Common menu bar links

Archived - Budget 2011

Chapter 4.4: Preserving Canada’s Fiscal Advantage (JUNE 6, 2011)

Table of Contents - Previous - Next

Highlights

- Strong fiscal management will continue to be the cornerstone of the Government’s economic policy.

- The International Monetary Fund (IMF) expects that Canada will return to budget balance by 2016, one of only two Group of Seven (G‑7) countries expected to do so, and considers that its fiscal prospects are among the best in the G‑20.

- Maintaining a focus on balanced budgets and debt reduction will allow the Government to keep taxes low and take actions to foster long-term growth and the creation of well-paying jobs for Canadians in the future.

Preserving Canada’s Fiscal Advantage

Strong fiscal management is the cornerstone of the Next Phase of Canada’s Economic Action Plan—A Low-Tax Plan for Jobs and Growth. By maintaining a focus on balanced budgets and debt reduction, the Government will be able to keep taxes low and take actions to foster long-term growth and the creation of well-paying jobs for Canadians in the future.

Since coming to office, the Government has taken action to strengthen fiscal management through improved public accountability, strengthened management and oversight of federal spending, and an increased focus on debt reduction. For example:

- The Government introduced ongoing strategic reviews of departmental spending in Budget 2007. These reviews helped ensure that federal programs are achieving their intended results, are effectively managed and are appropriately aligned with the priorities of Canadians. Savings from the strategic reviews will reach $11 billion over seven years and more than $2.8 billion on an ongoing basis. Strategic reviews are being temporarily replaced as the Government undertakes a one-year Strategic and Operating Review, in keeping with the Government’s careful approach to managing spending.

- The Government used budget surpluses recorded in the years prior to the economic crisis to lower the federal debt-to-GDP (gross domestic product) ratio to 29 per cent in 2008–09—the lowest debt ratio in nearly 30 years.

These actions helped the Government improve its international fiscal position and ensured that Canada faced the global financial and economic crisis from a position of fiscal strength. Canada’s low debt levels allowed the Government to implement the stimulus that was necessary to maintain jobs without jeopardizing Canada’s long-term fiscal advantage. As a result of sound management, Canada’s fiscal position remains the envy of the world, which has allowed Canada to continue to retain a leadership position in international fora.

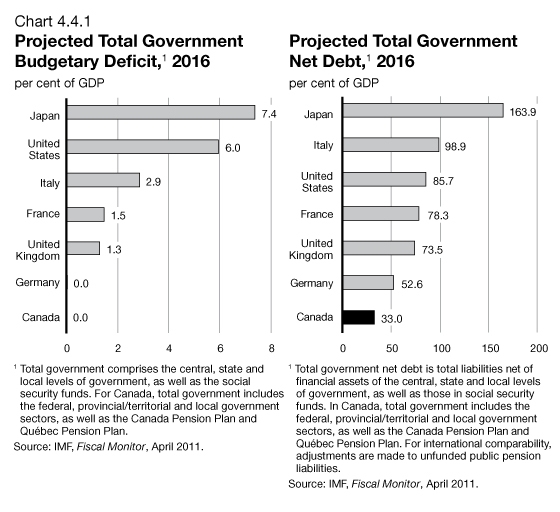

The IMF projects that Canada will return to balance by 2016, along with Germany, the only two G‑7 countries expected to do so. This is expected to allow Canada to maintain by far the lowest net debt burden among G‑7 countries (Chart 4.4.1).

— International Monetary Fund,

Canada: 2010 Article IV Consultation,

December 2010

This chart from Budget 2011 has been revised based on the IMF's April 2011 Fiscal Monitor. It was originally based on the IMF's November 2010 Fiscal Monitor.

This chart from Budget 2011 has been revised based on the IMF's April 2011 Fiscal Monitor. It was originally based on the IMF's November 2010 Fiscal Monitor.

Going forward, strong fiscal management will continue to be the foundation of the Next Phase of Canada’s Economic Action Plan. Balanced budgets and low levels of public debt are critical to Canada’s long-term growth and prosperity. Reducing debt:

- Frees up tax dollars otherwise absorbed by interest costs, which can be reinvested in other priorities such as health care, public services or lower taxes.

- Keeps interest rates low, encouraging businesses to invest for the future.

- Signals that public services are sustainable over the long run.

- Strengthens the country’s ability to respond to economic shocks such as the recent global financial crisis and challenges such as population aging.

- Preserves Canada’s low-tax plan, fostering the long-term growth that generates high-wage jobs for all Canadians.

Now that the world economy is emerging from crisis and governments are turning their attention to controlling their deficits, Canadians can be confident in Canada’s fiscal position and in this Government’s fiscal management. Recognizing that the recovery is still fragile, Chapter 5 details the Government’s plan to return to balance over the medium term without raising taxes or cutting transfers to individuals or other levels of government in a manner that will ensure that Canadians continue to enjoy sustainable improvements in their standard of living.