Archived - Annex 2:

Debt Management Strategy

Introduction

The 2022-23 Debt Management Strategy sets out the Government of Canada’s objectives, strategy, and borrowing plans for its domestic and foreign debt program and the management of its official reserves.

The Financial Administration Act (FAA) requires that the Minister of Finance table, in each House of Parliament, a report on the anticipated borrowing to be undertaken in the fiscal year ahead, including the purposes for which the money will be borrowed and the management of the public debt, no later than 30 sitting days after the beginning of the fiscal year. The 2022-23 Debt Management Strategy fulfills this requirement.

Since the beginning of the pandemic, the government has been successful in maximizing long bond issuance to fund COVID-19-related debt. This year’s debt management strategy continues to implement this strategic direction, first outlined in the 2020 Economic and Fiscal Snapshot.

Objectives

For 2022-23, the government will maintain its long-term emphasis in the debt management strategy. This prudent approach aims to lower future annual refinancing and provides predictability in public debt charges.

The fundamental objectives of debt management are to raise stable and low-cost funding to meet the financial requirements of the Government of Canada and to maintain a well-functioning market for Government of Canada securities.

The government will closely monitor financial markets and may adjust issuance in response to shifts in market demand and/or changes to financial requirements. Having access to a well-functioning government securities market contributes to lower costs and less volatile pricing for the government, ensuring that funds can be raised efficiently over time to meet the government’s financial requirements. Moreover, to support a liquid and well-functioning market for Government of Canada securities, the government strives to promote transparency and consistency.

Outlook for Government of Canada Debt

Prudent fiscal management means Canada continues to have an enviable fiscal position relative to international peers, with the lowest net debt-to-GDP ratio in the G7. Rating agencies have indicated that Canada's effective, stable, and predictable policymaking and political institutions, economic resilience and diversity, well-regulated financial markets, and its monetary and fiscal flexibility contribute to Canada's strong current credit ratings: Moody’s (Aaa), S&P (AAA), DBRS (AAA), and Fitch (AA+).

Planned Borrowing Activities for 2022-23

The projected sources and uses of borrowings for 2022-23 are presented in Table A2.1. The comparison of actual sources and uses of borrowings against projections will be reported in the Debt Management Report for 2022-23. This document will be released soon after the Public Accounts of Canada 2022, which provides detailed accounting information on the government’s interest- bearing debt.

Sources of Borrowings

The aggregate principal amount of money to be borrowed by the government in 2022-23 is projected to be $435 billion, about 80 per cent of which is composed of existing debt that is maturing and being refinanced. This level of borrowing is consistent with the maximum borrowing amount of $1,831 billion set out in the Borrowing Authority Act and the approved Governor in Council Order that set the annual borrowing limit for 2022-23 at $513.3 billion.

Uses of Borrowings

The government’s borrowing needs are driven by the refinancing of debt and projected incremental financial requirements. The size of the program reflects both requirements to refinance domestic debt of $369 billion as well as the projected financial requirement of $85 billion. Borrowings for domestic needs will be sourced from domestic wholesale markets (Table A2.1).

The government has maintained higher cash balances during the COVID-19 pandemic to be prepared for uncertain spending needs such as emergency supports for people and businesses. These cash balances are expected to be reduced during 2022-23 to offset some of the government’s financial requirements, as part of a general shift in the return to normal government operations.

Despite record borrowings to support Canadians and the economy during the COVID-19 pandemic, public debt charges are projected to remain sustainable at $26.9 billion for 2022-23, representing 1 per cent of GDP. Interest rates are forecasted to increase slightly throughout the forecast horizon, resulting in public debt charges rising to $42.9 billion, or 1.4 per cent of GDP by 2026-27. This is still substantially lower than the average cost of financing debt over the last two decades, even with a significantly higher public debt because of COVID-19. As a share of total government revenue, debt charges are projected to sit at approximately 8.6 per cent by 2026-27, similar to the level in 2014-15.

Actual borrowings for the year may differ due to uncertainty associated with economic and fiscal projections, the timing of cash transactions, and other factors such as changes in foreign reserve needs and Crown corporation borrowings. To adjust for these unexpected changes in financial requirements, debt issuance can be altered during the year, typically through changes in the issuance of treasury bills.

In addition, the government will closely monitor market conditions and may adjust issuance for treasury bills and bonds in response to shifts in market demand.

| Sources of borrowings | |

|---|---|

Payable in Canadian Currency |

|

Treasury bills1 |

213 |

Bonds |

212 |

Total payable in Canadian currency |

425 |

Payable in foreign currencies |

10 |

Total sources of borrowings |

435 |

| Uses of borrowings | |

| Refinancing needs | |

Payable in Canadian Currency |

|

Treasury bills |

187 |

Bonds |

182 |

Retail debt |

0 |

Total payable in Canadian currency |

369 |

Payable in foreign currencies |

9 |

Total refinancing needs |

378 |

Financial requirement |

|

Budgetary balance |

53 |

Non-budgetary transactions |

|

Pension and other accounts |

-10 |

Non-financial assets |

0 |

Loans, investments and advances |

10 |

Of which: |

|

Enterprise Crown corporations |

7 |

Other |

3 |

Other transactions2 |

33 |

| Total financial requirement | 85 |

| Total uses of borrowings | 463 |

| Change in other unmatured debt transactions3 | 0 |

| Net increase or decrease (-) in cash | -28 |

|

Source: Department of Finance Canada calculations. |

|

2022-23 Borrowing Program

Canada will continue, as much as possible, to fund the remaining COVID-19-related debt through long-term issuance. This strategic direction will provide security and stability to the government balance sheet by lowering annual debt refinancing needs and providing more predictability in public debt charges.

The share of bond issuances with a maturity of 10 years or greater will remain high, at 35 per cent of total issuances (Table A2.2). The government will continue issuance of the ultra-long 50-year bond for 2022-23. Accordingly, the Average Term to Maturity of the government’s market debt is expected to increase from just over 5 years at the end of June 2020 to nearly 7 years by the end of 2022-23.

In the decade prior to the pandemic, on average about 20 per cent of the bonds issued by the government were issued at maturities of 10 years or greater. Over the course of 2021-22, federal government allocations of long bonds was about 45 per cent. The government is now proposing to target about 35 per cent in long bond issuance in 2022-23 to fund the remaining COVID-19-related debt through long-term issuance while also maintaining a well-functioning market in other issuance sectors.

As was the case last year, this target may be adjusted in response to shifts in market demand and/or changes to financial requirements.

| 2021-22 Previous Year |

2022-23 Planned |

10 Year Average1 | |||

|---|---|---|---|---|---|

| Issuance | Share of Bond Issuance |

Issuance | Share of Bond Issuance | Share of Bond Issuance | |

| Short (2, 3, 5-year sectors) | 136 | 53% | 132 | 62% | 80% |

| Long (10-year+) | 114 | 45% | 75 | 35% | 20% |

| Green bonds | 5 | 2% | 52 | 2% | - |

| Gross Bond Issuance | 255 | 100% | 212 | 100% | 100% |

|

Note: Numbers may not add due to rounding. |

|||||

Composition of Market Debt

The total stock of market debt is projected to reach $1,291 billion by the end of 2022-23 (Table A2.3).

| 2018-19 Actual |

2019-20 Actual |

2020-21 Actual |

2021-22 Estimated |

2022-23 Projected |

|

|---|---|---|---|---|---|

| Domestic bonds1 | 569 | 597 | 879 | 1,031 | 1,063 |

| Treasury bills | 134 | 152 | 219 | 187 | 213 |

| Foreign debt | 16 | 16 | 15 | 14 | 15 |

| Retail debt | 1 | 1 | 0 | 0 | 0 |

| Total market debt | 721 | 765 | 1,114 | 1,232 | 1,291 |

|

Sources: Bank of Canada; Department of Finance Canada calculations. |

|||||

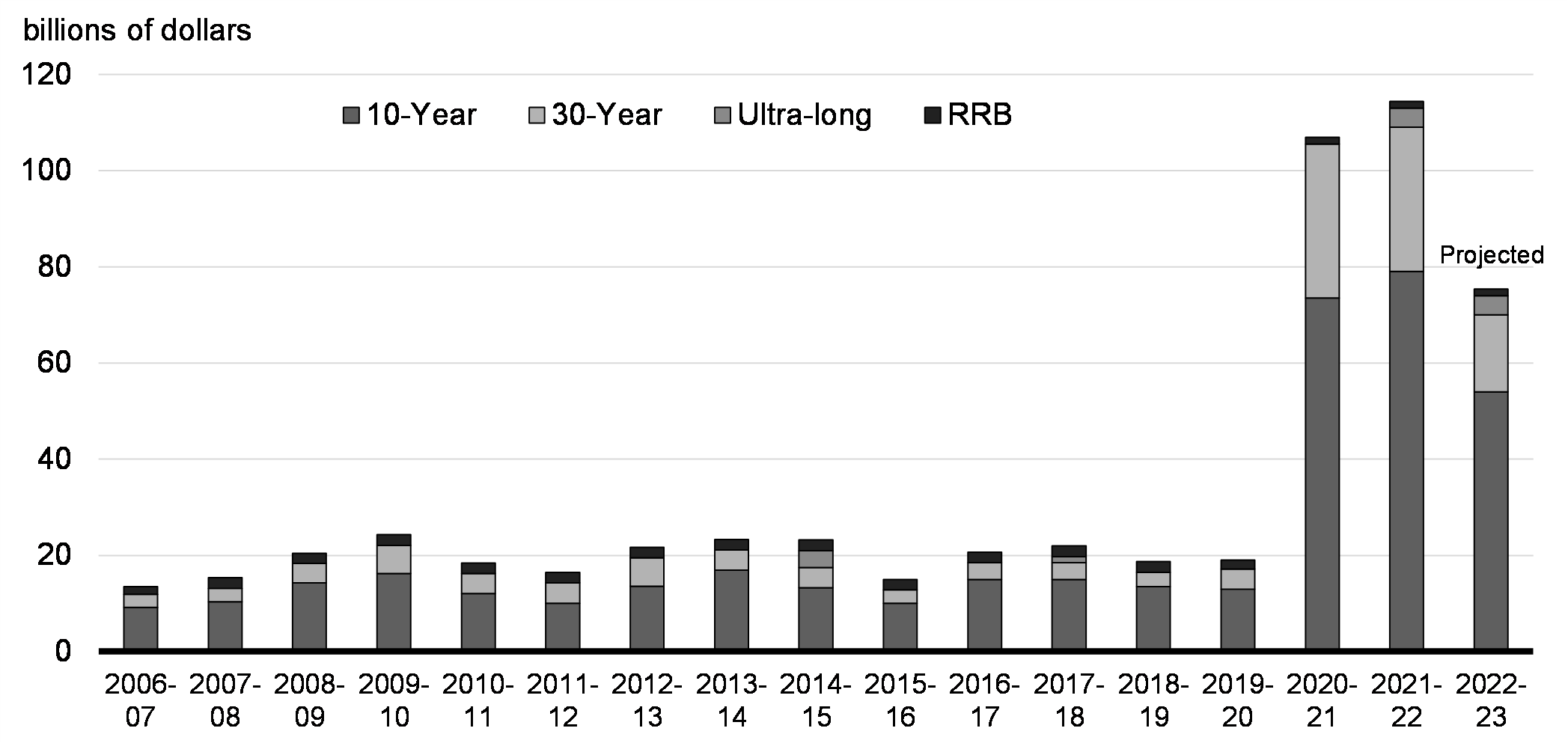

Gross debt issuance will fall in 2022-23 compared to 2021-22, reflecting lower financial requirements (Table A2.4). However, the level of issuance of bonds with a term to maturity of 10 years or more is planned to remain high by historical standards (Chart A2.1).

| 2020-21 Actual |

2021-22 Estimated |

2022-23 Planned |

||

|---|---|---|---|---|

Treasury bills |

219 | 187 | 213 | |

2-year |

129 | 67 | 74 | |

3-year |

56 | 29 | 24 | |

5-year |

82 | 40 | 34 | |

10-year |

74 | 79 | 54 | |

30-year |

32 | 30 | 16 | |

Real Return Bonds |

1 | 1 | 1 | |

Ultra-long |

- | 4 | 4 | |

Green bonds |

- | 5 | 51 | |

Total bonds |

374 | 255 | 212 | |

| Total gross issuance | 593 | 442 | 425 | |

|

Sources: Bank of Canada; Department of Finance Canada calculations. |

||||

Government of Canada Issuance of Long-term Bonds

Treasury Bill Program

Bi-weekly issuance of 3-, 6-, and 12-month maturities are planned for 2022-23, with auction sizes planned to be largely within the $14 billion to $26 billion range. The government targets an increase in the year-end stock of treasury bills to $213 billion by the end of 2022-23, from an estimated $187 billion on March 31, 2022. This approach is intended to support a liquid and well-functioning market for Canadian federal government treasury bills, which helps investors, as a whole, who need access to short-term, interest-bearing securities in lieu of cash.

This approach is also informed by consultations with market participants held in October 2021. Market participants indicated that treasury bills were currently in high demand due to excess cash in the financial markets, both from domestic and international investors. Market participants noted that treasury bill issuance could be increased but should definitely not be decreased in the event of lower financial requirements. A detailed summary of these consultations can be found online at: https://www.bankofcanada.ca/2021/12/summary-comments-fall-2021-debt-management-strategy-consultations.

Cash management bills (i.e., short-dated treasury bills) help manage government cash requirements in an efficient manner. These instruments will also be used in 2022-23 when needed.

2022-23 Bond Program

Annual gross bond issuance is planned to be about $212 billion in 2022-23, $43 billion lower than the $255 billion issued for 2021-22 (Table A2.4). This approach balances liquidity requirements in both the treasury bill and core benchmark bond sectors, while also satisfying the government’s objective of funding COVID-19-related debt through long-term issuance.

Maturity Date Cycles and Benchmark Bond Target Range Sizes

For 2022-23, benchmark sizes will be lower in many sectors relative to 2021-22, reflecting the decreased overall issuance in bonds (Table A2.5).

| Feb. | Mar. | Apr. | May | June | Aug. | Sept. | Oct. | Nov. | Dec. | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2-year | 16-20 | 16-20 | 16-20 | 16-20 | ||||||

| 3-year | 10-14 | 10-14 | ||||||||

| 5-year | 16-20 | 16-20 | ||||||||

| 10-year | 18-32 | 18-32 | ||||||||

| 30-year2 | 25-40 | |||||||||

| Real Return Bonds2,3 | 8-12 | |||||||||

| Ultra-long4 | N/A | |||||||||

|

Source: Department of Finance Canada calculations. |

||||||||||

Bond Auction Schedule

In 2022-23 there will be quarterly auctions of 2-, 3-, 5-, 10-, 30-, and 50-year bonds. Some of these bonds may be issued multiple times per quarter. The number of planned auctions in 2022-23 for each sector is shown in Table A2.6. The actual number of auctions for 2022-23 may be different from the planned number due to unexpected changes in borrowing requirements or shifts in market demand.

Sector |

Planned Bond Auctions |

|---|---|

| 2-year | 17 |

| 3-year | 8 |

| 5-year | 8 |

| 10-year | 14 |

| 30-year | 8 |

| Real Return Bonds | 4 |

| Ultra-long1 | 4 |

|

Source: Department of Finance Canada |

|

The dates of each auction will continue to be announced through the Quarterly Bond Schedule, which is published on the Bank of Canada’s website prior to the start of each quarter.

Federal Green Bond Program

To support the growth of the sustainable finance market in Canada, in March 2022 the government published a green bond framework and issued its inaugural federal green bond, delivering on commitments made in Budget 2021.

The inaugural issuance of $5 billion received strong demand from green bond investors. Canada’s inaugural green bond issuance, the largest Canadian dollar green bond offering in Canadian history, saw strong demand from green and socially minded investors, who represented 72 per cent of buyers.

Consistent with Canada’s green bond framework, the government plans to release the allocation report for its inaugural green bond in 2022-23 and the first impact report will follow. Additionally, another green bond issuance is planned for 2022-23. Future decisions on size, tenor, and timing of the next green bond issuance will take into consideration views from market participants and the availability of eligible green expenditures.

The ongoing success of Canada’s green bond program will involve a whole-of-government approach via continued support from federal departments that develop and deliver Canada’s programs to meet climate and environmental objectives.

Management of Canada’s Official International Reserves

The Exchange Fund Account, managed by the Minister of Finance on behalf of the Government of Canada, represents the largest component of Canada’s official international reserves. It is a portfolio of Canada’s liquid foreign exchange reserves and special drawing rights (SDRs) used to aid in the control and protection of the external value of the Canadian dollar and provide a source of liquidity to the government, if needed. In addition to the Exchange Fund Account, Canada’s official international reserves include Canada’s reserve position held at the International Monetary Fund.

The government borrows to invest in liquid reserves, which are maintained at a level at or above 3 per cent of nominal GDP. Net funding requirements for 2022-23 are estimated to be around US$16 billion, but may vary as a result of movements in foreign interest rates and exchange rates.

Foreign debt is used exclusively to provide funding for Canada’s official international reserves. The anticipated rise in foreign funding in fiscal year 2022-23 is required to fund the increase in the reserves level and the maturing liabilities.

The mix of funding sources used to finance the liquid reserves in 2022-23 will depend on a number of considerations, including relative cost, market conditions, and the objective of maintaining a prudent foreign-currency- denominated debt maturity structure. Potential funding sources include a short-term US-dollar paper program (Canada bills), medium-term notes, cross-currency swaps involving the exchange of Canadian dollars for foreign currency to acquire liquid reserves, and the issuance of global bonds.

Further information on foreign currency funding and the foreign reserve assets is available in the Report on the Management of Canada’s Official International Reserves (https://www.canada.ca/en/department-finance/services/publications/official-international-reserves.html) and in The Fiscal Monitor (https://www.canada.ca/en/department-finance/services/publications/fiscal-monitor.html).

Cash Management

The core objective of cash management is to ensure that the government has sufficient cash available at all times to meet its operating requirements.

At this time, the government’s cash is entirely on deposit with the Bank of Canada, including operational balances and balances held for prudential liquidity. Periodic updates on the liquidity position are available in The Fiscal Monitor https://www.canada.ca/en/department-finance/services/publications/fiscal-monitor.html.

Prudential Liquidity

The government holds liquid financial assets in the form of domestic cash deposits and foreign exchange reserves to safeguard its ability to meet payment obligations in situations where normal access to funding markets may be disrupted or delayed. The government’s overall liquidity levels are managed to normally cover at least one month of net projected cash flows, including coupon payments and debt refinancing needs.

Borrowing Authority

In spring of 2021, in response to pressure created by the COVID-19 pandemic, the Government of Canada invoked section 46.1(c) of the FAA to borrow under extraordinary circumstances. The borrowing that ensued totals approximately $8.4 billion and has occurred between March 23, 2021, and May 6, 2021, inclusively.

Since then, the government has reported to Parliament on the extraordinary amounts borrowed through the 2021-22 Extraordinary Borrowing Report to Parliament, which was tabled in Parliament on May 25, 2021.

Given that the period of extraordinary borrowing has ended, and that the government has reported on it to Parliament, the government is proposing to introduce legislation to treat this amount as regular borrowings and to cause it to be counted against the Borrowing Authority Act maximum amount. This is consistent with the approach taken in fall 2020, when a similar tranche of extraordinary borrowing was completed and subsequently consolidated into the overall borrowing limit.

Additionally, the government is proposing to amend the FAA to no longer treat this amount as extraordinary borrowing for the purpose of reporting requirements under the FAA and to simplify the legislative reporting requirements associated with extraordinary borrowing amounts in the annual Debt Management Report to only require that the amounts be reported as at the fiscal year-end. This ensures a consistent and transparent approach for reporting and understanding the government’s overall borrowing activity.

Report a problem on this page

- Date modified: