Backgrounder: A Strong and Growing Economy for the Middle Class

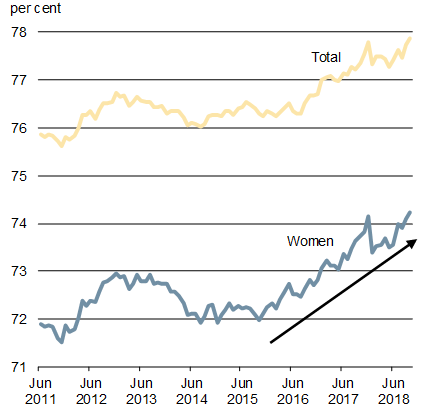

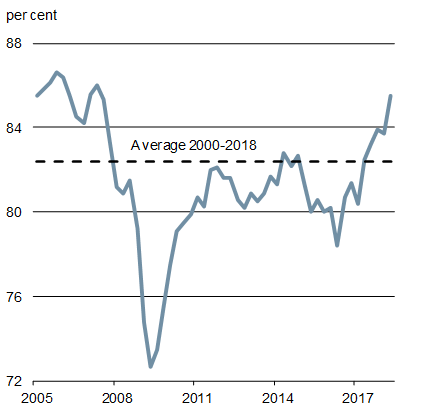

Across the country, a strong and growing middle class is driving economic growth—creating new jobs and opportunities for people to succeed. Thanks to the hard work of Canadians, and supportive investments by the Government in people and in communities, Canada's economy is strong and growing, the unemployment rate is at its lowest level in 40 years, wages are rising at their fastest rate in eight years, business investment is recovering and the employment rate of working-age Canadians is at its highest level today than ever before in Canada's history.

Canadians work hard every day to build a better life for themselves and their families. Thanks to their efforts:

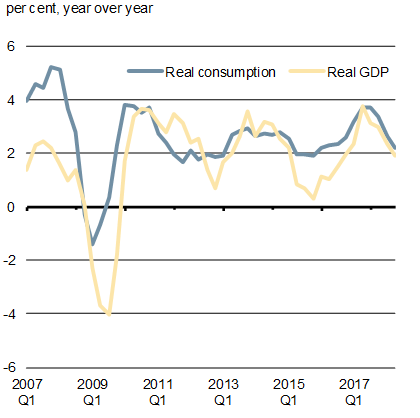

Canada's economy is strong and growing. At 3 per cent, Canada had the strongest economic growth of all the Group of Seven (G7) countries in 2017, and is expected to stay near the top this year and next.

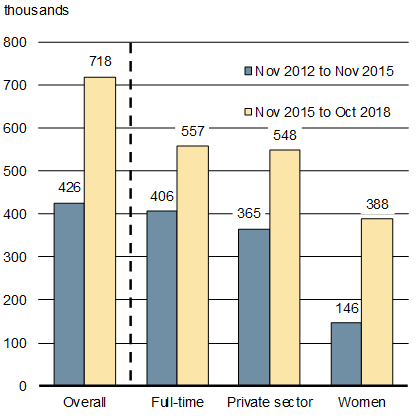

There are more good, well-paying jobs. Canadians have created more than half a million new full-time jobs in the last three years, helping to push the unemployment rate to its lowest level in 40 years.

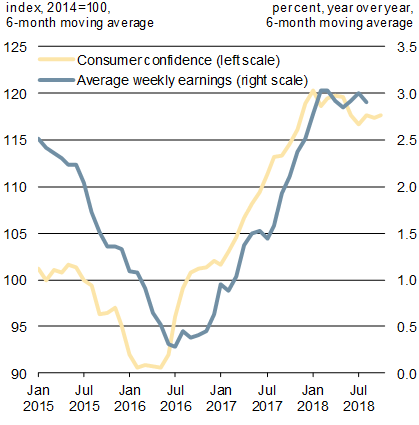

Wages are growing. So far in 2018, wages are growing at their fastest pace in eight years.

Consumer confidence is strong. With more jobs, rising wages, and lower taxes, consumer confidence remains strong.

As a result of lower taxes and measures like the Canada Child Benefit, by this time next year a typical middle class family of four will have about $2,000 more each year to help with the cost of raising their children, save for their future, and help grow the economy for the benefit of everyone.

