Chapter

2:

Shifting from reliance to resilience

Find out more about the expected gender and diversity impacts for each measure in Chapter 2: Shifting from reliance to resilience.

The global trade landscape is rapidly changing, shaped by growing geopolitical tensions and persistent unfair trade practices. Amid these shifts, the United States is fundamentally transforming all of its trade relationships. The effective U.S. tariff rate is now the highest it has been since the Great Depression in the 1930s, and these tariffs are being applied to all countries and nearly all goods. Canada has the best deal of any U.S. trading partner—85 per cent of trade with the U.S. is now tariff free and we have the lowest average tariff of any country in the world. Yet, we cannot rely on our most important trade relationship as we once did.

The changes in the U.S. policy go beyond tariffs. Countries must now buy access to the world's largest economy through investments, unilateral trade liberalisation, and policy changes in their home markets.

All the while, the transformation of global trade is occurring against a backdrop of wide economic disruptions: geopolitical realignment, AI and technological transformations, and a shift to a low-carbon economy.

The effect is profound—hurting companies, displacing workers, disrupting supply chains, forcing companies to rethink where they source their materials and products, and causing uncertainty that is curbing investment.

This disruption calls for a new, bold approach. Given we cannot control what other nations do, Canada's new government is focused on what we can control: building our strength at home. Canada will invest in domestic production, Canadian expertise, and diversifying trade with reliable economic partners. This is how we will meet the challenges of our times: through a strong and resilient Canadian industrial base.

Our new industrial strategy will transform our economy—from one that is overly reliant on a single trading partner, to one that is more resilient to global shocks. A new economy built on the solid foundation of Canadian industries and bolstered by diverse international trade partners.

2.1 Protecting Canada's Strategic Industries

In order to protect, retool, and support the largest industrial pivot in a generation, Canada's new government introduced a series of new, strategic measures for workers and businesses in those sectors most impacted by U.S. tariffs and trade disruptions—from the auto industry, to steel and aluminum, to forestry and agriculture. Canada has also adopted a series of protective measures—including counter tariffs—in order to safeguard Canadian workers and businesses. These initiatives will help workers acquire new skills and businesses retool their production and diversify their products, while spurring more domestic demand for Canadian businesses. As we build the economy of the future, we are ensuring workers and industries can seize its opportunities.

These new measures will help give industries and workers the tools they need to build a better future. With economic uncertainty creating a challenging investment environment in Canada, the time to act is now. That's why the government is stepping in with the most comprehensive suite of trade resilience measures in Canadian history. By supporting our workers and industries, we will build Canada strong.

Protecting Workers and Transforming Canada's Strategic Industries

Canada's new government is building a new industrial strategy to meet this moment. This will transform our economy—from one of reliance on specific trade partners to one that is more resilient to global shocks.

Given the urgency of the moment, the government has announced a series of new measures to protect workers and businesses in sectors most impacted by U.S. tariffs and trade disruptions. During this time of uncertainty, Canada's new government is supporting our auto workers and agricultural producers, manufacturers, and other workers who have felt the effects of trade tensions. As set out below, over $25 billion has been announced for supports for workers and businesses, with an expected cost of over $12 billion on an accrual basis over five years, starting in 2025-26. The government also expects $4.4 billion in tariff revenue. These measures will help give industries and workers the tools they need to build a more resilient Canadian economy.

1. Support for Agriculture, Fish, and Seafood

Canada is one of the largest exporters of agriculture, fish, and seafood in the world, and these sectors contribute to Canada's competitiveness, sustainability, and food security. The Canadian agricultural sector is a symbol of the country's ingenuity, resilience, and ability to move up the value chain. Together with the fish and seafood sectors, it plays a vital role in supporting jobs and growth across the country and in rural communities. With clear standards for labelling food products, the government helps customers choose Canada. The government is helping these sectors adapt and respond to economic challenges and a shifting trade environment, while positioning them to take advantage of new opportunities. The government has committed more than $639 million over five years, starting in 2025-26, for the following measures:

- $109.2 million in 2025-26 to Agriculture and Agri-Food Canada for the federal-provincial-territorial cost-shared AgriStability program, to increase the compensation rate for agricultural producers from 80 to 90 per cent, along with raising the payment cap per farm from $3 million to $6 million. This is available to help agricultural producers cope with large declines in farming income due to increased costs, adverse market conditions, and other challenges.

- $75 million over five years, starting in 2026-27, to Agriculture and Agri-Food Canada for the AgriMarketing Program to enhance the diversification and promotion of Canada's agriculture, agri-food, fish, and seafood products into new markets.

- $97.5 million over two years, starting in 2025-26, to temporarily increase the Advance Payments Program's interest-free limit to $500,000 for canola advances for the 2025 and 2026 program years, together with the temporary increase to $250,000 of the interest-free limit for all producers for the 2025 program year, which will result in interest savings for producers while increasing access to cash flow to help cover costs until they sell their products.

- $372 million over two years, starting in 2026-27, to Natural Resources Canada to establish a Biofuels Production Incentive to support the stability and resiliency of domestic producers of biodiesel and renewable diesel, of which $175.2 million will be repurposed from the Clean Fuels Fund; and the intention to make targeted amendments to the Clean Fuel Regulations to support the domestic biofuels industry.

In addition, Farm Credit Canada launched the Trade Disruption Customer Support Program in March 2025 to make available $1 billion in new lending to help reduce financial barriers for the Canadian agriculture and food industry.

2. Support for Forestry

The government is helping the forestry and softwood lumber sector transform to remain competitive. These measures will help unlock the full potential of the industry to keep pace with increased housing and major infrastructure construction.

- Up to $700 million over two years on a cash basis, starting 2025-26, in loan guarantees administered by the Business Development Bank of Canada, to help ensure companies have the financing and credit support they need to maintain and restructure their operations during this period of transformation.

- $500 million over three years on a cash basis, starting in 2026-27, to renew and expand existing Natural Resources Canada's forestry programs focused on market and product diversification (including new export initiatives). It also includes a commitment to prioritise Canadian materials in construction and changing federal procurement processes to require companies contracting with the federal government to source Canadian lumber.

3. Equipping Companies for Growth and Diversification

Canada's new government is helping companies overcome immediate trade pressures and providing them with support to pivot, grow, or diversify their operations by supporting projects to deepen their reach within Canada and find new reliable markets abroad.

- $5 billion over six years, starting in 2025-26, for the Strategic Response Fund, a new program with flexible terms to help firms in all sectors and regions impacted by tariffs to adapt, diversify, and grow. The program will seek to maintain industrial capacity by offsetting new market access costs, supporting retooling, and helping Canada-based firms to expand or secure new markets. This includes $1 billion in Strategic Innovation Fund support for the steel industry's transition toward new lines of business and strengthening domestic supply chains announced in July 2025.

- Up to $1 billion over three years, starting in 2025-26, to the Regional Development Agencies for the Regional Tariff Response Initiative to support businesses impacted by tariffs across all affected sectors, including increasing non-repayable contributions for eligible businesses.

4. Supporting Workers

The government is implementing a new reskilling package for workers, has made Employment Insurance more flexible and with extended benefits, and will launch a new digital jobs and training platform with private-sector partners to connect Canadians more quickly to careers.

- $570 million over three years, starting in 2025-26, through Labour Market Development Agreements with provinces and territories to support training and employment assistance for workers impacted by tariffs and global market shifts.

- $382.9 million over five years, starting in 2026-27, and $56.1 million ongoing, to launch new Workforce Alliances to bring together employers, unions, and industry groups to work on ways to help businesses and workers succeed in the changing labour market and coordinate public and private investments in skills development. A new Workforce Innovation Fund will invest in projects tailored to local job markets to help businesses in key sectors and regions recruit and retain the workforce they need.

- Temporary flexibilities to the Employment Insurance Work-Sharing program, as announced on March 7, 2025, to provide EI benefits to eligible employees who agree to work reduced hours due to a decrease in business activity beyond their employer's control. This helps employers and employees avoid layoffs while supplementing reduced income with EI benefits. This measure is expected to cost $370.5 million over five years, starting in 2025-26, and $18.5 million ongoing.

- Temporary Employment Insurance measures that enhance income supports for Canadian workers whose jobs have been impacted by the economic uncertainty caused by foreign tariffs. These supports are expected to cost $3.7 billion over three years, starting in 2025-26.

- $50 million over five years, starting in 2026-27, and $8 million ongoing, to implement a new digital tool to facilitate job search and applications, and launch a national online training platform in partnership with the private sector.

5. Ensuring Access to Financing

The government has also introduced liquidity measures to support small, medium, and large Canadian businesses. These measures include:

- Launching the Large Enterprise Tariff Loan (LETL) facility, a $10 billion financing facility designed to support otherwise successful Canadian firms negatively affected by actual or potential tariffs and countermeasures. The Canada Enterprise Emergency Funding Corporation (CEEFC) announced its first LETL loan to Algoma Steel Inc., which will provide Algoma with access to $400 million in liquidity, with the Government of Ontario contributing an additional $100 million under the same terms to help stabilise a major Canadian player in the competitive steel industry, amid current disruptions to the global steel trade.

- Enhancing the Business Development Bank of Canada's $500 million Pivot to Grow program to provide support to eligible small- and medium-sized steel enterprises facing liquidity challenges. This program will cost $231 million on an accrual basis over five years starting in 2025-26.

- $940 million in 2025-26 for the deferral of corporate income tax payments and GST/HST remittances due to the Canada Revenue Agency from April 2 to June 30, 2025, providing up to $40 billion in liquidity support for Canadian businesses.

Becoming Our Own Best Customer

To build our strength at home, we have to focus on what we can control. We can control who we buy from, and we choose to buy Canadian. The government is launching a new Buy Canadian Policy—moving from "best efforts" to a clear obligation to buy Canadian. When domestic suppliers are not available, purchases will be required to include Canadian content or be sourced from trusted partners. Such cases will remain the exception, not the norm, and will require ministerial approval. To facilitate the implementation of the Buy Canadian Policy, the government will also implement regulatory amendments to ensure that Buy Canadian aspects of federal procurement processes are not subject to review by the Canadian International Trade Tribunal.

This new approach will extend to all federal agencies and Crown corporations, like VIA Rail and Alto, which is responsible for the new High-Speed Rail initiative, leveraging every public dollar to strengthen Canada's economy, create jobs, and building capacity at home. The policy will also cut red tape and make it easier for Canadian businesses to access federal procurement opportunities. This policy will ensure that federal procurement will also support Canadian social enterprises.

To support this policy, the federal government will also set up a Small and Medium Business Procurement Program to help Canadian small- and medium-sized enterprises access federal procurement opportunities.

Canada's new government is on a mission to build Canada strong through major infrastructure projects, a modern defence industry, and millions more homes. Through the new Buy Canadian Policy, we are making government a force for nation-building—becoming our own best customer, protecting Canadian businesses, and empowering our workers with high-paying careers that build prosperity at home.

-

Budget 2025 proposes to provide $98.2 million over five years, starting in 2026-27, and $9.8 million ongoing to Public Services and Procurement Canada and $7.7 million over three years, starting in 2026-27, to the Treasury Board Secretariat to support the implementation of the new Buy Canadian Policy.

-

Budget 2025 also proposes to provide $79.9 million over five years, starting in 2026-27, to Innovation, Science and Economic Development Canada to support the new Small and Medium Business Procurement Program.

Investing Where It Counts: Resilient Canadian Power Through the Darlington New Nuclear Project

Canada will be the first G7 country to bring small modular reactor (SMR) power online, helping to drive innovation, jobs, and industrial growth. At full potential of four SMRs, the Darlington New Nuclear Project in Bowmanville, Ontario, will provide 1,200 megawatts of clean, reliable electricity, the equivalent of around 1.2 million homes.

The project was made possible through a federal and provincial commitment to invest in a stronger, more resilient Canada. The project is also an example of securing broader benefits to the Canadian economy, with an estimated 80 per cent of small modular reactor construction to occur in Ontario.

As announced on October 23, 2025, financial support includes a $2 billion investment from the Canada Growth Fund, along with an additional $1 billion investment from the province of Ontario, through the Building Ontario Fund.

2.2 Growing Canada's Trade with the World

Doubling exports of goods and services to non-U.S. markets over the next decade

A New Trade Infrastructure Strategy

As Canada deepens its trade relationships with reliable partners, we will need to build the infrastructure that will advance our goal of doubling non-U.S. exports over a decade, generating $300 billion more in trade. To that end, Budget 2025 includes a suite of new supports for trade and transportation infrastructure projects. These new initiatives will be supported by the Canada Infrastructure Bank in assessing projects and determining the appropriate mix of government supports.

-

Budget 2025 proposes to provide $5.0 billion over seven years, starting in 2025-26, to Transport Canada to create the Trade Diversification Corridors Fund. By investing in the infrastructure that moves our products to global markets, this fund will strengthen supply chains, unlock new export opportunities, and build a more resilient, diversified economy. The Fund will support projects of all scales, including digital infrastructure, to improve the ability of our imports and exports to travel efficiently across the country and to and from the rest of the world. For example, the government will consider investments in key projects in the Great Lakes-St. Lawrence Region, at ports in northeastern Québec like enhancing the Port of Saguenay's capacity to build a second wharf, rail lines in Alberta, port and rail infrastructure on the West Coast, and more.

- As part of additional resources for Canada Border Services Agency (CBSA) announced on October 17, 2025, CBSA will work with Public Safety, Transport Canada, and Global Affairs Canada to identify additional ports for container import and export designation, particularly in the Great Lakes-St Lawrence Region, like Québec City and Hamilton. This will help catalyse private investment at ports and is essential to diversifying our trade.

We must also protect our sovereignty in the North and connect northern communities to domestic and global markets. While increasing trade opportunities and improving defence readiness, investments in northern transportation infrastructure can improve the lives of northern residents, including for First Nations, Inuit, and Métis communities, through new connections to Canada's economy and transportation network.

-

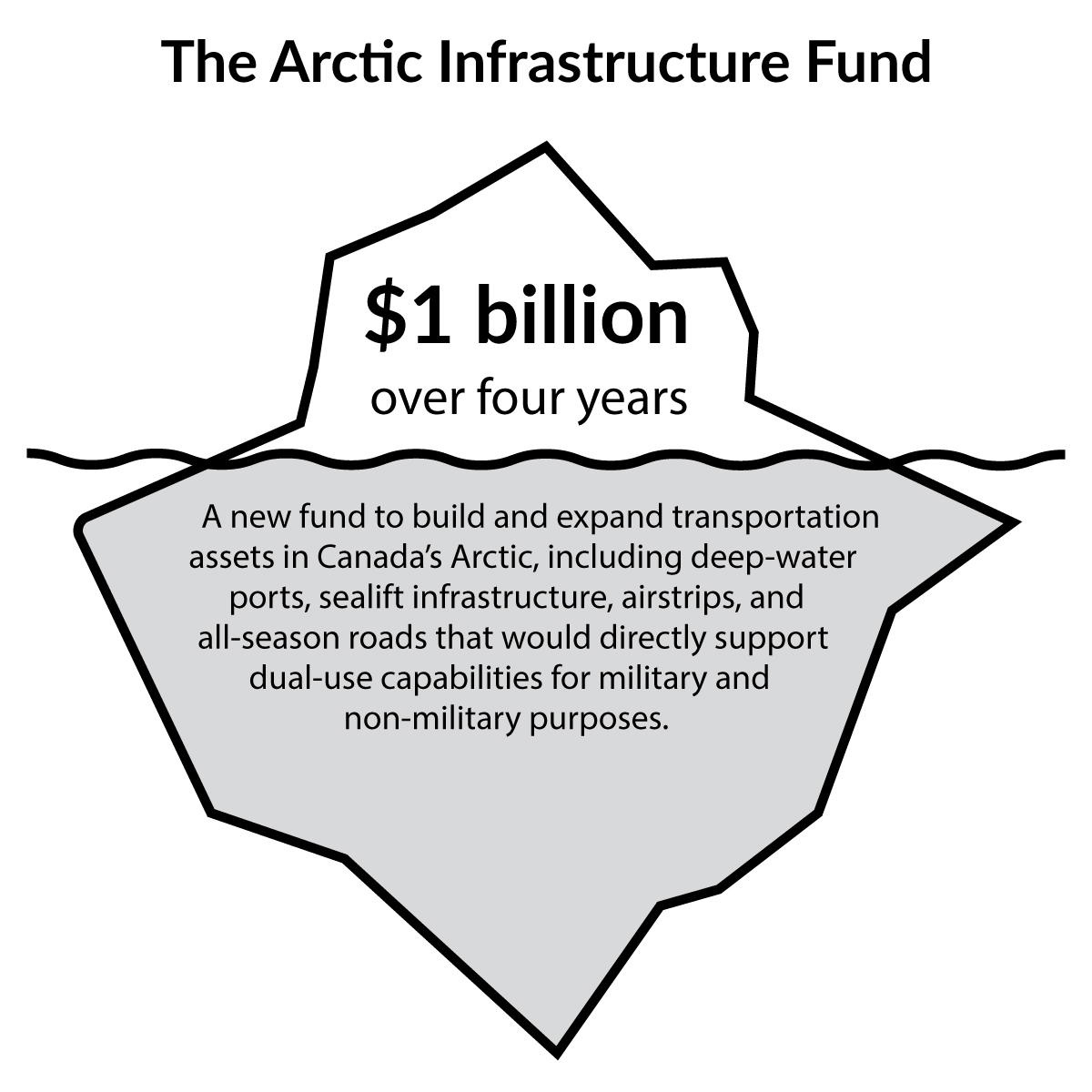

Budget 2025 proposes to provide $1 billion over four years, starting in 2025-26, to Transport Canada to create the Arctic Infrastructure Fund, which will invest in major transportation projects in the North with dual-use applications for civilian and military use, including airports, seaports, all-season roads, and highways. These investments will strengthen Canada's sovereignty, support economic development and job creation in Northern communities, advance Indigenous economic reconciliation, and promote further trade diversification by opening new gateways to global markets. Dual use infrastructure investments in the North will reliably meet both military and local needs, and the government recognizes that Inuit, First Nations, and other communities are best placed to identify community needs.

Arctic Infrastructure Fund

-

To facilitate the Arctic Infrastructure Fund's support for northern projects, Budget 2025 also proposes to provide $25.5 million over four years, starting in 2025-26, to Crown-Indigenous Relations and Northern Affairs Canada, and $41.7 million over four years, starting in 2025-26, to Canadian Northern Economic Development Agency, to help accelerate regulatory processes in Canada's North—including consultation with Indigenous governments and organisations, and local northern communities. Canada is an Arctic nation. Indigenous partnerships are critical to Canada's sovereignty and security related investments.

Investing Where It Counts: Infrastructure to Diversify Trade

Improving Canada's transportation network strengthens economic resilience and supports trade diversification. Canada is a trading nation with trade totaling approximately two-thirds of gross domestic product (GDP). However, Canada's trade remains heavily concentrated with a single partner: the United States. At the same time, Canada has significant untapped potential to diversify its trade. While Canada's trade deal with the United States and Mexico gives preferential access to about 28 per cent of the global economy, its network of other trade agreements extends that reach to around 66 per cent, including every other G7 country.

Canada holds a comparative advantage not only in primary sectors—such as agriculture, forestry, fishing, mining, and oil and gas—but also across a range of manufacturing industries, including wood, paper, transportation equipment, aerospace, food and beverage, and primary metals. This is in addition to a thriving services, technology and value-added goods trade—the economy of the future.

Unlocking this potential requires targeted, forward-looking investments in trade infrastructure that allow goods to move efficiently, avoiding bottlenecks. To enable this investment, Budget 2025 proposes to invest $6 billion in Canadian transportation infrastructure, which could raise productivity and increase Canadian GDP by up to $21 billion.

Beyond facilitating access to international markets for Canadian companies affected by trade disruptions, these investments will benefit the broader economy by connecting markets, enabling businesses and industries to expand, all while creating jobs and ensuring Canadians have access to alternative suppliers when trade is disrupted. By improving the efficiency and resilience of Canada's transportation network, trade infrastructure investment directly supports both economic growth and strategic trade diversification.

Growing and Diversifying Canada's Trade

1. Export Development Canada's Support for Trade Diversification: Growing Business by $25 billion

The measures proposed in Budget 2025 expand on recent initiatives brought forward to help Canadian exporters reach new markets, including Export Development Canada (EDC)'s two-year, $5 billion Trade Impact Program, which launched in March 2025 and offers a range of export tools including trade credit insurance, export guarantees, and foreign exchange guarantees. Across virtually all sectors, companies are facing increased uncertainty and costs, and EDC continues to actively engage with customers and industry stakeholders to better understand their needs and to determine how to best support them.

-

Budget 2025 announces the government's intention for EDC to increase total business facilitated by $25 billion by 2030. This will help expand Canada's exports and trade development activities in sectors of strategic importance for Canada, including in critical minerals, energy, clean technology, infrastructure, and defence.

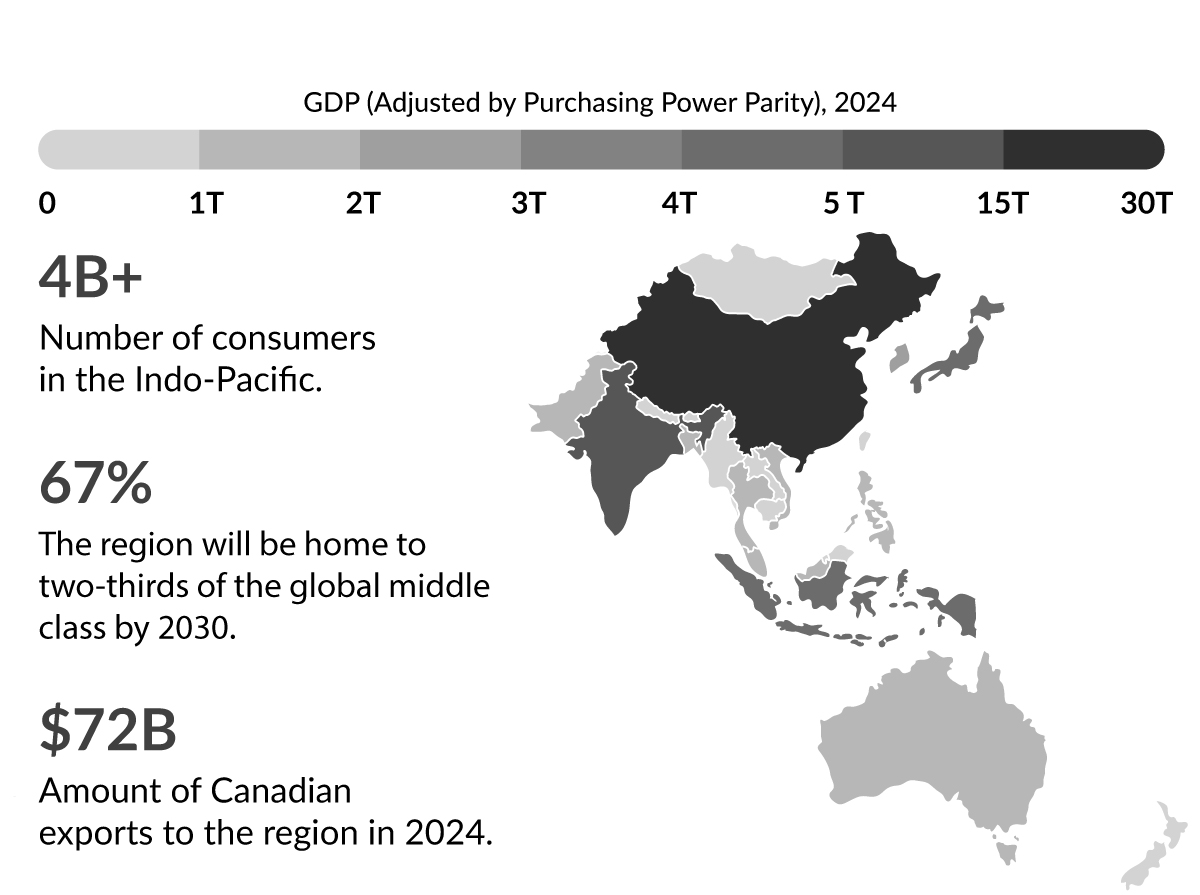

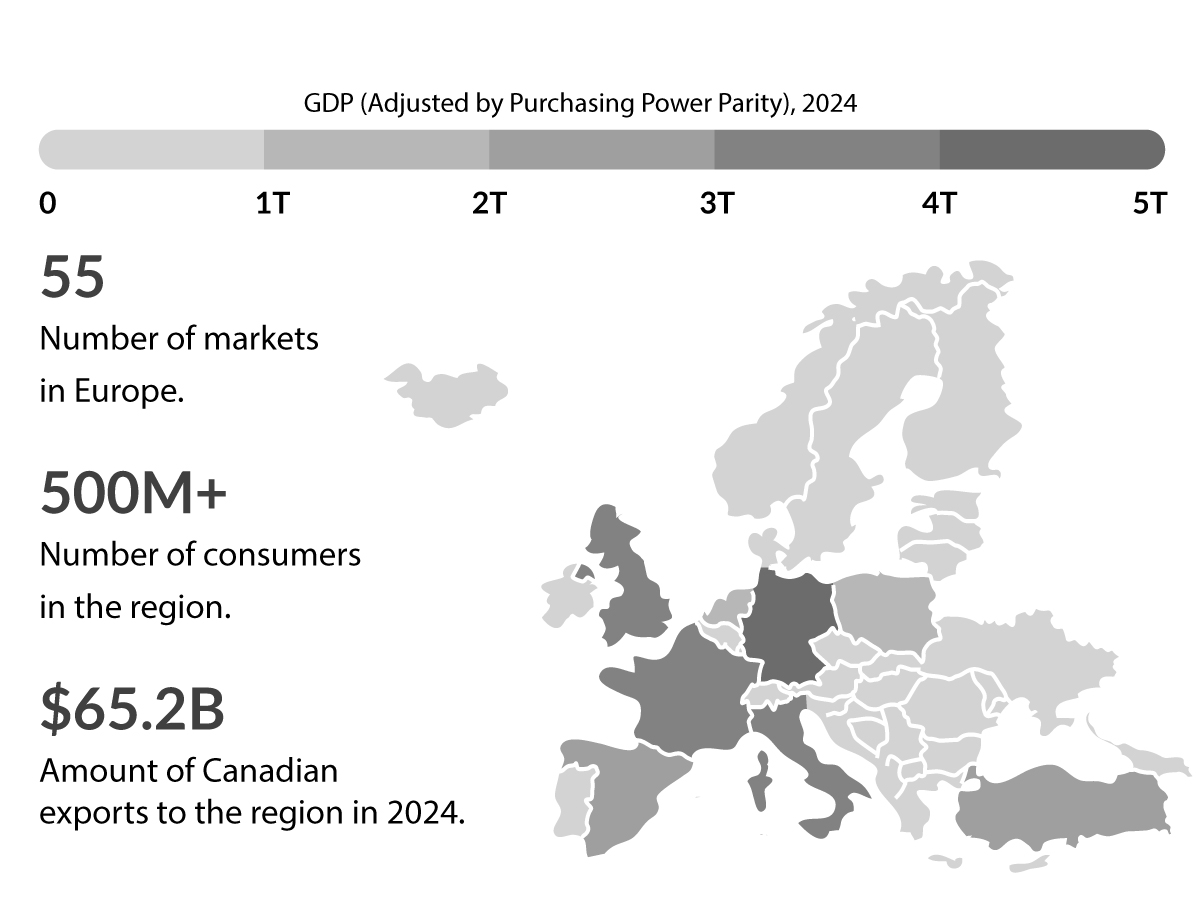

2. Strengthening Ties in the Indo-Pacific and Europe

Canada's path to long-term economic resilience hinges on diversifying our exports. This means doing more business across the world—particularly in growth-markets—to increase overall trade volumes, move beyond traditional north-south trade patterns, and strengthen our collaboration with reliable trading partners and Allies around the world. In particular, the government will focus its efforts on the Indo-Pacific—a pivotal source of long-term demand—and in Europe, where businesses can take advantage of established export links, a similar business culture, shared geopolitical interests, and emerging sectoral opportunities.

Despite a more expansive free trade network than any other G7 country, offering access to about two thirds of the global economy, 70 per cent of Canadian exports remained concentrated in the U.S. as of 2024, with only 4 per cent directed to CETA markets and 8 per cent to CPTPP countries. Recent survey data from EDC shows that goods exporters are continuing to prioritise North American and advanced European markets for expansion, with economies in Asia notably absent from their plans.

Canada enters this period of trade transformation in a highly favourable position—the first G7 country with free trade agreements with all of its G7 partners. Demand is high and will remain at this level for many of the goods we produce in abundance, including energy, potash and other critical minerals, agri-food, and related products—as well as value-added goods, services, and technology. And we are similarly well-placed as an investment destination. In exchange, partnerships with foreign firms can offer Canadian businesses new footholds in global supply chains.

The government is committed to equipping Canadian businesses to compete globally in sectors where we are traditionally strong, as well as in new markets for new advanced technologies that will shape the economies of the future. This renewed effort, supported by over $1.7 billion in new investments, forms a key part of Canada's new comprehensive industrial strategy for building the strongest economy in the G7.

Leveraging Strategic Opportunities in the Indo-Pacific Region

- Agriculture and Agri-Food

- The Indo-Pacific region is a critical market for Canadian agriculture. Our agri-food products and innovation can help the region's population and growing middle-class meet its food and nutrition needs.

- Clean Technology

- Canadian capital, expertise, and cleantech innovations are in demand as Asia seeks to urbanise and industrialise in a sustainable manner. There are significant opportunities to export our nuclear technology.

- Energy and Infrastructure

- Countries across the Indo-Pacific are making infrastructure investments to support economic growth, power digital transformation, provide new services, and address climate change. We can help provide energy security to key partners in the region.

- Advanced Manufacturing

- The region is fast to adopt new technologies for manufacturing and digital transformation which creates opportunities for Canadian innovation.

- Service Exports

- Digital services are Canada's fastest growing export category. There are significant export opportunities for digital service exports in Indonesia, Japan, and the Philippines.

Leveraging Strategic Opportunities in Europe

- Agriculture and Agri-Food

- European farming and agriculture are changing, and sectors such as artificial intelligence and nanotech are assuming an increasing role in industry, which is opening a rich source of business opportunities.

- Clean Technology

- Countries throughout Europe have strong demand for Canadian clean technology and energy products. In 2025, the European Union (EU) released a roadmap to fully end dependency on Russian energy imports while providing affordable alternatives for citizens and industry.

- Continental Defence and Ukrainian Reconstruction

- There are opportunities for Canadian firms to support increased European defence spending, while Ukraine's reconstruction needs could total $1 trillion, and Canadian businesses can benefit from enormous opportunities across nearly every sector, from engineering and energy to agri-food, health care, and technology.

- Minerals and Metals

- Canada-EU cooperation on critical minerals offers strategic opportunities for Canada's mining sector. As the top western producer of aluminum, nickel, and platinum, and a source of copper, Canada has the potential to bring a significant amount of critical minerals into production, supporting the EU's electrification, decarbonisation, and national security.

- Service Exports

- Canada's post-pandemic growth in service exports has outshone that of many advanced economies, and Europe is Canada's second largest service export market, behind the United States.

To seize these opportunities, Budget 2025 proposes a step change, and a series of new measures to help Canadian enterprises compete and succeed internationally. These include concessional financing to open doors in priority markets, more financial support to help businesses explore international partnerships, and digitalisation and infrastructure investments to position Canada as a fast, reliable supplier of choice to the region.

3. Trade Diversification Strategy

Canada is setting a new goal to double non-U.S. exports over the next decade, generating $300 billion more in trade—that's an increase of over $100 billion in 5 years. To do this, Canada must focus on growing areas of key competitive advantage and supercharging engagement with the world's fastest growing markets.

- New Strategic Exports Office: Canada's competitors are increasingly fusing traditional diplomacy with commercial acumen to help their businesses and workers win opportunities abroad. To coordinate engagement across all departments and Government of Canada tools, a new Strategic Exports Office at Global Affairs Canada will curate a pipeline of international business opportunities and build sophisticated, proactive roadmaps for Canadian senior-level engagement to open doors and remove roadblocks for Canadian companies. This Office will operate with resolve and laser-focus to remove longstanding trade irritants, market access barriers, infrastructure gaps, and financing needs.

4. Making New Business-to-Business Connections in Europe

Building on recent and continuing efforts in the Indo-Pacific region, the government will launch a series of new initiatives to showcase the talent and competitiveness of Canadian enterprises in European markets.

-

Budget 2025 proposes to provide $8 million over four years, starting in 2026-27, and $2 million ongoing, to Global Affairs Canada to deepen trade relations with European partners by undertaking new trade missions with Canadian businesses and supporting Canadian Chambers of Commerce in Europe.

Helping Small and Medium-sized Enterprises Abroad

Québec City's WaterShed Monitoring Inc's international success is a great Canadian small and medium-sized enterprise (SME) success story. With the help of Canada's Trade Commissioner Service (TCS), the water management company has grown and expanded in European countries, maintaining a corporate office in France. It is now pursuing opportunities in the Indo-Pacific region, with company representatives joining a Team Canada Trade Mission to Malaysia and Vietnam in March 2024 and taking part in the TCS' first South-East Asia Watertech Canadian Technology Accelerator in Singapore.

5. Removing Barriers and Modernising Trade

In addition to opening up access to new, high-growth markets, ongoing trade negotiations play an essential role in lowering the barriers businesses face under existing agreements. This includes important efforts to modernise rules that support trade in the rapidly expanding digital services sector.

-

Budget 2025 proposes to provide $20 million over four years, starting in 2026-27, and $4.8 million ongoing, to enhance Global Affairs Canada's capacity to negotiate and implement trade and investment-related agreements.

Connecting Canadian Businesses to the Global Market

1. Seizing International Opportunities Through Trade Finance

For over 80 years, EDC has helped exporters to finance deals, offset the risks of doing business abroad, and access new markets. The government is committed to ensuring EDC's toolkit fits the needs of Canadian exporters and supports resilience and growth in the current trade context.

-

Budget 2025 announces the government's intention for EDC to launch a $2 billion concessional trade finance envelope, on a cash basis, to encourage international partners to buy Canadian. This new financial tool will help exporters in key sectors—such as infrastructure and clean technology—to engage in projects in some of the world's fastest-growing developing economies, particularly in the Indo-Pacific region, and to participate in the reconstruction of Ukraine's critical infrastructure. This will be funded from EDC's existing capital envelope and Global Affairs Canada's existing departmental resources.

2. Backing for Businesses Exploring New Markets

Financial supports and specialised advisory services help businesses grow internationally by enabling them to manage important upfront investments, such as travel, distribution and agent fees, product licensing, and hiring staff. A range of supports are available through specialised federal entities, and are often complemented by provincial or territorial programs.

-

Budget 2025 proposes to provide $68.5 million over four years, starting in 2026-27, with $19.9 million ongoing, to Global Affairs Canada to enhance CanExport, which encourages small- and medium-sized enterprises (SMEs), national industry associations, and innovators to diversify their exports to new markets abroad by sharing the costs of international business development activities, such as legal expenses, trade shows, and market research. Of this amount, $14.6 million over four years starting in 2026-27 and $2.6 million ongoing will be repurposed from existing resources.

-

Budget 2025 proposes to provide $7.6 million over four years, starting in 2026-27, with $2.1 million ongoing to Global Affairs Canada to support Canadian companies through the Innovation Partnership Program and the Canadian Technology Accelerator. The Innovation Partnership Program helps Canadian companies scale up their exports through international partnerships, and the Canadian Technology Accelerator helps Canadian technology companies access international markets and export opportunities. Of this amount, $1.9 million over four years, starting in 2026-27, and $0.6 million ongoing will be repurposed from existing resources.

-

Budget 2025 proposes to provide $46.5 million over four years, starting in 2026-27, to Innovation, Science and Economic Development Canada for the SME Export Readiness Initiative, to support training for SMEs with limited exporting experience to build capacity to make informed, strategic decisions as they diversify trade. This will help Canadian firms access and be successful in new international markets and increase economic resilience.

-

Budget 2025 proposes to provide $4.2 million over three years, starting in 2027-28, and $1.4 million ongoing to Natural Resources Canada to maintain capacity to promote nuclear energy exports and strategic engagement in key export markets.

-

Budget 2025 proposes to provide $39.9 million over four years, starting in 2026-27, and $11.1 million ongoing to the National Research Council of Canada's Industrial Research Assistance Program to expand the Clean Technology Demonstration initiative to global markets.

Increasing Food Exports

Canada's agricultural producers and fish and seafood harvesters are known around the world for the quality, safety, and sustainability of their products, from canola to seafood to beef. Recent trade tensions and retaliatory measures have created challenges for these key sectors, and the government continues to stand behind them in defending fair, rules-based trade. With global demand for high-quality, nutritious food and plant protein on the rise, Canada is ready to meet the moment: expanding agriculture and agri-food, fish, and seafood exports, adding more value at home, and making export processes faster, more efficient, and more digital to help agriculture producers, harvesters, and processors reach new markets.

-

Budget 2025 proposes to provide $76 million over five years, starting in 2026-27, with $31.3 million in remaining amortisation, to the Canadian Food Inspection Agency (CFIA) to support modernised digital trade tools and services and integrate artificial intelligence into internal processes. This includes moving away from paper-based systems and expanding the use of digitalised import and export certificates to simplify processes, reduce the risk of errors, fraud, and delays, and enhance traceability. Export certificates would also be standardised to help exporters adhere to other countries' requirements and reduce the burden of attesting to product safety. These investments will support faster, simpler, and more reliable services from the CFIA—crucial for Canadian exporters.

-

Budget 2025 proposes to provide $32.8 million over four years, starting in 2026-27, and $9.6 million ongoing to the CFIA to secure, expand, and restore market access for Canadian agriculture and agri-food, fish, and seafood sectors. This includes engaging directly with other countries to strike new trade agreements and expand existing ones, identify and address trade barriers, enhance regulatory cooperation, and advocate for greater market access.

As a prominent exporter of grain, Canada is reliant on a robust and well-coordinated supply chain to facilitate the efficient movement of grain across the country and to international markets. The government acknowledges the interdependence within Canada's grain supply chain and is committed to ensuring interests are appropriately balanced and that the system enables business investment and confidence in our capacity to meet the transportation needs of the sector.

- The government will continue ongoing work to assess the challenges facing different stakeholders within the supply chain and how changes in one area may impact others. This work includes longstanding issues, such as transportation forecasting and planning, and infrastructure capacity.

Gender and Diversity Impacts Spotlight

Budget 2025 takes action to support Canadian businesses by:

- Prioritising inclusion in federal procurement through a new Buy Canadian Policy. This will include a Small and Medium Business Procurement Program to help lower barriers for these enterprises accessing federal procurement opportunities.

Budget 2025 also works to ensure the benefits of growth are widely shared by removing barriers that limit participation and access for underrepresented groups by:

- Enhancing Canada's Trade Access Through Digital Modernisation to help agriculture, agri-food, fish and seafood producers, harvesters, and processors export more efficiently. Recognising digital divides, firms with limited internet, populations with lower digital literacy, and persons with disabilities may face barriers. To mitigate these barriers, the program will include real-time user feedback to address accessibility.

- Amendments to AgriStability. In the immediate term this program will support livestock agricultural producers with pasture-related feed charges but will also take steps to identify barriers for underrepresented groups who may face challenges in accessing financing, by starting voluntary collection of disaggregated data in fall 2025.

For more information on the expected impacts of Budget 2025 measures on these and other diverse groups of Canadians, please see Annex 6.

| 2025-2026 | 2026-2027 | 2027-2028 | 2028-2029 | 2029-2030 | Total | |

|---|---|---|---|---|---|---|

| 2.1 Protecting Canada's Strategic Industries1 | 3,041 | 3,974 | 2,501 | 1,482 | 1,091 | 12,089 |

| Protecting Workers and Transforming Canada's Strategic Industries - Support for Agriculture, Fish, and Seafood* | 178 | 230 | 201 | 15 | 15 | 639 |

|

Less: Funds Sourced From

Existing Departmental Resources

|

0 | -3 | -74 | -87 | -12 | -175 |

| Protecting Workers and Transforming Canada's Strategic Industries - Support for Forestry | 4 | 225 | 267 | 267 | 97 | 859 |

| Protecting Workers and Transforming Canada's Strategic Industries - Equipping Companies for Growth and Diversification* | 594 | 1,201 | 1,948 | 1,503 | 1,253 | 6,499 |

|

Less: Funds Previously

Provisioned in the Fiscal Framework

|

-1,000 | -250 | -250 | -250 | -250 | -2,000 |

| Protecting Workers and Transforming Canada's Strategic Industries - Supporting Workers | 1,989 | 2,371 | 371 | 104 | 103 | 4,939 |

| Protecting Workers and Transforming Canada's Strategic Industries - Ensuring Access to Financing | 1,276 | 159 | -7 | -108 | -149 | 1,171 |

| Becoming Our Own Best Customer2 | 0 | 41 | 45 | 38 | 33 | 157 |

| 2.2 Growing Canada's Trade with the World | 33 | 741 | 1,211 | 1,412 | 1,037 | 4,433 |

| A New Trade Infrastructure Strategy* | 15 | 690 | 1,140 | 1,340 | 965 | 4,150 |

| Making New Business-to-Business Connections in Europe | 0 | 2 | 2 | 2 | 2 | 8 |

| Removing Barriers and Modernising Trade | 0 | 5 | 5 | 5 | 5 | 20 |

| Seizing International Opportunities Through Trade Finance | 64 | 48 | 48 | 0 | 0 | 159 |

|

Less: Projected Revenues

|

0 | -1 | -2 | -3 | -3 | -10 |

|

Less: Funds Sourced From

Existing Departmental Resources / Sourced from the International

Assistance Envelope Strategic Priorities Fund

|

-46 | -46 | -46 | 0 | 0 | -138 |

| Backing for Businesses Exploring New Markets* | 0 | 26 | 46 | 48 | 48 | 167 |

|

Less: Funds Previously

Provisioned in the Fiscal Framework

|

0 | -5 | -4 | -4 | -4 | -17 |

| Increasing Food Exports* | 0 | 22 | 23 | 24 | 24 | 94 |

| Additional Investments – Shifting from Reliance to Resilience | 0 | 5 | 5 | 1 | 1 | 12 |

| Migrating the Canada Tariff Finder Software* | 0 | 0 | 0 | 1 | 1 | 1 |

| Funding proposed for GAC to maintain the Canada Tariff Finder on a new server. The tariff finder provides important information on tariff rates in world markets to Canadian companies. | ||||||

| Trade Controls to Defend Canadian Steel | 0 | 4 | 4 | 0 | 0 | 9 |

| Funding proposed for GAC to support the effective implementation of trade controls to defend the steel industry from trade diversion and global excess capacity. | ||||||

| Enhancing Economic Expertise on Exporting Sectors | 0 | 1 | 1 | 1 | 1 | 2 |

| Funding proposed for GAC to augment economic analysis and policy expertise on exporting sectors. | ||||||

| Amendments to AgriStability | 0 | 8 | 8 | 8 | 8 | 33 |

Less: Funds Sourced From Existing Departmental

Resources |

0 | -8 | -8 | -8 | -8 | -33 |

| Amendments to the federal-provincial-territorial cost-shared AgriStability program to make pasture-related feed costs eligible under the program. | ||||||

| Chapter 2 - Net Fiscal Impact | 3,074 | 4,720 | 3,717 | 2,895 | 2,129 | 16,534 |

| Of which, capital investment: | -541 | 1,442 | 2,639 | 2,548 | 1,951 | 8,040 |

|

1 Several measures in Section 2.1. were announced between March 7 and September 5, 2025. 2 Becoming Our Own Best Customer was announced on September 5, 2025. *Measure includes funding classified as a capital investment. Note: Numbers may not add due to rounding. A glossary of abbreviations used in this table can be found at the end of Annex 1. |

||||||

Page details

- Date modified: