Archived -

Chapter 3

Building an Economy That Works for All Canadians

On this page:

Following a strong recovery from the pandemic recession, the federal government's economic plan has ensured that the Canadian economy remains resilient. Over a million more Canadians are employed compared to when the pandemic hit, our unemployment rate remains low by historical standards, and wage growth has outpaced inflation for the past nine months.

We must address the challenges facing Canadians and the Canadian economy today—and seize the opportunities ahead of us in the years to come.

The global economy is evolving. Countries around the world are moving quickly to fight climate change and to build their clean economies. As the world moves towards net-zero, the federal government is delivering on its economic plan to ensure that Canadian workers and businesses lead the way.

In Budget 2023, the federal government released Canada's clean economy jobs plan, which will create a new generation of great middle class careers to help Canadians support their families, advance economic reconciliation and ensure that Indigenous Peoples share in the prosperity of major clean energy projects, while ensuring that the Canadian economy is a leader in a net-zero world.

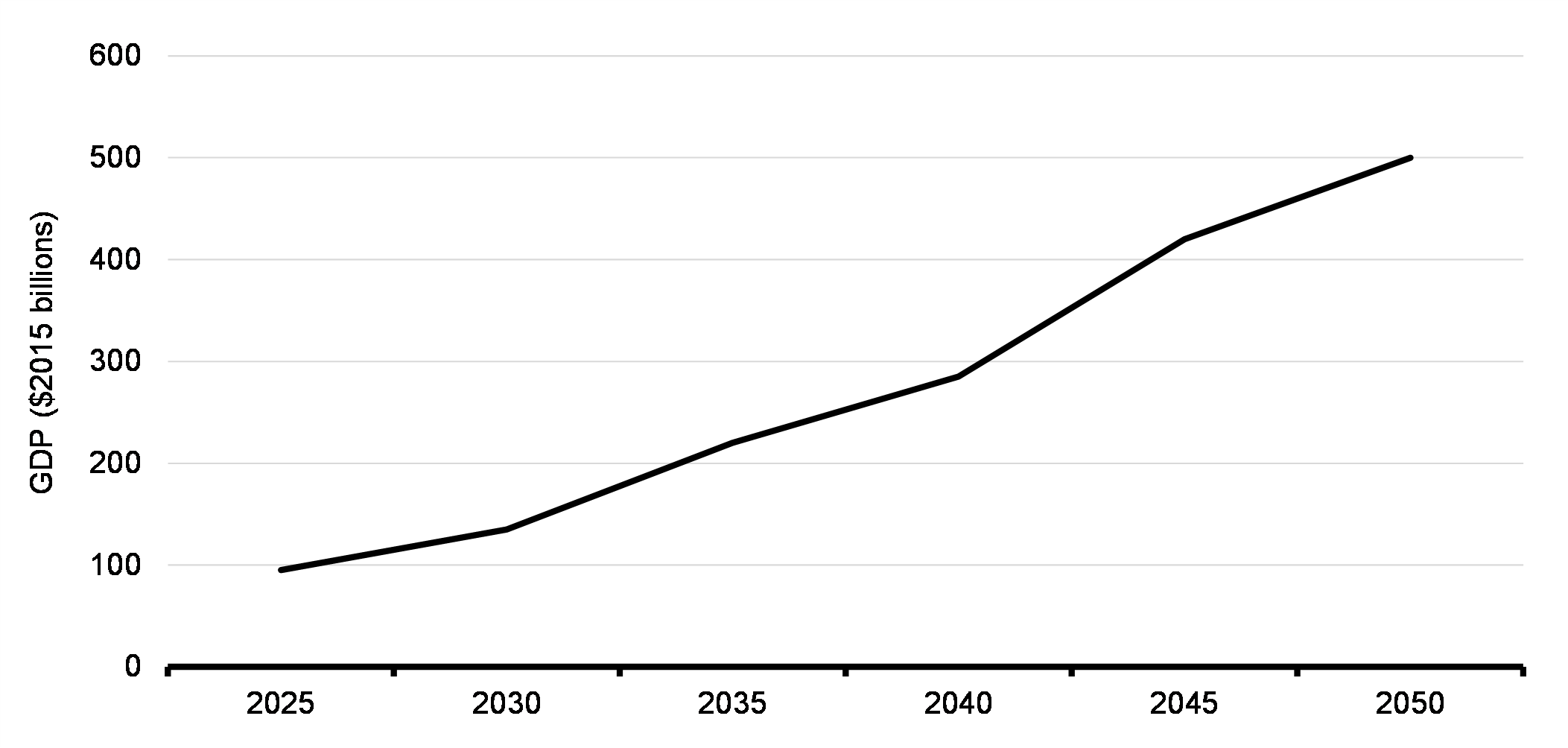

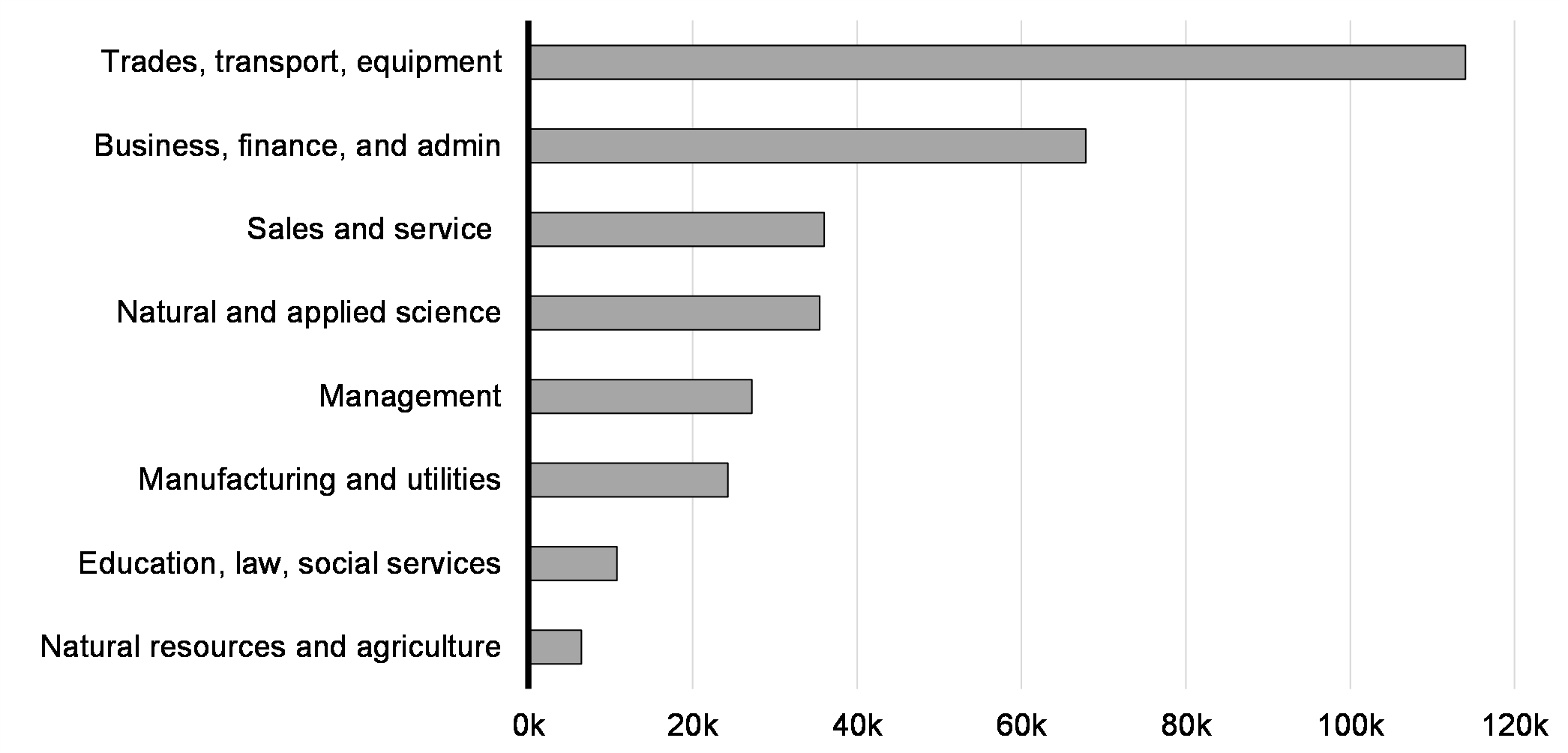

According to Clean Energy Canada's estimates, the clean energy sector's contribution to our economy could increase as much as six-fold by 2050. Further analysis by RBC Economics suggests 235,000 to 400,000 new jobs will be created in the clean economy over the coming decade, with a number of sectors seeing significant growth (Chart 3.2).