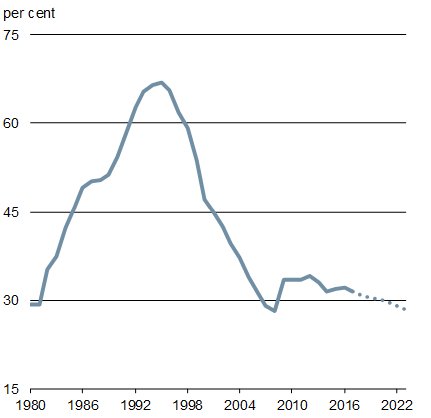

Canada's strong economy today makes it possible for the Government to continue investing in the middle class, laying a solid foundation for future generations. The Government is making future-focused investments in people, communities, and the economy while carefully managing deficits and protecting long-term fiscal sustainability.

The Canadian economy has added 550,000 full-time jobs since November 2015

Sources: Statistics Canada; Department of Finance Canada calculations.

Sources: Statistics Canada; Department of Finance Canada calculations.

Stronger wage growth and more Canadians working in good, well-paying jobs have boosted consumer confidence over the past couple of years, which has further supported household spending. Recently, household spending growth has slowed, led by interest-rate sensitive spending. However, it remains at a solid pace.

Rising employment, wage growth and consumer confidence have supported household spending

Sources: Statistics Canada; The Conference Board of Canada.

Source: Statistics Canada.

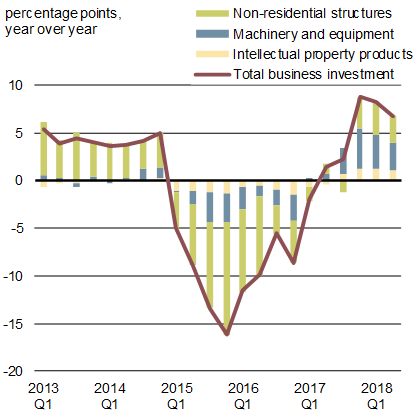

Improved business confidence has contributed to an upturn in business investment. Business investment has grown by roughly 8 per cent per quarter on average since the end of 2016, the fastest rate of growth over the last six years. Since the end of 2016, business investment has improved in the vast majority of provinces, and across a wide range of capital goods, such as machinery and equipment.

Businesses appear to be responding to capacity pressures, investing in a wide range of capital goods

Source: Statistics Canada.

Last observation is 2018Q2.

Sources: Statistics Canada; Department of Finance Canada calculations.

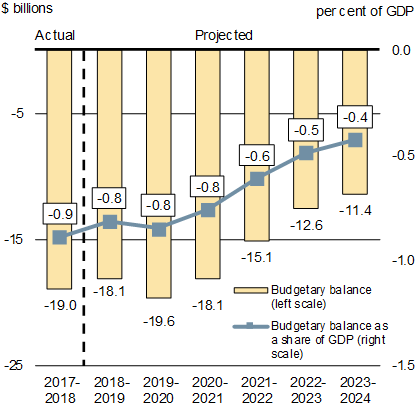

The 2018 Fall Economic Statement projects deficits which decline from $19.6 billion in 2019–20 to $11.4 billion by 2023–24 and lead to a projected continuous decline in the federal debt-to-GDP ratio, which is expected to reach 28.5 per cent in 2023–24.

The Government continues to carefully manage deficits to ensure long-term fiscal sustainability for future generations of Canadians

Sources: Fiscal Reference Tables; Department of Finance Canada calculations.

Sources: Fiscal Reference Tables; Department of Finance Canada calculations.

Opportunities Ahead

Prospects are good for continued growth in the Canadian economy—wages are rising at their fastest rate in eight years, and the recovery in business investment is expected to continue amid a positive investment climate. This will be further supported by measures included in the 2018 Fall Economic Statement and by the recently negotiated United States-Mexico-Canada Agreement on trade.

Canada's current positive outlook is also a reflection of our many competitive strengths, such as an abundance of natural resources, a highly skilled labour force, preferential access to global markets, and strong capacity for research, innovation and commercialization in important emerging fields.

While prospects are good, more work remains to improve the performance of Canada's economy and give hard-working middle class Canadians more opportunities to benefit from economic growth. The Fall Economic Statement takes the next steps to building an economy that works for everyone.

- Date modified: