Archived - Chapter 2:

Lifting Up Every Generation

On this page:

Impacts report

Find out more about the expected gender and diversity impacts for each measure in Chapter 2: Lifting Up Every Generation.

As Canadians, we take care of each other. It's a promise at the heart of who we are, and it goes back generations.

From universal public health care to Employment Insurance to strong, stable, funded pensions, like the Canada Pension Plan (CPP), there has always been an agreement that we will take care of our neighbours when they have the need. It gave our workers stability, and our businesses confidence, that the right supports were in place to keep our economy fair, keep people healthy, ready, and well supported, and keep the middle class strong.

In 2015, the government recognized that the economy had changed. People needed more supports, and of a new kind. The government got to work. The Canada Child Benefit was introduced, which has helped cut the child poverty rate by more than half. The security and dignity of retirement income was reinforced, by strengthening the CPP and increasing Old Age Security (OAS) for seniors 75 and over. The government permanently eliminated interest on federal student and apprenticeship loans. And it made generational investments in $10-a-day child care, cutting child care costs by at least half—giving families money back in their pockets and giving children the best start in life.

These have been investments in people, unprecedented in the history of Canada. Consistent, reliable support has provided certainty for families in a deeply uncertain time, making sure they have the support they rely on to get ahead. It has meant regular monthly or quarterly benefits that help people keep up with the cost of living; supports that provide stability, support that was not there nine years ago. The government has enhanced and strengthened our social safety net for every generation.

The hard work of previous generations who built Canada's world-renowned pension funds built the foundation of our progress today. Canada's social safety net needs to be there for every generation. And we are making it work for them.

For young families, especially Millennial parents, who too often face high rent, high child care costs, and worries about their child's future, a stronger social safety net is now here. For every younger Canadian to pursue their dreams, we're making it more affordable to get an education, save for a home, and build a career.

Budget 2024 takes action to ensure Canada's social safety net works for every generation, especially Millennials and Gen Z. Transformative investments will continue levelling the playing field and lifting up every generation.

2.1 Taking Care of Every Generation

At the heart of Canada's social safety is the promise of access to universal public health care. We have made a promise to each other, as Canadians, that if you get ill or injured or are born with complicated health issues, you don't need to go into debt just to get essential care. Here in Canada, no matter where you live or what you earn, you should always be able to get the medical care you need.

To maintain the core pillar of our social safety net, last year, the federal government announced our $200 billion ten year health care plan to clear backlogs, improve primary care, and cut wait times, delivering the health outcomes that Canadians need and deserve.

When people are healthy, our economy is healthy. Since 2015, the government has promised and delivered more. That includes ensuring access to affordable dental care and prescription medications. In December, the new Canadian Dental Care Plan began enrollment, which is expected to support nine million uninsured Canadians by 2025.

In February, the federal government introduced legislation to deliver the first phase of national pharmacare to provide universal coverage for most contraceptives and many diabetes medications, in partnership with provinces and territories. Pharmacare will ensure every woman can choose the birth control that is best for her, and that every woman, no matter how much money she has, can control her own body.

Now, the government's generational transformation of Canada's social safety net is delivering a new Canada Disability Benefit. Soon, we will begin consultations on how we can better support caregivers in their essential roles upholding the health and well-being of Canadians.

Budget 2024 highlights new measures that will strengthen Canada's social safety net to lift up every generation. No matter your age, your income, or your circumstances, every Canadian deserves to feel secure in the knowledge that they will get the care and support they need. Because this is what Canadians do; they take care of each other.

Key Ongoing Actions

-

Providing nearly $200 billion over ten years to strengthen universal public health care for Canadians, including $1.7 billion to support wage increases for personal support workers and related professions, and $5.4 billion for long-term care and home and community care to help people age with dignity close to home.

-

Enhancing the Canada Workers Benefit to help hard-working people with full-time, low-wage jobs support themselves and their families, by providing up to $2,739 to working families and $1,590 to single workers, through four payments spread throughout the year.

-

Rolling out the Canadian Dental Care Plan to provide dental coverage for uninsured Canadians with a family income of less than $90,000. To date, over 1.7 million applications have been approved for eligible seniors, who will be able to visit an oral health provider as early as May of this year.

-

Launching the first phase of the National Strategy for Drugs for Rare Diseases to help increase access to, and affordability of, effective drugs for rare diseases for patients across Canada.

Stronger Universal Public Health Care

A strong and effective public health care system is at the heart of what it means to be Canadian. Canada boasts world-class doctors, nurses, midwives, personal support workers, hospitals, and research institutions, and Canadians deserve access to world-class care. In February 2023, the government committednearly $200 billion over ten years to improve Canada's universal public health care system.

Since then, agreements have been signed with all provinces and territories that will translate into health care improvements for Canadians. In Ontario, over 700 new spots to train doctors, nurses, and other health care workers will be created. In Nova Scotia, improvements in rural and remote communities mean 88 per cent of residents will have regular access to a health care provider within three years. These are just some of the real benefits that Canadians can count on thanks to federal investments in public health care.

The government has been engaging with First Nations, Inuit, and Métis leadership on the $2 billion Indigenous Health Equity Fund since spring 2023 and looks forward to announcing final design and implementation details for the program in 2024-25.

Helping Every Province and Territory Improve Health Care

The Canada Health Act helps ensure that all eligible residents of Canada have reasonable access to insured health services, without financial barriers. No Canadian should have to pay for medically necessary health care services, and the federal government is continuously working to uphold this principle for every Canadian.

As part of the federal government's work to deliver better health outcomes for Canadians, it has now signed agreements with all provinces and territories to begin delivering the $25 billion in new funding available in the ten-year health care plan through bilateral agreements.

British Columbia

$976 million over three years announced on October 10, 2023

- Develop an innovative model of care so nurses can spend more time with patients;

- Increase the percentage of people in the province who have access to their own electronic health information; and,

- Increase the percentage of family health service providers that can securely share patient health information.

Prince Edward Island

$87 million over three years announced on December 19, 2023

- Advance interprovincial and foreign credential recognition in the health workforce, by developing a strategic plan to recruit internationally educated health professionals, and by leveraging technology for streamlined training;

- Increase access to diagnostic services by expanding laboratory services, extending hours of operation, and reducing wait times for patients; and,

- Invest in Mobile Mental Health units and Student Well-being Teams to reach an additional 2,500 patients by 2026.

Alberta

$855 million over three years announced on December 21, 2023

- Increase access to primary care by expanding team-based care and enhancing virtual care;

- Enhance access to digital health services and health information by implementing e-referral services and accelerating the secure exchange of data across the health system; and,

- Reduce wait times for community mental health and substance use services by establishing new treatment spaces and improving existing ones.

Nova Scotia

$308 million over three years announced on January 10, 2024

- Increase access to health care providers by expanding clinic hours in rural and remote communities, and introducing mobile health services and virtual urgent care;

- Increase the number of family physicians, nurse practitioners, and registered nurses to address workforce needs; and,

- Develop digital tools to access health information, book appointments, and access virtual health services.

Ontario

$2.5 billion over three years announced on February 9, 2024

- Expand enrollment in health care education programs by over 700 spots;

- Modernize digital infrastructure, including information reporting, collection, and sharing; and,

- Make health care more convenient, connected, and patient-centred by expanding the availability of electronic health information and increasing the number of health professionals who can securely access and share it.

Northwest Territories

$22 million over three years announced on February 13, 2024

- Increase coordination and access to primary care across the regions by establishing a territorial public health unit;

- Support recruitment, retention, and training initiatives for health workers; and,

- Enhance culturally appropriate mental wellness and suicide prevention programming, including crisis response.

Manitoba

$369 million over three years announced on February 15, 2024

- Hire 400 more doctors, 300 more nurses, 200 paramedics, and 100 home care workers to address staffing shortages;

- Hire more psychologists to help reduce wait times for counselling; and,

- Support new acute care beds to increase system capacity and the number of acute care beds.

Nunavut

$21 million over three years announced on March 5, 2024

- Increase coordination and access to primary care across the regions, including expanding existing paramedic care to all 25 Nunavut communities;

- Help reduce backlogs, for example, by acquiring key medical equipment to reduce reliance on patient travel to Ottawa; and,

- Expand the delivery of culturally appropriate mental health and addiction services and specialized care.

Yukon

$22 million over three years announced on March 12, 2024

- Improve access to family health services, including establishing a new walk-in primary care clinic expected to help at least 1,500 patients annually; and,

- Expand the delivery of mental health and additions services, for example, by creating Yukon's first residential managed alcohol withdrawal program with a capacity of ten beds by 2025-26.

Saskatchewan

$336 million over three years announced on March 18, 2024

- Improve access to family health services and acute and urgent care including by creating new permanent acute care and complex care beds in Regina and Saskatoon hospitals;

- Help reduce backlogs through the recruitment of new health care workers, and by supporting the expansion of 550 post-secondary training seats; and,

- Modernize health care systems with health data and digital tools by continuing investments in eHealth and health sector information technology.

Newfoundland and Labrador

$232 million over three years announced on March 25, 2024

- Increase access to primary care by continuing to add new family care teams, creating urgent care centres to service the Northeast Avalon, and adding new positions to substantially improve how children receive care;

- Increase the number of Newfoundlanders and Labradorians who can access their own health record electronically; and,

- Increase the number of people with access to mental health teams.

New Brunswick

$276 million over three years announced on March 26, 2024

- Increase the quality and availability of primary care providers across the province, including by allowing nurse practitioners to provide non-urgent care as an alternative to emergency department visits;

- Support recruitment, retention, and training for health care workers to reduce backlogs, such as by incentivizing doctors to move to rural and underserved areas, including Francophone communities, and making it easier for health professionals with international credentials to practice; and,

- Expand mental health and substance use supports, including for Indigenous communities, particularly youth, and increasing the number of beds in mental health care facilities.

Quebec

$2 billion over four years announced on March 27, 2024

- Improve access to family health teams by opening new front-line clinics, make it easier to book appointments through the "Votre Santé" portal, and improve care for patients with rare or chronic diseases;

- Reduce surgical and diagnostic backlogs, by supporting the new approach developed for vaccination and screening and extending it to other front-line services;

- Accelerate digitalization across the health care network to make it easier for patients to access their information and faster for doctors to update charts; and,

- Strengthen mental health care, and homelessness and addictions services, including by creating new services and spaces for youth and children with disabilities.

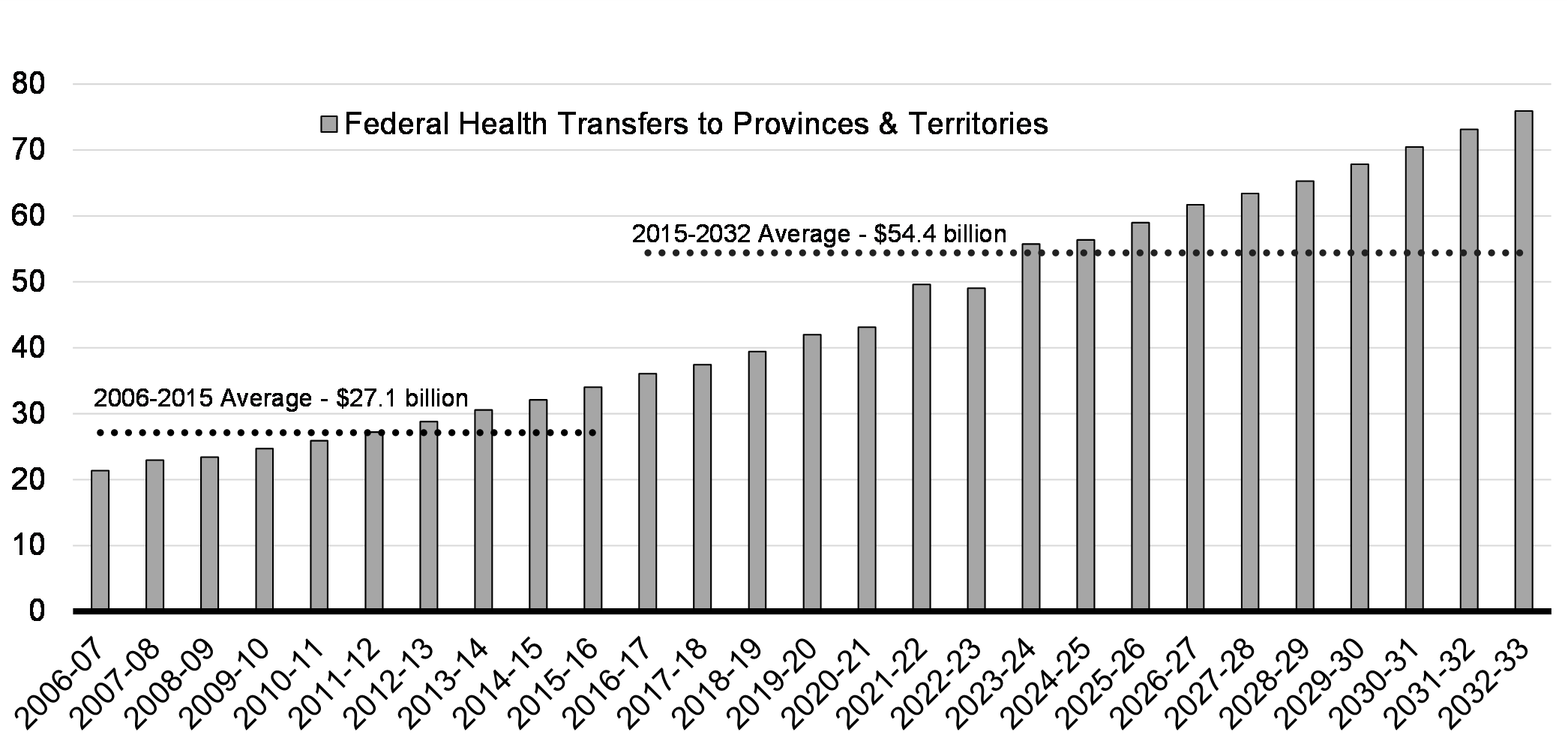

The investment in health care announced in February 2023 will provide nearly $200 billion over ten years to support the health and well-being of Canadians.

- GDP-Driven Growth: an additional $146.6 billion is estimated over the ten years from 2023-24 to 2032-33 through the Canada Health Transfer.

- Canada Health Transfer Top-Up: a $2 billion top-up in June 2023 to address immediate pressures on the health care system, especially in pediatric hospitals, emergency rooms, and operating rooms.

- Canada Health Transfer Five Per Cent Guarantee: an estimated $15.3 billion through increases of at least five per cent from 2023-24 to 2027-28 to the Canada Health Transfer, for provinces and territories that are taking steps to improve collection and management of health data.

- Tailored Bilateral Agreements: $25 billion over ten years that provinces and territories can use to address the unique needs of their populations and geography, on top of an existing $7.8 billion for bilateral agreements in home care, mental health, and long-term care.

- Personal Support Worker Wage Support: $1.7 billion over five years to support hourly wage increases for personal support workers and related professions.

- Territorial Health Investment Fund: $350 million over ten years in recognition of medical travel and the higher cost of delivering health care in the territories.

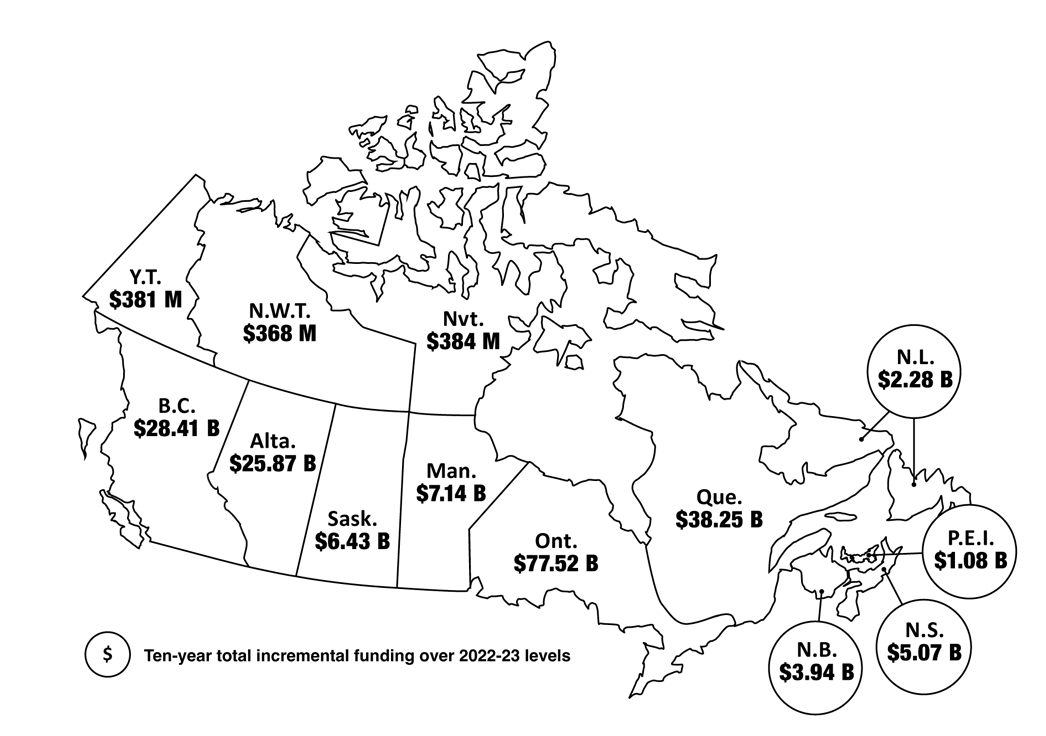

Table 2.1 provides the provincial and territorial allocations over ten years for both new funding and total funding including existing Canada Health Transfer commitments:

Province/Territory |

New Funding | Total Incremental Funding |

|---|---|---|

| Ontario | $15.23 billion | $77.52 billion |

| Quebec | $8.56 billion | $38.25 billion |

| Nova Scotia | $1.45 billion | $5.07 billion |

| New Brunswick | $1.24 billion | $3.94 billion |

| Manitoba | $1.84 billion | $7.14 billion |

| British Columbia | $5.75 billion | $28.41 billion |

| Prince Edward Island | $364 million | $1.08 billion |

| Saskatchewan | $1.64 billion | $6.43 billion |

| Alberta | $5.02 billion | $25.87 billion |

| Newfoundland and Labrador | $961 million | $2.28 billion |

| Northwest Territories | $93 million | $368 million |

| Yukon | $93 million | $381 million |

| Nunavut | $88 million | $384 million |

| Total | $44.05 billion | $198.82 billion |

|

Notes: 1. Funding for personal support workers has yet to be allocated but is included in total. 2. Provincial/territorial allocations are based on internal population projections and Statistics Canada modelling. 3. All Canada Health Transfer amounts starting in 2025-26 are notional, estimated based on December private sector nominal GDP forecast, and are subject to change. 4. Values may not equal total due to rounding. 5. Provinces and territories are ordered by precedence. |

||

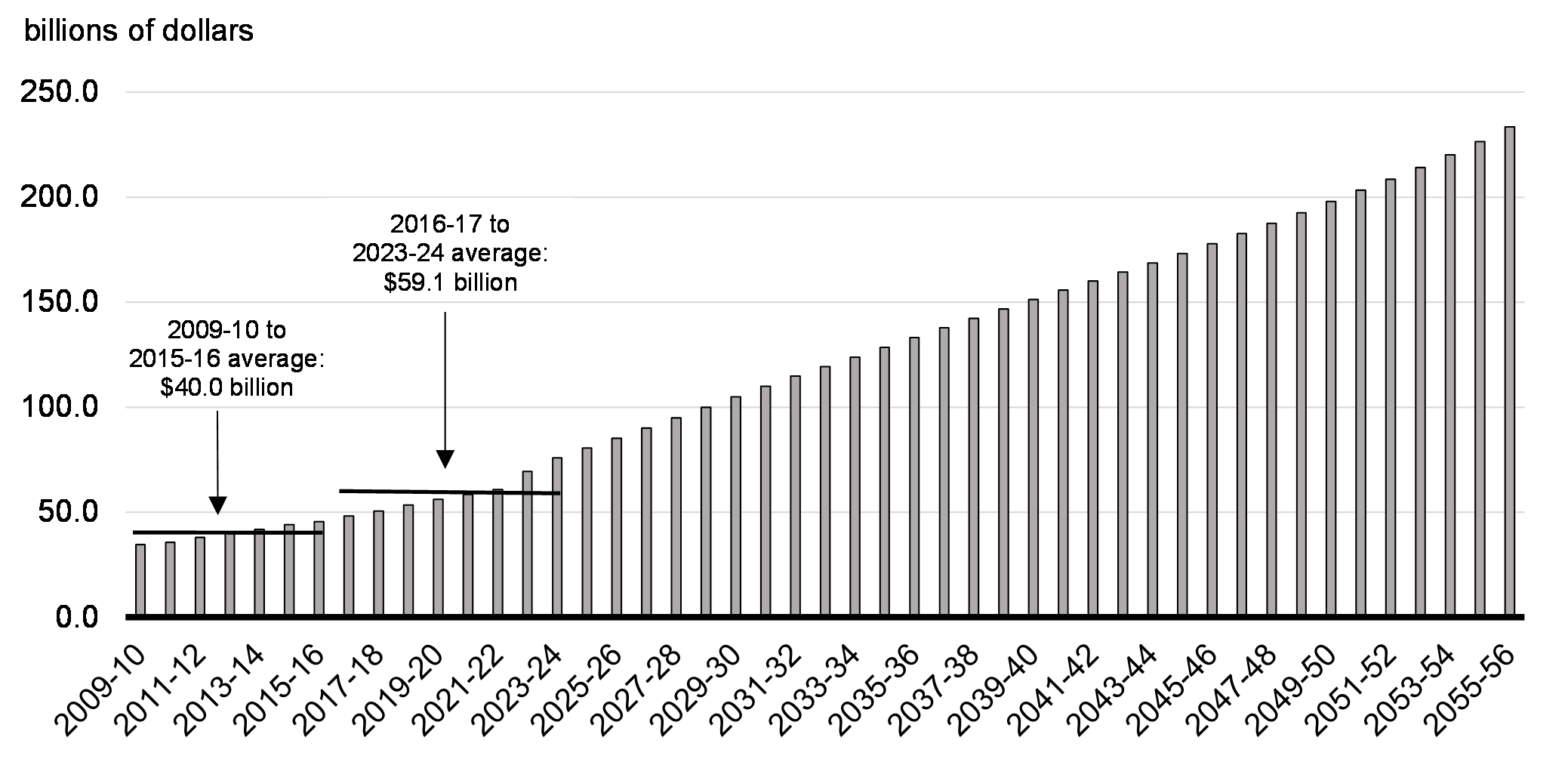

Chart 2.1 shows the increase over time in federal transfers to provinces and territories for health care.

Federal Health Transfers to Provinces and Territories, 2006-07 to 2032-33

Foreign Health Care Credential Recognition

Every day, people move to Canada with the skills our economy needs. But too often, even though they are well-trained and fully capable, their credentials aren't recognized. Until the barriers to recognizing foreign credentials are removed, neither our workers nor our economy can reach their full potential. We want to work with partners to overcome these barriers and help our economy grow.

At a time when Canada is facing labour shortages, in key sectors from health care to construction, we must enable all available workers in Canada to contribute. More health care workers will help reduce long wait times and make it easier to find a family doctor. More construction workers, as detailed in Chapter 1, will help us build more homes, faster to ensure everyone can find an affordable place to call home.

In October 2023, federal, provincial, and territorial health ministers committed to streamline foreign credential recognition so that internationally educated health care professionals can get to work more quickly. On January 15, 2024, the government announced $86 million to support 15 projects through external organizations to increase credential recognition capacity for 6,600 internationally educated health care professionals.

-

Budget 2024 proposes to provide $77.1 million over four years, starting in 2025-26, to more effectively integrate internationally educated health care professionals into Canada's health workforce by creating 120 specific training positions, increasing assessment capacity and providing support to navigate credential recognition systems.

There are an estimated 198,000 internationally educated health professionals employed in Canada, but only 58 per cent—114,000 workers—have employment in their chosen field. Red tape is holding back tens of thousands of doctors, nurses, and other health care professionals. This measure will help address that.

Helping more nurses practice in Canada

Maria worked as a nurse in Quezon City, Philippines, for ten years before she decided to immigrate to Canada to join her cousins in Scarborough.

Unfortunately, because of long and difficult credential recognition processes, Maria had to seek work outside her field of expertise, despite her nursing experience and qualifications.

With federal investments in integrating internationally educated health professionals, along with federal pressure on provinces and territories to make credential recognition faster and easier for newcomers, Maria will enter the Ontario healthcare system as a nurse with less hassle and in faster time, helping to reduce the health care professional shortage in Canada.

Canada's doctors and nurses work hard to ensure that Canadians and their families receive timely access to the health services that they need. Unfortunately, many nurses and physicians who are newcomers to this country cannot work in their chosen field due to difficulties having their credentials recognized.

This is why federal, provincial, and territorial governments have been working hard and have undertaken a variety of initiatives to improve foreign credential recognition and streamline entry into the labour force for internationally educated health professionals. Examples include:

Bilateral Agreements under Working Together to Improve Health Care for Canadians: A key objective under this $25 billion federal investment is to support provincial efforts to streamline foreign credential recognition for internationally educated health professionals. The federal government has now signed bilateral agreements with all provinces and territories. These agreements include plans such as:

-

Ontario plans to reimburse internationally educated nurses for registration fees, develop a centralized information and registration site, and accelerate licensure for international medical graduates.

-

British Columbia's Health Human Resources Coordination Centre's plan to develop incentive programs to remove barriers to credential recognition.

-

Prince Edward Island has committed to developing an Internationally Educated Health Professionals Strategic Plan to remove impediments to credential recognition and streamline hiring processes for internationally educated health workers.

Residency positions and Practice Ready Assessment (PRA) programs: PRA programs offer a route to licensure for internationally educated physicians. In recent years, several provinces have expanded or committed to expand their PRA programs. For example:

-

BC is tripling its seats for Practice Ready Assessment (PRA) program by March 2024.

-

In April 2022, Saskatchewan announced $1.1 million to expand its capacity assess international medical graduates so that they can practice independently in the province.

-

Alberta's Mount Royal University is creating 256 new seats for the Bridge to Canadian Nursing program to support internationally educated nurses as they transition into the Canadian healthcare system.

Recruitment Initiatives: Several provinces have signed memoranda of understanding with other countries designed to reduce barriers and recruit internationally educated health care professionals. For example:

-

Alberta, Saskatchewan and Manitoba have memoranda of understanding with the Philippines to recruit foreign nurses.

-

Quebec has mutual recognition agreements with Switzerland and France.

-

Provinces and territories also have expedited licensure pathways for internationally educated health care professionals from countries such as the United States, Australia, Ireland, and New Zealand for graduate dental programs.

Financial Support: Provinces and territories have expanded grant and bursary programs to offset the cost of training, assessment, licensing and registrations for internationally educated health care professionals:

-

In 2023, New Brunswick announced a new initiative to reduce financial barriers for up to 300 internationally educated nurses per year.

-

In July 2021, Manitoba announced plans to provide financial and process support for internationally educated nurses (IENs) looking to become licensed in Manitoba.

-

From August 18, 2022 to March 31, 2024, Ontario provided temporary reimbursement of registration fees program for inactive or international educated nurses.

Regulatory and legislative reform: Provinces are adjusting eligibility requirements to help integrate internationally educated health care professionals into the healthcare system. For example:

-

In April 2022, Saskatchewan introduced the Labour Mobility and Fair Registration Act to reduce barriers and ensure that skilled workers can have their credentials recognized.

-

Alberta's Fair Restrictions Practices Act ensures that qualified individuals entering regulated professions and designated occupations or trades do not face unfair processes or barriers.

-

New Brunswick's Fair Registration Practices in Regulated Professions Act helps ensure that processes for international accreditation are transparent, objective, and fair.

Navigator programs: Information and access to resources are a critical part of credential recognition. Provinces and territories have taken steps to improve guidance for internationally educated health care professionals through initiatives like:

-

In 2022, New Brunswick expanded its International Educated Professionals navigational support program to include all regulated health professions.

-

Ontario's Access Centre provides programs and support to internationally educated health care professionals to help them integrate into the Ontario healthcare system.

-

In 2022, BC piloted a new international educated nurse navigator to make it easier for eligible internationally educated nurses to enter the province's health system.

Other Provincial and Territorial Investments: Provinces and territories are also investing more broadly in foreign credential recognition, including examples such as:

-

In December 2023, Quebec announced $130 million to develop an immigrant credential recognition plan.

-

Ontario's Budget 2022 committed $230 million, including funding to support up to 1,000 internationally educated nurses become accredited nurses in Ontario.

-

In November 2022, Manitoba announced $200 million for its Health Human Resource Action Plan, which includes funding to train and recruit internationally educated nurses.

-

In September 2022, Saskatchewan committed $60 million to create a Health Human Resources Action Plan, that includes funding to train and recruit internationally educated health care professionals.

-

In September 2022, BC announced its multi-year BC Health Workforce Strategy, including support for foreign credential recognition.

Launching a National Pharmacare Plan

In a landmark move towards building a comprehensive national pharmacare program, the federal government has introduced legislation to help make essential medications more accessible and affordable for Canadians.

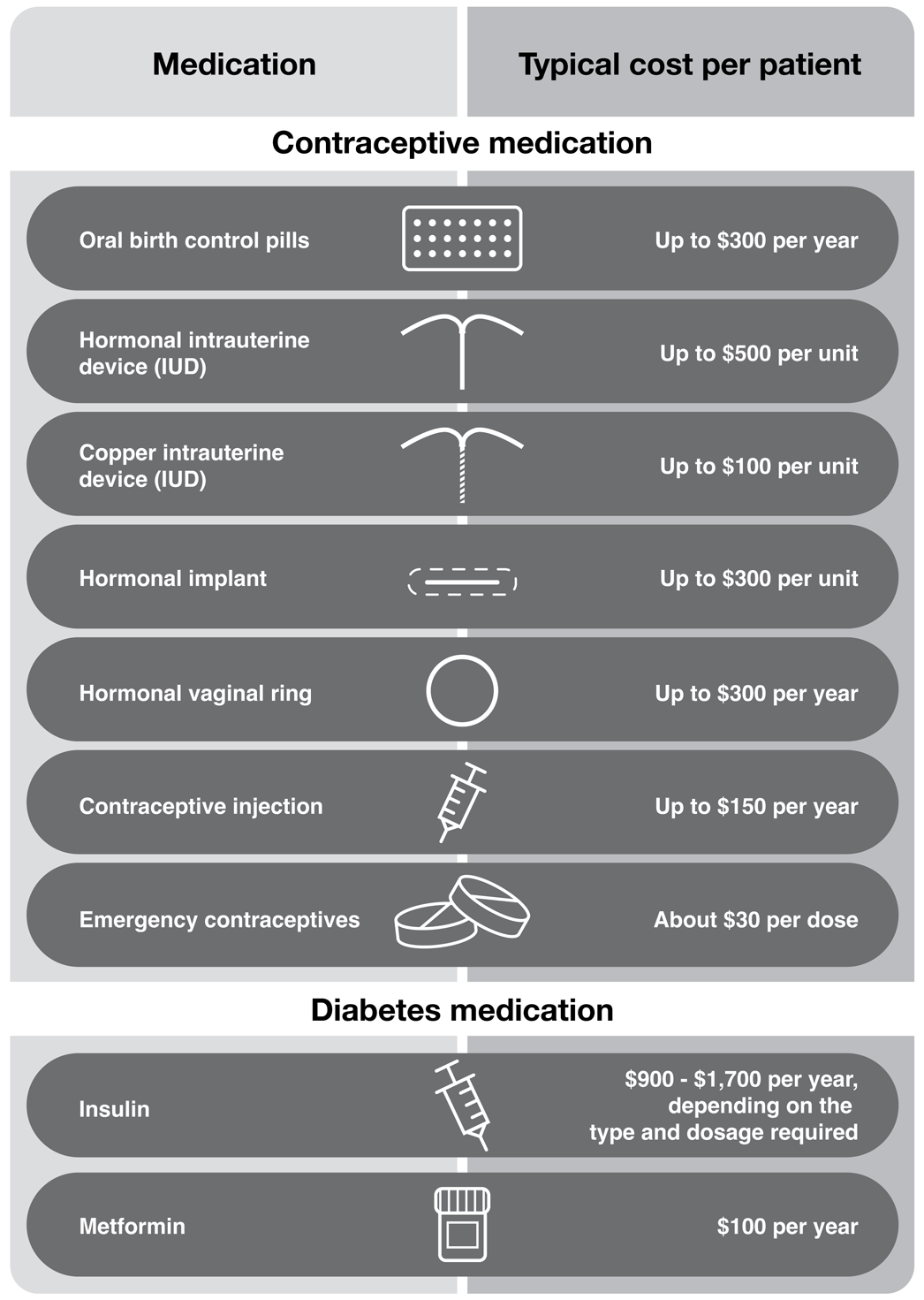

Bill C-64, thePharmacare Act, proposes the foundational principles for the first phase of national universal pharmacare in Canada and describes the federal government's intent to work with provinces and territories to provide universal, single-payer coverage for a number of contraception and diabetes medications.

This first phase will ensure the effective roll-out of pharmacare, while providing immediate support for health care needs of women, as well as people with diabetes. Every woman has the right to choose the family planning options that work best for her—and national pharmacare ensures cost is not a barrier restricting that right.

-

Coverage of contraceptives will mean that nine million women in Canada will have better access to contraception and reproductive autonomy, reducing the risk of unintended pregnancies and improving their ability to plan for the future.

Cost has consistently been identified as the single most important barrier to access these medications and the cost is unevenly borne by women. In addition to family planning, many Canadians rely on prescription contraceptives to mitigate a variety of reproductive health concerns and conditions.

-

Diabetes is a complex disease that has no cure. Treatment requires a lifetime of careful, continuous management, using safe and effective, yet costly, medication.

One in four Canadians with diabetes have reported not following their treatment plan due to cost. Improving access to diabetes medications will help improve the health of 3.7 million Canadians with diabetes and will reduce the risk of serious life-changing health complications such as blindness, heart disease, or amputations.

People with diabetes will have access to first-line treatments that lower blood glucose levels, including insulin and metformin, as well as medications that are often used in combination by patients with type 2 diabetes.

Beyond support for diabetes medication, the federal government announced its plan to establish a fund to support access to diabetes devices and supplies. Further details regarding this fund will be announced following discussions with provincial and territorial partners, who will be essential to its roll-out.

Free Contraception and Free Insulin to Save Canadians Money

The federal government will work towards implementing coverage of these essential medications through existing provincial and territorial pharmacare programs, following negotiations. New federal funding will expand and enhance, rather than replace, existing provincial and territorial spending on public drug benefit programs. This approach ensures that the unique needs and existing coverage plans of each province and territory are considered, advancing collaborative federalism where the federal, provincial, and territorial governments work together towards a common goal.

The Pharmacare Act is a concrete step towards the vision of a national pharmacare program that is comprehensive, inclusive, and fiscally sustainable—today and for the next generation.

-

Budget 2024 proposes to provide $1.5 billion over five years, starting in 2024-25, to Health Canada to support the launch of the National Pharmacare Plan.

Saving Women With Diabetes up to $3,680 per Year

Jenny is a part-time, uninsured worker with type 1 diabetes. Managing her diabetes costs her over $100 every month, leaving her unable to afford the $500 up-front cost of her preferred method of contraception, a hormonal IUD. With the introduction of universal pharmacare, Jenny will save up to $1,700 per year in insulin expenses and will be able to access a hormonal IUD for free, without any out-of-pocket costs, once implemented in her province. In addition, having type 1 diabetes qualifies Jenny for the Disability Tax Credit, which provides her with an additional $1,480 per year.

To make essential menstrual products more accessible, the government is committed to continuing the work of the Menstrual Equity Fund pilot project, which helps food banks and other community organizations ensure women have the menstrual products they need. The government will announce further details in the 2024 Fall Economic Statement.

The Canadian Dental Care Plan

Regular visits to the dentist reduce the risk of tooth decay, gum disease, and other serious health problems that disproportionately affect seniors, such as cardiovascular disease and stroke. Pain and disability associated with poor oral health can affect eating habits, speech, and appearance, which impacts both physical and mental health.

Since the Canadian Dental Care Plan was announced in Budget 2023, historic progress has been made to ensure everyone in Canada has access to the dental care they need. Children are already receiving care thanks to the interim Canada Dental Benefit and seniors have begun enrolling in the Canadian Dental Care Plan. By 2025, up to nine million uninsured Canadians will have dental coverage.

More than 1.7 million Canadians have already been approved for the Canadian Dental Care Plan since mid-December, when seniors over age 87 first became eligible to sign up. As early as May 2024, eligible seniors will be able to visit an oral health professional for the care they need. By May, all seniors aged 65 and older will be able to apply, followed by persons with disabilities with a valid Disability Tax Credit certificate and children under the age of 18. All uninsured Canadians between the ages of 18 and 64, with a family income up to $90,000, will be able to apply online, and visit a dentist, in 2025.

The interim Canada Dental Benefit, which launched in December 2022 and has already supported more than 406,000 children, will ensure seamless dental coverage for children under age 12 until June 30, 2024, after which they can enroll in the Canadian Dental Care Plan.

| Group | Applications Open |

|---|---|

|

Seniors aged 87 and above |

Starting December 2023 |

|

Seniors aged 77 to 86 |

Starting January 2024 |

|

Seniors aged 72 to 76 |

Starting February 2024 |

|

Seniors aged 70 to 71 |

Starting March 2024 |

|

Seniors aged 65 to 69 |

Starting May 2024 |

|

Persons with a valid Disability Tax Credit certificate |

Starting June 2024 |

|

Children under 18 years old |

Starting June 2024 |

|

All remaining eligible Canadian residents |

Starting 2025 |

Saving a Family of Four $1,809 per Year

Chris and Kate live in British Columbia and earn a combined income of $68,000 and don't have dental insurance through their jobs. They often skip going to the dentist to save money, so they can pay for their two kids to get the care they need.

Since the interim Canada Dental Benefit launched in 2022, they've received $2,600 from the government to help cover dental costs for their kids, Jessica, 11, and Sacha, 5. Starting this June, Chris and Kate will be able to enroll their kids in the Canadian Dental Care Plan, saving about $433 in dental costs every year.

In 2025, when the Canadian Dental Care Plan expands to all Canadians with a family income of up to $90,000, Chris and Kate will be able to enroll themselves, helping their family save a total of around $1,809 every year.

Saving a Senior Couple $2,604

Jack, 89, and Evelyn, 87, live in Ontario and have a combined household income of $65,000. While Evelyn is fortunate enough to have all healthy teeth, after many years without affordable access to dental care, Jack is missing all his teeth. Thanks to the Canadian Dental Care Plan, this year, Jack and Evelyn will save a total of $2,604, including the price of a complete new set of dentures for Jack.

Canada's Support for Persons with Disabilities

Persons with disabilities face significant barriers to financial security, making it hard to cover the costs of today, or save for the expenses of tomorrow. This challenge is compounded by both the added cost of assistive devices and services and difficulties in finding accessible, good-paying jobs, leaving many persons with disabilities below the poverty line. An economy that's fair for everyone makes sure that there is support for those who need it.

The federal government's Disability Inclusion Action Plan aims to improve the quality of life for Canadians with disabilities. This plan already includes:

-

About $1.7 billion per year to support persons with severe and prolonged mental and physical impairments through the Disability Tax Credit;

-

Up to an additional $821 every year to workers with disabilities through the Canada Workers Benefit Disability Supplement, beyond the basic Canada Workers Benefit amounts of up to $1,590 for a worker and up to $2,739 for a family;

-

Ongoing support for the Registered Disability Savings Plan, which has helped 260,000 persons with disabilities save a total of $8.8 billion since 2008, to provide greater income security;

-

Over $800 million per year through Canada Disability Savings Grants and Bonds;

-

$722 million through the Workforce Development Agreements in 2024-25, approximately 30 per cent of which supports persons with disabilities with training, skills development, and work experience;

-

Over $650 million annually through more generous Canada Student Grants and Loans. Students with disabilities also have access to more generous repayment assistance, as well as loan forgiveness for those with severe permanent disabilities.

-

$105 million in 2024-25 to support the implementation of an employment strategy for persons with disabilities through the Opportunities Fund; and,

-

About $500 million per year through the Child Disability Benefit provided as a supplement to the Canada Child Benefit for parents of children with severe and prolonged disabilities, providing an average of approximately $3,000 in annual support.

We need to do more. That's why we are launching the Canada Disability Benefit—a key pillar in our plan that will provide direct support to those who need it most.

Launching the Canada Disability Benefit

The government's landmark legislation, the Canada Disability Benefit Act, created the legal framework for a direct benefit for low-income working age persons with disabilities. This benefit fills a gap in the federal government social safety net between the Canada Child Benefit and the Old Age Security for persons with disabilities and is intended to supplement, not replace, existing provincial and territorial income support measures. The federal government is making this new benefit a reality.

-

Budget 2024 proposes funding of $6.1 billion over six years, beginning in 2024-25, and $1.4 billion per year ongoing, for a new Canada Disability Benefit, including costs to deliver the benefit.

-

Budget 2024 further announces the government would begin providing payments to eligible Canadians starting in July 2025, following successful completion of the regulatory process and consultations with persons with disabilities.

-

To ensure access to the Canada Disability Benefit for eligible Canadians, and to address an anticipated significant financial barrier associated with benefit take-up, Budget 2024 further proposes funding of $243 million over six years, beginning in 2024-25, and $41 million per year ongoing, to cover the cost of the medical forms required to apply for the Disability Tax Credit.

In the spirit of "Nothing Without Us", through the regulatory process, the government will provide meaningful and barrier-free opportunities to collaborate and ensure the benefit is reflective of the needs of those receiving it. Persons with disabilities will be consulted on key elements of the benefit's design, including maximum income thresholds and phase-out rates. The benefit design will need to fit the investment proposed in Budget 2024.

The government intends for the Canada Disability Benefit Act to come into force in June 2024 in order for payments to begin in July 2025. The proposed design is based on a maximum benefit amount of $2,400 per year for low-income persons with disabilities between the ages of 18 and 64. To deliver the benefit as quickly as possible and to ensure nation-wide consistency of eligibility, the proposed Canada Disability Benefit would be available to people with a valid Disability Tax Credit certificate. As proposed, this benefit is estimated to increase the financial well-being of over 600,000 low-income persons with disabilities.

The government will continue working with persons with disabilities as well as health care and tax professionals to find ways to increase take-up, and lower the administrative burden, of obtaining a Disability Tax Credit certificate.

To avoid persons with disabilities facing claw backs, on their provincial and territorial supports, the federal government is calling on provinces and territories to exempt Canada Disability Benefit payments from counting as income in relation to provincial or territorial supports. The federal government is making this investment due to the inadequacy of disability assistance provided by many provinces, which currently leaves far too many persons with disabilities in poverty.

The Canada Disability Benefit establishes an important support for persons with disabilities and will ensure a more fair chance for future generations of persons with disabilities. We know that every dollar matters to those living with a disability. That is why the government aspires to see the combined amount of federal and provincial or territorial income supports for persons with disabilities grow to the level of Old Age Security (OAS) and the Guaranteed Income Supplement (GIS), to fundamentally address the rates of poverty experienced by persons with disabilities.

$5,200 in Federal Benefits for a Full-Time Student with a Disability

Nathan is a 22-year-old full-time student who uses a wheelchair. Because he is keen to complete his studies and join the workforce, Nathan is taking a full course load year-round and unable to work. With a valid Disability Tax Credit certificate, Nathan would also receive the maximum Canada Disability Benefit Amount of $2,400 per year.

Combined with his Canada Student Grant for Students with Disabilities of $2,800, Nathan would receive a total of $5,200 in federal disability support per year to help him complete his studies. He may also be eligible to receive up to $20,000 per year via the Canada Student Grant for Services and Equipment for Students with Disabilities, to help him pay for the cost of equipment and services he may need for his studies.

Expanding the Disability Supports Deduction

To help persons with disabilities have a fair chance at success, the federal government helps cover the cost of certain services (such as attendant care, tutoring, and note taking), and the cost of accessibility tools and devices (such as braille note-taker devices and electronic speech synthesizers). The government is committed to ensuring persons with disabilities have the tools they need to pursue an education, advance their careers, become entrepreneurs, or achieve whatever their aspirations may be.

-

Budget 2024 announces the government's intention to amend the Income Tax Act to make additional expenses eligible for the Disability Supports Deduction, subject to certain conditions, such as:

- service animals trained to perform specific tasks for people with certain severe impairments;

- alternative computer input devices, such as assistive keyboards, braille display, digital pens, and speech recognition devices; and,

- ergonomic work chairs and bed positioning devices, including related assessments.

It is estimated that this proposal would cost $5 million over five years, starting in 2024-25, and $1 million per year, ongoing.

To continually improve the Disability Supports Deduction to meet the needs of Canadians, the government will consult persons with disabilities and stakeholders on the list of eligible expenses every four years, beginning in 2028.

Supporting the Care Economy

The pandemic shone a light on the importance of paid and unpaid care work in our economy and for the well-being of every generation. The care economy provides crucial care to aging parents and grandparents, children, and many adults who live with disabilities or long-term conditions.

The federal government has made historic investments to strengthen the social infrastructure that is the care economy, including in early learning and child care and long-term care. It also took action to help make sure personal support workers get fair pay for their important work, and improved tax support for caregivers by providing the Canada Caregiver Credit.

Building on these investments, the federal government is announcing new measures to further address the challenges faced by this sector.

-

Budget 2024 proposes a Sectoral Table on the Care Economy that will consult and provide recommendations to the federal government on concrete actions to better support the care economy, including with regard to early learning and child care.

-

Budget 2024 announces the government's intention to launch consultations on the development of a National Caregiving Strategy.

Ensuring Access to Essential Drugs and Medical Devices

Shortages of health products are becoming increasingly frequent and severe due to recurring global supply chain disruptions. Recent examples were the shortages of children's pain medications and baby formula, which left many parents worried about their children's well-being.

These shortages are detrimental to patient health outcomes and impede the ability of our health care systems to provide treatment. Access to essential drugs and medical devices is critical to preventing drug rationing by clinicians or patients, delayed or cancelled treatments, or the use of less effective substitutions.

-

To mitigate the effects of health product shortages and expedite emergency responses when supply chains fail, Budget 2024 proposes to provide $3.2 million over three years, starting in 2024-25, to upgrade Health Canada's supply management capacity for drugs and medical devices.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 2.1 Taking Care of Every Generation.

2.2 The Best Start for Every Child

Children are the future of Canada. They will become tomorrow's doctors, nurses, electricians, teachers, scientists, and small business owners. Every child deserves the best start in life. Their success is Canada's success.

As part of the government's generational investments in the care economy, we have worked with all provinces and territories to build a Canada-wide early learning and child care system that is saving young families, many led by Millennials, thousands of dollars every year. Affordable child care is unlocking new opportunities for parents—particularly mothers—to fully participate in the workforce and build a fulfilling and profitable career. It levels the playing field for parents and families.

This builds on efforts since 2015 that are providing real support to families, including the Canada Child Benefit, which is providing nearly $8,000, per child, to families this year.

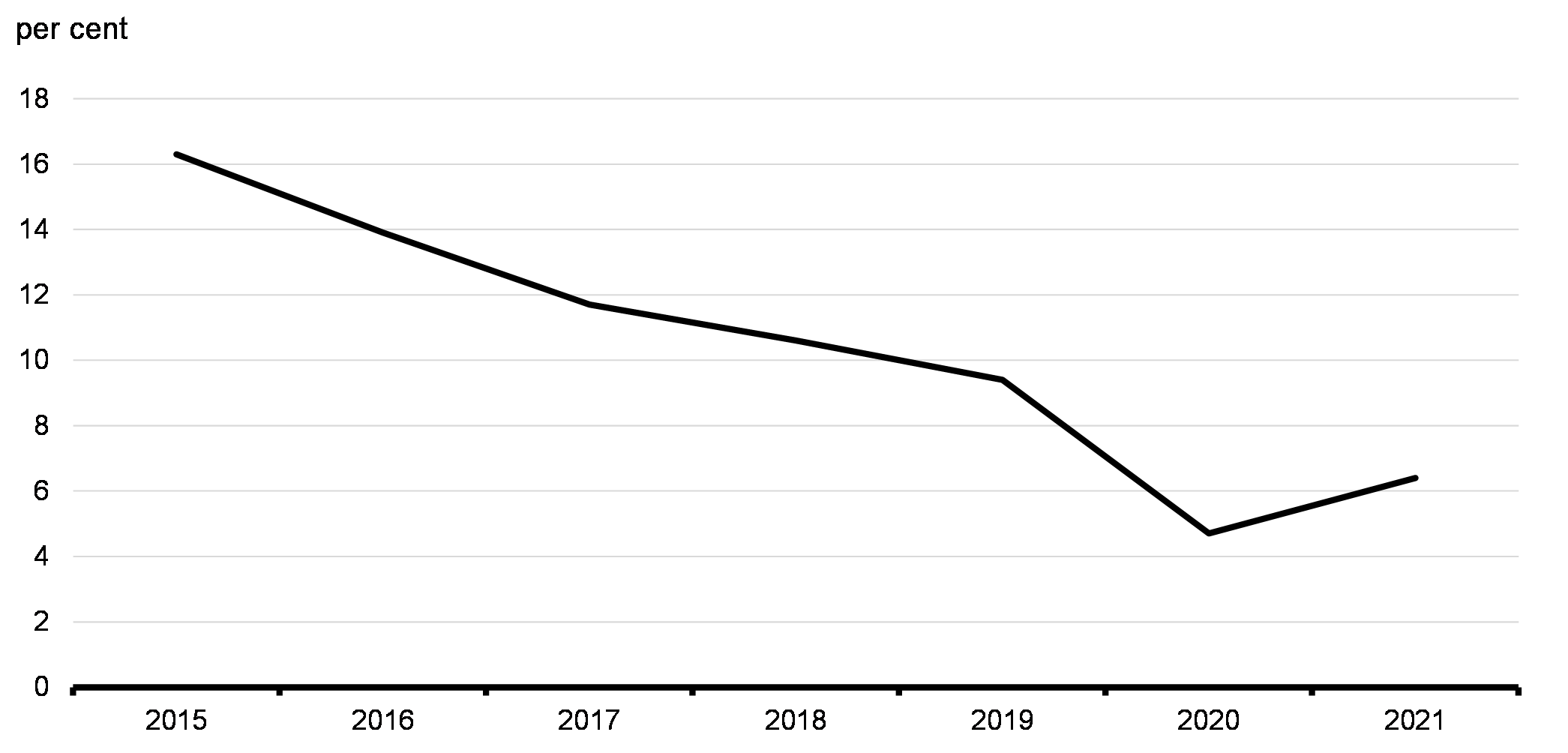

Since the Canada Child Benefit was introduced in 2016, child poverty in Canada has dropped from 16.3 per cent in 2015 to 6.4 per cent in 2021. That's 650,000 children lifted out of poverty in just six years (Chart 2.2).

Reducing Child Poverty from 16.3 per cent to 6.4 per cent, 2015-2021

In Budget 2024, the government is advancing this progress through investments to strengthen and grow our Canada-wide early learning and child care system, save for an education later in life, and have good health care, and unlock the promise of Canada for the next generation.

Key Ongoing Actions

-

Providing over $25 billion in support to about 3.5 million families with children annually through the tax-free Canada Child Benefit, with eligible families receiving up to $7,787 per child in 2024-25.

-

Building a Canada-wide system of early learning and child care, which is delivering $10-a-day child care in eight provinces and territories, with all other provinces already cutting fees by 50 per cent and remaining on track to deliver $10-a-day child care by March 2026, significantly ahead of schedule.

-

Launching the Canada Dental Benefit to provide eligible parents or guardians with direct, up-front, tax-free payments of up to $1,300 over two years to cover the cost of dental care for their children under 12 years old.

A National School Food Program

Every child in Canada deserves to have the best start in life. But higher grocery prices are making it more difficult for moms and dads to afford the food their kids need.

Nearly one in four children do not get enough food, and that has a real impact on their opportunities to learn and grow. According to the Toronto District School Board, students who regularly ate breakfast were 17 percentage points more likely to be on track to graduate compared to students who did not have access to breakfast.

The federal government is taking decisive action to launch a new National School Food Program to help ensure that children have the food they need to get a fair start in life, regardless of their family's circumstance.

-

Budget 2024 announces the creation of a National School Food Program, which will provide $1 billion over five years to Employment and Social Development Canada, Crown-Indigenous Relations and Northern Affairs Canada, and Indigenous Services Canada, starting in 2024‑25, to work with provinces, territories, and Indigenous partners to expand access to school food programs. This includes investments for First Nations, Inuit, and Métis communities as well as Self-Governing and Modern Treaty Partners, many of whom have some of the highest rates of food insecurity in Canada.

The National School Food Program is expected to provide meals for more than 400,000 kids each year. And for families who manage to put enough food on the table but struggle to pay for it, this program is expected to save the average participating family with two children as much as $800 per year in grocery costs, with lower-income families benefitting the most.

The federal government will work with provincial, territorial, and Indigenous governments to deliver the National School Food Program, with support beginning as early as the 2024‑25 school year.

More Affordable Child Care

For young families, many with Millennial parents, the costs of child care can add up to a second rent or mortgage payment. This makes it harder to start and grow a family, and means parents—especially moms—are often not able to pursue their careers because of high costs and low access to child care. For too many, the cost of child care is greater than the income from returning to work. No matter how hard parents work, it feels nearly impossible to get ahead.

That's why the government launched a Canada-wide affordable child care system in 2021. This program is saving Canadian families thousands of dollars every year. Already, eight provinces and territories have reached $10-a-day, and the rest have cut fees by 50 per cent. All provinces and territories are on track to offer $10-a-day child care.

Affordable child care helps more moms return to the workforce, helping our economy to reach its full potential. These supply-side investments are working.

In September 2023, the labour force participation rate of prime working aged women reached a record high of 85.7 per cent. That means more families are bringing home more income. And, more people working means more economic growth. This is good social policy and good economic policy, and it is good feminist policy.

But there still aren't enough child care spaces. We need to build more spaces to give every child the best start in life, help every family save thousands of dollars on child care, and ensure the next generation of parents don't have to choose between having a family or a career. That is why the federal government is helping build more child care spaces.

-

To launch a $1 billion Child Care Expansion Loan Program, Budget 2024 proposes to provide $179.4 million over five years, starting in 2024-25, with $5.7 million in future years, to the Canada Mortgage and Housing Corporation.

-

The Child Care Expansion Loan Program will offer $1 billion in low-cost loans and $60 million in non-repayable contributions to public and not-for-profit child care providers to build more child care spaces and renovate their existing child care centres.

- The Canada Mortgage and Housing Corporation's expertise in financing capital projects will result in a fast roll-out of the program, and enable synergies between child care infrastructure and housing development.

-

Budget 2024 also proposes to reallocate up to $41.5 million over four years, starting in 2025-26, and up to $15 million ongoing from within Employment and Social Development Canada to establish a new capacity building program to help providers apply for funding through the Child Care Expansion Loan Program, and to support Early Learning and Child Care research initiatives.

Budget 2024 also proposes investments to improve child care services for Canadian Armed Forces personnel and their families. See Chapter 7 for additional details.

These investments are not just about ensuring we have the spaces needed. They are also about ensuring that these spaces meet the diverse needs of Canadian families. The new child care spaces created through the Child Care Expansion Loan Program will increase access to affordable child care across Canada, saving more families thousands, per child, every year.

Helping Early Childhood Educators

Early childhood educators are critical to the success of the early learning and child care system. They help our children learn and grow. That's why the federal government has made fair wages for these educators a cornerstone of its plan; and why it is pushing provinces and territories to raise their wages.

Every community needs more educators, and the government is working to put the right incentives in place to make sure that happens. To increase access to early learning and child care in rural and remote communities, and increase training for early childhood educators nation-wide:

-

Budget 2024 announces the government's intent to introduce legislative amendments to the Canada Student Financial Assistance Act and the Canada Student Loans Act to expand the reach of the Canada Student Loan Forgiveness Program to early childhood educators who work in rural and remote communities. The cost of this measures is estimated to be $48 million over four years, starting in 2025-26, and $15.8 million ongoing.

- Student loan forgiveness will increase the longer an early childhood educator stays in the profession in a rural or remote area. This builds on enhanced student loan forgiveness provided to attract more doctors and nurses to rural and remote communities.

- On an ongoing basis, this is expected to benefit over 3,000 early childhood educators per year who work in rural and remote communities.

-

Budget 2024 proposes to provide $10 million over two years, starting in 2024-25, to Employment and Social Development Canada's Sectoral Workforce Solutions Program to increase training for early childhood educators.

The federal government is calling on provinces and territories to do the same, and to ensure that the early childhood educators who instruct and care for our country's youngest are fairly compensated for the important work they do. This should include the creation of robust pension regimes. For a clear example of leadership, Nova Scotia recently announced a defined benefit level pension benefits for early childhood educators. Prince Edward Island also announced in the last year its defined contribution pension regime.

The federal government is pushing provinces and territories to take the bold action needed to support early childhood educators by developing workforce strategies that best support the recruitment, retention, and recognition of these essential workers. In addition, the government is extending student loan forgiveness to workers across health care and social services who work in rural and remote communities, as detailed later in this chapter.

Since its launch in Budget 2021, the federal government's Canada-wide system of affordable early learning and child care has delivered real results for middle class families and hit key milestones:

-

As of April 1, 2024, eight provinces and territories are providing regulated child care for an average of $10-a-day or less, significantly ahead of schedule, and all other provinces have already reduced fees by 50 per cent.

-

In Quebec, which has been a leader in affordable child care since 1997, federal investments are creating more than 30,000 new spaces.

-

Alongside provinces and territories, we have announced over 100,000 new spaces, well on our way to reaching our goal of creating 250,000 new spaces by March 2026.

-

Indigenous Early Learning and Child Care is already reaching 35,000 children in 463 child care sites in First Nations and Inuit communities, 341 Aboriginal Head Start on Reserve programs, and 134 Aboriginal Head Start in Urban and Northern Communities programs.

-

This progress has been made possible by the federal government's generational investments: In Budgets 2016 and 2017, the federal government invested $7.5 billion over 11 years, starting in 2017–18, to begin work on establishing an early learning and child care system to support and create more high-quality, affordable child care spaces across the country, including for Indigenous children living on and off reserve. This funding was made permanent through the 2020 Fall Economic Statement.

-

In Budget 2021, the federal government made an historic and transformative investment in early learning and child care and in Indigenous early learning and child care of $30 billion over five years, and $8.3 billion ongoing.

-

In Budget 2022, the federal government provided an additional $625 million over four years to Employment and Social Development Canada for provinces and territories for an Early Learning and Child Care Infrastructure Fund.

In total, since 2021, the federal government has committed more than $34.2 billion over five years starting in 2021-22, and $9.2 billion ongoing for affordable child care. Now it's time for provinces and territories to deliver on their end of the deal.

|

Province / Territory |

Progress Towards |

Estimated Federal Funding, 2021-22 to 2025-261 |

Number of New Spaces to be Created by March 31, 20262 |

Estimated Annual Savings per Child in 2024 (Gross)3 |

|---|---|---|---|---|

|

ON |

50 per cent on average reduction as of December 2022 |

$10.23 billion |

76,700 (86,000 by December 2026) |

up to $8,500 |

|

QC4 |

$9.10 per day as of January 1, 20245 |

$5.96 billion |

30,000 |

Close to 20,500 additional subsidized spaces already created since the launch of the "Grand chantier pour les familles" in October 2021. |

|

NS |

50 per cent on average reduction as of December 2022 |

$605 million |

9,500 |

up to $6,000 |

|

NB |

50 per cent on average reduction as of June 2022 |

$492 million |

3,400 |

up to $3,600 |

|

MB |

$10-a-day effective April 2, 2023 |

$1.20 billion |

23,000 |

up to $2,610 |

|

BC |

50 per cent on average reduction as of December 2022 |

$3.21 billion |

30,000 (40,000 by March 31, 2028) |

up to $6,600 |

|

PEI |

$10-a-day as of January 1, 2024 |

$118 million |

452 |

up to $4,170 |

|

SK |

$10-a-day effective April 1, 2023 |

$1.10 billion |

28,000 |

up to $6,900 |

|

AB |

$15-a-day as of January 2024 |

$3.80 billion |

68,700 |

up to $13,700 |

|

NL |

$10-a-day as of January 1, 2023 |

$306 million |

5,895 |

up to $6,300 |

|

NWT |

$10-a-day as of April 2024 |

$51 million |

300 |

up to $9,120 |

|

YT |

Yukon committed to a $10-a-day average fee prior to Budget 2021 |

$42 million |

110 |

up to $7,300 |

|

NU |

$10-a-day as of December 2022 |

$66 million |

238 |

up to $14,300 |

|

1 Initial estimated funding amounts when the bilateral Canada-wide Early Learning and Child Care Agreements were signed. Actual funding amounts are subject to annual adjustments based on provincial/territorial shares of Canada's 0-12 year-old population. 2 Space creation commitments from the bilateral Canada-wide Early Leaning and Child Care Agreements as originally signed with provinces and territories. 3 Estimated savings for ON, NS, NB, BC, PEI, SK, AB, NL, and NWT are provincial and territorial estimates. Remaining savings calculations (MB, YK, and NU) are Employment and Social Development Canada estimates and are illustrative only. All estimates are relative to 2019 levels unless updated data is provided by provinces and territories. All estimates are based on out-of-pocket parent fees excluding amounts that would be recovered through provincial/territorial tax credits or the federal child care expense deduction at tax time, or changes to provincial/territorial or federal benefits as a result of lower child care expenses. Actual savings for families will vary based on factors such as actual fees paid prior to reductions. Provincial and territorial methodologies and data for calculating estimated savings may vary. 4 The Government of Canada has entered into an asymmetrical agreement with the province of Quebec that will allow for further improvements to its early learning and child care system, where parents with a subsidized, reduced contribution space already pay a single fee of less than $10-a-day. 5 This amount is indexed and may increase with inflation or the growth rate of the cost of subsidized spaces. Parents of children in non-subsidized spaces are entitled to a refundable tax credit for child care expenses covering between 67-78 per cent of all expenses paid, depending on family income, with a maximum eligible expense of $43 per day in 2023. |

||||

Making it Easier to Save for Your Child's Education

Helping your child pursue post-secondary education is one of the best investments you can make. But saving enough isn't easy. To help low-income families afford this, the government created the Canada Learning Bond in 2004. The Canada Learning Bond provides up to $2,000—without any family contribution necessary.

The only requirement is that you enroll your child. However, many families are simply not aware that their child is entitled to these benefits, and for those who do know, the onus of enrollment can be challenging while raising a family. We don't think it is fair that families and children are missing out on this support that they are entitled to. Every child should have all the help they can get to pursue a post-secondary education.

-

Budget 2024 announces the government's intention to amend the Canada Education Savings Act to introduce automatic enrolment in the Canada Learning Bond for eligible children who do not have a Registered Education Savings Plan opened for them by the time the child turns four.

- Starting in 2028-29, all eligible children born in 2024 or later would have a Registered Education Savings Plan automatically opened for them and the eligible Canada Learning Bond payments would be auto-deposited in these accounts.

- To ensure that all children can benefit from this simplified process, starting in 2028-29, caregivers of eligible children born before 2024 would also be able to request that Employment and Social Development Canada open a Registered Education Savings Plan for their child and auto-deposit the eligible Canada Learning Bond payments.

- This will ensure that 130,000 additional children receive the Canada Learning Bond each year through automatic enrolment.

-

Budget 2024 also announces the government's intention to introduce changes to the Canada Education Savings Act to extend the age from 20 to 30 years to retroactively claim the Canada Learning Bond. This would provide those who start their post-secondary education later to benefit from the government's contribution to their education savings.

These measures are expected to cost $161.9 million over five years, starting in 2024-25, with $148.8 million ongoing.

Number of children |

Adjusted income level |

|---|---|

|

One to three children |

Less than or equal to $53,359 |

|

Four children |

Less than $60,205 |

|

Five children |

Less than $67,079 |

|

Note: Income eligibility threshold for July 1, 2023 to June 30, 2024. |

|

The government's recent efforts to expand automatic tax-filing initiatives will help ensure that more low-income Canadians are able to receive the benefits to which they are entitled, including the Canada Learning Bond. See Chapter 8 for additional details.

$2,000 for Low-Income Families to Grow Their Child's RESP

Eli is born on February 25, 2024, and his parents only make $50,000 a year. Eli's parents receive a letter from Employment and Social Development Canada (ESDC) informing them of the Canada Learning Bond and encouraging them to open a Registered Education Savings Plan (RESP) to receive the benefit and kick-start savings for Eli's post-secondary education. As of February 25, 2028, Eli's parents have not opened a RESP for Eli.

With the new automatic enrollment, ESDC would automatically open a RESP for Eli when he turns four, and deposit up to $800 in Canada Learning Bond payments. This payment would be $500 for the first year of eligibility and $100 for the next three years. Each year, his account continues to grow by $100. Eli's parents could take over Eli's RESP any time, contribute their own savings, and receive additional Canada Education Savings Grants.

Even if Eli's parents do not take over the account or contribute their own savings, by 16, Eli could have up to $2,000 available from federal contributions alone, plus interest earned. At 18, Eli could take over his RESP account and use it to pay for tuition, rent, or transportation, reducing his need for Canada Student Loans.

After-School Learning

After-school learning and supports, such as mentorship and academic assistance, play an important role in helping students succeed in their academic pursuits, especially for at-risk students. These supports help young people do their best in school, and sets them up for success in post-secondary, priming them for success in whatever career they may choose.

To help all Canadian students reach their full potential, the government is enhancing financial support for after-school learning, so all young Canadians have a fair chance at success, regardless of their background.

-

Budget 2024 proposes to provide $67.5 million over three years, to Employment and Social Development Canada, as follows:

- $9.5 million to Pathways to Education Canada in 2024-25 to support youth in low-income communities helping them graduate from high school and build a successful future.

- $8 million to Indspire in 2024-25 to continue investing in the education of First Nations, Inuit and Métis people for the long term benefit of their families and communities.

- $50 million over two years, starting in 2025-26, for the Supports for Student Learning Program to make sure students have the supports they need in their education to help guide them towards their future success.

Coding Skills for Kids

To succeed in the increasingly digital global economy, kids need digital skills. Learning to code from a young age can set kids up for success, particularly as jobs in technology are set to grow exponentially over the coming years and decades. This gives them a fair chance in the economy of the future.

CanCode is a federal program that, since its launch, has helped over 4.5 million students—from kindergarten through grade 12—to develop coding and digital skills, priming kids for success in science, technology, engineering, and mathematics. CanCode's programming has equipped over 200,000 teachers with the tools they need to help their students learn to code.

-

Budget 2024 proposes to provide $39.2 million over two years, starting in 2024-25, to Innovation, Science and Economic Development Canada to advance the next phase of CanCode.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 2.2 The Best Start for Every Child.

2.3 A Fair Chance for Millennials and Gen Z

For too many younger Canadians, particularly Millennials and Gen Z, it feels like their hard work isn't paying off. They're not getting the same deal their parents and grandparents did. They don't feel like they're getting the same fair chance at success.

None of this is their fault. Institutions built by previous generations haven't kept up to changing times.

We must restore a fair chance for Millennials and Gen Z. If you stay in school and study hard, you should be able to afford college, university, or an apprenticeship, graduate into a good job, put a roof over your head, and build a good middle class life.

We've made progress for younger Canadians. We're investing in skills and training and work experience opportunities. Student and apprentice loans are now permanently interest free. And, you don't have to start making full payments on those loans until earning a middle class income.

But not every younger Canadian has the money they need to go to school, so we're increasing student grants and loans, and now providing more rent support, too. When you graduate, you deserve a pathway to a good job.

In Budget 2024, the government is helping to restore generational fairness for Millennials and Gen Z by unlocking access to post-secondary, including for the most vulnerable students and youth; and creating new opportunities for younger Canadians to get the skills they need to get good jobs.

Key Ongoing Actions

-

Reducing the burden of student debt by eliminating interest on Canada Student Loans and Canada Apprentice Loans, saving student loan borrowers an average of $610 every year on interest payments, and ensuring they do not need to make payments on their loans until they earn at least $42,720 per year.

-

Increasing, in 2016, Canada Student Grants from $2,000 to $3,000 per year for students from low-income households, to help cover the cost of education without increasing student debt loads.

-

Further increasing, in Budget 2023, Canada Student Grants from $3,000 to $4,200, for one year.

-

Enhancing student loan forgiveness to up to $60,000 for doctors and up to $30,000 for nurses who choose to work in rural and remote communities.

-

Introducing a flat-rate student contribution for financial assistance, allowing students to work and gain valuable labour market experience without worrying about a reduction in their federal support.

-

The Youth Employment and Skills Strategy's programs (Canada Summer Jobs and the Youth Employment and Skills Strategy Program), which in 2022-23, served a total of 141,262 youth and provided them with supports such as skills development, training, and work experiences.

-

The Student Work Placement Program, which in 2022-23, created 51,711 work-integrated placement opportunities (co-ops, internships) for post-secondary students related to their field of study.

Increasing Student Grants and Loans

Since 2016, the federal government has supported 638,000 post-secondary students per year, on average, with $38.4 billion in up-front grants and interest-free loans—enabling young Canadians to pursue their education, regardless of their background. To ensure this support keeps up with the cost of an education, the government permanently increased Canada Student Grants by 50 per cent to $3,000 dollars. In 2020, when students faced challenges finding work and affording school, the government temporarily doubled Canada Student Grants to provide $6,000 each year for three school years.

Even with increases in financial supports for students, and the permanent elimination of interest on student loans, many students still need more support to cover rising costs. Some provinces—British Columbia, Manitoba, Nova Scotia, New Brunswick, Prince Edward Island, and Newfoundland and Labrador—are aligned with the federal government in making their student loans interest free. The federal government is calling on the provinces and territories that still charge interest on student loans—Alberta, Saskatchewan, Ontario, Quebec, Nunavut, and the Northwest Territories—to make their student loans interest-free.

-

Budget 2024 announces the government's intention to extend for an additional year the increase in full-time Canada Student Grants from $3,000 to $4,200 per year, and interest-free Canada Student Loans from $210 to $300 per week. Increased students grants and loans will be available for the 2024-2025 school year, at an estimated total cost of $1.1 billion in 2024-25. With this change, Canada Student Grants will have doubled in size since 2014.

- Grants for part-time students, students with disabilities, and students with dependants will also be increased proportionately.

- Increased grants will support 587,000 students and increased interest-free loans will support 652,000 students, with a combined $7.3 billion for the upcoming academic year.

| Maximum Amount in 2014 | Maximum Amount in 2019 | Maximum Amount in 2024 | |

|---|---|---|---|

| Full-Time Students | $2,000 | $3,000 | $4,200 |

| Part-Time Students | $1,200 | $1,800 | $2,520 |

| Students with Dependants (Full-Time) | $1,600 (per dependant) |

$1,600 (per dependant) |

$2,240 (per dependant) |

| Students with Dependants (Part-Time) | $1,920 | $1,920 | $2,688 |

| Students with Disabilities | $2,000 | $2,000 | $2,800 |

The federal government is also calling on provinces and territories to make education more affordable through robust investments in student financial assistance and post-secondary institutions.

Quebec, the Northwest Territories, and Nunavut, which do not participate in the federal program, can receive funding to provide their own comparable support.

More Rural Health and Social Services Workers

The Canadians who work in health care and social services are indispensable for building healthier, more resilient communities and ensuring that individuals have access to the care and support they need to thrive, whether that is dental care, mental health care, or more.

Many rural and remote communities are struggling to find workers in the health and social services sector. Addressing these workforce challenges in rural and remote communities is critical so that all Canadians can benefit from greater access to the full suite of health and social services they need.

As Canada grows, and our population ages, ensuring a healthy population means ensuring there are enough health care professionals in all parts of our vast country. One way to do this is to encourage younger generations to relocate to rural and remote communities, where homes are often cheaper than our biggest cities, and where professionals in health care and social services are needed. The government already encourages doctors and nurses to move to rural and remote communities by offering student loan forgiveness. It is only fair that other health professionals who spent a similar number of years studying hard are afforded that same opportunity.

-

Budget 2024 announces the government's intent to introduce amendments to the Canada Student Financial Assistance Act and the Canada Student Loans Act to permanently expand the reach of the Canada Student Loan Forgiveness Program to more health care and social services professionals working in rural and remote communities:

- Dentists;

- Dental hygienists;

- Pharmacists;

- Midwives;

- Teachers;

- Social workers;

- Personal support workers;

- Physiotherapists; and,

- Psychologists.

The cost of this measure is estimated to be $253.8 million over four years, starting in 2025-26, and $84.3 million ongoing.

This is in addition to new student loan forgiveness for rural and remote early childhood educators, and recently expanded student loan forgiveness for doctors and nurses in rural and remote communities.

Fair Access to Student Aid

The federal government will also be bringing forward changes to the designated educational institutions at which students can enrol in order to be eligible for Canada Student Financial Assistance.

-

To ensure students have access to the best education outcomes, and with a view to limiting the financial risk to the Crown, Budget 2024 announces the government will review the designated educational institution status of private learning institutions for the purposes of the Canada Student Financial Assistance Program. Further details on this review will be announced in the 2024 Fall Economic Statement.

-

To ensure federal funding does not flow to institutions that are subject to international sanctions, Budget 2024 also announces the government's intention to ensure that, beginning on August 1, 2024, Canadian citizens and permanent residents will be ineligible to receive Canada Student Financial Assistance while studying at Russian post-secondary institutions. This step emphasizes the importance of international law and reaffirms Canada's unwavering stance against Russia's full-scale invasion of Ukraine.

More Rent Support for Students

Students should not have to choose between focusing on school and affording rent and groceries each month. Although federal student grants and loans are intended to help cover the cost of shelter, the formula used to estimate students' housing costs has not been updated since 1998.

-

To reflect the true rental housing costs faced by most post-secondary students, Budget 2024 proposes to modernize the shelter allowances used by the Canada Student Financial Assistance Program when determining financial need, at an estimated cost of $154.6 million over five years, starting in 2024-25, and $32.3 million per year ongoing.

- This new approach will provide additional student aid to approximately 79,000 students each year.

As detailed in Chapter 1, the government is also incentivizing post-secondary institutions to build more student housing, and providing the low-cost financing needed, so more students can find an affordable place to call home.

Helping People Return to School

Currently, adults hoping to return to post-secondary school face barriers if they have a low credit score. For example, a mature student who has a poor credit history because of common life circumstances, such as unplanned major health expenses, or the costs of raising children, faces a cumbersome review process before they can receive federal student aid.