Chapter 1 - Help for the Middle Class

Introduction

A strong economy starts with a strong middle class.

Canadians understand this, and the Government does, too. That’s why building an economy that works for middle class Canadians and their families is this Government’s top priority.

Today, too many middle class families struggle with the costs of raising their children, and too many children continue to live in poverty.

To build the brighter future that all Canadians deserve, investments are needed: investments that will strengthen and grow the middle class, that will help young Canadians to succeed, and that will support those who need help entering or re-entering the workforce.

Budget 2016 invests in Canadians, sets the stage for greater economic equality, and positions Canada for sustained economic growth in the years to come.

This chapter outlines the Government’s plan to help Canada’s middle class and those working hard to join it.

Strengthening the Middle Class

On December 7, 2015, as one of its first actions, the Government delivered on its commitment to strengthen the middle class.

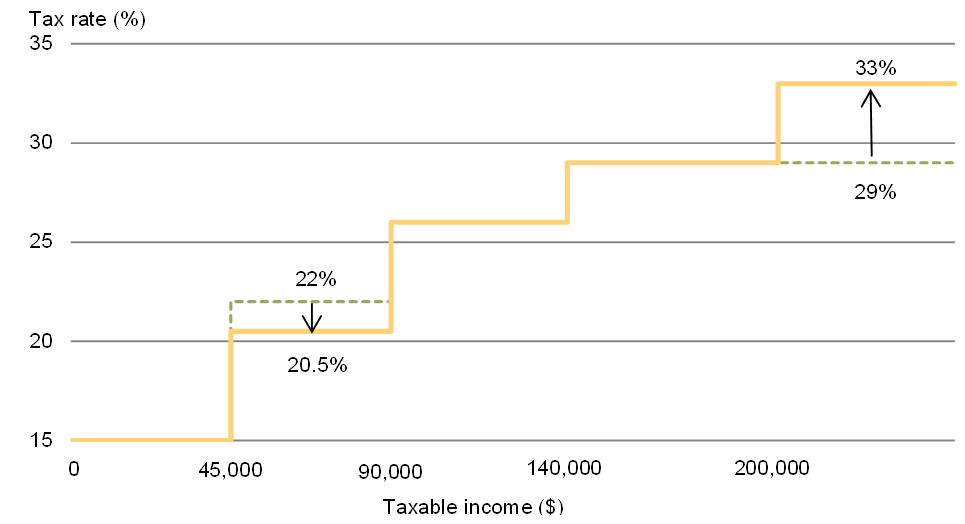

It did so by introducing a tax cut for Canada’s middle class, reducing the second personal income tax rate to 20.5 per cent from 22 per cent—a 7 per cent reduction. Beginning January 1, 2016, Canadians with taxable income between $45,282 and $90,563 saw their income tax rate fall, leaving more money on their paycheques to save, invest and grow the economy.

In total, nearly 9 million Canadians are now benefitting from this tax cut. Single Canadians who benefit from this measure will see an average tax reduction of $330 every year, and couples who benefit will see an average tax reduction of $540 every year.

To help pay for this middle class tax cut, the Government raised taxes on the wealthiest Canadians by introducing a new top income tax rate of 33 per cent for individuals with more than $200,000 in taxable income each year.

Taken together, these changes give middle class Canadians a tax break by making taxes fairer, as shown in Chart 1.1.

With more money in their pockets, middle class families will be able to save more, enhancing their own financial security. They will also have a greater opportunity to invest—in their own future and that of their children. Finally, they will have more money to spend, which will boost economic activity in the short term, and also put Canada on a firmer growth path over the long term.

It is widely recognized that increasing support for low-income families also has a positive and long-term effect. Poverty is not just a problem for individual Canadians—all of Canada is affected. It makes it more difficult to get and stay healthy, and more difficult to find and keep good work.

Poverty is particularly challenging in the case of children, and its effect can be long term. When children are lifted out of poverty, they are better able to develop to their fullest potential, an opportunity that every Canadian deserves.

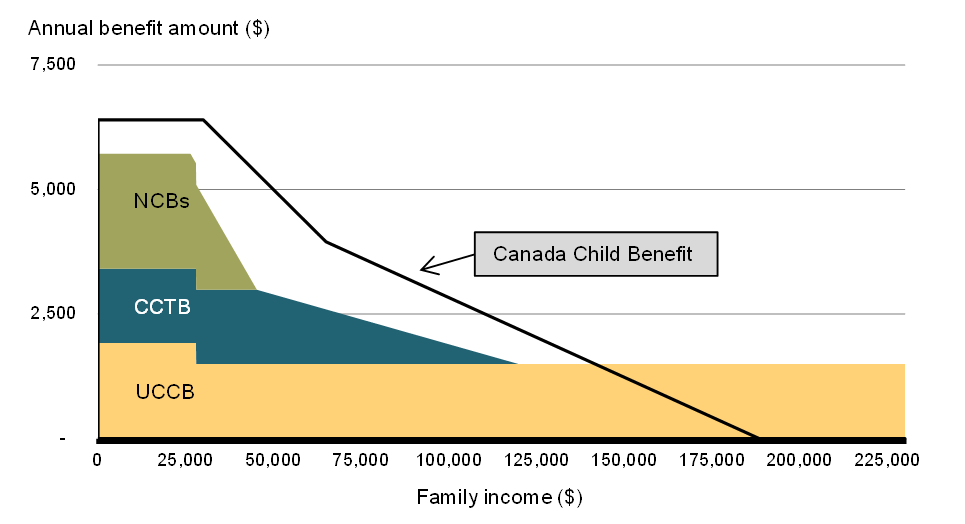

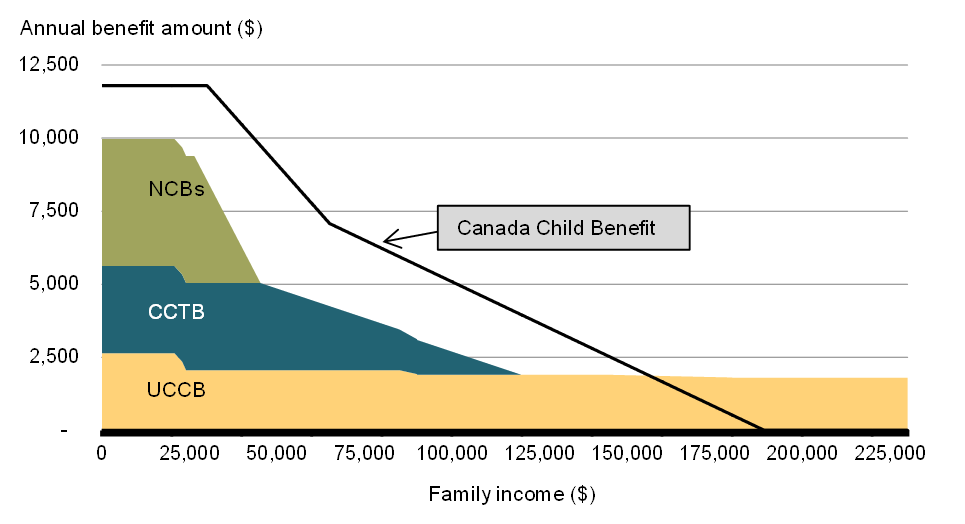

Canada’s existing child benefit system is complicated, consisting of a tax-free, income-tested Canada Child Tax Benefit with two components (the base benefit and the National Child Benefit supplement) and a taxable Universal Child Care Benefit received by all families, regardless of income.

It is a system that is both inadequate (it does not provide families with the support they need) and not sufficiently targeted to those who need it most (families with very high incomes receive benefits). Canadian families deserve better, and with this budget, will get the help they need to succeed.

Introducing the Canada Child Benefit

Budget 2016 gives Canadian families more money to help with the high cost of raising their children, by replacing the current complicated child benefit system with the new Canada Child Benefit. The introduction of the Canada Child Benefit represents the most significant social policy innovation in a generation.

The Canada Child Benefit will be:

- simpler—families will receive a single payment every month;

- tax-free—families will not have to pay back part of the amount received when they file their tax returns;

- better-targeted to those who need it most—low- and middle-income families will receive more benefits, and those with the highest incomes (generally over $150,000) will receive lower benefits than under the current system; and

- much more generous—families benefitting will see an average increase in child benefits of almost $2,300 in the 2016–17 benefit year.

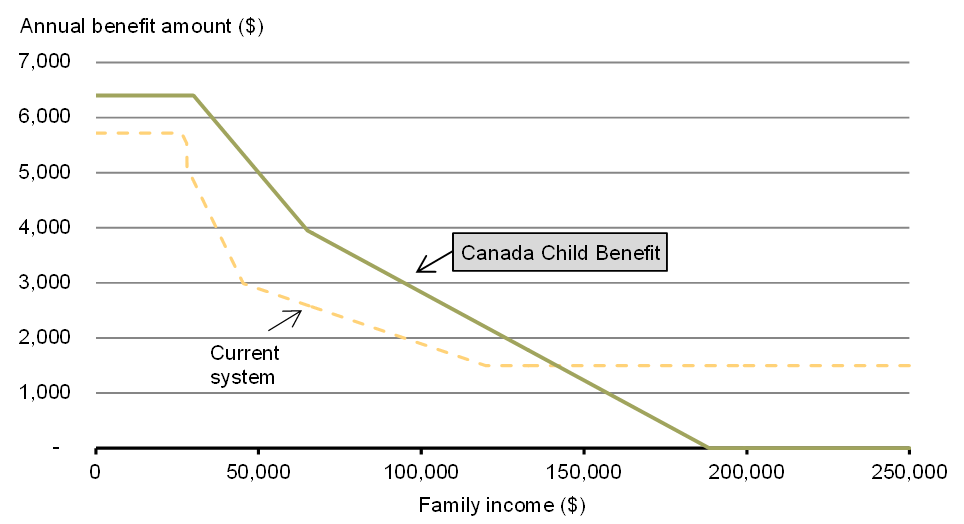

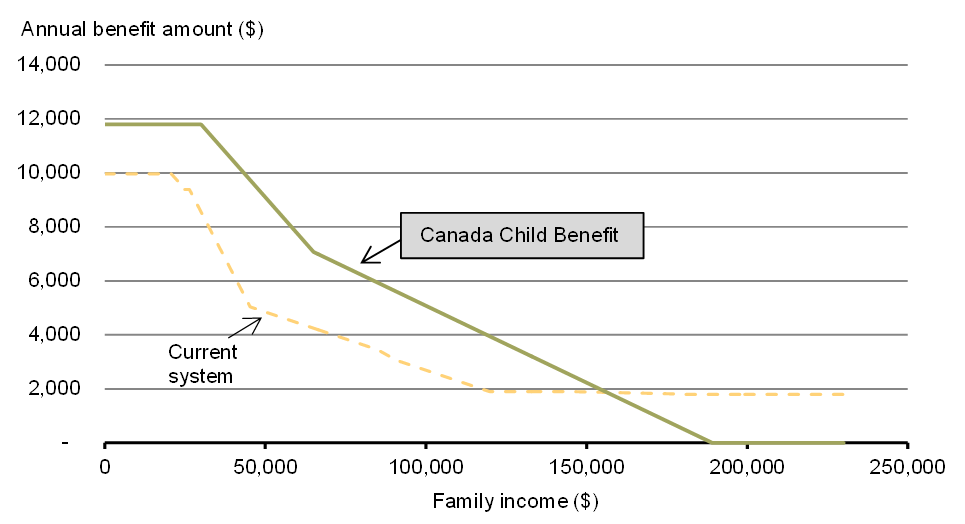

The Canada Child Benefit will provide a maximum annual benefit of up to $6,400 per child under the age of 6 and up to $5,400 per child for those aged 6 through 17. Families with less than $30,000 in net income will receive the maximum benefit.

Under the current system, families with $30,000 in net income and one child would have received $4,852 in child benefits, after tax, if their child is under the age of 6 and $3,916 if their child is aged 6 through 17.

To recognize the additional costs of caring for a child with a severe disability, Budget 2016 proposes to continue to provide the Child Disability Benefit, an additional amount of up to $2,730 per child eligible for the Disability Tax Credit.

More details on phase-out thresholds and rates for the Canada Child Benefit and the Child Disability Benefit can be found in the accompanying document Tax Measures: Supplementary Information.

The Canada Child Benefit will be paid monthly to eligible families, beginning in July 2016, replacing the Canada Child Tax Benefit and the Universal Child Care Benefit.

It is estimated that families will receive approximately $23 billion in Canada Child Benefit payments during the 2016–17 benefit year. Nine out of ten families will receive more in child benefits than under the current system (see Charts 1.2 and 1.3 for illustrations).

Another key feature of the Canada Child Benefit is that it will deliver enhanced support to low-income families, including many single parents. As Charts 1.2 and 1.3 illustrate, the maximum benefit will be much more generous than that provided by the current system. Moreover, the benefit will start to be reduced at a higher income level, and will be reduced more gradually as income rises.

With the introduction of a much better-targeted Canada Child Benefit, about 300,000 fewer children will be living in poverty in 2016–17 compared with 2014–15. This represents a major step forward towards the goal of ensuring that all children have a fair shot at succeeding. The Canada Child Benefit will continue to play a leading role in supporting poverty reduction in future years.

How Canadian Families Will Benefit From the New Canada Child Benefit

Increased Benefits for a Family of Four With $90,000—Example

Aveen and Sarita have two children aged 8 and 5. Aveen earned $30,000 and Sarita earned $60,000 in 2015. Together, they would have received $3,145 under the current system (for the July 2016 to June 2017 benefit year). In comparison, the Canada Child Benefit program will deliver $5,650 in tax-free payments—a net after-tax increase of $2,505.

Increased Benefits for a Single Parent With One Child and $30,000—Example

Samantha is a single parent with one child aged 3. She earned $30,000 in 2015. Samantha would have received $4,852 under the current system (for the July 2016 to June 2017 benefit year). Instead, she will receive $6,400 in tax-free Canada Child Benefit payments—a net after-tax increase of $1,548.

Increased Benefits for a Family of Four With $120,000—Example

Ann and Derek have two children aged 7 and 4. Derek earned $84,000 and Ann earned $36,000 in 2015. Together, they would have received $1,901 under the current system (for the July 2016 to June 2017 benefit year). They will receive $3,940 in tax-free Canada Child Benefit payments—a net after-tax increase of $2,039.

Increased Benefits for a Family With One Child Eligible for the Child Disability Benefit—Example

Marion and Jacques have one child aged 4 who is eligible for the Child Disability Benefit. Marion earned $40,000 and Jacques earned $20,000 in 2015. Marion and Jacques would have received $5,129 under the current system (for the July 2016 to June 2017 benefit year). Instead, they will receive $7,030 in tax-free Canada Child Benefit payments—a net after-tax increase of $1,901.

These additional child benefits include:

- An increase of $1,607 from the introduction of the Canada Child Benefit; and

- An increase of $294 from the change to the Child Disability Benefit.

The Canada Child Benefit will be complemented by other investments for families with children proposed in Budget 2016, such as funding towards establishing a National Framework on Early Learning and Child Care (see Chapter 2—Growth for the Middle Class).

Eliminating Income Splitting for Couples With Children

To better deliver help to those families who need it most, Budget 2016 proposes to eliminate income splitting for couples with children under the age of 18 for the 2016 and subsequent taxation years. Pension income splitting will not be affected by this change.

Eliminating the Children’s Fitness Tax Credit and the Children’s Arts Tax Credit

The Children’s Fitness and Arts Tax Credits are currently worth up to $150 and $75 per child on up to $1,000 and $500 in eligible expenses, respectively. As part of the Government’s efforts to simplify the tax code and better target support for families with children, Budget 2016 proposes to reduce the maximum eligible expenses for the Children’s Fitness and Arts Tax Credits by half for 2016, and to eliminate both credits as of 2017.

The Government’s measures for families with children, combined with the middle class tax cut, will provide these families with additional net after-tax benefits of approximately $14 billion during the 2015–16 to 2020–21 period.

Helping Young Canadians Succeed

For generations, Canadian parents have told their children a similar story: if you want a good job, stay in school. At the same time, employers are constantly seeking highly skilled workers. It’s what our economy needs to grow and remain competitive.

Young Canadians took this message to heart. They knew that studying hard in school would guarantee entry into an affordable college, university or apprenticeship program, which would in turn lead to a steady and secure job that made it possible to pay down what little debt they had accumulated.

Unfortunately, for too many Canadians, rising costs have made post-secondary education less affordable. Fewer are able to save for their education, and those who receive financial assistance often find it difficult to repay their loans.

As Canada’s population ages, its prosperity will increasingly depend on young Canadians getting the education and training they need to prepare for the jobs of today and tomorrow. Now more than ever, it is important that post-secondary education remains affordable and accessible, and that young Canadians have access to meaningful work at the beginning of their careers.

The future of young Canadians—and indeed, the future of all Canadians—depends on it.

Making Post-Secondary Education More Affordable

Budget 2016 proposes a package of reforms to the Canada Student Loans Program that will make post-secondary education more affordable for students from low- and middle-income families and ensure that student debt loads are manageable. These measures will also simplify the application process for student financial assistance, making the Canada Student Loans Program more transparent and predictable.

Enhancing Canada Student Grants

Budget 2016 proposes to increase Canada Student Grant amounts by 50 per cent:

- from $2,000 to $3,000 per year for students from low-income families;

- from $800 to $1,200 per year for students from middle-income families; and

- from $1,200 to $1,800 per year for part-time students.

Increased grant amounts will be available for the 2016–17 academic year.

Enhancing the Canada Student Grant amounts, which have not been updated since 2009, will ensure that students receive help that reflects the rising costs of post-secondary education, and that keeps debt loads manageable.

Middle-income families that struggle to save for their kids’ education will benefit from these increased amounts. Nearly 100,000 students from middle-income families will receive increased assistance each year as a result of this measure.

The results are even greater for low-income families, many of whom find it impossible to save for post-secondary education. Approximately 247,000 students from low-income families will benefit from these changes.

Part-time students, who often attend school while working or caring for families of their own, will benefit as well. Approximately 16,000 part-time students will receive more financial assistance.

In total, these measures will provide assistance of $1.53 billion over five years, starting in 2016–17, and $329 million per year thereafter.

Going forward, the Government will work with the provinces and territories to expand eligibility for Canada Student Grants so that even more students can receive non-repayable assistance. Under the new model, the existing low- and middle-income thresholds will be replaced with a single progressive threshold under which grant amounts will gradually decline based on income and family size.

The new eligibility thresholds are expected to be in place for the 2017–18 academic year, following consultations with provinces and territories. Budget 2016 proposes to provide $790 million over four years, starting in 2017–18, and $216 million per year thereafter to expand eligibility thresholds.

The Canada Student Grants Program has been a great success and has had a tremendous impact on students in this country. To remain relevant it must be increased to keep up with the rising costs associated with attaining an education…Targeted grants are the best mechanism to reduce student debt loads, and are associated with higher rates of successful debt repayment over time.

Making Student Debt More Manageable

Too often, former students are confronted with sizeable outstanding loans that they are unable to repay.

Budget 2016 proposes to increase the loan repayment threshold under the Canada Student Loans Program’s Repayment Assistance Plan to ensure that no student will have to repay their Canada Student Loan until they are earning at least $25,000 per year.

This new threshold will provide increased flexibility in repayment and better reflects minimum wages, helping to ease students’ transition into the workforce.

This measure will provide assistance of $131.4 million over five years, beginning in 2016–17, and $31 million per year thereafter. The Government will also increase efforts to make sure that students eligible for assistance under the Repayment Assistance Plan are making full use of the program.

Making Student Debt More Manageable

Steven, a recent post-secondary graduate, earns $23,000 per year at his current job. He is finding it difficult to repay his outstanding Canada Student Loans debt of $12,000. Under the proposed changes to the Repayment Assistance Plan, Steven will not be required to make any immediate payments on his Canada Student Loan since his annual income is below the new $25,000 income threshold for repayment. The Government will cover the interest owing on Steven’s Canada Student Loan until he has the financial flexibility to repay his loan.

Introducing a Flat-Rate Student Contribution

Budget 2016 proposes to introduce a flat-rate student contribution to determine eligibility for Canada Student Loans and Grants to replace the current system of assessing student income and financial assets.

This change would allow students to work and gain valuable labour market experience without having to worry about a reduction in their level of financial assistance. It would also benefit adult learners, many of whom may work while studying or have significant financial assets. This measure will provide assistance of $267.7 million over four years, starting in 2017–18, and $73 million per year thereafter.

The Government will work collaboratively with provinces and territories to finalize the flat-rate contribution model in time for implementation in the 2017–18 academic year.

Eliminating the Education Tax Credit and the Textbook Tax Credit

In support of the Government’s commitment to improve the affordability of post-secondary education for low- and middle-income families, Budget 2016 proposes to eliminate the Education and Textbook Tax Credits, effective January 1, 2017. These credits are not targeted based on income and often provide little direct support to students at the time they need it most.

Savings realized from eliminating these credits will be used to enhance student financial assistance, to help provide timely assistance to students from low- and middle-income families. Tax credit amounts carried forward from years prior to 2017 will still be claimable in 2017 and subsequent years.

Measures proposed in Budget 2015 related to the Canada Student Loans Program and Canada Student Grants will not be pursued in order to better target support to students from low- and middle-income families.

| Current Program | Proposed Changes1 | Impact | |

|---|---|---|---|

| Enhancing Canada Student Grants |

|

|

These changes will help students cover the costs of their education without increasing student debt loads. Further enhancements to expand eligibility for Canada Student Grants will be in place for the 2017–18 academic year. |

| Introducing a Flat-Rate Student Contribution | Students must estimate their financial assets and income earned while studying to determine eligibility for Canada Student Loans and Grants. | Students will be required to contribute a flat amount each year towards the costs of their education, and financial assets and student income will no longer be considered. | This change will allow students to work and gain valuable labour market experience without having to worry about a reduction in their level of financial assistance. It will also benefit adult learners, many of whom may work while studying or have significant financial assets. |

| Making Student Debt More Manageable | Loan repayment threshold under the Repayment Assistance Plan is $20,210 | Loan repayment threshold under the Repayment Assistance Plan will be $25,000 | This change will ensure that no student will have to repay their Canada Student Loan until they are earning at least $25,000 per year. |

Helping Youth Obtain Valuable Work Experience

A Renewed Youth Employment Strategy

Each year the Government invests more than $330 million in the Youth Employment Strategy to help young people gain the skills, abilities and work experience they need to find and maintain good employment.

To expand employment opportunities for young Canadians, Budget 2016 proposes to invest an additional $165.4 million in the Youth Employment Strategy in 2016–17.

Funding will be used to:

- create new green jobs for youth, to help young Canadians gain valuable work experience, learn about our natural environment and contribute to economic growth in environmental sectors;

- increase the number of youth who access the Skills Link program, which helps young Canadians—including Indigenous and disabled youth—make a more successful transition to the workforce; and

- increase job opportunities for young Canadians in the heritage sector, under the Young Canada Works program.

This funding would be in addition to the $339 million already announced for the Canada Summer Jobs program, to be delivered over three years, starting in 2016–17.

Going forward, the Government will make additional investments in the Youth Employment Strategy in 2017–18 and 2018–19. These investments will be targeted toward supporting employment opportunities for vulnerable youth.

The Government of Canada understands that to successfully transition into the labour market, young Canadians need meaningful work at the beginning of their careers. A summer job is an important way for youth to gain work experience.

To that end, on February 12, 2016, the Government announced that it will invest $339 million over three years, starting in 2016–17, to create up to 35,000 additional jobs in each of the next three years under the Canada Summer Jobs program. This investment will more than double the number of job opportunities supported by the program.

The Canada Summer Jobs program helps employers create summer job opportunities for students. The program provides funding to not-for-profit organizations, public-sector employers and small businesses with 50 or fewer employees to create summer job opportunities for young people aged 15 to 30 years who are full-time students intending to return to their studies in the next school year. The program is part of the Government’s Youth Employment Strategy.

Prime Minister’s Youth Council

To ensure the Government does a better job of understanding and addressing the needs of Canada’s youth, over the course of the next year, the Government will develop and establish a Prime Minister’s Youth Advisory Council, consisting of young Canadians aged 16-24 from diverse communities and from all regions of Canada. The Council will provide non-partisan advice to the Prime Minister on key issues such as employment and education, building stronger communities as well as climate change and clean growth.

Youth Service

The Government is committed to helping young Canadians gain valuable work and life experience while providing support for communities across Canada. Budget 2016 proposes to provide $105 million over five years, starting in 2016–17, and $25 million per year thereafter in support of youth service. Further details will be announced in the coming months.

Expert Panel on Youth Employment

More can—and should—be done to improve job outcomes for vulnerable youth. To that end, Budget 2016 proposes to establish an Expert Panel on Youth Employment to assess the barriers faced by vulnerable youth in finding and keeping jobs, and to examine innovative practices used by governments, non-governmental organizations and employers both at home and abroad to improve job opportunities for vulnerable youth.

The Panel will report back to the Minister of Youth and the Minister of Employment, Workforce Development and Labour by December 2016. The Panel’s findings will help inform future investments in this area, including enhancements to the Youth Employment Strategy.

Increasing Co-op Placements and Strengthening Work Integrated Learning

Recognizing the importance of demand-driven education and training, the Government will launch the Post-Secondary Industry Partnership and Co-operative Placement Initiative in 2016. The Initiative will support partnerships between employers and willing post-secondary educational institutions to better align what is taught with the needs of employers. The Initiative will also support new co-op placements and work-integrated learning opportunities for young Canadians, with a focus on high-demand fields, such as science, technology, engineering, mathematics and business. Total costs of this measure would be $73 million over four years, starting in 2016–17. Further development of support for co-op placements will be integrated in the Government’s commitment to advance an Innovation Agenda to spur economic growth (see Chapter 2—Growth for the Middle Class).

Improving Employment Insurance

Canada’s Employment Insurance (EI) program provides economic security to Canadians when they need it most. For some, help is needed because they have lost their job through no fault of their own. For others, extra support is required because they are out of the workforce to raise children or provide care for a loved one. Whatever the circumstance, no Canadian should struggle to get the assistance they need.

To better make sure that Canadians get the help they need, when they need it, the Government is taking immediate action to improve Employment Insurance. This includes making changes to the eligibility rules for new entrants and re-entrants, temporarily enhancing benefits in certain regions, and investing in improved service delivery. In addition, starting in 2017, the waiting period for benefits will be reduced. This means that when a worker loses their job and applies for Employment Insurance, they will be without income for a shorter period of time.

Expanding Access to Employment Insurance for New Entrants and Re-entrants

Many new workers—such as young Canadians and recent immigrants—find it difficult to access EI support. At present, new entrants and re-entrants to the labour market must accumulate at least 910 hours of insurable employment before being eligible for EI regular benefits. Budget 2016 proposes to amend the rules to eliminate the higher EI eligibility requirements that restrict access for new entrants and re-entrants to the labour market. With these changes, new entrants and re-entrants will face the same eligibility requirements as other claimants in the region where they live. An estimated 50,000 additional claimants will become eligible for EI benefits as a result of this measure, which will take effect in July 2016.

Eliminating the New Entrant and Re-entrant Employment Insurance Requirements

Donald lives in Winnipeg, Manitoba, where he has worked part-time over the past six months since graduating from college. He was recently laid off.

Under current EI eligibility rules, Donald would be considered a new entrant to the labour force. As a result, he would need to have worked at least 910 hours over the past 52 weeks to qualify for EI benefits. Since Donald only worked 780 hours over this period, he does not qualify for benefits.

Under the proposed changes, Donald would face the same EI eligibility requirements as other claimants in his region. As of March 13, 2016, the threshold for applicants living in Winnipeg is set at 665 hours. Donald would meet this requirement, and could receive up to 17 weeks of EI benefits while he looks for new work to start his career.

This measure is proposed to take effect in July 2016.

Reducing the Employment Insurance Waiting Period From Two Weeks to One

Under the EI program, claimants must wait two weeks before they can start receiving benefits. This waiting period acts like the deductible that must be paid for other types of insurance. Unfortunately, this delay can make it difficult for some to make ends meet while they wait for their first EI payment. To help reduce the period of time during which a claimant is without income, Budget 2016 proposes to make legislative changes to reduce the EI waiting period from two weeks to one week effective January 1, 2017.

Extending the Working While on Claim Pilot Project

The Working While on Claim pilot project helps individuals stay connected to the labour market by ensuring that claimants always benefit from accepting work. Under the current pilot, claimants can keep 50 cents of their EI benefits for every dollar they earn, up to a maximum of 90 per cent of the weekly insurable earnings used to calculate their EI benefit amount. Budget 2016 proposes to extend the current EI Working While on Claim pilot project until August 2018. Extending the pilot will allow time for further assessment to ensure the program works for Canadians. Under the extended pilot, claimants will be able to have the rules of an earlier pilot, introduced in 2005, applied to their claims.

Simplifying Job Search Responsibilities for Employment Insurance Claimants

In 2012, changes were made to the EI program to specify the type of jobs that unemployed workers are expected to search for and accept. For some claimants, this has meant having to accept work at lower rates of pay and with longer commuting times. Budget 2016 proposes to reverse those changes that strictly define the job search responsibilities of unemployed workers. The Government will also ensure that there are fair and flexible supports to assist EI claimants train for and find new employment.

Extending Employment Insurance Regular Benefits in Affected Regions

Canadians help each other in hard times and deserve an EI program that reflects that reality.

The EI program automatically adjusts to economic conditions by gradually increasing accessibility and benefits as regional unemployment rates rise. However, dramatic declines in global oil prices since late 2014 have produced sharp and sustained unemployment shocks in commodity-based regions.

In response to these unemployment shocks, Budget 2016 proposes to make legislative changes to extend the duration of EI regular benefits by 5 weeks, up to a maximum of 50 weeks of benefits, for all eligible claimants in the 12 EI economic regions that have experienced the sharpest and most severe increases in unemployment.

Extended benefits will be available for one year starting in July 2016, with the measure being applied retroactively to all eligible claims as of January 4, 2015. This measure will ensure that EI claimants in these 12 regions have the financial support they need while they search for work.

Budget 2016 also proposes to make legislative changes to offer up to an additional 20 weeks of EI regular benefits to long-tenured workers in the same 12 EI economic regions, up to a maximum of 70 weeks of benefits.

Extended benefits for long-tenured workers will be available for one year starting in July 2016, with the measure being applied retroactively to all eligible claims as of January 4, 2015. This measure will ensure that long-tenured workers, who may have spent years working in one industry or for one employer, have the financial support they need while they search for work, possibly in an entirely different industry.

Extending Employment Insurance Benefits

Gary lives in Red Deer, Alberta, where he has worked as a pipefitter in the oil and gas sector earning $60,000 per year for the past 12 years. He was recently laid off, and he is worried about making ends meet for his family. The unemployment rate in his region has increased from 5.4 per cent in February 2015 to 8.3 per cent as of March 13, 2016.

Gary worked 1,750 hours in the 52 weeks prior to losing his job. In his economic region, this means that he qualifies for up to 40 weeks of EI benefits at a weekly benefit rate of $537. In total, under the program’s current parameters, Gary will receive $21,480 in income support while he looks for work.

However, under the temporary measures proposed in Budget 2016, Gary would be entitled to receive an extra 5 weeks of benefits. In addition, Gary has been paying maximum EI premiums and has never had a prior claim for benefits. As a result, he would also qualify to receive up to an additional 20 weeks of benefits for long-tenured workers. These additional weeks of benefits bring Gary’s total support under the EI program to 65 weeks of benefits. At his weekly benefit rate, this equals up to $34,905 in income support.

The extended weeks of benefits will provide Gary with the peace of mind that he can provide for his family while he transitions to new employment.

These measures are proposed to take effect in July 2016.Extending Employment Insurance Benefits

Budget 2016 proposes to extend EI regular benefits by 5 weeks to all eligible claimants, and to provide up to an additional 20 weeks of EI regular benefits to long-tenured workers, in the following EI economic regions:

- Newfoundland/Labrador

- Sudbury

- Northern Ontario

- Northern Manitoba

- Saskatoon

- Northern Saskatchewan

- Calgary

- Northern Alberta

- Southern Alberta

- Northern British Columbia

- Whitehorse

- Nunavut

In these regions, the unemployment rate increased by two percentage points or more for a sustained period between March 2015 and February 2016, compared to its lowest point between December 2014 and February 2015, without showing significant signs of recovery.

Extending the Maximum Duration of Work-Sharing Agreements

Work-Sharing helps employers and employees avoid layoffs when there is a temporary reduction in the normal level of business activity that is beyond the control of the employer. Work-Sharing provides income support to employees eligible for EI benefits who work a temporarily reduced work schedule while their employer recovers.

Budget 2016 proposes to extend the maximum duration of Work‑Sharing agreements from 38 weeks to 76 weeks across Canada. Extended Work-Sharing agreements will help employers retain skilled employees and avoid the costs of recruiting and training new employees when business returns to normal levels. They also enable employees to continue working and maintain their skills while supplementing their wages with EI benefits for the days they are not working.

Making Employment Insurance Service Delivery More Responsive

Between December 2014 and December 2015, EI claims increased 7.8 per cent and the number of EI beneficiaries increased 7.3 per cent nationally. To ensure that Canadians get timely access to the benefits to which they are entitled, Budget 2016 proposes to provide $19 million in 2016–17 to enable Service Canada to meet the increased demand for EI claims processing, and offer better support to Canadians as they search for new employment.

Enhancing Access to Employment Insurance Call Centres

EI Call Centre agents provide support to Canadians who require assistance to submit EI claim information or need to check the status of their EI claims. Budget 2016 proposes to invest $73 million over two years, starting in 2016–17, to improve access to EI Call Centres. This investment will increase the number of call centre agents, which will reduce waiting times and ensure that Canadians can access the information and support they need to receive their EI benefits as quickly as possible.

Strengthening the Integrity of the Employment Insurance Program

Canadians expect sound stewardship and accountability of the EI program, which is funded through premiums paid by employers and workers. To ensure that benefits help those in need, Budget 2016 proposes to direct $21 million over three years, starting in 2016–17, to promote compliance with program rules.

In addition, the Government is committed to further improving EI. This includes making Compassionate Care Benefits easier to access, more flexible and more inclusive for those who provide care for seriously ill family members, and providing more flexibility in parental leave benefits to better accommodate unique family and work situations. These objectives will be advanced over the course of the Government’s mandate.

| Current Program | Proposed Changes | Impact | |

|---|---|---|---|

| Expanding Access for New Entrants and Re-entrants | New entrants and re-entrants to the labour market must accumulate at least 910 hours of insurable employment in the 52 weeks preceding their claim in order to qualify for EI benefits. | New entrants and re-entrants would only need to accumulate 420 to 700 hours of insurable employment, depending on the unemployment rate in their region to qualify for EI benefits. | New entrants and re-entrants will face the same eligibility criteria as other claimants in the region where they live. |

| Reducing the EI Waiting Period from Two Weeks to One | Currently, EI claimants must serve a two-week waiting period prior to receiving benefits. | The waiting period would be reduced from two weeks to one week. | Reducing the EI waiting period will help reduce the period of time claimants are without income. |

| Extending the Working While on Claim Pilot Project | The EI Act allows claimants who work while on claim to earn the greater of $50 or 25 per cent of their weekly EI benefits before their benefits are reduced dollar for dollar. | The Working While on Claim Pilot Project allows claimants to keep 50 cents of every dollar earned while on claim, up to a maximum of 90 per cent of their weekly insurable earnings. | Extending the Working While on Claim Pilot Project will encourage claimants to accept available work by allowing them to earn higher amounts of income while in receipt of EI benefits. |

| Simplifying Job Search Responsibilities for EI Claimants | Since 2012, claimants have been required to accept employment at lower wages and at further distances from home the longer they receive EI. | Claimants would continue to be required to conduct job search activities and accept suitable employment, but requirements to accept work at lower pay and with longer commuting times would be eliminated. | Simplifying job search requirements for EI claimants will provide more fairness and flexibility for claimants in searching for new employment. |

| Extending EI Regular Benefits in Affected Regions | Claimants are eligible to receive between 14 and 45 weeks of EI regular benefits, depending on the unemployment rate in their region and the number of insurable hours worked during their qualifying period. | Claimants in affected regions would be eligible to receive an extra 5 weeks of EI regular benefits, up to a maximum of 50 weeks. Long-tenured workers in affected regions would be eligible to receive up to an additional 20 weeks of EI regular benefits, up to a maximum of 70 weeks. |

Extending EI regular benefits in affected regions, including for long-tenured workers, will ensure that claimants in these regions have the financial support they need while they search for work. |

| Extending the Maximum Duration of Work-Sharing Agreements | Work-Sharing agreements may be established for 26 weeks, and can be extended by 12 weeks, for a maximum length of 38 weeks. | The maximum duration of Work-Sharing agreements would be extended to 76 weeks. | Extending Work-Sharing agreements will help employers retain skilled employees and avoid the costs of recruiting and training new employees, and will help employees maintain their skills and jobs while supplementing their earnings with EI benefits. |

Investing in Skills and Training

In today’s rapidly changing economy, Canadians need to obtain the skills and training necessary to qualify for well-paying jobs, both now and in the future. While Canada’s labour force is already highly skilled, there are opportunities to further improve Canada’s performance by helping middle class Canadians, and those working hard to join it, obtain the skills and training needed to participate fully in the labour market. That is why Budget 2016 proposes additional investments in skills training to help Canadians succeed and to strengthen the middle class.

Enhancing Investments in Training

Through agreements with provinces and territories, the Government funds a range of training and employment programs for unemployed and underemployed Canadians. These programs provide Canadians opportunities to develop and upgrade their skills and to access job search tools and career counselling. Through the Labour Market Development Agreements, the Government provides $1.95 billion each year to provinces and territories to support unemployed workers who are eligible for Employment Insurance. For those who are not eligible for Employment Insurance, the Government provides $500 million each year to provinces and territories through the Canada Job Fund Agreements. Budget 2016 proposes to provide an additional $125 million in 2016–17 for the Labour Market Development Agreements, and an additional $50 million in 2016–17 for the Canada Job Fund Agreements. These investments will help ensure unemployed and underemployed Canadians can access the training and supports they need to develop their skills and pursue opportunities for a better future.

This is the first step in the Government’s plan to boost support for skills and training through these agreements. The Government will conduct broad-based consultations with provinces, territories and stakeholders in 2016–17 to identify ways to improve these agreements and guide future investments to strengthen labour market programming.

Strengthening Union-Based Apprenticeship Training

A skilled, mobile and certified skilled trades workforce is built upon high-quality apprenticeship training systems. Apprentices work and learn in a variety of settings, including on-the-job, at colleges and polytechnics, and through union-based training centres. To strengthen the role of union-based training providers, Budget 2016 proposes to provide $85.4 million over five years, starting in 2016–17, to develop a new framework to support union-based apprenticeship training. As well as improving the quality of training through investments in equipment, the framework will seek to incorporate greater union involvement in apprenticeship training and support innovative approaches and partnerships with other stakeholders, including employers.

Investing in Adult Basic Education in the North

The Northern Adult Basic Education Program provides targeted funding to northern colleges to expand and improve their adult basic education services and leverage their existing network of learning infrastructure.

To support the delivery of adult basic education services by colleges in the territories, Budget 2016 proposes to provide $3.9 million in 2016–17 to extend the Northern Adult Basic Education Program for one year. During this time, the Government will review the program with a view to determining how to best support the participation of Northerners in the labour market.

Increasing the Northern Residents Deduction

To help draw skilled labour to northern and isolated communities, Budget 2016 proposes to increase the maximum daily residency deduction to $22 from $16.50. This measure will be effective as of January 1, 2016 and is estimated to reduce federal revenues by about $255 million over the 2015–16 to 2020–21 period.

Supporting Flexible Work Arrangements

Many Canadians struggle to balance the responsibilities of work and family, which can affect their overall well-being and productivity at work. Flexible work arrangements, such as flexible start and finish times or the ability to work from home, can help employees to balance these responsibilities. The Government will explore ways to ensure that federally regulated employees are better able to manage the demands of paid work and their personal and family responsibilities outside of work.

Labour Market Information for Canadians

Access to timely, reliable, and comprehensive labour market information is critical to ensure that all Canadians, including students, workers, employers and educators, have the information they need to make informed decisions. The Government remains committed to working collaboratively with provinces and territories to provide information that will equip Canadians with the tools to access a broad range of job opportunities.

Introducing a Teacher and Early Childhood Educator School Supply Tax Credit

In recognition of the costs educators often incur at their own expense for supplies that enrich our children’s learning environment, Budget 2016 proposes a new Teacher and Early Childhood Educator School Supply Tax Credit. The proposed 15-per-cent refundable income tax credit will apply on up to $1,000 of eligible supplies (such as paper, glue and paint for art projects, games and puzzles, and supplementary books). The proposal will apply to the 2016 and subsequent tax years and will provide a benefit worth about $140 million over the 2015–16 to 2020–21 period.

| 2015-16 | 2016-17 | 2017-18 | Total | |

|---|---|---|---|---|

| Strengthening the Middle Class | ||||

| Middle Class Tax Cut and Related Measures | 370 | 1,265 | 1,180 | 2,815 |

| Introducing the Canada Child Benefit—Net Cost | 4,510 | 5,370 | 9,880 | |

| Of which: | ||||

| Canada Child Benefit | 17,355 | 22,875 | 40,230 | |

| Canada Child Tax Benefit and National Child Benefit Supplement | -7,920 | -10,740 | -18,660 | |

| Universal Child Care Benefit | -4,925 | -6,765 | -11,690 | |

| Eliminating Income Splitting for Couples With Children | -475 | -1,920 | -1,980 | -4,375 |

| Eliminating the Children's Fitness Tax Credit and the Children's Arts Tax Credit | -20 | -120 | -245 | -385 |

| Subtotal—Strengthening the Middle Class | -125 | 3,735 | 4,325 | 7,935 |

| Helping Young Canadians Succeed | ||||

| Enhancing Canada Student Grants | 216 | 468 | 684 | |

| Making Student Debt More Manageable | 15 | 25 | 40 | |

| Introducing a Flat-Rate Student Contribution | 49 | 49 | ||

| Eliminating the Education Tax Credit and the Textbook Tax Credit | -105 | -445 | -550 | |

| Savings From Not Proceeding With Budget 2015 Measures Related to Canada Student Loans and Grants | -76 | -113 | -189 | |

| A Renewed Youth Employment Strategy | 165 | 165 | ||

| Youth Service | 5 | 25 | 30 | |

| Increasing Co-op Placements and Strengthening Work Integrated Learning | 12 | 12 | 24 | |

| Subtotal—Helping Young Canadians Succeed | 232 | 21 | 253 | |

| Improving Employment Insurance | ||||

| Expanding Access to Employment Insurance for New Entrants and Re-entrants | 259 | 307 | 567 | |

| Reducing the Employment Insurance Waiting Period From Two Weeks to One | 206 | 752 | 957 | |

| Extending the Working While on Claim Pilot Project | 48 | 81 | 129 | |

| Extending Employment Insurance Regular Benefits in Affected Regions | 405 | 177 | 582 | |

| Extending the Maximum Duration of Work-Sharing Agreements | 44 | 83 | 126 | |

| Making Employment Insurance Service Delivery More Responsive | 19 | 19 | ||

| Enhancing Access to Employment Insurance Call Centres | 32 | 41 | 73 | |

| Strengthening the Integrity of the Employment Insurance Program | 6 | 8 | 14 | |

| Subtotal—Improving Employment Insurance | 1,018 | 1,449 | 2,467 | |

| Investing in Skills and Training | ||||

| Enhancing Investments in Training | 175 | 175 | ||

| Strengthening Union-Based Apprenticeship Training | 10 | 10 | ||

| Investing in Adult Basic Education in the North | 4 | 4 | ||

| Increasing the Northern Residents Deduction | 10 | 45 | 50 | 105 |

| Introducing a Teacher and Early Childhood Educator School Supply Tax Credit | 5 | 25 | 25 | 55 |

| Subtotal—Investing in Skills and Training | 15 | 249 | 85 | 349 |

| Total | -110 | 5,234 | 5,880 | 10,914 |

| Less previously announced funds | -370 | -1,275 | -1,190 | -2,835 |

| Less projected revenues | -369 | -1,057 | -1,426 | |

| Net Fiscal Cost | -480 | 3,590 | 3,633 | 6,743 |