The 2023 Fall Economic Statement introduces a series of new measures to advance the government's economic plan by continuing to build a stronger economy, and provides important updates on key pillars of the government's plan to fight climate change and create great careers for Canadians from coast to coast to coast.

Clean Energy GDP Growth, 2025 to 2050

New Clean Economy Jobs by Industry, 2022 to 2032

3.1 Building Canada's Clean Economy

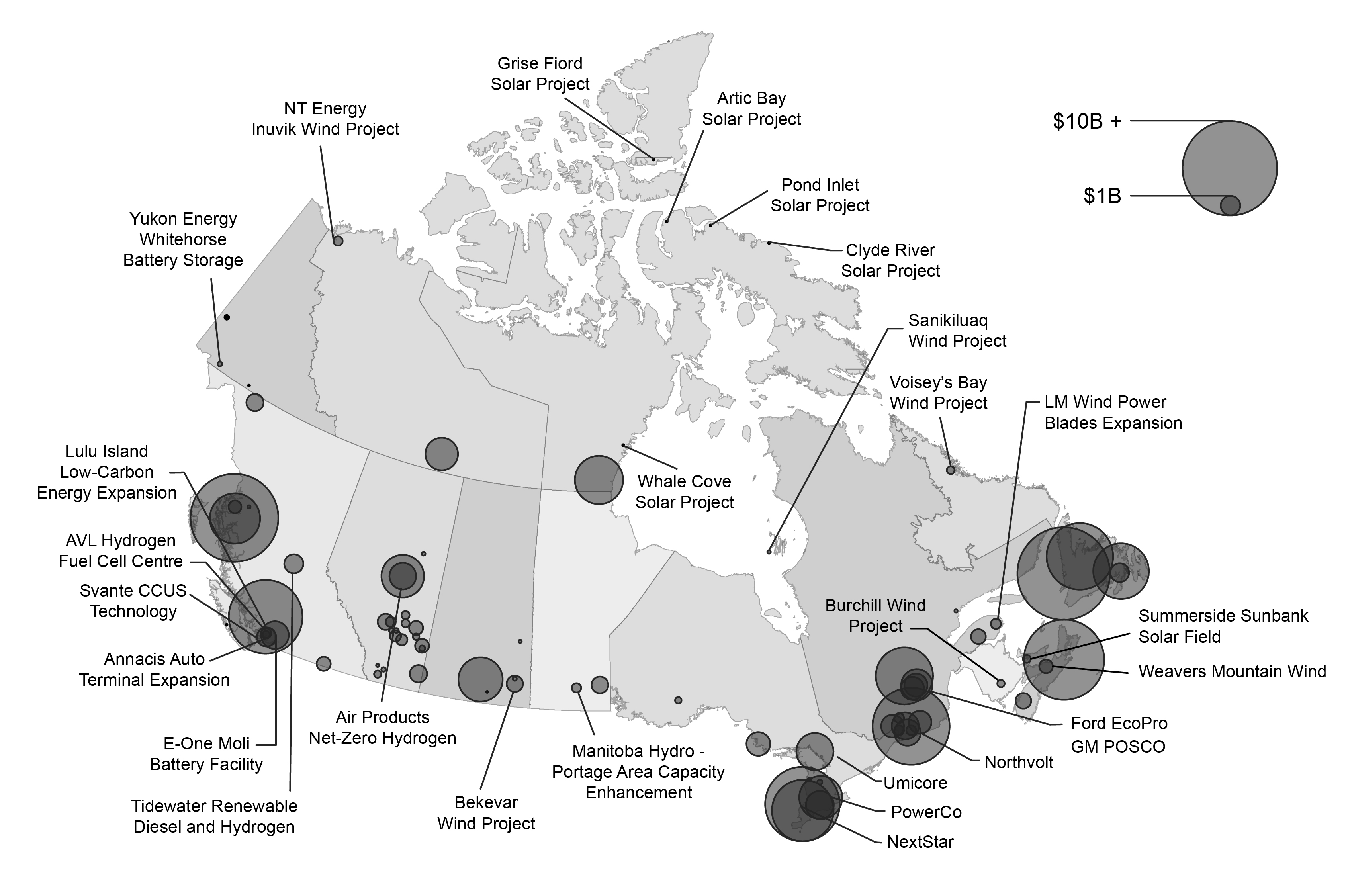

The federal government's plan to build Canada's clean economy is already delivering results. Over the past three years alone, more than 90 clean growth projects valued at a total of more than $40 billion, including private investment, are underway or will soon move forward into construction across Canada. Clean economy projects are drawing investments into every region of the country and creating great jobs for the middle class (Figure 3.1).

Companies from around the world are already capitalizing on the Canadian advantage. According to the OECD, Canada is ranked third in the world for the most foreign direct investment in the first half of 2023.

With more than $1 trillion in private capital ready to be invested to build the clean economies of the 21st century, Canada has the abundant resources needed to thrive—from critical minerals, to world-leading research and innovation, to a strong and deep pool of talented and diverse workers who are supported by programs like affordable child care and strong public health care. Beyond that, Canada has the stable political and economic institutions that companies around the world are looking for as a safe place to do business.

Canada's clean economy jobs plan is about capitalizing on our remarkable competitive advantages in order to attract investment and create good jobs across the country.

Snapshot of Recent and Proposed Investments in the Clean Economy

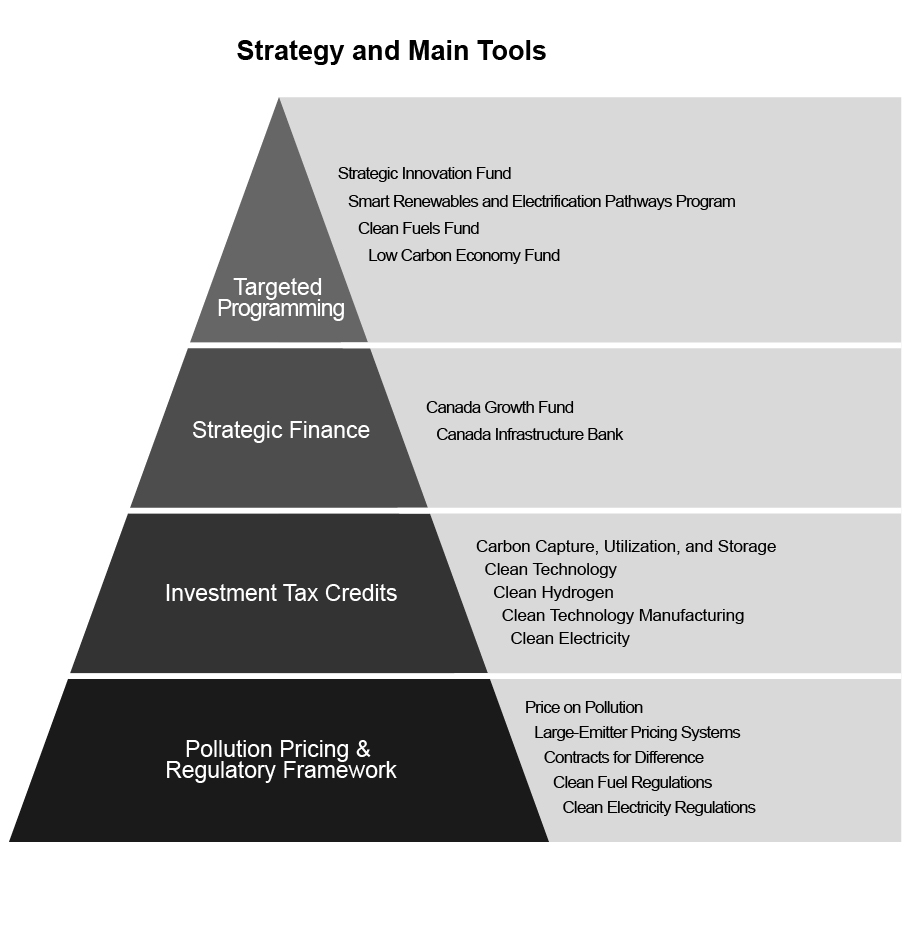

Strategy and Main Tools

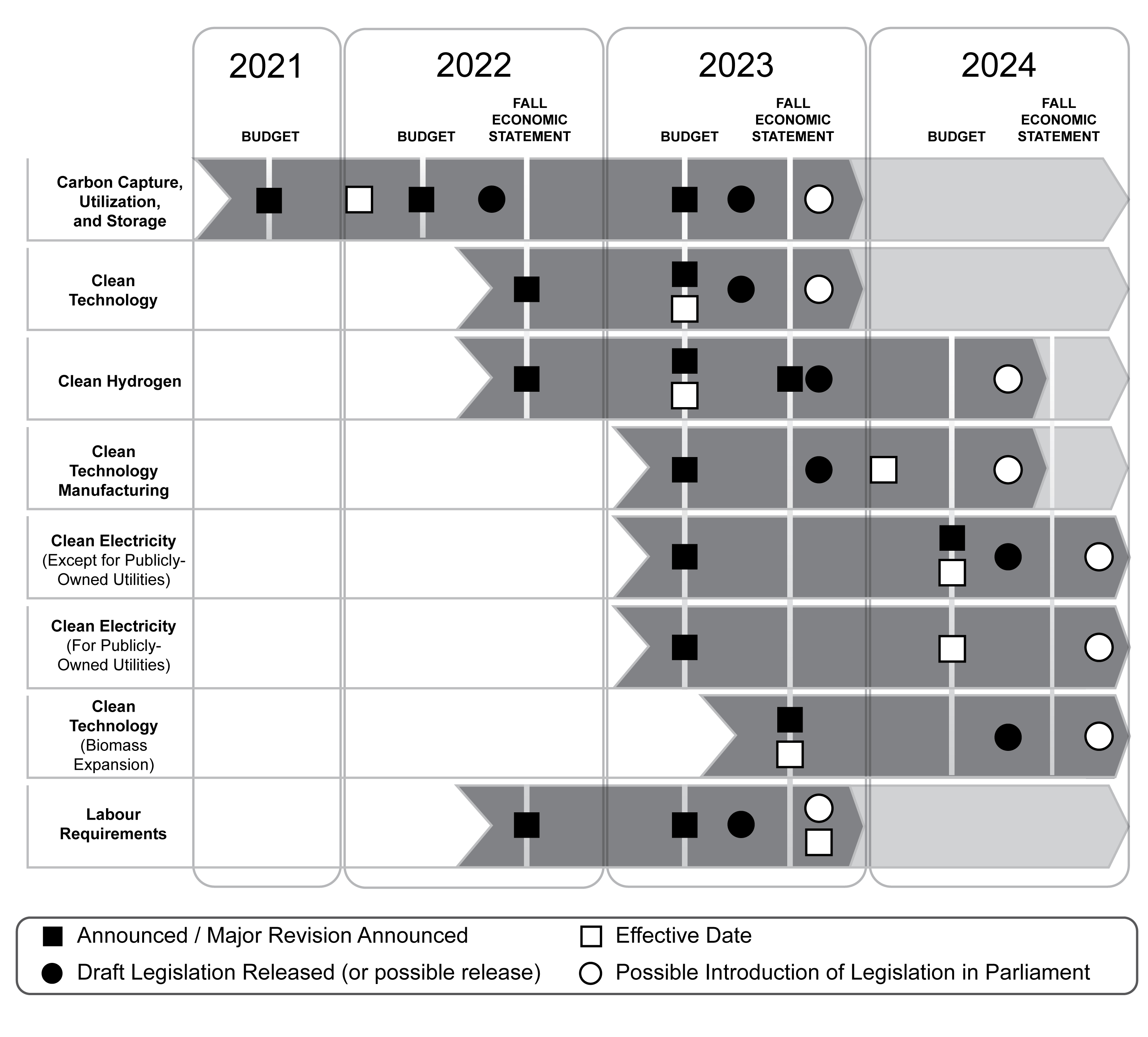

As an important pillar of Canada's clean economy jobs plan, the government is focused on implementing, on a priority basis, the new clean economy investment tax credits for carbon capture, utilization, and storage; clean technology adoption; clean hydrogen; clean technology manufacturing; and clean electricity. The following timelines outline the federal government's path towards delivering all investment tax credits in 2024.

The clean economy investment tax credits will be implemented as follows, subject to the results of consultations:

Carbon Capture, Utilization, and Storage (CCUS):

- Legislation will be introduced in Parliament this fall.

- Consultations on draft legislation were held from August 4, 2023, to September 8, 2023.

- The tax credit would be available from January 1, 2022.

Clean Technology:

- Legislation will be introduced in Parliament this fall.

- Consultations on draft legislation were held from August 4, 2023, to September 8, 2023.

- The tax credit would be available from March 28, 2023.

Clean Hydrogen:

- Consultations on draft legislation will launch this fall.

- The government is targeting to introduce legislation in Parliament in early 2024.

- The tax credit would be available from March 28, 2023.

Clean Technology Manufacturing:

- Consultations on draft legislation will launch this fall.

- The government is targeting to introduce legislation in Parliament in early 2024.

- The tax credit would be available from January 1, 2024.

Clean Electricity (Except for Publicly-Owned Utilities):

- Design and implementation details will be published in early 2024.

- Consultations on draft legislation will launch in summer 2024.

- The government is targeting to introduce legislation in Parliament in fall 2024.

- The tax credit would be available from the day of Budget 2024 for projects that did not begin construction before March 28, 2023.

Clean Electricity (For Publicly-Owned Utilities):

- Consultations with provinces and territories will take place in 2024.

- The government is targeting to introduce legislation in Parliament in fall 2024.

- The tax credit would be available from the day of Budget 2024 for projects that did not begin construction before March 28, 2023.

Expanding Eligibility for the Clean Technology and Clean Electricity Investment Tax Credits to Support Using Waste Biomass to Generate Heat and Electricity:

- Consultations on draft legislation will launch in summer 2024.

- The government is targeting to introduce legislation in Parliament in fall 2024.

- The expansion of the Clean Technology investment tax credit would be available from the day of the 2023 Fall Economic Statement.

- The expansion of the Clean Electricity investment tax credit would be available from the day of Budget 2024 for projects that did not begin construction before March 28, 2023.

Labour Requirements

Budget 2023 announced that labour requirements to pay prevailing union wages and provide apprenticeship training opportunities will need to be met in order to receive the maximum credit rate of the Clean Technology, Clean Hydrogen, Clean Electricity, and CCUS investment tax credits.

- Legislation to implement the labour requirements will be introduced in Parliament this fall.

- Consultations on draft legislation were held from August 4, 2023, to September 8, 2023.

- The effective date for the labour requirements will be the date that a Notice of Ways and Means Motion for the enabling legislation is first tabled this fall.

Delivery and Implementation Timeline for Investment Tax Credits

Using Waste Biomass to Generate Electricity and Heat

During the course of production, industries like forestry and agriculture generate organic by-products, such as leftover wood chips and crop residues, which have the potential to be used to generate affordable energy while also reducing emissions.

-

To reduce biowaste and support new affordable electricity and heat generation in Canada, the 2023 Fall Economic Statement proposes to expand eligibility for:

- The 30-per-cent Clean Technology investment tax credit to include systems that produce electricity, heat, or both electricity and heat from waste biomass. This expansion of the Clean Technology Investment Tax Credit would be available to businesses investing in eligible property that is acquired and becomes available for use on or after the date of the 2023 Fall Economic Statement.

- The 15-per-cent Clean Electricity investment tax credit to include systems that produce electricity or both electricity and heat from waste biomass, which would be available as of the date of Budget 2024 for projects that did not begin construction before March 28, 2023.

The labour requirements to pay prevailing wages and provide apprenticeship training opportunities will apply to the expanded investment tax credits. Turning waste biomass into electricity and heat is, on a lifecycle basis, a carbon-neutral energy solution, with potential to be carbon-negative when combined with carbon capture, utilization, and storage, while providing new opportunities for major Canadian industries. This proposal is expected to cost $853 million from 2023-24 to 2028-29, and an additional $1.2 billion from 2029‑30 to 2034-35.

3.2 Canada's Economic Plan is Globally Competitive

Canada has been at the forefront of global efforts to build the clean economy. Since the federal government launched Canada's first climate plan in 2016, our clean tech companies have created world-leading technologies, our researchers have been driving new clean innovation, and our workers have been transforming the way we build and deliver economic growth all while cutting pollution and protecting the environment.

The world is catching up, and our friends and allies around the world—chief among them the United States and the European Union—are helping to accelerate this important shift in the global economy. The U.S. Inflation Reduction Act is estimated to mobilize as much as US$1.7 trillion of private and public investments in the U.S. economy. The European Union has also made significant commitments including the new Green Deal Industrial Plan, which makes available €245 billion in public investment to build Europe's clean economy. The significant new measures announced in Budget 2023 help ensure Canadian businesses and Canadian workers will have their share of benefit in the clean economy today and for generations to come.

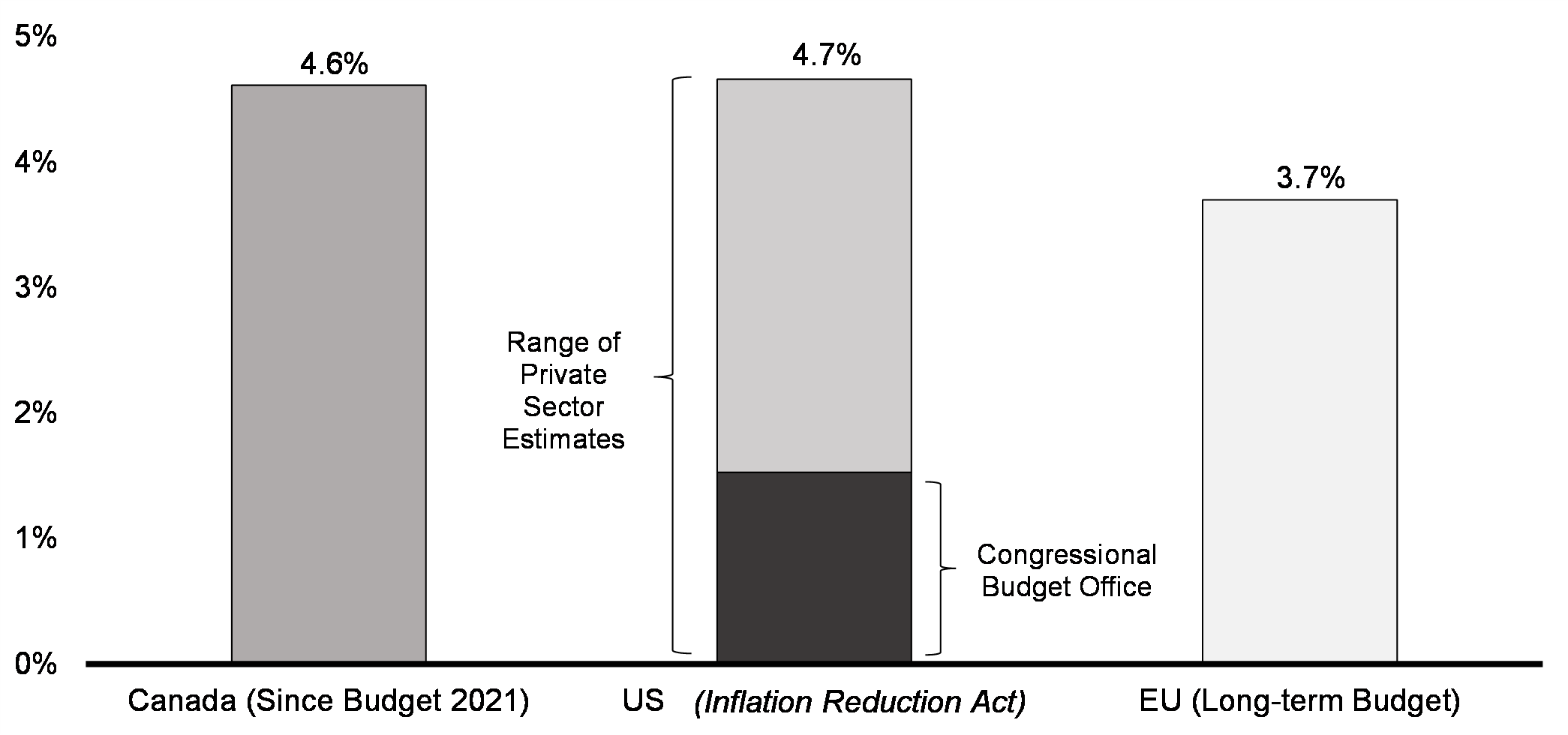

Independent analyses show that Canada's clean economy jobs plan is competitive with both the U.S. and the EU (Chart 3.3), and will ensure that Canada can attract the clean investment needed to create good jobs from coast to coast to coast:

"Canada's financial support for the clean energy transition is yielding positive results and has established a competitive position relative to the U.S."

"Amid the turmoil of the global energy crisis, Canada continues to be a bright spot in advancing the clean energy transition while supporting international energy security and paying close attention to the social and economic implications of change."

"Budget 2023's relatively hands-off approach has many advantages, as it allows markets, rather than governments, to identify the best investments and prevents governments from spending money without impact."

"Canada's [Budget 2023 clean economy investment tax credits] will make the country a global leader in favorable financial conditions for green energy projects…these new tax breaks will raise the value of some projects by more than 50 per cent over their lifetime, positioning Canada as the second most attractive place for renewable developers, behind only the U.S."

"This budget will not only make a low-carbon future possible, it will also make clean electricity more affordable. The big "winners" of today's budget are Canadian electricity customers."

"Today, the federal government is proposing interesting measures to ensure that Canada can succeed in the area of electricity and a clean economy. Competition between different countries in this area is fierce."

Public Investments in the Clean Economy

As a percentage of 2022 GDP.

3.3 Investing in Canada's Economy

Building Canada's Strong Electric Vehicle Battery Supply Chain

Major automakers are rapidly pivoting to build the electric vehicles that are quickly becoming the vehicles of choice for people around the world and which are integral to the emissions reductions plans of many governments.

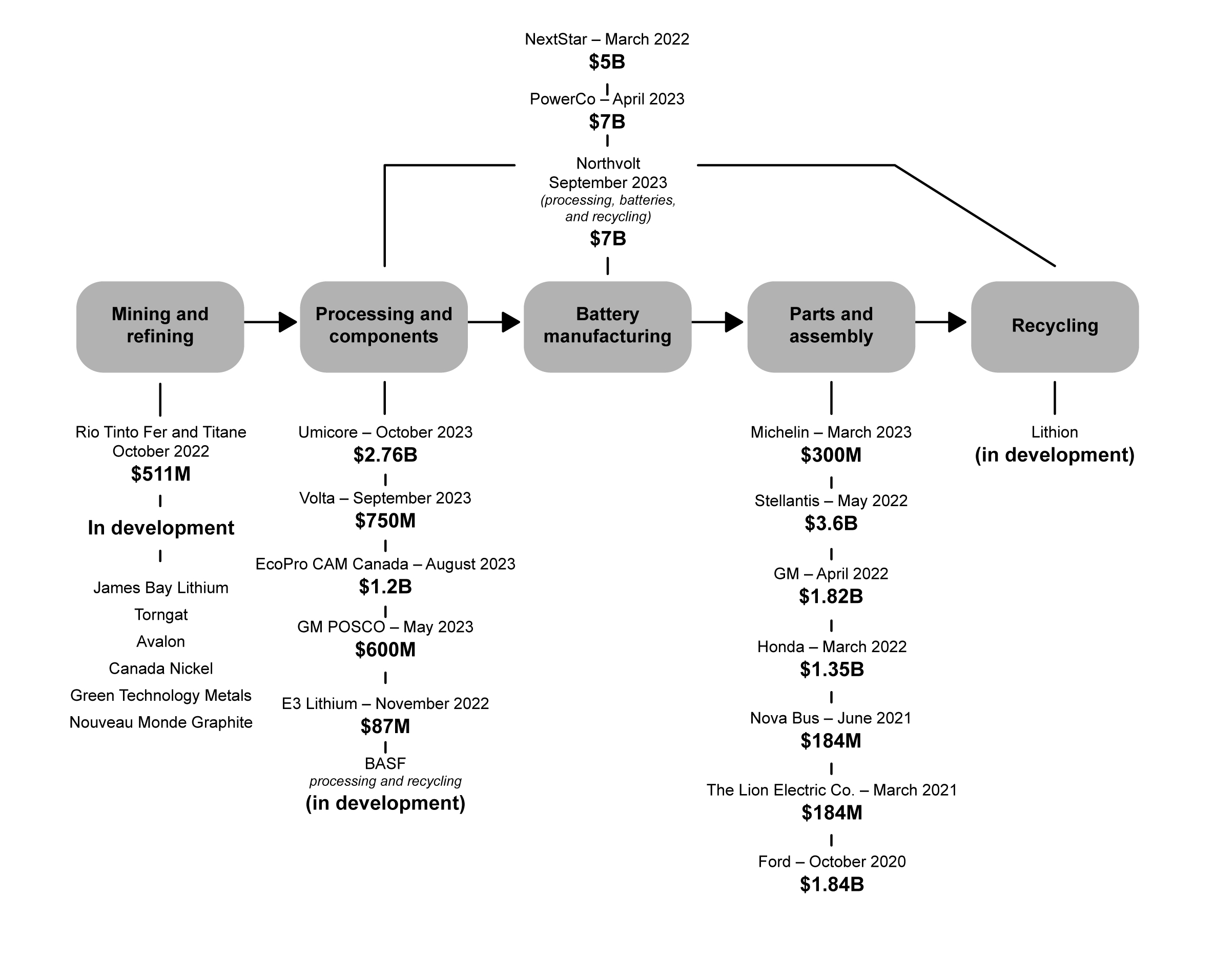

Canada has the best auto workers in the world, and our electric vehicle supply chain—from critical minerals extraction and processing to battery and components manufacturing and vehicle parts and assembly—will be a key pillar of Canada's clean economy. In 2022, Canada's auto sector—our second largest exporter—employed more than 500,000 workers and contributed over $14 billion to GDP.

To grow Canada's economy and secure long-term opportunities for Canada's auto supply chain workers, the federal government has been working hard to secure major electric vehicle battery projects.

Since 2020, Canada has secured more than $34 billion in investment in the batteries and automotive supply chain, which will help our economy grow and create and protect well-paying middle class jobs—today and for generations to come. In 2023, the federal government has secured landmark battery manufacturing facilities—Volkswagen and Stellantis-LGES in Ontario, and Northvolt in Quebec. These projects will employ thousands of Canadians and anchor the future of Canada's electric vehicle industry, while also creating new opportunities for workers and businesses across Canada's critical minerals, clean manufacturing, and clean technology industries.

Canada is the destination of choice for major investments across the EV supply chain, from early-stage mining and refining, to battery manufacturing, to assembly and recycling. The following are just some of the recent major projects.

Major Investments in Canada's Electric Vehicle Supply Chain

The federal government has also been securing other major investments in Canada's economy, including:

Summer 2022

-

BHP, in Jansen, Saskatchewan, with a $100 million federal investment to support a $7.5 billion project to advance the development of a world-leading low-emissions potash mine. This investment will ensure Canada remains a global leader in both potash production and sustainable mining.

Fall 2022

-

Rio Tinto Fer and Titane, in Sorel-Tracy, Quebec, with a proposed federal investment of up to $222 million to support a $511 million project to increase the company's production of critical minerals including lithium, titanium, and scandium.

Winter 2023

-

Xanadu Quantum Technologies, in Toronto, Ontario, with a $40 million federal investment to support a $178 million project to build and commercialize the world's first photonic-based, fault-tolerant quantum computer.

Spring 2023

-

Michelin North America Inc., in Bridgewater, Pictou and Waterville, Nova Scotia, will receive up to $44.3 million in federal funding pending a final agreement and a provincial tax credit of about $61.3 million over five years from the government of Nova Scotia, to support a $300 million project. This investment will enable the modernization of the company's Nova Scotia facilities, leveraging technological innovation to manufacture more efficient tires, including tires for electric vehicles, and cut production emissions through electrification.

-

Ranovus Inc., in Ottawa, Ontario, with a $36 million federal investment to support a $100 million project that will advance the company's domestic production and manufacturing of semiconductor products and services, and help position Canada as a key player in the strategically important semiconductor industry.

-

AbCellera Biologics Inc., in Vancouver, British Columbia, with federal and provincial investments of $225 million and $75 million, respectively, to support a $701 million project to enhance and expand the Canadian supply chain in leading-edge antibody drug development and clinical research, giving Canadian patients early access to innovative medicines created here at home.

Summer 2023

-

AVL Fuel Cell Canada Inc., in Burnaby, British Columbia, with a $15 million federal investment to support a $38.5 million project to develop the company's innovative hydrogen fuel cell technologies and world-class engineering solutions for customers in the global transportation sector.

-

General Dynamics Mission Systems, in Sherbrooke, Quebec, with a $10 million federal investment to support a $34 million project to undertake mission system integration, testing, and demonstration on the LX300 helicopter, a Canadian-made remotely piloted aircraft produced by Quebec-based Laflamme Aero.

Fall 2023

-

Umicore, in Loyalist, Ontario, with federal and provincial investments of up to $551.3 million and $424.6 million, respectively, to support a $2.76 billion project to build a manufacturing facility of cathode active materials and precursor cathode active materials—critical components for producing electric vehicle batteries.

-

E-One Moli Energy, in Maple Ridge, British Columbia, with federal and provincial investmentsof up to $204.5 million and $80 million, respectively, to support a $1 billion project to build Canada's largest lithium-ion battery cell manufacturing facility. The lithium-ion battery cells produced in Maple Ridge will be used to electrify devices that have traditionally relied on diesel, such as power tools, medical devices, high-performance vehicles, and aerospace applications, supporting the transition to cleaner, more efficient energy sources.

Delivering the Canada Growth Fund

To help attract billions of dollars worth of investments in Canadian workers and Canadian businesses, the federal government launched the Canada Growth Fund, a $15 billion arm's length public investment vehicle led by some of Canada's leading investment professionals from the Public Sector Pension Investment Board (PSP Investments).

The Canada Growth Fund's investments in cutting-edge Canadian businesses and technologies will help them grow in Canada and create good jobs for Canadians.

In summer 2023, the Canada Growth Fund commenced operations, and is deploying a suite of financial tools to de-risk and bolster private investment in low-carbon projects, technologies, businesses, and supply chains. The Canada Growth Fund has already met with more than 150 market participants and has developed a pipeline of projects across leading clean economy sectors, including carbon capture, utilization, and storage; hydrogen; biofuels; critical minerals; and clean tech.

The Canada Growth Fund announced its first investment on October 25, 2023. With a $90 million investment in a groundbreaking geothermal energy company, Calgary's Eavor Techologies Inc., the Canada Growth Fund is supporting good jobs for Albertans and securing a Canadian future for a company at the leading-edge of the global clean economy. The Canada Growth Fund's investment will enable Eavor to scale-up its emissions-reducing technology, ensure the company's headquarters and majority of its workforce remain in Canada, and create new jobs at its Calgary headquarters.

Further Canada Growth Fund investments will be announced in the coming weeks and months.

Carbon Contracts for Difference

One of the financial tools the Canada Growth Fund is providing to support clean growth projects is contracts for difference—including contracts on the future price of carbon. Carbon contracts for difference will backstop the future price of carbon and provide predictability to businesses in order to de-risk important emission-reducing projects. Since Budget 2023, the federal government has been consulting on a broad-based approach to carbon contracts for difference complementary to the offerings of the Canada Growth Fund. Federal accounting authorities have undertaken work on the accounting recognition of broad-based carbon contracts for difference. Contracts of these types, with a high strike price, could expose the government to significant fiscal risks and require upfront recognition of potential costs.

-

The 2023 Fall Economic Statement announces that the Canada Growth Fund will be the principal federal entity issuing carbon contracts for difference. The Canada Growth Fund will allocate, on a priority basis, up to $7 billion of its current $15 billion in capital to issue all forms of contracts for difference and offtake agreements.

The Canada Growth Fund is already in the process of negotiating carbon contracts for difference with a number of project proponents across a range of sectors. The Canada Growth Fund's carbon contracts for difference will also support the establishment of robust carbon credit markets. The government will continue to explore additional ways to provide businesses certainty regarding the carbon pricing trajectory, including potential legislative approaches and other new measures, in conjunction with provinces and territories. In addition, the government remains committed to enforcing the existing requirement under the carbon pricing benchmark that the design of provincial and territorial output-based pricing systems preserve a marginal price signal at or above the minimum national carbon pollution price, on an ongoing basis, to maintain a strong carbon credit market.

3.4 Creating Opportunities for Workers and Businesses

Canada's competitive advantages, including our democratic stability, highly educated workforce, broad trade access to global markets, strong social safety net, and abundant natural resources, make Canada an incredibly attractive place to do business. The federal government is continuing to take action to build on these competitive advantages by cutting red tape, making it easier for businesses to get the support they need to create good jobs, and improving market access for Canadian businesses.

To ensure that the Canadian economy continues to be competitive for businesses, workers, and consumers, the federal government has introduced and updated federal legislation and regulations, including:

- The Modernization of the Competition Framework, based on the broad public consultation on competition reform undertaken by the government, will increase the robustness of competition enforcement across all industries to ensure more competitive, open, and dynamic markets across Canada.

- The Digital Charter Implementation Actintroduces three proposed Acts, which, if enacted, would create a national legislative framework on privacy and artificial intelligence. The proposed Consumer Privacy Protection Act will ensure the privacy of Canadians will be protected and that innovative businesses can benefit from clear rules as technology continues to evolve.

- An Act to amend the Investment Canada Act,if passed, would ensure that Canada can continue to address changing threats that can arise from foreign investment. This will safeguard economic growth and Canadian jobs without compromising national security or national interests.

- The Annual Regulatory Modernization Bill process is in place to help the government address overly complicated, inconsistent, or outdated federal regulatory requirements. The recurring bill helps to keep the regulatory system relevant and up to date.

- The government has conducted a range of Targeted Regulatory Reviews of existing regulations and regulatory practices in order to support economic growth and innovation. Stakeholder engagement is central to these reviews and feedback supports more agile, transparent, and responsive regulations. Themes have included agri-food, aquaculture, and clean technology.

Getting Major Projects Built Faster

For Canada to build a thriving economy, investments in clean projects—from critical minerals, to clean electricity, to clean energy and beyond—must be able to move forward quickly and effectively. Canada is a world leader in getting these projects done right—with strong environmental protections, robust labour standards, and engagements with Indigenous partners. However, more needs to be done to ensure major projects get built in a timely manner.

Budget 2023 announced that, by the end of this year, the government will outline a concrete plan to further improve the efficiency of the permitting and impact assessment processes for major projects, which will include clarifying and reducing timelines, mitigating inefficiencies, and improving engagement and partnerships. The recently announced Ministerial Working Group on Regulatory Efficiency for Clean Growth Projects is coordinating government-wide efforts and details of the government's plan will be released in the coming months.

The global clean economy will be dependent on access to the critical minerals and metals that are required for low-carbon technologies, ranging from electric vehicle batteries to semiconductors. By some estimates, global demand for critical minerals for clean energy technologies will double or even triple by 2030, driven largely by electric vehicles and battery storage, as well as clean electricity generation and transmission.

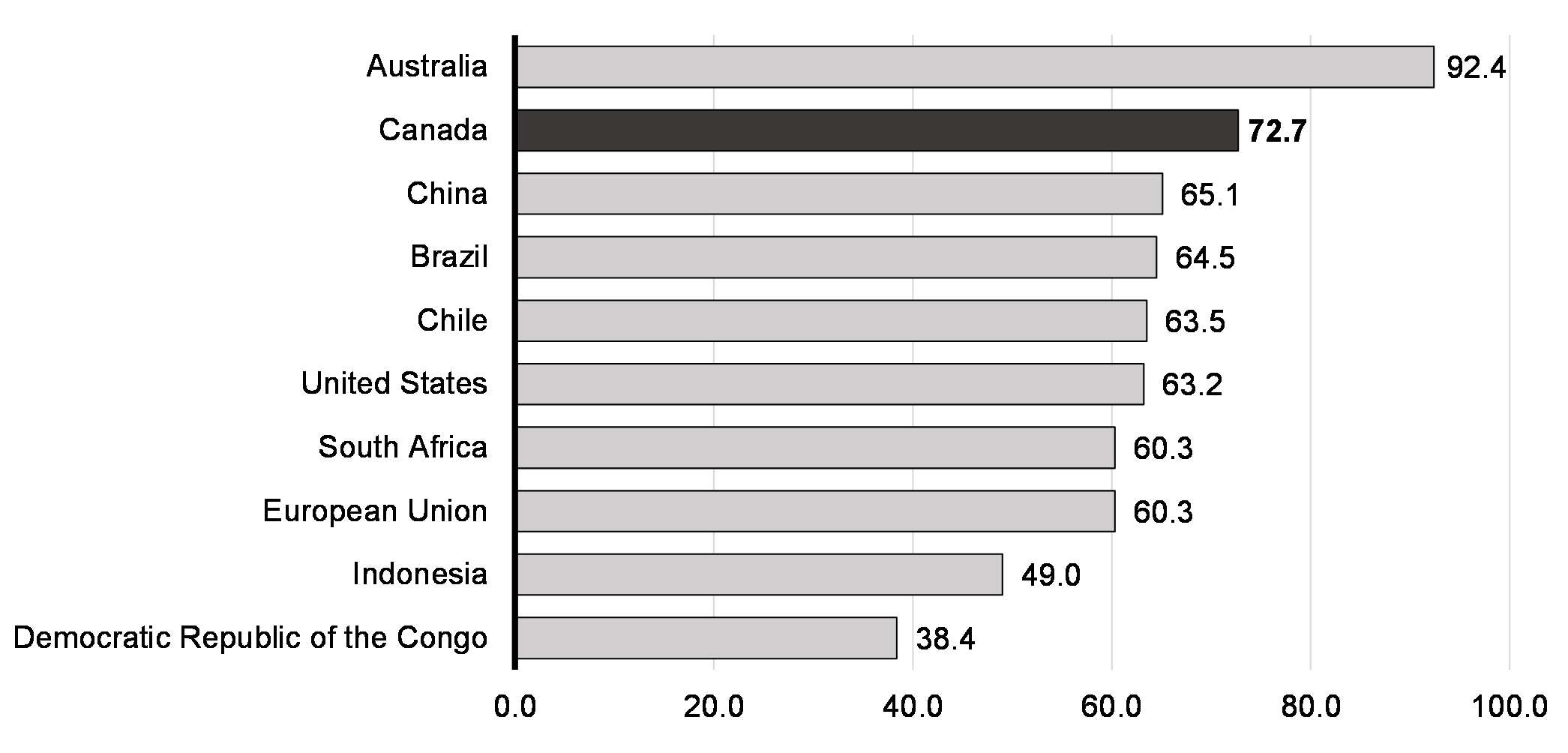

Canada is a global mining leader with a fortunate abundance of many of the world's essential critical minerals, including lithium, graphite, cobalt, and nickel. Moving quickly to ensure that Canada can capitalize on this critical economic shift is essential. Canada is already home to almost half of the world's publicly listed mining and mineral exploration companies, with a presence in nearly 100 countries and a combined market capitalization of over $500 billion. These Canadian mining companies currently produce 60 minerals and metals at 200 mines and 6,500 quarries across the country. Canada's mining sector ranks second among BloombergNEF's scoring of 10 leading critical mineral producers, all while meeting world-leading sustainability requirements and creating good-paying jobs for Canadians.

"I would say there is no place on the planet that I get more optimistic about than Canada."

Canada is Globally Competitive in Critical Minerals and Metals Production

As the world shifts to sustainable energy and adopts clean technologies, it is essential for workers to lead the way. The federal government is ensuring that workers continue earning wages that help them to take care of their families and build a brighter future.

-

This includes by making most of Canada's new suite of clean economy investment tax credits more generous when employers pay the prevailing wage and create apprenticeship opportunities.

-

Since 2015, the government has been equipping Canadian workers with the skills they need through programs like the Union Training and Innovation Program, and has since launched the new Apprenticeship Service and made Canada Apprentice Loans interest-free.

-

In the 2022 Fall Economic Statement, the government announced the creation of a Sustainable Jobs Training Centre and Secretariat, and more recently, introduced the Canadian Sustainable Jobs Act to put Canadian workers and communities at the centre of federal decision making as the government makes further important clean economy investments.

Pension Fund Investment

Canada's pension funds provide Canadians with the secure and dignified retirements they deserve and have contributed to after a lifetime of hard work. By responsibly investing Canadians' pension contributions, Canadian pension funds now manage more than $3 trillion in pension assets, representing one of the largest pools of investment savings in the world. These savings are invested in diverse portfolios that include public and private equities, real estate, infrastructure, and fixed income, and are made in line with the fiduciary duty to maximize risk-adjusted returns for plan members and retirees. The stability and security of retirement supported by Canadian pension funds, and their strong performance, are the envy of the world.

Canada is one of the safest and most attractive investment destinations in the world—whether it is for the clean economy and major infrastructure projects, or new housing, or supporting our innovative companies. Our robust economy, highly skilled workforce, well-regulated financial sector, strong governance culture, and competitive tax rates provide many investment opportunities.

The federal government believes that continued domestic investments by Canada's pension funds have the potential to boost Canada's economy and create good careers for people across the country.

-

The 2023 Fall Economic Statement announces that the federal government will work collaboratively with Canadian pension funds to create an environment that encourages and identifies more opportunities for investments in Canada by pension funds and by other responsible investment pools, while helping to deliver secure pensions for Canadians.

-

To enable pension funds to more fully participate in Canada's economic growth, the 2023 Fall Economic Statement also announces that the government will explore removing the "30 per cent rule" from investments in Canada. The 30 per cent rule restricts Canadian pension funds from holding more than 30 per cent of the voting shares of most corporations.

-

As part of this effort, and in order to improve transparency around pension investments, the government also proposes to require large federally-regulated pension plans to disclose the distribution of their investments, both by jurisdiction and asset-type per jurisdiction, to the Office of the Superintendent of Financial Institutions (OSFI). This information will be made publicly available, and the government will engage with provinces and territories to discuss similar disclosures by Canada's largest pension plans in a simple and uniform format.

Supporting Employee Ownership Trusts

An Employee Ownership Trust owns shares in a business on behalf of its employees, enabling greater worker participation in business decisions and profits. The trusts can also provide an alternative business succession option for retiring business owners, especially since more than 75 per cent of small business owners plan to exit their business in the next decade. Budget 2023 introduced tax rules to facilitate the creation of Employee Ownership Trusts.

-

Building on this effort, and to encourage more business owners to sell to an Employee Ownership Trust, the 2023 Fall Economic Statement proposes to exempt the first $10 million in capital gains realized on the sale of a business to an Employee Ownership Trust from taxation, subject to certain conditions.

This incentive would be in effect for the 2024, 2025, and 2026 tax years and is expected to reduce federal revenues by $52 million over the 2023-24 to 2026-27 period. Further details will be provided in the coming months. The Department of Finance will monitor the adoption of Employment Ownership Trusts in Canada and their associated impacts on the economy and Canadians.

Indigenous Loan Guarantee Program

Everyone in Canada deserves to share in Canada's economic prosperity, and the clean economy opportunities that lie ahead offer new ways to advance economic reconciliation. Economic reconciliation—whether through engagement with Indigenous partners, creating good jobs in Indigenous communities, or helping ensure Indigenous communities share in the prosperity of major projects—is a major part of the federal government's work to build a strong and sustainable economy.

The federal government is determined to ensure that Indigenous communities can share in the benefits of major projects in their territories on their own terms.

With the number of major projects with potential for Indigenous equity ownership anticipated to grow significantly over the next decade, the government, with Indigenous partners, is working to increase access to the affordable capital that Indigenous communities will require to make these opportunities a reality. This will make projects more economically feasible for Indigenous communities by decreasing the cost of capital.

-

Informed by Natural Resources Canada's ongoing work to develop a National Benefits-Sharing Framework, the 2023 Fall Economic Statement announces that the government will advance development of an Indigenous Loan Guarantee Program to help facilitate Indigenous equity ownership in major projects in the natural resource sector. Next steps will be announced in Budget 2024.

Sustainable Finance Action

Canada is a world leader in climate finance. The federal government wants to keep this advantage, including by moving towards mandatory reporting of climate-related financial risks across a broad spectrum of the Canadian economy. Last year, the government also issued the first Canada Green Bond, worth $5 billion, of which 45 per cent of investors were international and which saw a final order book of over $11 billion, showing there is strong appetite from investors around the world to make clean investments in Canada.

In 2021, the federal government established the Sustainable Finance Action Council (SFAC), with a three-year mandate to provide advice to the Minister of Finance and the Minister of Environment and Climate Change and to help lead the Canadian financial sector towards integrating sustainable finance into its standard industry practices.

The government has since received SFAC's Taxonomy Roadmap Report with recommendations for advancing a Canadian taxonomy, or classification, to identify economic activities that the financial sector could label as "green" or "transition", as well as SFAC's advice on advancing climate-related disclosures in Canada. In the coming months, SFAC will provide additional advice to the federal government on strategies for aligning private sector capital with net-zero, as well as on climate data and analytics.

-

To expand the coverage of mandatory climate disclosures, the 2023 Fall Economic Statement announces that the Department of Finance; Innovation, Science and Economic Development Canada; and Environment and Climate Change Canada will develop options for making climate disclosures mandatory for private companies.

-

Building on SFAC's Taxonomy Roadmap Report, the 2023 Fall Economic Statement also announces that the Department of Finance will work with Environment and Climate Change Canada and Natural Resources Canada to undertake next steps, in consultation with regulators, the financial sector, industry and independent experts, to develop a taxonomy that is aligned with reaching net-zero by 2050. This work will be supported by external technical experts. The 2023 Fall Economic Statement proposes to provide $1.5 million in 2024-25 to the Department of Finance to support this work.

The federal government recognizes the important work and contributions to Canada by the Sustainable Finance Action Council, particularly its Chair, as well as all members, over the course of its mandate.

Defending Canadian Businesses Against Unfair Foreign Treatment

Canadian workers and businesses deserve to be treated fairly by Canada's trading partners. When the Government of Canada opens its markets to goods and services from other countries, Canada expects those countries to also grant Canadian businesses the same access that we provide their companies.

To protect Canadian workers and Canadian businesses—and to develop mutually beneficial and resilient supply chains—going forward, Canada will consider reciprocity as a key design element for new policies, including certain clean economy investment tax credits, federal procurement, and federally-funded infrastructure projects. This includes reciprocal procurement to ensure that countries that do not provide Canadian goods and services with a similar level of market access do not unfairly benefit from access to Canada's markets. Concurrent to this announcement, the government is releasing a policy statement with further details on Canada's approach to reciprocity.

Ensuring Crown Corporations Are Delivering for Canadians

The Business Development Bank of Canada, Export Development Canada, and Farm Credit Canada were designed to complement the private sector in supporting Canadian businesses and farmers with the financing, insurance, and advice they need to compete and thrive in the global economy. Amidst a changing global economy, it is critical for these Crown corporations to continue delivering effective support.

-

To ensure these Crown corporations maximize their existing resources and best support Canadian businesses and farmers, the 2023 Fall Economic Statement announces that the government will be reviewing their roles and taking steps to increase risk appetite where appropriate. Next steps will be announced in Budget 2024.

| 2023- 2024 |

2024- 2025 |

2025- 2026 |

2026- 2027 |

2027- 2028 |

2028- 2029 |

Total | |

|---|---|---|---|---|---|---|---|

| 3.1. Building Canada's Clean Economy | 0 | 26 | 193 | 214 | 210 | 210 | 853 |

| Using Waste Biomass to Generate Electricity and Heat | 0 | 26 | 193 | 214 | 210 | 210 | 853 |

| 3.4. Creating Opportunities for Workers and Businesses | 2 | 12 | 15 | 25 | 0 | 0 | 54 |

| Supporting Employee Ownership Trusts | 2 | 10 | 15 | 25 | 0 | 0 | 52 |

| Sustainable Finance Action | 0 | 2 | 0 | 0 | 0 | 0 | 2 |

| Chapter 3 - Fiscal Impact | 0 | 28 | 193 | 214 | 210 | 210 | 907 |

| Clean Economy Industrial Supports – Net Impact of Policy Actions Since Budget 2023* | 555 | 693 | 1,895 | 2,027 | 1,911 | 1,391 | 8,472 |

| Net Fiscal Impact of Measures | 557 | 730 | 2,103 | 2,266 | 2,121 | 1,601 | 9,378 |

|

Note: Numbers may not add due to rounding. *Fiscal impact of industrial supports for the clean economy, including battery production, net of amounts previously provisioned in the fiscal framework. Shown at the aggregate level to preserve commercial confidence. |

|||||||

Page details

- Date modified: