Archived - Annex 2

Update on the 2020-21 Debt Management Strategy

Introduction

The Government of Canada released its annual Debt Management Strategy, the 2020-21 Debt Management Strategy, in the July 2020 Economic and Fiscal Snapshot, setting out the objectives, strategy and borrowing plans for its domestic debt program and the management of its official international reserves. It announced a significant increase in borrowing for 2020-21 in order to make the necessary investments to stabilize the Canadian economy in response to the extraordinary circumstances of the COVID-19 pandemic.

The 2020-21 Debt Management Strategy also outlined how historically low interest rates have ensured Canada’s debt is affordable and sustainable. In fact, despite an increase in federal debt for the year, Canada’s public debt charges are expected to be more than $3 billion lower this year compared to last year’s Economic and Fiscal Update.

In pursuing a historic increase in long-term bonds, the government announced that it would consult with market participants to assess the market’s capacity for long-term debt, and would make adjustments as warranted to maintain stability in Canada’s fixed-income markets in these evolving circumstances, taking into account the requirements of other issuers, such as provinces, municipalities and corporations. The government committed to provide an update on the 2020-21 Debt Management Strategy this fall based on feedback from market participants.

Highlights from Market Consultations

Market consultations are an integral part of the debt management process — the feedback helps guide the design and implementation of the Government of Canada’s domestic debt program, especially in the context of the ongoing COVID-19 pandemic.

In September and October 2020, the Department of Finance and the Bank of Canada held over 30 bilateral virtual meetings and received written comments from dealers, investors and other relevant market participants. These consultations sought the views of market participants on issues related to the design and operation of the Government of Canada’s domestic debt program for 2020–21.

Overall, market participants indicated that the market is working well following initial market stresses experienced at the onset of the COVID-19 pandemic. Participants highlighted that early and transparent changes to the debt program and the Bank of Canada’s various financial market support programs were paramount in successfully stabilizing financial markets and allowing for a record amount of federal government debt to be absorbed, especially in long-term sectors. A broad consensus supported the continuation of the main components of the 2020-21 Debt Management Strategy, as outlined in the July Economic and Fiscal Snapshot.

Market participants indicated treasury bills are currently in high demand due to excess cash in the financial markets, both from domestic and international investors. There is ample room to increase bill issuance as evidenced by yields remaining well below the overnight rate.

As for potential effects of the government’s borrowing strategy on other large issuers, such as provinces’ and municipalities’ long bond issuances, most market participants indicated that federal issuances have not had a significant impact since provinces’ and municipalities’ long-term instruments are considered different enough from their federal analogues. A more detailed summary of the fall 2020 consultations can be found on the Bank of Canada Website.

A Prudent Borrowing Strategy

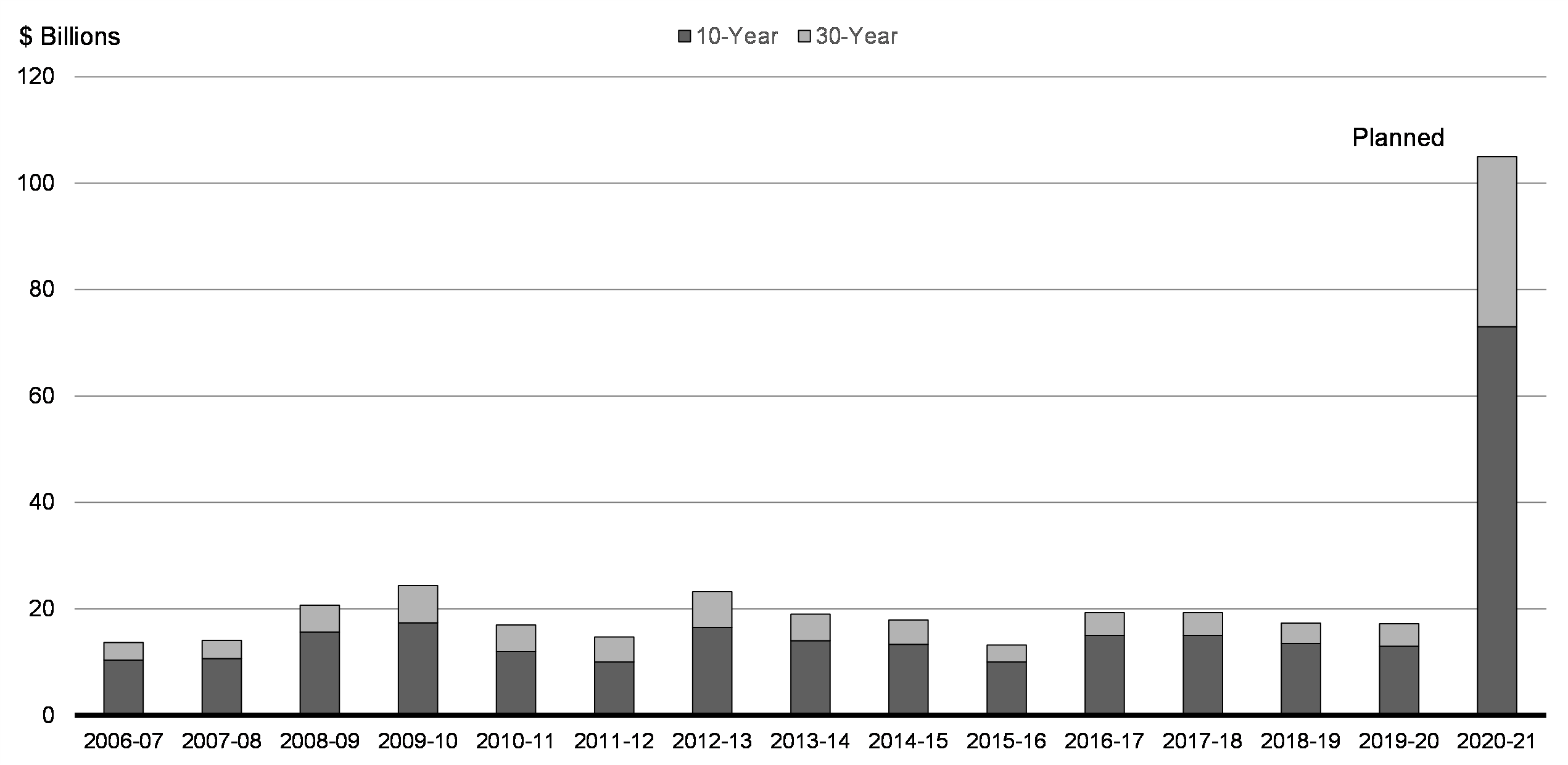

Reflecting feedback from a broad variety of market participants, the federal government will remain attentive for every opportunity to lock in long-term favourable interest rates, consistent with the general direction laid out in 2020-21 Debt Management Strategy in the July 2020 Economic and Fiscal Snapshot. As such, the 2020-21 Debt Management Strategy will continue to follow a prudent approach that locks in historically low rates and enhances the predictability of debt servicing costs by maintaining the historic increase in issuance in long-term sectors (Chart A2.1). Further changes may be considered as part of the 2021-22 plan.

Government of Canada Issuance in Long-term Bonds (historical vs. planned)

Since the beginning of the COVID-19 crisis, the government has raised its borrowing to historic levels to finance its financial requirements and has built a larger cash position for contingency purposes. Given the rapid cash requirement to support government action to support the economy, the federal government has issued mainly treasury bills and short-term bonds. Other countries have adopted similarly prudent approaches to managing and building up their cash balances. Accordingly, to help manage its larger cash position, the government is transitioning towards a strategy to steadily reduce issuance in short- to medium-term Bond sectors (Table A2.1) to provide more predictability on financing costs. As a result of these changes, an even higher share of the 2020-21 bond program will lock in historically low rates at longer maturities, as planned issuance levels in long-term sectors will remain unchanged. Issuance reductions in short-term sectors will be managed carefully to help ensure well-functioning markets for Government of Canada securities. The government will continue to communicate regularly with market participants to balance the need for transparency for the market as well as flexibility for the government.

| 2019-20 Previous Year |

2020-21 Planned |

2020-21 (FES Update) |

Increase from 2019-20 | |

|---|---|---|---|---|

| Treasury bills | 152 | 294 | 329 | 116% |

2-year |

53 | 150 | 129 | 143% |

3-year |

19 | 67 | 57 | 194% |

5-year |

33 | 88 | 82 | 147% |

10-year |

13 | 74 | 74 | 465% |

30-year |

4 | 32 | 32 | 662% |

RRB |

1.8 | 1.4 | 1.4 | -22% |

| Total bonds | 124 | 409 | 374 | 201% |

| Total gross issuance | 276 | 713 | 703 | 155% |

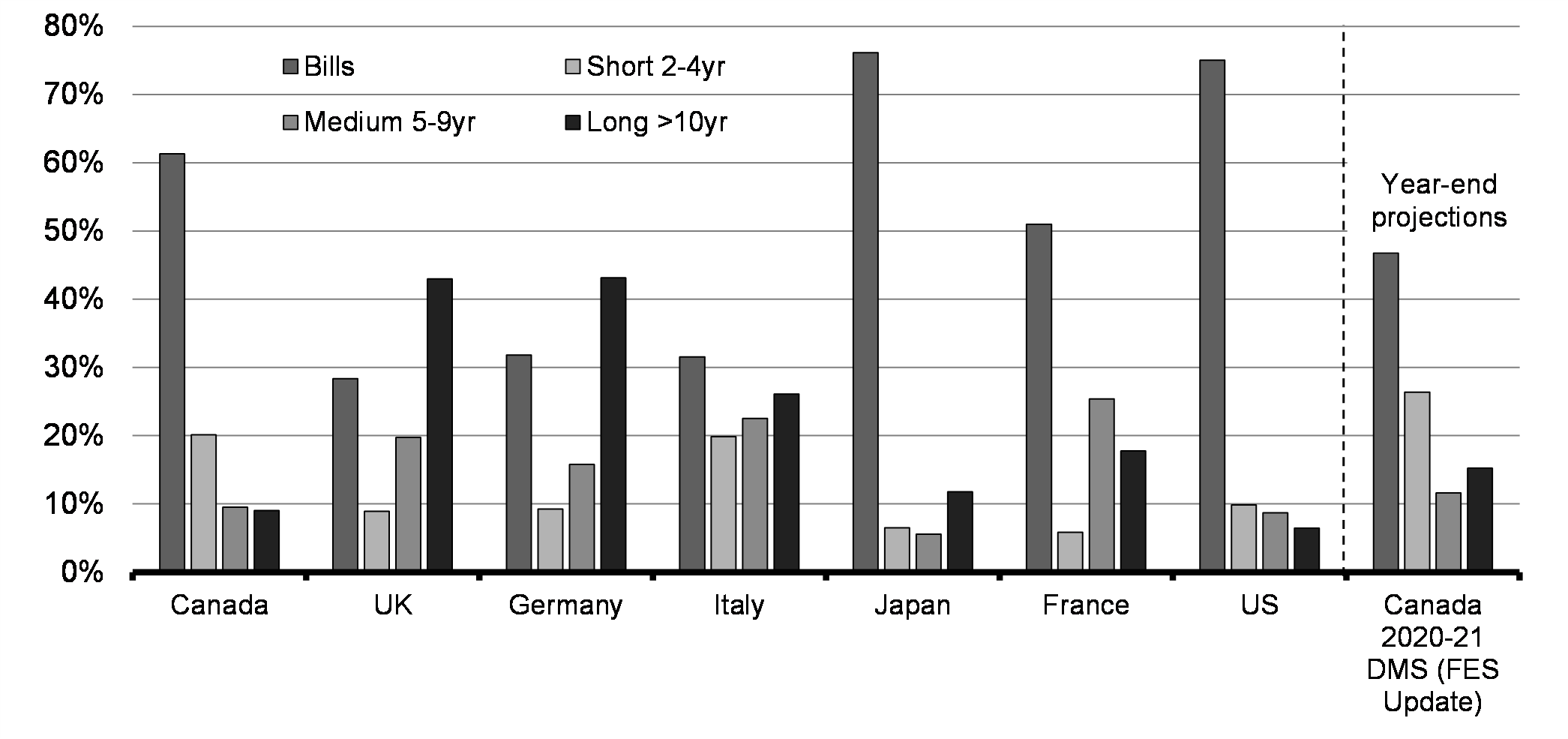

Canada is not alone in dealing with the extraordinary increase in public debt as a result of COVID-19 – every country faces the same challenge. Like our international peers, a significant proportion of Canada’s borrowings early in 2020-21 consisted of short-term instruments, mainly treasury bills, given the ability to issue these instruments in volume quickly to raise needed funding (Chart A2.2). With the 2020-21 Debt Management Strategy, the government is shifting its issuances more toward long-term bonds in order to take advantage of low interest rates. As this occurs, this approach will help Canada manage its rollover risk and provide more certainty regarding future debt charges. Since mid-March Canada has been able to proportionally lock in more of its debt as multi-year bonds, at historically low, interest rates than the United States and Japan – a trend which will continue to steadily improve over the coming months and years as the government pursues additional opportunities to lengthen out maturities.

Federal Debt Issuance Comparison - COVID: from March 16, 2020 to November 19, 2020

Strategic Direction

When the government shifts from emergency response to recovery planning, it will continue to use fiscal policy to support the economy until it is firmly back on track, as described in Chapter 3. The government’s fiscal strategy will be implemented responsibly, with a sustainable approach for future generations. Reflecting this, the government will continue to review options to extend the maturity of the debt in future years, including the potential re-opening, next year, of the ultra-long, 50-year bond. As additional stimulus spending is brought on, steps will be taken where possible to continue to increase the proportion of bond issuance occurring at the long-end and to diversify its lender base. As per the 2020-21 strategy, this proportion is expected to double compared to last year (Table A2.2). This approach will help manage the rollover of debt in future years, and will help ensure Canada’s debt remains affordable and is less vulnerable to increases in interest rates for future generations.

| 2019-20 Previous Year | 2020-21 Planned | |||

|---|---|---|---|---|

| Issuance ($ Billions) |

Share of Bond Issuance |

Issuance ($ Billions) |

Share of Bond Issuance |

|

| Short (2, 3, 5-year sectors) | 105 | 85% | 267 | 71% |

| Long (10-year+) | 19 | 15% | 107 | 29% |

| Gross bond issuance | 124 | 100% | 374 | 100% |

Green Bonds

To help finance the government’s historic investments in green infrastructure and other green initiatives, the government is announcing its intention to issue the federal government’s first ever green bond in 2021-22. The government will continue to assess options on the appropriate structure for a federal green bond issuance and will provide more information in the context of the 2021-22 Debt Management Strategy, which will be presented in Budget 2021.

The government is funding a public-private Sustainable Finance Action Council, over the next three years, to ensure the stability and long-term growth of our financial system in the face of climate change. More details are provided in Chapter 3.

Borrowing Authority Act Amendments

In Budget 2016, the government introduced changes to increase the transparency of federal borrowings so that Parliament formally approves all debt issued by Canada. Under the Borrowing Authority Act, introduced by the government in 2017, Parliament must approve the maximum amount that can be borrowed every three years. Actual borrowings may be less than this amount.

At the onset of COVID-19 earlier this spring, this limit was temporarily suspended as part of emergency legislative changes approved by Parliament.

The maximum borrowing amount is a gross borrowings measure. In addition to the federal government borrowings, it includes borrowings from agent Crown corporations and Canada Mortgage Bonds. This is not the debt measure that is commonly used to compare debt-to-GDP, a ratio which often compares the accumulated deficit relative to the size of an economy (See box below).

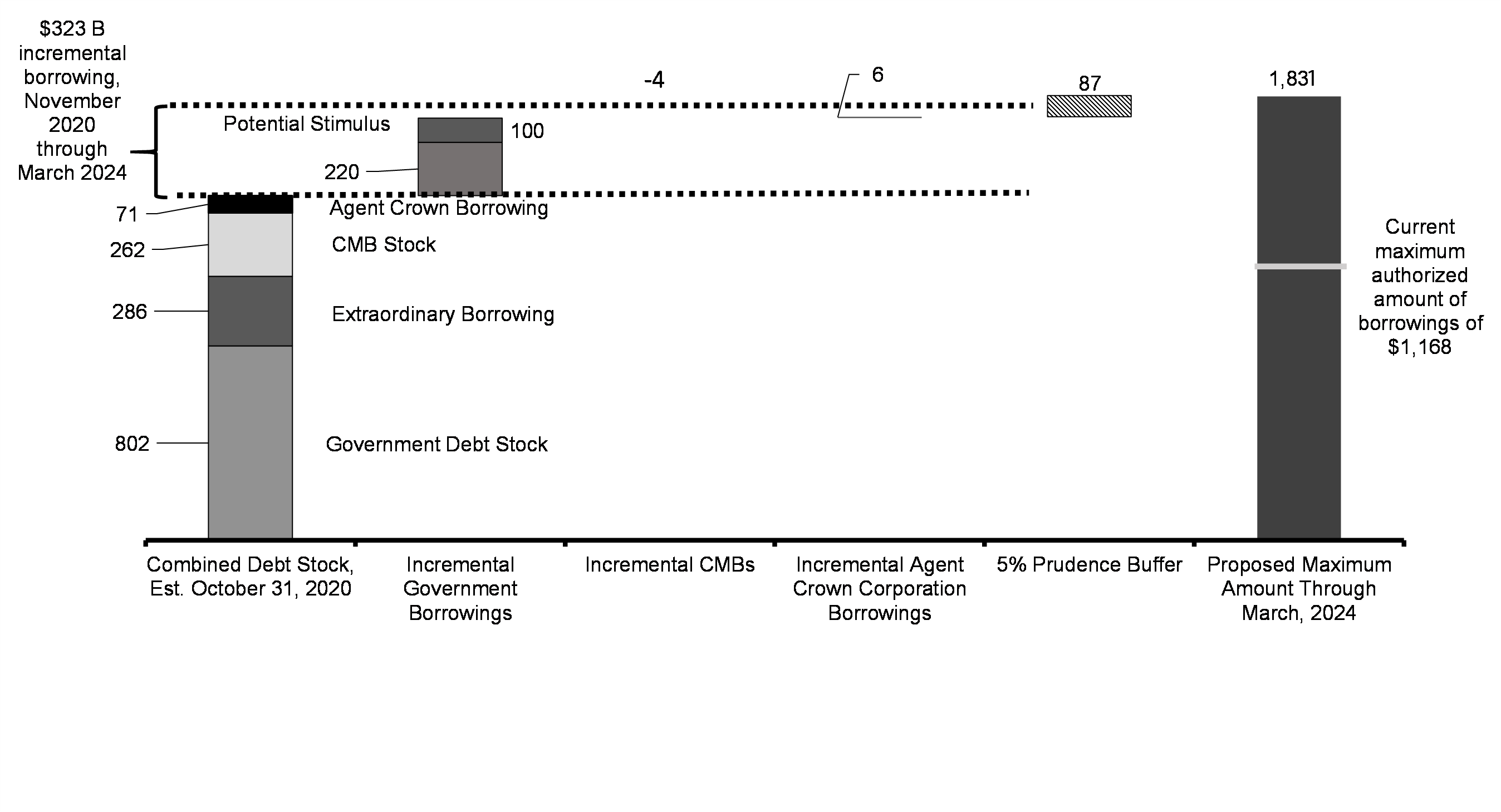

To allow the government to continue to implement its borrowing strategy and allow for the needed investments in the economy, the government is proposing to amend the Borrowing Authority Act to increase the maximum borrowing amount and to enhance the transparency of the maximum borrowing amount, as described in the 2020 Borrowing Authority Act Report.

The proposal to amend the Borrowing Authority Act will increase the maximum borrowing amount from $1,168 billion (which does not currently include in its calculation the extraordinary borrowings taken between April and September 2020, as a result of COVID-19) to an estimated $1,831 billion, including extraordinary borrowings taken to date (see Chart A2.3). The government will table legislation on this soon. The estimated new maximum amount of $1,831 billion is projected to cover borrowings until the end of the fiscal year 2023-24, consistent with the financial requirements set out in the 2020 Fall Economic Statement and the latest approved corporate plans of agent Crown corporations. The new maximum amount takes into account the government’s combined debt stock as of October 31, 2020 of $1,421 billion, which includes $286 billion of extraordinary borrowings occurring from April 1 to September 30, 2020.

The proposed maximum amount also includes projected incremental borrowings from November 1, 2020 to March 31, 2024 of $323 billion, which consists of $320 billion in incremental government borrowings (including up to $100 billion in new stimulus spending), a projected decrease in Canada Mortgage Bonds of $3.6 billion and a projected increase of agent Crown corporation borrowings $6 billion over the next three years, as well as a prudence buffer of five per cent $87 billion. The decline in Canada Mortgage Bonds reflects a return to normal mortgage funding levels after the increase due to COVID-19.

Proposed Maximum Borrowing Amount

Measures of Government Debt

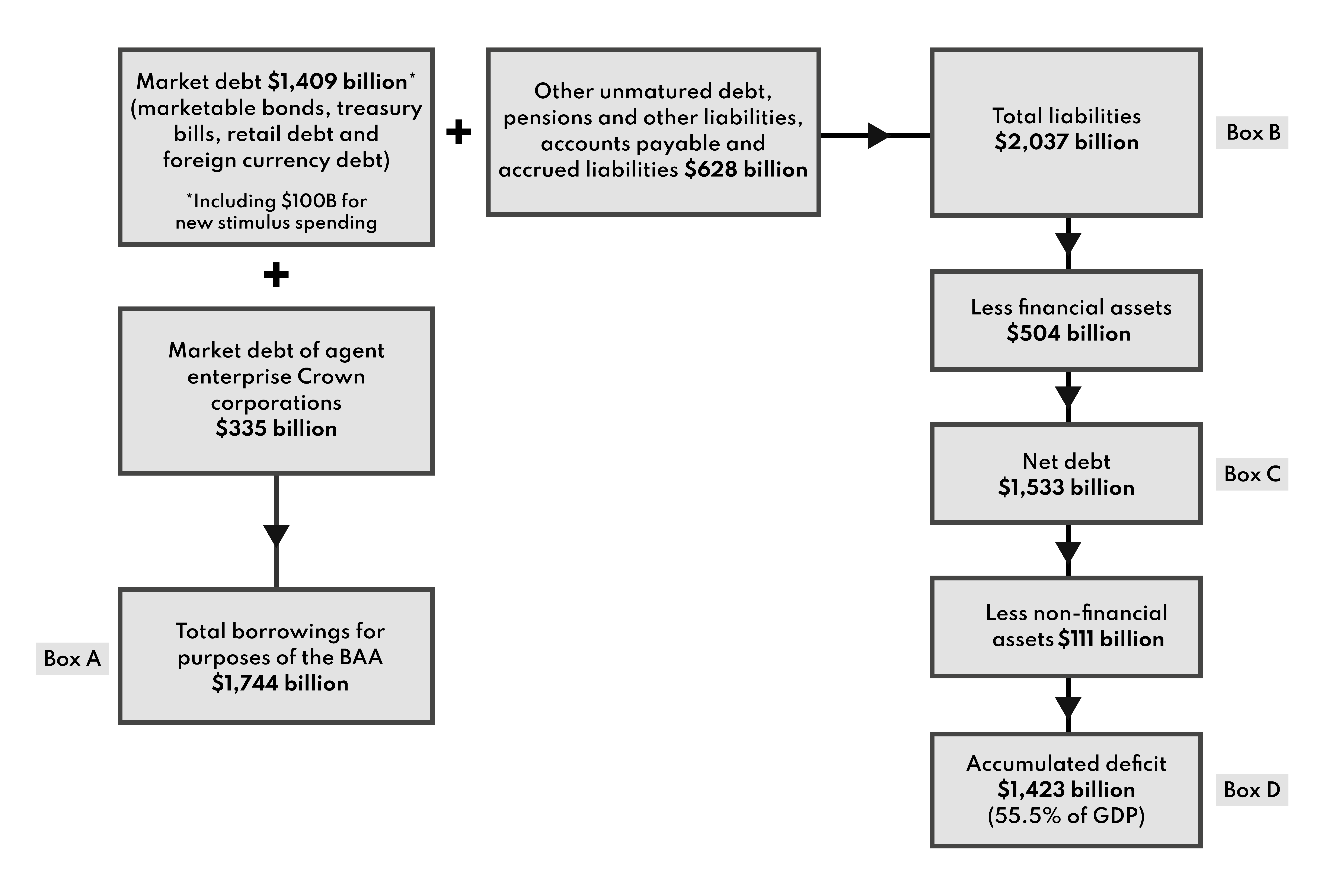

There are several key measures of the government’s debt. These measures include borrowings under limits established by the Borrowing Authority Act, the government’s total outstanding liabilities, net debt and the federal debt (accumulated deficit). The following chart provides an overview of these measures, as projected at March 31, 2024, the end of the period to be covered by the proposed new limit on government borrowings (including up to $100 billion for new stimulus spending).

Box A: Under the Borrowing Authority Act, the limit on total government borrowings is proposed to be set at $1,831 billion. By March 31, 2024, total borrowings, which include borrowings of agent enterprise Crown corporations, are expected to total $1,744 billion.

It is important to note that these borrowings support investments in financial assets. After deducting the value of the government’s financial assets, net government borrowings are expected to reach $905 billion by the end of 2023-24.

Box B: Total liabilities of the government consist of market debt, or debt issued on the credit markets; other unmatured debt, such as obligations under capital leases; pension and other future benefit liabilities; other interest-bearing liabilities, including deposit and trust accounts; and, accounts payable and accrued liabilities. Total liabilities would be expected to reach $2,037 billion by March 31, 2024.

Box C: Net debt represents the total liabilities of the government less its financial assets. Financial assets include cash and cash equivalents, accounts receivable, foreign exchange accounts, loans, investments and advances, and public sector pension assets. Financial assets also include the value of the government’s equity in enterprise Crown corporations, which is equal to the assets held by these corporations, less their borrowings and other liabilities. Net debt is expected to be $1,533 billion by March 31, 2024.

Box D: The federal debt, or accumulated deficit, is equal to total liabilities less total assets—both financial and non-financial. Non-financial assets include tangible capital assets, such as land and buildings, inventories, and prepaid expenses and other. The federal debt expected to be $1,423 billion, or 55.5 per cent of GDP, by March 31, 2024.

Text version

This figure illustrates the difference between total borrowing (as reported in the BAA report and amendment) and net debt/accumulated deficit (typically shown in the Debt Management Report) for the Government. The data is projected to March 31, 2024 to be consistent with the proposed new maximum BAA amount.

Report a problem on this page

- Date modified: