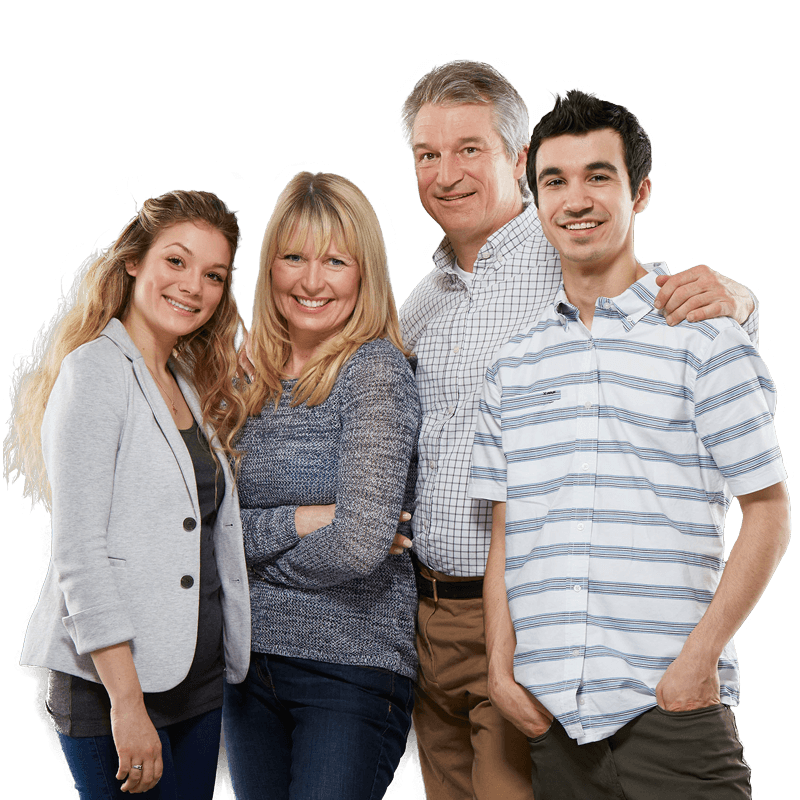

Meet Chantal

and Roger

They're small

business owners

and, like you, are helping

to put their two kids

through school.

Working to

support their

family

Between tuition fees, supporting their aging parents, and investing in their business, Chantal and Roger have learned to make every dollar count.

As small business owners helping with their kids' tuition,

Chantal and Roger will receive up to

$11,670

in tax relief and enhanced benefits in 2015.

Your

Money

Matters

Like Chantal and Roger, improve your bottom line by using the Registered Education Savings Plan to help your kids through school.

Save money with the Family Caregiver Tax Credit.

And put more money in your pocket with the Family Tax Cut.

Benefit from the Small Business Job Credit as you grow your business and create jobs.

We're

investing in you too

The Canada Small Business Financing Program will help your small business succeed.

The New Building Canada Plan, the largest and longest federal infrastructure investment in our nation's history, is investing in infrastructure like bridges, roads, and public transit—helping to get your goods to market.

How can

you

benefit?

GET MORE INFORMATION

Education

Share Chantal and Roger'sstory

MEET MORE CANADIANS