Common menu bar links

Home > Frequently Asked Questions

Archived - Frequently Asked Questions

-

How much stimulus is the Government providing to the economy and how much longer will it last?

Canada’s Economic Action Plan is a two-year plan providing significant support to the economy in response to the largest synchronized global recession since the Great Depression of the 1930s.

For the current fiscal year, the plan has provided $28 billion in federal stimulus, augmented by more than $8 billion in stimulus from provinces, territories, municipalities and other partners for a total stimulus of $37 billion.

Year 2 of the Action Plan delivers $19 billion in federal stimulus spending, augmented by $6 billion in stimulus from provinces, territories, municipalities and other partners for a total of $25 billion.Over 90 per cent of Year 2 funding is committed and ready to be delivered. This includes:

- $3.2 billion in personal income tax relief;

- More than $4 billion in actions to create and protect jobs;

- $7.7 billion to modernize infrastructure and improve housing across Canada;

- $1.9 billion to create the economy of tomorrow; and,

- $2.2 billion to support industries and communities.

-

What is the impact of the Economic Action Plan on jobs?

Canada’s Economic Action Plan, including provincial and territorial actions, is expected to create or maintain 220,000 jobs by the end of 2010.

The Action Plan is on track.

The estimated impacts on employment do not include the impact of the work-sharing program on preserving jobs. Over 160,000 Canadians are benefiting from this program.

Overall, the EAP has contributed to the creation of over 135,000 jobs since July 2009 across the country.

-

What is the Government doing to improve Canada’s productivity?

The Government’s economic plan, Advantage Canada, is designed to improve productivity and provide sustained economic prosperity for the long term.

Advantage Canada is centred on building five key strategic advantages for Canada:

- A Tax Advantage – reducing the tax burden on Canadians and Canadian businesses.

- A Knowledge Advantage – fostering skills, training and education.

- An Infrastructure Advantage – building a modern, world-class infrastructure.

- An Entrepreneurial Advantage – making product and financial markets more efficient.

- A Fiscal Advantage – strengthening Canada’s fiscal position for current and future generations.

Since 2006, the Government has made significant progress in implementing elements of Advantage Canada:

- The Government has reduced taxes in every way that it collects revenues, and is ensuring that Canadians and businesses keep more of their hard-earned money.

- The Government has aligned capital cost allowance rates for a number of assets to better reflect their useful life, including buildings used for manufacturing or processing. This reduces the tax burden on investment and ensures neutral treatment of different capital assets, encouraging investment to flow to its most productive uses.

- The Government has made significant new investments in education and training to ensure Canada has the best educated and most skilled and flexible workforce in the world.

- Historic federal infrastructure investments are increasing productivity and competitiveness, cleaning up the environment and strengthening communities.

- To build a more competitive business environment, the Government has reformed federally regulated private pension plans, signed bilateral free trade agreements, implemented unilateral tariff reductions and strengthened Canada’s financial system.

- All these achievements are sustainable. In contrast to the situation in other G7 countries, Canada’s fiscal position is strong. Canada entered the recession with a total government net debt-to-GDP ratio of 23.5 per cent. Looking ahead, Canada’s net debt burden is projected to increase by just 5.9 percentage points between 2007 and 2014. This compares to an expected increase of between 24 and 63 percentage points for other G7 countries.

-

Is the Economic Action Plan working?

Canada’s Economic Action Plan is working.

Canada has fared better than all other G7 countries during the global recession.

Recent economic developments suggest that the Economic Action Plan has helped stabilize the domestic economy and has supported the resumption of economic growth.

- Over 135,000 jobs have been created since July 2009.

- Consumer and business confidence has improved significantly and are now back to historical norms.

- Domestic demand has increased far more than in any other G7 country.

-

How does the Government intend to return to balanced budgets?

Budget 2010 outlines a three-point plan for returning to budgetary balance once the economy has recovered.

- First, the Government will follow through with the “exit strategy” built into the Economic Action Plan. Temporary measures in the Action Plan will be wound down as planned.

- Second, the Government will restrain growth in spending through targeted measures. Towards achieving this objective, Budget 2010 proposes $17.6 billion in savings over five years.

- Third, the Government will undertake additional restraint through a comprehensive review of administrative functions and overhead costs.

The Government will not raise taxes. The Government will not cut major transfers to persons and other levels of government.

As a result of the planned wind-down in the Economic Action Plan and the spending growth restraint measures in this budget, the deficit is projected to fall by almost half to $27.6 billion in 2011–12, and by two-thirds to $17.5 billion by 2012–13.

The debt-to-GDP (gross domestic product) ratio is expected to increase to a peak of 35.4 per cent in 2010–11 and then fall to 35.2 per cent in 2011–12 and 31.9 per cent by 2014–15.

Program spending as a share of GDP is expected to decline from 15.6 per cent in 2009–10 to 13.2 per cent in 2014–15.

-

How have low- and middle-income Canadians benefited from the Government’s tax relief?

Actions taken by the Government since 2006 are providing significant tax relief to individuals, totalling almost $160 billion over 2008–09 and the following five fiscal years.

- All Canadians—even those who do not earn enough to pay personal income tax—are benefiting from the two-percentage-point reduction in the Goods and Services Tax (GST) rate. Maintaining the GST credit level while reducing the GST rate by two percentage points translates into more than $1.1 billion in GST credit benefits annually for low- and modest income Canadians.

- All taxpayers are benefiting from the reduction in the lowest personal income tax rate to 15 per cent from 16 per cent and increases in the amount of income that can be earned before paying federal income tax.

- The Working Income Tax Benefit, first introduced in Budget 2007 and enhanced under the Economic Action Plan, provides $1.1 billion annually to reduce the welfare wall and strengthen work incentives for low-income working Canadians by increasing the rewards from working.

- The Age Credit amount was increased by $1,000 in 2006 and by $1,000 again in 2009 to provide tax relief to low- and middle-income seniors. As a result, in 2010 the Age Credit provides up to $967 in tax relief for eligible seniors.

- The Pension Income Credit was doubled from $1,000 to $2,000, benefiting nearly 3.3 million pensioners.

Low- and middle-income Canadians particularly benefit from the Government’s personal income tax reductions.

Due to measures taken since 2006, more than one million Canadians have been removed from the tax rolls in 2010.

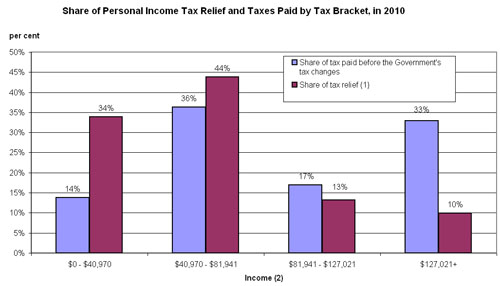

In 2010, over 30 per cent of the personal income tax relief provided by the Government will go to Canadians with incomes under $40,970, and close to 45 per cent will go to those with incomes between $40,970 and $81,941. In total, Canadians with incomes under $81,941 are receiving more than three-quarters of this tax relief as shown in the graph below.

Note: Bar totals may not add due to rounding.

(1) Budgets 2006, 2007, 2008, 2009, the 2006 Tax Fairness Plan and the 2007, 2008 and 2009 Economic Statements (not including GST reduction).

(2) Individual taxable income.

-

How have families benefited from tax relief and other support provided by the Government?

The Government has implemented numerous measures to recognize the daily expenses incurred by Canadian families. These include:

- Introducing the Universal Child Care benefit, which gives families more choice in child care by providing $100 per month for each child under six.

- Introducing the Child Tax Credit, which provides parents up to $315 per child in tax relief in 2010 to recognize the additional costs associated with raising children.

- Increasing the amount families with children can earn before the National Child Benefit supplement is fully phased out, or before the base benefit under the Canada Child Tax Benefit begins to be phased out, thereby providing up to $436 per year in additional benefits for a low-income family with two children.

- Introducing a number of tax measures to better recognize other expenses, including the Children’s Fitness Tax Credit, the Public Transit Tax Credit and the Textbook Tax Credit.

- Introducing the Canada Employment Credit, to better recognize the costs incurred by working Canadians.

Families are major beneficiaries of the general tax relief implemented by this Government, including personal tax cuts, such as reducing the lowest personal income tax rate from 16 to 15 per cent and increases to the basic personal amount and rate thresholds, and the two-percentage-point reduction in the GST.

In total, as a result of measures introduced since 2006, this Government is providing almost $160 billion in tax relief to individuals over 2008–09 and the following five fiscal years. -

What is the Government doing to help provinces and territories?

Provinces and territories can continue to count on long-term, growing support from this Government.

In 2010–11, major federal transfers to provinces and territories will total an all-time high of nearly $53.6 billion, an increase of $2.1 billion over 2009–10.

In 2010–11, this support includes an additional:

- $1.4 billion in the Canada Health Transfer (CHT) for a total of $25 billion. This funding is legislated to grow at 6 per cent annually until 2013–14;

- $321 million in the Canada Social Transfer (CST) for a total of $11.2 billion, growing at 3 per cent annually until 2013–14;

- $187 million in Equalization for a total of $14.4 billion. Support through the Equalization program has grown by 32 per cent over the last five years and will continue to grow in line with the economy; and

- $166 million in Territorial Formula Financing (TFF) for a total of $2.7 billion.

In addition, $525 million will be provided through one-time payments to ensure provinces are protected from any decline in their total transfers (CHT, CST and Equalization) in 2010–11 in recognition of the short-term challenges being faced by provinces as we emerge from the global recession.

- The Government is thus ensuring that all provinces and territories receive at least as much support through major transfers this year as they did last year.

- In Budget 2008, in response to requests for stable, long-term funding, the Government announced that the Gas Tax Fund would be extended at $2 billion per year beyond 2013–14 and become a permanent measure. This is allowing all municipalities to better plan and finance their long-term infrastructure needs.

-

What is the Government doing to support health care?

In 2010–11, the Government’s support to provinces and territories for health care is at an all-time high and it will continue to grow.

The Government provides support through cash transfers, direct spending and tax measures.

In 2010–11, cash support to provinces and territories for health includes $25 billion:

- $25 billion through the Canada Health Transfer (CHT), a $1.4-billion increase over 2009–10. This funding is legislated to grow at 6 per cent annually until 2013–14.

- $250 million through the Wait Times Reduction Transfer.

In 2010–11, direct spending and tax measures for health will be close to $10 billion:

- $6.7 billion in direct federal spending annually for First Nations and veterans’ health care, health protection, disease prevention and health-related research; and,

- $1.2 billion in tax measures through the medical expense tax credit, caregiver and infirm dependants tax credits, and the refundable medical expense supplement.

The Economic Action Plan provides $500 million for Canada Health Infoway to enhance the safety, quality and efficiency of the health care system and create thousands of sustainable knowledge-based jobs throughout Canada.

In addition, Budget 2010 provides additional support for Aboriginal health with a $285-million over-two-year investment to improve Aboriginal health outcomes for five key areas: the Aboriginal Diabetes Initiative, the Aboriginal Youth Suicide Prevention Strategy, maternal and child health programs, the Aboriginal Health Human Resource Initiative and the Aboriginal Health Transition Fund.

-

What is the Government doing to support innovation?

The Government recognizes that research and development is an important driver of long-term economic growth, and that discoveries stemming from research help improve the quality of life of Canadians. Canada ranks first among the G7 countries in terms of expenditures on research and development in the higher education sector as a share of the economy. In Advantage Canada, its long-term economic plan, the Government committed to maintaining this global leadership position.

Through Budgets 2006, 2007, and 2008, the Government provided an additional $2.2 billion in new funding for science and technology initiatives between 2005–06 and 2009–10. Canada’s Economic Action Plan built on these investments by providing an unprecedented $4.9 billion in additional funding for research infrastructure, research, highly skilled people and commercialization. Budget 2010 continues this momentum by providing additional funding to support world-class research and researchers, including:

- $32 million per year to the federal research granting councils to enhance their support for new and promising researchers, and to sustain their overall support for researchers at Canada’s universities, colleges and research hospitals. This includes:

- $16 million per year to the Canadian Institutes of Health Research;

- $13 million per year to the Natural Sciences and Engineering Research Council, including $8 million per year to strengthen its support for advanced research, and $5 million per year to foster closer research collaborations between academic institutions and the private sector through its Strategy for Partnerships and Innovation, and;

- $3 million per year to the Social Sciences and Humanities Research Council.

- $8 million per year for the Indirect Costs of Research Program to help

post-secondary institutions support the additional research activities to be funded by the granting councils; - $45 million over five years to the granting councils to establish and administer the Canada Post-Doctoral Fellowships Program. When fully implemented, the program will annually fund 140 new taxable two-year post-doctoral fellowships valued at $70,000 each per year;

- $15 million per year to the College and Community Innovation Program to support additional research collaborations between businesses and colleges;

- $222 million over five years to support research and commercialization activities at TRIUMF, Canada’s premier national laboratory for nuclear and particle physics research;

- $75 million in 2009–10 to Genome Canada to allow it to launch a new targeted research competition in a priority area and sustain funding for the regional genomics innovation centres.

- $48 million over two years for research, development and demonstration of new technologies for the production of isotopes.

In order to maximize the Government’s recent investments in science and technology, we need a strong private-sector commitment to research and development and innovation.

Budget 2010 indicates that the Government will review all federal support for research and development to improve its contribution to innovation and economic opportunities for business. This review will inform future decisions regarding federal support for research and development. -

How is the Government helping Canadian workers affected by this recession?

The Economic Action Plan is helping workers and their families by strengthening benefits and enhancing the availability of training while the economy moves into a fragile recovery. Under the Action Plan, $1.5 billion will be available to strengthen benefits for Canadian workers in 2010–11, including:

- Providing up to five extra weeks of EI regular benefits to a maximum of 50 weeks for all EI eligible claimants;

- Providing greater access to EI regular benefits for long-tenured workers; and,

- Extending work-sharing agreements by up to 14 weeks, to a maximum of 52 weeks, and offering greater flexibility in the qualifying criteria.

The Economic Action Plan is also providing an additional $965 million in 2010–11 to enhance training opportunities for all Canadian workers, including:

- Providing an additional $750 million to the provinces and territories in order to expand the availability of training and skills development;

- Helping older workers access support by expanding the scope of the Target Initiative for Older Workers.

- Helping youth to gain work experience and necessary skills through the Canada Summer Jobs program and the federal public service employment program and supporting apprentices with the Apprenticeship Completion Grant; and,

- Offering more skills development and training opportunities to Aboriginal Canadians through the Aboriginal Skills and Employment Partnerships initiative and the Aboriginal Skills and Training Investment Fund.

Budget 2010 invests nearly $180 million in 2010–11 for targeted measures to further support job creation while the economy and labour market continues its tentative recovery, including:

- Extending by an additional 26 weeks existing or recently terminated work-sharing agreements, to a maximum of 78 weeks, and continuing to offer greater flexibility in the qualifying criteria;

- Providing support to young people looking to gain education and skills by making further investments in the Skills Link and Career Focus components of the Youth Employment Strategy;

- Providing funds to Pathways to Education Canada to support its work with disadvantaged youth facing barriers to their pursuit of post-secondary education; and,

- Supporting better education outcomes for First Nations and Inuit students.

-

What does Budget 2010 do for the environment?

Budget 2010 includes new measures totalling more than $190 million to support a cleaner and more sustainable environment, and help meet Canada’s climate change objectives. For example, the Budget provides:

- $100 million over four years to support clean energy generation in Canada’s forestry sector through the new Next Generation Renewable Power initiative. This funding will help reduce greenhouse gas emissions by supporting the development, commercialization and implementation of emerging clean energy technologies in the forestry sector, which could include new bio-fuels, renewable electricity and chemicals from forest biomass.

- Expansion of the accelerated capital cost allowance for clean energy generation equipment to additional applications involving heat recovery and district energy.

- $16 million over two years to continue to implement the Government’s action plan to protect the Great Lakes by cleaning up areas identified as being most degraded.

- $38 million over two years for Canada’s Invasive Alien Species Strategy to reduce the risk of invasive animal and plant species being introduced to Canada.

- Up to $11.4 million over two years to deliver meteorological services and navigational services in the North to meet Canada’s commitments to the International Maritime Organization.

- $8 million over two years to support community-based environmental monitoring, reporting and baseline data collection in the North.

- $18.4 million over two years to support the Government’s annual reporting on key environmental indicators such as clean air, clean water and greenhouse gas emissions.

These new resources build on the important ongoing investments initiated under Canada’s Economic Action Plan to help make our economy more sustainable and strengthen Canada’s position as a clean energy superpower. These include:

- $1 billion over five years for the Clean Energy Fund in support of clean energy research, development and demonstration projects, including carbon capture and storage.

- $1 billion over five years for the Green Infrastructure Fund for priorities such as green energy generation and transmission infrastructure, carbon transmission and storage infrastructure.

- $380 million in dedicated new resources for the ecoEnergy for Homes Retrofit program to support Canadians in making their homes more energy efficient.

In 2009, the Government also provided $1 billion over three years to support the Pulp and Paper Green Transformation Program. This program provides incentive for pulp and paper mills to reduce greenhouse gas emissions, and become leaders in the production of renewable energy from biomass.

-

What is the Government doing to help seniors?

Budget 2010 provides $10 million over two years to increase funding for the New Horizons for Seniors Program. The enhanced funding will support projects that focus on volunteering among seniors and raising awareness of financial abuse of seniors.

This builds on other investments since 2006, which include:

- A $10-million per year increase in funding for the New Horizons Program for Seniors in Budget 2007;

- An additional $13 million over three years in Budget 2008 to help combat elder abuse;

- Increasing the amounts that can be earned from employment to $3,500 before the GIS is reduced in Budget 2008; and

- $400 million over two years in targeted funding for the construction of new housing units for low-income seniors in Budget 2009.

In addition, as a result of measures taken by this Government, seniors and pensioners are receiving over $2.3 billion in targeted tax relief for the 2010–11 fiscal year. In particular:

- The Government increased the Age Credit by $1,000 in 2006, and by another $1,000 in 2009. In 2010, the Age Credit provides up to $967 in tax relief for eligible seniors.

- The pension income credit was doubled from $1,000 to $2,000, benefiting nearly 3.3 million pensioners.

- The Government introduced pension income splitting, allowing seniors and pensioners to allocate up to one-half of eligible pension income to their resident spouse or common-law partner for tax purposes.

- The age limit for maturing pensions and RRSPs was increased to 71 from 69 years of age, allowing more flexible phased retirement arrangements.

- The introduction of the Tax-Free Savings Account helps seniors over 71 years of age, who are prevented from contributing to an RRSP, to save on a tax-assisted basis.

In recognition of the exceptional deterioration in market conditions in 2008 and its impact on retirees’ savings, the required minimum withdrawal amount for RRIFs was reduced by 25 per cent for 2008, providing $200 million in tax relief to seniors.

Seniors also benefit from general personal tax cuts, such as reducing the lowest personal income tax rate from 16 to 15 per cent, increases to the basic personal amount and rate thresholds, and the two-percentage-point reduction in the GST.

In total, as a result of measures introduced since 2006, this Government is providing almost $160 billion in tax relief to individuals over 2008–09 and the following five fiscal years.

-

What is the Government doing to help persons with disabilities?

The Government is committed to helping persons with disabilities and their families, to support their full participation in Canada’s social and economic life.

Budget 2010 proposes a number of actions:

- In recognition that families of children with disabilities may not be able to contribute regularly to their Registered Disability Savings Plan (RDSP), Budget 2010 proposes to allow a 10-year carry-forward of CDSG and CDSB entitlements.

- To provide parents more flexibility in ensuring that their savings may be used to support a disabled child, when they are no longer able to support the child, Budget 2010 proposes to allow a deceased individual’s RRSP or RRIF proceeds to be transferred, on a tax-free basis, to the RDSP of a financially dependent infirm child or grandchild.

- To enhance accessibility for people with disabilities, Budget 2010 extends the Enabling Accessibility Fund and provides $45 million over the next three years. The Fund will continue its support for small projects, which focus on removing barriers and enhancing accessibility. The program will also support a number of mid-sized projects, allowing for communities to undertake larger retrofit projects or foster partnerships for new facilities.

- $5 million a year to the Canadian Paralympic Committee to build on the successes of our Paralympians and continue to encourage persons with disabilities to actively participate in sport.

This builds on the significant investments made by this Government to assist persons with disabilities.

Budget 2009 provided a one-time federal investment of $1 billion over two years to address the backlog in demand for renovation and energy retrofits of social housing, including renovations that support persons with disabilities. These investments should improve the access persons with disabilities have to social housing. Budget 2009 also invested an additional $75 million over two years in the Affordable Housing Initiative for the construction of new housing units for persons with disabilities.

Budget 2009 enhanced tax relief provided by the Working Income Tax Benefit (WITB) by $580 million for the 2009 and subsequent taxation years, including an increase in the WITB supplement for persons eligible for the Disability Tax Credit. The supplement currently provides up to $462.50 in additional WITB payments.

Budget 2008 introduced new GST/HST exemptions for various medical/assistive devices and training to help individuals cope with disabilities or disorders.

In addition, eligibility for the Medical Expense Tax Credit was expanded to recognize various medical and disability-related expenses.

Budget 2007 included a number of initiatives to support Canadians with disabilities:

- The new Registered Disability Savings Plan (RDSP) to help parents and grandparents of children with severe disabilities better provide for their child’s long-term financial security.

- The new Working Income Tax Benefit with a disability supplement;

- Investments of $30 million in the Rick Hansen Man in Motion Foundation;

- $45 million over three years for a new Enabling Accessibility Fund;

- Starting in 2009–2010, funding of $15 million per year ongoing for the establishment of the Canadian Mental Health Commission.

Budget 2006 increased the maximum annual Child Disability Benefit (CDB) and extended the eligibility for the CDB to middle- and higher-income families. Budget 2006 also increased the maximum amount of the Refundable Medical Expense Supplement.

In addition, the Government provides support for Canadians with disabilities through the Employment Insurance Sickness Benefit, the Canada Pension Plan - Disability Benefit and the Veterans’ disability pensions and awards, programs that assist people with disabilities to integrate into the labour market. The Government also provides a number of tax measures recognizing that persons with disabilities face extra disability-related expenses that reduce their ability to pay tax. -

What is the Government doing for Aboriginal Canadians?

Budget 2010 provides $908 million over the next two years to assist Aboriginal Canadians and their communities. This includes:

- $30 million to support an implementation-ready tripartite K-12 education agreement that will ensure First Nations students benefit from comparable education results whether the classroom is located on or off reserve.

- $10 million to address the disturbingly high number of missing and murdered Aboriginal women through concrete actions in law enforcement and in the justice system.

- $53 million to further progress on developing partnerships with First Nation organizations and provincial and territorial governments on the delivery of child and family services.

- Almost $200 million to support implementation of the Indian Residential Schools Settlement Agreement and help former students, their families, and Aboriginal communities embark on the path of healing and reconciliation with the legacy of Indian Residential Schools by ensuring timely payments and health supports.

- $285 million to improve Aboriginal health outcomes by renewing investments in the Aboriginal Diabetes Initiative, Youth Suicide Prevention Initiative, maternal and child health programs, Aboriginal Health Human Resource Initiative and the Aboriginal Health Transition Fund.

- $330 million to continue the First Nations Water and Wastewater Action Plan to improve access to safe drinking water on reserve.

In 2009, Canada’s Economic Action Plan provided $1.4 billion over two years for investments in Aboriginal skills and training, housing and infrastructure.

This builds on significant investments since 2006, which include:- Budget 2006 committed $450 million over two years to support priorities in education, women, children and families, and water and housing. In addition, Budget 2006 provided $600 million for off-reserve Aboriginal housing and affordable housing in the territories.

- Budget 2007 provided $35 million over two years to improve Aboriginal employment through the Aboriginal Skills and Employment Partnership initiative. In addition, Budget 2007 committed $20 million over two years to ensure First Nation participation in integrated Atlantic commercial fisheries.

- Budget 2008 committed $330 million over two years to improve access to safe drinking water in First Nations communities. Budget 2008 also directed funds to strengthen partnerships with Aboriginal Canadians in support of priorities in economic development; education; child and family services; and First Nations and Inuit health.

What is the Government doing to support youth?

The Government recognizes the important of high quality education and skills training for young Canadians. A number of programs are already in place to help youth get an education, acquire skills and get a job:

- $342 million per year for the Youth Employment Strategy to give young Canadians needed support as they pursue an education and careers.

- $2.2 billion per year to help students deal with the costs of education through grants, scholarships and loan programs.

- $100 million per year for the Apprenticeship Incentive Grant and $40 million per year for the Apprenticeship Completion Grant to encourage more young Canadians to pursue apprenticeships.

- $80 million per year for a tax credit to a maximum of $2,000 per apprentice per year through the Apprenticeship Job Creation Tax Credit to encourage employers to hire apprentices.

- $20 million per year for two years under the Economic Action Plan to enhance student employment opportunities under the Canada Summer Jobs Program and the Federal Student Work Experience Program.

Budget 2010 provides further investments to support young people looking to gain skills and experience:

- $30 million for the Career Focus component of the Youth Employment Strategy to offer career-related work experience.

- $10 million to the Canadian Youth Business Foundation to support young entrepreneurs.

- $30 million for Skills Link to provide more opportunities for young Canadians to join the labour market.

- $20 million for Pathways to Education Canada to work with disadvantaged youth.

- $30 million for First Nations’ elementary and secondary education