Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Chapter 3.5 - Growing Trade and Expanding Markets

Highlights

Fostering Trade

- Providing $50 million over five years for a program to share the cost of exploring new export opportunities with small and medium-sized enterprises.

- Providing $42 million over five years to expand the footprint and resources of the Trade Commissioner Service.

- Securing agriculture market access by providing $18.1 million over two years, starting in 2016–17, to promote competitiveness and trade opportunities for the agriculture and agri-food sector.

- Providing an additional $12 million over two years, starting in 2016–17, to market Canadian agricultural and agri‑food products around the world.

- Providing $5.7 million over five years, starting in 2015–16, to help secure new market access for Canadian seal products.

- Providing $3 million over three years, starting in 2015–16, for the International Maritime Centre to attract foreign shipping companies to establish their headquarters in Vancouver.

- Supporting a new tourism marketing campaign in the United States.

- Ensuring that Canada’s trade remedy system operates in an effective, accessible and transparent manner.

- Continuing to implement the Beyond the Border and Regulatory Cooperation Council Action Plans with the United States to strengthen our long-term security and trade relationship.

- Creating an Internal Trade Promotion Office within Industry Canada to support efforts to renew the Agreement on Internal Trade.

Responsible Resource Development

- Providing accelerated capital cost allowance treatment for assets used in facilities that liquefy natural gas.

- Extending the Mineral Exploration Tax Credit until March 31, 2016.

- Continuing to support effective project approvals through the Major Projects Management Office Initiative, with $135 million over five years, starting in 2015–16.

- Providing $34 million over five years, starting in 2015–16, to continue consultations with Canadians related to projects assessed under the Canadian Environmental Assessment Act.

- Dedicating $80 million over five years, starting in 2015–16, to the National Energy Board for safety and environmental protection and greater engagement with Canadians. This funding will be fully cost-recovered from industry.

- Providing $30.8 million over five years, starting in 2015–16, for measures to enhance the safety of marine transportation in the Arctic and further strengthen marine incident prevention, preparedness and response in waters south of the 60th parallel.

- Providing $22 million over five years, starting in 2015–16, to Natural Resources Canada to renew the Targeted Geoscience Initiative.

- Dedicating $23 million over five years, starting in 2015–16, from Natural Resources Canada to stimulate the technological innovation needed to separate and develop rare earth elements and chromite.

- Continuing to support the transformation of the forest sector by providing $86 million over two years, starting in 2016–17, to extend the Forest Innovation Program and the Expanding Market Opportunities Program.

Introduction

Since 2006, the Government has, as part of its long-term economic plan, focused on creating the right conditions and opportunities in international trade and investment and responsibly developing Canada’s natural resources. These areas are vital to the continued growth of the Canadian economy and contribute to the prosperity of people and businesses across Canada.

The Government is focused on ensuring Canadian businesses have preferential terms of trade and investment with other nations. Since 2006, the Government has concluded free trade agreements with 38 countries, bringing Canada’s total to 43. The past year was particularly successful, with the conclusion of the Canada‑European Union trade negotiations, the entry into force of the Canada-Korea Free Trade Agreement and the Canada-China Foreign Investment Promotion and Protection Agreement, and significant progress towards concluding the Trans-Pacific Partnership Agreement with 11 other Asia-Pacific nations. With new trade agreements complete and more soon to be in place, the Government is now focusing on helping Canadian businesses fully capitalize on global opportunities.

Canada has the potential to be a major player in the global energy economy because of its abundant natural resources. With the third largest known oil reserves in the world, a commitment to environmentally responsible development and the ability to provide a stable and secure supply, Canada’s natural resources are well placed to meet growing global demand. Responsible Resource Development is an important part of the Government’s economic plan to create jobs, growth and long-term prosperity. The Government has implemented system-wide improvements to achieve the goal of “one project, one review” in a clearly defined time period. The approach features predictable and timely reviews for major natural resource projects, reduced regulatory duplication, strengthened environmental protection and enhanced consultations with Aboriginal peoples.

Fostering Trade

With the increasing importance of global value chains, Canadian exporters benefit from preferential access to foreign markets and the reduction of trade barriers. Trade growth also benefits Canadians here at home, through increased job creation and increased competition, which can lead to lower prices and higher standards of living.

This Government has placed a priority on securing preferential terms of trade and investment with other nations for Canadian business. Since 2006, the Government has concluded free trade agreements with 38 countries, bringing Canada’s total to 43. The past year has been particularly successful:

- In September 2014, the Government of Canada and the European Union released the complete text of the Canada‑European Union Comprehensive Economic and Trade Agreement. The agreement opens the way to vastly increased trade, job creation and greater prosperity, providing preferred access to the world’s largest and most lucrative market, with more than 500 million consumers in 28 countries.

- On January 1, 2015, the Canada-Korea Free Trade Agreement, Canada’s first trade agreement in Asia, came into force. Nearly 90 per cent of Canada’s current exports to South Korea are now duty-free, and Canadian businesses will be able to benefit from South Korea’s position as a gateway to the dynamic Asian region and tap into its global value chains.

- On October 1, 2014, Canada’s trade agreement with Honduras entered into force—Canada’s seventh free trade agreement in the Americas.

- Also on October 1, 2014, Canada’s foreign investment promotion and protection agreement with China came into force, helping to ensure that Canadian companies investing in China are treated fairly and benefit from a more predictable, secure and transparent business environment. This brings to 28 the number of investment agreements Canada has with countries around the world.

- On November 27, 2014, Canada and other World Trade Organization (WTO) members adopted a protocol to implement the WTO Trade Facilitation Agreement. The Agreement will introduce binding rules to expedite the movement and clearance of goods at borders in order to reduce red tape and delays. This will reduce border transaction costs for Canadian exporters, directly benefitting small and medium-sized businesses, for which border delays can be particularly burdensome. Canada will undertake procedures necessary to ratify and implement the Agreement.

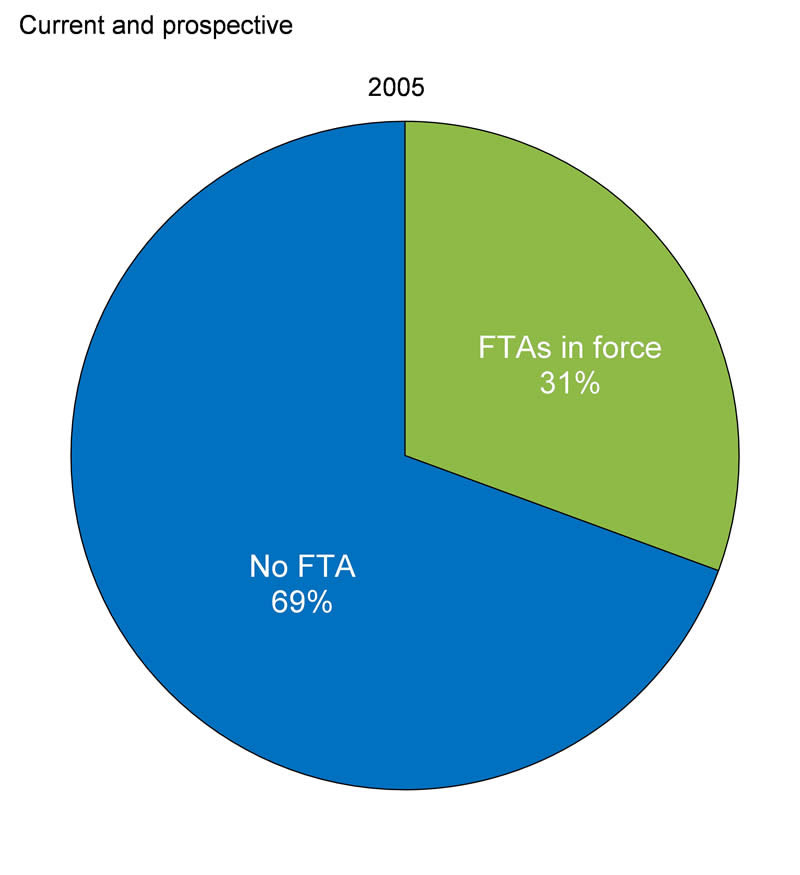

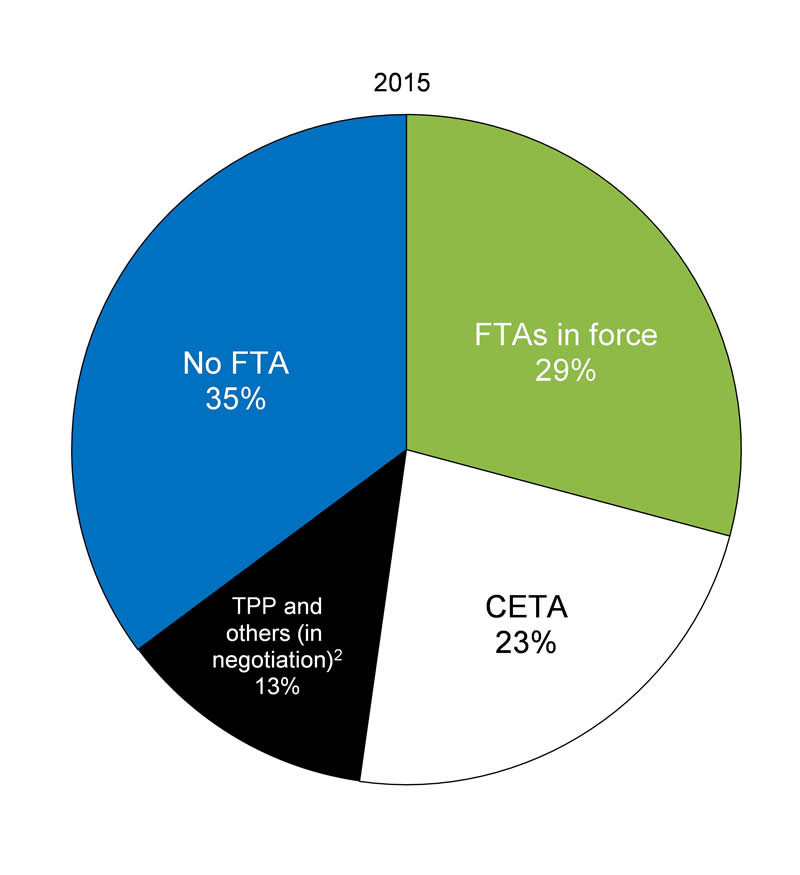

With new trade agreements with the European Union and South Korea, Canadian businesses will soon benefit from preferential access to more than half of the entire global marketplace (Chart 3.5.1). In addition to these agreements, Canada continues to work towards concluding the Trans-Pacific Partnership, a trade agreement between 12 Asia-Pacific nations, including Canada’s North American Free Trade Agreement partners, with a combined population of nearly 800 million and gross domestic product (GDP) of over $27 trillion. Such an agreement will help to strengthen North American production linkages and further increase Canada’s trade growth with Asia.

Share of Global GDP Covered by Canada’s Trade Agreements and Agenda1

With new trade agreements now complete and more soon to be in place, the Government is focusing on helping Canadian businesses fully capitalize on global opportunities. Economic Action Plan 2015 proposes significant new investments to support trade. These investments build on the Government’s commitment to encourage and support entrepreneurship by connecting small and medium-sized firms with the tools and resources they need to succeed both at home and abroad.

Export Market Development Program

Economic Action Plan 2015 proposes to provide $50 million over five years, starting in 2015–16, to create an export market development program to share the financial costs with small and medium-sized enterprises as they explore and pursue new export opportunities.

Small and medium-sized enterprises (SMEs) represent 99 per cent of all businesses in Canada. This Government’s pro-jobs and pro-export plan recognizes the importance of supporting SMEs to take advantage of Canada’s new trade agreements in Europe and Asia, which, in combination with Canada’s existing trade agreements, will provide SMEs with preferential access to more than half of the global marketplace.

To this end, Economic Action Plan 2015 proposes a new export market development program that will help SMEs develop export opportunities by providing direct financial assistance to entrepreneurs seeking to develop new markets, especially in high-growth emerging markets. This initiative will be particularly helpful in supporting SMEs finance activities such as market research, participation in trade fairs and missions, shipping prototypes and pilot projects to create new business opportunities. The program is targeting between 500 and 1,000 Canadian exporters per year across the country. The program will also ensure coordination with other Canadian partners (governments, agencies and private sector organizations) in order to maximize the support for new exporters. Details of the program will be announced in the coming months.

Enhancing the Trade Commissioner Service

Economic Action Plan 2015 proposes to provide increased funding of $42 million over five years, starting in 2015–16, and $9.3 million per year thereafter to expand the footprint and resources of the Canadian Trade Commissioner Service, to support Canadian firms with on-the-ground intelligence and practical advice on foreign markets to help them achieve their goals.

The Canadian Trade Commissioner Service has more than 160 trade offices and almost 1,000 staff in Canada and around the world to help provide export advice and guidance to entrepreneurs, such as information on local regulations, customs and business practices. In 2013–14, the Canadian Trade Commissioner Service provided direct services to almost 12,000 Canadian firms to help them enter foreign markets.

Additional investments in the Canadian Trade Commissioner Service will help Canadian exporters take advantage of the market access gains achieved through Canada’s new trade and investment agreements. 20 new trade commissioner positions and new programming resources will be focused on recently announced free trade partners, such as South Korea and the European Union, as well as in high-growth emerging markets and commercially important established markets that are home to large numbers of global value chain leaders and are major sources of foreign investment and innovation.

Securing Agriculture Market Access

Economic Action Plan 2015 proposes to provide $18.1 million over two years, starting in 2016–17, to promote competitiveness and trade opportunities for the agriculture and agri-food sector.

Canada has achieved considerable success in opening up new markets and creating opportunities for the agriculture and agri-food sector through new free trade agreements. With export sales of $46 billion in 2013, Canada is the fifth largest exporter of agricultural and agri-food products globally.

In 2009, the Government created the Market Access Secretariat to help maintain access to new and existing markets. The Market Access Secretariat is the Government’s single window to assist industry in addressing trade-related concerns by reopening, maintaining and expanding market access for Canadian agricultural and agri-food exports.

To build on the achievements to date, Economic Action Plan 2015 proposes to provide $18.1 million over two years, starting in 2016–17, to expand the activities of the Market Access Secretariat, to introduce new agriculture trade commissioners abroad and to play a more active role in setting international science-based standards. This will support the agriculture sector in continuing to expand and diversify into new markets and in continuing to capitalize on opportunities created by new trade agreements.

On April 15, 2015, the Minister of Agriculture and Agri-Food, the Honourable Gerry Ritz, announced Government of Canada approval of a deal reached between CWB (formerly the Canadian Wheat Board) and G3 Global Grain Group, which ensures that CWB becomes a fully private and global competitor in the Canadian grain sector. With this deal, the Government has fully delivered on its commitment to marketing freedom by increasing marketing choice for Western Canadian grain farmers.

Expanding the AgriMarketing Program

Economic Action Plan 2015 proposes to provide $12 million over two years, starting in 2016–17, to the AgriMarketing Program to promote Canadian agricultural and agri-food products around the world.

Agricultural and agri-food products produced in Canada are among the safest and highest quality in the world. Economic Action Plan 2015 proposes to provide $12 million over two years, starting in 2016–17, to expand Agriculture and Agri-Food Canada’s AgriMarketing Program to promote and differentiate Canadian products in a highly competitive global and domestic marketplace. This builds on the $341 million in funding over five years currently available through the AgriMarketing Program under Growing Forward 2. Funding will enable farmers to further enhance marketing capacity at home and abroad, and to enhance Canada’s international presence in priority markets and build strong relationships with trade partners.

The AgriMarketing program helps farmers and food processors compete in markets at home and abroad. Under this program, not-for-profit industry organizations and small and medium-sized enterprises in the agriculture, agri-food, and fish and seafood sectors receive support for promotional activities. Specific activities supported include:

- Development and implementation of long-term market development strategies.

- Industry-wide branding, promotion and advertising, including in-store and food service promotions and product demonstrations for buyers both domestically and internationally.

- Technical training for buyers about Canadian products and product handling.

- Trade seminars designed to inform industry representatives of specific attributes of Canadian agriculture, agri‑food, fish and seafood products.

Funding through the AgriMarketing program supports a wide range of agricultural products including Canadian pork, beef, grains and fish and seafood products, including lobster.

Supporting the Canadian Sealing Industry

Economic Action Plan 2015 proposes to provide $5.7 million over five years, starting in 2015–16, to help secure new market access for Canadian seal products.

Sealing is a way of life and a valuable source of food in many Aboriginal and coastal communities. Seal products also generate income in some communities that have limited job opportunities. The Government will establish a system to certify seal products resulting from hunts traditionally conducted by Aboriginal communities in order to meet the requirement set by the European Union so that seal products can enter that market. Actions will also be taken to help Aboriginal sealers develop effective sealing businesses by providing business advice and training. The Government will continue to support efforts by the broader sealing industry to increase export market opportunities.

Promoting Canada as a Global Maritime Centre

Economic Action Plan 2015 proposes to provide $3 million over three years, starting in 2015–16, for the International Maritime Centre in Vancouver.

Canada’s shipping industry is critical for ensuring goods get safely to market. The International Maritime Centre aims to attract targeted foreign investment into Canada, facilitate foreign shipping companies and support businesses in establishing their headquarters in Vancouver. Port Metro Vancouver is Canada’s largest port and links Canadian businesses with over 150 trading economies in the world. The Centre will further promote British Columbia as a maritime centre and best-in-class transportation and logistics hub, and help create jobs and promote regional economic growth.

This announcement follows amendments made in December 2014 to the Income Tax Act to modernize Canada’s international shipping tax regime by introducing more flexible rules for international shipping corporations in order to reflect the structures of modern shipping organizations.

Economic Action Plan 2015 proposes to provide $3 million over three years, cost-matched by the province of British Columbia, starting in 2015–16, to support the International Maritime Centre in Vancouver.

Promoting Canadian Tourism

Economic Action Plan 2015 proposes to provide additional support to the Canadian Tourism Commission to embark on a new marketing campaign in the United States, in partnership with the tourism industry. Details will be announced in the coming months.

Canada’s tourism sector is an important contributor to our economy, comprising 178,000 businesses across Canada in industries such as transportation, accommodation, food and beverage services, recreation and entertainment, and travel services.

Building on the Canadian Tourism Commission’s strong track record of marketing Canada to visitors from all over the world, Economic Action Plan 2015 proposes to provide additional support for the Commission to lead a new initiative, in partnership with the tourism industry, to promote Canada to travellers from the United States. This targeted campaign is expected to attract a larger number of American visitors to destinations across Canada, helping to promote economic activity and job creation in the tourism sector. Details will be provided in the coming months after the Government consults with important stakeholders in the tourism sector.

Economic Action Plan 2015 also proposes to expand the Electronic Travel Authorization eligibility to low-risk travellers from four countries, including Brazil and Mexico, which are two of the Commission’s priority markets where a visa is required for citizens travelling to Canada. This will help make Canada a more attractive destination for tourism and business, while allowing the Government to focus resources where it matters most—on higher-risk travellers (see Chapter 4.3, “Facilitating Legitimate Travel to Canada”).

Ensuring an Effective Trade Remedy System

The Government’s expanded trade agenda is critical for the growth of the Canadian economy. To support Canadian jobs and investment, trade must not only be free, it must also be fair. Therefore, Canada’s commitment to open markets includes a trade remedy system that ensures that goods are not unfairly priced or subsidized when coming into the Canadian market. These rules support conditions for Canadian manufacturers to thrive, in both domestic and international markets. To maintain a level playing field for Canadian producers, the Government will ensure that the trade remedy system operates in an effective, accessible, and transparent manner, in consultation with stakeholders such as the Canadian Steel Producers Association.

Canada-U.S. Beyond the Border Action Plan and Regulatory Cooperation Council Action Plan

Prime Minister Stephen Harper and United States President Barack Obama announced the Beyond the Border Action Plan and the Regulatory Cooperation Council Action Plan in December 2011. These Plans outlined concrete measures to speed up legitimate trade and travel, improve security and economic competitiveness, and align regulatory approaches between the two countries. The Government will continue to implement these initiatives, with a renewed emphasis through new Forward Plans, to strengthen our long-term security and trade relationship—where nearly $2 billion worth of goods and services and over 300,000 people cross our shared border every day.

Beyond the Border Action Plan

Since the Beyond the Border Action Plan was announced over three years ago, Canada and the U.S. have taken great strides to enhance security, transform border management and facilitate the flow of legitimate travellers and cargo. These important efforts and investments have begun to pay off for businesses and travellers through an increasingly efficient, modernized and secure border. Examples of key achievements over the past year include:

- Signing on March 16 a historic, comprehensive pre-clearance agreement with the U.S. that will facilitate travel by allowing pre-inspection by U.S. or Canadian officials at approved land, rail and marine ports of entry and by enhancing the existing air pre-clearance arrangements.

- Implementing major new investments in priority border infrastructure in Canada and the U.S. in line with Canada-U.S. Joint Border Infrastructure Investment Plans.

- Enrolling over 1 million members in the NEXUS trusted traveller program—an 80 per cent increase since 2011—and adding new NEXUS benefits, resulting in greater time savings at the land border, airports and marine ports of entry.

Regulatory Cooperation Council Joint Forward Plan

Building on the momentum generated through the first year’s work of the Canada‑U.S. Regulatory Cooperation Council and incorporating ongoing stakeholder input, work will continue through the next phase of regulatory cooperation as outlined in the Canada-U.S. Joint Forward Plan, which was developed through the first half of 2014 and released in August 2014. The Plan, which sets out new binational partnerships between Canadian and U.S. departments and agencies, represents a pivot point for the regulatory relationship between the two countries.

Reducing Barriers to Internal Trade

Economic Action Plan 2015 announces the creation of an Internal Trade Promotion Office within Industry Canada to support federal-provincial-territorial negotiations to strengthen the domestic economy by comprehensively renewing the Agreement on Internal Trade.

Canada has made significant progress towards improving trade relations around the world. However, improvements to trade within Canada are not keeping pace. Persistent barriers to internal trade fragment our economy. They restrict opportunities for Canadian firms to grow and compete, limit access to jobs for workers and increase costs to consumers. The willingness of provinces and territories expressed at the 2014 Council of the Federation meeting to modernize the Agreement on Internal Trade represents a key opportunity to address internal trade barriers that weaken the Canadian economic union.

To maintain momentum and support this ongoing work with provinces, territories and businesses to eliminate barriers to internal trade, the Government will establish a federal Internal Trade Promotion Office within Industry Canada. The Office will act as the federal hub for research and analysis to enhance our collective understanding of the impact of barriers to internal trade, building on the Government’s Internal Trade Barriers Index announced in Economic Action Plan 2014. The Office will also engage with provinces and territories, businesses, workers, consumers and academia to explore opportunities to address internal trade barriers, including through regulatory cooperation activities.

Responsible Resource Development

Responsible Resource Development is an important part of the Government’s economic plan to create jobs, growth and long-term prosperity. Canada’s natural resource sector represents 19 per cent of the economy, over half our merchandise exports and supports 1.8 million jobs directly and indirectly. Canada’s natural resources sector is one of the leading private employers of Aboriginal people. On average, natural resource firms have contributed about $30 billion per year in revenue for governments in Canada (2008–12).

The Government’s plan for Responsible Resource Development has improved the review process for major resource projects while strengthening environmental protection and enhancing consultations with Aboriginal peoples. As a result, the review process for major projects is efficient and effective.

Additional actions have also been taken to ensure the safety of federally regulated pipelines and to strengthen Canada’s marine oil spill prevention, preparedness, and response regime:

- The Government has enshrined the principle of “polluter pays” in legislation. The absolute liability for oil and gas companies operating in the offshore has been raised to $1 billion. Operator liability remains unlimited in cases of fault or negligence. Through the Pipeline Safety Act (Bill C-46), the Government is currently proposing to hold polluters financially responsible for the costs and damages they cause. Companies operating major oil pipelines will be required to have a minimum financial capability of $1 billion to respond to incidents and remedy damage. The Government has also introduced legislative amendments to make an unlimited amount of compensation from Canada’s domestic ship-source compensation fund (which is financed through a levy on industry) available in response to a specific marine oil spill incident.

- Since 2012, the Government has provided funding to strengthen Canada’s marine spill prevention, preparedness and response regime. Measures in support of a world-class tanker safety regime have included: extending the National Aerial Surveillance Program, to prevent and detect discharges of pollutants; a new Incident Command System, to more effectively manage oil spill response operations; increasing inspection of foreign tankers on their first visit to Canada; and engaging community partnerships in Aboriginal and Northern communities to foster engagement in planning processes for an oil spill response operation.

- The Government has introduced additional measures to improve and strengthen the tanker safety system in waters south of the 60th parallel, such as modernizing Canada’s marine navigation system; supporting leading-edge scientific research on petroleum products and response measures; and piloting Area Response Planning in four areas across Canada.

Canada is a world leader in the production of major minerals and metals: first in potash; second in uranium and cobalt; third in aluminum and tungsten; fourth in platinum group metals, sulphur and titanium; and, fifth in nickel and diamonds. Canada has one of the largest mining supply sectors globally with more than 3,400 companies supplying engineering, geotechnical, environmental, financial and other services to mining operations. According to the Mining Association of Canada, 57 per cent of the world’s public mining companies are listed on the TSX and TSX Venture exchanges. Together, the two exchanges handled 48 per cent of global mining equity transactions, and accounted for 46 per cent of global mining equity capital in 2013.

The measures proposed in Economic Action Plan 2015 will continue to encourage responsible resource development, further enhance marine safety, sustain Canada’s global leadership in the mining sector, and support Canada’s forest sector to create jobs across Canada.

Supporting the Creation of an LNG Industry in Canada

Economic Action Plan 2015 affirms the Government’s intent to provide accelerated capital cost allowance (CCA) treatment for assets used in facilities that liquefy natural gas.

Canada benefits from large reserves of natural gas but has a limited capacity to supply it to emerging international and domestic markets where demand is growing. Natural gas can be cooled to a liquid state (liquefied natural gas, known as LNG), thereby reducing its volume and facilitating its transportation and storage. The liquefaction of natural gas is a capital-intensive activity that requires large upfront investments.

On February 19, 2015, the Prime Minister announced the Government’s intention to provide accelerated capital cost allowance (CCA) treatment for assets used in facilities that liquefy natural gas. This will build on Canada’s existing advantages and encourage investment in facilities that supply LNG to new markets.

The accelerated CCA treatment will allow businesses to more quickly recover the cost of their initial capital investment.

- Equipment used for natural gas liquefaction is generally included in CCA Class 47 with a CCA rate of 8 per cent. The accelerated CCA will take the form of an additional 22 per cent allowance that will bring the CCA rate up to 30 per cent for Class 47 property used in Canada in connection with natural gas liquefaction.

- Non-residential buildings at a facility that liquefies natural gas are currently eligible for a CCA rate of 6 per cent. A second additional allowance will bring the CCA rate up to 10 per cent for non-residential buildings that are part of a liquefaction facility.

The deferral of tax associated with this measure is expected to reduce federal taxes by $45 million over the 2015–16 to 2019–20 period.

[ACCA for LNG] is great news for the creation of LNG jobs in British Columbia, and great news for Canada …. We have been working with the federal government and industry for some time to achieve this outcome, and I am pleased they have delivered...

We view this as a positive step by the Government of Canada and this will help increase the fiscal certainty that we’ve been looking for.

The faster tax write-off will provide companies a very competitive incentive to invest in LNG liquefaction facilities in Canada… We have seen the very positive impact that accelerated depreciation has had on manufacturing investments.

Supporting Junior Mineral Exploration

Economic Action Plan 2015 affirms the Government’s intent to extend the 15 per cent Mineral Exploration Tax Credit for flow-through share investors for an additional year.

Canada is one of the world’s leading mining nations and has had the largest global share of spending on exploration for non-ferrous minerals every year since 2002. About 380,000 Canadian jobs are in the mining and mineral processing industries.

Promoting the exploration of Canada’s mineral resources by junior exploration companies helps create jobs and economic development across the country. The 15 per cent Mineral Exploration Tax Credit helps these companies raise capital by providing an incentive to investors in flow-through shares issued to finance mineral exploration. This credit is in addition to the deduction provided to the investor for the exploration expenses “flowed through” by the company that issues the shares. Since 2006, the Mineral Exploration Tax Credit has helped junior mining companies raise over $5.5 billion for exploration. In 2013, more than 250 companies issued flow-through shares with the benefit of the credit to more than 19,000 individual investors.

On March 1, 2015, the Government announced its intention to extend the Mineral Exploration Tax Credit for an additional year, until March 31, 2016.

It is estimated that this measure will result in a net reduction in federal revenues of $35 million over the 2015–16 to 2016–17 period.

Facilitating Responsible Resource Development

Economic Action Plan 2015 affirms the Government’s intent to ensure that the costs associated with undertaking environmental studies and community consultations that are required in order to obtain an exploration permit will be eligible for Canadian Exploration Expense treatment.

On March 1, 2015, the Government also announced its intention to modify the tax rules to ensure that the costs of environmental studies and community consultations that are required in order to obtain an exploration permit will be eligible for treatment as Canadian Exploration Expenses (CEE).

Canadians pride themselves on our country’s strong environmental protections, and meaningful consultation with local residents remains a key plank in the Government’s Responsible Resource Development plan. But in the past, environmental studies and community consultations required to pursue an exploration project were not always eligible for CEE treatment. The Government recognizes that the associated cost of these requirements is part of doing business in Canada, and these changes aim to make Canada an even better place to do business.

CEE treatment recognizes the enormous challenges facing mining and oil and gas companies as they explore for resources: a low probability of success; large capital requirements; and long timeframes before reporting positive cash flow. With CEE treatment, the costs of environmental studies and community consultations will be immediately deductible, eligible to be renounced to investors using flow-through shares, and for eligible projects could qualify for the 15 per cent Mineral Exploration Tax Credit.

To ensure the proposed changes meet the needs of communities and companies, the Government will consult with stakeholders in drafting the implementing legislation.

It is estimated that this measure will result in a reduction of federal revenues on the order of $21 million over the years 2015–16 to 2019–20.

Mining is key for Canada’s prosperity. About 380,000 Canadian jobs are in the mining and mineral processing industries, with the highest wages and salaries of all of Canada’s industrial sectors. When we strengthen this industry, we create jobs, growth and long-term prosperity from coast to coast to coast.

Major Projects Management Office Initiative

Economic Action Plan 2015 proposes to provide $135 million over five years, starting in 2015–16, to continue to improve the efficiency and effectiveness of project approvals through the Major Projects Management Office Initiative.

Created in 2007 to provide a single window on the federal regulatory process for industry, the Major Projects Management Office Initiative has helped to transform the approvals process for major natural resource projects by shortening timelines, streamlining reviews and improving accountability by monitoring and reporting on the performance of federal regulatory departments. Numerous projects are currently benefitting from the system-wide improvements implemented by the Initiative. More than 35 projects have completed the review process since the Initiative was established.

Economic Action Plan 2015 proposes to provide $135 million over five years, starting in 2015–16, to the Major Projects Management Office Initiative. The Office will continue to provide a single window into the federal regulatory process and improve accountability to support the effective approval of major resource projects.

Supporting Consultations and Public Engagement in Federal Environmental Assessment Processes

Economic Action Plan 2015 proposes to provide $34 million over five years, starting in 2015–16, to the Canadian Environmental Assessment Agency to continue to support consultations related to projects assessed under the Canadian Environmental Assessment Act, 2012.

Consultation and public engagement are fundamental elements of the environmental assessment process. The Government is committed to consulting with Aboriginal peoples in the review of projects to ensure that their rights are respected and interests are taken into consideration. Meaningful engagement can also facilitate discussions on how Aboriginal peoples can benefit from the economic development opportunities associated with these projects.

Economic Action Plan 2015 proposes to provide $34 million over five years, starting in 2015–16, to the Canadian Environmental Assessment Agency. This will allow the Agency to consult with Canadians, including Aboriginal peoples, enabling them to participate in the environmental assessment of projects assessed under the Canadian Environmental Assessment Act 2012.

Contributing to the Safety of Energy Transportation Infrastructure

Economic Action Plan 2015 proposes to provide $80 million over five years, starting in 2015–16, to the National Energy Board for safety and environmental protection and greater engagement with Canadians.

The National Energy Board is an independent federal agency that regulates international and interprovincial aspects of the oil, gas and electric utility industries, including international and interprovincial pipelines. In 2013, the National Energy Board conducted about 300 compliance activities to ensure that the infrastructure under its purview met rigorous safety, security and environmental requirements.

Economic Action Plan 2015 proposes to provide $80 million over five years, starting in 2015–16, to the National Energy Board. These resources will contribute to safety and environmental protection, and enhance engagement with Canadians related to energy transportation infrastructure. This funding will be fully cost-recovered from industry.

Extending Natural Gas Export Licences

Economic Action Plan 2015 proposes to extend the maximum length of natural gas export licences from 25 years to 40 years to improve regulatory certainty for natural gas exporters.

The National Energy Board is responsible for issuing oil and gas export licences. Under the National Energy Board Act, the maximum length of natural gas export licences is currently limited to 25 years. Taking into consideration the significant investments required for liquefied natural gas (LNG) projects, and their significant anticipated economic benefits, the Government is taking additional steps to support the LNG industry and other natural gas exporters by extending the maximum limit of natural gas export licences from 25 to 40 years, to improve regulatory certainty. This measure builds on Canada’s existing advantages, in addition to the recently announced accelerated capital cost treatment for assets used in facilities that liquefy natural gas, to encourage investment in facilities that supply LNG to new markets.

Economic Action Plan 2015 proposes to introduce legislative amendments to the National Energy Board Act that would extend the maximum length of natural gas export licences from 25 years to 40 years.

Safe and Secure Shipping

Economic Action Plan 2015 proposes to provide $30.8 million over five years, starting in 2015–16, for measures to enhance the safety of marine transportation in the Arctic and further strengthen marine incident prevention, preparedness and response in waters south of the 60th parallel.

As a trading nation, Canada relies on a safe marine transportation network to bring products and resources to markets. Marine shipping in Canada is evolving, most notably in the North, with changing ice conditions, resource development and a growing population. At the same time, marine shipping on Canada’s east and west coasts continues to grow. The report of the Tanker Safety Expert Panel, A Review of Canada’s Ship-Source Spill Preparedness and Response: Setting the Course for the Future, Phase II – Requirements for the Arctic and for Hazardous and Noxious Substances Nationally, released on April 8, 2015, made a number of recommendations on ship-source spill prevention, preparedness and response requirements in the Arctic, for ship-source releases of hazardous and noxious substances in Canadian waters, and on the management of marine incidents.

Economic Action Plan 2015 proposes to provide $30.8 million over five years to enhance the safety of marine transportation in the Arctic and further strengthen environmental protection and marine incident prevention, preparedness and response south of the 60th parallel. Measures related to the Arctic include targeted investments of $17.0 million over five years to strengthen marine navigation safety by improving charting of the seafloor, designing navigation aids, engaging local and Aboriginal communities, as well as strengthening prevention, preparedness and response capacity. Measures in waters south of the 60th parallel include targeted investments of $13.8 million over five years to fund scientific research on the behaviour of oil in freshwater in order to contribute to the knowledge base to effectively respond to oil spills in some of the highest risk areas in Canada, and to increase marine oil spill response capacity in the St. Lawrence River. Through these investments, the Government is taking steps to ensure Canadian goods can be safely transported to market.

Supporting Jobs in Mining Through Geoscience Investments

Economic Action Plan 2015 proposes to provide $22 million over five years, starting in 2015–16, to Natural Resources Canada to renew the Targeted Geoscience Initiative, with a focus on developing new in-depth geoscience knowledge to inform the exploration of deeper mineral deposits.

Through the Targeted Geoscience Initiative, the Government works in partnership with provinces, territories, industry and universities to provide integrated geoscience knowledge pertaining to areas with mineral potential, and to help stimulate private sector resource investment and exploration.

Economic Action Plan 2015 proposes to provide $22 million over five years, starting in 2015–16, to Natural Resources Canada to renew the Targeted Geoscience Initiative. This initiative will support mining industries by developing knowledge and expertise to increase their competitiveness. The initiative contributes to increased private sector exploration and successful discovery rates for base metals; grows the pool of highly qualified people available to industry; and extends the life of existing mines and communities.

Unlocking Rare Earth Elements and Chromite Production in Canada

Economic Action Plan 2015 proposes to allocate $23 million over five years, starting in 2015–16, from Natural Resources Canada to stimulate the technological innovation needed to separate and develop rare earth elements and chromite.

The commercial production of rare earth elements and chromite in Canada represents a significant economic opportunity. Realizing this opportunity will require advances in science and technology.

Rare earth elements have specific properties that make them critical inputs to the defence, aerospace, automotive, energy and consumer electronics industries. Canada also has significant unexploited deposits of chromite, which is used to manufacture steel and other alloys.

There is considerable resource potential for chromite and rare earth element production in Canada.

Chromite deposits located in Ontario’s Ring of Fire have production potential that could make Canada a significant global producer, processor and supplier of products that contain the critical metal chromium. Over 90 per cent of global chromite production is used to manufacture stainless steel and other alloys. There is no substitute for this mineral in the production of stainless steel, which has unique corrosion resistance properties. Chromium-based alloys are also used in gas turbines, aircraft engines and other high temperature applications. There are currently six chromite projects at the exploration phase in Canada, which are estimated to have about 105 million tons of chromite. Global demand for stainless steel is forecast to grow at 4-5 per cent annually to 2020. Although major steel mills exist in North America, there is currently no chromite production in North America. This presents an opportunity for Canada to develop its abundant deposits and become a global supplier. To date, the Government has invested more than $35 million towards the development of the Ring of Fire, including Aboriginal capacity building, support to small business and skills development and training.

Rare earth elements are critical minerals that represent an opportunity for Canada to enter an emerging and globally strategic market. The metallurgy for Canadian ores containing rare earth elements involves a complex sequence of individual separation, refinement, alloying and formation stages before they can be used in the production of permanent magnets, consumer electronics and other high value-added high-tech products. Canada does not currently produce any rare earth elements, but has deposits with significant potential. According to the Technology Metal Research Group, there are currently 51 advanced rare earth elements exploration projects in the world; 21 are located across Canada. Canada has the possibility to play a leading role in supplying rare earth elements by potentially fulfilling 20 per cent of global demand.

Economic Action Plan 2015 proposes to allocate $23 million over five years, starting in 2015–16, from Natural Resource Canada to address the technical challenges of separating and processing rare earth elements for use in advanced manufacturing applications and products. Funding will also support the development of efficient and green processing technologies to reduce the environmental impacts of chromite production.

Supporting Forest Sector Innovation and Marketing

Economic Action Plan 2015 proposes to provide $86 million over two years, starting in 2016–17, to extend the Forest Innovation Program and the Expanding Market Opportunities Program.

The forest industry directly employed an estimated 216,500 workers and contributed over $20.9 billion to Canada’s gross domestic product in 2013.

The Government has provided significant support to the forest sector to facilitate its transformation. In Economic Action Plans 2012 and 2013, the Government announced $197 million over four years, starting in 2012–13, in support for the Forest Innovation Program and the Expanding Market Opportunities Program.

- The Forest Innovation Program supports research, development and technology transfer, including the work of FPInnovations and the Canadian Wood Fibre Centre.

- The Expanding Market Opportunities Program helps the forest sector expand and diversify export opportunities in North America, as well as emerging offshore markets such as Europe, Japan, China, South Korea, India and the Middle East.

Recently, Economic Action Plan 2014 provided $90.4 million over four years to renew the Investments in Forest Industry Transformation program, which enables Canadian forestry companies to lead the world in demonstrating the viability of new technologies that improve efficiency, reduce environmental impacts, and create high-value products from Canada’s world-class forest resources.

Economic Action Plan 2015 proposes to provide $86 million over two years, starting in 2016–17, to continue to support the transformation of the forest sector by extending the Forest Innovation Program and the Expanding Market Opportunities Program. These programs will help forestry companies adopt emerging technologies and develop new markets for Canadian wood products.

The Government of Canada provides significant support to the Canadian forest sector to become more economically competitive and sustainable. Announced in Economic Action Plan 2012 and extended in Economic Action Plan 2013, the Forest Innovation Program and the Expanding Market Opportunities Program have helped companies adopt emerging technologies, as well as expand market opportunities in North America and internationally.

Projects funded under the Forest Innovation Program include:

- $6.1 million for research by FPInnovations on the development and market acceptance of Cross-laminated Timber. Cross-laminated Timber is a large wood panel product made of multiple layers of timber stacked and glued together resulting in a strength-enhanced product, which results in a smaller environmental footprint and faster construction.

- $4.25 million for research by Canadian Wood Fibre Centre on airborne laser scanning technology and high resolution imagery, as well as advanced measuring techniques, to enable forest companies and provincial agencies to obtain more precise information on their forest inventory to improve forest management planning and business decisions, while lessening environmental impacts.

Through the Expanding Market Opportunities Program, the Government of Canada, in partnership with the provinces and wood product associations, has made significant efforts to diversify wood export markets, including to China, a key market for Canadian wood products. For example, the Government of Canada has supported a number of market development activities in China, including:

- Increasing the knowledge of architects and builders of the use of wood in construction.

- Addressing issues that could limit the access of Canadian forest products, such as product standards and building codes, training, and quality assurance.

- Participating in outreach activities like trade missions and trade fairs.

Between 2007 and 2014, these activities have led to the value of wood product exports to China increasing by more than 10 times to $1.92 billion. Similar activities are being pursued in other markets, including India.

Other initiatives funded under the Expanding Market Opportunities Program include:

- $2.3 million to support research that would permit the construction of larger and taller buildings made of wood and foster greater use of wood in mid-rise public and private buildings in Canada, which would help improve the overall competitiveness of the forest sector.

- $2.2 million for the construction of public structures in Japan using Canadian wood products. The project aims to expand the use of wood in Japan and promote Canadian forest products as an environmentally responsible choice.

The Canadian forest products industry has overcome significant challenges and is now unleashing its enormous potential as a global leader in transformation and breakthrough innovation—a revolution that will result in significant economic opportunities and jobs. More and more surprising uses are being discovered for wood fibre—everything from clothing to car parts, from cosmetics to chemicals to advanced construction systems and more.

The Canadian forest products sector is poised to lead the global revolution in developing game changing technology from wood fibre by leveraging our unique innovation system of strategic partnership alignment, pooled resources, and targeted research which involves governments, industry, research bodies, academia and others.

| 2014–2015 | 2015–2016 | 2016–2017 | 2017–2018 | 2018–2019 | 2019–2020 | Total | |

|---|---|---|---|---|---|---|---|

| Fostering Trade | |||||||

| Export Market Development Program | 10 | 10 | 10 | 10 | 10 | 50 | |

| Enhancing the Trade Commissioner Service | 5 | 9 | 9 | 9 | 9 | 42 | |

| Securing Agriculture Market Access | 6 | 12 | 18 | ||||

| Expanding the AgriMarketing Program | 6 | 6 | 12 | ||||

| Supporting the Canadian Sealing Industry | 1 | 2 | 1 | 1 | 1 | 6 | |

| Promoting Canada as a Global Maritime Centre | 1 | 1 | 1 | 3 | |||

| Subtotal—Fostering Trade | 17 | 34 | 39 | 20 | 20 | 131 | |

| Responsible Resource Development | |||||||

| Supporting the Creation of an LNG Industry in Canada | 10 | 15 | 10 | 10 | 45 | ||

| Supporting Junior Mineral Exploration | 45 | -10 | 35 | ||||

| Facilitating Responsible Resource Development | 4 | 4 | 4 | 4 | 5 | 21 | |

| Major Projects Management Office Initiative | 27 | 27 | 27 | 27 | 27 | 135 | |

| Supporting Consultations and Public Engagement in Federal Environmental Assessment Processes | 7 | 7 | 7 | 7 | 7 | 34 | |

| Contributing to the Safety of Energy Transportation Infrastructure | 18 | 19 | 15 | 14 | 14 | 80 | |

| Safe and Secure Shipping | 5 | 8 | 7 | 6 | 4 | 31 | |

| Supporting Jobs in Mining Through Geoscience Investments | 1 | 4 | 7 | 7 | 4 | 22 | |

| Unlocking Rare Earth Elements and Chromite Production in Canada | 2 | 5 | 5 | 6 | 5 | 23 | |

| Supporting Forest Sector Innovation and Marketing | 43 | 43 | 86 | ||||

| Subtotal—Responsible Resource Development | 110 | 117 | 130 | 80 | 76 | 513 | |

| Total—Growing Trade and Expanding Markets | 127 | 151 | 169 | 100 | 96 | 644 | |

| Less anticipated cost recovery | 18 | 19 | 15 | 14 | 14 | 80 | |

| Less funds existing in the fiscal framework | 39 | 39 | 82 | 39 | 39 | 237 | |

| Less funds sourced from internal reallocations | 3 | 49 | 6 | 6 | 5 | 69 | |

| Net Fiscal Cost | 67 | 45 | 66 | 41 | 38 | 257 | |