Common menu bar links

Archived - Budget 2011

Chapter 4.1: Supporting Job Creation (June 6, 2011)

Table of Contents - Previous - Next

Highlights

Fostering Canada’s Business Advantage

The Next Phase of Canada’s Economic Action Plan—A Low-Tax Plan for Jobs and Growth takes important steps to improve the ability of businesses and entrepreneurs to respond to emerging growth opportunities and create jobs. Budget 2011 measures include:

- Providing a one-time Hiring Credit for Small Business of up to $1,000 against a small firm’s increase in its 2011 Employment Insurance (EI) premiums over those paid in 2010 to encourage hiring.

- Providing assistance to Canada’s manufacturing and processing sector by extending the temporary accelerated capital cost allowance rate for investment in machinery and equipment for two additional years.

- Renewing the Best 14 Weeks and Working While on Claim EI pilot projects for one year.

- Providing $20 million over two years to help the Canadian Youth Business Foundation to support young entrepreneurs.

- Reducing red tape to lessen the compliance burden on small businesses through the Red Tape Reduction Commission and upgrading the BizPaL service.

Investing in a Cleaner Energy Economy

The Next Phase of Canada’s Economic Action Plan advances Canadian leadership in the development and promotion of clean energy technologies, with new budget measures including:

- Providing renewed funding of almost $100 million over two years for research, development and demonstrations of clean energy and energy efficiency.

- Expanding eligibility for the accelerated capital cost allowance for clean energy generation equipment.

- Providing $8 million over two years to promote the deployment of clean energy technologies in Aboriginal and Northern communities.

- Aligning deduction rates for intangible capital expenses in oil sands projects with rates in the conventional oil and gas sector.

Strengthening Canada’s International Engagement

The Next Phase of Canada’s Economic Action Plan takes action to strengthen Canada’s trade arrangements and to engage in the global economy through new budget measures such as:

- Streamlining Canada’s trade instruments, including an overhaul of the Customs Tariff legislation to reduce the processing burden for Canadian business.

- Extending the temporary powers of Export Development Canada to provide financing support to Canadian exporters in the domestic market.

Maintaining Canada’s Financial Sector Advantage

The Next Phase of Canada’s Economic Action Plan further strengthens Canada’s financial system. Budget 2011 measures include:

- Introducing legislation to reinforce the stability of Canadian housing finance and strengthen the mortgage insurance regime.

- Moving forward on the recommendations of the Task Force on Financial Literacy, and announcing the Government’s intention to appoint a Financial Literacy Leader to promote national efforts.

- Enhancing consumer protection by banning unsolicited credit card cheques and developing measures related to network-branded prepaid cards.

Strengthening Canada’s Public Infrastructure

The Next Phase of Canada’s Economic Action Plan builds on the significant investments in public infrastructure announced under the Building Canada plan and in Budget 2009 with new budget measures including:

- Legislating a permanent annual investment of $2 billion in the Gas Tax Fund to provide predictable, long-term infrastructure funding for municipalities.

- Providing $228 million over three years to fund repairs and major maintenance to federal bridges in Greater Montréal.

- Investing $148 million over the next five years to maintain bridges, dams and other specialized federal assets managed by Public Works and Government Services Canada across Canada.

- Providing up to $72 million over three years for repairs to storm-damaged small craft harbours.

- Contributing $150 million toward the construction of an all-season road between Inuvik and Tuktoyaktuk that completes the Dempster Highway, connecting Canadians from coast to coast to coast.

Supporting Canadian Agriculture

The Next Phase of Canada’s Economic Action Plan promotes the long-term profitability and global competitiveness of the agricultural sector by:

- Announcing a two-year, $50-million Agricultural Innovation Initiative to support knowledge creation and transfer and increased commercialization of agricultural innovations.

- Providing $17 million over five years for a management and monitoring strategy to contain and prevent the spread of plum pox.

- Providing $24 million over two years to extend the Initiative for the Control of Diseases in the Hog Industry.

- Ensuring that the Agri-Québec program is accorded the same tax treatment that is currently provided to the federal AgriInvest program.

- Providing an additional $100 million over five years to the Canadian Food Inspection Agency to improve food inspection capacity.

Supporting Forestry

The Next Phase of Canada’s Economic Action Plan invests in Canada’s forestry sector by:

- Supporting the transformation of the forestry sector by proposing to provide $60 million in 2011–12 to help forestry companies innovate and tap into new opportunities abroad.

Since 2006, the Government has promoted job creation by fostering an environment in which businesses can grow and succeed. This reflects the Government’s fundamental belief that the ingenuity, hard work and innovation of individual Canadians are the sources of long-term growth and wealth creation.

To tap the potential of the private sector, the Government has taken a range of actions to increase Canada’s openness to trade and investment, provide tax relief, invest in critical public infrastructure, improve the regulatory environment, strengthen the financial sector and support a greener economy, including:

- Reducing taxes to allow all Canadians to keep more of their hard-earned money, to encourage savings, to improve work incentives, and to establish a tax advantage for investment.

- Limiting the increase in Employment Insurance premiums to 5 cents in 2011 and 10 cents for subsequent years.

- The permanent elimination of tariffs on machinery and equipment in Budget 2009, providing average annual savings of $88 million to Canadian businesses, and the elimination in Budget 2010 of all remaining tariffs on industrial inputs, which will provide $300 million in additional annual savings and make Canada a tariff-free zone for manufacturers.

- Significant investments as part of the strategy to promote trade and help Canadian companies access new markets in a competitive global economy.

- The launch of a long-term plan for infrastructure, the $33-billion seven-year Building Canada plan, to meet infrastructure needs across the country. This includes investments of more than $3.5 billion for gateway-related initiatives, including under the Asia-Pacific Gateway and Corridor Initiative, the recently released Atlantic Gateway strategy, and Canada’s Continental Gateway, which is being finalized with Ontario and Quebec.

- Continuing to take steps along with the State of Michigan, the U.S. Government and the Province of Ontario to advance the construction of a new international bridge for the Windsor-Detroit trade corridor.

- Strategic investments in federal infrastructure assets in all regions of Canada, such as VIA Rail Canada’s passenger rail network, federal bridges and roads, border crossings, and small craft harbours.

- An investment of $3.8 billion in environmental initiatives for cleaner energy, renewable energy, energy efficiency and new environmental technologies in Budget 2007, and an additional $2 billion over five years under Canada’s Economic Action Plan to support clean energy demonstration projects and green infrastructure.

- A new Framework for Aboriginal Economic Development focused on strengthening Aboriginal entrepreneurship, supporting Aboriginal skills development, enhancing the value of Aboriginal assets and forging new and effective partnerships with provinces, territories and the private sector. As part of the implementation of the Framework, the Government of Canada is investing $200 million.

- A 20-per-cent reduction in the paperwork burden, and the launch in January 2011 of a new Red Tape Reduction Commission.

- Ongoing efforts to keep Canada’s double taxation conventions up to date and negotiate tax information exchange agreements, to both promote cross-border trade and investment and support Canada’s efforts to combat domestic and international tax evasion.

- Implementation of the Capital Markets Plan to enhance regulatory efficiency, strengthen market integrity, create greater opportunities for businesses and investors, and improve investor information.

Targeted Measures to Support the Recovery

As discussed in detail in Chapter 3, Budget 2011 introduces a number of short-term targeted actions to support job creation during the fragile global economic recovery.

Budget 2011 announces the extension of the temporary accelerated capital cost allowance treatment for investment in machinery and equipment in the manufacturing and processing sector for two additional years. This will help businesses make the additional investments needed to improve their productivity and create jobs in a sector that was particularly hard hit by the global recession.

Budget 2011 will also assist small businesses in hiring new workers so they can take advantage of emerging opportunities and compete in the global economy. Budget 2011 announces a one-time Hiring Credit for Small Business of up to $1,000 against an employer’s increase in 2011 Employment Insurance premiums over 2010 to help defray the costs of additional hiring.

Other proposed Budget 2011 measures to support the economic recovery include:

- Extending existing or recently terminated work-sharing agreements by up to 16 weeks so that companies can avoid layoffs by offering Employment Insurance benefits to workers willing to work a reduced work week while their company recovers.

- Renewing the Best 14 Weeks and Working While on Claim Employment Insurance pilot projects for one year.

- Enhancing the Wage Earner Protection Program to cover more workers affected by employer bankruptcy or receivership.

- Extending the Targeted Initiative for Older Workers to support training and employment programs for older workers.

- Extending the Mineral Exploration Tax Credit for flow-through share investors for an additional year.

These measures build on programs from Canada’s Economic Action Plan, as well as measures taken to support the recovery during the fall of 2010.

Looking ahead, under the Next Phase of Canada’s Economic Action Plan, the Government will continue to promote job creation and sustainable economic growth by building on its strong record in improving Canada’s business environment and in branding Canada as a premier destination for business investment. The objective will continue to be the creation of a more productive economy that generates well-paid jobs and continued prosperity for Canadians. To this end, the Government will:

- Further improve the personal income tax system to enhance incentives to work, save and invest, while taking action to ensure the integrity of the tax system and to secure the low-tax environment necessary to encourage business investment and improve productivity.

- Continue its efforts to bring the benefits of foreign investment to Canada while securing access to foreign markets for Canadian businesses. It will also continue to improve Canada’s regulatory and marketplace frameworks through better coordination and cooperation with other countries, new domestic approaches, and a continued focus on promoting competition, protecting intellectual property, safeguarding national interests and reducing the administrative burden on Canadian business.

- Pursue targeted measures at home to ensure that Canada maintains its global financial sector advantage and that Canadians continue to benefit from a world-class financial system. In addition, Canada will continue to play a leading role in advancing the Group of Twenty (G-20) financial sector reform agenda aimed at strengthening the global financial system.

- Take additional steps to foster a stronger economic union by continuing to engage with the provinces and territories to enhance internal trade and labour mobility. It will ensure that all regions of the country have modern public infrastructure and will continue to support sectors of strategic importance. The Government will support the development of new environmental and clean energy technologies and pursue efficient regulatory approaches to create a cleaner, healthier environment.

Budget 2011 takes important steps in all of these directions, with measures focused on improving the business environment; protecting Canada’s environment and promoting clean energy; opening up international markets for trade; strengthening Canada’s financial sector; investing in public infrastructure; and providing support to key sectors such as energy, mining, manufacturing, tourism, agriculture and forestry.

Fostering Canada’s Business Advantage

Building on the low-tax plan implemented by the Government since 2006, Budget 2011 takes additional important steps to improve the conditions for private sector growth by reducing red tape and making it easier for small and medium-sized enterprises to do business.

Supporting Small Business and Entrepreneurs

Through innovation and ingenuity, small business owners and entrepreneurs create jobs and generate wealth in communities across Canada. The Government has consulted closely with business stakeholders and has taken decisive action to address barriers faced by entrepreneurs, including by reducing taxes and red tape, improving access to business financing, supporting training and research, and opening up new markets. The Government has declared 2011 the Year of the Entrepreneur, in order to help increase public awareness of the important role played by small businesses.

As discussed in Chapter 3, Budget 2011 announces further support for small businesses through the temporary Hiring Credit for Small Business, which would provide a one-time credit of up to $1,000 against a small firm’s increase in its 2011 Employment Insurance (EI) premiums over those paid in 2010. This new credit will be available to approximately 525,000 employers whose total EI premiums were at or below $10,000 in 2010, reducing their 2011 payroll costs by about $165 million.

Budget 2011 includes a number of measures to further enable small businesses and entrepreneurs to grow and create jobs.

Supporting Young Entrepreneurs

The Canadian Youth Business Foundation works with young entrepreneurs across the country to help them become the business leaders of tomorrow through mentorship, learning resources and start-up financing. Since 2002, the Foundation has helped young Canadians to start more than 4,000 businesses, creating close to 18,000 new jobs.

Budget 2011 proposes $20 million over two years to enable the Canadian Youth Business Foundation to continue its important support for young entrepreneurs.

Reducing Red Tape for Small Business—BizPaL

Launched in 2006, BizPaL is a free online service that significantly reduces the red tape burden on small business owners by allowing them to quickly and efficiently create a tailored list of permits and licences that are required from all levels of government to operate their specific business. Budget 2011 provides $3 million per year to make BizPaL permanent and allow the program to upgrade its technology infrastructure to provide even greater value to small businesses.

Moving Forward With the Red Tape Reduction Commission

Complex and overlapping regulatory requirements impose a significant compliance burden on small businesses. Red tape ties up Canadian businesses and entrepreneurs, reducing their competitiveness and forcing them to spend time and money that could be better spent strengthening Canada’s economic recovery.

Recognizing the costs imposed by unnecessary regulatory requirements, in January 2011 the Government fulfilled its Budget 2010 commitment to establish the Red Tape Reduction Commission. The Commission will help find effective and lasting solutions to reducing red tape for Canadian small and medium-sized businesses. The Commission, chaired by the Minister of State (Small Business and Tourism), is taking the perspectives of small business into account to identify irritants stemming from federal regulatory requirements.

The Commission has solicited advice from Canadians through an online consultation process and has held a series of roundtables across Canada. In the fall of 2011, the Commission will make recommendations to the Government on how to address regulatory irritants and provide options for lasting reforms to keep red tape from creeping back, while protecting the health, safety and security of Canadians.

Businesses, especially small business owners and entrepreneurs, have told the Commission that the Government must act now to begin addressing their concerns and to promote growth and competitiveness. This Government has listened and will take early action by:

- Tasking regulators with examining the effects of their regulations through a “small business lens” to ensure that regulatory requirements do not have unintended impacts on small businesses and are administered as fairly and efficiently as possible.

- Using an advertising and outreach campaign to reduce frustration for small businesses by pointing them to the right information about programs and regulations.

- Demonstrating the Government’s progress on red tape reduction by posting current initiatives on the Commission’s website.

- Improving transparency by posting all regulatory consultations on the Consulting With Canadians web portal.

- Integrating and simplifying services to employers through Human Resources and Skills Development Canada’s Employer Contact Centre initiative.

- Streamlining and focusing requirements for airports and air carriers through Transport Canada’s Aviation Security Regulatory Framework.

- Proposing legislation to eliminate mandatory registration for small vessels, including canoes and kayaks.

Continuing to Improve Taxpayer Fairness

In Budget 2010, the Government committed to consult with key stakeholders to identify ways to strengthen the transparency and accessibility of taxpayer fairness instruments such as the Taxpayer Bill of Rights, the Service Complaints program and the taxpayer relief provisions. The Canada Revenue Agency (CRA) completed consultations in 2010 and found that more could be done to ensure that Canadians have the information they need. The CRA will take action this year to increase awareness of taxpayer fairness instruments by improving its Internet site, providing targeted information to tax professionals, and reviewing guides, pamphlets and other publications to ensure that information is provided in a clear and consistent manner to all Canadians.

The CRA will continue to consult with the business community and key stakeholders, such as the Canadian Federation of Independent Business, to identify opportunities to further improve its services and reduce the administrative burden while respecting the overall integrity of the tax system. For example, the CRA has clarified the reporting expectations related to the recent update of the T4A form as a result of the helpful feedback received from stakeholders. The CRA will also introduce, by April 2012, written electronic answers to written queries from clients using the My Business Account interface. As well, the CRA will review the penalty structure for the late filing of information returns, with particular regard to its impact on small businesses. Any changes to the penalty structure as a result of this review will be announced in advance of the filing due date for the 2011 taxation year.

These activities will help to ensure that the administration of the tax system is as fair and efficient as possible and will complement the ongoing work of the Red Tape Reduction Commission in reducing the administrative burden facing businesses.

Other Measures to Strengthen the Business Environment

Preventing Labour Disruptions

Labour Canada’s Preventive Mediation Program helps employers and unions build and maintain constructive working relationships through a variety of services and workshops designed to help parties move from adversarial to collaborative relationships.

Budget 2011 expands the delivery of the Preventive Mediation Program with an investment of $1 million over two years. With this new investment, more employers and unions will benefit from this voluntary service.

Strengthening Canada’s Standards System

The Standards Council of Canada is a Crown corporation that helps to promote Canada’s economic growth through the pursuit of efficient and effective standardization. Standards are put in place to safeguard the health and safety of Canadians, improve the flow of goods and services within Canada and internationally, and reduce red tape and compliance costs facing Canadian businesses.

Budget 2011 proposes to provide an additional $2.1 million per year starting in 2012–13 to the Standards Council of Canada to modernize national standards and support a stronger Canadian voice in developing international standards.

Improving Military Procurement

In 2008, the Government announced the Canada First Defence Strategy—a long-term strategy to modernize the Canadian Forces. This commitment has set the stage for a renewed relationship with Canada’s industry, knowledge and technology sectors, allowing unprecedented opportunities for every region of the country and creating an environment in which companies can plan ahead, positioning themselves to compete for defence contracts in Canada and in the global marketplace.

Considerable progress has been achieved in streamlining and improving military procurement processes, including through the National Shipbuilding Procurement Strategy and enhancements to the Industrial and Regional Benefits Policy. The Government is committed to continuing these efforts by developing a procurement strategy, in consultation with industry, to maximize job creation, support Canadian manufacturing capabilities and innovation, and bolster economic growth in Canada.

Launching a Review of Aerospace Policy and Programs

Canada’s aerospace sector is a global technology leader and a major source of high-quality jobs. The Government will conduct—through a consultative process involving the Aerospace Industries Association of Canada and their member firms—a comprehensive review of all policies and programs related to the aerospace/space industry to develop a federal policy framework to maximize the competitiveness of this export-oriented sector and the resulting benefits to Canadians. This review will be coordinated with the ongoing Review of Federal Support to Research and Development.

The Government has made substantial, successful investments to leverage private sector investment in this important, high-tech and growing sector of our economy. To build on these successes, the Government will ensure that stable funding is provided for the Strategic Aerospace and Defence Initiative through this 12-18 month consultative review, and examine options for continuing the level of funding thereafter.

Investing in a Cleaner Energy Economy

Canada is an energy superpower with one of the world’s largest resource endowments from both traditional and emerging sources of energy. Canada is increasingly looked to as a secure and dependable supplier of a wide range of energy products. Budget 2011 includes measures that further Canadian leadership and support the development of clean energy technologies by proposing:

- $97 million over two years to renew funding for technology and innovation in the areas of clean energy and energy efficiency.

- $8 million over two years to renew funding to promote the deployment of clean energy technologies in Aboriginal and Northern communities.

Supporting the Development of the Alaska Pipeline Project

Budget 2011 provides $4 million over the next two years to the Northern Pipeline Agency to create a cost-recovered consultations initiative, primarily focused on Aboriginal groups, with respect to the Alaska Pipeline Project.

Expanding Tax Support for Clean Energy Generation

The tax system encourages businesses to invest in clean energy generation and energy efficiency equipment by providing an accelerated capital cost allowance (CCA) rate. CCA Class 43.2 includes a variety of stationary equipment that generates energy by using renewable sources or fuels from waste, or by using fuel more efficiently. It allows the cost of eligible assets to be deducted for tax purposes at a rate of 50 per cent per year on a declining balance basis—which is faster than would be implied by the useful life of the assets.

Budget 2011 proposes to expand eligibility for accelerated CCA under Class 43.2 to include equipment that generates electricity using waste heat from sources such as industrial processes. This expansion will encourage investment in technologies that increase energy efficiency and can help displace the use of fossil fuels for generation of electricity.

It is estimated that this measure will reduce federal revenues by about $1 million in 2011–12 and $2 million in 2012–13.

Extending Qualifying Environmental Trust Rules to Pipelines

Government regulators sometimes require that a company operating a mine, quarry or waste disposal site set aside funds in trust in order to cover the future cost of cleaning up or “reclaiming” the site. The income tax rules allow a deduction for contributions made to such a trust, provided it meets the conditions for being a qualifying environmental trust (QET) for tax purposes.

The National Energy Board recently announced that companies operating pipelines under its jurisdiction will be required in coming years to begin setting aside funds during a pipeline’s operating life to cover future abandonment costs. Budget 2011 therefore proposes to expand the scope of the QET rules to include trusts that are required to be established to fund reclamation costs associated with pipelines. This change will apply to trusts created after 2011. In addition, to provide more flexibility to regulators in determining appropriate investments for the trusts that they mandate, Budget 2011 proposes to expand the range of eligible investments that a QET may make. This change will apply to trusts created after 2011. It will also apply after 2011 to trusts created before 2012 if the trust and the regulatory authority jointly so elect.

This measure is expected to decrease federal revenues by $40 million in 2015–16. No impact is anticipated before that date, as companies are not expected to begin setting aside funds until 2015.

Eliminating Fossil Fuel Subsidies

With the oil sands sector vibrant and growing, Budget 2007 announced the phase-out of the accelerated capital cost allowance for tangible capital assets in the sector. Budget 2011 builds on this change by proposing to reduce the deduction rates for intangible capital expenses in oil sands projects and align them with the rates applicable in the conventional oil and gas sector.

These changes will improve fairness and neutrality of the taxation of oil sands relative to other sectors of the economy. They constitute further action by Canada in support of the commitment by G-20 Leaders to rationalize and phase out over the medium term inefficient fossil fuel subsidies.

These changes are expected to increase federal revenues by approximately $15 million in 2011–12 and $30 million in 2012–13.

Supporting Atomic Energy of Canada Ltd.

Atomic Energy of Canada Limited (AECL) is a federal Crown corporation which specializes in a range of nuclear products and services and works with Canada’s diverse nuclear industry. The Government has initiated a process to restructure AECL to position the corporation for future success and create new opportunities for Canada’s nuclear industry. Delivering competitive solutions and containing financial risks and costs to Canadian taxpayers is an important consideration in this regard. Budget 2011 provides $405 million on a cash basis in 2011–12 for AECL’s operations to cover anticipated commercial losses and support the corporation’s operations, including to ensure a secure supply of medical isotopes and maintain safe and reliable operations at the Chalk River Laboratories.

Strengthening Canada’s International Engagement

Canada’s long-term prosperity depends on its ability to engage in the global economy, and an open, strong and resilient global economy creates trade and investment opportunities for Canadian businesses.

Expanding and Facilitating Trade

Open markets create business opportunities for Canadian firms, leading to economic growth, better jobs and lower prices for Canadian consumers. For this reason, the Government launched a comprehensive Global Commerce Strategy in 2007 to ensure that Canadian businesses can take full advantage of global market opportunities. Budget 2011 includes measures that further promote an open and efficient trading system.

Although Canada continues to anchor its trade liberalization efforts at the World Trade Organization and remains active in the Doha Round of multilateral trade negotiations, a timely conclusion to the Round is uncertain. The Government has supplemented these efforts with an ambitious free trade and investment agenda that seeks to provide new and diverse opportunities to Canadian companies over a short-time horizon. In the last five years, Canada has concluded free trade agreements with eight countries and is currently in negotiations with some 50 other countries. This includes the negotiation of a Comprehensive Economic and Trade Agreement with the European Union, which is expected to be concluded this year, as well as free trade negotiations launched with India last November. Taken together, these free trade initiatives with the European Union and India could provide Canadian businesses with improved access to markets of over 1.7 billion people, with a combined gross domestic product (GDP) of $20 trillion, and create thousands of job opportunities. Furthermore, the Government recently announced the launch of a joint study to examine the potential for an Economic Partnership Agreement with Japan.

At the same time, Canada continues to enhance its most important trading relationship with the United States—our neighbour and the world’s largest economy—through the Shared Vision for Perimeter Security and Economic Competitiveness, announced February 4, 2011. In this context, Canada and the United States are working to establish an action plan to implement the Shared Vision for Perimeter Security and Economic Competitiveness that will accelerate the legitimate flows of people and goods between both countries, while strengthening security and economic competitiveness.

Streamlining Canada’s Trade Instruments

Budget 2011 builds on recent tariff relief efforts and emphasizes Canada’s openness to trade and investment by simplifying and streamlining Canada’s trade instruments. This will include changes to modernize Canada’s Customs Tariff legislation with a view to facilitate trade and lower the administrative burden for businesses and government. Among other initiatives, measures will be introduced to facilitate the classification of goods by importers, streamline the processing of low-value non-commercial imports and modernize the Act to make it more user-friendly. In addition, the Government will propose measures to ensure that Canada operates an efficient trade remedy system that provides Canadian industry with the appropriate mechanisms to address unfair trade.

Foreign Trade Zone Programming

Through longstanding tax and tariff export-related programs, Canada has been providing benefits to businesses comparable to those found in foreign trade zones in other countries while having the advantage of not being site-specific. These programs, which are administered by the Canada Border Services Agency and the Canada Revenue Agency, relieve tariffs (Duty Deferral Program) and the Goods and Services Tax (Export Distribution Centre Program and Exporters of Processing Services Program).

Building on the success of the Government’s gateways and corridor approach, Budget 2011 commits to an examination of Canada’s current foreign trade zone-like policies and programs. Specifically, the Government will concentrate on ensuring that these policies and programs are internationally competitive, effectively marketed and administratively efficient.

India Engagement Strategy

In addition to the Global Commerce Strategy, the Government is developing a more targeted engagement strategy to forge closer ties with India across different sectors. India is one of the world’s fastest growing economies, and developing a focused strategy to enhance our bilateral relationship will result in a more effective and beneficial partnership.

This strategy will harness funding provided in recent budgets for measures such as the Global Commerce Strategy and the International Science and Technology Partnerships Program to enhance the Canada-India relationship as Canada pursues stronger economic ties through free trade and investment agreement negotiations. Specific initiatives will include:

- High-level engagement and branding of Canada in India.

- Market development by promoting Canadian innovation, bilateral investment, and closer business-to-business relationships.

- Public service engagement, including exchanges.

- Strengthening academic networks by building linkages between Canadian and Indian institutions and promoting Canadian universities in India.

Establishing a Canada-India Research Centre of Excellence

Canadian post-secondary institutions are becoming more globally connected and strengthening their research linkages with peer institutions in emerging markets, particularly in India. Our universities and colleges have worked to establish important academic exchanges and research collaborations with Indian students, researchers and faculty. In addition to building stronger research ties and creating valuable learning opportunities, these partnerships will generate positive impacts for Canada’s economy and society.

As part of the Government’s wider India engagement strategy, Budget 2011 provides $12 million over five years for a competition to select a Canada-India Research Centre of Excellence, open to proposals in all areas of research. The centre will focus on creating partnerships that bring together key individuals and organizations from Canada and India, accelerating the exchange of research results, and increasing Canada’s international visibility and reputation as a research leader.

In addition, as noted in Chapter 4.3, Budget 2011 provides $10 million over two years to develop an international education strategy that will promote Canadian colleges and universities abroad, with a focus on emerging economies such as India. This will strengthen our engagement with emerging economies and ensure greater collaboration between Canadian and foreign institutions.

Export Development Canada

Export Development Canada (EDC) helps Canadian exporters take advantage of international opportunities. EDC’s role was especially important during the financial crisis. Measures included in Canada’s Economic Action Plan enabled EDC to provide additional financing support to Canadian exporters, including on an exceptional basis in the domestic market.

As the economy recovers, businesses are being increasingly served by private sector sources of credit. As a sign of the decreasing need for extraordinary measures, EDC recently paid a $350-million dividend to the Government, an amount equal to the additional capital provided to the corporation during the financial crisis. This is consistent with the goal of the Economic Action Plan to provide short-term stimulus to the Canadian economy, in this case stimulus in the form of an investment which is now being repaid. Budget 2011 announces that the Government will review the regulatory framework that governs EDC’s role in the domestic financing market. In the interim, the temporary powers granted to EDC in Budget 2009 have been extended until March 2012.

Meeting Our Global Responsibilities

Canada makes a strong contribution to supporting the effective functioning of the global economy and improving the welfare of others in the world. Over the past year, as Chair of the G-8 and as host of the G-20 Toronto Summit, Canada has been playing a pivotal role in shaping global actions on the economy. Canada secured an agreement at the Toronto Summit for all advanced economies to halve their deficits by 2013 and stabilize or reduce their debt-to-GDP ratios by 2016. Canadian leadership also paved the way for the commitment from advanced and emerging G-20 economies to better coordinate their policies and act to address the shared challenges that stand in the way of a sustainable and lasting recovery. Canada continues to lead these efforts as co-chair of the G-20 Framework for Strong, Sustainable and Balanced Growth. Canada has also played a strong role in mobilizing the resources of the G-20 in support of critical development objectives such as Haiti debt relief, and increasing lending resources of the multilateral development banks.

International Civil Aviation Organization

Since 1947, Canada has hosted the International Civil Aviation Organization (ICAO), a United Nations agency based in Montréal. The ICAO plays a key role in the governance of civil aviation, and also serves as an important anchor to the city’s aerospace industry and economy. The organization employs over 600 people and adds an estimated $100 million per year to the local economy. Budget 2011 announces $9.7 million over five years to enhance the Government’s support for the agency’s headquarters in Montréal.

International Microfinance and Entrepreneurship

The strength of Canada’s relationship with the broader global community has been built in part on its long and active engagement in international development. Canada has consistently been at the forefront of poverty eradication efforts, including through its investments to promote private sector participation, a priority essential to achieve sustained economic growth.

For over 40 years Canada has supported microfinance initiatives throughout the developing world. In the last five years, Canada’s annual spending in this sector has averaged over $45 million, which includes help to entrepreneurs to access the credit that is needed to grow their businesses and support their families. For example:

- In Haiti, Canada helped to create a federation of credit unions, Le Levier, which includes 28 service outlets and 48 financial co-operatives to serve more than 350,000 members, nearly half of whom are women.

- In Afghanistan, Canada’s support to the microfinance industry helps over 430,000 clients, 60 per cent of whom are women, to obtain small loans and financial services.

- Access to financial services, including microfinance, more than doubled (from 324,000 in 2009 to over 771,000 in 2010) in Tanzania last year, thanks in part to Canada’s contribution to a multi-donor effort.

This past year Canada supported a number of new initiatives that leverage private sector ideas and resources to address global priorities. Canada led the development of the G-20 SME Finance Challenge, an international competition that is providing financing to scale up successful initiatives including Canada’s Peace Dividend Trust, which helps local entrepreneurs in post-conflict countries through guaranteed credit lines. As well, Canada played a key role in creating the International Finance Corporation’s new private sector window of the Global Agriculture and Food Security Program, which will help expand access to credit for farmers and small businesses in the agricultural sector in poor countries.

Moving forward, the Government will continue to help poor countries achieve sustainable economic growth through support for private sector development, in line with the Canadian International Development Agency’s new Sustainable Economic Growth Strategy and ongoing efforts to strengthen the effectiveness of Canada’s aid program.

Maintaining Canada’s Financial Sector Advantage

Canada’s financial system continues to be recognized as one of the soundest in the world. Our well-capitalized and prudently regulated financial institutions withstood the global financial crisis, avoiding the need for government bailouts that occurred in many other countries.

The Government of Canada will pursue targeted measures at home to safeguard this competitive advantage and ensure that Canadians continue to benefit from the resulting economic growth and jobs. Canada’s financial sector directly employs over 750,000 Canadians, contributing nearly 7 per cent of GDP in 2010. Canada will continue to play a leading role in advancing the G-20 financial sector reform agenda targeted at strengthening the global financial system, including by participating in the Financial Stability Board’s peer review exercise of executive compensation practices, which is aimed at ensuring that compensation arrangements discourage executives from making risky deals for short-term profit.

Budget 2011 introduces measures to reinforce the soundness of Canadian housing finance and the broader financial system. This includes moving forward with implementing the recommendations of the Task Force on Financial Literacy aimed at improving financial literacy for all Canadians and enhancing financial consumer protection.

Maintaining the Stability and Efficiency of Canada’s Financial Sector

Maintaining Canada’s financial sector advantage is especially important as the global financial system changes and adapts to the fallout of the global financial crisis. Canada must continue to assess the potential impact of new international standards on its ability to compete and to attract investment while maintaining confidence in Canada’s capital markets.

Reinforcing the Stability of Canada’s Housing Finance System

The Government recognizes the importance of a stable and well-functioning housing market to the overall economy and Canada’s financial system.

Canada’s system of housing finance plays an important role in providing a reliable source of funds to help support home ownership in Canada. Prudent mortgage lending standards and mandatory mortgage insurance for high ratio loans allowed Canada to avoid the housing crisis that occurred in other countries. Since 2008, the Government has taken prudent and measured steps to ensure this system remains stable over the long term while maintaining economic growth.

In July 2008, February 2010 and January 2011, the Government announced adjustments to the rules for Government-backed insured mortgages. These changes will significantly reduce the total interest payments Canadians make on their mortgages, promote saving through responsible home ownership, and limit repackaging of consumer debt into mortgages guaranteed by taxpayers.

Going forward, the Government of Canada will introduce a legislative framework that will formalize existing mortgage insurance arrangements with private mortgage insurers and Canada Mortgage and Housing Corporation, including the rules for Government-backed insured mortgages. The measures strengthen the Government’s oversight of the mortgage insurance industry.

The Government is pursuing a number of other measures to ensure the stability of our financial system, which are discussed below.

Developing a Legislative Framework for Covered Bonds

The Government has been working co-operatively with stakeholders to develop the details of a legislative framework for covered bonds. Covered bonds are debt instruments that are secured by high-quality assets, such as residential mortgages. A legislative framework will support financial stability by helping Canadian lenders find new sources of funding and by making the market for Canadian covered bonds more robust.

Reviewing Financial Institutions Legislation

A stable, efficient and competitive financial sector such as Canada’s is based on a sound legislative framework that is reviewed and updated regularly to ensure it is responsive to global and domestic developments.

The Government has launched its five-year review of federal financial institutions legislation and will consider the views of Canadians on how to improve our financial system through legislative amendments. The Government will also introduce legislation to clarify the regulator’s cost recovery framework applying to life insurance companies engaged in global business activities.

Demutualization of Property and Casualty Mutual Insurance Companies

The Government is developing a framework for the demutualization of federally regulated property and casualty mutual insurance companies, which will provide, for companies that choose to demutualize, an orderly and transparent process and ensure that policyholders are treated fairly and equitably. The Government will be in a position to review applications to demutualize once regulations are in place. Amendments to the Insurance Companies Act, including amendments that would prevent any mutual company from demutualizing indirectly, will be introduced.

Partnering With Provinces and Territories on Securities Regulation

In May 2010, the Government tabled for information in Parliament the proposed Canadian Securities Act, and concurrently referred it to the Supreme Court of Canada. The Supreme Court of Canada will rule on whether Parliament has the constitutional authority to enact the proposed Canadian Securities Act.

The Government will continue working with willing provinces and territories to establish a Canadian securities regulator. Participation is voluntary, and the Government encourages all jurisdictions to partner and help shape the future of this new Canadian institution.

Should a favourable ruling be received from the Supreme Court of Canada, the Government intends to introduce for adoption in Parliament a Securities Act, which would then go through the normal parliamentary legislative process. The Government will take the necessary steps to support a transition that minimizes disruption and uncertainty.

Enhancing Financial Literacy

With the growing use of financial services by consumers, the importance of ensuring that Canadians have the tools and knowledge to be confident in their financial decisions cannot be overstated. The Government has received the recommendations of the Task Force on Financial Literacy, and it commends the important work that was done in support of this goal. As a first step, the Government is announcing that a Financial Literacy Leader will soon be appointed to promote national efforts, and is providing funding to advance financial literacy initiatives.

Budget 2011 proposes to provide $3 million per year, in addition to the $2 million per year already provided to the Financial Consumer Agency of Canada, to undertake financial literacy initiatives. Improving financial literacy is a long-term goal and a shared responsibility that requires all partners to work collaboratively to leverage the excellent efforts now underway across the country.

Protecting Consumers

The Government has taken decisive action to protect consumers of financial products and services. The Government has taken measures related to credit cards, and more recently it has announced measures to prohibit negative option billing and reduce cheque hold periods while providing timelier access to funds.

Banning Unsolicited Credit Card Cheques

The Government is taking proactive and prudent steps to assist consumers in managing credit indebtedness. The Government is proposing to ban the distribution of unsolicited credit card cheques to assist consumers in managing their debt levels.

Protecting Consumers of Prepaid Cards

The domestic payments system in Canada continues to evolve rapidly, adapting to the growing trend towards electronic forms of payment. As new financial and payment products appear on the marketplace, the best interests of consumers must be considered. The Government is responding to concerns regarding the terms and conditions associated with network-branded prepaid cards by developing measures to enhance the consumer protection framework.

The Government will continue to monitor developments in the financial sector and take additional targeted action as needed to protect consumers’ interests.

Modernizing Canada’s Currency

Budget 2010 announced the steps the Government is taking to modernize Canada’s currency and protect against counterfeiting. In June, the Bank of Canada will unveil the designs of the new $50 and $100 bills that will come into circulation later this fiscal year. The Royal Canadian Mint will also begin issuing new multi-ply plated $1 and $2 coins later in 2011–12. The Government will continue to work with the Mint to improve the efficiency of the currency system.

Strengthening Canada’s Public Infrastructure

The Government recognizes the importance of investment in public infrastructure. State-of-the-art infrastructure moves people, goods and services to market and improves business competitiveness, allowing the economy to grow and prosper.

In 2007, the Government of Canada launched an ambitious plan to help provinces, territories and municipalities address their infrastructure needs. The Building Canada plan is supported by $33 billion in federal funding over seven years.

As the global economy was entering the worst financial and economic crisis since the 1930s, the Government accelerated this investment and introduced new stimulus initiatives under Canada’s Economic Action Plan to boost infrastructure investment during the 2009 and 2010 construction seasons. Work on some of these projects will continue through to the end of October 2011.

Going forward, the Government will work with provinces, territories, the Federation of Canadian Municipalities and other stakeholders to develop a long-term plan for public infrastructure that extends beyond the expiry of the Building Canada plan.

The Government also continues to invest in our gateways. Canada’s world-class gateways and trade corridors are essential components of a strong and competitive economy. Building on the success of the Asia-Pacific Gateway and Corridor Initiative, the federal government recently released an Atlantic Gateway strategy in conjunction with the Atlantic provinces. In addition, the Government is continuing to work with Ontario and Quebec towards the development of a strategy for Canada’s Continental Gateway.

The Government continues to work with the State of Michigan, the U.S. Government, and the Province of Ontario to advance the construction of a new international bridge in the Windsor-Detroit trade corridor. A major milestone was achieved in 2010 when Ontario concluded the procurement process with a private sector consortium to design, build, finance, operate and maintain the Windsor-Essex Parkway, a six-lane below-grade highway that will extend Highway 401 in Windsor to the new international bridge. Through the Gateways and Border Crossings Fund, the Government is providing up to $1 billion to fund 50 per cent of this project’s eligible capital costs. The project will spur economic activity in southern Ontario and benefit Quebec and eastern Canada.

Budget 2011 makes important investments in public infrastructure and supports the use of public-private partnerships in delivering infrastructure programs and projects.

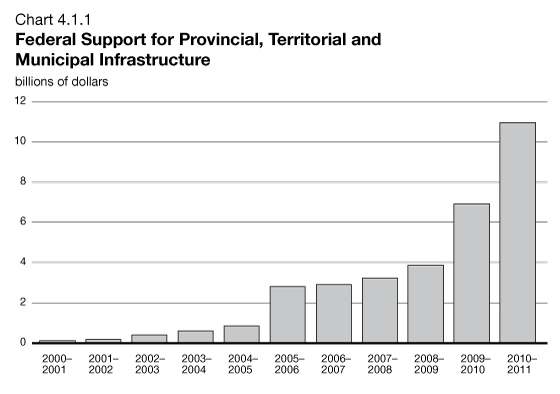

and Municipal Infrastructure

The federal government has significantly increased its direct support for provincial, territorial and municipal infrastructure in recent years as a result of two key initiatives: (1) Canada’s long-term infrastructure plan, the Building Canada plan, and (2) infrastructure stimulus measures under the Economic Action Plan.

Announced in Budget 2007, the seven-year, $33-billion Building Canada plan consists of a suite of programs to meet infrastructure needs across the country, including:

- The Gas Tax Fund and full rebate of the Goods and Services Tax paid by municipalities, which provide predictable long-term funding for municipalities.

- The Provincial/Territorial Base Funding Initiative, which provides $25 million per year for each province and territory.

- The Building Canada Fund, which supports infrastructure projects across Canada, both large and small.

- The Gateways and Border Crossings Fund and the Asia-Pacific Gateway and Corridor Initiative to strengthen trade-related infrastructure.

- The Public-Private Partnerships (P3) Fund, the first Canadian infrastructure fund dedicated to P3s.

These programs continue to create significant employment opportunities for Canadians.

The Government also launched a number of new initiatives as part of Canada’s Economic Action Plan to stimulate additional investment in provincial, territorial and municipal infrastructure. These new stimulus initiatives consisted of the Infrastructure Stimulus Fund, the Knowledge Infrastructure Program, the Building Canada Fund Communities Component Top-Up, the Green Infrastructure Fund, the Recreational Infrastructure Canada program, and funding for recreational trails. By working closely with each province and territory to approve projects quickly, the Government has allocated more than $7.7 billion in stimulus funding toward more than 7,700 projects across the country.

As a result of these investments, the amount of federal funding available to provinces, territories and municipalities for infrastructure projects will be close to $11 billion in 2010–11, almost seven times the average annual federal support over the period from 1999–2000 to 2008–09.

This chart has been updated since Budget 2011.

Making Gas Tax Funding for Municipalities Permanent

In 2008, the Government announced that the Gas Tax Fund would become a permanent measure, providing $2 billion per year in predictable and long-term infrastructure funding to Canada’s cities and towns.

The Gas Tax Fund supports environmentally sustainable municipal infrastructure projects that contribute to cleaner air, cleaner water and reduced greenhouse gas emissions. Municipalities can pool, bank and borrow against this funding, providing significant additional financial flexibility.

To provide greater certainty to provinces, territories and municipalities, Budget 2011 proposes to legislate a permanent annual investment of $2 billion in municipal infrastructure through the Gas Tax Fund.

Advancing Public-Private Partnerships

Public-private partnerships (P3s) have demonstrated their ability to produce value for taxpayers in the delivery of public infrastructure. By partnering with the private sector to manage many of the risks associated with the construction, financing and operation of infrastructure projects, governments can build public infrastructure faster and at a lower cost to taxpayers.

Canada aspires to be a leader in P3s. In 2008, the Government established PPP Canada Inc., a federal Crown corporation, to advance federal efforts to increase the effective use of P3s in Canada. In addition to administering the P3 Canada Fund, the first Canadian infrastructure fund dedicated to P3s, PPP Canada Inc. is supporting the development of P3s by the Government of Canada by providing advice and expertise to federal departments and agencies. The Government is taking steps to strengthen PPP Canada Inc.’s role at the federal level.

The Government will build on the success of recent federal projects that are being implemented as P3s such as the new Royal Canadian Mounted Police E Division Headquarters in Surrey, British Columbia, and the Communications Security Establishment Canada long-term accommodation project in Ottawa. Going forward, federal departments will be required to evaluate the potential for using a P3 for large federal capital projects. All infrastructure projects creating an asset with a lifespan of at least 20 years, and having capital costs of $100 million or more, will be subjected to a P3 screen to determine whether a P3 may be a suitable procurement option. Should the assessment conclude that there is P3 potential, the procuring department will be required to develop a P3 proposal among possible procurement options.

Departments will also be encouraged to explore the potential of P3 approaches for other types of projects and procurements of services.

Completing Canada’s Highway From Coast to Coast to Coast

The construction of an all-season road between Inuvik and Tuktoyaktuk has been identified as a priority by the Government of the Northwest Territories. This road will connect Canada from coast to coast to coast by extending the Dempster Highway to the Arctic coast. It will also strengthen Canada’s Arctic presence and contribute to economic and social development in the North.

Budget 2011 provides $150 million over five years, starting in 2012–13, to support this project in partnership with the Government of the Northwest Territories, the private sector, the Inuvialuit Regional Corporation and local communities.

Moving Ahead on Peterborough-Toronto Rail Service

The Government of Canada reaffirms its commitment to the development of a Peterborough-Toronto passenger rail service. The Government of Canada and the Government of Ontario have each set aside funding for this rail service under the Building Canada Fund, as outlined in the Canada-Ontario Building Canada Framework Agreement. A portion of this funding will be used to advance the project to the next phase, including the production of an engineering report, to be done in collaboration with the current rail owners and the Province of Ontario.

Maintaining Safe and Reliable Bridges

in Greater Montréal

The Jacques Cartier and Champlain Bridges Incorporated manages federal bridges in the Greater Montréal Area. These include the Jacques Cartier and Champlain Bridges, which are among the busiest in Canada with almost 100 million crossings every year. In support of the Continental Gateway Strategy, the Government is proposing to provide new funding of $228 million over three years on a cash basis to The Jacques Cartier and Champlain Bridges Incorporated to fund repairs and major maintenance to ensure that federal bridges in Greater Montréal continue to serve the needs of commuters while meeting the highest safety standards.

Supporting the Refurbishment of the Saint John Harbour Bridge

The Saint John Harbour Bridge in Saint John, New Brunswick, is a key component of the trade and transport corridor of the Atlantic Gateway. The Government has recently announced it will contribute to a major refurbishing of the bridge and forgive the outstanding debt owed to the Government of Canada by the Saint John Harbour Bridge Authority, conditional on the bridge being transferred to the Province and the tolls being removed. This arrangement will benefit the transportation industry and other regional businesses, and will help create jobs over the long term. Budget 2011 takes steps to implement the Government’s commitment.

Creating New Capacity at Ridley Terminals

Ridley Terminals Inc. is a federal Crown corporation which owns and operates a marine terminal providing for the transfer of bulk commodities, mainly metallurgical coal, from railcars onto ocean-going vessels. The terminal is located in Prince Rupert, British Columbia. The corporation operates as a commercial entity from the revenues received from the terminal’s bulk shipping activities.

In 2010, the corporation achieved record throughput volumes of bulk products, particularly coal. This is expected to continue over the coming years. To ensure that Ridley Terminals Inc. can accommodate growing throughput and meet the needs of its customers, the Government of Canada proposes to allow the corporation to borrow from capital markets so it can proceed with the necessary expansion of its facilities.

Maintaining and Improving Federal Infrastructure

Public Works and Government Services Canada manages, operates and maintains a number of engineering assets, such as bridges, dams and other specialized assets, across Canada. These assets include interprovincial bridges, such as the Macdonald-Cartier and Alexandra Bridges located in the National Capital Region, the Des Allumettes and Des Joachims Bridges connecting communities in Ontario and Quebec, and the J.C. Van Horne Bridge connecting communities in New Brunswick and Quebec; 835 kilometres of the Alaska Highway in British Columbia; the St. Andrews Lock and Dam in Manitoba; and the Kingston Dry Dock and Marine Museum in Ontario.

Budget 2011 provides $148 million, on a cash basis, over the next five years to Public Works and Government Services Canada to carry out capital expenditures required to maintain the safety of these assets. These upgrades will create jobs in the affected communities and ensure the assets continue to provide valuable services to the communities in which they are located.

Repairing Storm-Damaged Small Craft Harbours

The Government of Canada operates and maintains a national system of over 1,000 small craft harbours to provide commercial fish harvesters and other harbour users with safe and accessible facilities. These harbours are critical for the industry and small coastal communities, where approximately 90 per cent of all fish landings in Canada take place.

In the latter part of 2010, a series of storms damaged over 250 small craft harbours in Manitoba, Quebec and across Atlantic Canada. The Government is providing up to $72 million over three years, on a cash basis, for repairs and associated dredging to ensure that storm-damaged harbours remain safe and functional. Of this amount, $15 million will be sourced from the existing resources of Fisheries and Oceans Canada.

Supporting Canadian Agriculture

The agriculture and agri-food sector provides jobs and opportunities across Canada. The Government has been working closely with its provincial and territorial partners and industry to improve the profitability of the sector and provide a strong economic foundation for rural communities. Under the federal/provincial/territorial Growing Forward policy framework, the Government has provided over $4 billion since 2008 to the benefit of agriculture producers through business risk management programs, including $470 million to provide assistance to grain and livestock farmers following the 2010 spring floods in Western Canada. The Government has also provided targeted assistance to support the competitiveness of the sector and enhance market access through initiatives such as the Slaughter Improvement Program, the Hog Industry Loan Loss Reserve Program, the Hog Farm Transition Program and the Market Access Secretariat.

In the coming year, governments will seek input from the sector and Canadians to help set priorities and develop program options for the next agricultural policy framework, Growing Forward 2, which will be launched in 2013–14. The Government will assess program options to ensure they provide effective support to the sector while remaining affordable.

Budget 2011 proposes measures that will support innovation and the long-term profitability of the agriculture sector and strengthen food safety in Canada.

Investing in Agricultural Innovation

Long-term growth, profitability and global competitiveness of the Canadian agricultural sector depend on innovation. A sector that fails to innovate not only fails to grow, but it loses ground as competitors exploit emerging new opportunities and capture market share. To ensure that Canadian producers remain on the cutting edge of science and technology, Budget 2011 announces a two-year, $50-million Agricultural Innovation Initiative to support knowledge creation and transfer and increased commercialization of agricultural innovations.

Addressing Plant and Animal Health Risks

Effective management of plant and animal diseases limits the negative impact that these diseases can have on production and the livelihood of producers. Active mitigation efforts serve to reduce the likelihood of future disease outbreaks and will help improve the productivity of the sector.

Plum pox virus is a disease that affects the fruit, yield and productive life of peach, plum, apricot and nectarine trees. Building on progress achieved to date with the support of Canadian producers to eradicate the virus, Budget 2011 allocates $17 million over five years for a management and monitoring strategy to contain and prevent the spread of plum pox.

The Government has provided support to the hog industry to manage diseases such as circovirus, which can cause negative health impacts and increased mortality for young hogs. Budget 2011 extends the existing Initiative for the Control of Diseases in the Hog Industry and proposes to provide $24 million for an additional two years until March 2013. This will enable the Canadian Swine Health Board to complete initiatives directed at national biosecurity standards and best management practices.

Agri-Québec

AgriInvest is a federal-provincial program designed to encourage farmers, through government-matched contributions, to set aside earnings in order to provide coverage against income declines. It also supports investments that help mitigate risks or improve market income. Beginning this year, the province of Quebec will supplement AgriInvest with the new Agri-Québec program.

Under AgriInvest, government contributions and income earned on these contributions are taxable only on withdrawal from a producer’s AgriInvest account. In the spirit of coordinating federal and provincial policies to improve the delivery of programs to Canadians, the Government will ensure that, for the 2011 and subsequent taxation years, the Agri-Québec program is accorded the same income tax treatment that is currently provided to the federal AgriInvest program.

It is estimated that this measure will reduce federal revenues by $5 million in 2011–12 and by $1 million in 2012–13.

Strengthening Food Safety

Food safety is fundamental to the health and daily life of Canadian families, which is why the Government continues to take the steps necessary to improve Canada’s food safety system. In response to the recommendations of the Report of the Independent Investigator Into the 2008 Listeriosis Outbreak (the Weatherill Report), the Government initiated a review of Canada’s food inspection system and announced an initial investment of $75 million over three years in 2009 to improve the Government’s ability to prevent, detect and respond to food-borne illness outbreaks. Budget 2011 provides an additional $100 million over five years on a cash basis to the Canadian Food Inspection Agency to improve food inspection capacity. This initiative will enable the Government to complete its response to all of the recommendations of the Weatherill Report through targeted investments in inspector training, additional science capacity, and electronic tools to support the work of front-line inspectors.

Supporting Forestry

The forestry sector enriches the economy of many regions in Canada. In recent years, the sector has taken important steps to embrace innovative technologies and transition to higher-value activities.

The Government is helping to accelerate the forestry sector’s transformation and supporting workers and communities by helping to open up new paths to success. Budget 2010 dedicated $100 million to the development of advanced clean energy technologies and new bioproducts in the forestry sector, and the $1-billion Pulp and Paper Green Transformation Program announced in June 2009 is helping the sector improve its energy efficiency.

Budget 2011 takes additional action to support the transformation of the forestry sector by proposing to provide $60 million in 2011–12 to help forestry companies innovate and tap into new opportunities abroad. This funding will support the development of emerging and breakthrough technologies through the Transformative Technology Program administered by FPInnovations. It will also help forestry companies to diversify and to expand their markets through the Value to Wood Program, the Canada Wood Export Program and the North American Wood First Initiative.

The measures proposed in Budget 2011 complement previous and ongoing federal initiatives that are helping to ensure that Canada’s forestry sector can continue to provide high-quality jobs in the industry and the communities that depend on it.

| 2010–11 | 2011–12 | 2012–13 | Total | |

|---|---|---|---|---|

| (millions of dollars) | ||||

| Fostering Canada’s Business Advantage | ||||

| Supporting Small Business and Entrepreneurs | ||||

| Supporting young entrepreneurs | 10 | 10 | 20 | |

| Reducing red tape for small business—BizPaL | 3 | 3 | 6 | |

| Other Measures to Strengthen the Business Environment |

||||

| Preventing labour disruptions | 1 | 1 | 1 | |

| Strengthening Canada’s standards system | 2 | 2 | ||

| Subtotal—Fostering Canada’s Business Advantage | 14 | 16 | 29 | |

| Investing in a Cleaner Energy Economy | ||||

| Clean energy technology and innovation | 32 | 64 | 97 | |

| Promoting clean energy in Aboriginal and Northern communities |

4 | 4 | 8 | |

| Supporting the development of the Alaska Pipeline Project |

2 | 2 | 4 | |

| Expanding tax support for clean energy generation |

1 | 2 | 3 | |

| Extending qualifying environmental trust rules to pipelines |

||||

| Eliminating fossil fuel subsidies | -15 | -30 | -45 | |

| Supporting Atomic Energy of Canada Ltd. | 364 | 1 | 365 | |

| Subtotal—Investing in a Cleaner Energy Economy | 388 | 43 | 431 | |

| Strengthening Canada’s International Engagement | ||||

| Expanding and Facilitating Trade | ||||

| Establishing a Canada-India Research Centre of Excellence |

3 | 3 | ||

| Meeting Our Global Responsibilities | ||||

| International Civil Aviation Organization | 1 | 1 | 2 | |

| Subtotal—Strengthening Canada’s International Engagement |

1 | 4 | 5 | |

| Maintaining Canada’s Financial Sector Advantage | ||||

| Enhancing financial literacy | 3 | 3 | 6 | |

| Strengthening Canada’s Public Infrastructure | ||||

| Completing Canada’s highway from coast to coast to coast |

30 | 30 | ||

| Maintaining safe and reliable bridges in Greater Montréal |

15 | 47 | 62 | |

| Maintaining and improving federal infrastructure | 1 | 3 | 4 | |

| Repairing storm-damaged small craft harbours | 14 | 1 | 15 | |

| Subtotal—Strengthening Canada’s Public Infrastructure |

30 | 81 | 111 | |

| Supporting Canadian Agriculture | ||||

| Investing in agricultural innovation | 25 | 25 | 50 | |

| Addressing plant and animal health risks | -24 | 19 | 13 | 8 |

| Agri-Québec | 5 | 1 | 6 | |

| Strengthening food safety | 9 | 8 | 18 | |

| Subtotal—Supporting Canadian Agriculture | -24 | 58 | 47 | 82 |

| Supporting Forestry | ||||

| Forest innovation and market development support | 60 | 60 | ||

| Total—Supporting Job Creation | -24 | 554 | 194 | 724 |

| Less funds existing in the fiscal framework | 85 | 105 | 189 | |

| Net fiscal cost | -24 | 469 | 90 | 534 |

| Note: Totals may not add due to rounding. | ||||