Archived - Annex 2:

Debt Management

Strategy

View the impact assessment

On this page:

Introduction

The 2023-24 Debt Management Strategy sets out the Government of Canada's objectives, strategy, and borrowing plans for its domestic and foreign debt program and the management of its official reserves.

The Financial Administration Act (FAA) requires that the Minister of Finance table, in each House of Parliament, a report on the anticipated borrowing to be undertaken in the fiscal year ahead, including the purposes for which the money will be borrowed and the management of the public debt, no later than 30 sitting days after the beginning of the fiscal year. The 2023-24 Debt Management Strategy fulfills this requirement.

Objectives

The fundamental objectives of debt management are to raise stable and low-cost funding to meet the financial requirements of the Government of Canada and to maintain a well-functioning market for Government of Canada securities.

Having access to a well-functioning government securities market contributes to lower costs and less volatile pricing for the government, ensuring that funds can be raised efficiently over time to meet the government's financial requirements.

The Debt Management Strategy provides transparency on the government's borrowing plans in order to support a liquid and well-functioning market for Government of Canada securities and ensure the long-term sustainability of its borrowing plans.

The government will continue to closely monitor financial markets and will adjust issuance if necessary to appropriately and responsibly respond to shifts in market demand or changes to financial requirements.

Outlook for Government of Canada Debt

As a result of the government's responsible fiscal management, Canada continues to have an enviable fiscal position relative to international peers, with the lowest net debt-to-GDP ratio in the G7. Rating agencies have stated that Canada's effective, stable, and predictable policymaking and political institutions, economic resilience and diversity, well-regulated financial markets, and its monetary and fiscal flexibility all contribute to Canada's strong current credit ratings: Moody's (Aaa), S&P (AAA), DBRS (AAA), and Fitch (AA+).

Planned Borrowing Activities for 2023-24

The projected sources and uses of borrowings for 2023-24 are presented in Table A2.1. The comparison of actual sources and uses of borrowings against projections will be reported in the Debt Management Report for 2023-24. This document will be released soon after the Public Accounts of Canada 2024, which will provide detailed accounting information on the government's interest-bearing debt.

Sources of Borrowings

The aggregate principal amount of money to be borrowed by the government in 2023-24 is projected to be $421 billion, about 85 per cent of which will be used to refinance maturing debt. This level of borrowing is consistent with the current legislated limit of $1,831 billion set out in the Borrowing Authority Act and the approved Governor in Council Order that set the annual borrowing limit for 2023-24 at $444 billion.

Uses of Borrowings

The size of the 2023-24 borrowing program reflects both requirements to refinance debt of $358 billion as well as the projected financial requirement of $63 billion. Borrowings for domestic needs will be sourced from domestic wholesale markets (Table A2.1).

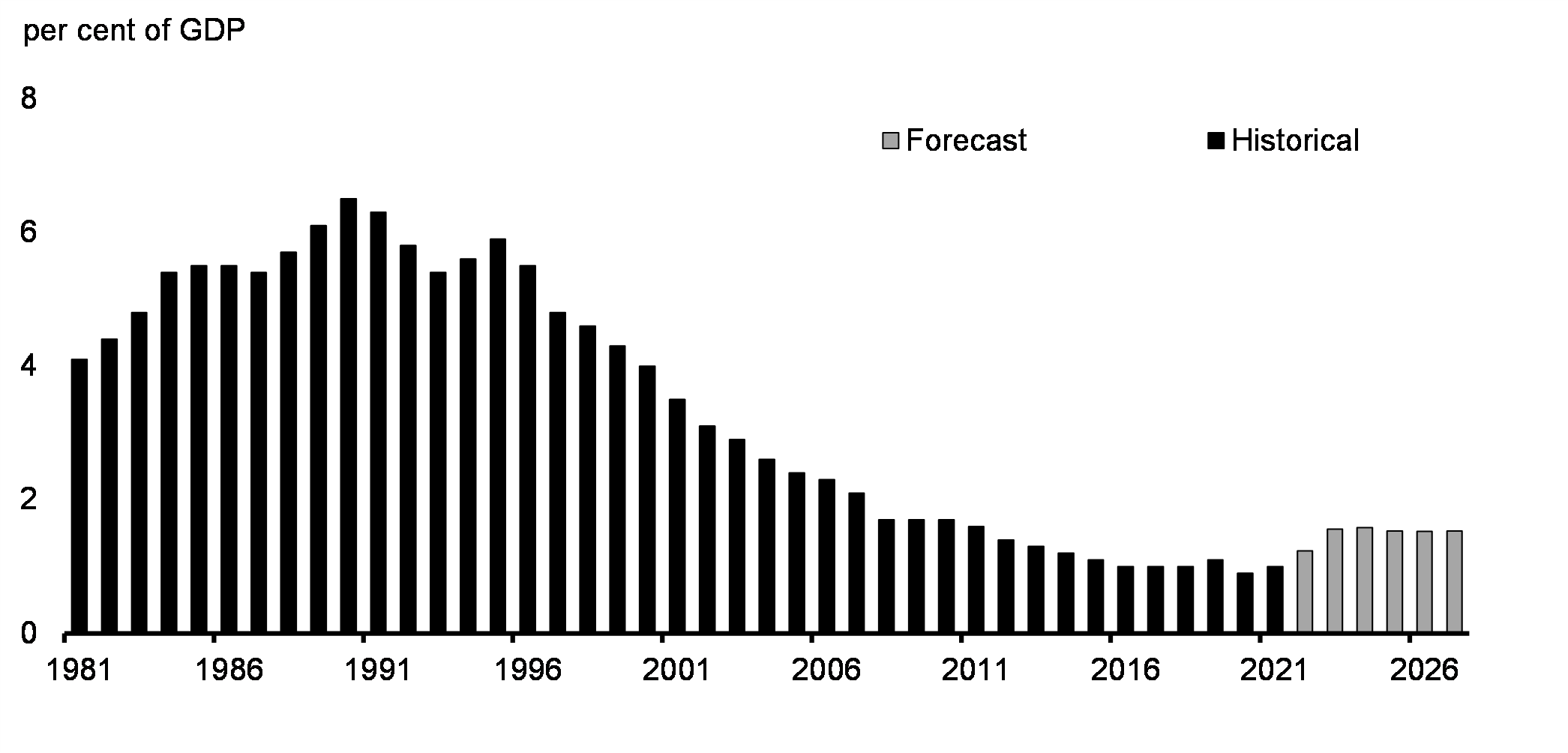

Reflecting the increase in interest rates over the last year, public debt charges have risen and are projected to be $43.9 billion for 2023-24, representing 1.6 per cent of GDP (Chart A2.1). Over the forecast horizon, public debt charges are projected to remain steady as a share of GDP, at 1.5 per cent of GDP ($50.3 billion) by 2027-28. This level is substantially lower than the average cost of financing debt over the last two decades, even with a significantly higher public debt because of COVID-19. Debt charges are projected to represent approximately 9.3 per cent of total government revenue by 2027-28, similar to the level in 2013-14.

Actual borrowings for the year may differ due to uncertainty associated with economic and fiscal projections, the timing of cash transactions, and other factors such as changes in foreign reserve needs and Crown corporation borrowings. To adjust for these unexpected changes in financial requirements, debt issuance can be altered during the year, typically first through changes in the issuance of treasury bills. The government may also adjust issuance for bonds in response to shifts in market demand.

| Sources of borrowings | |

|---|---|

|

Payable in Canadian Currency

|

|

|

Treasury bills1

|

242 |

|

Bonds

|

172 |

|

Total payable in Canadian currency

|

414 |

|

Payable in foreign currencies

|

7 |

| Total sources of borrowings | 421 |

| Uses of borrowings | |

| Refinancing needs | |

|

Payable in Canadian Currency

|

|

|

Treasury bills

|

202 |

|

Bonds

|

153 |

|

Retail debt

|

0 |

|

Total payable in Canadian currency

|

355 |

|

Payable in foreign currencies

|

3 |

| Total refinancing needs | 358 |

| Financial requirement | |

|

Budgetary balance

|

40 |

|

Non-budgetary transactions

|

|

|

Pension and other accounts

|

-9 |

|

Non-financial assets

|

2 |

|

Loans, investments and advances

|

|

|

Of which:

|

|

|

Loans to enterprise Crown corporations

|

10 |

|

Other

|

-21 |

|

Other transactions2

|

41 |

| Total financial requirement | 63 |

| Total uses of borrowings | 421 |

| Change in other unmatured debt transactions3 | 0 |

| Net increase or decrease (-) in cash | 0 |

|

Source: Department of Finance Canada calculations. Notes: Numbers may not add due to rounding. In the uses of borrowings section, a negative sign denotes a financial source. 1 Treasury bills are rolled over, or refinanced, a number of times during the year. This results in a larger number of new issues per year than the stock of outstanding at the end of the fiscal year, which is presented in the table. 2 Other transactions primarily comprise the conversion of accrual transactions to cash inflows and outflows for taxes and other accounts receivable, provincial and territorial tax collection agreements, amounts payable to taxpayers and other liabilities, and foreign exchange accounts. 3 Includes cross-currency swap revaluation, unamortized discounts on debt issues, obligations related to capital leases, and other unmatured debt, where this refers to in the table. |

|

Public Debt Charges as a percentage of GDP

2023-24 Borrowing Program

In 2023-24, Canada will continue transitioning away from the long-term emphasis maintained during COVID-19. This will allow Canada to return to a more sustainable debt structure that ensures sufficient issuance across all sectors and better balances the costs and risks of Canada's debt program over the longer term. Nonetheless, the share of bond issuances with a maturity of 10 years or greater will remain relatively historically high at 29 per cent of bond issuances (Table A2.2). In the decade prior to the pandemic, on average about 20 per cent of the bonds issued by the government were issued at maturities of 10 years or greater.

Cancellation of the 3-Year Sector

The 3-year sector has been reintroduced multiple times since its inception to manage higher funding needs and was helpful to fund the government's COVID-19 response.

However, overall issuance has declined significantly from a peak of $593 billion during COVID-19, with a borrowing program of $421 billion expected for 2023-24. Reflecting lower funding needs and to support well-functioning markets, the government will cease issuance in the 3-year sector effective in the second fiscal quarter. This will ensure the current 3-year benchmark bond maturing in April 2026 is built to an appropriate size before issuances are discontinued.

This decision will support liquid markets by consolidating issuance within core funding sectors, and will provide additional flexibility to reduce issuance in the remaining sectors without impairing market functioning.

This decision also reflects the outcome of the annual Debt Management Strategy consultations. In fall 2022, as in past years, market participants suggested reallocating 3-year bond issuance to other sectors. These comments are included in the detailed summary of the fall 2022 consultations.

| 10 Year Average1 | 2022-23 Estimated |

2023-24 Planned |

|||

|---|---|---|---|---|---|

| Share of Bond Issuance | Issuance | Share of Bond Issuance | Issuance | Share of Bond Issuance | |

| Short (2, 3, 5-year sectors) | 77% | 118 | 64% | 122 | 71% |

| Long (10-year+) | 23% | 67 | 36% | 50 | 29% |

| Gross Bond Issuance | 100% | 185 | 100% | 172 | 100% |

|

Note: Numbers may not add due to rounding. 1 The average of the previous 10 fiscal years (2012-13 through 2021-22). |

|||||

Composition of Market Debt

The total stock of market debt is projected to reach $1,319 billion by the end of 2023-24 (Table A2.3).

| 2019-20 Actual |

2020-21 Actual |

2021-22 Actual |

2022-23 Estimated |

2023-24 Projected |

|

|---|---|---|---|---|---|

| Domestic bonds1 | 597 | 875 | 1,031 | 1,038 | 1,057 |

| Treasury bills | 152 | 219 | 187 | 202 | 242 |

| Foreign debt | 16 | 15 | 14 | 15 | 20 |

| Retail debt | 1 | 0 | 0 | 0 | 0 |

| Total market debt | 765 | 1,109 | 1,232 | 1,255 | 1,319 |

|

Sources: Bank of Canada; Department of Finance Canada calculations. Note: Numbers may not add due to rounding. 1 Includes additional debt that accrues during the fiscal year as a result of the inflation adjustments to Real Return Bonds. |

|||||

Gross debt issuance will increase in 2023-24 compared to 2022-23 as cash balances were used to offset some of the government's financial requirements in 2022-23 (Table A2.4).

| 2021-22 Actual |

2022-23 Estimated |

2023-24 Planned |

|

|---|---|---|---|

| Treasury bills | 187 | 202 | 242 |

|

2-year

|

67 | 67 | 76 |

|

3-year

|

29 | 20 | 6 |

|

5-year

|

44 | 31 | 40 |

|

10-year

|

79 | 52 | 40 |

|

30-year

|

28 | 14 | 10 |

|

Green bonds

|

5 | - | -1 |

|

Total bonds

|

2572 | 1853 | 172 |

| Total gross issuance | 444 | 387 | 414 |

|

Sources: Bank of Canada; Department of Finance Canada calculations. Notes: Numbers may not add due to rounding. 1 Issuance subject to expenditure availability and market conditions. 2 Total issuance includes real-return bonds and ultra-long bonds. 3 Total issuance includes real-return bonds, ultra-long bonds, and the Ukraine Sovereignty Bond. |

|||

Treasury Bill Program

Bi-weekly issuance of 3-, 6-, and 12-month maturities are planned for 2023-24, with auction sizes planned to be largely within the $14 billion to $30 billion range. The government targets an increase in the year-end stock of treasury bills to $242 billion by the end of 2023-24, from an estimated $202 billion on March 31, 2023. This approach is intended to support a liquid and well-functioning market for Canadian federal government treasury bills, which helps investors who need access to short-term, interest-bearing securities in lieu of cash.

This approach is also informed by the Debt Management Strategy consultations with market participants held in fall 2022. Market participants indicated that there continues to be a high level of demand for treasury bills, driven by the uncertainty in markets and the rising interest rate environment.

Cash management bills (i.e., short-dated treasury bills) help manage government cash requirements in an efficient manner. These instruments will also be used in 2023-24 when needed.

2023-24 Bond Program

Annual gross bond issuance is planned to be about $172 billion in 2023-24, $13 billion lower than the $185 billion issued for 2022-23 (Table A2.4).

Maturity Date Cycles and Benchmark Bond Target Range Sizes

For 2023-24, reflecting the cancellation of the 3-year sector, benchmark target range sizes in the shorter-term bond sectors are higher relative to 2022-23 (Table A2.5). The continued transition away from the long-term emphasis results in lower benchmark target range sizes for longer-term bond sectors relative to 2022-23.

| Feb. | Mar. | Apr. | May | June | Aug. | Sept. | Oct. | Nov. | Dec. | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2-year | 16-22 | 16-22 | 16-22 | 16-22 | ||||||

| 3-year | 8-12 | |||||||||

| 5-year | 16-22 | 16-22 | ||||||||

| 10-year | 16-22 | 16-22 | ||||||||

| 30-year | 18-28 | |||||||||

|

Source: Department of Finance Canada calculations. Note: These amounts do not include coupon payments. 1 Actual annual issuance may differ. |

||||||||||

Bond Auction Schedule

In 2023-24, there will be regular auctions of 2-, 5-, 10-, and 30-year bonds. 3-year bond auctions will only take place in the first fiscal quarter. The number of planned auctions in 2023-24 for each sector is shown in Table A2.6. The actual number of auctions for 2023-24 may be different from the planned number due to unexpected changes in borrowing requirements or shifts in market demand.

| Sector | Planned Bond Auctions |

|---|---|

| 2-year | 16 |

| 3-year | 2 |

| 5-year | 8 |

| 10-year | 12 |

| 30-year | 8 |

|

Source: Department of Finance Canada. Note: These amounts do not include coupon payments. |

|

The dates of each auction will continue to be announced through the Quarterly Bond Schedule, which is published on the Bank of Canada's website prior to the start of each quarter.

Federal Green Bond Program

To support the growth of the sustainable finance market in Canada, in March 2022 the government published a green bond framework and issued its inaugural federal green bond, delivering on commitments made in Budget 2021. The government remains committed to regular green bond issuances.

The government continues to monitor developments related to green investment taxonomies, including the Sustainable Finance Action Council's "Taxonomy Roadmap Report", the European Commission's "EU Taxonomy for Sustainable Activities", the forthcoming EU Green Bond framework and the UK's green taxonomy, as well as evolving market standards and investor preferences.

The government is also continuing to explore a Sustainable Bond Framework which could include green, social, and transition bonds. Targeted discussions with market participants on this issue are ongoing.

Consultations on Canada Mortgage Bonds

In 2001, Canada Mortgage and Housing Corporation (CMHC) launched the Canada Mortgage Bond (CMB) program to help stabilize access to mortgage funding in all economic conditions. CMBs carry the full faith and credit of Canada and constitute a direct, unconditional obligation of Canada. However, despite carrying the same credit rating, CMBs are a more costly form of borrowing compared to regular Government of Canada bonds. In this context, consolidating CMBs into the regular Government of Canada borrowing program represents an opportunity to reduce debt charges and reinvest savings into important affordable housing programs.

The government intends to undertake market consultations on the proposal to consolidate the Canada Mortgage Bonds within the government's regular borrowing program, including on an implementation plan that would ensure stable access to mortgage financing. The government will return in the fall economic and fiscal update on this matter.

Management of Canada's Official International Reserves

The Exchange Fund Account, managed by the Minister of Finance on behalf of the Government of Canada, represents the largest component of Canada's official international reserves. It is a portfolio of Canada's liquid foreign exchange reserves and special drawing rights (SDRs) used to aid in the control and protection of the external value of the Canadian dollar and provide a source of liquidity to the government, if needed. In addition to the Exchange Fund Account, Canada's official international reserves include Canada's reserve position held at the International Monetary Fund.

The government borrows to invest in liquid reserves, which are maintained at a level at or above 3 per cent of nominal GDP. Net funding requirements for 2023-24 are estimated to be around US$13 billion but may vary as a result of movements in foreign interest rates and exchange rates.

Foreign debt is used exclusively to provide funding for Canada's official international reserves. The anticipated rise in foreign funding in fiscal year 2023-24 is required to fund the increase in the reserves level and to refinance maturing liabilities.

The mix of funding sources used to finance the liquid reserves in 2023-24 will depend on a number of considerations, including relative cost and market conditions. Potential funding sources include a short-term US-dollar paper program (Canada bills), medium-term notes, cross-currency swaps involving the exchange of Canadian dollars for foreign currency to acquire liquid reserves, and the issuance of global bonds.

Further information on foreign currency funding and the foreign reserve assets is available in the Report on the Management of Canada's Official International Reserves and in The Fiscal Monitor.

Bond Buyback Programs

The government announced the resumption of the Government of Canada Cash Management Bond Buyback program in

November 2022. This treasury management operation is intended to effectively manage Government of Canada cash

flows ahead of large bond maturities.

The government plans to continue conducting cash management bond buybacks in 2023-24.

Cash Management

The core objective of cash management is to ensure that the government has sufficient cash available at all times to meet its operating requirements.

As part of a general shift in the return to normal government operations outlined in last year's Debt Management Strategy, the higher cash balances maintained during the COVID-19 pandemic were reduced during 2022-23 from $90 billion to $40 billion.

At this time, the government's cash is entirely on deposit with the Bank of Canada, including operational balances and balances held for prudential liquidity. Periodic updates on the liquidity position are available in The Fiscal Monitor.

Prudential Liquidity

The government holds liquid financial assets in the form of domestic cash deposits and foreign exchange reserves to safeguard its ability to meet payment obligations in situations where normal access to funding markets may be disrupted or delayed. The government's overall liquidity levels are managed to normally cover at least one month of net projected cash flows, including coupon payments and debt refinancing needs.

Page details

- Date modified: