Common menu bar links

Archived - Budget 2011

Chapter 3: Canada's Economic Action Plan (June 6, 2011)

Table of Contents - Previous - Next

- There have been no updates to any of the measures contained in this chapter relative to Budget 2011.

- The discussion of stimulus programs announced as part of Canada’s Economic Action Plan in Budget 2009 has been updated to reflect new information received from provinces and territories.

Highlights

- Canada’s Economic Action Plan is on track to deliver $60 billion in extraordinary stimulus to support jobs and growth during the worst of the global recession. The vast majority of this support ended on March 31, 2011, as planned.

- As of March, more than 28,500 Economic Action Plan projects had been completed or were underway across Canada. These projects have generated significant employment opportunities in local industries.

- Following the extension of four key infrastructure programs, provinces and territories indicated that they expected a total of roughly $1 billion in federal funding to be claimed in 2011–12, out of a total of $7 billion allocated to these programs in Budget 2009.

- Based on information provided by partners in late April, it is now expected that roughly $1.3 billion in federal funding for extended infrastructure programs will be claimed in 2011–12.

- In addition, roughly $160 million related to other Economic Action Plan programs has been reprofiled from 2010–11 to future years.

- In recognition of the ongoing fragility of the world economy, Budget 2011 announces new targeted measures to support jobs and growth, including:

- Providing assistance to Canada's manufacturing and processing sector by extending the temporary accelerated capital cost allowance rate for investment in machinery and equipment for two additional years.

- Providing a temporary Hiring Credit for Small Business of up to $1,000 against a small firm's increase in its 2011 Employment Insurance (EI) premiums over those paid in 2010 to encourage hiring.

- Extending work-sharing agreements by up to 16 weeks so that companies can avoid layoffs by offering EI benefits to workers willing to work a reduced work week while their company recovers.

- Renewing the Best 14 Weeks and Working While on Claim EI pilot projects for one year.

- Extending the Targeted Initiative for Older Workers to support training and employment programs for older workers.

- Enhancing the Wage Earner Protection Program to cover more workers affected by employer bankruptcy or receivership.

- Extending the Mineral Exploration Tax Credit for flow-through share investors for an additional year.

- Going forward, the investments made through Canada's Economic Action Plan will continue to benefit Canadians through a legacy of modernized infrastructure, enhanced skills training, and lower taxes.

Introduction

Canada's Economic Action Plan was part of a coordinated international response adopted to address the extraordinary challenges posed by the worst global economic and financial crisis since the 1930s. It was designed to fight the effects of the global recession by providing timely, targeted and temporary stimulus to safeguard jobs and protect incomes, while making important investments to ensure Canada's long-term economic prosperity.

Implementation remains on track, and the Action Plan has been effective in shielding Canadians from the worst of the global recession. As of March, over 28,500 projects had been completed or were underway across the country, creating a significant number of jobs in communities across Canada. With the creation of more than 540,000 jobs since July 2009, Canada has recovered all of the jobs lost during the recession, and has posted the strongest employment growth among the Group of Seven (G-7) countries.

Even though Canada's recovery has been encouraging, the global economy remains fragile, and too many Canadians remain out of work. Building on targeted actions taken during the fall of 2010 to help secure the recovery, Budget 2011 announces new measures to support job creation and growth. Together, these actions will help get more Canadians back to work, and will ensure that the economic recovery remains on track.

Delivering on Canada's Economic Action Plan

The implementation of Canada's Economic Action Plan remains on track. Through the Action Plan, $60 billion in extraordinary stimulus is being delivered to the economy. In the first year of implementation alone, almost $32 billion in stimulus spending and tax relief was delivered, and the Government remains on track to deliver a further $28 billion in support for the recovery (Table 3.1).

Investments made through Canada's Economic Action Plan have provided significant support to jobs and growth and have helped promote economic stability for Canadians during the worst of the global recession. These investments include:

- $6.2 billion in personal income tax relief. This includes allowing all Canadians to earn more income before paying federal income tax and before being subject to higher tax rates. It also includes the enhanced Working Income Tax Benefit to strengthen work incentives for low‑income Canadians, higher child benefits for parents and lower taxes for low‑ and middle-income seniors.

- $8.2 billion in help for the unemployed. This includes additional EI benefits, lower EI premiums, and more training opportunities to help unemployed Canadians re-enter the workforce and prosper in the future.

- $14.8 billion in infrastructure stimulus to create jobs. This funding has supported a broad range of infrastructure improvements in our roads, bridges, social housing, public transit, parks and water treatment facilities, and has supported jobs in housing construction through the Home Renovation Tax Credit.

- $3.8 billion to advance Canada’s knowledge economy. These investments are helping to develop and attract talented people, to strengthen our capacity for world-leading research and improve commercialization, to accelerate private sector investment, to enhance the ability of Canadian firms to participate in global markets, and to create an advantage for Canadian business.

- $13.2 billion to support industries and communities. This funding has supported adjustment and has provided job opportunities in parts of Canada that have been hit hard by the global economic downturn. It has provided assistance for affected sectors, including the auto sector, forestry, agriculture, small business, tourism, shipbuilding and culture.

| 2009–10 Dollars Spent1 |

2010–11 Stimulus Value |

2011–12 Infrastructure Extension2 |

Total | |

|---|---|---|---|---|

| (millions of dollars—cash basis) | ||||

| Reducing the Tax Burden for Canadians | 3,020 | 3,180 | 0 | 6,200 |

| Helping the Unemployed | 3,348 | 4,885 | 0 | 8,233 |

| Building Infrastructure to Create Jobs | 6,031 | 7,746 | 1,041 | 14,817 |

| Advancing Canada's Knowledge Economy and Creating Better Jobs |

1,550 | 1,959 | 251 | 3,759 |

| Supporting Industries and Communities | 10,979 | 2,211 | 0 | 13,191 |

| Total federal stimulus measures | 24,928 | 19,981 | 1,291 | 46,200 |

| Provincial and territorial actions | 7,062 | 5,514 | 1,454 | 14,030 |

| Total Economic Action Plan stimulus | 31,989 | 25,494 | 2,745 | 60,229 |

Note: Totals may not add due to rounding. |

||||

The estimated federal stimulus value of the Economic Action Plan in 2010–11 and 2011–12 has been revised since March. The net result of these revisions has been to reduce the federal stimulus value of the Economic Action Plan by $516 million in 2010–11 and to increase amounts related to the infrastructure extension in 2011–12 by $357 million.

Most of this change is the result of the extension of four key Economic Action Plan infrastructure programs, which is discussed in more detail in the following section. The Government has also made minor adjustments to other Economic Action Plan programs to ensure that funds are used effectively. In total, roughly $160 million in funding originally planned for 2010–11 will be provided in later years. This funding relates to a limited number of largely multi-year initiatives. Changes to funding profiles are small relative to stimulus provided in 2009–10 and 2010–11.

Meeting its Objective for Job Creation

Canada's Economic Action Plan: Delivering Results

In cities and rural communities across Canada, funding from the Economic Action Plan has put hundreds of thousands of Canadians to work and has delivered a sustained boost to incomes during the worst of the global recession.

Based on reports from our partners received in March, over 28,500 Economic Action Plan projects had been completed or were underway across Canada. These included:

- Over 8,100 provincial, territorial and municipal infrastructure projects, including over 4,100 Infrastructure Stimulus Fund projects, and over 2,000 Recreational Infrastructure Canada projects.

- Over 14,000 social housing and First Nations housing projects.

- Over 500 projects to improve infrastructure at colleges and universities.

- Almost 1,900 projects to assist communities hardest hit by the recession through the Community Adjustment Fund.

- Over 2,100 projects to renovate and repair Crown-owned buildings, including 300 projects to enhance accessibility for persons with disabilities.

- 272 projects to improve small craft harbours.

- 140 cultural infrastructure projects.

- 230 projects to upgrade facilities at National Parks and National Historic Sites.

- Over 200 projects to modernize federal laboratories.

- Almost 100 major infrastructure projects in First Nations communities.

In addition to delivering an immediate boost to local jobs and incomes, these projects will continue to deliver benefits to communities for many years ahead. For example, improvements to roads and bridges will reduce travel times for commuters and speed delivery of goods and services; better water systems and recreational infrastructure will keep Canadians healthy and active; and investments in post-secondary education will help to attract the best minds to our colleges and universities.

Continuing to Deliver Benefits for Canadians

Examples of Completed Infrastructure Projects

Improving the Tourist Experience (Newfoundland and Labrador)

As the main trunk highway from the Trans-Canada to the tip of the Bonavista Peninsula, Route 230 gets heavy tourist traffic. The Infrastructure Stimulus Fund provided $1.5 million for improved drainage, new culverts and guardrails, upgraded shoulders and fresh paving on the route. These upgrades have reduced travel times for users of the route, and are contributing to the tourism industry.

Upgrading Social Housing in Lower Sackville

(Nova Scotia)

The federal government has helped to improve social housing in Lower Sackville, Nova Scotia. Crosswood Housing Co-op received $1.2 million in federal and provincial funding to carry out renovations and retrofits to 50 housing units.

— Denise Peterson-Rafuse, Nova Scotia Minister of Community Services

Expansion and Retrofit at Collège Montmorency (Quebec)

With the help of more than $8.1 million through the Knowledge Infrastructure Program, Collège Montmorency expanded its facilities to accommodate its growing student enrolment. The project involved the addition of ten classrooms, five laboratories, three computer labs and common rooms for students and staff. The project also involved the complete refit of the dietetics department and the civil engineering technology department.

New Recreation Complex Encouraging Active Living in Hanover (Ontario)

With the help of $3.5 million in federal assistance, the Town of Hanover replaced its old arena with a new 6,224-square-metre sports complex. The new facility is attached to the town's aquatic centre and features a regulation-size rink, dry land training area and multi-purpose room. This new facility is encouraging active living for residents young and old.

New Sewage Treatment Facilities for Black Lake and Fond du Lac Denesuline First Nations (Saskatchewan)

Construction of two new sewage treatment systems was completed in November 2010 for the Denesuline First Nations communities of Black Lake and Fond du Lac. The new facilities will better serve the residents of these growing communities today and in the future, by contributing to a cleaner environment.

Supporting More Bike Trails (British Columbia)

Increasing cycling and walking is a key part of the Central Okanagan Smart Transit Plan. However, a highway cutting through the middle of Kelowna made this difficult. With the help of more than $3.8 million from the Infrastructure Stimulus Fund, the City of Kelowna built a new pedestrian overpass. New trail networks linked to this overpass are providing access to parks, recreational facilities, businesses and shops, as well as public transit.

Investments in First Nations Improve Housing Conditions (Yukon)

The Government of Canada has committed more than $3.2 million in funding through Canada's Economic Action Plan to improve housing conditions for First Nations in Yukon. Of this funding, Tr'ondëk Hwëch'in First Nation will receive close to $755,000 to retrofit 67 housing units and $630,000 toward the construction of two new units.

— Chief Eddie Taylor, Tr'ondëk Hwëch'in First Nation

The significant and timely stimulus has contributed to a major acceleration in government infrastructure investment. As of the fourth quarter of 2010, government infrastructure investment was $7.5 billion higher than the trend in place prior to the implementation of the Economic Action Plan (Chart 3.1), which has delivered a major boost to jobs and growth. This performance is in sharp contrast to that of the U.S., where government capital investment has remained near its trend over the last two years.

has supported the recovery

Note: Current as of March 22, 2011.

Note: Current as of March 22, 2011.

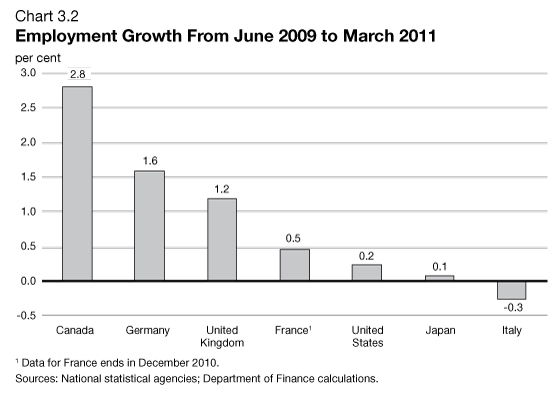

Infrastructure investments through Canada's Economic Action Plan have in turn contributed to a solid recovery in employment. Indeed, Canada's labour market has performed better than those of its G-7 peers, with Canada posting the strongest employment growth among G-7 countries since June 2009 (Chart 3.2).

growth among G-7 countries

This chart was included in Budget 2011. It has been updated to include results for January to March for Canada, Germany, the United Kingdom, Japan, the United States and Italy, and results for October to December for France.

The rollout of one of the most ambitious infrastructure investments in Canadian history represents a major achievement requiring the coordination and effort of countless individuals working in the private sector and across multiple levels of government.

In order to provide additional flexibility to the Government's partners, a one-time extension of the completion deadline, from March 31, 2011 to October 31, 2011, was announced for projects under four programs: the Infrastructure Stimulus Fund, the Building Canada Fund Communities Component Top-Up, the Knowledge Infrastructure Program and the Recreational Infrastructure Canada program.

Provinces and territories requested extensions for a total of roughly 2,200 projects under the four programs. As of January 31, 2011, provinces and territories indicated that approximately $6 billion out of a total of $7 billion in federal contributions available through the four infrastructure programs would be claimed within the original two-year window, with the remaining $1 billion expected to flow in 2011–12.

Estimates of funding to be claimed in 2011–12 have since been revised, reflecting the receipt in April of final 2010–11 invoices for projects qualifying for the extension. It is now expected that roughly $5.7 billion out of a total of $7 billion in federal contributions available for these programs will be claimed within the original two-year window. The remaining $1.3 billion is expected to flow in 2011–12 (Table 3.2).

| Original Two-Year Federal Stimulus Value |

Revised Two-Year Stimulus Value |

Estimated Spending in 2011–12 |

|

|---|---|---|---|

| (millions of dollars) | |||

| Infrastructure Stimulus Fund | 4,000 | 3,204 | 796 |

| Knowledge Infrastructure Program | 2,000 | 1,740 | 251 |

| Building Canada Fund Communities Component Top-Up | 500 | 337 | 163 |

| Recreational Infrastructure Canada | 500 | 417 | 81 |

| Total | 7,000 | 5,698 | 1,291 |

Note: Totals may not add due to rounding. |

|||

Building Canada Plan

Even as infrastructure projects funded through the Economic Action Plan begin to wind down, Canada has a long-term infrastructure plan that will continue to support jobs and growth beyond the recession. Announced in Budget 2007, the seven-year, $33-billion Building Canada plan consists of a suite of programs to meet varying infrastructure needs across the country, including:

- The Gas Tax Fund and a full rebate of the Goods and Services Tax paid by municipalities. This base funding provides significant and predictable long-term funding that directly benefits municipalities. To provide even greater certainty to provinces, territories and municipalities, Budget 2011 proposes to legislate a permanent investment in municipal infrastructure through the Gas Tax Fund (see Chapter 4.1).

- The Provincial/Territorial Base Funding Initiative, which provides $25 million per year for each province and territory.

- The Building Canada Fund, which supports infrastructure projects across Canada, both large and small.

- The Gateways and Border Crossings Fund and the Asia-Pacific Gateway and Corridor Initiative to strengthen trade-related infrastructure.

- The Public Private Partnerships (P3) Fund, the first Canadian infrastructure fund dedicated to P3s.

These programs will continue to create significant employment opportunities for Canadians even as the extraordinary stimulus measures through Canada's Economic Action Plan expire. In 2011–12, it is expected that the Building Canada plan, including contributions from provinces and territories, will result in infrastructure investments of about $10 billion, leading to significant job opportunities.

Supporting the Recovery

Job creation remains the Government's top priority. Recognizing the fragility of the world economic recovery, the Government took additional actions to secure the recovery in the fall of 2010, including limiting EI premium rate increases, continuing EI pilot projects and extending the completion deadline for four key infrastructure programs. Budget 2011 builds on these initiatives with new targeted and temporary measures to help Canadians during the recovery, including tax relief and support for workers.

Extending Assistance for Canada's Manufacturing and Processing Sector

The manufacturing sector was particularly hard hit by the global recession and the substantial decline in demand for Canadian exports. In support of the economic recovery, Budget 2011 announces the extension of the temporary accelerated capital cost allowance (CCA) treatment for investment in machinery and equipment in the manufacturing and processing sector for two additional years. A 50-per-cent straight-line rate will be provided for eligible assets acquired before 2014. This will help businesses make the additional investments needed to improve their productivity and create jobs, and has been identified as a priority for continued growth by stakeholders, including the Canadian Manufacturers & Exporters.

The two-year extension of the 50-per-cent straight-line accelerated CCA rate is estimated to reduce federal revenues by $65 million in 2012–13 and a total of $620 million over the 2012–13 to 2015–16 period.

Hiring Credit for Small Business

Small businesses are a key part of Canada's economy. The Government agrees with the Canadian Federation of Independent Business that "small businesses are indispensable in their role as job creators and innovators all across Canada." As the economy recovers, it is important that small businesses are able to hire new workers so they can take advantage of emerging opportunities and compete in the global economy. To encourage additional hiring by this vital sector, Budget 2011 proposes a temporary Hiring Credit for Small Business of up to $1,000 against a small employer's increase in its 2011 EI premiums over those paid in 2010. This temporary credit will be available to approximately 525,000 employers whose total EI premiums were at or below $10,000 in 2010, reducing their 2011 payroll costs by about $165 million.

Extending the Work-Sharing Program

The work-sharing program protects jobs and avoids layoffs by offering EI benefits to workers willing to work a reduced work week while their company recovers. The program has helped stabilize Canada's job market over the last two years, with more than 277,000 workers participating in work-sharing agreements.

Budget 2011 provides $10 million in additional support to assist those employers that continue to face challenges by making available an extension of up to 16 weeks for active or recently terminated work-sharing agreements. The extension will be phased out by October 2011. In addition, the Government will also make the program more flexible and efficient for employers signing new agreements by recognizing fluctuations in work schedules and by reducing administrative complexity.

Renewing Employment Insurance Pilot Projects

In October 2010, the Government announced the continuation of three Employment Insurance (EI) pilot projects. The extra 5 weeks pilot project was renewed until 2012, while the other two of these pilots—Working While on Claim and Best 14 Weeks—are scheduled to expire in the summer of 2011. Budget 2011 provides $420 million to renew these two pilots for one year. The Working While on Claim pilot project, available across Canada, will allow EI claimants to earn additional money while receiving income support. It will be renewed until August 2012. The Best 14 Weeks pilot project, which allows claimants in 25 regions of higher unemployment to have their EI benefits calculated based on the highest 14 weeks of earnings over the year preceding a claim, will be renewed until June 2012.

Extending the Targeted Initiative for Older Workers

The Targeted Initiative for Older Workers is a federal-provincial-territorial employment program that provides a range of employment activities for unemployed older workers in vulnerable communities with populations of less than 250,000 to help them stay in the workforce.

To continue to support the reintegration of older workers into the workforce, Budget 2011 provides $50 million over two years to extend the program until 2013–14. This funding will ensure that displaced older workers have access to the training and employment programs they need to secure new employment.

Expanding the Wage Earner Protection Program

The Wage Earner Protection Program (WEPP) provides guaranteed and timely compensation of up to $3,400 in 2011 to workers for unpaid wages, vacation pay, severance and termination pay earned in the six months preceding an employer bankruptcy or receivership.

Budget 2011 announces more protection for workers by extending the WEPP to also cover employees who lose their jobs when their employer's attempt at restructuring takes longer than six months, is subsequently unsuccessful and ends in bankruptcy or receivership. The enhanced protection is estimated to provide an additional $4.5 million annually in support to workers affected by the bankruptcy of their employer.

Supporting Mineral Exploration

Exploration and development of Canada's rich mineral resources offer important investment and employment benefits in many parts of the country, particularly in rural and remote regions.

The temporary 15-per-cent Mineral Exploration Tax Credit helps companies raise capital by providing an incentive to individuals who invest in flow-through shares issued to finance mineral exploration. This credit is in addition to the regular deduction provided for the exploration expenses "flowed through" from the issuing company.

Following extensions in Canada's Economic Action Plan and in Budget 2010, the credit was scheduled to expire on March 31, 2011. In support of the economic recovery, Budget 2011 proposes to extend the credit for an additional year, until March 31, 2012.

It is estimated that the extension of this measure will result in a net reduction of federal revenues of $90 million over the 2011–12 to 2012–13 period.

Limiting EI Premium Rate Increases and Launching EI Consultations

On September 30, 2010, the Government announced that it would take further action to support Canada's economic recovery by limiting the potential increase in EI premium rates. The increase in EI premiums was limited to 5 cents per $100 of insurable earnings for 2011 and 10 cents for subsequent years. This measure is leaving $1.2 billion in the pockets of Canadian workers and businesses in 2011 alone.

The Government will also be consulting Canadians on how the EI rate-setting mechanism can be further improved to ensure more stable, predictable rates going forward. A Web-based consultation process will be undertaken to invite written recommendations. In addition, the Parliamentary Secretaries to the Ministers of Finance and Human Resources and Skills Development will convene a number of roundtables to hear the views of key stakeholders. A consultation paper will be released in the coming weeks.

Moving to the Next Phase of Canada's Economic Action Plan

Because the stimulus in Canada's Economic Action Plan was designed to provide temporary support to the economy, the vast majority of initiatives announced in Budget 2009 ended as planned on March 31, 2011. Canada's Economic Action Plan succeeded in creating jobs and growth when support was needed most. As the Economic Action Plan moves into a new phase focused on long-term growth and prosperity, the investments made to combat the global economic recession will continue to pay benefits. For example, the tens of thousands of infrastructure projects funded through the Plan will leave a legacy of more efficient transportation networks, cleaner water systems and improved recreational facilities that will make our economy more competitive and increase our standard of living.

Permanent tax reductions announced in the Plan and provided by the Government since 2006 will allow hard-working Canadians to keep more of their earnings, while encouraging business investment and supporting job growth.

In short, by supporting productive investments, Canada's Economic Action Plan has helped lay the foundation for long-term economic growth and prosperity.

| 2010–11 | 2011–12 | 2012–13 | Total | |

|---|---|---|---|---|

| (millions of dollars) | ||||

| Extending assistance for Canada's manufacturing and processing sector |

65 | 65 | ||

| Hiring Credit for Small Business | 41 | 124 | 165 | |

| Extending the work-sharing program | 10 | 10 | ||

| Renewing EI pilot projects | 240 | 180 | 420 | |

| Extending the Targeted Initiative for Older Workers | 25 | 25 | ||

| Expanding the Wage Earner Protection Program | 5 | 5 | 9 | |

| Supporting mineral exploration | 120 | -30 | 90 | |

| Total—Supporting the Recovery | 41 | 499 | 245 | 784 |

| Less: funds existing in the fiscal framework | 5 | 30 | 34 | |

| Net fiscal cost | 41 | 494 | 215 | 750 |

| Note: Totals may not add due to rounding. | ||||

Annex—Updates to Tables

| 2010–11 Stimulus Value |

2011–12 Infrastructure Extension1 |

Total | |

|---|---|---|---|

| (millions of dollars—cash basis) | |||

| Reducing the Tax Burden for Canadians | 0 | 0 | 0 |

| Helping the Unemployed | -39 | 0 | -39 |

| Building Infrastructure to Create Jobs | -362 | 357 | -5 |

| Advancing Canada's Knowledge Economy and Creating Better Jobs |

-65 | 0 | -65 |

| Supporting Industries and Communities | -50 | 0 | -50 |

| Total federal stimulus measures | -516 | 357 | -159 |

| Provincial and territorial actions | -442 | 438 | -4 |

| Total Economic Action Plan stimulus | -958 | 796 | -163 |

Note: Numbers may not add due to rounding. |

|||

| Revised Two-Year Stimulus Value |

Estimated Spending in 2011–12 |

|

|---|---|---|

| (millions of dollars) | ||

| Infrastructure Stimulus Fund | -271 | 271 |

| Knowledge Infrastructure Program | 0 | 0 |

| Building Canada Fund Communities Component Top-Up |

-81 | 81 |

| Recreational Infrastructure Canada | -5 | 5 |

| Total | -357 | 357 |

Note: Numbers may not add due to rounding. |

||