Archived - Technical

Backgrounder:

Canada Growth Fund

Technical Backgrounder: Canada Growth Fund(PDF, 220 Kb)

On this page:

- 1. Introduction and Rationale

- 2. Implementation of the Canada Growth Fund

- 3. Mandate

- 4. Go-To-Market Approach

- 5. Performance Evaluation, Transparency and Accountability

1. Introduction and Rationale

Budget 2022 announced the government’s intention to create the Canada Growth Fund (CGF)— to be capitalized with $15 billion—and committed to provide details about its launch in the fall economic update. This technical backgrounder sets out the details that are proposed to govern CGF, including its implementation, mandate, operations, financial instruments, investment approaches, performance metrics, and transparency and accountability frameworks.

1.1 Rationale

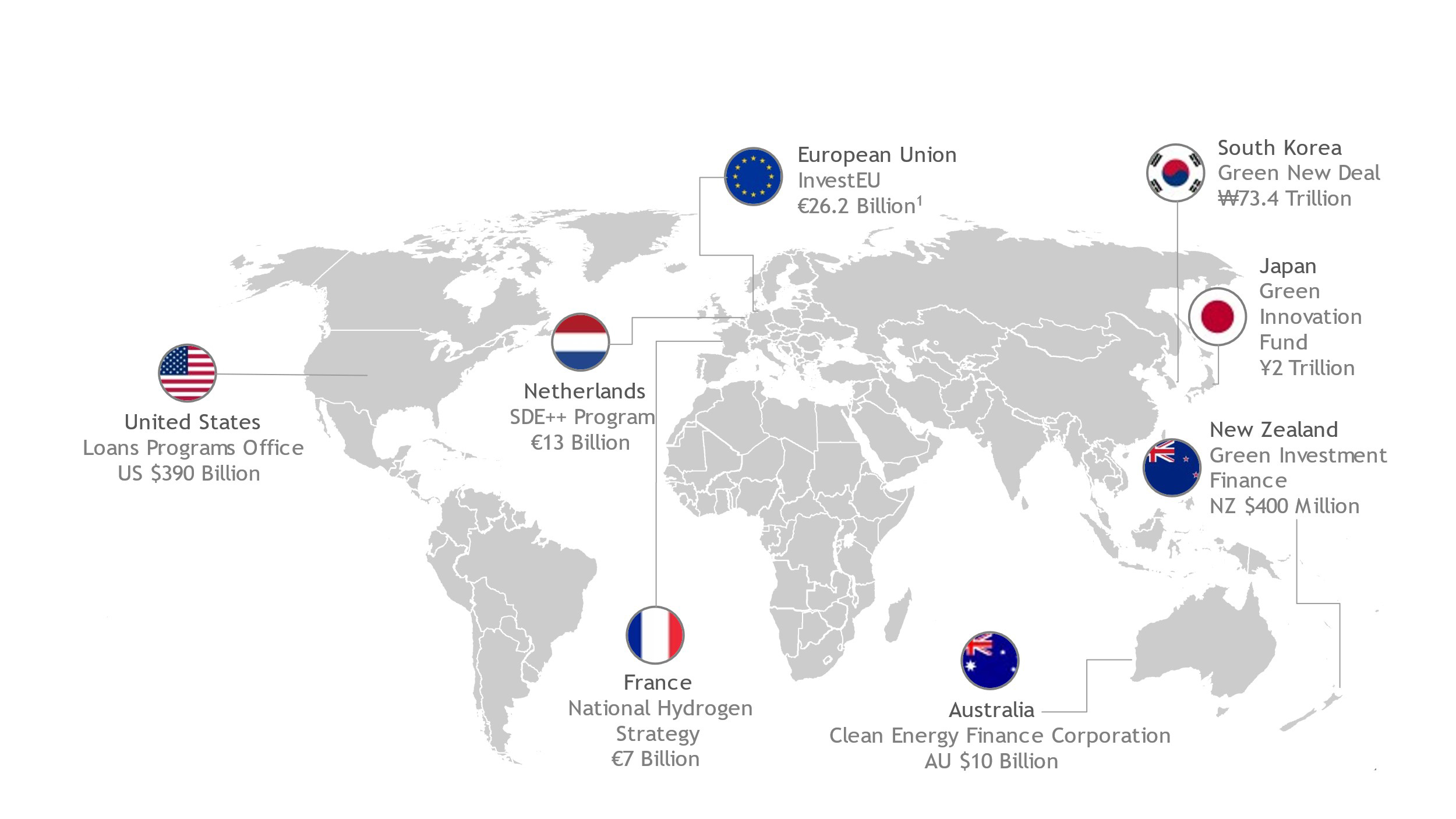

The CGF will help Canada keep pace with a growing list of jurisdictions that are using innovative public funding tools to attract the significant private capital required to accelerate the deployment of technologies required to decarbonize and grow their economies.

Because Canada’s economic prosperity has traditionally been built on natural resources and other emissions-intensive industries, a substantial transformation of our industrial base will be required to meet our climate targets and ensure long-term prosperity for Canadians and the Canadian economy. Canada needs to build the technology, infrastructure, and businesses to reduce our carbon reliance, but this will not occur without rapidly increasing—and then sustaining—private investment in activities and sectors that will strengthen Canada’s position as a leading low-carbon economy.

Today, while companies and investors are aware of opportunities to commercialize and deploy emissions-reduction technologies, they are often restrained due to investment risks that are often associated with these investment opportunities. The CGF is designed to invest in a manner that mitigates these risks that currently limit private investment, and unlock the domestic and foreign capital that Canada needs now.

The energy security and climate change provisions in the recently passed Inflation Reduction Act (IRA) in the United States have created particular urgency for Canada. The IRA includes US$369 billion in new climate and energy spending to find new areas of growth in the American economy. To further unlock private investment, the IRA increased the loan and loan guarantee authority of the U.S. Department of Energy’s Loan Programs Office (LPO) almost tenfold—from US$40 billion to US$390 billion, which significantly expanded available financing for both new innovative clean energy projects and the retooling and decarbonization of existing energy infrastructure.

The magnitude of the IRA incentives and expanded financing supports will significantly mobilize investment and improve U.S. project economics. This will draw capital, talent, and raw materials away from Canada if we do not respond. As an instrument that can attract private capital, the CGF will be an important part of Canada’s work to respond to the IRA and remain competitive.

2. Implementation of the Canada Growth Fund

The implementation of CGF will be guided by five principal criteria:

- Speed: CGF must be stood up quickly in order to keep pace with other jurisdictions—especially the U.S.—and contribute as soon as possible to achieving Canada’s ambitious 2030 emissions reduction targets. Time is of the essence if we are to succeed.

- Independence and market credibility: CGF requires the capacity to make timely, independent investment decisions—which is crucial to its market credibility and the willingness of other investors to work with CGF.

- Source of funding: CGF requires a secure funding mechanism to provide it with a stable capital base for the long-term.

- Governance: CGF needs to quickly have a governance structure and executive team put in place, as well as the ability to attract and retain the talent required to responsibly manage a large investment fund that is of critical importance to Canada.

- Transparency: To ensure its full accountability to the people of Canada, CGF must have

transparent public reporting, including to Parliament, on its operations, investments, and the performance of

CGF against its mandate.

To ensure timely progress towards meeting the strategic objectives listed below, CGF will be launched in two phases:

- CGF will be established in 2022 as a subsidiary of the Canada Development Investment Corporation (CDEV). The government will establish priorities and accountabilities for this operationally independent entity based on sound investment principles.

- The second phase will establish a permanent, independent structure for CGF in the first half of 2023.

3. Mandate

3.1 Strategic Objectives

CGF will make investments that catalyze substantial private sector investment in Canadian businesses and projects to help transform and grow Canada’s economy at speed and scale on the path to net-zero. CGF’s investments will help Canada meet the following national economic and climate policy goals:- Reduce emissions and achieve Canada’s climate targets;

- Accelerate the deployment of key technologies, such as low-carbon hydrogen and carbon capture, utilization, and storage (CCUS);

- Scale up companies that will create jobs, drive productivity and clean growth across new and traditional sectors of Canada’s industrial base, and encourage the retention of intellectual property in Canada; and,

- Capitalize on Canada’s abundance of natural resources and strengthen critical supply chains to secure Canada’s future economic and environmental well-being.

3.2 Scope of Investment Activities

To achieve its strategic objectives, CGF will use investment instruments that absorb certain risks in order to encourage private investment in low carbon projects, technologies, businesses, and supply chains. This includes investments that scale Canadian clean technology businesses.

Specifically, CGF’s investments will have three areas of focus:

- Projects that use less mature technologies and processes (proven in pilots but not yet widely adopted) to reduce emissions across the Canadian economy. These could include but are not limited to carbon capture, utilization, and storage; hydrogen; and biofuels.

- Technology companies, including small and medium enterprises (SMEs), which are scaling less mature technologies that are currently in the demonstration or commercialization stages of development.

- Companies, including SMEs, and projects across low-carbon or climate tech value chains, including low-carbon natural resource development.

3.3 Risks the Canada Growth Fund Will Mitigate

Private sector investments in CGF’s areas of focus are often hindered by four key types of risk:

- Demand risk associated with uncertainty around end market demand and pricing.

- Policy risk related to perceived uncertainty around climate regulations, such as a carbon price or clean fuel standards.

- Regulatory risk with respect to project assessments and permitting approvals for constructing projects.

- Execution risk from building first-of-a-kind commercialized products and companies.

These risks, separately or in combination, are limiting the deployment and scaling of private investment because of the uncertainty they create about an investment’s longer term financial prospects.

CGF will invest in a manner that accepts some portion of these risks to bridge the private market funding gaps and draw in more capital to projects that support Canada’s long-term growth and decarbonization plans.

CGF will not engage in R&D and technology pilot projects and will not undertake venture capital investing. These types of investments are covered by other government policies and programs.

While CGF will focus on scale-up projects, companies, and technologies beyond the technology demonstration stage, it will accept—with investment partners—some risk associated with new technologies.

3.4 Financial Framework

CGF will differ from traditional for-profit private sector investors seeking market returns and traditional public sector grant and contribution programs. Its objective will be to deliver against its strategic objectives while recovering its capital on a portfolio basis and recycling its capital base over the long term.

CGF will invest concessionally by accepting, where necessary, below-market returns relative to the risk it incurs. Three principles will guide the structure of these concessional investments:

- CGF will seek to minimize the level of concessionality of its investments necessary for the private sector to proceed with an investment, such as by seeking a minimal discount to its return or increasing its loss exposure relative to what a traditional private sector player would traditionally accept.

- CGF will participate, alongside traditional private sector players, in the upside generated by its investments and ensure that private investors do not earn a disproportionate share of the returns (i.e., returns in excess of what the private sector requires to proceed with an investment given the level of risk it is bearing, taking into account the CGF’s participation).

- CGF will expect private sector players to share in the downside of investments. While CGF may accept a first-loss position, for example, investors should share in the financial downside of under-performing investments.

3.5 Range of Investment Instruments

CGF will have flexibility to invest across the capital structure via equity, debt, and derivative contracts (and other forms of price assurance) to draw in private investment to projects and companies. It will not provide grants or generally invest where it does not have a reasonable expectation of a return of capital. As a financial solutions provider, CGF’s investment in a given project will be dependent on a particular project’s needs and risk profile. CGF will work collaboratively with the private sector to customize these solutions to be:

- Additional (i.e., address an undersupply of private sector financing or reduce the barriers hindering private sector investment); and

- Efficient (i.e., generally have a reasonable prospect of a return of capital or better).

CGF will have at least four distinct investment offerings:

- Concessional equity or debt to address a lack of private market financing at rates that allow the project to be competitive.

- Equity instruments where the CGF earns below-market returns and/or has higher exposure to loss, such as first-loss equity or equity with a capped return where the CGF shares in the upside of an investment.

- Debt instruments where the CGF earns below-market returns and/or has higher exposure to loss (e.g., through low-interest loan or subordinated debt).

- Contracts for difference (and other forms of price assurance) to address demand and policy risk and improve project economics. Contracts can help manage perceived uncertainty around, for example, the evolution of a carbon price or of the price of a product, such as hydrogen. There are two types of contracts:

- Two-way contract: When the market price is less than a “strike price” (the price that enables the project to meet its target return), the project would receive a payment from CGF equal to the difference between the strike price and the market price. When the market price is greater than the strike price, CGF would receive a payment from the project equal to the difference between the market price and the strike price.

- One-way contract: When the market price is less than the strike price, the project would receive a payment from CGF equal to the difference between the strike price and the market price. CGF can participate in project upside through revenue-sharing warrants. Participating in the upside by receiving warrants may also apply to other investments by CGF.

- Anchor equity to provide financing where the risk level and capital required creates a limited pool of private capital.

- Offtake contracts to address demand risk and improve project economics.

- Contracts to provide revenue for a volume of production where sufficient demand from prospective private buyers is still developing.

3.6 Complementary to the Suite of Existing Government Initiatives

CGF will not be a replacement for government initiatives such as the Net Zero Accelerator or tax policies that incent investment. Given the recent actions of other jurisdictions, including the U.S.’ passage of the IRA, a number of initiatives will be required for Canada to continue to compete internationally for capital investment. CGF will, however, distinguish itself from other federal financing initiatives in a number of ways:

- Investment Stage: CGF will generally target projects and companies at the scale-up stage of development. This will distinguish CGF’s investments from:

- Research and development or demonstration projects, which are funded through grants and contributions programs;

- Start-up companies funded through venture capital funds; and,

- Projects that use mature technologies and mature companies that can attract private sector investment.

- Financing Tools: CGF will have a broad suite of tools permitting it to offer innovative forms of concessional financing, including instruments where CGF takes on an above-market risk with the flexibility to earn below-market returns. This will distinguish CGF from:

- Grants and contributions programs that provide funding to proponents; and,

- Commercial financing provided to proponents on market terms.

- Delivery Expertise: CGF will be delivered by a team of investment professionals with capital market experience, reporting to the board of directors of the CGF. This team will also draw on expertise in clean technology from co-investors.

- Project Type: CGF will focus on private projects and companies, rather than on public projects.

4. Go-To-Market Approach

4.1 Partnership

CGF will access investment opportunities by partnering with the private sector in three ways:

- Direct: On a deal-by-deal basis, CGF will directly engage in two different models:

- Bilateral partnerships: CGF will work one-on-one with strategic partners, such as industrial emitters, clean tech companies, and companies across low-carbon supply chains, including the production of critical minerals, to invest in their projects and/or growth.

- Coalitions: CGF will act as sponsor of a transaction, identifying opportunities and convening multiple financial and strategic partners to deliver a project.

- Co-invest: On a deal-by-deal basis, other investors, such as private sector funds, pension funds, and other institutional investors, will approach CGF with opportunities requiring CGF to structure a mutually beneficial concessional investment.

- Anchor investments in other funds: CGF will invest in newly established funds of third-party

managers when their target investments align with CGF’s strategic objectives. Investments of this kind

will provide CGF with influence to shape the third-party fund’s investment strategy.

Partnering with third-party investment managers, via co-investments and anchor fund investments, will allow CGF to access deep private sector investment expertise and a broader pool of potential transactions—thus crowding-in more private capital and leveraging an investment team to effectively deploy the CGF capital invested in the fund.

4.2 Sourcing

CGF will develop an investment pipeline in two ways:- Actively identifying and engaging with key constituencies, such as investors, emitters, or clean technology companies, including by:

- Establishing market presence via direct outreach, including “deal formation” by structuring and proposing investments that could be undertaken with the CGF’s participation;

- Partnering with third-party investors to leverage their sourcing capabilities and increase the breadth of potential investments; and,

- Building multi-investor coalitions to develop and deliver large, complex projects in priority investment areas.

- Developing an open, transparent application process for the private sector to submit investment opportunities.

4.3 Investment Selection Criteria

CGF will apply investment principles rigorously and consistently with a view to enable quick investment decisions that will meet the timelines of other investors.

The principles for the selection of investments will be applied by investment management teams. These criteria will include:

Consistency with goals: The investment will advance the mandate of CGF.

Long-term benefits for Canada: The investment has a reasonable chance to strengthen the development of Canadian workers and generate knowledge that will produce long-term benefits for the Canadian economybeyond those realized directly by the specific investment in the project or company. For example:

- Canadian presence: activities related to the project or company are done in Canada and may generate widely shared benefits.

- Intellectual property: the activity will enable the development, utilization, or commercialization of Canadian intellectual property.

- Value chain creation: the investment will develop or strengthen Canadian competitiveness by participation in a new or existing value chain.

Additionality: The investment will draw in private sector investment that will not have been secured without the participation of CGF.

Financial soundness: The investment will fit within a portfolio that will target a return of capital and thus a recycling of capital for ongoing contribution to the goals of CGF.

Consistency with ESG principles: The investment will fit within a portfolio that will enable CGF to meet the highest internationally recognized standards of Environment, Social and Governance (ESG) measurement, disclosure, and performance.

4.4 Monitoring and Management of Investments

CGF, by drawing to the greatest extent on the diligence of its private sector partners, will actively monitor the performance of its investments post-close, ensuring responsiveness to changing market and operating conditions, and accountability for results against CGF’s mandate. This monitoring will include:

- Operational oversight: execution of projects and implementation of corporate plans as per terms agreed with investment partners, for the achievement of economic and environmental benefits.

- Financial oversight: responsible management of financial risks and realization of expected returns.

- Strategic oversight: an ongoing relationship with investment partners to ensure sustained

commitment to projects and corporate growth in Canada, and to mitigate risks such as the change of control of

partner investors or a decision by partner investors to divest of project shares.

CGF will build internal capacity and, over time, offer its expertise, capabilities, and networks to project proponents and investee companies in order to further support their growth and development.

5. Performance Evaluation, Transparency and Accountability

5.1 Performance Evaluation

CGF will monitor its investments and track performance against its objectives and investment principles. It will measure the progress of its individual investments and overall portfolio along objective metrics. It will also assess follow-on impacts; for example, private investment in other parts of the supply chain enabled or catalyzed by CGF's investment.

Strategic Objectives and Investment Principles |

Potential Performance Metric |

|---|---|

| Quickly and significantly reduce emissions and contribute to achieving Canada’s climate targets |

|

| Scale up technologies and companies that will drive productivity, competitiveness and clean growth and jobs across new and traditional sectors of Canada’s industrial base |

|

| Capitalize on Canada’s resource endowment and strengthen critical supply chains in order to secure Canada’s future economic prosperity |

|

| Additionality |

|

| Long-term benefits for Canada |

|

| Consistency with Environmental, Social, and Governance (ESG) Principles |

|

| Financial soundness |

|

5.2 Public Reporting, Transparency and Accountability

The government will establish a market-leading reporting framework for CGF that will ensure public transparency

and accountability with regard to investment policies, deal selection and application processes, ESG impacts,

actual investments, and the performance evaluation of CGF against its mandate.

Performance reports will be submitted to the government to be tabled in Parliament. The reports will meet the

highest standards of disclosure for public investment funds, ensuring transparency and accountability to

Canadians.

Report a problem on this page

- Date modified: