditions. |

||||

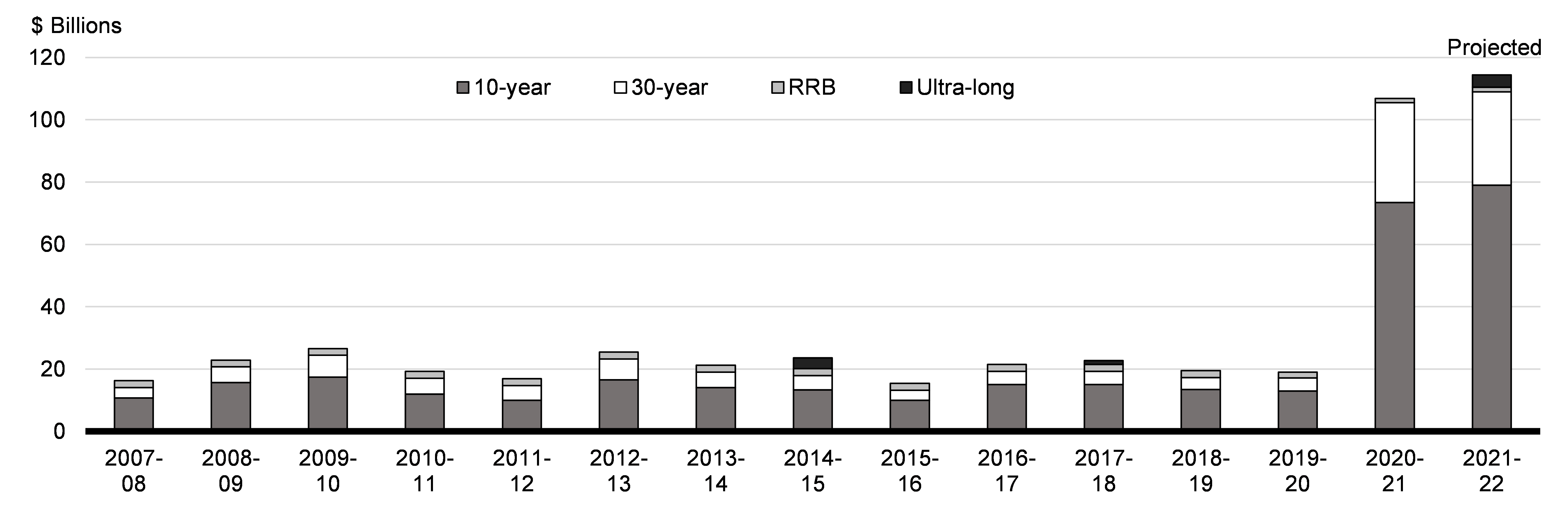

The reductions to this year’s bond program relative to the Budget 2021 plan reflect lower-than-expected financial requirements. They have been implemented to support market well-functioning across all sectors, while still maintaining the government’s objective of maximizing the financing of COVID-19-related debt through long-term issuance, which remains at historically high issuance levels (Chart A2.1).

Government of Canada Issuance of Long-term Bonds (historical vs. projected)

As a result of the adjustments, issuances with a maturity of 10 years or greater are now at a higher proportion of total bond issuances than what was initially planned in the 2021-22 Debt Management Strategy. Furthermore, as Table A2.2 shows, the level of bonds with a maturity of 10 years or greater will be higher in 2021-22 than 2020-21 in both relative and absolute terms.

It is expected that nearly half of the government’s bond issuance this year will be long-term bonds. This is a significant shift since 2019-20, when approximately 15 per cent of bonds issued had a maturity of 10 years or greater.

|

2020-21 Previous Year |

2021-22 Budget 2021 |

2021-22 Update |

||||

|---|---|---|---|---|---|---|

| Issuance1 | Share of Bond Issuance | Issuance | Share of Bond Issuance | Issuance | Share of Bond Issuance | |

| Short (2, 3, 5-year sectors) | 267 | 71% | 160 | 56% | 136 | 53% |

| Long (10-year+) | 107 | 29% | 121 | 42% | 114 | 45% |

| Green bond | - | - | 52 | 2% | 52 | 2% |

| Gross Bond Issuance | 374 | 100% | 286 | 100% | 255 | 100% |

|

Sources: Bank of Canada; Department of Finance Canada calculations. Note: Numbers may not add due to rounding 1 Includes a 5-year auction conducted in March 2021 with a settlement date in the 2021-22 fiscal year. 2 Target issuance, subject to market conditions. |

||||||

Green Bonds

In the Fall Economic Statement 2020, the government announced its intention to issue the federal government’s first ever green bond to support its historic investments in climate action and environmental initiatives.

Significant progress has been made in preparation for Canada’s inaugural green bond issuance, including the establishment of an Interdepartmental Green Bond Committee to support the development of Canada’s green bond framework, the engagement of HSBC and TD Securities as structuring advisors, and the appointment of Sustainalytics to undertake a second-party opinion review process.

The government plans to publish its green bond framework in the final quarter of 2021-22. The inaugural green bond issuance will target $5 billion and is planned by the end of 2021-22, subject to market conditions. This will be Canada’s first green bond and the government intends for it to be a regular offering.

Report a problem on this page

- Date modified: