Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Welcome to Canada.ca

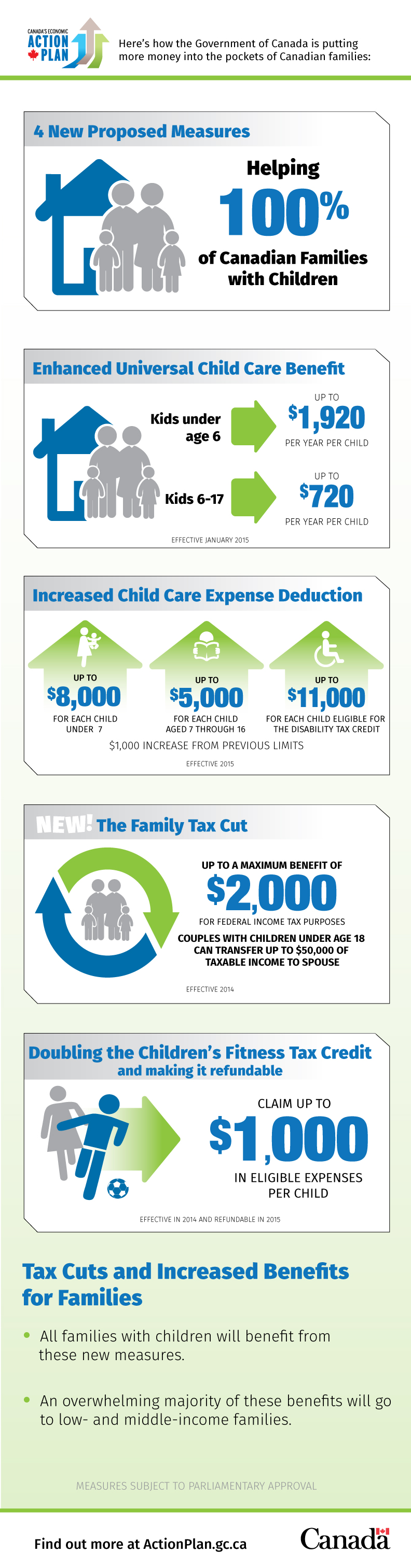

Universal Child Care Benefit

The Universal Child Care Benefit currently provides all families with up to $1,200 per year for each child under the age of 6. The Government is proposing to increase and expand the UCCB starting in 2015 to provide up to $1,920 per year for each child under the age of 6, and up to $720 per year for children aged 6 through 17.

Read more

Child Care Expense Deduction

The CCED allows child care expenses to be deducted from income when those expenses are incurred to earn employment or business income, pursue education or perform research. The Government is proposing a $1,000 increase to the maximum dollar amounts that could be claimed, starting in the 2015 tax year.

Read more

Family Tax Cut

The proposed Family Tax Cut would allow a spouse to, in effect, transfer up to $50,000 of taxable income to a spouse in a lower tax bracket, up to a maximum benefit of $2,000. The Family Tax Cut would take effect starting in the 2014 tax year. Couples would be able to claim the credit when they file their 2014 tax returns. More than 1.7 million families are expected to benefit from the new Family Tax Cut.

Read more

Doubling the Children's Fitness Tax Credit

The Government has doubled the Children’s Fitness Tax Credit to $1,000, starting in the 2014 tax year. The Government has also made the credit refundable for the 2015 and subsequent tax years to ensure those who do not earn enough to pay income taxes can benefit from this credit.

Read more