Archived - Chapter 5:

Canada's Leadership in the World

On this page:

As a member of the G7, G20, the Commonwealth, and La Francophonie, an important contributor to NATO, and a global supporter of democracy, equality, and human rights, Canada is a steadfast defender of the rules-based international order in an increasingly dangerous and competitive world.

Russia's illegal and barbaric invasion of Ukraine is the most significant threat to the rules-based international order since its creation following the Second World War. Thousands of Ukrainians have been murdered, and many millions more have been displaced. The conflict has accelerated longstanding issues of poverty, income inequality, and food insecurity in the Global South.

In response, Canada has provided critical financial and military assistance to Ukraine, worked to implement unprecedented sanctions on Vladimir Putin, his henchmen, and the Russian economy, stepped up to support vulnerable people around the world who are feeling the effects of Putin's barbaric invasion, and welcomed tens of thousands of Ukrainians to Canada.

With democracy under threat from countries like China and Russia, with global progress towards the Sustainable Development Goals slowing, and with climate change contributing to instability around the world, Canada must continue to take action on pressing humanitarian, development, and security challenges—both here at home and around the world.

Over the past year this has meant responding to the hunger crisis in the Horn of Africa, providing critical humanitarian and disaster assistance in Pakistan, Türkiye, and Syria, supporting women in Iran fighting for political and human rights, and providing assistance to restore security for the Haitian people.

Budget 2023 reinforces the government's commitment to keeping Canadians safe, defending the rules-based international order and contributing to global security, supporting the world's poorest and most vulnerable, and standing up for Canadian values around the world.

Key Ongoing Actions

In the past year, the federal government has announced a series of investments that have enhanced Canada's security and our leadership around the world. These include:

-

$38.6 billion over 20 years to invest in the defence of North America and the modernization of NORAD;

-

More than $5.4 billion in assistance for Ukraine, including critical financial, military, and humanitarian support;

-

More than $545 million in emergency food and nutrition assistance in 2022-23 to help address the global food security crisis and respond to urgent hunger and nutrition needs;

-

$2.3 billion over the next five years to launch Canada's Indo-Pacific Strategy, including the further global capitalization of FinDev Canada, which will deepen Canada's engagement with our partners, support economic growth and regional security, and strengthen our ties with people in the Indo-Pacific;

-

$350 million over three years in international biodiversity financing, in addition to Canada's commitment to provide $5.3 billion in climate financing over five years, to support developing countries' efforts to protect nature;

-

$875 million over five years, and $238 million ongoing, to enhance Canada's cybersecurity capabilities;

-

Delivering on a commitment to spend $1.4 billion each year on global health, of which $700 million will be dedicated to sexual and reproductive health and rights for women and girls; and,

-

Channeling almost 30 per cent of Canada's newly allocated International Monetary Fund (IMF) Special Drawing Rights to support low-income and vulnerable countries, surpassing the G7's 20 per cent target.

5.1 Defending Canada

Whether defending Canada from global threats or working with our allies around the world, the Canadian Armed Forces play an essential role in keeping Canadians safe and supporting global security.

To ensure those who serve our country in uniform continue to have the resources they need, Budget 2022 took significant action to reinforce the Canadian Armed Forces. Budget 2023 lays out the next steps to invest in and strengthen the Canadian Armed Forces.

Budget 2023 also takes decisive action to defend Canada and our public institutions from foreign threats and interference.

Stable, Predictable, and Increasing Defence Spending

Canada's defence policy, Strong, Secure, Engaged, committed to ensuring the Department of National Defence (DND) has stable, predictable funding. The government has delivered on this commitment. As a result of Strong, Secure, Engaged and subsequent funding increases, including funding for NORAD modernization and continental defence announced in June 2022, DND's annual budget is expected to more than double over ten years, from $18.6 billion in 2016-17 to $39.7 billion in 2026-27 on a cash basis.

Defence Policy Update

In response to a changed global security environment following Russia's illegal invasion of Ukraine, the federal government committed in Budget 2022 to a Defence Policy Update that would update Canada's existing defence policy, Strong, Secure, Engaged.

This review, including public consultations, is ongoing, and is focused on the roles, responsibilities, and capabilities of the Canadian Armed Forces. The Department of National Defence will return with a Defence Policy Update that will ensure the Canadian Armed Forces remain strong at home, secure in North America, and engaged around the world.

With this review ongoing, the Canadian Armed Forces have continued to protect Canada's sovereignty in the Arctic, support our NATO allies in Eastern Europe, and contribute to operations in the Indo-Pacific.

In the past year, the government has made significant, foundational investments in Canada's national defence, which total more than $55 billion over 20 years. These include:

-

$38.6 billion over 20 years to strengthen the defence of North America, reinforce Canada's support of our partnership with the United States under NORAD, and protect our sovereignty in the North;

-

$2.1 billion over seven years, starting in 2022-23, and $706.0 million ongoing for Canada's contribution to increasing NATO's common budget;

-

$1.4 billion over 14 years, starting in 2023-24, to acquire new critical weapons systems needed to protect the Canadian Armed Forces in case of high intensity conflict, including air defence, anti-tank, and anti-drone capabilities;

-

$605.8 million over five years, starting in 2023-24, with $2.6 million in remaining amortization, to replenish the Canadian Armed Forces' stocks of ammunition and explosives, and to replace materiel donated to Ukraine;

-

$562.2 million over six years, starting in 2022-23, with $112.0 million in remaining amortization, and $69 million ongoing to improve the digital systems of the Canadian Armed Forces;

-

Up to $90.4 million over five years, starting in 2022-23, to further support initiatives to increase the capabilities of the Canadian Armed Forces; and,

-

$30.1 million over four years, starting in 2023-24, and $10.4 million ongoing to establish the new North American regional office in Halifax for NATO's Defence Innovation Accelerator for the North Atlantic.

In addition, the government is providing $1.4 billion to upgrade the facilities of Joint Task Force 2, Canada's elite counterterrorism unit.

A New Generation of Canadian Fighter Aircraft

With the largest investment in the Royal Canadian Air Force in 30 years, the government is acquiring 88 F-35 fighter aircraft, at a cost of $19 billion. The first of these modern aircraft is scheduled for delivery by 2026.

Canada's new fleet of F-35s will play an essential role in defending Canada's sovereignty, protecting North America, and supporting our allies around the world.

The government will also invest $7.3 billion to modernize, replace, and build new infrastructure to support the arrival of the new F-35s. This is the first project approved under Canada's plan to modernize NORAD.

Establishing the NATO Climate Change and Security Centre of Excellence in Montreal

View the impact assessmentClimate change has repercussions for people, economic security, public safety, and critical infrastructure around the world. It also poses a significant threat to global security, and in 2022, NATO's new Strategic Concept recognized climate change for the first time as a major security challenge for the Alliance.

At the 2022 NATO Summit in Madrid, Montreal was announced as the host city for NATO's new Climate Change and Security Centre of Excellence, which will bring together NATO allies to mitigate the impact of climate change on military activities and analyze new climate change-driven security challenges, such as the implications for Canada's Arctic.

-

Budget 2023 proposes to provide $40.4 million over five years, starting in 2023-24, with $0.3 million in remaining amortization and $7 million ongoing, to Global Affairs Canada and the Department of National Defence to establish the NATO Climate Change and Security Centre of Excellence.

Securing Our Economy

Depending on dictatorships for key goods and resources is a major strategic and economic vulnerability. The world has seen this over the past year with Russia's attempts to break European resolve by cutting off natural gas supplies. Our allies are moving quickly to protect themselves from economic extortion, which includes friendshoring their economies by building their critical supply chains through other democracies.

Canada is doing the same, and by working together with our allies and partners, we will ensure that our supply chains are not vulnerable to exploitation, and that hostile foreign powers cannot buy up Canadian industries and natural resources.

As this process continues across the world's democracies, it can make our economies more resilient, our supply chains true to our values, and it can protect our workers from unfair competition created by coercive states and race-to-the-bottom business practices.

Here in Canada, it can also create economic opportunities for Canadian workers and communities. Canada has the talented workforce and the resources needed to become a reliable supplier of the critical goods and resources that our allies need. Budget 2023 investments in building Canada's clean economy will also ensure Canadian workers benefit as we support our allies in friendshoring their economies.

Protecting Diaspora Communities and All Canadians From Foreign Interference, Threats, and Covert Activities

View the impact assessmentAs an advanced economy and a free and diverse democracy, Canada's strengths also make us a target for hostile states seeking to acquire information and technology, intelligence, and influence to advance their own interests.

This can include foreign actors working to steal information from Canadian companies to benefit their domestic industries, hostile proxies intimidating diaspora communities in Canada because of their beliefs and values, or intelligence officers seeking to infiltrate Canada's public and research institutions.

Authoritarian regimes, such as Russia, China, and Iran, believe they can act with impunity and meddle in the affairs of democracies—and democracies must act to defend ourselves. No one in Canada should ever be threatened by foreign actors, and Canadian businesses and Canada's public institutions must be free of foreign interference.

-

Budget 2023 proposes to provide $48.9 million over three years on a cash basis, starting in 2023-24, to the Royal Canadian Mounted Police to protect Canadians from harassment and intimidation, increase its investigative capacity, and more proactively engage with communities at greater risk of being targeted.

-

Budget 2023 proposes to provide $13.5 million over five years, starting in 2023-24, and $3.1 million ongoing to Public Safety Canada to establish a National Counter-Foreign Interference Office.

5.2 Supporting Ukraine

Since Russia's illegal full-scale invasion of Ukraine, Canada has supported the people of Ukraine as they fight for their sovereignty and democracy—and for democracy around the world. Canada will stand with them for as long as it takes.

With more than $5.4 billion in total aid, Canada has provided essential financial assistance to the government of Ukraine and delivered significant military support.

In helping to lead a global effort to inflict crushing economic sanctions on Russia, Canada has also played an important role in reducing Putin's war chest and holding his henchmen accountable.

Canada's financial assistance to Ukraine includes:

-

$2.45 billion in loans to the Government of Ukraine to help deliver essential services to Ukrainians, including proceeds from the world-first $500 million Ukraine Sovereignty Bond, which allowed Canadians to support Ukraine directly;

-

Leading the creation of the IMF Administered Account for Ukraine, which has facilitated more than $3.8 billion in financial assistance from Canada and our international partners;

-

A €36.5 million (approximately $50 million) loan guarantee through the European Bank for Reconstruction and Development to facilitate support to Ukraine's state-owned energy company, Naftogaz; and,

-

$115 million in grant assistance to repair Kyiv's power grid.

Canada's military contributions to support the Armed Forces of Ukraine include:

-

More than $1 billion committed in military aid and equipment donations, including for armoured vehicles; a National Advanced Surface-to-Air Missile System; 39 armoured combat support vehicles; four M777 howitzers; anti-tank weapons and small arms; and,

-

The continuation of the Canadian Armed Forces' Operation UNIFIER, which has trained more than 35,000 members of Ukraine's security forces since 2015.

Other Canadian support for Ukraine has included:

-

$320 million in humanitarian assistance;

-

$96 million in development assistance, which has supported the resilience of Ukraine's government institutions and civil society organizations, and provided grain storage solutions for farmers;

-

More than $81 million in support for demining operations, securing Ukraine's nuclear storage facilities, and other peace and stability initiatives; and,

-

Temporarily waiving all duties on Ukrainian imports.

Canada is also playing a leading role in efforts to cut Russia off from the global economy and hold Putin and his hangers-on accountable for their illegal war on Ukraine. Canada's sanctions efforts include:

-

Sanctioning more than 1,800 individuals and entities since February 2022;

-

Working with our partners in the Russian Elites, Proxies, and Oligarchs (REPO) Task Force to block or freeze more than $58 billion worth of assets from sanctioned individuals and entities;

-

Playing a key role in the development of price caps on Russian oil and petroleum products to deprive the Kremlin of revenues to fund its illegal war;

-

Becoming the first country to revoke Russia's and Belarus's Most-Favoured-Nation status, which reduced imports from these two countries by more than 97 per cent;

-

Implementing a new, world-leading regime to enable the federal government to pursue the forfeiture and sale of sanctioned Russian assets in Canada;

-

Playing a leading role in international efforts to ban Russian banks from the global SWIFT financial transaction processing system;

-

Prohibiting the importation of aluminum and steel products and other key goods from Russia; and,

-

Banning the exportation of a broad range of products to Russia and Belarus, including goods that could be used in the manufacture of weapons.

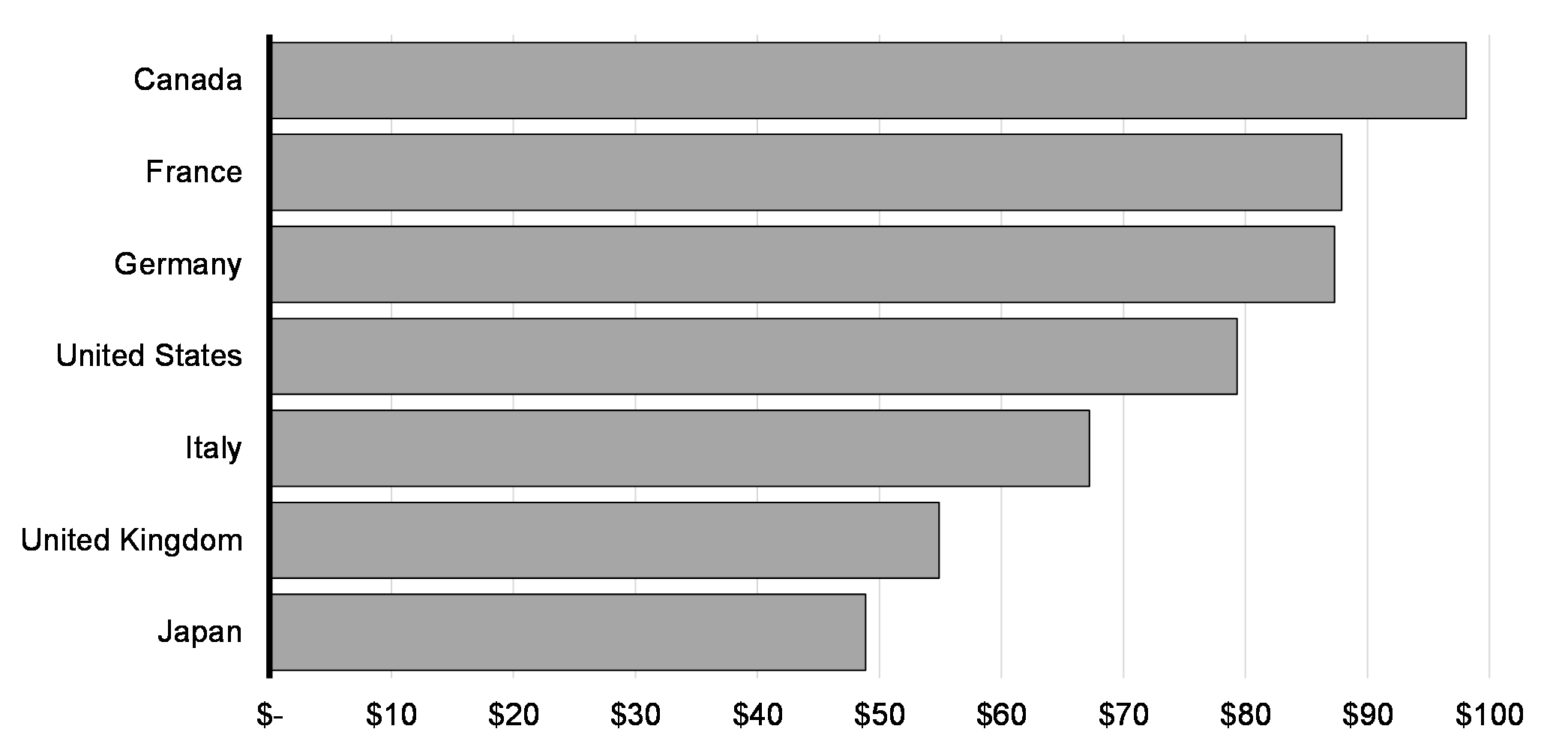

Financial Support to Ukraine

(per capita, USD)

Financial Assistance to Ukraine in 2023

View the impact assessmentCanada's financial support for Ukraine has helped its government continue to operate in the face of Russia's illegal invasion, including by paying pensions and delivering essential government services to Ukrainians, purchasing fuel to get through the winter, and restoring damaged energy infrastructure.

-

Budget 2023 provides Ukraine with an additional loan of $2.4 billion for 2023, which will be provided via the IMF Administered Account for Ukraine.

Bolstering the Defence of Ukraine

View the impact assessmentCanada is steadfast in our commitment to help Ukraine defend its sovereignty, territorial integrity, and democracy, and Budget 2023 commits additional funds for military aid to Ukraine.

-

Budget 2023 proposes to provide $200 million in 2022-23 to the Department of National Defence for donations of existing Canadian Armed Forces military equipment to Ukraine, including eight previously announced Leopard 2 main battle tanks.

Humanitarian, Development, and Security and Stabilization Assistance for Ukraine

View the impact assessmentAs Ukraine bravely fights back against Putin's illegal invasion, Canada will continue to provide further assistance to the people of Ukraine.

-

Budget 2023 announces that $84.8 million in 2023-24 will be allocated by Global Affairs Canada to provide targeted support to Ukraine for humanitarian assistance, mental health support, demining, agriculture, and other priority areas. All funds would be sourced from existing departmental resources.

To support Ukraine's ultimate recovery and reconstruction, Canada will also work to assist Ukraine in ensuring its ability to access private capital in the years to come.

A Safe Haven for Ukrainians

View the impact assessmentSince January 2022, and particularly since the beginning of Russia's full-scale illegal invasion of Ukraine, Canada has become a safe haven for nearly 200,000 Ukrainian citizens and returning Canadian permanent residents of Ukrainian origin, including through the temporary Canada-Ukraine authorization for emergency travel.

On March 22, 2023, the federal government announced that it was extending this pathway by allowing Ukrainians to apply until July 15, 2023, and arrive in Canada until March 31, 2024.

To support this extension, the government has committed an additional $171.4 million over three years, starting in 2022-23.

Indefinite Withdrawal of Most-Favoured-Nation Status From Russia and Belarus

View the impact assessmentOn March 2, 2022, Canada became the first country to revoke Russian and Belarusian eligibility for Most-Favoured-Nation status, placing Russia and Belarus in the same category as North Korea. This applied the 35 per cent General Tariff to virtually all Russian and Belarusian imports. Similar measures were subsequently implemented by the United States, the United Kingdom, and other major trading partners.

-

Budget 2023 proposes to amend the Customs Tariff to indefinitely extend the withdrawal of Most-Favoured-Nation preferential tariff treatment for Russian and Belarusian imports.

5.3 Standing Up for Canadian Values

With human rights and the rule of law under threat from authoritarian regimes around the world, Canada has an important role to play in fighting for the values we cherish. Indeed, as a democracy, Canada has an obligation to take steps to protect the most vulnerable and help to build a safer and more prosperous world for people everywhere.

Canada is committed to improving the lives of women, girls, and vulnerable populations around the world, and to increasing international development assistance every year towards 2030. Through our Feminist International Assistance Policy, Canada has delivered high levels of international assistance.

Building on this progress, Budget 2023 continues to take action to stand up for Canadian values around the world.

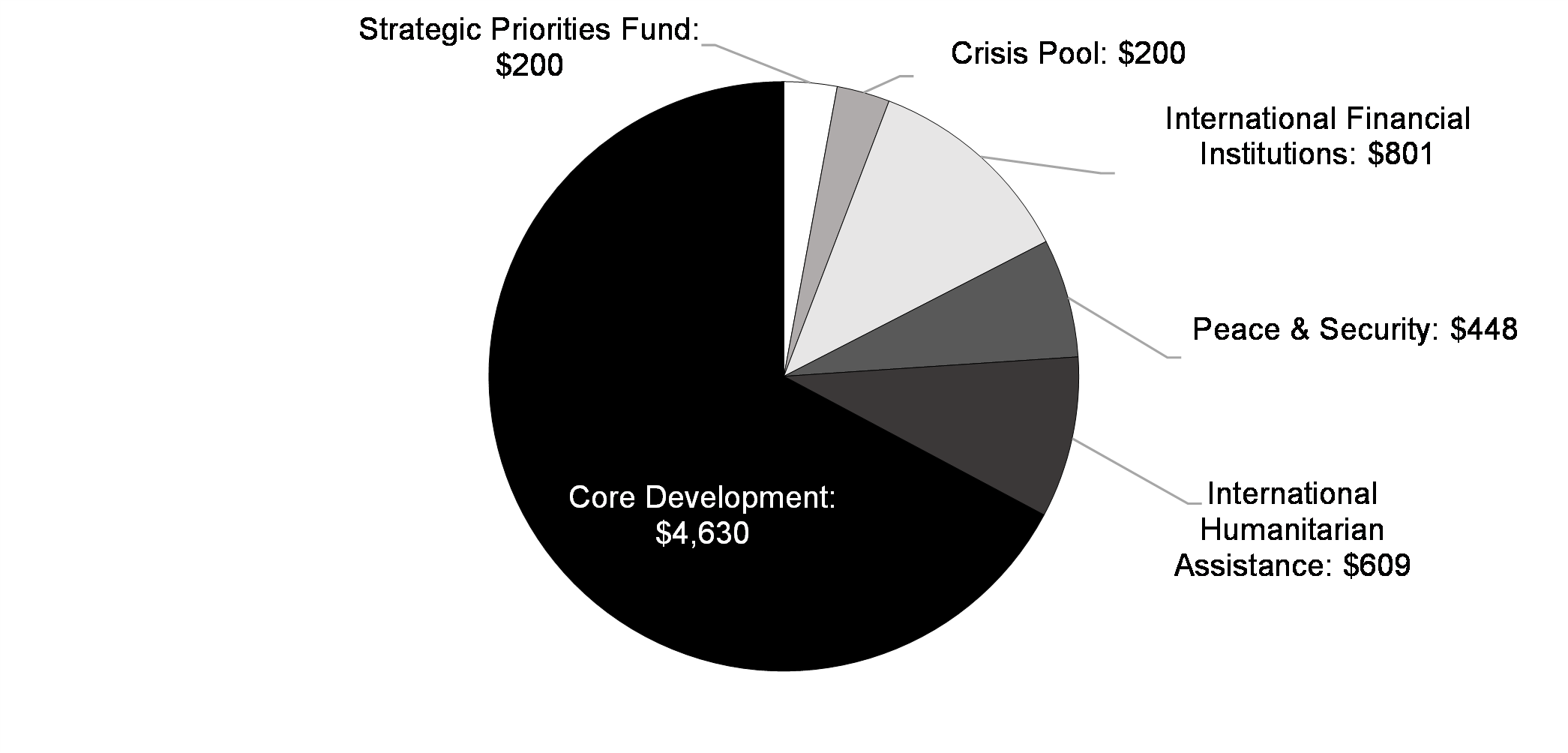

Projected International Assistance Envelope Spending, 2023-24

(millions, cash basis)

Supporting the Economic Growth of Developing Countries

View the impact assessmentSince the 1970s, Canada has offered preferential tariff programs to developing countries, which support these countries in growing their economies through the export of goods to Canada.

-

Budget 2023 proposes to update and renew the General Preferential Tariff and the Least Developed Country Tariff until 2034, and create a new General Preferential Tariff Plus. This new program will build on Canada's progressive trade agenda and incentivize countries to adhere to international standards on human rights, labour conditions, gender equality, and climate change.

This is estimated to reduce federal tariff revenues by $130 million over six years.

Eradicating Forced Labour from Canadian Supply Chains

View the impact assessmentCanada is gravely concerned by the ongoing human rights violations against Uyghurs and Muslim minorities in China, as well as by the use of forced labour around the world. Given these concerns, it is important that importers address their supply chain vulnerabilities and ensure their production promotes our shared Canadian values around the world.

-

Budget 2023 announces the federal government's intention to introduce legislation by 2024 to eradicate forced labour from Canadian supply chains to strengthen the import ban on goods produced using forced labour. The government will also work to ensure existing legislation fits within the government's overall framework to safeguard our supply chains.

5.4 Combatting Financial Crime

Serious financial crimes, such as money laundering, terrorist financing, and the evasion of financial sanctions, threaten the safety of Canadians and the integrity of our financial system. Canada requires a comprehensive, responsive, and modern system to counter these sophisticated and rapidly evolving threats.

Canada must not be a financial haven for oligarchs or the kleptocratic apparatchiks of authoritarian, corrupt, or theocratic regimes—such as those of Russia, China, Iran, and Haiti. We will not allow our world-renowned financial system to be used to clandestinely and illegally move money to fund foreign interference inside Canada.

Since 2019, the federal government has modernized Canada's Anti-Money Laundering and Anti-Terrorist Financing (AML/ATF) Regime to address risks posed by new technologies and sectors, and made investments to strengthen Canada's financial intelligence, information sharing, and investigative capacity.

Canada's AML/ATF Regime must continue to be strengthened in order to combat the complex and evolving threats our democracy faces, and to ensure that Canada is never a haven for illicit financial flows or ill-gotten gains.

In Budget 2023, the government is proposing further important measures to deter, detect, and prosecute financial crimes, protect financial institutions from foreign interference, and protect Canadians from the emerging risks associated with crypto-assets.

Combatting Money Laundering and Terrorist Financing

View the impact assessmentMoney laundering and terrorist financing can threaten the integrity of the Canadian economy, and put Canadians at risk by supporting terrorist activity, drug and human trafficking, and other criminal activities. Taking stronger action to tackle these threats is essential to protecting Canada's economic security.

In June 2022, the Government of British Columbia released the final report of the Commission of Inquiry into Money Laundering in British Columbia, also known as the Cullen Commission. This report highlighted major gaps in the current AML/ATF Regime, as well as areas for deepened federal-provincial collaboration. Between measures previously introduced and those proposed in Budget 2023, as well as through consultations that the government has committed to launching, the federal government will have responded to all of the recommendations within its jurisdiction in the Cullen Commission report.

In Budget 2023, the federal government is taking action to address gaps in Canada's AML/ATF Regime, and strengthen cooperation between orders of government.

-

Budget 2023 announces the government's intention to introduce legislative amendments to the Criminal Code and the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) to strengthen the investigative, enforcement, and information sharing tools of Canada's AML/ATF Regime.

These legislative changes will:

- Give law enforcement the ability to freeze and seize virtual assets with suspected links to crime;

- Improve financial intelligence information sharing between law enforcement and the Canada Revenue Agency (CRA), and law enforcement and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC);

- Introduce a new offence for structuring financial transactions to avoid FINTRAC reporting;

- Strengthen the registration framework, including through criminal record checks, for currency dealers and other money services businesses to prevent their abuse;

- Criminalize the operation of unregistered money services businesses;

- Establish powers for FINTRAC to disseminate strategic analysis related to the financing of threats to the safety of Canada;

- Provide whistleblowing protections for employees who report information to FINTRAC;

- Broaden the use of non-compliance reports by FINTRAC in criminal investigations; and,

- Set up obligations for the financial sector to report sanctions-related information to FINTRAC.

Strengthening Efforts Against Money Laundering and Terrorist Financing

In keeping with the requirements of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), the federal government will launch a parliamentary review of this act this year.

This review will include a public consultation that will examine ways to improve Canada's Anti-Money Laundering and Terrorist Financing (AML/ATF) Regime, as well as examine how different orders of government can collaborate more closely. This will include how governments can better use existing tools to seize the proceeds of crime, and the potential need for new measures, such as unexplained wealth orders. Other topics of consultation will include, but will not be limited to, measures to support investigations and prosecutions, enhance information sharing, close regulatory gaps, examine the role of the AML/ATF Regime in protecting national and economic security, as well as the remaining recommendations from the Cullen Commission.

-

Budget 2023 announces that the government will bring forward further legislative amendments, to be informed by these consultations, to give the government more tools to fight money laundering and terrorist financing.

Canada is also leading the global fight against illicit financial flows, having been chosen to serve for two years, effective July 2023, as Vice President of the Financial Action Task Force (from which Russia has been suspended indefinitely), as well as co-Chair of the Asia/Pacific Group on Money Laundering for two years, beginning in July 2022.

Implementing a Publicly Accessible Federal Beneficial Ownership Registry

View the impact assessmentThe use of anonymous Canadian shell companies can conceal the true ownership of property, businesses, and other valuable assets. When authorities don't have the tools to determine their true ownership, these shell companies can become tools of those seeking to launder money, avoid taxes, evade sanctions, or interfere in our democracy.

To address this, the federal government committed in Budget 2022 to implementing a public, searchable beneficial ownership registry of federal corporations by the end of 2023.

This registry will cover corporations governed under the Canada Business Corporations Act, and will be scalable to allow access to the beneficial ownership data held by provinces and territories that agree to participate in a national registry.

While an initial round of amendments to the Canada Business Corporations Act received Royal Assent in June 2022, further amendments are needed to implement a beneficial ownership registry.

The government is introducing further amendments to the Canada Business Corporations Act and other laws, including the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and the Income Tax Act, to implement a publicly accessible beneficial ownership registry through Bill C-42. This represents a major blow to money laundering operations and will be a powerful tool to strengthen the security and integrity of Canada's economy.

The federal government will continue calling upon provincial and territorial governments to advance a national approach to beneficial ownership transparency to strengthen the fight against money laundering, tax evasion, and terrorist financing.

Modernizing Financial Sector Oversight to Address Emerging Risks

View the impact assessmentCanadians must be confident that federally regulated financial institutions and their owners act with integrity, and that Canada's financial institutions are protected, including from foreign interference.

-

Budget 2023 announces the government's intention to amend the Bank Act, the Insurance Companies Act, the Trust and Loan Companies Act, the Office of the Superintendent of Financial Institutions Act, and the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) to modernize the federal financial framework to address emerging risks to Canada's financial sector.

These legislative changes will:

- Expand the mandate of the Office of the Superintendent of Financial Institutions (OSFI) to include supervising federally regulated financial institutions (FRFIs) in order to determine whether they have adequate policies and procedures to protect themselves against threats to their integrity and security, including protection against foreign interference;

- Expand the range of circumstances where OSFI can take control of an FRFI to include where the integrity and security of that FRFI is at risk, where all shareholders have been precluded from exercising their voting rights, or where there are national security risks;

- Expand the existing authority for the Superintendent to issue a direction of compliance to include an act that threatens the integrity and security of an FRFI;

- Provide new powers under the PCMLTFA to allow the Minister of Finance to impose enhanced due diligence requirements to protect Canada's financial system from the financing of national security threats, and allow the Director of FINTRAC to share intelligence analysis with the Minister of Finance to help assess national security or financial integrity risks posed by financial entities;

- Improve the sharing of compliance information between FINTRAC, OSFI, and the Minister of Finance; and,

- Designate OSFI as a recipient of FINTRAC disclosures pertaining to threats to the security of Canada, where relevant to OSFI's responsibilities.

The government will also review the mandate of FINTRAC to determine whether it should be expanded to counter sanctions evasion and will provide an update in the 2023 fall economic and fiscal update. In addition, the government will review whether FINTRAC's mandate should evolve to include the financing of threats to Canada's national and economic security as part of the parliamentary review.

These actions will continue the strong oversight of the financial sector that underpins a sound and stable Canadian economy.

Canada Financial Crimes Agency

To strengthen Canada's ability to respond to complex cases of financial crime, Budget 2022 announced the government's intent to establish a new Canada Financial Crimes Agency (CFCA), and provided $2 million to Public Safety Canada to undertake this work.

The CFCA will become Canada's lead enforcement agency against financial crime. It will bring together expertise necessary to increase money laundering charges, prosecutions and convictions, and asset forfeiture results in Canada. These actions will address the key operational challenges identified in both domestic and international reviews of Canada's AML/ATF Regime.

Public Safety Canada is developing options for the design of the CFCA, working in conjunction with federal, provincial and territorial partners and external experts, as well as engaging extensively with stakeholders. Further details on the structure and mandate of the CFCA will be provided by the 2023 fall economic and fiscal update.

Protecting Canadians from the Risks of Crypto-Assets

View the impact assessmentOngoing turbulence in crypto-asset markets, and the recent high-profile failures of crypto trading platform FTX, and of Signature Bank, have demonstrated that crypto-assets can threaten the financial well-being of people, national security, and the stability and integrity of the global financial system.

To protect Canadians from the risks that come with crypto-assets, there is a clear need for different orders of government to take an active role in addressing consumer protection gaps and risks to our financial system.

The federal government is working closely with regulators and provincial and territorial partners to protect Canadians' hard-earned savings and pensions, and Budget 2023 proposes new measures to protect Canadians.

-

To help protect Canadians' savings and the security of our financial sector, Budget 2023 announces that the Office of the Superintendent of Financial Institutions (OSFI) will consult federally regulated financial institutions on guidelines for publicly disclosing their exposure to crypto-assets.

Secure pension plans are the cornerstone of a dignified retirement. While pension plan administrators are required to prudently manage their investments, the unique nature and evolving risks of crypto-assets and related activities require continued monitoring.

-

To help protect Canadians' retirements, Budget 2023 announces that the government will require federally regulated pension funds to disclose their crypto-asset exposures to OSFI. The government will also work with provinces and territories to discuss crypto-asset or related activities disclosures by Canada's largest pension plans, which would ensure Canadians are aware of their pension plan's potential exposure to crypto-assets.

The federal government launched targeted consultations on crypto-assets as part of the review on the digitalization of money announced in Budget 2022. Moving forward, the government will continue to work closely with partners to advance the review, will bring forward proposals to protect Canadians from the risks of crypto-asset markets, and will provide further details in the 2023 fall economic and fiscal update.

| 2022- 2023 |

2023- 2024 |

2024- 2025 |

2025- 2026 |

2026-2027 | 2027-2028 | Total | |

|---|---|---|---|---|---|---|---|

| 5.1. Defending Canada | 0 | 15 | 27 | 26 | 9 | 10 | 86 |

| Increasing NATO's Common Budget | 70 | 116 | 235 | 298 | 374 | 465 | 1,558 |

Less: Funds Previously Provisioned in the Fiscal Framework |

-70 | -116 | -235 | -298 | -374 | -465 | -1,558 |

| Acquiring New Critical Weapons Systems | 0 | 112 | 127 | 101 | 101 | 101 | 542 |

Less: Funds Previously Provisioned in the Fiscal Framework |

0 | -112 | -127 | -101 | -101 | -101 | -542 |

| Replenishing the Canadian Armed Forces' Stocks | 0 | 135 | 121 | 119 | 100 | 130 | 606 |

Less: Funds Previously Provisioned in the Fiscal Framework |

0 | -135 | -121 | -119 | -100 | -130 | -606 |

| Improving the Digital Systems of the Canadian Armed Forces | 32 | 161 | 161 | 69 | 69 | 69 | 562 |

Less: Funds Previously Provisioned in the Fiscal Framework |

-32 | -161 | -161 | -69 | -69 | -69 | -562 |

| Further Support Initiatives to Increase the Capabilities of the Canadian Armed Forces | 2 | 30 | 28 | 16 | 15 | 0 | 90 |

Less: Funds Previously Provisioned in the Fiscal Framework |

-2 | -30 | -28 | -16 | -15 | 0 | -90 |

| Establishing a Regional Office for NATO's Defence Innovation Accelerator for the North Atlantic | 0 | 4 | 6 | 10 | 10 | 10 | 41 |

Less: Funds Previously Provisioned in the Fiscal Framework |

0 | -4 | -6 | -10 | -10 | -10 | -41 |

| Establishing the NATO Climate Change and Security Centre of Excellence in Montreal | 0 | 11 | 8 | 7 | 7 | 7 | 40 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -3 | -2 | -2 | -2 | -2 | -10 |

| Protecting Diaspora Communities and All Canadians from Foreign Interference, Threats and Covert Activities | 0 | 8 | 21 | 20 | 4 | 4 | 56 |

| 5.2. Supporting Ukraine | 98 | 212 | 61 | 0 | 0 | 0 | 371 |

| Bolstering the Defence of Ukraine | 200 | 0 | 0 | 0 | 0 | 0 | 200 |

| Humanitarian, Development and Security and Stabilization Assistance for Ukraine | 0 | 85 | 0 | 0 | 0 | 0 | 85 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -85 | 0 | 0 | 0 | 0 | -85 |

| A Safe Haven for Ukrainians1 | 0 | 212 | 61 | 0 | 0 | 0 | 273 |

Less: Funds Previously Provisioned in the Fiscal Framework |

-102 | 0 | 0 | 0 | 0 | 0 | -102 |

| 5.3. Standing Up for Canadian Values | 0 | 0 | 10 | 40 | 40 | 40 | 130 |

| Supporting the Economic Growth of Developing Countries | 0 | 0 | 10 | 41 | 41 | 41 | 132 |

Less: Projected Revenues |

0 | 0 | 0 | -1 | -1 | -1 | -2 |

| Additional Investments – Canada's Leadership in the World | 0 | 13 | 27 | 36 | 31 | 32 | 140 |

| Establishing a Cyber Security Certification Program for Defence Procurement View the impact assessment | 0 | 6 | 9 | 9 | 0 | 0 | 25 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -3 | -4 | -4 | 0 | 0 | -11 |

| Funding proposed for PSPC, DND, and the SCC-CCN to establish a cyber security certification program to protect Canada's defence supply chain. Cost recovery options will be explored for the program's administration. | |||||||

| Canada's Extended Continental Shelf (UNCLOS) Program View the impact assessment | 0 | 6 | 13 | 31 | 31 | 32 | 113 |

| Funding proposed for NRCan to prepare a revised submission to secure Canada's rights over its extended continental shelf in the Arctic Ocean, and to protect Canadian sovereignty in this increasingly contested area. | |||||||

| Enabling Humanitarian Assistance View the impact assessment | 0 | 5 | 11 | 0 | 0 | 0 | 16 |

Less: Funds Sourced From Existing Departmental Resources |

0 | -1 | -2 | 0 | 0 | 0 | -3 |

| Funding proposed for PS, the RCMP, GAC, and CSE to support the delivery of a mechanism under proposed amendments to the Criminal Code, to permit humanitarian assistance and other activities (e.g., to support refugee resettlement), in areas controlled by terrorist entities. | |||||||

| Chapter 5 - Net Fiscal Impact | 98 | 241 | 125 | 102 | 80 | 81 | 728 |

|

Note: Numbers may not add due to rounding. A glossary of abbreviations used in this table can be found at the end of Annex 1. 1Announced March 22, 2023. |

|||||||

Page details

- Date modified: