Archived - Overview

In 2015, Canada's economy was in a weak position—and so were many Canadians. Low growth, rising unemployment and weak wage growth made it harder for middle class Canadian families to make ends meet, save and plan for the future.

At the same time, Canada's relatively low debt burden, combined with historically low interest rates, gave the Government room to invest to grow the economy—helping to create good, well-paying jobs in the short term, while building the infrastructure and skilled workforce needed to keep the economy strong and growing for years to come.

The results speak for themselves. Instead of facing low growth as a result of austerity and cuts, the Government's investments in people and in the communities they call home have helped to drive the strong economic growth Canadians needed to feel more confident.

With Budget 2019, the Government is continuing to deliver on its economic plan—one that favours investment over austerity, with a clear focus on fiscal responsibility.

Canadian Economic Context

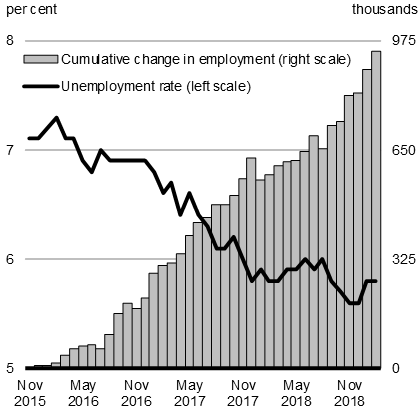

In a challenging global economic environment, Canada's economy remains sound. Since November 2015, targeted investments and strong economic fundamentals have contributed to creating over 900,000 new jobs, pushing the unemployment rate to its lowest levels in over 40 years (Chart 1). In 2018 alone, all employment gains were full-time jobs.

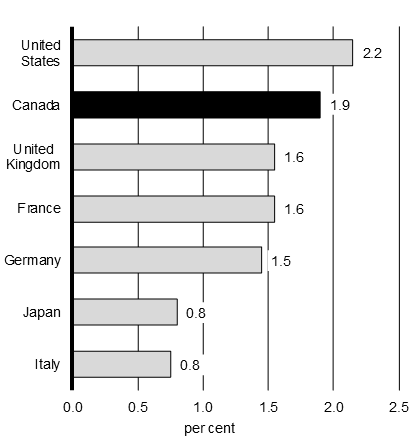

At 3 per cent growth, Canada had the strongest economic growth of all G7 countries in 2017, and was second only to the U.S. in 2018. Recently, growth in global economic activity has slowed more than expected. At home, growth in the Canadian economy was softer at the end of 2018.

Despite these challenges, the Canadian economy is expected to strengthen over the second half of 2019, and to remain among the leaders for economic growth in the G7 in both 2019 and 2020.

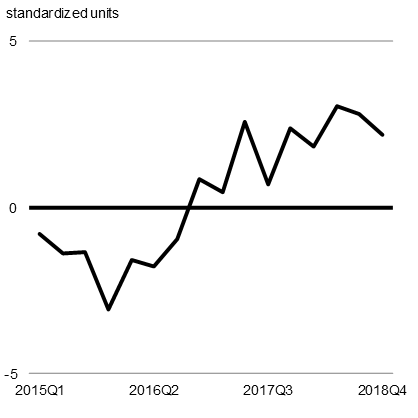

Canada's solid economic performance—bolstered by a strong labour market and the Government's investments in the middle class—also supported solid wage growth last year, coming in at one of the fastest paces of growth recorded in the past eight years. With higher earnings and a strong economy, consumer confidence remains solid. This confidence is expected to help drive household spending and continued economic growth going forward.

At the same time, business sentiment in Canada remains firmly positive and growth in business investment and exports is expected to regain momentum over 2019, supported by new and modernized arrangements with many trading partners, and recently announced tax incentives designed to encourage businesses to invest in and create middle class jobs (Chart 2). This outlook is also supported by Canada's reputation as a good place to invest and do business, as evidenced by Canada being the only G7 country to witness a material improvement in foreign direct investment into the country over the first three quarters of 2018.

Budget 2019 Investments

Nearly 20 years into the new century, Canada faces a number of challenges: the cost of living continues to rise for many Canadian families; a rapidly changing world leaves many worried about finding and keeping good, well-paying work; and things like global climate change and the growth of populism are fuelling uncertainty about the future. These challenges call for a responsible and forward-looking response, with a plan for the economy that is fiscally responsible and squarely focused on making life better for the middle class and people working hard to join it.

Budget 2019 continues the Government's plan to invest in the middle class, with a special focus on investing in people and in the things they need to succeed: more affordable places to live, especially for first-time home buyers; skills for a changing job market; lower prescription drug costs to support good health; local infrastructure that helps deliver a good quality of life; and better connections to each other and the world through universal high-speed internet.

| Projection | ||||||

|---|---|---|---|---|---|---|

| 2018– 2019 | 2019– 2020 | 2020– 2021 | 2021– 2022 | 2022– 2023 | 2023– 2024 | |

| FES 2018 budgetary balance1 | -18.1 | -19.6 | -18.1 | -15.1 | -12.6 | -11.4 |

| Adjustment for risk from FES 2018 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 | 3.0 |

| FES 2018 budgetary balance (without risk adjustment) | -15.1 | -16.6 | -15.1 | -12.1 | -9.6 | -8.4 |

| Economic and fiscal developments since FES 2018 | 5.9 | 4.8 | 4.7 | 3.7 | 4.1 | 4.6 |

| Revised budgetary balance before policy actions and investments | -9.3 | -11.9 | -10.4 | -8.4 | -5.5 | -3.9 |

| Policy actions since FES 20182 | -1.4 | -1.0 | -0.6 | -0.6 | -0.2 | -0.2 |

| Investments in Budget 2019 | ||||||

| Investing in People | 0.0 | -0.6 | -1.3 | -1.8 | -2.3 | -2.4 |

| Building a Better Canada | -3.2 | -0.3 | -0.8 | -0.8 | -0.6 | -0.4 |

| Advancing Reconciliation | -0.9 | -0.7 | -1.0 | -1.0 | -0.6 | -0.6 |

| Delivering Real Change | -0.1 | -1.7 | -1.6 | -0.8 | -0.5 | -0.6 |

| Other Budget 2019 investments3 | 0.0 | -0.7 | -0.9 | 1.6 | 0.6 | 1.2 |

| Total investments in Budget 2019 | -4.2 | -4.0 | -5.7 | -2.7 | -3.4 | -2.8 |

| Total policy actions and investments since FES 2018 | -5.6 | -5.0 | -6.3 | -3.3 | -3.6 | -2.9 |

| Budgetary balance | -14.9 | -16.8 | -16.7 | -11.8 | -9.1 | -6.8 |

| Adjustment for risk | -3.0 | -3.0 | -3.0 | -3.0 | -3.0 | |

| Final budgetary balance (with risk adjustment) | -14.9 | -19.8 | -19.7 | -14.8 | -12.1 | -9.8 |

| Federal debt (per cent of GDP) | 30.8 | 30.7 | 30.5 | 30.0 | 29.3 | 28.6 |

Maintaining Canada's Low-Debt Advantage

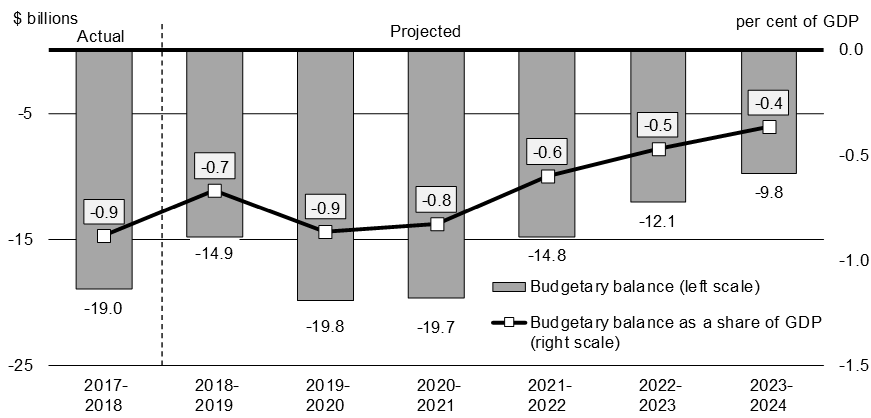

The Government continues to invest in Canada, and in Canadians, in a fiscally responsible way. The Budget 2019 fiscal track is broadly unchanged from that presented in the 2018 Fall Economic Statement, with a deficit that is projected to decline from $19.8 billion in 2019–20 to $9.8 billion in 2023–24.

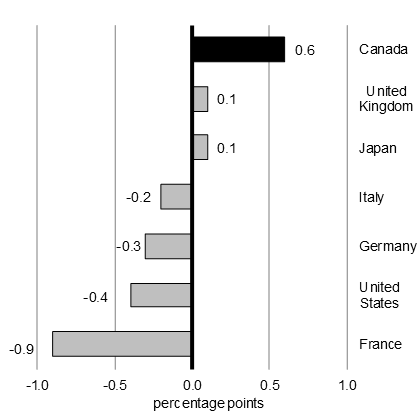

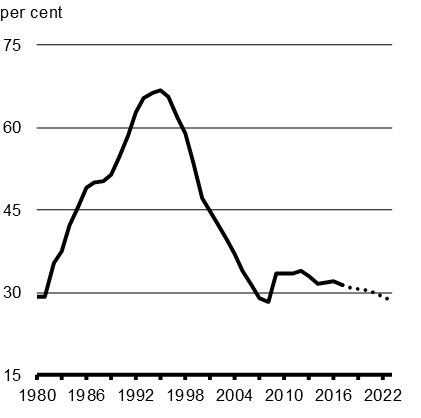

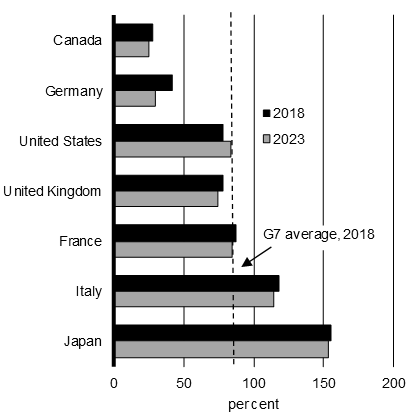

The federal debt-to-GDP ratio is also expected to decline every year over the forecast horizon, reaching 28.6 per cent by 2023–24 (Chart 4). A declining federal debt-to-GDP ratio will help to further reduce Canada's net debt-to-GDP ratio, which is already the lowest among G7 countries.

The Government, like Canadians, understands the importance of preserving a low-debt advantage for current and future generations—it supports economic growth and gives Canada the flexibility it needs to respond to changing economic circumstances.

- Date modified: