Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Chapter 4.2: Strong Communities

Highlights

Supporting the Charitable and Non-Profit Sector

- Exempting donations involving private shares and real estate from capital gains tax.

- Providing charities with more flexibility to diversify their investments.

Taking Action for Veterans

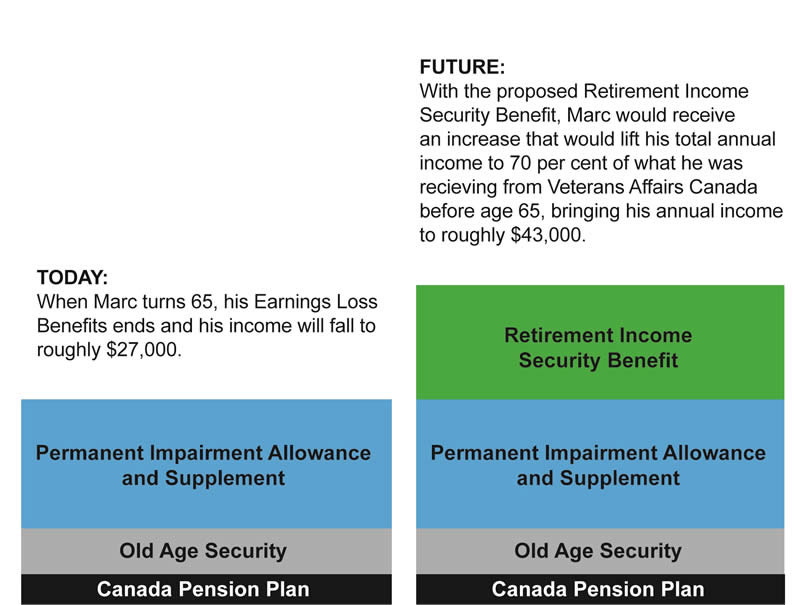

- Introducing a new Retirement Income Security Benefit to provide additional financial security after the age of 65 for moderately to severely disabled veterans.

- Expanding access to the Permanent Impairment Allowance to help compensate disabled veterans for the loss of career opportunities associated with their disabilities.

- Modifying the Earnings Loss Benefit to ensure that part-time Reserve Force veterans have access to the same level of income support as Regular and full-time Reserve Force veterans.

- Creating a new tax-free Family Caregiver Relief Benefit to recognize the vital contributions of informal caregivers to the health and well-being of veterans.

- Increasing the level of individualized care to veterans requiring regular support by improving the ratio of veterans to case managers.

Supporting the Most Vulnerable in Communities

- Providing $150 million over four years, starting in 2016–17, to allow cooperative and non-profit social housing providers to prepay long-term, non-renewable mortgages held with Canada Mortgage and Housing Corporation without penalty.

- Enhancing support for Child Advocacy Centres across Canada.

Helping Canadians With Disabilities

- Introducing a new Home Accessibility Tax Credit for persons with disabilities and seniors to help with the costs of ensuring their homes remain safe, secure and accessible.

- $2.0 million in 2015–16 to support stakeholder consultations on a Canadian Autism Partnership.

- Extending the temporary measure that allows a qualifying family member to become the plan holder of a Registered Disability Savings Plan.

- Introducing amendments to the Copyright Act that will enable Canada to implement and accede to the Marrakesh Treaty to Facilitate Access to Published Works for Persons Who Are Blind, Visually Impaired or Otherwise Print Disabled.

Investing in the Health of Canadians

- Increasing transfers for health care by a projected $27 billion over the next five years.

- Providing $14 million over two years for the Canadian Foundation for Healthcare Improvement to help identify efficiencies in the health system.

- Renewing the mandate of the Mental Health Commission of Canada for another 10 years, beginning in 2017–18.

- Providing up to $42 million over five years, starting in 2015–16, to help improve seniors’ health through innovation by establishing the Canadian Centre for Aging and Brain Health Innovation.

Investing in Aboriginal Communities

- Investing $30.3 million over five years for the expansion of the First Nations Land Management Regime to create further opportunities for economic development on reserve.

- Providing $200 million over five years, starting in 2015–16, to improve First Nations education.

- Providing $12 million over three years to Indspire to provide post-secondary scholarships and bursaries for First Nations and Inuit students.

- Investing $2 million per year ongoing for mental wellness teams in First Nations Communities.

Assisting International Communities

- $6 million over five years, starting in 2015–16, to introduce measures that will help ensure Canadians have access to safe, reliable and lower-cost remittance services.

- $22.8 million in 2016–17 for Grand Challenges Canada to continue its promising work towards solving global health challenges through innovation.

- Establishing the Development Finance Initiative to support effective international development by providing financing, technical assistance and business advisory services to firms operating in developing countries.

Celebrating Our Heritage

- Supporting activities and events to celebrate Canada’s 150th anniversary in 2017, with $210 million over four years, starting in 2015–16.

- Providing $13.4 million over five years, starting in 2015–16, and $2.8 million ongoing to support and modernize the Canadian Honours System and bring it closer to all Canadians.

- Investing up to $20 million over four years, beginning in 2016–17, to support the next generation of Canadian Olympic and Paralympic athletes.

- Promoting arts and culture at Toronto’s waterfront by providing $25 million over five years, beginning in 2016–17, to renew the Harbourfront Centre Funding Program.

- Proposing changes to the Copyright Act to extend the term of protection of sound recordings and performances.

Protecting Canada’s Environment

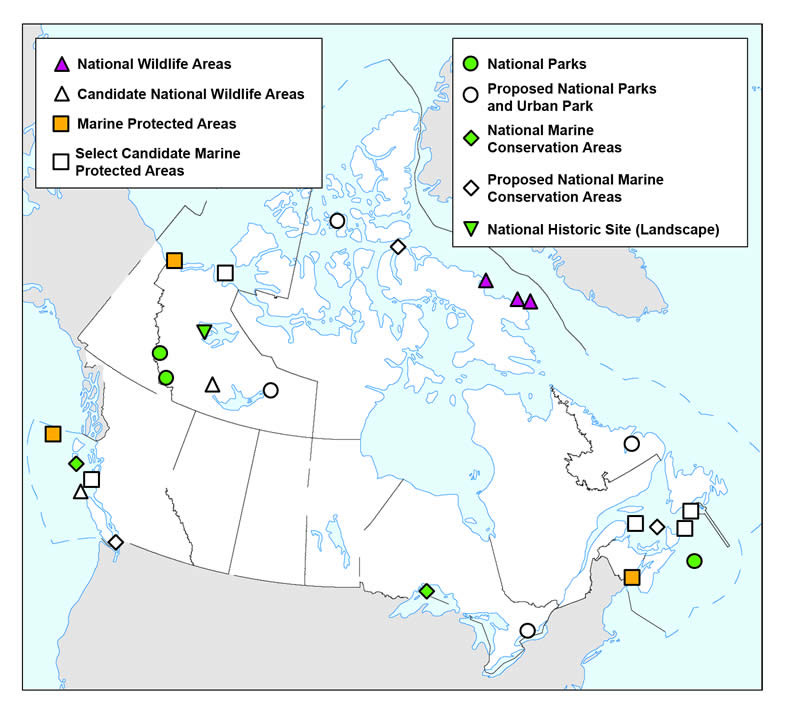

- Continuing to support, with $75 million over five years, starting in 2015–16, the implementation of the Species at Risk Act to protect Canada’s diverse species and secure the necessary actions for their recovery.

- Providing $2.0 million in 2015–16 to the Pacific Salmon Foundation to support the Salish Sea Marine Survival Project.

- Extending the Recreational Fisheries Conservation Program by providing $10 million per year for three years, starting in 2016–17, to support the conservation of recreational fisheries across the country.

- Dedicating $34 million over five years, starting in 2015–16, to continue to support meteorological and navigational warning services in the Arctic.

- Renewing the Chemicals Management Plan, with $491.8 million over five years, starting in 2016–17, to continue to assess and manage the risks to human health and the environment from new and existing chemical substances.

- Renewing support for the Federal Contaminated Sites Action Plan with $99.6 million over four years ($1.35 billion on a cash basis), starting in 2016–17.

Introduction

Economic Action Plan 2015 advances the Government’s ongoing commitment to improve the quality of life for all Canadians by promoting safe and healthy communities, celebrating our cultural heritage and protecting the environment with initiatives that will:

- Encourage charitable donations and provide greater investment flexibility to registered charities.

- Help the most vulnerable in our communities through support for social housing providers.

- Enhance support for Canadians with disabilities and their families.

- Help Aboriginal communities reach their economic potential, including through achieving better education outcomes for First Nations and Inuit youth.

- Ensure that Canada’s international assistance efforts are aligned with broader priorities and lead to concrete results for the world’s poorest.

- Build stronger communities by bringing people together through shared artistic and cultural experiences.

- Recognize our natural heritage by promoting a safe and clean environment.

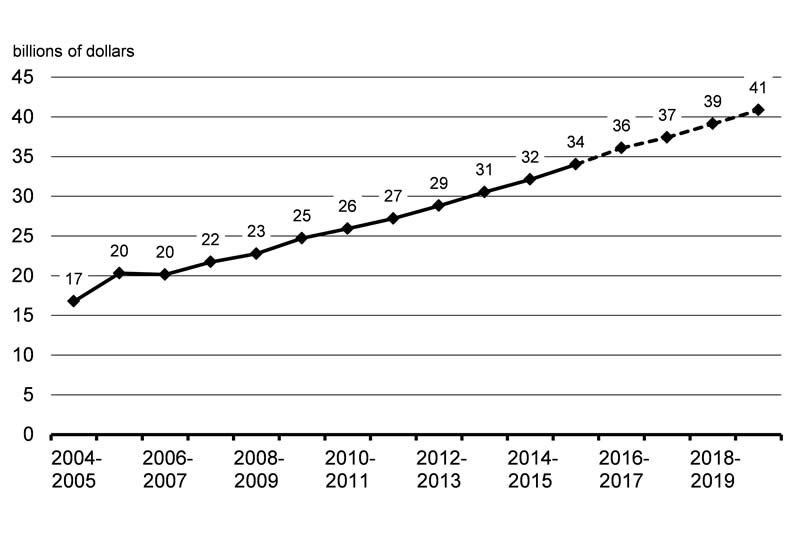

The Government also recognizes the important role major transfers play within the federation in helping to fund health care, education and social programs, an important part of building and maintaining strong families and communities. The four major transfers to provinces and territories will amount to almost $68 billion1 in 2015–16, an all-time high. This is an increase of more than $3 billion over 2014–15 and an increase of almost 63 per cent since 2005–06.

Equalization and Territorial Formula Financing ensure that all Canadians, wherever they live, have access to reasonably comparable services at reasonably comparable levels of taxation. Equalization will continue to grow in line with the economy, and Territorial Formula Financing will continue to grow based on its current formula.

The Government remains committed to a publicly funded, universally accessible health care system for Canadian families. As legislated in 2012, the Canada Health Transfer will continue to grow by 6 per cent annually until 2016–17. Starting in 2017–18, the Canada Health Transfer will grow in line with the economy, with funding guaranteed to increase by at least 3 per cent per year.

The Canada Social Transfer provides significant funding to provinces and territories in support of programs that touch the lives of every Canadian. The Canada Social Transfer supports the delivery of social assistance and social services that reduce poverty and protect vulnerable Canadians in our communities. It also supports the delivery of post-secondary education to Canadians preparing to enter the labour market and supports provinces and territories with early childhood development programs and the creation of child care spaces that are responsive to the needs of parents. Recognizing the importance of this funding, the Canada Social Transfer will continue to grow at 3 per cent per year.

Supporting the Charitable and Non-Profit Sector

The Government of Canada recognizes that the charitable and non-profit sector makes an enormous social and economic contribution to Canada. Organizations working in areas as diverse as health care and research, education, the arts, overseas development, environmental conservation and stewardship, amateur sport, and religious observation help to create the communities in which Canadians want to live. The charitable and non-profit sector is also an engine of economic activity, employing some two million Canadians across the country. Economic Action Plan 2015 proposes measures that build on existing support for Canada’s charitable sector by permitting charities to invest in limited partnerships and by providing a capital gains tax exemption for individual and corporate donors on the disposition of private shares or real estate.

Economic Action Plan 2015 also confirms the Government’s commitment to support social entrepreneurs through the social finance accelerator initiative.

Supporting the Charitable Sector

Charities receive significant assistance through the tax system. In particular, registered charities are exempt from tax on their income and may issue official donation receipts for gifts received. Individual donors can claim a tax credit, and corporations a deduction, for their charitable donations.

Since 2006, the Government has introduced a number of measures to encourage charitable giving and to reduce administrative complexity for the charitable sector. For instance:

- Donations of publicly listed securities and ecological gifts have been fully exempted from capital gains tax.

- A temporary First-Time Donor’s Super Credit is available on cash donations of up to $1,000 made before 2018, to encourage young Canadians and first-time donors to give to charity.

- To reduce the administrative burden on charities, the Government eliminated a number of disbursement quota requirements, allowing charities to focus more of their time and resources on charitable activities.

- The credit card fee reductions that the Government accepted from Visa and MasterCard in the fall of 2014 were targeted to help small businesses and charities.

We are delighted that Canada's charities are meant to benefit from a reduction in interchange fees, thereby ensuring that a higher percentage of donated funds, intended to support community initiatives, will assist a wide range of causes. This landmark agreement will both satisfy the intentions of donors and provide an injection of much needed funds to charitable organizations.

Building on these actions, Economic Action Plan 2015 proposes additional measures to support the charitable sector. The two measures described below respond further to the 2013 report of the House of Commons Standing Committee on Finance on charitable donation tax incentives. The Government looks forward to continuing to work with Imagine Canada and charities across Canada to find ways to help the sector thrive.

Exempting Donations Involving Private Shares and Real Estate From Capital Gains Tax

Economic Action Plan 2015 proposes a capital gains exemption in respect of private shares or real estate when sold and the proceeds donated to charity.

At present, donations of private shares and real estate to registered charities and other qualified donees can give rise to taxable capital gains. To help Canadians provide more gifts, Economic Action Plan 2015 proposes to exempt individual and corporate donors from tax on the sale of private shares or real estate to an arm’s length party if the proceeds are donated within 30 days. If a portion of the proceeds is donated, the exemption from capital gains tax would apply to that portion. This measure will apply to donations in respect of dispositions occurring after 2016.

[Broadening the tax exemption on capital gains] would benefit charitable organizations of all types – everything from hospitals, universities and cultural groups to the vast network of social service agencies funded by the United Way across the country. It’s a cost-effective way of unlocking more private wealth for the public good.

This new measure will build on previous measures by providing a significant new incentive to donate. It is estimated that this measure will reduce federal revenues by about $265 million over the 2016–17 to 2019–20 period.

Providing Charities With More Flexibility to Diversify Their Investments

Economic Action Plan 2015 proposes to permit charities to invest in limited partnerships.

Canadian charities, especially foundations, often invest a portion of their resources in long-term investments. Economic Action Plan 2015 proposes to permit charities to invest in limited partnerships. This would allow charities to diversify their investment portfolios to better support their charitable purposes. In addition, since limited partnerships are also used to structure some social impact investments, allowing investments in limited partnerships would give charities the flexibility to use more innovative approaches to address pressing social and economic needs in Canada. This proposal will also apply to registered Canadian amateur athletic associations.

It is estimated that this measure will reduce federal revenues by a small amount each year.

Social Finance Accelerator Initiative

Economic Action Plan 2015 confirms the Government’s commitment to support social entrepreneurs with innovative solutions and announces the implementation of a social finance accelerator initiative to help develop promising social finance proposals.

The Government recognizes that social entrepreneurs can be instrumental in addressing complex societal issues. Social finance is an innovative approach to mobilizing multiple sources of capital that delivers both a social value and an economic return. Facilitating new partnerships through social finance initiatives can help leverage expertise and innovation for the achievement of sustainable, long-term results in improving social and economic outcomes for Canadians.

Employment and Social Development Canada will implement a social finance accelerator initiative to help promising social finance proposals become investment-ready, attract private investment and turn social entrepreneurs’ proposals into action. Through this initiative, workshops, advisory services, mentorship, networking opportunities and investor introductions will help to fast-track promising social finance ventures to a greater stage of investment readiness.

Taking Action for Veterans

The Government of Canada is dedicated to ensuring that veterans and their families receive the support they need. With the implementation of the New Veterans Charter in 2006, the Government significantly increased the range of benefits and services it provides to ensure that disabled veterans not only receive compensation for the pain and suffering related to their disabilities, but that they also receive support aimed at restoring their ability to function at home, in their community and in the workplace.

Since implementing the Charter, the Government has made important improvements to the New Veterans Charter to adapt it to the needs of veterans, allocating close to $5 billion in additional resources to enhance veterans’ benefits, programs and services. This includes:

- Establishing a minimum pre-tax income of $42,426 for veterans receiving the Earnings Loss Benefit, which provides income replacement for disabled veterans.

- Introducing a new monthly supplement to help severely injured veterans who are permanently impaired and unable to return to gainful employment.

- Increasing the overall level of benefits provided to Disability Pension recipients by having the pension no longer offset other Veterans Affairs Canada and National Defence benefits.

- Expanding access to the Funeral and Burial Program for younger veterans.

- Improving online services.

- Enhancing employment opportunities in the federal public service for veterans and Canadian Armed Forces personnel.

- Expanding Veterans Affairs Canada’s network of Operational Stress Injuries clinics to better serve veterans suffering from mental health conditions.

Building on progress to date, the Government recently announced additional investments to significantly expand benefits and services for veterans and their families. These changes reaffirm the Government’s ongoing commitment to veterans and will help ensure that the New Veterans Charter continues to meet the increasingly complex and diverse needs of Canada’s veterans and their families.

Beginning in March 2015, the Government has announced a series of complementary improvements to the spectrum of benefits and supports available to veterans and their families. As a result of these actions:

- Moderately to severely disabled veterans—those who need it most—will be provided with continued assistance in the form of a new monthly Retirement Income Security Benefit beginning at age 65.

- More disabled veterans will receive lifetime support under the Permanent Impairment Allowance.

- Part-time Reserve Force veterans will receive the same level of income support under the Earnings Loss Benefit as Regular and full-time Reserve Force veterans.

- Family members taking care of seriously disabled veterans will have their contribution recognized through the new tax-free Family Caregiver Relief Benefit.

- Eligible veterans and Canadian Armed Forces members will receive a $70,000

tax-free benefit to recognize and compensate for the most severe and traumatic injuries or diseases. - Veterans suffering from severe and complex disabilities will have greater access to Veterans Affairs Canada’s case managers, who will have more time to provide dedicated one-on-one support.

- Veterans will receive faster decisions on their Disability Benefit applications.

Enhancing the New Veterans Charter

Economic Action Plan 2015 confirms significant new investments to enhance benefits for severely disabled veterans, provide fair treatment to part-time Reserve Force veterans and increase support for family caregivers.

Economic Action Plan 2015 confirms funding to create a new Retirement Income Security Benefit for moderately to severely disabled veterans who receive income replacement under the Earnings Loss Benefit or the Service Income Security Insurance Plan. This new benefit will provide additional financial security by guaranteeing that the income of eligible recipients after age 65 does not fall below 70 per cent of pre-65 income provided through National Defence’s Service Income Security Insurance Plan and through Veterans Affairs Canada’s Earnings Loss Benefit, Permanent Impairment Allowance and Permanent Impairment Allowance Supplement. This will ensure that moderately to severely disabled veterans have the necessary financial resources to maintain their quality of life in their retirement years.

Economic Action Plan 2015 also confirms an expansion of the Permanent Impairment Allowance. The Permanent Impairment Allowance is a financial benefit which is paid to veterans for life to compensate for the loss of employment potential and career advancement opportunities caused by disabilities suffered while serving in the Canadian Armed Forces. By expanding access to the program, the Government is ensuring that veterans who suffer from severe impairments receive compensation for the economic disadvantages associated with their disabilities.

John was medically released from the Canadian Armed Forces due to a severe service-related back condition. Despite severe and constant pain, he is able to perform his daily self-care activities himself without the aid of a caregiver, but very slowly and with the aid of medications.

John has received a Disability Award, receives an annual income from the Earnings Loss Benefit (at least $42,426), and is in Veterans Affairs Canada’s Rehabilitation Program.

Previously, John was not eligible for the Permanent Impairment Allowance, as he did not require assistance from a caregiver to perform activities like dressing, feeding and mobility.

As of April 1, 2015, the Permanent Impairment Allowance is now available to all Canadian Armed Forces veterans who have a permanent and severe disability even if they do not require assistance to perform daily activities. Because of this change, John will now be entitled to receive additional income of at least $7,016 per year from the Permanent Impairment Allowance.

In addition, Economic Action Plan 2015 confirms funding to create a Critical Injury Benefit. This new benefit would provide a tax-free lump-sum amount of $70,000 to compensate eligible Canadian Armed Forces members and veterans for the immediate consequences of very severe and traumatic injuries sustained in the line of duty.

The Government also wishes to recognize the important contribution made by Canadian Armed Forces Reserve Force members. As such, Economic Action Plan 2015 confirms modifications to the Earnings Loss Benefit to ensure that part-time Reserve Force veterans have access to the same level of income support as Regular and full-time Reserve Force veterans while they rehabilitate and transition to civilian life. This improvement will also increase the value of the Retirement Income Security Benefit that a disabled Reservist could be eligible for at age 65.

Greg was a part-time Reservist who was injured in a training exercise. As a result of his injuries, he was medically released and was deemed eligible for the Earnings Loss Benefit.

Previously, Greg was receiving an Earnings Loss Benefit of $24,300 annually. Starting April 1, 2015, Greg’s income support will be calculated in the same way as any other Regular or full-time Reserve Force veteran. As a result, his annual Earnings Loss Benefit would increase to a minimum of $42,426, almost double what he was receiving before. This is in addition to other benefits he may receive under the improved New Veterans Charter.

To further support rehabilitation of our veterans, the Government has expanded vocational training in order to provide eligible veterans with the flexibility to pursue new career directions that are not directly linked to skills developed during their military service.

The Government also recognizes that families, and in particular informal caregivers, provide significant and often underappreciated support to Canadian Armed Forces members and veterans. To better recognize this important contribution, Economic Action Plan 2015 confirms funding to create a new tax-free Family Caregiver Relief Benefit to seriously disabled veterans requiring daily assistance from an informal caregiver. The new benefit would provide annual financial support of $7,238 to eligible veterans so that they can purchase services to allow respite for their informal caregiver. The Government is proposing to create an interactive online workshop for caregivers of veterans with a physical or mental health condition.

The budgetary projection reflects the costs associated with amendments to veterans benefit plans. These costs incorporate the accrued value of future benefit payments to eligible veterans, which must be recognized up-front, consistent with public sector accounting standards.The value of the overall commitment that the Government is making to veterans through these measures is estimated at $2.5 billion over six years, starting in 2014–15. These amounts have been incorporated into the Government’s budgetary projection. By recording $2.5 billion at this stage, the Government is setting aside funding to ensure that enhanced benefits will be available to veterans and their families in the years ahead.

Of this amount, the Government expects—based on current projections of demand from veterans—that $85.5 million over five years, starting in 2015–16, will flow to veterans in the form of increased benefits and services. The cash value of benefits provided to veterans will significantly increase over time. For example, as more modern-day veterans reach 65 they will become eligible for financial support under the Retirement Income Security Benefit.

Improving Services to Veterans

Economic Action Plan 2015 confirms additional resources of $193.4 million over five years, starting in 2015–16, to Veterans Affairs Canada to continue to improve its service delivery to veterans and their families.

The Government of Canada places the highest priority on service excellence by making sure veterans and their families have the support and services they need, when they need them. Recognizing that increasing numbers of veterans are coming forward with complex disabilities that require a higher level of care, Economic Action Plan 2015 confirms additional investments to ensure that Veterans Affairs Canada can continue to improve its services.

Specifically, Economic Action Plan 2015 confirms funding to increase the level of dedicated one-on-one support provided by Veterans Affairs Canada’s case managers to veterans suffering from severe and complex disabilities. The Government will deliver on this commitment by reducing caseloads to an average of 30 veterans for each case manager and by hiring more than 100 permanent case managers. This will allow case managers to dedicate more time and attention to meeting the individual needs of veterans.

Economic Action Plan 2015 also confirms funding to hire more than 100 new disability benefits staff, both temporary and permanent, to ensure veterans receive faster decisions on Disability Benefit applications. Faster decisions on Disability Benefit applications will in turn expedite access to other financial benefits, health care and mental health treatment.

To implement these commitments, Economic Action Plan 2015 proposes to invest up to $193.4 million over the next five years.

Supporting the Most Vulnerable in Communities

Economic Action Plan 2015 builds on previous actions by the Government to support the most vulnerable members of our communities through targeted investments to support social housing and youth who are victims of crime.

Cooperative and Non-Profit Social Housing

Economic Action Plan 2015 proposes to provide $150 million over four years, starting in 2016–17, to support social housing in Canada by allowing social housing providers to prepay their long-term, non-renewable mortgages without penalty.

The Government recognizes the need for low-income families and other vulnerable Canadians to have access to quality and affordable housing options, including

co-operative and non-profit housing units. However, many co-operative and

non-profit social housing providers hold long-term, non-renewable loans at interest rates well above the current national average, making it difficult for them to refinance their outstanding mortgage balance and access additional funds for capital repairs without incurring significant penalties.

Building upon the prepayment flexibilities for co-operative and non-profit social housing providers announced in 2013, Economic Action Plan 2015 proposes to provide further support to social housing providers by eliminating the mortgage prepayment penalty on long-term, non-renewable loans held with Canada Mortgage and Housing Corporation. This initiative will enable eligible co-operative and non-profit social housing providers to access private sector loans with more favourable interest rates, significantly reducing their mortgage expenses. For example, a social housing provider with an outstanding mortgage balance of $450,000 with an interest rate of 9 per cent that is able to refinance at an interest rate of 5 per cent will see a reduction in their annual mortgage expenses of over $11,000 in the first year without incurring a prepayment penalty. Lower mortgage expenses will assist social housing providers to undertake capital repairs and renovations to help improve the condition and quality of affordable housing units.

Federal Support for Affordable Housing

Economic Action Plan 2015 reaffirms the Government’s commitment to ensuring

low-income families and vulnerable Canadians in need have access to affordable housing options.

The Government is committed to ensuring that the housing needs of low-income and vulnerable Canadians are met. Through targeted investments, the Government works with provincial and territorial governments, First Nations, not-for-profit organizations and other stakeholders at the community level to increase the supply, quality, accessibility and affordability of housing across Canada.

Overall, the Government will spend more than $2.3 billion per year over the next four years to help ensure Canadians in need have access to affordable, sound and suitable housing. Of this amount, Canada Mortgage and Housing Corporation will invest $1.7 billion annually to support 570,000 households that depend on social housing support, both off and on reserve. In addition, about $170 million per year will be provided to First Nations to support the construction, rehabilitation, and renovation of affordable housing on reserves and to enhance the management of the housing stock through Canada Mortgage and Housing Corporation and Aboriginal Affairs and Northern Development Canada.

Further, Economic Action Plan 2013 announced $253 million per year, beginning in April 2014, to extend the Investment in Affordable Housing to March 31, 2019. Under this initiative, provinces and territories match federal investments and have the flexibility to design and deliver programs that are tailored to address their local housing needs and pressures. Since the introduction of the Investment in Affordable Housing in 2011, over 205,000 households have benefitted from the initiative.

Economic Action Plan 2013 also provided $119 million per year over five years to renew the Homelessness Partnering Strategy until 2018–19. Using a Housing First approach, support is provided to assist homeless individuals transition from shelters and the streets into stable housing.

In addition to the federal investment in affordable housing, Canada Mortgage and Housing Corporation’s Direct Lending activities offer low-cost loans to federally assisted social housing projects, including to First Nations on reserves. In 2013, over $1.126 billion was provided in direct loans.

Child Advocacy Centres

Economic Action Plan 2015 proposes to enhance support to Child Advocacy Centres across Canada.

The Government is taking further steps to ensure that victims of crime are at the heart of Canada’s judicial system.

Economic Action Plan 2015 proposes to build on the Government’s investments by providing additional support for Child Advocacy Centres through the Victims Fund. Child Advocacy Centres deliver community-based programs that address the needs of young victims of or witnesses to crime. This would help establish new centres, and expand existing centres, to ensure that more children and families receive the care and help they need to recover from victimization and navigate the justice system.

Helping Canadians With Disabilities

The Government of Canada has a strong record of supporting individuals with disabilities and their families through a number of tax measures and programs. Canada is recognized globally for its innovative supports, including the landmark Registered Disability Savings Plan (RDSP), along with the Canada Disability Savings Grant (CDSG) and Canada Disability Savings Bond (CDSB) programs. The RDSP was introduced in Budget 2007 under the strong leadership of the late Honourable Jim Flaherty, who left a lasting legacy of support for the disabilities community.

The RDSP allows individuals with disabilities—and their families—to better save for their future. Contributions to an RDSP are permitted to a lifetime maximum of $200,000. Annual RDSP contributions attract CDSGs at matching rates of 100, 200 or 300 per cent, depending on the beneficiary’s family income and the amount contributed, up to a lifetime maximum of $70,000. The Government of Canada also provides up to $1,000 in CDSBs annually to RDSPs established by low- and modest-income families, up to a lifetime maximum of $20,000. This important policy innovation is helping to give individuals with disabilities, and their families, peace of mind about their long-term financial security.

Beyond the RDSP, support for individuals with disabilities introduced by the Government since 2006 has included:

- Helping individuals with disabilities enter the workforce through funding for the Labour Market Agreements for Persons with Disabilities, the Opportunities Fund, and innovative programs like the Ready, Willing, & Ableinitiative of the Canadian Association for Community Living.

- Providing additional tax relief through an expanded Medical Expense Tax Credit and the new Family Caregiver Tax Credit, amongst others.

- Tackling growing trends in the disabilities community, such as Autism Spectrum Disorders, by investing in research and partnering with community organizations to develop targeted programs like the CommunityWorks vocational training program for individuals with Autism Spectrum Disorder.

Economic Action Plan 2015 builds on the Government’s support for persons with disabilities through new initiatives, including the introduction of a new Home Accessibility Tax Credit for persons with disabilities and seniors. This credit will provide tax relief for the cost of improvements to a home that allow a person who is eligible for the Disability Tax Credit, or a senior, to be more mobile, safe and functional within their home (see Chapter 4.1 for additional information).

Economic Action Plan 2015 proposes to provide $2.0 million in 2015–16 to support a working group tasked with the development of a Canadian Autism Partnership.

Economic Action Plan 2015 also proposes an extension of the temporary measure that allows a qualifying family member to become the plan holder of an RDSP for an adult individual who might not be able to enter into a contract.

In addition, Economic Action Plan 2015 proposes amendments to the Copyright Act to implement and accede to the Marrakesh Treaty to Facilitate Access to Published Works for Persons Who Are Blind, Visually Impaired or Otherwise Print Disabled.

The Government of Canada recognizes the challenges facing individuals with disabilities and their families.

The Government also recognizes the contributions that persons with disabilities can and do make to the economy, and that employment provides all individuals with a sense of dignity and independence.

Under the strong leadership of the late Minister of Finance, the Honourable Jim Flaherty, the Government of Canada has built a strong record of support for individuals with disabilities. This support includes:

- Introducing the landmark Registered Disability Savings Plan, which allows individuals with disabilities—and their families—to better save for their long-term financial security.

- Investing $222 million per year for Labour Market Agreements for Persons with Disabilities to assist provinces and territories in improving the employment situation of Canadians with disabilities.

- Investing $40 million annually in the Opportunities Fund to help persons with disabilities prepare for, obtain and maintain employment.

- Supporting caregivers and recognizing their enormous contribution through tax measures.

- Providing $15 million over three years to the Ready, Willing & Able initiative of the Canadian Association for Community Living to connect persons with development disabilities with jobs, as announced in Economic Action Plan 2014.

- Removing the Goods and Services Tax/Harmonized Sales Tax on more health care products and services, including acupuncture and naturopathic services, eyewear specially designed to electronically enhance the vision of individuals with vision impairment, and special training to help individuals cope with the effects of a disorder or disability.

- Expanding tax relief under the Medical Expense Tax Credit, including costs associated with service animals trained to help people with diabetes (i.e., diabetes alert dogs) and the design of specialized therapy plans to help individuals with the effects of a disorder or disability.

Going forward, the Government remains committed to providing support to Canadians of all abilities.

Taking Action on Autism Spectrum Disorder

Economic Action Plan 2015 proposes to provide $2.0 million in 2015–16 to support the development of a Canadian Autism Partnership.

Autism Spectrum Disorder (“autism”) is widely considered the fastest growing neurological disorder in Canada, impacting an estimated 1 in 68 children. It is a lifelong diagnosis that manifests itself in a wide-range of symptoms, including difficulty communicating, social impairments, and restricted and repetitive behaviour. Individuals with autism and their families face unique challenges over their lifespan, often leading to families in crisis situations. The Government recognizes these challenges and recognizes that Autism Spectrum Disorder is not just a health issue—it has overarching implications for Canadian society as a whole.

Economic Action Plan 2015 proposes to provide $2.0 million in 2015–16 to create a working group, led by the Minister of Health, to consult with stakeholders including the Canadian Autism Spectrum Disorder Alliance, on the development of a Canadian Autism Partnership. Of the $2.0 million in funding, $1.5 million would be used to support stakeholder participation in the working group. This working group will be tasked with the development of a plan for the Canadian Autism Partnership that would address key issues such as information sharing and research, early detection, diagnosis and treatment, and supporting families.

The Government of Canada recognizes that Canadians with Autism Spectrum Disorders (ASDs) and their families face unique challenges. ASDs are widely considered the fastest growing neurological disorders in Canada, and the Government has taken action to support autism research, coordination, and support for employment opportunities.

The Government’s record of support for individuals with autism includes:

- Providing $100 million in Economic Action Plan 2011 for the Canada Brain Research Fund, administered by Brain Canada, to support world-leading neuroscience research, foster collaborative research initiatives, and accelerate the pace of discovery in order to improve the health and quality of life of Canadians who suffer from brain disorders, including ASDs.

- Announcing the establishment of a National Surveillance System to establish reliable data to determine how common ASDs are and how rates differ across Canada, describe the population of Canadians living with ASDs, and understand changes in the number of children being diagnosed over time.

- Launching a Research Chair in Autism Spectrum Disorders Treatment and Care Research Program, in partnership with the Canadian Institutes of Health Research Institute of Neurosciences, Autism Speaks Canada, the Canadian Autism Spectrum Disorders Alliance, and NeuroDevNet.

- Announcing in Economic Action Plan 2014 that the Government would provide $11.4 million over four years to support the expansion of vocational training programs for individuals with ASDs.

Registered Disability Savings Plans—Legal Representation

Economic Action Plan 2015 proposes to extend, until the end of 2018, the temporary federal measure that allows a qualifying family member to become the plan holder of a Registered Disability Savings Plan for an adult individual who might not be able to enter into a contract.

The Registered Disability Savings Plan (RDSP)—a tax-assisted savings vehicle introduced in Budget 2007—is widely regarded as a major policy innovation in helping to ensure the long-term financial security of Canadians with severe disabilities. Since becoming available in 2008, over 100,000 RDSPs have been opened.

However, some adults with disabilities have experienced difficulties in establishing an RDSP because their capacity to enter into a contract is in doubt. In some provinces and territories, the only way an RDSP can be opened in such cases is for the individual to be declared legally incompetent and to have someone named as their legal guardian—a potentially lengthy and expensive process that could have significant repercussions for the individual.

To address this issue, Economic Action Plan 2012 allowed—on a temporary basis until the end of 2016—a qualifying family member (i.e., a beneficiary’s parent, spouse or common-law partner) to become the plan holder of the RDSP for an adult individual who may lack the capacity to enter into a contract.

While the temporary measure has facilitated greater access to RDSPs, it does not represent a complete solution because only those potential RDSP beneficiaries who have parents, spouses or common-law partners can benefit. In addition, under provincial and territorial trust law, withdrawals from RDSPs must be paid to the beneficiary of the plan or his or her legal representative.

Some provinces and territories have already instituted streamlined processes that allow for the appointment of a trusted person to manage resources on behalf of an adult who lacks contractual capacity, or have indicated that their system already provides sufficient flexibility to address this concern. In this regard, the Government of Canada recognizes the leadership shown by the governments of British Columbia, Alberta, Saskatchewan, Manitoba, Newfoundland and Labrador, Yukon and the Northwest Territories.

The Government of Canada also appreciates the work that the Government of Ontario has undertaken with the Law Commission of Ontario to develop a streamlined process for establishing a legal representative for RDSP beneficiaries.

The Government of Canada continues to encourage the governments of other jurisdictions to take prompt action to facilitate and simplify the process of establishing RDSPs for adults who might not be able to open a plan due to concerns about their ability to enter into a contract.

In recognition of the need for time to develop a solution that is suitable for a jurisdiction’s needs, Economic Action Plan 2015 proposes to extend the temporary measure introduced in Economic Action Plan 2012 by two years, to apply to the end of 2018.

Improving Access to Print Materials for the Visually Impaired

The Government will propose amendments to the Copyright Act to implement and accede to the Marrakesh Treaty to Facilitate Access to Published Works for Persons Who Are Blind, Visually Impaired or Otherwise Print Disabled.

The ability to access printed information is essential to prepare for and participate in Canada’s economy, society and job market. According to Statistics Canada, approximately 1 million Canadians live with blindness or partial sight. The Government will propose amendments to the Copyright Act to implement and accede to the Marrakesh Treaty to Facilitate Access to Published Works for Persons Who Are Blind, Visually Impaired or Otherwise Print Disabled (the Marrakesh Treaty). Aligning Canada’s copyright limitations and exceptions with the international standard established by the Marrakesh Treaty would enable Canada to accede to this international agreement. Once the treaty is in force, as a member country, Canadians would benefit from greater access to adapted materials.

Investing in the Health of Canadians

The Government is committed to improving the health of Canadians and has supported innovation in the health care system by funding health innovation research.

Most recently, the Minister of Health created the Advisory Panel on Healthcare Innovation in June 2014 to look at innovation in health care and how the Government can support efforts to improve the delivery of high-quality health care at an affordable and sustainable cost to Canadians. The Advisory Panel’s recommendations and the final report are expected no later than the end of May 2015.

Economic Action Plan 2015 proposes to provide funding to support health system innovation and research to address specific health issues affecting many Canadians and their families, particularly mental health.

Supporting Health Care in Canada

The Government will increase the Canada Health Transfer by a projected total of $27 billion over the next five years, from $32.1 billion in 2014–15 to $40.9 billion in 2019-20.

The Government of Canada is committed to a publicly funded, universally accessible health care system that is strong and sustainable. The Canada Health Transfer is the largest major transfer to the provinces and territories. It provides long-term predictable funding for health care, and supports the principles of the Canada Health Act—universality, comprehensiveness, portability, accessibility and public administration, as well as the prohibition of extra-billing and user charges.

Provincial and territorial governments are working to ensure that health care systems are on sustainable spending paths. Recent data from the Canadian Institute for Health Information shows that growth in provincial and territorial health expenditures is projected to average just under 3 per cent per year over the 2010 to 2014 period.

The Government remains committed to growing the Canada Health Transfer on a sustainable and predictable path going forward. Funding for health care is legislated to continue to grow from 2017–18 in line with the growth of the economy with a guaranteed increase of at least 3 per cent each year. As a result, the Canada Health Transfer is projected to grow from $32.1 billion in 2014–15 to $40.9 billion in 2019–20. This represents a projected total additional investment of $27 billion over the next five years. This will ensure that the Government’s long-term fiscal position is sustainable, while also providing certainty and stability to the provinces and territories.

In addition to the cash transfer support provided to provinces and territories in support of health care, the Government will continue to provide health-related tax credits and direct spending initiatives. In 2014–15, the Government provided almost $9 billion for these measures, which includes support for First Nations’ and veterans’ health care, health protection, disease prevention and health-related research.

Health System Innovation: Canadian Foundation for Healthcare Improvement

Economic Action Plan 2015 proposes to provide $14 million over two years, starting in 2015–16, to provide targeted support for innovations in health systems.

Health spending across Canadian jurisdictions has stabilized in recent years after an extended period of growth. In order to ensure the health system is affordable, innovation is critical to the continued delivery of high quality care.

Economic Action Plan 2015 proposes to provide $14 million over two years, starting in 2015–16, for the Canadian Foundation for Healthcare Improvement to support applied health services research and to support the Foundation’s work to identify savings and efficiencies in the health system. One of its priorities will be evaluating and disseminating data about best practices with respect to palliative care services.

As outlined in Chapter 3.1, Economic Action Plan 2015 also proposes to provide $15 million per year ongoing, starting in 2016–17, for the Canadian Institutes of Health Research to continue to expand the Strategy for Patient-Oriented Research and support additional research to better understand and address the health challenges posed by anti-microbial resistant infections.

The Government supports health research primarily through the Canadian Institutes of Health Research (CIHR). With an annual budget of $1 billion, the CIHR is the single largest investor in health research and innovation in Canada. The organization works in collaboration with a wide range of Canadian and international partners and supports more than 13,700 health researchers and trainees across Canada. Work funded by the CIHR advances the understanding of human health and disease and enhances the capacity to provide accessible, affordable and reliable health care services.

In 2013–14, the CIHR awarded more than 3,600 operating grants that fuelled the ideas and supported the research teams of 6,844 investigators. This includes significant funding to support priority research areas to improve the health and well-being of Canadians:

- $161 million in cancer research funding to prevent and combat this devastating disease.

- $97 million in research focusing on children’s health issues.

- $71 million in cardiovascular and stroke research.

- $55 million to support research related to mental health and behavioural conditions as well as traumatic brain injuries.

- $53.3 million in stem cell research, recognizing the unique capacity of these cells to renew themselves and their potential to provide treatments for a number of conditions and injuries.

- $43.2 million in diabetes-related research.

- $37.8 million in research on Alzheimer's disease and related dementias.

- $30.7 million in Aboriginal health research to improve and promote the health of First Nations, Inuit and Métis peoples in Canada.

Mental Health Commission of Canada

Economic Action Plan 2015 announces the Government’s intention to renew the mandate of the Mental Health Commission of Canada for another 10 years, beginning in 2017–18.

The Mental Health Commission of Canada, established in 2007, is an arm’s length not-for-profit corporation that supports improvements in the mental health system in Canada. The Commission has achieved a number of important milestones since 2007, including creating a national mental health strategy, developing a national anti-stigma initiative to help reduce discrimination faced by Canadians living with a mental illness, and establishing a knowledge exchange centre as a source of information for governments, stakeholders and the public. The Commission has also been involved in training Canadians on how to respond to mental health crises, and developing best practices to help Canadians facing mental health and homelessness challenges.

Economic Action Plan 2008 provided one-time funding of $110 million for the Commission to support innovative research demonstration projects to develop best practices to help Canadians facing mental health and homelessness challenges.

Economic Action Plan 2015 announces the Government’s intention to renew the mandate of the Mental Health Commission of Canada for another 10 years, beginning in 2017–18 so that the Commission can continue its important work to promote mental health in Canada and foster change in the delivery of mental health services, including suicide prevention. Following consultations with stakeholders, including Partners for Mental Health, the Minister of Health will be outlining the new mandate and direction of the Commission in the coming months.

Mental illness does not discriminate, anyone can be affected. Approximately one in five Canadians are affected by mental illness.

Improving Seniors’ Health Through Innovation

Economic Action Plan 2015 proposes to provide up to $42 million over five years, starting in 2015–16, to help establish the Canadian Centre for Aging and Brain Health Innovation.

As Canada’s population ages, age-related cognitive impairment and chronic conditions are becoming more prevalent; the burden on families is vast and continues to grow. Research on aging and brain health issues such as dementia can lead to better diagnostic tools and more effective treatments that improve Canadians’ quality of life.

Economic Action Plan 2015 proposes to provide up to $42 million over five years, starting in 2015–16, to Baycrest Health Sciences, based in Toronto, to support the establishment of the Canadian Centre for Aging and Brain Health Innovation. This funding includes $32 million in support from the Federal Economic Development Agency for Southern Ontario. In addition to providing world-class geriatric health care, Baycrest is home to a leading academic health sciences centre, affiliated with the University of Toronto and collaborating with research institutions across North America. Researchers at Baycrest have developed a free online tool to test memory function and help detect changes in cognition. The Cogniciti test is a “thermometer for the mind” and can help people with concerns about memory loss to evaluate whether or not to discuss the issue with a doctor. Working in collaboration with important stakeholders, this funding will support new research and the development of products and services to support brain health and aging.

This investment builds upon the government’s strong record of investments in research and support for Canadians suffering from dementia and other neurodegenerative diseases.

The Canadian Centre for Aging & Brain Health Innovation will be a specialized R&D organization that provides unparalleled access to communities of users in key elder-care settings.

The Government of Canada recognizes the importance of improving the quality of life of individuals living with Alzheimer’s disease and dementia, their families and caregivers. The Government continues to show leadership at national and international levels with the ambition of finding a cure to dementia by 2025.

The Government’s record of support for Canadians with Alzheimer’s disease and dementia includes:

- Announcing in Economic Action Plan 2014 the creation of the Canadian Consortium on Neurodegeneration in Aging (CCNA). The CCNA has brought together some of the brightest minds in Canadian research to make a difference in the quality of life and treatment for those suffering from neurodegenerative diseases.

- Hosting the Canada-France Global Dementia Legacy Event, one of four such events stemming from the 2013 Summit on Dementia held in London, U.K. The Legacy Event brought together global dementia experts, as well as people living with dementia and family members to further action on translating research into solutions that will lead to prevention, treatment, research and better care for individuals living with dementia.

- Launching the National Dementia Research and Prevention Plan to continue the momentum on making vital discoveries to improve the standards of care and reduce the burden on families caring for a loved one suffering from dementia. The Plan outlines the Government of Canada’s investments, partnerships and key initiatives related to dementia research and prevention.

- Working with the Alzheimer Society of Canada to bring Dementia Friends, a community-based program successfully implemented in Japan and the United Kingdom to make daily life better for those living with dementia, to Canada this year. Dementia Friends will help Canadians become better informed about how they can support people living with dementia in their communities.

- Releasing Mapping Connections: An Understanding of Neurological Conditions in Canada, which presents the findings from the most comprehensive study of neurological conditions ever to be conducted in Canada. The National Population Health Study of Neurological Conditions is a four-year, $15 million undertaking led by the Public Health Agency of Canada in partnership with Neurological Health Charities of Canada, a collaborative of 24 charities representing individuals and families impacted by neurological conditions across the country.

- Continuing to work with provincial and territorial Health Ministers and stakeholders to develop a national dementia plan. As a first step, Ministers will bring research and best practices together and present them at the next Health Ministers Meeting.

We must continue to work together to stem the tide and improve our understanding of these conditions, to alleviate the suffering it causes. I applaud organizations like the Alzheimer Society of Canada for the work they are doing and look forward to bringing initiatives like Dementia Friends to Canada.

We see great opportunity to partner with (the) Canadian Centre for Aging & Brain Health Innovation to co-develop education assets, translate knowledge, and disseminate expertise to our stakeholders.

Investing in Aboriginal Communities

The Government recognizes that in order to reach their full potential, Aboriginal peoples need support to build strong communities. Economic Action Plan 2015 proposes to provide funding for additional First Nations communities on reserve to be able to enact their own land management laws that can help unlock economic development potential. To help Aboriginal peoples achieve increased economic opportunity and greater self-reliance, Economic Action Plan 2015 proposes funding to help First Nations to achieve better education outcomes and for post-secondary scholarships for First Nations and Inuit students delivered by Indspire. These proposals would complement the $500 million investment to construct and renovate schools on reserve announced in November 2014.

First Nations Land Management

Economic Action Plan 2015 proposes to provide $30.3 million over five years for the expansion of the First Nations Land Management Regime to create further opportunities for economic development on reserve.

Enabling First Nations communities to enact their own land management laws can help unlock the significant economic development potential of reserve lands. Economic Action Plan 2013 invested $9 million over two years for the expansion of the First Nations Land Management Regime to provide additional First Nations with the opportunity to manage the development, conservation, use and possession of reserve lands. This has added 36 First Nations to the regime, bringing the total number of First Nations to 94 across the country that are taking advantage of this opportunity. Building on this investment, Economic Action Plan 2015 proposes to provide $30.3 million over five years, which is expected to lead to an additional 25 First Nations joining the First Nations Land Management Regime.

To further increase economic opportunities for First Nations on reserve, the Government will also be moving forward with amendments to the First Nations Fiscal Management Act.

Improving First Nations Education

Economic Action Plan 2015 proposes to provide $200 million over five years, starting in 2015–16, to improve First Nations education.

Earning a high school diploma is an important achievement that opens the door to a range of education, training and work opportunities. Economic Action Plan 2015 proposes to provide $200 million over five years, starting in 2015–16, to help support First Nations to achieve better education outcomes, including building partnerships with provincial school systems. The proposed investment in the Strong Schools, Successful Students Initiative will support the First Nation Student Success Program and the Education Partnerships Program.

This builds on the Government’s investment of $500 million for the construction and renovation of schools on reserve, which was announced in November 2014.

The Government remains committed to working with willing First Nations partners and provinces to improve First Nations educational outcomes so that students living on reserve are better placed to reach their potential.

Indspire

Economic Action Plan 2015 proposes to provide $12 million over three years to Indspire to provide post-secondary scholarships and bursaries for First Nations and Inuit students.

Indspire has a proven record of success, providing scholarships and bursaries to thousands of Aboriginal students each year and raising significant support from a range of corporate donors to help support student success.

Building on a similar investment as part of Economic Action Plan 2013, Economic Action Plan 2015 proposes to provide $12 million over three years to Indspire for post-secondary scholarships and bursaries for First Nations and Inuit students. At least $1 million of this amount will be devoted to supporting students pursuing an education in the skilled trades.

With this new investment, Indspire will be able to provide scholarships to thousands more Aboriginal youth, helping them reach their potential and strengthen Aboriginal communities across the country.

Sustained Support for Mental Health Services in First Nations Communities

Economic Action Plan 2015 proposes to provide $2 million per year ongoing, beginning in 2016–17, for mental wellness teams serving First Nations communities.

Good mental health helps people realize their full potential, contributes to strong communities and helps support a more productive economy.

Economic Action Plan 2015 proposes to provide ongoing funding of $2 million per year, beginning in 2016–17, to support specialized mental health services in First Nations communities. The proposed investment will continue support for four multidisciplinary mental wellness teams, ensuring the presence of a team in each region served by Health Canada. The teams provide specialized and culturally appropriate treatment to individuals living in First Nations communities who are facing mental health issues. The proposed investment complements the Government’s annual investment of approximately $235 million per year for community-based mental health and addiction programs for First Nations and Inuit.

Surveys on Aboriginal People

Economic Action Plan 2015 proposes to provide $33.2 million over four years starting in 2016–17 to support the Surveys on Aboriginal People.

The Surveys on Aboriginal People collect socio-economic and demographic information on the Aboriginal population both on and off reserve. Economic Action Plan 2015 proposes to provide $33.2 million over four years starting in 2016–17 to continue the surveys. Of this amount, $22.3 million will be provided from the existing resources of Aboriginal Affairs and Northern Development Canada, Employment and Social Development Canada and Health Canada. The proposed investment will allow the collection of information on Aboriginal participation in the economy, the focus of the next surveys, which will cover the period 2016–17 to 2020–21. The next surveys will also provide other key socio-economic information including income, mobility and health. Federal, provincial and municipal governments, as well as Aboriginal communities and organizations, will be able to use the results of the surveys to help design their programming.

Assisting International Communities

The Government of Canada is focused on addressing key international development challenges, and ensuring that Canada’s international assistance efforts are aligned with broader priorities and lead to concrete results for the world’s poorest. The Government also continues to take steps to improve, including through relevant legislative amendments, the effectiveness, coherence and accountability of Canada’s assistance.

Economic Action Plan 2015 proposes to make targeted investments to help reduce the cost of sending remittances from Canada and to support the innovative work of Grand Challenges Canada. Economic Action Plan 2015 also proposes to expand Canada’s development finance capability by creating the Development Finance Initiative.

Ensuring That Canadians Have Access to Safe, Reliable and Lower-Cost Remittance Services

Economic Action Plan 2015 proposes to provide $6 million over five years, starting in 2015–16, to introduce measures that will help ensure Canadians have access to safe, reliable and lower-cost remittance services.

Remittances represent an important source of income for families in the developing world and can help pay for essential needs such as nutrition, education and health care. Economic Action Plan 2015 proposes to provide $6 million over five years, starting in 2015–16, to introduce measures that help ensure Canadians have access to safe, reliable and lower-cost remittance services when sending money to family and friends living in developing countries. This includes establishing a remittance price comparison website that will increase transparency by providing information on fees charged across service providers, allowing users to make informed decisions. In addition, through Statistics Canada and the Department of Foreign Affairs, Trade and Development, the Government will take steps to gather data on remittance flows from Canada to better understand the needs of Canadian remitters. The Government will also work with financial institutions to evaluate possible collaboration opportunities to expand access to lower-cost remittance services.

Corridor |

Volume from Canada ($US millions) |

|---|---|

| Philippines | 2,075 |

| Vietnam | 843 |

| Sri Lanka | 482 |

| Nigeria | 410 |

| Pakistan | 437 |

| Jamaica | 286 |

| Egypt | 264 |

| El Salvador | 133 |

| Haiti | 119 |

| Morocco | 109 |

| Ukraine | 103 |

| Guatemala | 98 |

| Kenya | 98 |

| Bangladesh | 91 |

| Colombia | 86 |

| South Africa | 61 |

| Peru | 50 |

| Jordan | 42 |

| Indonesia | 32 |

| Honduras | 30 |

Grand Challenges Canada

The Government of Canada proposes to provide $22.8 million in 2016–17 in continued support for Grand Challenges Canada.

In Budget 2008, the Government created the Development Innovation Fund, through which a contribution of $225 million was provided to Grand Challenges Canada (GCC). Under the leadership of the late Joseph Rotman, this organization has become an important partner to the Government of Canada, and is well aligned with Canada’s top development priority of maternal, newborn and child health. The Government’s initial strategic investment in this organization has contributed to stimulating breakthrough solutions in global health with the potential to significantly impact the lives of millions in the developing world. Economic Action Plan 2015 proposes to provide $22.8 million in 2016–17 in order to continue supporting GCC’s innovative and promising work in a variety of areas.

With strategic investments from the Government of Canada, Grand Challenges Canada (GCC) continues to stimulate innovative ideas in global health, many of which are aligned with Canada’s Muskoka Initiative on Maternal, Newborn and Child Health. This includes $2.4 million in grants announced by GCC in September 2014 in support of 22 new ideas, which will contribute to assist with childbirth in remote areas via mobile telecommunications, stabilizing vaccines without refrigeration, producing snacks from rice bran waste to fight children’s iron deficiency, and helping Bangladesh garment workers express and store breast milk. GCC currently supports over 170 innovators that work toward developing innovative solutions to support women’s and children’s health.

The Development Finance Initiative

Economic Action Plan 2015 announces the Government’s intention to establish the Development Finance Initiative, with a capitalization growing to $300 million over the first five years. This initiative, to be housed within Export Development Canada, will support effective international development by providing financing, technical assistance and business advisory services to the private sector to facilitate and encourage investments in developing countries. This initiative will enhance Canada’s development finance toolkit and increase Canada’s efforts to reduce poverty globally.

The Government is committed to improving the coherence and effectiveness of its international assistance, with an emphasis on enhanced private sector involvement. As the driving force behind economic growth, private sector investment is essential to meet resource needs and achieve meaningful development outcomes that raise people out of poverty and put them on the road to prosperity. However, private sector firms, including Canadian companies, often face numerous challenges impeding them from investing in frontier markets. To promote alternative sources of private finance for development, Economic Action Plan 2015 announces the Government’s intent to leverage development-focused private investments in these challenging markets. With this initiative, Canada joins other nations, including every G-7 country, that have put in place development finance tools to contribute to economic growth in developing countries through further private sector investment. Through the Development Finance Initiative, supported by a capital base that will grow to $300 million over five years, the Government will provide financing to firms operating in low- and middle-income countries whose activities complement the Government’s existing international assistance priorities. This initiative will enhance Canada’s ability to advance its international assistance objectives by partnering with the private sector to address critical financing gaps in developing countries. The expansion of Canada’s development finance capability will also deliver benefits for Canada beyond supporting the Government’s international development objectives, including laying the groundwork for future trade and investment in emerging and frontier markets.

Private sector investment is the key driver of economic growth: it’s essential to creating new businesses that provide jobs, earn profits and generate tax revenue, as well as other benefits to society. But some promising enterprises in many low- and middle-income countries—and Canadian companies that work in these regions—can’t access the long-term financing they need to grow and reduce poverty.

Business and economic development go hand-in-hand. Over the past two decades, private sector-led growth has driven 90 per cent of job creation in developing countries and pulled hundreds of millions out of poverty. [...] Accelerating these private capital flows will be difficult, but instrumental to the next wave of poverty reduction.

Celebrating Our Heritage

The Government is continuing to make investments which will ensure that Canadians have opportunities to celebrate and commemorate Canada’s heritage and values. Economic Action Plan 2015 proposes to provide funding to support activities and events to celebrate Canada’s 150th anniversary in 2017.

Economic Action Plan 2015 also proposes to provide funding to support and modernize the Canadian Honours System, to help Canada’s future Olympians and Paralympians, and to support the Harbourfront Centre in Toronto. Economic Action Plan 2015 also proposes to amend the Copyright Act to protect sound recordings and performances for an additional 20 years.

The Government has consistently shown a commitment to provide strong support to Canadian arts and culture to help ensure that all Canadians have the opportunity to participate in shared artistic and cultural experiences. Examples include:

- In November 2014, the Government announced funding of $80.5 million to repair, retrofit and renovate the Canada Science and Technology Museum. In December 2014, the Government announced an investment of $110.5 million for the architectural renewal of the National Arts Centre to transform it into a world-class facility.

- Economic Action Plan 2014 provided ongoing funding of $105 million per year in support of culture-related programs, in addition to $9 million per year for the Canada Book Fund and $8.8 million per year for the Canada Music Fund.

- Economic Action Plan 2013 increased the Endowment Incentive component of the Canada Cultural Investment Fund to a maximum benefit of $15 million over the life of the program to help promote corporate philanthropy and private investment in the arts. In addition, funding of $8 million was provided to help support the restoration and revitalization of Massey Hall to support Canada’s current and future artists.

- Economic Action Plan 2012 announced support for major exhibitions at Canadian museums and galleries by modernizing the Canada Travelling Exhibitions Indemnification Program to help attract new exhibitions.

- Economic Action Plan 2011 provided $15 million per year to the Canada Periodical Fund to support a broad range of publications and ensure a diversity of Canadian content. In addition, to mark the 100th anniversary of the Grey Cup and the Calgary Stampede, $5 million was provided to each of these anniversary celebrations.

- Economic Action Plan 2009 provided targeted two-year funding of $60 million to support infrastructure-related costs for local and community cultural and heritage institutions such as local theatres, libraries and small museums.

Moving forward, Economic Action Plan 2015 proposes to provide $210 million over four years to support activities and events, including festivals and concerts, to celebrate Canada’s 150th anniversary in 2017. Economic Action Plan 2015 also proposes to provide $25 million over five years, beginning in 2016–17, to renew support for the Harbourfront Centre, which delivers arts, culture and recreation programming. Economic Action Plan 2015 also proposes to amend the Copyright Act to extend the term of protection of sound recordings and performances from 50 to 70 years following the first release of the sound recording, so that performers and record labels are fairly compensated for the use of their music for an additional 20 years.

Through the Road to 2017, the Government has been highlighting nation-building historic milestone anniversaries toward the celebration of Canada’s 150th anniversary in 2017. The Government has successfully delivered commemorative initiatives recognizing the Bicentennial of the War of 1812 and The Queen’s Diamond Jubilee. In 2014, the commemorations of the 100th anniversary of the First World War and the 75th anniversary of the Second World War were launched.

The Government will continue to commemorate important milestone anniversaries through the Road to 2017, including the 100th anniversary of Canadian women’s suffrage in 2016 and the 50th anniversary of the Canada Games and 125th anniversary of the Stanley Cup in 2017.

Canada 150

Economic Action Plan 2015 proposes to provide $210 million over four years, starting in 2015–16, to support activities and events to celebrate Canada’s 150th anniversary in 2017.

In 2017, Canada will mark the 150th anniversary of Confederation. This milestone will provide an opportunity to celebrate Canada’s history, heritage, values and future. To mark this event, Economic Action Plan 2015 proposes to provide $210 million over four years, starting in 2015–16, to support activities, events and celebrations across Canada.

Funding will be used to support local community events such as festivals and concerts, enhanced Canada Day celebrations in the National Capital Region and other major Canadian cities, and other national initiatives, such as Rendez-vous naval 2017, that will unite Canadians from coast to coast to coast.

Canada 150 will be a historic opportunity for Canadians to connect with our past, celebrate our achievements and create a lasting legacy for our future.

Our 150th anniversary can be a nation-building event on par with 1967, a year that gave us the Order of Canada and our Canadian Honours System, Expo 67 and multicultural celebrations across the country, to name just a few legacies of that year.

Canada is nothing if not a bold experiment in diversity, and a community-based approach to our 150th anniversary is entirely in keeping with this fact.

[Canada’s 150th anniversary] will be an opportunity to strengthen the ties that unite us and to work towards our country’s future. On the road to 2017, let us continue to celebrate everything that has helped make Canada a country that is strong, proud and free.

Renewal and Enhancement of Canada’s Honours System

Economic Action Plan 2015 proposes to provide additional funding of $13.4 million over five years, starting in 2015–16, and $2.8 million ongoing to support and modernize the Canadian Honours System and bring it closer to all Canadians.

Canada’s Honours System enables us to commemorate great Canadians and strengthens the culture of excellence in our country by highlighting role models who inspire others to contribute and foster unity and inclusion. Economic Action Plan 2015 proposes to provide additional funding of $13.4 million over five years, starting in 2015–16, and $2.8 million ongoing to implement enhancements to the Canadian Honours System.

These enhancements include increasing the number of nominations to the Order of Canada from under-represented sectors and modernizing eligibility and selection criteria for a number of other honours and awards.

Economic Action Plan 2015 also proposes to bring the Canadian honours and honourees closer to all Canadians through additional events and ceremonies, as well as the creation of an online portal.

Supporting Canada’s Olympic and Paralympic Athletes

Economic Action Plan 2015 proposes to provide up to $20 million over four years, beginning in 2016–17, to support the next generation of Canadian Olympic and Paralympic athletes.

On October 16, 2014, His Excellency the Right Honourable David Johnston, Governor General of Canada, proclaimed 2015 the “Year of Sport” in Canada. During 2015, Canadians are being encouraged to celebrate the role that sport plays in the country and to participate in and seek the benefits of sport.