Archived -

Budget 2021

A Recovery Plan for Jobs, Growth, and Resilience

The Government of Canada’s plan to finish the fight against COVID-19 — and ensure a resilient economic recovery that creates jobs and growth for Canadians.

Transcript

A Recovery Plan for Jobs, Growth, and Resilience - Budget 2021

The Government of Canada is doing everything it can to finish the fight against COVID-19, and will continue to be there for those who need help.

Our plan will build a more resilient economy that benefits the middle class and everyone working hard to join it.

Budget 2021 includes a jobs and growth plan to increase opportunities for women and young Canadians including investments in a Canada-wide Early Learning and Child Care system.

The Government of Canada has a plan to create 1 million new jobs and drive economic growth.

Budget 2021 supports Canadians by creating new opportunities in the trades and helping people develop the skills needed to succeed.

The Government of Canada will continue to help businesses grow and innovate by creating incentives to hire workers, providing access to financing to scale-up businesses, and making it easier to adopt new technologies to reach more Canadians.

We will continue implementing our plan for a healthy environment and a healthy economy by creating jobs in the clean tech sector, and ensuring our kids and grandkids grow up in a country with clean air and clean water.

Find out how Budget 2021 will help get us all through this pandemic, create jobs, and build a more resilient Canada.

Themes

Jobs Creation

Creating One Million Jobs

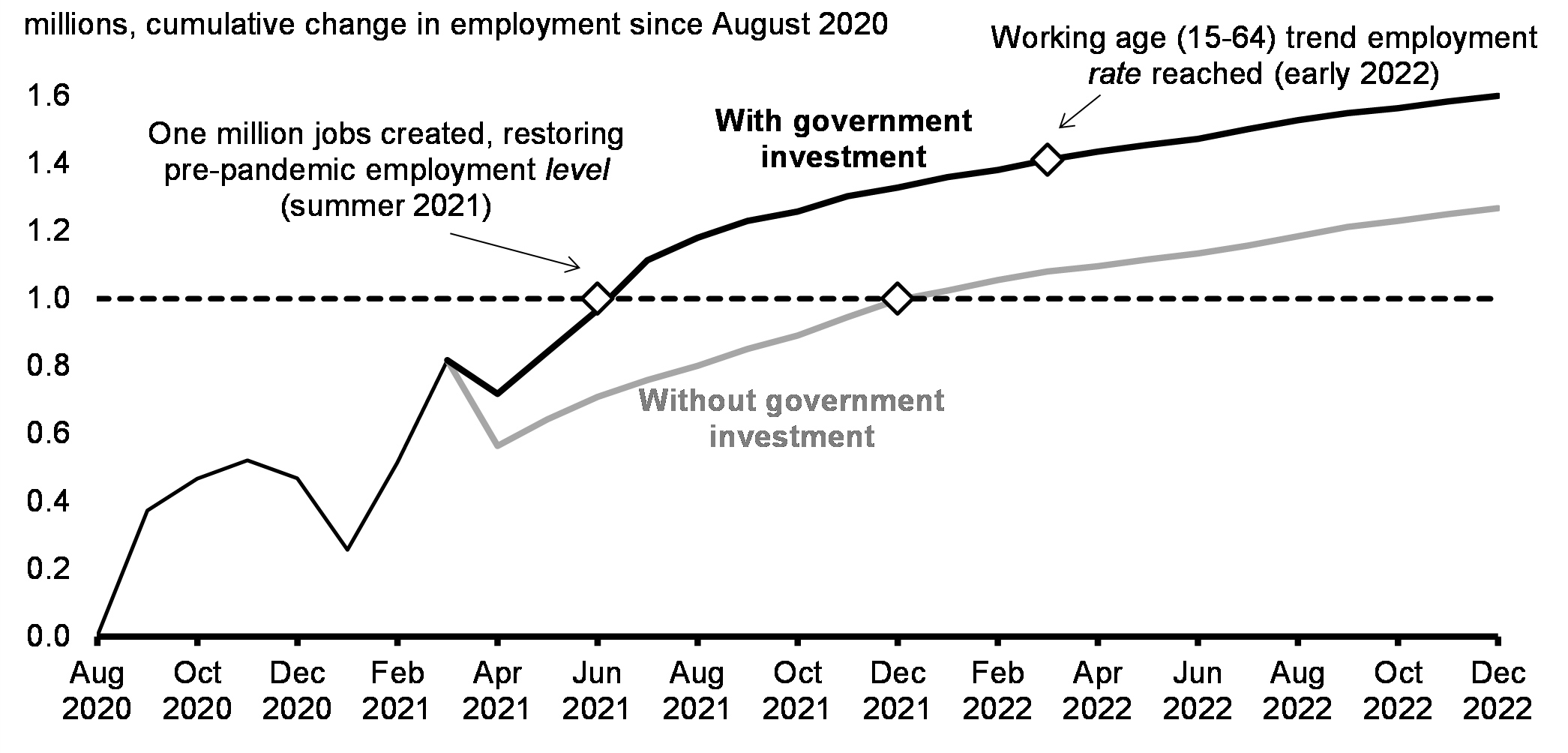

In last fall’s Speech from the Throne, the government announced its commitment to create one million jobs and restore employment to previous levels. Despite the severe impact of the second wave on Canadian workers and businesses, we are on path to create one million jobs by the end of the year—ahead of expectations.

Helping Hard-hit Businesses Hire More Workers

Budget 2021 proposes to introduce the new Canada Recovery Hiring Program for eligible employers that continue to experience qualifying declines in revenues relative to before the pandemic. The proposed subsidy would offset a portion of the extra costs employers take on as they reopen, either by increasing wages or hours worked, or by hiring more staff.

Extension of Canada Emergency Wage Subsidy, the Canada Emergency Rent Subsidy and Lockdown Support Beyond June 2021

The Canada Emergency Wage Subsidy has helped more than 5.3 million Canadians keep their jobs, and the Canada Emergency Rent Subsidy and Lockdown Support have helped more than 154,000 organizations with rent, mortgage, and other expenses. Budget 2021 proposes to extend the wage subsidy, the rent subsidy, and Lockdown Support until September 25, 2021.

Enhancing the Canada Small Business Financing Program

To make sure small business and independent entrepreneurs can access the capital they need to recover, innovate, and grow in the long-term, Budget 2021 proposes to improve the Canada Small Business Financing Program. These proposed amendments are projected to increase annual financing by $560 million, supporting approximately 2,900 additional small businesses.

Creating New Opportunities for Skilled Tradespeople

The skilled trades are vital to our economy, and apprenticeships are the bridge that help skilled workers, especially young people starting their careers, connect with businesses and find well-paying jobs. Budget 2021 proposes to provide $470 million over three years, beginning in 2021-22, to Employment and Social Development Canada to establish a new Apprenticeship Service. The Apprenticeship Service would help 55,000 first-year apprentices in construction and manufacturing Red Seal trades connect with opportunities at small and medium-sized employers. It will provide an additional incentive for employers who hire people traditionally underrepresented in the trades, including women, racialized Canadians, and persons with disabilities.

Small Businesses and Growth

Canada Technology Adoption Fund

To fuel the recovery, jobs, and growth, the government is launching the Canada Digital Adoption Program, which will create thousands of jobs for young Canadians and help as many as 160,000 small and medium-sized businesses adopt new digital technologies. Eligible businesses will receive micro-grants and access to zero-interest financing to help offset the costs of going digital—and be able to access support from digital trainers within a network of up to 28,000 well trained young Canadians.

Canada Small Business Financing Program

Small businesses need access to financing in order to invest in people and innovation, and to have the space to operate and grow. Budget 2021 proposes to improve the Canada Small Business Financing Program to increase annual financing by $560 million, supporting approximately 2,900 additional small businesses, alongside other enhancements that will increase the eligibility to this financing and permit lending against intellectual property and start-up assets and expenses.

Credit Card Swipe Fees

With a rise in online transactions during the pandemic, small- and medium-sized businesses incur interchange fees for these transactions. The government will engage with key stakeholders to: lower the average overall cost of interchange fees for merchants; ensure that small businesses benefit from pricing that is similar to large businesses; and protect existing rewards points for Canadian consumers.

Extension of Canada Emergency Wage Subsidy, the Canada Emergency Rent Subsidy and Lockdown Support Beyond June 2021

The Canada Emergency Wage Subsidy has helped more than 5.3 million Canadians keep their jobs, and the Canada Emergency Rent Subsidy and Lockdown Support have helped more than 154,000 organizations with rent, mortgage, and other expenses. Budget 2021 proposes to extend the wage subsidy, the rent subsidy, and Lockdown Support until September 25, 2021.

Canada Community Revitalization Fund

In many communities, the most vibrant spaces in our communities have laid dormant as Canadians took precautions to stay safe. Budget 2021 proposes to provide $500 million over two years, starting in 2021-22, to the regional development agencies for community infrastructure. These projects will stimulate local economies, create jobs, and improve the quality of life for Canadians from coast to coast to coast.

Women and Early Learning and Child Care

Establishing a Canada-Wide Early Learning and Child Care System

Budget 2021 makes a generational investment to build a Canada-wide early learning and child care system. This plan will aim to reduce fees for parents with children in regulated child care by 50 per cent on average, by 2022, with a goal of reaching $10 per day on average by 2026, everywhere outside of Quebec. Budget 2021 will invest almost $30 billion over the next five years and provide permanent ongoing funding, working with provincial and territorial, and Indigenous partners to support quality, not-for-profit child care, and ensuring the needs of early childhood educators are at the heart of the system.

Supporting Women Entrepreneurs

To provide affordable financing, increase data, and strengthen capacity within the entrepreneurship ecosystem, Budget 2021 proposes to provide up to $146.9 million over four years, starting in 2021-22, to strengthen the Women Entrepreneurship Strategy. Women entrepreneurs would have greater access to financing, mentorship, and training. Funding would also further support the Women Entrepreneurship Ecosystem Fund and the Women Entrepreneurship Knowledge Hub.

Advancing a National Action Plan to End Gender-Based Violence

The government—in consultation with provinces, territories, municipalities, Indigenous peoples, gender-based violence experts, stakeholders, and, most importantly, survivors of gender-based violence—is moving forward on a first-ever National Action Plan to End Gender-Based Violence. This plan will focus on ensuring that anyone facing gender-based violence has reliable and timely access to protection and services, no matter where they live. Budget 2021 proposes to invest $601.3 million over five years, starting in 2021-22, to advance this plan.

Responding to the Tragedy of Missing and Murdered Indigenous Women and Girls

The government is accelerating work on the National Action Plan in response to the National Inquiry into Missing and Murdered Indigenous Women and Girls’ Calls for Justice and the implementation of the Truth and Reconciliation Commission’s Calls to Action.

Budget 2021 proposes to invest an additional $2.2 billion over five years, beginning in 2021-22, and $160.9 million ongoing, to help build a safer, stronger, and more inclusive society.

Supporting Access to Sexual and Reproductive Health Care Information and Services

All Canadians should have access to a full suite of sexual and reproductive health resources and services, no matter where they live. To improve access to sexual and reproductive health care, support, information, and services—including access to abortion—Budget 2021 proposes to provide $45 million to fund community-based organizations that help make sexual and reproductive health care information and services more accessible for vulnerable populations.

Climate Action and a Green Economy

Lower Home Energy Bills Through Interest-free Loans for Retrofits

Climate action starts at home, and deep home energy retrofits can have a big effect on emissions reduction. Budget 2021 proposes to provide $4.4 billion on a cash basis ($778.7 million on an accrual basis over five years, starting in 2021-22, with $414.1 million in future years), to the Canada Mortgage and Housing Corporation (CMHC) to help homeowners complete deep home retrofits through interest-free loans worth up to $40,000. The program would be available by summer 2021 and support retrofits for up to 200,000 households.

Historic Investments in Canada’s Natural Legacy

Budget 2021 proposes to provide $2.3 billion over five years, starting in 2021-22, with $100.5 million in remaining amortization, to Environment and Climate Change Canada, Parks Canada, and the Department of Fisheries and Oceans to conserve up to 1 million square kilometers more land and inland waters. This in support of our goal to conserve 25 per cent of Canada’s lands and oceans by 2025. Budget 2021 will also invest $200 million to build natural infrastructure like parks, green spaces, ravines, waterfronts, and wetlands.

Accelerating Canada’s Net-zero Transformation Through Innovation

The Net Zero Accelerator, launched in the government’s strengthened climate plan last December, will help build and secure Canada’s clean industrial advantage. Budget 2021 proposes to provide $5 billion over seven years to the Net Zero Accelerator. This funding would allow the government to provide up to $8 billion of support for good jobs and projects that will help reduce domestic greenhouse gas emissions across the Canadian economy.

Carbon Capture, Utilization, and Storage

Carbon capture, utilization, and storage (CCUS) is an important tool for reducing emissions in high emitting sectors. Canada is a leader in CCUS, with domestic projects that currently capture 4 megatonnes of carbon every year, but we have the technical and geological capacity to capture and store much more. Budget 2021 proposes to introduce an investment tax credit for capital invested in CCUS projects, beginning in 2022, with the goal of reducing emissions by at least 15 megatonnes of CO2 annually. Budget 2021 proposes to provide $319 million over seven years, starting in 2021-22, with $1.5 million in remaining amortization, to Natural Resources Canada to support research and development that would improve the commercial viability of carbon capture, utilization, and storage technologies.

Keeping Canadians Safer from Floods

Communities across Canada now face once-in-a century floods every few years due to climate change. These devastating deluges are damaging homes, businesses, and infrastructure. In fact, floods are Canada’s most costly natural disaster, causing over $1 billion in direct damage annually. To make our communities safer and more resilient. Budget 2021 proposes to provide $63.8 million over three years, starting in 2021-22, to Natural Resources Canada, Environment and Climate Change Canada, and Public Safety Canada to work with provinces and territories to complete flood maps for higher-risk areas.

Young Canadians

Financial assistance for students

Budget 2021 proposes to invest $4.1 billion to help make postsecondary education more affordable, and to provide direct support to students with the greatest need. This includes:

- Doubling of the Canada Student Grants for two additional years.

- Waiving interest on federal student loans until March 31, 2023.

- Enhancing repayment assistance so that no person earning $40,000 per year or less will need to make any payments on their federal student loans.

- Extending disability supports for recipients of student financial assistance whose disabilities are persistent or prolonged, but not necessarily permanent.

Supporting Indigenous postsecondary education during COVID-19

Budget 2021 proposes to provide $150.6 million over two years, starting in 2021-22, to support Indigenous students. This support would help offset lost income that many Indigenous students rely on to pay for tuition, books, housing, and other living expenses.

It also proposes to provide $26.4 million, in 2021-22, to support Indigenous post-secondary institutions during COVID-19.

Helping youth and students build skills and start jobs

To ensure youth and students can access valuable job skills and experience, Budget 2021 is proposing to invest $721 million over the next two years to help connect them with employers and provide them with over 100,000 new, quality job opportunities.

- Student Work Placement Program: 50,000 (an increase of 20,000) work-integrated learning opportunities for post-secondary students

- Youth Employment and Skills Strategy: over 7,000 additional job placements

- Canada Summer Jobs: approximately 94,000 additional job placements

Internship, apprenticeship, and work opportunities

Budget 2021 proposes to provide $708 million over five years, starting in 2021 22, to create at least 85,000 work-integrated learning placements that provide on-the-job learning and provide businesses with support to develop talent and grow.

It also proposes to provide $470 million over three years, beginning in 2021-22, to establish a new Apprenticeship Service. It would help 55,000 first-year apprentices in construction and manufacturing Red Seal trades connect with opportunities at small- and medium-sized employers, and provide an extra incentive for employers to hire women, racialized Canadians, and persons with disabilities.

The new Canada Digital Adoption Program will also create training and work opportunities for as many as 28,000 young people to help small- and medium-sized businesses across Canada adopt new technology.

Supporting the mental health of those most affected by COVID-19

As part of an overall investment of $1 billion in the mental health of Canadians, including veterans and Indigenous people, Budget 2021 proposes to provide $100 million over three years, starting in 2021-22, to support projects for innovative mental health interventions for populations disproportionately impacted by COVID 19, including health care workers, front-line workers, youth, seniors, Indigenous peoples, and racialized and Black Canadians.

Funding for the Kids Help Line has been extended into 2021-22 to ensure that it can continue to deliver counselling services to youth during the pandemic. Canadians aged 5 to 29 can call the Kids Help Phone at 1-800-668-6868.

Measures

Report a problem on this page

- Date modified: