Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Helping Families Make Ends Meet

To access a Portable Document Format (PDF) file you must have a PDF reader installed. If you do not already have such a reader, there are numerous PDF readers available for free download or for purchase on the Internet.

The Harper Government is fulfilling its promise to balance the budget in 2015. Canada's Economic Action Plan has been underpinned by prudent fiscal management and the Government's low-tax plan for jobs, growth and security. Since the depths of the recession, over 1.2 million net new jobs have been created—overwhelmingly full-time, well-paying and in the private sector.

At the same time, the Government has lowered taxes every year since coming into office, and has delivered the lowest overall federal tax burden in over 50 years.

The Government's balanced-budget, low-tax plan for jobs, growth and security is working. But the job is not done. There are new challenges on the horizon, and the Government must stay the course to protect the economic interests of Canadians and the security of Canada.

Economic Action Plan 2015 (EAP 2015) builds a stronger Canada by:

Keeping Taxes Low

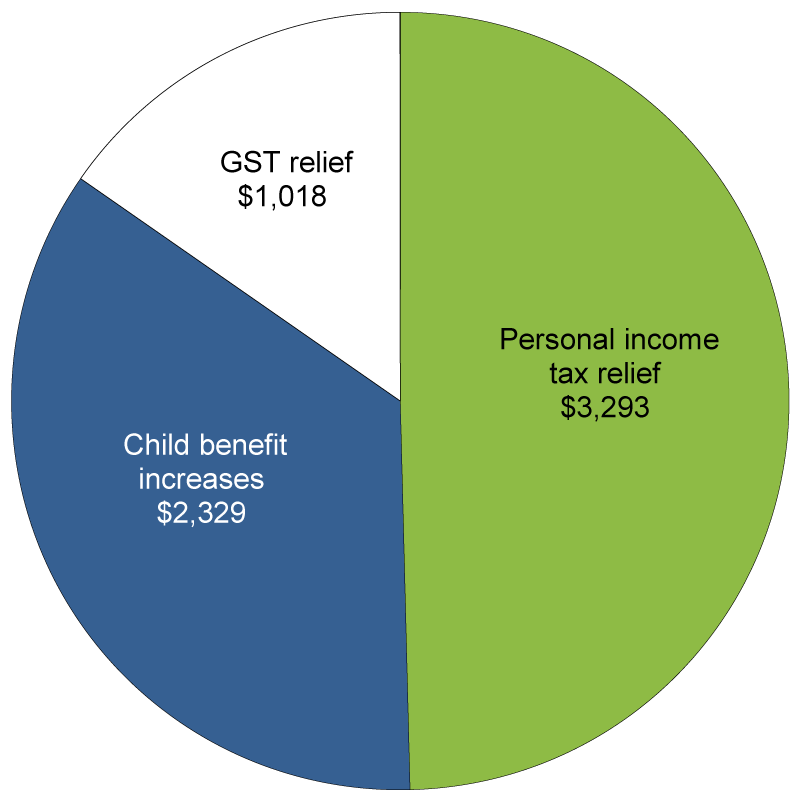

Measures introduced by the Government since 2006 will provide tax relief and benefits of up to about $6,600 for a typical, two-earner Canadian family of four in 2015.

Since 2006, the Government has introduced measures to make life more affordable for families:

- Reducing the lowest personal income tax rate and increasing the basic personal amount.

- Cutting the GST from 7% to 5%.

- Introducing pension income splitting.

- Establishing tax credits to support working low-income individuals and families, public transit users, first-time home buyers, and families caring for infirm relatives.

- Providing families with children with support through the children's arts and fitness tax credits, and enhancements to the Adoption Expense Tax Credit and Registered Education Savings Plan.

- Proposing a new Family Tax Cut and enhancements to the Universal Child Care Benefit and Child Care Expense Deduction.

EAP 2015 keeps taxes low and builds on the Harper Government's historic tax cuts by introducing new measures to further encourage individual savings, make it easier for seniors to save more for retirement, and give families greater peace of mind.

Helping Canadians Save More in Tax-Free Savings Accounts

EAP 2015 proposes to increase the Tax-Free Savings Account (TFSA) annual contribution limit to $10,000, effective for the 2015 and subsequent taxation years.

Since 2009, the TFSA has been helping Canadians save for important priorities such as buying a home, paying for post-secondary education and helping fund retirement.

The TFSA complements existing registered savings plans like the Registered Retirement Savings Plan and the Registered Education Savings Plan.

The TFSA is a flexible, registered general-purpose savings vehicle that allows Canadian residents aged 18 or older to earn tax-free investment income, including interest, dividends and capital gains, to more easily meet lifetime savings needs. TFSAs can include a wide range of investment options such as mutual funds, Guaranteed Investment Certificates, publicly traded shares and bonds. Contributions to a TFSA are not tax-deductible, but investment income earned in a TFSA and withdrawals from it are tax-free. Unused TFSA contribution room is carried forward and the amount of withdrawals from a TFSA can be re-contributed in future years.

The TFSA provides greater savings incentives for low- and modest-income individuals because, in addition to the tax savings, neither the income earned in a TFSA nor withdrawals from it affect eligibility for federal income-tested benefits and credits, such as the Canada Child Tax Benefit, the Goods and Services Tax/Harmonized Sales Tax Credit, the Age Credit, and Old Age Security and Guaranteed Income Supplement benefits.

Individuals with annual incomes of less than $80,000 accounted for more than 80 per cent of all TFSA holders as of the end of 2013.

The TFSA has become a popular means of saving for Canadians at all income levels, with about half of TFSA holders having annual incomes of under $42,000.

At the end of 2013, nearly 11 million individuals had opened a TFSA and about 1.9 million had contributed the maximum amount to their TFSAs.

The TFSA was introduced with an annual contribution limit of $5,000, indexed to inflation in $500 increments. Due to indexation, the limit increased to $5,500 in 2013.

Supporting Seniors

Seniors are already benefiting from important money-saving measures such as pension income splitting. And now with EAP 2015, they will have even more money to put in their pockets with two new measures:

- Changes to the Registered Retirement Income Fund (RRIF) minimum withdrawal requirements that will allow them to defer tax on more of their savings.

- A new tax credit that will recognize costs of renovations that help seniors and persons with disabilities live independently and remain in their homes.

RRIF Changes

A Registered Retirement Savings Plan (RRSP) must be converted to a RRIF by the end of the year in which the RRSP holder reaches 71 years of age, and a minimum amount must be withdrawn from the RRIF annually beginning the year after it is established. Alternatively, RRSP savings can be used to purchase an annuity.

Helen turned 71 in 2014 and converted her RRSP to a RRIF at the end of that year. At the beginning of 2015, Helen's RRIF assets amounted to $100,000. Under the existing RRIF factors, Helen would have been required to withdraw a minimum amount of $7,380 from her RRIF in 2015. Under the new RRIF factors, the minimum amount Helen is required to withdraw from her RRIF in 2015 is reduced to $5,280.

Raymond was 75 at the start of 2015, at which time his RRIF assets amounted to $250,000. Under the existing RRIF factors, Raymond would have been required to withdraw a minimum amount of $19,625 from his RRIF in 2015. Under the new RRIF factors, the minimum amount Raymond is required to withdraw from his RRIF in 2015 is reduced to $14,550.

Similarly, the new RRIF factors will reduce the percentage of RRIF assets that Helen and Raymond are required to withdraw in subsequent years, until after they turn 95. By reducing their RRIF withdrawals, Helen and Raymond can retain more assets in their RRIFs—assets that will continue to accumulate on a tax-deferred basis to support their future retirement income needs should they live to an advanced age. In addition, if Helen and Raymond do not need their minimum RRIF withdrawal for income purposes, they can save the after-tax amount for future needs—for example, in a TFSA if they have available TFSA contribution room.

To determine the required minimum RRIF withdrawal, a percentage factor corresponding to the RRIF holder's age is applied to the value of the RRIF assets. RRIF holders can also base minimum withdrawals on the age of a spouse or common-law partner when the RRIF is established.

EAP 2015 proposes to adjust the RRIF minimum withdrawal factors that apply in respect of ages 71 to 94 to better reflect more recent long-term historical real rates of return and expected inflation. As a result, the new factors will be substantially lower than the existing ones.

The new factors will allow for greater preservation of RRIF capital to older ages, thereby reducing the risk for seniors of outliving their savings.

Home Accessibility Tax Credit

EAP 2015 proposes a new, permanent Home Accessibility Tax Credit. This proposed 15-per-cent non-refundable income tax credit would apply on up to $10,000 of eligible home renovation expenditures per year, providing up to $1,500 in tax relief. Eligible expenditures will be for improvements that allow a senior or a person who is eligible for the Disability Tax Credit to be more mobile, safe and functional within their home

Extending Compassionate Care Benefits

Through the Employment Insurance program, Compassionate Care Benefits provide financial assistance to people who have to be away from work temporarily to care for a family member who is gravely ill and at significant risk of death. EAP 2015 proposes to provide up to $37 million annually to extend Employment Insurance Compassionate Care Benefits from six weeks to six months.

With these and other measures, EAP 2015 is helping families keep more of their hard-earned money to

spend on their priorities.