Archived - Tax Measures:

Supplementary Information

Table of Contents

- Tax Measures: Supplementary Information

- Overview

- Personal Income Tax Measures

- Tax-Free First Home Savings Account

- Home Buyers’ Tax Credit

- Multigenerational Home Renovation Tax Credit

- Home Accessibility Tax Credit

- Residential Property Flipping Rule

- Labour Mobility Deduction for Tradespeople

- Medical Expense Tax Credit for Surrogacy and Other Expenses

- Annual Disbursement Quota for Registered Charities

- Charitable Partnerships

- Amendments to the Children’s Special Allowances Act and to the Income Tax Act

- Borrowing by Defined Benefit Pension Plans

- Reporting Requirements for RRSPs and RRIFs

- Business Income Tax Measures

- Canada Recovery Dividend and Additional Tax on Banks and Life Insurers

- Investment Tax Credit for Carbon Capture, Utilization, and Storage

- Clean Technology Tax Incentives – Air-Source Heat Pumps

- Critical Mineral Exploration Tax Credit

- Flow-Through Shares for Oil, Gas, and Coal Activities

- Small Business Deduction

- International Financial Reporting Standards for Insurance Contracts (IFRS 17)

- Hedging and Short Selling by Canadian Financial Institutions

- Application of the General Anti-Avoidance Rule to Tax Attributes

- Genuine Intergenerational Share Transfers

- Substantive CCPCs

- International Tax Measures

- Sales and Excise Tax Measures

- Other Tax Measures

- Previously Announced Measures

- Notice of Ways and Means Motion to amend the Income Tax Act and Other Legislation

- Notice of Ways and Means Motion to amend the Excise Tax Act

- Notice of Ways and Means Motion to amend the Excise Act, 2001

- Notice of Ways and Means Motion to amend the Excise Act

Overview

This annex provides detailed information on tax measures proposed in the Budget.

Table 1 lists these measures and provides estimates of their fiscal impact.

The annex also provides Notices of Ways and Means Motions to amend the Income Tax Act, the Excise Tax Act, the Excise Act, 2001, the Excise Act and other legislation and draft amendments to various regulations.

In this annex, references to “Budget Day” are to be read as references to the day on which this Budget is presented.

| 2021–2022 | 2022–2023 | 2023–2024 | 2024–2025 | 2025–2026 | 2026–2027 | Total | |

|---|---|---|---|---|---|---|---|

| Personal Income Tax | |||||||

| Tax-Free First Home Savings Account | - | - | 55 | 215 | 225 | 230 | 725 |

| Home Buyers’ Tax Credit | 30 | 125 | 130 | 130 | 130 | 130 | 675 |

| Multigenerational Home Renovation Tax Credit | - | 5 | 25 | 25 | 25 | 25 | 105 |

| Home Accessibility Tax Credit | 3 | 15 | 15 | 15 | 15 | 15 | 78 |

| Residential Property Flipping Rule | - | -4 | -15 | -15 | -15 | -15 | -64 |

| Labour Mobility Deduction for Tradespeople | 25 | 110 | 110 | 115 | 115 | 120 | 595 |

| Medical Expense Tax Credit for Surrogacy and Other Expenses | 4 | 15 | 15 | 15 | 15 | 15 | 79 |

| Annual Disbursement Quota for Registered Charities | - | - | - | - | - | - | - |

| Charitable Partnerships | - | 7 | 13 | 35 | 45 | 65 | 165 |

| Amendments to the Children’s Special Allowances Act and to the Income Tax Act | - | - | - | - | - | - | - |

| Borrowing by Defined Benefit Pension Plans | - | - | - | - | - | - | - |

| Reporting Requirements for RRSPs and RRIFs | - | - | - | - | -20 | -30 | -50 |

| Business Income Tax | |||||||

| Canada Recovery Dividend | - | -810 | -810 | -810 | -810 | -810 | -4,050 |

| Additional Tax on Banks and Life Insurers | - | -290 | -460 | -430 | -430 | -445 | -2,055 |

| Investment Tax Credit for Carbon Capture, Utilization, and Storage | - | 35 | 70 | 285 | 755 | 1,455 | 2,600 |

| Clean Technology Incentives – Air Source Heat Pumps | - | 9 | 15 | 10 | 10 | 9 | 53 |

| Critical Mineral Exploration Tax Credit | - | 65 | 45 | 110 | 90 | 90 | 400 |

| Flow-Through Shares for Oil, Gas, and Coal Activities | - | - | -1 | -2 | -3 | -3 | -9 |

| Small Business Deduction | - | 10 | 165 | 160 | 160 | 165 | 660 |

| International Financial Reporting Standards for Insurance Contracts (IFRS 17) | - | - | -575 | -630 | -565 | -580 | -2,350 |

| Hedging and Short Selling by Canadian Financial Institutions | - | -65 | -135 | -140 | -145 | -150 | -635 |

| Application of the General Anti-Avoidance Rule to Tax Attributes | - | - | - | - | - | - | - |

| Genuine Intergenerational Share Transfers | - | - | - | - | - | - | - |

| Substantive CCPCs | - | -735 | -965 | -885 | -825 | -825 | -4,235 |

| International Tax Measures | |||||||

| International Tax Reform | |||||||

Pillar One – Reallocation of Taxing Rights3 |

- | - | - | - | - | - | - |

Pillar Two – Global Minimum Tax4 |

- | - | - | - | - | - | - |

| Exchange of Tax Information on Digital Economy Platform Sellers | - | - | - | - | - | - | - |

| Interest Coupon Stripping | - | -80 | -125 | -140 | -145 | -150 | -640 |

| Sales and Excise Tax Measures | |||||||

| GST/HST Health Care Rebate | - | 3 | 3 | 3 | 3 | 4 | 16 |

| GST/HST on Assignment Sales by Individuals | - | -10 | -10 | -10 | -10 | -10 | -50 |

| Taxation of Vaping Products | - | -69 | -145 | -145 | -145 | -150 | -654 |

| Cannabis Taxation Framework and General Administration under the Excise Act, 2001 | - | - | - | - | - | - | - |

| WTO Settlement on the 100-per-cent Canadian Wine Exemption | - | -55 | -80 | -80 | -85 | -90 | -390 |

| Beer Taxation | - | 1 | 2 | 2 | 2 | 2 | 9 |

| Other Tax Measure | |||||||

| Amendments to the Nisga’a Final Agreement Act to Advance Tax Measures in the Nisga’a Nation Taxation Agreement | - | - | - | - | - | - | - |

1 A positive amount represents a decrease in revenue; a negative amount represents an increase in revenue. |

|||||||

Personal Income Tax Measures

Tax-Free First Home Savings Account

Budget 2022 proposes to create the Tax-Free First Home Savings Account (FHSA), a new registered account to help individuals save for their first home. Contributions to an FHSA would be deductible and income earned in an FHSA would not be subject to tax. Qualifying withdrawals from an FHSA made to purchase a first home would be non-taxable.

Some key design features of the FHSA are described below. The government will release its proposals for other design elements in the near future.

Eligibility

To open an FHSA, an individual must be a resident of Canada, and at least 18 years of age. In addition, the individual must not have lived in a home that they owned either:

- at any time in the year the account is opened, or

- during the preceding four calendar years.

Individuals would be limited to making non-taxable withdrawals in respect of a single property in their lifetime.

Once an individual has made a non-taxable withdrawal to purchase a home, they would be required to close their FHSAs within a year from the first withdrawal and would not be eligible to open another FHSA.

Contributions

The lifetime limit on contributions would be $40,000, subject to an annual contribution limit of $8,000. The full annual contribution limit would be available starting in 2023.

Unused annual contribution room could not be carried forward, meaning an individual contributing less than $8,000 in a given year would still face an annual limit of $8,000 in subsequent years.

An individual would be permitted to hold more than one FHSA, but the total amount that an individual contributes to all of their FHSAs could not exceed their annual and lifetime FHSA contribution limits.

Withdrawals and Transfers

Amounts withdrawn to make a qualifying first home purchase would not be subject to tax. Amounts that are withdrawn for other purposes would be taxable.

To provide flexibility, an individual could transfer funds from an FHSA to a registered retirement savings plan (RRSP) (at any time before the year they turn 71) or registered retirement income fund (RRIF). Transfers to an RRSP or RRIF would not be taxable at the time of transfer, but amounts would be taxed when withdrawn from the RRSP or RRIF in the usual manner. Transfers would not reduce, or be limited by, the individual’s available RRSP room. Withdrawals and transfers would not replenish FHSA contribution limits.

If an individual has not used the funds in their FHSA for a qualifying first home purchase within 15 years of first opening an FHSA, their FHSA would have to be closed. Any unused savings could be transferred into an RRSP or RRIF, or would otherwise have to be withdrawn on a taxable basis.

Individuals would also be allowed to transfer funds from an RRSP to an FHSA on a tax-free basis, subject to the $40,000 lifetime and $8,000 annual contribution limits. These transfers would not restore an individual’s RRSP contribution room.

Home Buyers’ Plan

The home buyers’ plan (HBP) allows individuals to withdraw up to $35,000 from an RRSP to purchase or build a home without having to pay tax on the withdrawal. Amounts withdrawn under the HBP must be repaid to an RRSP over a period not exceeding 15 years, starting the second year following the year in which the withdrawal was made.

The HBP will continue to be available as under existing rules. However, an individual will not be permitted to make both an FHSA withdrawal and an HBP withdrawal in respect of the same qualifying home purchase.

Effective Date

The government would work with financial institutions to have the infrastructure in place for individuals to be able to open an FHSA and start contributing at some point in 2023.

Home Buyers’ Tax Credit

First-time home buyers who acquire a qualifying home can obtain up to $750 in tax relief by claiming the First-Time Home Buyers’ Tax Credit (HBTC). The value of this non-refundable credit is calculated by multiplying the credit amount of $5,000 by the lowest personal income tax rate (15 per cent in 2022). Any unused portion of the HBTC may be claimed by an individual’s spouse or common-law partner as long as the combined total does not exceed $750 in tax relief.

An individual is a first-time home buyer if neither the individual nor the individual’s spouse or common-law partner owned and lived in another home in the calendar year of the home purchase or in any of the four preceding calendar years. This credit is also available for certain acquisitions of a home by or for the benefit of an individual who is eligible for the Disability Tax Credit, even if the first-time home buyer condition is not met.

A qualifying home is one that the individual or individual’s spouse or common-law partner intends to occupy as their principal residence no later than one year after its acquisition.

Budget 2022 proposes to double the HBTC amount to $10,000, which would provide up to $1,500 in tax relief to eligible home buyers. Spouses or common-law partners would continue to be able to split the value of the credit as long as the combined total does not exceed $1,500 in tax relief.

This measure would apply to acquisitions of a qualifying home made on or after January 1, 2022.

Multigenerational Home Renovation Tax Credit

Budget 2022 proposes to introduce a new Multigenerational Home Renovation Tax Credit. The proposed refundable credit would provide recognition of eligible expenses for a qualifying renovation. A qualifying renovation would be one that creates a secondary dwelling unit to permit an eligible person (a senior or a person with a disability) to live with a qualifying relation. The value of the credit would be 15 per cent of the lesser of eligible expenses and $50,000.

Eligible Persons

Seniors and adults with disabilities would be considered eligible persons for the purpose of the Multigenerational Home Renovation Tax Credit.

- Seniors are individuals who are 65 years of age or older at the end of the taxation year that includes the end of the renovation period.

- Adults with disabilities are individuals who are 18 years of age or older at the end of the taxation year that includes the end of the renovation period, and who are eligible for the Disability Tax Credit at any time in that year.

Qualifying Relations

For the purposes of this credit, a qualifying relation, in respect of an eligible person, would be an individual who is 18 years of age or older at the end of the taxation year that includes the end of the renovation period and is a parent, grandparent, child, grandchild, brother, sister, aunt, uncle, niece or nephew of the eligible person (which includes the spouse or common-law partner of one of those individuals).

Eligible Claimants

The Multigenerational Home Renovation Tax Credit may be claimed by:

- an individual who ordinarily resides, or intends to ordinarily reside, in the eligible dwelling within twelve months after the end of the renovation period and who is:

- an eligible person;

- the spouse or common-law partner of the eligible person;

- a qualifying relation, in respect of an eligible person; or

- a qualifying relation, in respect of an eligible person, who owns the eligible dwelling.

Where one or more eligible claimants make a claim in respect of an eligible renovation, the total of all amounts claimed in respect of the qualifying renovation must not exceed $50,000. If the claimants cannot agree as to what portion of the amounts each can claim, the Minister of National Revenue would be allowed to fix the portions.

Eligible Dwelling

For the purposes of this credit, an eligible dwelling would be defined as a housing unit that is:

- owned (either jointly or otherwise) by the eligible person, the spouse or common-law partner of the eligible person or a qualifying relation in respect of the eligible person; and

- where the eligible person and a qualifying relation in respect of the eligible person ordinarily reside, or intend to ordinarily reside, within twelve months after the end of the renovation period.

An eligible dwelling would include the land subjacent to the housing unit and the immediately contiguous land, but would not include the portion of that land that exceeds the greater of ½ hectare and the portion of that land that the individual establishes is necessary for the use and enjoyment of the housing unit as a residence.

Qualifying Renovation

For the purposes of this credit, a qualifying renovation would be defined as a renovation or alteration of, or addition to, an eligible dwelling that is:

- of an enduring nature and integral to the eligible dwelling; and

- undertaken to enable an eligible person to reside in the dwelling with a qualifying relation, by establishing a secondary unit within the dwelling for occupancy by the eligible person or the qualifying relation.

A secondary unit would be defined as a self-contained dwelling unit with a private entrance, kitchen, bathroom facilities and sleeping area. The secondary unit could be newly constructed or created from an existing living space that did not already meet the requirements to be a secondary unit. To be eligible, relevant building permits for establishing a secondary unit must be obtained and renovations must be completed in accordance with the laws of the jurisdiction in which an eligible dwelling is located.

One qualifying renovation would be permitted to be claimed in respect of an eligible person over their lifetime.

Renovation Period

For the purposes of this credit, the renovation period means a period that:

- begins at the time that an application for a building permit for a qualifying renovation is submitted; and

- ends at the time when the qualifying renovation passes a final inspection, or proof of completion of the project according to all legal requirements of the jurisdiction in which the renovation was undertaken is otherwise obtained.

The credit would be available to be claimed for the taxation year that includes the end of the renovation period.

Eligible Expenses

Expenses would be eligible for the Multigenerational Home Renovation Tax Credit if they are made or incurred during the renovation period, for the purpose of a qualifying renovation, and are reasonable in the context of that purpose (i.e., enabling an eligible person to reside in the dwelling with a qualifying relation).

Eligible expenses would include the cost of labour and professional services, building materials, fixtures, equipment rentals and permits. Items such as furniture, as well as items that retain a value independent of the renovation (such as construction equipment and tools), would not be integral to the dwelling and expenses for such items would therefore not qualify for the credit.

The following are examples of other expenses that would not be eligible for the Multigenerational Home Renovation Tax Credit:

- the cost of annual, recurring or routine repair or maintenance;

- expenses for household appliances and devices, such as audio-visual electronics;

- payments for services such as outdoor maintenance and gardening, housekeeping or security;

- the costs of financing a renovation (e.g., mortgage interest costs);

- goods or services provided by a person not dealing at arm’s length with the claimant, unless that person is registered for Goods and Services Tax/Harmonized Sales Tax purposes under the Excise Tax Act; and

- any expenses not supported by receipts.

Expenses that may be included in a claim must be reduced by any reimbursement or any other form of assistance that an individual is or was entitled to receive, including any related rebates, such as those for Goods and Services Tax/Harmonized Sales Tax. Expenses would not be eligible for the Multigenerational Home Renovation Tax Credit if they are claimed under the Medical Expense Tax Credit and/or Home Accessibility Tax Credit.

Coming into Force

This measure would apply for the 2023 and subsequent taxation years, in respect of work performed and paid for and/or goods acquired on or after January 1, 2023.

Home Accessibility Tax Credit

The Home Accessibility Tax Credit is a non-refundable tax credit that provides recognition of eligible home renovation or alteration expenses in respect of an eligible dwelling of a qualifying individual. A qualifying individual is an individual who is eligible to claim the Disability Tax Credit at any time in a tax year, or an individual who is 65 years of age or older at the end of a tax year. The value of the credit is calculated by applying the lowest personal income tax rate (15 per cent in 2022) to an amount that is the lesser of eligible expenses and $10,000.

To better support independent living, Budget 2022 proposes to increase the annual expense limit of the Home Accessibility Tax Credit to $20,000. This enhancement would provide additional tax support for more significant renovations undertaken to improve accessibility, such as building a bedroom and/or a bathroom to permit first-floor occupancy for a qualifying person who has difficulty accessing living spaces on other floors.

This measure would apply to expenses incurred in the 2022 and subsequent taxation years.

Residential Property Flipping Rule

Property flipping involves purchasing real estate with the intention of reselling the property in a short period of time to realize a profit. Profits from flipping properties are fully taxable as business income, meaning they are not eligible for the 50-per-cent capital gains inclusion rate or the Principal Residence Exemption.

The Government is concerned that certain individuals engaged in flipping residential real estate are not properly reporting their profits as business income. Instead, these individuals may be improperly reporting their profits as capital gains and, in some cases, claiming the Principal Residence Exemption.

Budget 2022 proposes to introduce a new deeming rule to ensure profits from flipping residential real estate are always subject to full taxation. Specifically, profits arising from dispositions of residential property (including a rental property) that was owned for less than 12 months would be deemed to be business income.

The new deeming rule would not apply if the disposition of property is in relation to at least one of the life events listed below:

- Death: a disposition due to, or in anticipation of, the death of the taxpayer or a related person.

- Household addition: a disposition due to, or in anticipation of, a related person joining the taxpayer’s household or the taxpayer joining a related person’s household (e.g., birth of a child, adoption, care of an elderly parent).

- Separation: a disposition due to the breakdown of a marriage or common-law partnership, where the taxpayer has been living separate and apart from their spouse or common-law partner because of a breakdown in the relationship for a period of at least 90 days.

- Personal safety: a disposition due to a threat to the personal safety of the taxpayer or a related person, such as the threat of domestic violence.

- Disability or illness: a disposition due to a taxpayer or a related person suffering from a serious disability or illness.

- Employment change: a disposition for the taxpayer or their spouse or common-law partner to work at a new location or due to an involuntary termination of employment. In the case of work at a new location, the taxpayer’s new home must be at least 40 kilometres closer to the new work location.

- Insolvency: a disposition due to insolvency or to avoid insolvency (i.e., due to an accumulation of debts).

- Involuntary disposition: a disposition against someone’s will, for example, due to, expropriation or the destruction or condemnation of the taxpayer’s residence due to a natural or man-made disaster.

Where the new deeming rule applies, the Principal Residence Exemption would not be available.

Where the new deeming rule does not apply because of a life event listed above or because the property was owned for 12 months or more, it would remain a question of fact whether profits from the disposition are taxed as business income.

The measure would apply in respect of residential properties sold on or after January 1, 2023.

Labour Mobility Deduction for Tradespeople

Temporary relocations to obtain employment may not qualify for existing tax recognition for moving or travel expenses, particularly if they do not involve a change in an individual’s ordinary residence and the employer does not provide relocation assistance.

Budget 2022 proposes to introduce a Labour Mobility Deduction for Tradespeople to recognize certain travel and relocation expenses of workers in the construction industry, for whom such relocations are relatively common. This measure would allow eligible workers to deduct up to $4,000 in eligible expenses per year.

For the purposes of this deduction, an eligible individual would be a tradesperson or an apprentice who:

- makes a temporary relocation that enables them to obtain or maintain employment under which the duties performed by the taxpayer are of a temporary nature in a construction activity at a particular work location; and

- ordinarily resided prior to the relocation at a residence in Canada, and during the period of the relocation, at temporary lodging in Canada near that work location.

Eligible Temporary Relocation

To qualify as an eligible temporary relocation:

- the temporary lodging must be at least 150 kilometres closer than the ordinary residence to the particular work location;

- the particular work location must be located in Canada; and

- the temporary relocation must be for a minimum duration of 36 hours.

To ensure that the measure does not subsidize long-distance commuting or expenses of those who choose to live far from where they typically work, it would further be required that the particular work location not be in the locality in which the eligible individual principally works (i.e., carries on employment or business activity).

Eligible Expenses

Eligible expenses in respect of an eligible temporary relocation would be reasonable amounts associated with expenses incurred for:

- temporary lodging for the eligible individual near the particular work location;

- transportation for the individual for one round trip from the location where the individual ordinarily resides to the temporary lodging; and

- meals for the individual in the course of travel while making one round trip to and from the temporary lodging.

An individual would not be permitted to claim lodging expenses for a period of time under this measure unless they maintain an ordinary residence elsewhere that remains available for their or their immediate family’s use during that time period.

An individual would not be allowed to claim expenses in respect of which they received financial assistance from an employer that is not included in income. The maximum amount of expenses that could be claimed in respect of a particular eligible temporary relocation would be capped at 50 per cent of the worker’s employment income from construction activities at the particular work location in the year. Flexibility would be provided by allowing expenses to be claimed in a tax year before or after the year they were incurred provided they were not deductible in a prior year. This would enable workers to claim expenses in the tax year they earned the associated employment income and address cases where expenses related to a relocation span two tax years.

Amounts claimed under the Labour Mobility Deduction for Tradespeople would not be deductible under the existing Moving Expense Deduction. Similarly, amounts that are otherwise deducted could not be claimed under the Labour Mobility Deduction for Tradespeople.

Coming into Force

This measure would apply to the 2022 and subsequent taxation years.

Medical Expense Tax Credit for Surrogacy and Other Expenses

The Medical Expense Tax Credit (METC) is a 15-per-cent non-refundable tax credit that recognizes the effect of above-average medical or disability-related expenses on an individual’s ability to pay tax. For 2022, the METC is available for qualifying medical expenses in excess of the lesser of $2,479 and three per cent of the individual’s net income. Eligible expenses must generally be in respect of products and services received by the patient, defined as the taxpayer, the taxpayer’s spouse or common-law partner or certain dependants of the taxpayer.

Individuals who intend to be parents may pursue a number of approaches to build their families, including the use of assisted reproductive technologies. Many of the costs related to the use of reproductive technologies are already eligible expenses for the METC. For example, in vitro fertilization procedures and associated expenses are generally recognized as eligible expenses of the taxpayer under the credit, provided that the expenses relate to the patient, as described above. However, some approaches to building a family involve medical expenses for individuals other than the intended parents. Budget 2022 proposes to broaden the METC to recognize these circumstances.

Medical Expenses Related to a Surrogate Mother or Sperm, Ova or Embryo Donor

Budget 2022 proposes to provide a broader definition of patient in cases where an individual would rely on a surrogate or a donor in order to become a parent. In these cases, patient would be defined as:

- the taxpayer;

- the taxpayer’s spouse or common-law partner;

- a surrogate mother; or

- a donor of sperm, ova or embryos.

This broader definition would allow medical expenses paid by the taxpayer, or the taxpayer’s spouse or common-law partner, with respect to a surrogate mother or donor to be eligible for the METC. For example, expenses paid by the intended parent to a fertility clinic for an in vitro fertilization procedure with respect to a surrogate mother or for hormone medication for an ova donor would be eligible for the METC.

Reimbursement of Medical Expenses Incurred by a Surrogate Mother or Sperm, Ova or Embryo Donor

In Canada, it is illegal to pay consideration to surrogate mothers or donors; however, surrogate mothers and donors may receive reimbursement from intended parents of certain out-of-pocket expenses, including some medical expenses. Under current tax rules, reimbursements for medical expenses with respect to these individuals are not currently eligible to be claimed by the intended parents.

Budget 2022 proposes to allow reimbursements paid by the taxpayer to a patient, under the expanded definition proposed above, to be eligible for the METC, provided that the reimbursement is made in respect of an expense that would generally qualify under the credit. For example, the METC could be available for reimbursements paid by the taxpayer for expenses incurred by a surrogate mother with respect to an in vitro fertilization procedure or prescription medication related to their pregnancy.

Fees Paid to Acquire Donated Human Sperm or Ova

Budget 2022 also proposes to allow fees paid to fertility clinics and donor banks in order to obtain donor sperm or ova to be eligible under the METC. Such expenses would be eligible where the sperm or ova are acquired for use by an individual in order to become a parent.

Eligible Expenses

Only expenses incurred in Canada would be eligible. In Canada, surrogacy and gamete and embryo donation are regulated under the Assisted Human Reproduction Act. The Reimbursement Related to Assisted Human Reproduction Regulations outline which reimbursements are permissible under the Assisted Human Reproduction Act. All expenses claimed under the METC would be required to be in accordance with the Assisted Human Reproduction Act and associated regulations.

Coming into Force

This measure would apply to expenses incurred in the 2022 and subsequent taxation years.

Annual Disbursement Quota for Registered Charities

Registered charities are generally required to expend a minimum amount each year, referred to as the disbursement quota (DQ). The DQ is currently equal to 3.5 per cent of the registered charity’s property not used directly in charitable activities or administration. The DQ is designed to ensure the timely disbursement of tax-assisted funds towards charitable purposes, while allowing for reasonable asset growth within the charitable sector to support charitable activities in the future.

Budget 2022 proposes to make a number of changes to increase expenditures by larger charities, and to improve the enforcement and operation of the DQ rules.

Modifying the Rate of the DQ

Budget 2022 proposes to increase the DQ rate from 3.5 per cent to 5 per cent for the portion of property not used in charitable activities or administration that exceeds $1 million. This would increase expenditures by charities overall, while accommodating smaller grant-making charities that may not be able to realize the same investment returns as larger charities.

In addition, Budget 2022 proposes to amend the Income Tax Act to clarify that expenditures for administration and management are not considered qualifying expenditures for the purpose of satisfying a charity’s DQ.

Relief for Certain Circumstances

Where a charity is unable to meet its DQ, it may apply to the CRA and request relief from the DQ requirement. If granted, a charity is deemed to have a charitable expenditure for the tax year.

To better reflect actual expenditures on charitable activities, Budget 2022 proposes to amend the existing rule such that the CRA will have the discretion to grant a reduction in a charity’s DQ obligation for any particular tax year. In addition, to improve transparency with respect to charities that have a reduction to their DQ, Budget 2022 proposes to allow the CRA to publicly disclose information relating to such a decision.

The Income Tax Act alsoallows a charity to apply to the CRA for permission to accumulate property for a specific purpose. If granted, any property accumulated in accordance with the approval, including any income earned, is not included in calculating a charity’s DQ.

Given prior changes that simplified the DQ by removing a number of spending requirements, as well as existing provisions, which provide relief to charities, the accumulation of property rule is no longer necessary. Accordingly, Budget 2022 proposes to remove the accumulation of property rule.

Coming into Force

These measures would apply to charities in respect of their fiscal periods beginning on or after January 1, 2023. The amendment removing the accumulation of property rule would not apply to approved property accumulations resulting from applications submitted by a charity prior to January 1, 2023.

Charitable Partnerships

Under the Income Tax Act, registered charities are limited to devoting their resources to charitable activities they carry on themselves or providing gifts to qualified donees. Where charities conduct activities through an intermediary organization (other than a qualified donee), they must maintain sufficient control and direction over the activity such that it can be considered their own.

Budget 2022 proposes a number of changes to improve the operation of these rules, allowing charities to make qualified disbursements to organizations that are not qualified donees, provided that they meet certain accountability requirements under the Income Tax Act. Additional measures designed to ensure compliance by charities with these new rules are forthcoming.

Accountability Requirements

Budget 2022 proposes to allow charities to make qualifying disbursements to organizations that are not qualified donees, provided that these disbursements are in furtherance of the charity’s charitable purposes and the charity ensures that the funds are applied to charitable activities by the grantee.

In addition, in order to be considered a qualifying disbursement, charities will be required to meet certain mandatory accountability requirements defined in the Income Tax Act that are designed to ensure that their resources will be used for charitable purposes, including:

- Conducting a pre-grant inquiry sufficient to provide reasonable assurances that the charity’s resources will be used for the purposes set out in the written agreement. This will include a review of the identity, past history, practices, activities and areas of expertise of the grantee.

- Having a written agreement between the charity and the grantee, including:

-

- the terms and conditions of the funding provided;

- a description of the charitable activities that the recipient will undertake;

- a requirement that any funds not used for the purposes for which they were granted be returned to the charity; and

- a requirement that records relating to the use of the charity’s resources be maintained and accessible for a minimum of six years following the end of the relevant taxation year.

- Monitoring the grantee, which would include receiving periodic reports on the use of the charity’s resources, at least annually (e.g., details on the use of the funds, compliance with the terms of the grant, and progress made toward the purposes of the grant) and taking remedial action as required.

- Receiving full and detailed final reports from the grantee, including outlining the results achieved with the charity’s resources, detailing how the funds were spent, and providing sufficient documentary evidence to demonstrate that funds were used for the purposes for which they were granted. The charity would also be required to demonstrate that these final reports and supporting documentation were reviewed and approved by the charity.

- Publicly disclosing on its annual information return information relating to grants above $5,000.

Books and Records

To ensure that the CRA is able to verify that charitable resources have been applied to the purposes for which they have been granted, Budget 2022 proposes to require charities to, upon request by the CRA, take all reasonable steps to obtain receipts, invoices, or other documentary evidence from grantees to demonstrate amounts were spent appropriately.

Directed donations

Modifications to the current framework could increase the risk of a charity acting as a conduit for donations to other organizations. To address this issue, Budget 2022 proposes to extend an existing provision in the Income Tax Act, which currently applies to registered Canadian amateur athletic associations and registered journalism organizations, to registered charities. This rule would prohibit registered charities from accepting gifts, the granting of which was expressly or implicitly conditional on making a gift to a person other than a qualified donee.

Coming into Force

These changes would apply as of royal assent of the enacting legislation.

Amendments to the Children’s Special Allowances Act and to the Income Tax Act

As a consequence of An Act respecting First Nations, Inuit and Métis children, youth and families, which came into force on January 1, 2020, Budget 2022 proposes legislative amendments to the Children’s Special Allowances Act and its regulations and to the Income Tax Act to ensure that the special allowance, the Canada Child Benefit and the Canada Workers Benefit amount for families continue to support children in need of protection. Budget 2022 also proposes to amend the Income Tax Act to ensure consistent tax treatment of kinship care providers and foster parents who receive financial assistance from Indigenous communities.

Children’s Special Allowance

The Government of Canada pays the Children’s Special Allowance in respect of children who are in the care of, and maintained by, a federal, provincial, territorial or First Nations agency or institution (e.g., a child protection agency).

The Children’s Special Allowances Act currently requires an agency or institution to be licensed, or authorized to operate, under a federal, provincial or territorial law in order to be eligible for the special allowance.

Budget 2022 proposes to amend the Children’s Special Allowances Act and its regulations to allow the payment of the special allowance in respect of a child who is maintained under Indigenous laws where an Indigenous governing body has provided notice of intent to exercise its legislative authority in relation to child and family services to the Government of Canada (or has done so implicitly by requesting to enter into a coordination agreement for such services), under An Act respecting First Nations, Inuit and Métis children, youth and families (referred to hereafter as an “Indigenous governing body”).

Proposed amendments would also provide for adjustments to be made to the definition of Indigenous governing body, for the purpose of the special allowance, through the regulations. This would provide some flexibility for the Government of Canada to adapt to future developments in this evolving area as Indigenous communities work to establish their delivery models for child and family services.

Budget 2022 also proposes to amend the Children’s Special Allowance Regulations to allow:

- An Indigenous governing body to be recognized, where all other eligibility requirements are met, as:

-

- an eligible applicant for the special allowance; and

- maintaining a child for the purpose of the special allowance.

- For the exchange of information between the Government of Canada and an Indigenous governing body for the purpose of the administration of a social, income assistance or health insurance program of the Indigenous governing body, under certain conditions.

Tax Measures for Kinship Care Providers and Foster Parents of Indigenous Children

To ensure consistent treatment between kinship care providers and foster parents receiving financial assistance from an Indigenous governing body and those receiving such assistance from a provincial/territorial government, Budget 2022 proposes to amend the Income Tax Act to:

- clarify that a kinship care provider may be considered to be the parent of a child in their care for the purposes of the Canada Workers Benefit amount for families and the Canada Child Benefit, regardless of whether they receive financial assistance from an Indigenous governing body, provided they meet all other eligibility requirements; and

- ensure that financial assistance payments for the care of a child received by kinship care providers or foster parents from an Indigenous governing body are neither taxable, nor included in income for the purposes of determining entitlement to income-tested benefits and credits.

Coming into Force

These measures would apply for the 2020 and subsequent taxation years.

Borrowing by Defined Benefit Pension Plans

The rules in the Income Tax Regulations currently restrict a registered pension plan from borrowing money, except in limited circumstances. First, borrowing is allowed for the acquisition of income-producing real property where the borrowed amount does not exceed the cost of the real property and only the real property is used as security for the loan. Second, borrowing is permitted where the term of the loan does not exceed 90 days and the property of the plan is not pledged as security for the loan (unless the money is borrowed to avoid the distress sale of plan assets). Temporary rules permit borrowing for terms longer than 90 days if repaid by April 30, 2022.

Budget 2022 proposes to provide more borrowing flexibility to administrators of defined benefit registered pension plans (other than individual pension plans) by maintaining the borrowing rule for real property acquisitions and replacing the 90-day term limit with a limit on the total amount of additional borrowed money (for purposes other than acquiring real property), equal to the lesser of:

- 20 per cent of the value of the plan’s assets (net of unpaid borrowed amounts); and

- the amount, if any, by which 125 per cent of the plan’s actuarial liabilities exceeds the value of the plan’s assets (net of unpaid borrowed amounts).

The new borrowing limit would be redetermined on the first day of each fiscal year of the plan, based on the value of assets and unpaid borrowed amounts on that day and the actuarial liabilities on the effective date of the plan’s most recent actuarial valuation report. Each redetermined limit would not apply to borrowings entered into before that time.

Plan administrators must continue to comply with the provisions of federal or provincial pension benefit standards legislation which ensure that pension funds are administered with a duty of care, investments are made in a reasonable and prudent manner and the plan is funded in accordance with prescribed funding standards. These standards are designed to manage the risks to the promised benefits of plan members and ensure the stability of registered pension plans. They would be unaffected by the proposed measure.

This measure would apply to amounts borrowed by defined benefit registered pension plans (other than individual pension plans) on or after Budget Day.

Reporting Requirements for RRSPs and RRIFs

Registered retirement savings plans (RRSPs) and registered retirement income funds (RRIFs) form an important part of Canada’s retirement income system. The tax deferral provided by these savings vehicles assists and encourages Canadians to save for retirement and achieve their retirement income goals.

Financial institutions are currently required to report annually to the Canada Revenue Agency the payments out of, and contributions to, each RRSP and RRIF that they administer. By comparison, financial institutions file a comprehensive annual information return in respect of each tax-free savings account that they administer, which includes the fair market value of property held in the account.

Budget 2022 proposes to require financial institutions to annually report to the Canada Revenue Agency the total fair market value, determined at the end of the calendar year, of property held in each RRSP and RRIF that they administer. This information would assist the Canada Revenue Agency in its risk-assessment activities regarding qualified investments held by RRSPs and RRIFs.

This measure would apply to the 2023 and subsequent taxation years.

Business Income Tax Measures

Canada Recovery Dividend and Additional Tax on Banks and Life Insurers

Budget 2022 proposes to introduce the one-time Canada Recovery Dividend (CRD) and an additional tax on banks and life insurers.

Canada Recovery Dividend

Budget 2022 proposes to introduce the CRD in the form of a one-time 15-per-cent tax on bank and life insurer groups. A group would include a bank or life insurer and any other financial institution (for the purposes of Part VI of the Income Tax Act) that is related to the bank or life insurer.

The CRD would be determined based on a corporation’s taxable income for taxation years ending in 2021. A proration rule would be provided for short taxation years. Bank and life insurer groups subject to the CRD would be permitted to allocate a $1 billion taxable income exemption by agreement amongst group members.

The CRD liability would be imposed for the 2022 taxation year and would be payable in equal amounts over five years.

Additional Tax on Banks and Life Insurers

Budget 2022 proposes to introduce an additional tax of 1.5 per cent of the taxable income for members of bank and life insurer groups (determined in the same manner as the CRD). Bank and life insurer groups subject to the additional tax would be permitted to allocate a $100 million taxable income exemption by agreement amongst group members.

The proposed additional tax would apply to taxation years that end after Budget Day. For a taxation year that includes Budget Day, the additional tax would be prorated based on the number of days in the taxation year after Budget Day.

Investment Tax Credit for Carbon Capture, Utilization, and Storage

Carbon capture, utilization, and storage (CCUS) is a suite of technologies that capture carbon dioxide (CO2) emissions from fuel combustion, industrial processes or directly from the air, to either store the CO2 (typically deep underground) or use the CO2 in industry.

Budget 2022 proposes to introduce an investment tax credit for CCUS (the CCUS Tax Credit). The CCUS Tax Credit would be refundable and available to businesses that incur eligible expenses starting on January 1, 2022.

Eligible Expenses

The CCUS Tax Credit would be available in respect of the cost of purchasing and installing eligible equipment (see “Eligible Equipment” section) used in an eligible CCUS project (see “Eligible Project” section), so long as the equipment was part of a project where the captured CO2 was used for an eligible use (see “Eligible CO2 Uses” section).

The project would also be subject to the required validation and verification process (see “Validation and Verification” section), would need to meet the storage requirements (see “Storage Requirements” section), and a climate-related financial disclosure report would need to be produced (see “Climate Risk Disclosure” section), in order for the CCUS Tax Credit to be claimed.

Credit Rates

The following rates would apply to eligible expenses incurred after 2021 through 2030:

- 60 per cent for eligible capture equipment used in a direct air capture project;

- 50 per cent for all other eligible capture equipment; and

- 37.5 per cent for eligible transportation, storage, and use equipment.

Eligible expenses that are incurred after 2030 through 2040 would be subject to the lower rates set out below:

- 30 per cent for eligible capture equipment used in a direct air capture project;

- 25 per cent for all other eligible capture equipment; and

- 18.75 per cent for eligible transportation, storage, and use equipment.

Eligible Equipment

Equipment that will be used solely to capture, transport, store, or use CO2 as part of an eligible CCUS project would be considered eligible equipment.

Investors in CCUS technologies would be able to claim the CCUS Tax Credit on eligible expenses in respect of the tax year in which the expenses are incurred, regardless of when the equipment becomes available for use. The CCUS Tax Credit would not be available for equipment in respect of which a previous owner has received the CCUS Tax Credit.

CCUS equipment would be included in two new capital cost allowance classes:

- 8-per-cent capital cost allowance rate on a declining-balance basis:

- capture equipment: equipment that solely captures CO2, including required processing and compression equipment (not including dual purpose equipment that supports CCUS and production);

- transportation equipment: pipelines or dedicated vehicles for transporting CO2;

- storage equipment: injection and storage equipment; and

- 20-per-cent capital cost allowance rate on a declining-balance basis:

- use equipment: equipment required for using CO2 in an eligible use.

These classes would also include the cost of:

- converting existing equipment for use in a CCUS project or refurbishing eligible equipment;

- equipment for monitoring and tracking CO2; and

- buildings or other structures that solely support a CCUS project.

These classes would be eligible for enhanced first year depreciation under the Accelerated Investment Incentive.

Equipment that is required for hydrogen production, natural gas processing, acid gas injection or that does not support CCUS would be ineligible.

Other expenses that may be related to a CCUS project would not be eligible for the CCUS Tax Credit, including feasibility studies, front end engineering design studies and operating expenses.

Exploration and development expenses associated with storing CO2 would also not be eligible for the CCUS Tax Credit. Nonetheless, in recognition of these expenses that relate to a CCUS project, two new capital cost allowance classes would be established for intangible exploration expenses and development expenses associated with storing CO2. These would be depreciable at rates of 100 per cent and 30 per cent respectively, on a declining-balance basis.

Eligible Project

An eligible CCUS project is a new project that captures CO2 that would otherwise be released into the atmosphere, or captures CO2 from the ambient air, prepares the captured CO2 for compression, compresses and transports the captured CO2, and stores or uses the captured CO2. Direct air capture projects, which are eligible for a higher credit rate on capture equipment, must capture CO2 directly from the ambient air. Taxpayers may be involved in one or more of the activities that constitute a CCUS project.

Equipment will only be eligible if it is part of a CCUS project and is put in use in Canada. CO2 must be captured in Canada but can be stored or used outside of Canada (provided the project satisfies the requirements discussed under the “Eligible CO2 Uses” section and is located in a jurisdiction that satisfies the requirements discussed under the “Storage Requirements” section).

CCUS projects would not be eligible where emissions reductions are necessary in order to achieve compliance with the Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations and the Regulations Limiting Carbon Dioxide Emissions from Natural Gas-fired Generation of Electricity.

Eligible CO2 Uses

The extent to which the CCUS Tax Credit is available for eligible equipment would depend on the end use of the CO2 being captured. Eligible uses would initially include dedicated geological storage and storage in concrete. Enhanced oil recovery would not be eligible.

Where eligible equipment is part of a project that plans to store CO2 through both eligible and ineligible uses, the CCUS Tax Credit would be reduced by the portion of CO2 expected to go to ineligible uses over the life of the project, as set out in initial project plans.

Once the project begins operating, taxpayers would be required to track and account for the amount of CO2 being captured, and the portions that end up going to eligible and ineligible uses. To the extent that the portion of CO2 going to an ineligible use exceeds what was set out in the initial project plans, taxpayers may be required to repay CCUS Tax Credit amounts that were previously paid.

Recovery of the CCUS Tax Credit

Once projects begin to capture CO2, they would be assessed at five-year intervals, to a maximum of 20 years, to determine if a recovery of the CCUS Tax Credit is warranted. Assessments would be based on the total amount of CO2 going to an ineligible use over the five-year period being assessed.

A recovery would be calculated if the portion of CO2 going to an ineligible use is more than five percentage points higher than set out in the initial project plans (i.e., the basis on which the CCUS Tax Credit was paid).

Specific design features of the recovery will be released at a later date.

Storage Requirements

In the case of qualifying dedicated geological storage, the CCUS Tax Credit will only be available to projects in jurisdictions where there are sufficient regulations to ensure that CO2 is permanently stored as determined by Environment and Climate Change Canada. Initially, the CCUS Tax Credit will only be available to CCUS projects that store the CO2 in Saskatchewan or Alberta. All projects will be subject to relevant federal, provincial and territorial regulations.

For storage in concrete to be considered an eligible use, the process for using and storing CO2 in concrete must be approved by Environment and Climate Change Canada and demonstrate that at least 60 per cent of the CO2 that is injected into the concrete is mineralized and locked into the concrete produced. The CCUS Tax Credit would be available in all jurisdictions so long as the process for storing CO2 in this manner is approved.

Validation and Verification

Projects that expect to have eligible expenses of $100 million or greater over the life of the project based on project plans would generally be required to undergo an initial project tax assessment. The tax assessment would identify the expenses that are eligible for the CCUS Tax Credit, and the tax credit rate that is expected to apply, based on initial project design. Projects could also choose to undergo an initial project tax assessment on a voluntary basis.

Prior to claiming CCUS Tax Credit amounts, eligible expenses would need to be verified by Natural Resources Canada. Verification would occur as soon as possible after the end of the taxpayer’s tax year, and in advance of filing its tax return, in order for the refund to be processed upon filing. Administrative details of this process would be provided at a later date.

Knowledge Sharing

CCUS projects that expect to have eligible expenses of $250 million or greater over the life of the project based on project plans would be required to contribute to public knowledge sharing in Canada in order to be eligible for the CCUS Tax Credit.

Details on this process and information to be shared would be provided at a later date.

Climate Risk Disclosure

In order to be eligible for the CCUS Tax Credit, taxpayers would be required to produce a climate-related financial disclosure report highlighting how their corporate governance, strategies, policies and practices will help manage climate-related risks and opportunities and contribute to achieving Canada’s commitments under the Paris Agreement and goal of net zero by 2050.

Details on this process and information to be shared would be provided at a later date.

Coming into Force

This measure would apply to eligible expenses incurred after 2021 and before 2041.

Strategic Environmental Assessment Statement

This measure is expected to have a positive environmental impact by encouraging investment in technologies that would reduce emissions of greenhouse gases. This would help advance the government's Federal Sustainable Development Strategy target to reduce greenhouse gas emissions by 40 to 45 per cent below 2005 levels by 2030, and achieve net-zero greenhouse gas emissions by 2050.

Clean Technology Tax Incentives – Air-Source Heat Pumps

An air-source heat pump is a device that uses electrical energy to provide interior space heating or cooling by exchanging heat with the outside air. As a means to displace the use of fossil fuels for heating, or of providing a more efficient means of heating with electricity (e.g., compared to electric baseboard heaters), air-source heat pumps can play a role in reducing emissions of greenhouse gases and air pollutants associated with heating buildings in Canada.

Capital Cost Allowance for Clean Energy Equipment

Under the Income Tax Act, taxpayers are entitled to deduct a portion of the capital cost of a depreciable property, as capital cost allowance (CCA), in computing their income for each taxation year. With some exceptions, CCA deductions are claimed by class of property and are calculated on a declining-balance basis.

Under the CCA regime, Classes 43.1 and 43.2 of Schedule II to the Income Tax Regulations provide accelerated CCA rates (30 per cent and 50 per cent, respectively) for investments in specified clean energy generation and energy conservation equipment. Property in these classes that is acquired after November 20, 2018 and that becomes available for use before 2024 is eligible for immediate expensing while property that becomes available for use after 2023 and before 2028 is subject to a phase-out from these immediate expensing rules.

In addition, if the majority of the tangible property in a project is eligible for inclusion in Class 43.1 or 43.2, certain intangible project start-up expenses (e.g., engineering and design work, and feasibility studies) are treated as Canadian Renewable and Conservation Expenses. These expenses can generally be deducted in full in the year incurred, carried forward indefinitely for use in future years, or transferred to investors using flow-through shares.

Budget 2022 proposes to expand eligibility under Classes 43.1 and 43.2 to include air-source heat pumps primarily used for space or water heating. Eligible property would include equipment that is part of an air-source heat pump system that transfers heat from the outside air, including refrigerant piping, energy conversion equipment, thermal energy storage equipment, control equipment and equipment designed to enable the system to interface with other heating and cooling equipment. Eligible property would not include:

- buildings or parts of buildings;

- energy equipment that backs up an air-source heat pump system; or

- equipment that distributes heated or cooled air or water within a building.

This expansion of Classes 43.1 and 43.2 would apply in respect of property that is acquired and that becomes available for use on or after Budget Day, where it has not been used or acquired for use for any purpose before Budget Day.

Rate Reduction for Zero-Emission Technology Manufacturers

Budget 2021 proposed a temporary measure to reduce corporate income tax rates for qualifying zero-emission technology manufacturers. Specifically, taxpayers would be able to apply reduced tax rates on eligible zero-emission technology manufacturing and processing income of:

- 7.5 per cent, where that income would otherwise be taxed at the 15-per-cent general corporate tax rate; and

- 4.5 per cent, where that income would otherwise be taxed at the 9-per-cent small business tax rate.

The reduced tax rates would apply to taxation years that begin after 2021, subject to a phase-out starting in taxation years that begin in 2029, and would be fully phased out for taxation years that begin after 2031.

Budget 2022 proposes to include the manufacturing of air-source heat pumps used for space or water heating as an eligible zero-emission technology manufacturing or processing activity. Eligible activities would include the manufacturing of components or sub-assemblies only if such equipment is purpose-built or designed exclusively to form an integral part of an air-source heat pump.

Strategic Environmental Assessment Statement

These measures are expected to have a positive environmental impact by encouraging investment in a technology that would reduce emissions of greenhouse gases and air pollutants. These measures would also contribute to the Federal Sustainable Development Strategy goal of growing the clean technology industry in Canada.

Critical Mineral Exploration Tax Credit

Flow-through share agreements allow corporations to renounce or "flow through" specified expenses to investors, who can deduct the expenses in calculating their taxable income.

The Mineral Exploration Tax Credit (METC) provides an additional income tax benefit for individuals who invest in mining flow-through shares, which augments the tax benefits associated with the deductions that are flowed through. The METC is equal to 15 per cent of specified mineral exploration expenses incurred in Canada and renounced to flow-through share investors. The METC facilitates the raising of equity to fund exploration by enabling companies to issue shares at a premium.

Budget 2022 proposes to introduce a new 30-per-cent Critical Mineral Exploration Tax Credit (CMETC) for specified minerals. The specified minerals that would be eligible for the CMETC are: copper, nickel, lithium, cobalt, graphite, rare earth elements, scandium, titanium, gallium, vanadium, tellurium, magnesium, zinc, platinum group metals and uranium. These minerals are used in the production of batteries and permanent magnets, both of which are used in zero-emission vehicles, or are necessary in the production and processing of advanced materials, clean technology, or semi-conductors.

Eligible expenditures would not benefit from both the proposed CMETC and the METC. The administration of the CMETC would generally follow the rules in place for the METC. However, the CMETC would only apply in relation to exploration expenditures for the minerals listed above.

In order for exploration expenses to be eligible for the CMETC, a qualified person (as defined under National Instrument 43-101 published by the Canadian Securities Administrators as of Budget Day) would need to certify that the expenditures that will be renounced will be incurred as part of an exploration project that targets the specified minerals. If the qualified person cannot demonstrate that there is a reasonable expectation that the minerals targeted by the exploration are primarily specified minerals, then the related exploration expenditures would not be eligible for the CMETC. Any credit provided for ineligible expenditures would be recovered from the flow-through share investor that received the credit.

The CMETC would apply to expenditures renounced under eligible flow-through share agreements entered into after Budget Day and on or before March 31, 2027.

Strategic Environmental Assessment Statement

Mineral exploration, as well as new mining and related processing activities that could follow from successful exploration efforts, can be associated with a variety of environmental impacts to soil, water and air and, as a result, could have an impact on the targets and actions in the Federal Sustainable Development Strategy. All such activities, however, are subject to applicable federal and provincial environmental regulations, including project-specific environmental assessments.

Flow-Through Shares for Oil, Gas, and Coal Activities

Flow-through share agreements allow corporations to renounce or “flow through” both Canadian exploration expenses and Canadian development expenses to investors, who can deduct the expenses in calculating their taxable income (at a 100-per-cent or 30-per-cent rate on a declining-balance basis, respectively). This facilitates the raising of equity to fund eligible exploration and development by enabling companies to issue shares at a premium.

Budget 2022 proposes to eliminate the flow-through share regime for oil, gas, and coal activities by no longer allowing oil, gas and coal exploration or development expenditures to be renounced to a flow-through share investor.

This change would apply to expenditures renounced under flow-through share agreements entered into after March 31, 2023.

Strategic Environmental Assessment Statement

Oil, gas and coal exploration and development is associated with environmental impacts, including the release of air and water contaminants, the emission of greenhouse gases and the disturbance of natural habitat and wildlife. The tax treatment of oil, gas and coal exploration and development costs is only one of many factors that influence investment decisions, but to the extent that the revised treatment impacts investment decisions, this measure could reduce environmental impacts. This measure supports Canada’s international commitments to phase out or rationalize inefficient fossil fuel subsidies, and indirectly supports the targets and actions in the Federal Sustainable Development Strategy, including those related to reducing emissions of greenhouse gases.

Small Business Deduction

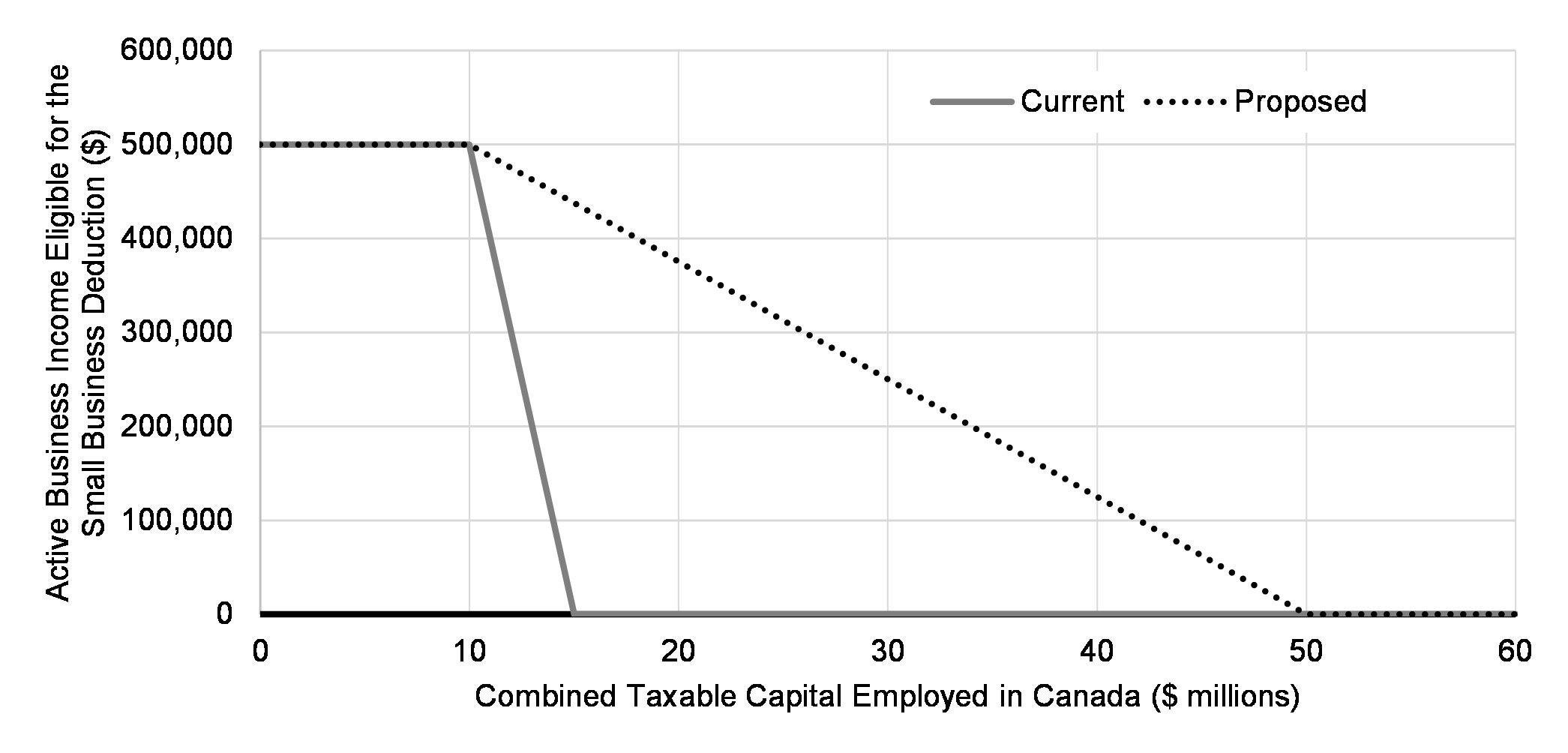

Small businesses may benefit from a reduced corporate income tax rate of 9 per cent – a preference relative to the general corporate income tax rate of 15 per cent. This rate reduction is provided through the “small business deduction” and applies on up to $500,000 per year of qualifying active business income (i.e., the “business limit”) of a Canadian-controlled private corporation (CCPC). There is a requirement to allocate the business limit among associated CCPCs.

In order to target the preferential tax rate to small businesses, the business limit is reduced on a straight-line basis when:

- the combined taxable capital employed in Canada of the CCPC and its associated corporations is between $10 million and $15 million; or

- the combined “adjusted aggregate investment income” of the CCPC and its associated corporations is between $50,000 and $150,000.

The business limit is the lesser of the two amounts determined by these business limit reductions.

The reduction in the business limit can significantly increase a CCPC’s marginal tax rate as the combined taxable capital of the CCPC and its associated corporations increases from $10 million to $15 million.

In order to facilitate small business growth, Budget 2022 proposes to extend the range over which the business limit is reduced based on the combined taxable capital employed in Canada of the CCPC and its associated corporations. The new range would be $10 million to $50 million (see Chart 1 below). This change would allow more medium-sized CCPCs to benefit from the small business deduction. Furthermore, it would increase the amount of qualifying active business income that can be eligible for the small business deduction. For example, under the new rules:

- a CCPC with $30 million in taxable capital would have up to $250,000 of active business income eligible for the small business deduction, compared to $0 under current rules; and

- a CCPC with $12 million in taxable capital would have up to $475,000 of active business income eligible for the small business deduction, compared to up to $300,000 under current rules.

This measure would apply to taxation years that begin on or after Budget Day.

Current and Proposed Reductions of the Business Limit Based on Taxable Capital

International Financial Reporting Standards for Insurance Contracts (IFRS 17)

On January 1, 2023, IFRS 17, the new accounting standards for insurance contracts, will substantially change financial reporting for all Canadian insurers. In broad terms, generally accepted accounting principles typically serve as the basis for computing a corporation’s income for tax purposes. With the introduction of a new IFRS 17 reserve, known as the contract service margin (CSM), a large portion of the profits earned on underwritten insurance contracts will be deferred and gradually released into income over the estimated life of the insurance contracts. The CSM arises primarily for insurance contracts greater than one year. If deductible for tax purposes, the CSM would lead to an undue income tax deferral.

On May 28 2021, the Government issued a news release (May 2021 Release) to announce that it intends to generally support the use of IFRS 17 accounting for income tax purposes. However, adjustments would be made to recognize underwriting profits as taxable income so that it remains aligned with economic activities. More specifically, the CSM would not be considered a deductible reserve for tax purposes. The Government’s overall objective is to recognize income for tax purposes when the key economic activities occur.

Following extensive consultations with the insurance industry, Budget 2022 proposes to maintain the policy intent described in the May 2021 Release, but proposes to make certain relieving modifications, as well as consequential changes to protect the minimum tax base for life insurers.

Life Insurance

Segregated Funds

Segregated funds are life insurance policies as a matter of law because they are in effect a pooled investment product with a death benefit or living benefit guarantees for the policyholder. The income-earning activities for segregated funds are primarily investment management activities rendered to policyholders after inception of the contract. Currently, fee income on segregated funds is recognized as earned each year, and expenses are deducted when incurred. Budget 2022 proposes that the CSM associated with segregated funds be fully deductible on the basis that this income will continue to be recognized as the relevant economic activities occur.

Ten per cent of CSM Deductible

Consistent with the May 2021 Release, the CSM would not be deductible for tax purposes (with the exception of the CSM for segregated funds). However, in recognition of future so-called non-attributable expenses that are included in deductible reserves at the inception of the contract under current rules, Budget 2022 proposes that ten per cent of the CSM associated with life insurance contracts (other than segregated funds) be deductible for tax purposes. The ten-per-cent deductible portion of the CSM will be included in income for tax purposes when the non-attributable expenses are incurred in the future.

Transition

Budget 2022 proposes transitional rules in the following circumstances:

- A transition period of five years to smooth out the tax impact of converting insurance reserves from IFRS 4 to IFRS 17, including the non-deductible portion of the CSM on transition;

- A transition period of five years for the mark-to-market gains or losses on certain fixed-income assets on the effective date, since insurers will also be required to adopt IFRS 9 effective January 1, 2023; and

- Certain reserves will be reclassified from insurance contracts under IFRS 4 to investment contracts under IFRS 17. A deduction for the investment contract amount will be allowed on transition since the premiums for these contracts have been included in income for accounting and tax purposes.

Adjustments to Maintain Minimum Tax

The Part VI federal tax is a capital-based tax on large financial institutions, which ensures that they pay a minimum amount of tax to the federal government each year. The Part VI tax base is partly comprised of surplus which includes after-tax retained earnings.

The Part VI tax base for life insurers will decrease as a consequence of IFRS 17. This is attributable primarily to the increase in total reserves, including the CSM, and the reclassification of gains and losses on certain fixed income assets from retained earnings to accumulated other comprehensive income (AOCI).

Deferred tax assets are income taxes anticipated to be recovered in future periods when temporary differences between income for accounting and tax purposes reverse. Deferred tax assets often arise because insurance contract liabilities recognized for accounting purposes exceed the amount of insurance reserves claimed for tax purposes. Deferred tax assets are currently deducted from the Part VI minimum tax base.

In order to avoid the erosion of the Part VI tax base due to IFRS 17, Budget 2022 proposes to include the non-deductible CSM and AOCI in the tax base. In addition, deferred tax assets will not be deducted from the minimum tax base for life insurers.

Mortgage and Title Insurance

Consistent with the changes for long-term insurance contracts, Budget 2022 proposes a deduction of ten per cent of the CSM for mortgage and title insurance contracts. The deductible portion of the CSM will be included in income when the non-attributable expenses are incurred in the future in the same manner described above in the context of life insurers.

Budget 2022 also proposes a transition period of five years to smooth out the tax impact of the non-deductible portion of the CSM.

Property and Casualty (P&C) Insurance

Budget 2022 proposes to maintain the current tax treatment for P&C insurance contracts (other than title and mortgage insurance contracts) on the basis that the CSM reserve is largely insignificant for these short-term contracts that are typically not longer than a year.

Budget 2022 also proposes a transition period of five years to smooth out the tax impact of converting P&C insurance reserves from IFRS 4 to IFRS 17.

Coming into Force

Budget 2022 proposes that all of these measures, including the transitional rules discussed above, would apply as of January 1, 2023.

Hedging and Short Selling by Canadian Financial Institutions

The Income Tax Act generally permits a Canadian corporation, in computing its taxable income, to claim a deduction (the “dividend received deduction”) for the amount of a taxable dividend received on a share (a “Canadian share”) that it holds in another Canadian corporation. This dividend received deduction is intended to limit the imposition of multiple levels of corporate taxation on earnings distributed from one corporation to another. There are exceptions from the availability of this deduction, including under certain circumstances where the economic exposure (that is, the risk of loss or opportunity for gain or profit) with respect to the share accrues to someone other than the taxpayer. In addition, under the securities lending arrangement rules, registered securities dealers are allowed to claim a deduction for two-thirds of a dividend compensation payment. This is an exception to the general rule whereby dividend compensation payments are not deductible.

The Government is concerned that certain taxpayers in financial institution groups are engaging in aggressive tax planning arrangements whereby a dividend received deduction is claimed in circumstances giving rise to an unintended tax benefit. For example, where a Canadian bank owns Canadian shares, a registered securities dealer in the Canadian bank’s corporate group will borrow identical shares under a securities lending arrangement and sell the borrowed shares short. The corporate group thereby eliminates its economic exposure to the Canadian shares. The registered securities dealer will generally hold the short position during the entire period that the Canadian bank owns the Canadian shares.

In this scenario, the Canadian bank claims a dividend received deduction for the dividends received on the Canadian shares, resulting in tax-free dividend income. The registered securities dealer deducts two-thirds of the amount of the dividend compensation payments made to the lender that reflect the same dividends paid on the shares. In sum, the Canadian banking group generates an artificial tax deduction under the arrangement equal to two-thirds of the amount of dividend compensation payments made to the lender over the term of the arrangement.

A registered securities dealer could carry out a similar transaction on its own with respect to Canadian shares owned by it. That is, it could borrow and sell short identical shares, claiming both the dividend received deduction for dividends received on its shares and a two-thirds deduction for dividend compensation payments made to the lender.

Although these arrangements can be challenged by the Government based on existing rules in the Income Tax Act, these challenges could be both time-consuming and costly. Accordingly, the Government is introducing specific legislation to prevent taxpayers from realizing artificial tax deductions through the use of these hedging and short selling arrangements.

Budget 2022 proposes amendments to the Income Tax Act to

- deny the dividend received deduction for dividends received by a taxpayer on Canadian shares if a registered securities dealer that does not deal at arm’s length with the taxpayer enters into transactions that hedge the taxpayer's economic exposure to the Canadian shares, where the registered securities dealer knew or ought to have known that these transactions would have such an effect;

- deny the dividend received deduction for dividends received by a registered securities dealer on Canadian shares that it holds if it eliminates all or substantially all of its economic exposure to the Canadian shares by entering into certain hedging transactions; and

- provide that in the above situations, the registered securities dealer will be permitted to claim a full, rather than a two-thirds, deduction for a dividend compensation payment it makes under a securities lending arrangement entered into in connection with the above hedging transactions.