Archived -

Annex 6:

Tax Measures - Supplementary Information

Table of Contents

- Overview

- Personal Income Tax Measures

- Disability Tax Credit

- Canada Workers Benefit

- Northern Residents Deductions

- Postdoctoral Fellowship Income

- Tax Treatment of COVID-19 Benefit Amounts

- Fixing Contribution Errors in Defined Contribution Pension Plans

- Taxes Applicable to Registered Investments

- Registration and Revocation Rules Applicable to Charities

- Electronic Filing and Certification of Tax and Information Returns

- Business Income Tax Measures

- International Tax Measures

- Sales and Excise Tax Measures

- Customs Tariff and Tax Measures

- Previously Announced Measures

- Notice of Ways and Means Motion to amend the Income Tax Act and Other Related Legislation

- Notice of Ways and Means Motion to amend the Excise Tax Act

- Notice of Ways and Means Motion to amend the Excise Act, 2001 and Other Legislation

- Notice of Ways and Means Motion to introduce an Act to implement a Tax on Select Luxury Goods

- Draft Amendments to Various GST/HST Regulations

Overview

This annex provides detailed information on tax measures proposed in the Budget.

Table 1 lists these measures and provides estimates of their fiscal impact.

The annex also provides Notices of Ways and Means Motions to amend the Income Tax Act, the Excise Tax Act, the Excise Act, 2001 and other legislation and draft amendments to various regulations.

In this annex, references to "Budget Day" are to be read as references to the day on which this Budget is presented.

| 2020–2021 | 2021–2022 | 2022–2023 | 2023–2024 | 2024–2025 | 2025–2026 | Total | |

|---|---|---|---|---|---|---|---|

| Personal Income Tax | |||||||

Disability Tax Credit |

- | 19 | 84 | 90 | 91 | 92 | 376 |

Canada Workers Benefit |

460 | 1,795 | 1,670 | 1,665 | 1,665 | 1,675 | 8,930 |

Northern Residents Deductions |

- | 26 | 26 | 26 | 26 | 26 | 128 |

Postdoctoral Fellowship Income |

- | - | - | - | 1 | 1 | 2 |

Tax Treatment of COVID-19 Benefit Amounts |

- | - | - | - | - | - | - |

Fixing Contribution Errors in Defined Contribution Pension Plans |

- | 1 | - | - | - | - | 1 |

Taxes Applicable to Registered Investments |

2 | 6 | 6 | 6 | 6 | 6 | 32 |

Registration and Revocation Rules Applicable to Charities |

- | - | - | - | - | - | - |

Electronic Filing and Certification of Tax and Information Returns |

- | - | - | - | - | - | - |

| Business Income Tax Measures | |||||||

Emergency Business Supports |

|||||||

Canada Emergency Wage Subsidy |

- | 10,140 | - | - | - | - | 10,140 |

Canada Emergency Rent Subsidy and Lockdown Support |

- | 1,920 | - | - | - | - | 1,920 |

Canada Recovery Hiring Program |

- | 595 | - | - | - | - | 595 |

Immediate Expensing |

- | 615 | 1,055 | 985 | -145 | -265 | 2,245 |

Rate Reduction for Zero-Emission Technology Manufacturers |

- | 1 | 10 | 10 | 10 | 15 | 46 |

Capital Cost Allowance for Clean Energy Equipment |

- | 14 | 22 | 30 | 34 | 42 | 142 |

Film or Video Production Tax Credits |

- | - | 20 | 25 | 15 | 5 | 65 |

Mandatory Disclosure Rules |

- | - | - | - | - | - | - |

Avoidance of Tax Debts |

- | - | - | - | - | - | - |

Audit Authorities |

- | - | - | - | - | - | - |

| International Tax Measures | |||||||

Base Erosion and Profit Shifting |

|||||||

Interest Deductibility Limits3 |

- | -26 | -398 | -1,329 | -1,754 | -1,809 | -5,316 |

Hybrid Mismatch Arrangements |

- | - | -130 | -205 | -215 | -225 | -775 |

| Sales and Excise Tax Measures | |||||||

Application of the GST/HST to E-commerce4 |

- | - | - | - | - | - | - |

Input Tax Credit Information Requirements |

- | - | - | - | - | - | - |

GST New Housing Rebate Conditions |

- | - | - | - | - | - | - |

Rebate of Excise Tax for Goods Purchased by Provinces |

- | - | - | - | - | - | - |

Excise Duty on Tobacco |

- | -415 | -440 | -435 | -425 | -420 | -2,135 |

Tax on Select Luxury Goods |

- | -34 | -140 | -140 | -145 | -145 | -604 |

| Customs Tariff and Tax Measures | |||||||

Duty and Tax Collection on Imported Goods |

- | -88 | -150 | -150 | -150 | -150 | -688 |

| Other Tax Measures5 | |||||||

Digital Services Tax |

- | -200 | -700 | -800 | -800 | -900 | -3,400 |

Less: Amounts Provisioned in the Fiscal Framework |

- | 200 | 700 | 800 | 800 | 900 | 3,400 |

Administrative Costs |

- | 17 | 7 | 4 | 4 | 4 | 35 |

Tax on Unproductive Use of Canadian Housing by Foreign Non-resident Owners |

- | - | -200 | -170 | -165 | -165 | -700 |

| 1 A "–" indicates a nil amount, a small amount (less than $500,000) or an amount that cannot be determined in respect of a measure that is intended to protect the tax base. 2 Totals may not add due to rounding. 3 An important proportion of the overall projected revenue impact (75%) relates to the expectation that the measure will help in preventing the shifting of debt into Canada. 4 The projected revenues from the GST/HST e-commerce proposals are set out in the 2020 Fall Economic Statement and have already been provisioned in the fiscal framework. This budget describes revisions to those proposals and the associated draft legislation in the attached Notice of Ways and Means Motion, following consultations with stakeholders. 5 Details of these proposed tax measures are presented in Annex 7. |

|||||||

Personal Income Tax Measures

Disability Tax Credit

The Disability Tax Credit (DTC) is a non-refundable tax credit that is intended to recognize the impact of non-itemizable disability-related costs on the ability to pay tax. For 2021, the value of the credit is $1,299.

To be eligible for the DTC, an individual must have a certificate confirming that they have a severe and prolonged impairment in physical or mental functions. The effects of the impairment must be such that, even with appropriate devices, medication and therapy, the individual is blind or is:

- markedly restricted in their ability to perform a basic activity of daily living, or would be so restricted were it not for certain therapy (commonly referred to as "extensive life-sustaining therapy"); or

- significantly restricted in their ability to perform more than one basic activity of daily living where the cumulative effect of those restrictions is comparable to being markedly restricted in a basic activity of daily living.

For these purposes, the Income Tax Act recognizes the following basic activities of daily living: walking; feeding or dressing oneself; mental functions necessary for everyday life; speaking; hearing; eliminating bodily waste; and, for the purposes of the "significantly restricted" test noted above, includes seeing.

A valid DTC certificate is also a requirement for accessing certain other tax-related measures, including Registered Disability Savings Plans, the Child Disability Benefit and the disability supplement to the Canada Workers Benefit.

Mental Functions Necessary for Everyday Life

Under current rules, mental functions necessary for everyday life include:

- memory;

- problem-solving, goal-setting and judgement (taken together); and

- adaptive functioning.

To ensure that the eligibility criteria for the DTC better articulate the range of mental functions necessary for everyday life, Budget 2021 proposes that, for the purposes of the DTC, mental functions necessary for everyday life include:

- attention;

- concentration;

- memory;

- judgement;

- perception of reality;

- problem-solving;

- goal-setting;

- regulation of behaviour and emotions;

- verbal and non-verbal comprehension; and

- adaptive functioning.

Life-Sustaining Therapy

Under current rules, extensive life-sustaining therapy is therapy that:

- is essential to sustain a vital function;

- is required to be administered at least three times each week for a total duration averaging not less than 14 hours a week; and

- cannot reasonably be expected to be of significant benefit to an individual who does not have a severe and prolonged impairment in physical or mental functions.

These requirements are intended to allow individuals to qualify for the DTC where they are undergoing therapies that have a significant impact on everyday living, comparable to the impact of being directly restricted in basic activities of daily living.

Under the current rules, time spent on the following activities may be included in determining time spent receiving therapy:

- activities that require the individual to take time away from normal, everyday activities in order to receive the therapy;

- where the therapy requires a regular dosage of medication that needs to be adjusted on a daily basis, activities directly involved in determining the appropriate dosage; and

- in the case of a child who is unable to perform the activities related to the therapy as a result of their age, the time spent by the child's primary caregivers to perform and supervise these activities for the child.

Time spent on the following activities cannot be included in determining time spent receiving therapy: activities related to dietary or exercise restrictions or regimes (even if those restrictions or regimes are a factor in determining the daily dosage of medication), travel time, medical appointments, shopping for medication and recuperation after therapy.

These rules can result in important components of therapy being excluded from the calculation of therapy time. For example, the determination of the appropriate dosage of medicine for treating diabetes in individuals who are insulin-dependent may require precise recording of dietary intake. In a similar fashion, therapy that involves the consumption of medical food or medical formula (such as for treating certain inherited metabolic conditions) may require, as part of the treatment, the precise recording of the dietary intake of particular compounds.

To better recognize these aspects of therapy for the purposes of calculating time spent on therapy, while ensuring that everyday activities (such as normal management of a healthy diet) and discretionary activities are not taken into account for that purpose, Budget 2021 proposes to:

- allow reasonable time spent determining dietary intake and/or physical exertion to be considered part of the therapy, where this information is essential to, and is undertaken for the purpose of, determining the dosage of medication that must be adjusted on a daily basis;

- clarify that the exclusion of time for medical appointments does not apply to appointments to receive therapy or to determine the daily dosage of medication;

- provide that the exclusion of time for recuperation after therapy does not apply to medically required recuperation; and

- in the case of therapy that requires the daily consumption of a medical food or medical formula to limit intake of a particular compound to levels required for the proper development or functioning of the body, allow reasonable time spent on activities that are directly related to the determination of the amount of the compound that can be safely consumed to be considered part of the therapy.

Budget 2021 also proposes that, where an individual is incapable of performing their therapy on their own due to the impacts of their disability, the time reasonably required by another person to assist the individual in performing and supervising the therapy would be allowed to be counted.

Budget 2021 further proposes that the requirement that therapy be administered at least three times each week be reduced to two times each week. The requirement that therapy be of a duration averaging not less than 14 hours a week would remain unchanged.

These proposed changes would apply to the 2021 and subsequent taxation years, in respect of DTC certificates filed with the Minister of National Revenue on or after Royal Assent.

Canada Workers Benefit

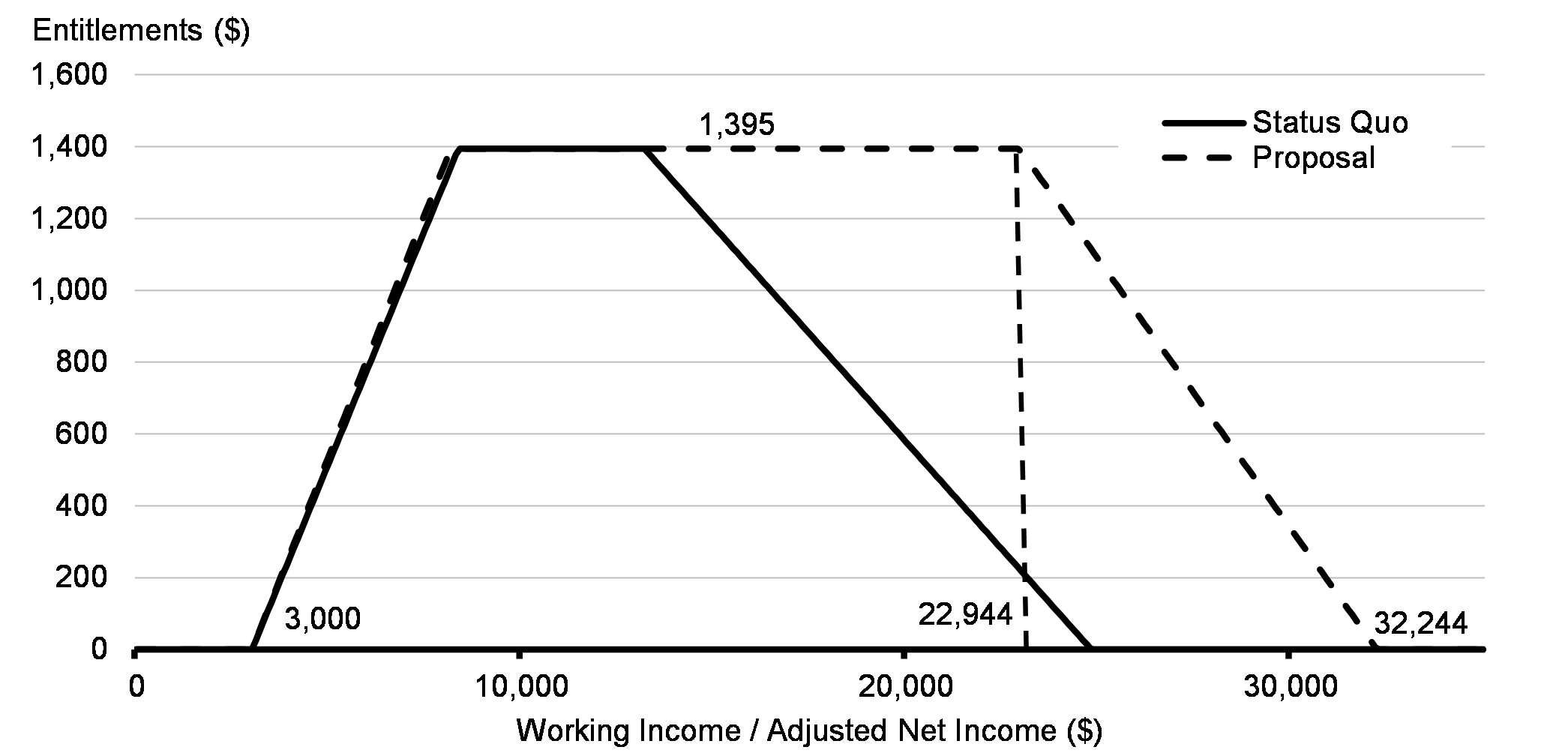

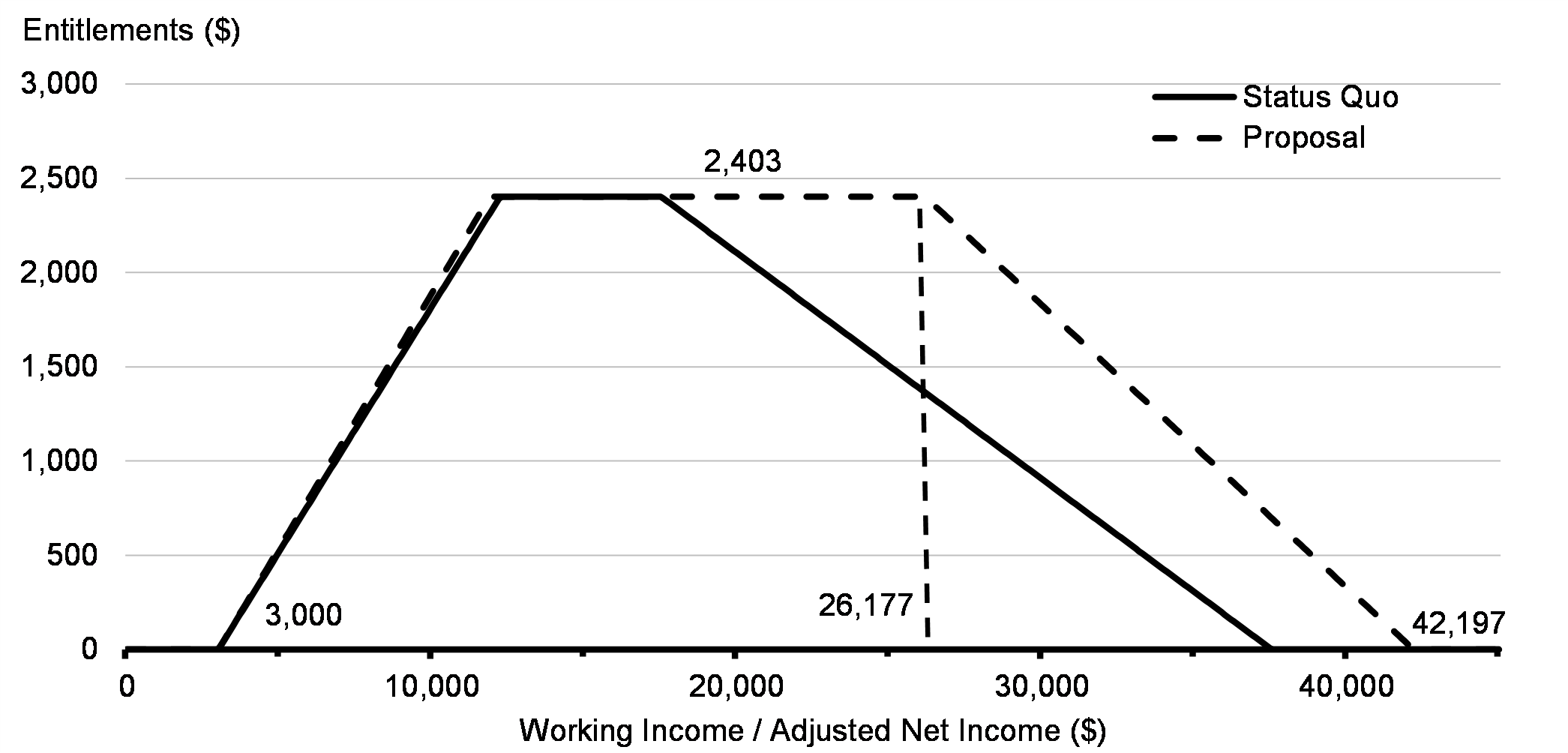

The Canada Workers Benefit (CWB) is a non-taxable refundable tax credit that supplements the earnings of low- and modest-income workers and improves their work incentives. Under current law, in 2021, the CWB grows by 26 cents for every dollar of "working income" (generally employment and business income) in excess of $3,000, up to a maximum entitlement of $1,395 for single individuals without dependants, or $2,403 for families (couples and single parents). The benefit is then reduced by 12 per cent of adjusted net income in excess of $13,194 for single individuals without dependants, or $17,522 for families.

Budget 2021 proposes to enhance the CWB starting in 2021. This enhancement would increase:

- the phase-in rate from 26 per cent to 27 per cent for single individuals without dependants as well as families;

- the phase-out thresholds from $13,194 to $22,944 for single individuals without dependants and from $17,522 to $26,177 for families; and

- the phase-out rate from 12 per cent to 15 per cent.

Chart 1 shows the proposed enhancement of the CWB in 2021 for a single individual without dependants and Chart 2 shows the same for families.

Enhanced Canada Workers Benefit—2021

(Single Individuals without Dependants)

Enhanced Canada Workers Benefit—2021

(Single Parents and Couples)

The CWB also features a supplement that is available to individuals who are eligible for the Disability Tax Credit. Corresponding changes would be made to the disability supplement's phase-in and reduction rates as well as the reduction threshold. Specifically, the supplement would phase out at a rate of 7.5 per cent for each individual in a couple where both individuals are in receipt of the supplement, and at a rate of 15 per cent otherwise. The reduction threshold would be increased to align with the point at which the base benefit is phased out completely (i.e., from $24,815 under current rules to $32,244, for single individuals without children, and from $37,548 under current rules to $42,197, for families).

To improve work incentives for secondary earners in a couple, Budget 2021 also proposes to introduce a "secondary earner exemption" to the CWB, a special rule for individuals with an eligible spouse. This would allow the spouse or common-law partner with the lower working income to exclude up to $14,000 of their working income in the computation of their adjusted net income, for the purpose of the CWB phase-out.

For example, in the absence of the secondary earner exemption, a dual-earner couple with adjusted family net income of $50,000 would receive no CWB in 2021. Suppose the secondary earner in this couple earned $20,000 of working income. With the introduction of the secondary earner exemption, the secondary earner's adjusted net income would be reduced by the lesser of their working income ($20,000) and $14,000. The resulting adjusted family net income of $36,000 would entitle the couple to a benefit of $930.

The government recognizes the efforts that provinces and territories have taken to improve work incentives for low- and modest-income individuals and families. To ensure that benefits are harmonized and that the CWB builds on these efforts, the government will continue to allow for province- or territory-specific changes to the design of the benefit through reconfiguration agreements, guided by the following principles:

- they build on actions taken by the province or territory to improve work incentives;

- they are cost-neutral to the federal government;

- they provide for a minimum benefit for all recipients of the benefit; and

- they preserve harmonization of the benefit with existing federal programs.

These measures would apply to the 2021 and subsequent taxation years. Indexation of amounts relating to the CWB would continue to apply after the 2021 taxation year, including the secondary earner exemption.

Northern Residents Deductions

Individuals who live in prescribed northern areas of Canada for at least six consecutive months beginning or ending in a taxation year may claim the Northern Residents Deductions in computing their taxable income for that year. These include both a residency component and a travel component.

The travel component allows a taxpayer receiving employer-provided travel benefits to deduct, in respect of a trip taken by the taxpayer or a member of the taxpayer's household, up to the least of:

- the amount of the employer-provided travel benefit received in respect of the trip;

- the total travel expenses paid for the trip; and

- the cost of the lowest return airfare to the nearest city designated in the Income Tax Regulations.

A taxpayer may deduct amounts in respect of travel for any number of trips made to obtain medical services not available locally and up to two trips per person per year for non-medical personal reasons. Residents of the prescribed Northern Zone may claim 100 per cent of the amounts described above, while residents of the prescribed Intermediate Zone may claim 50 per cent.

Budget 2021 proposes to expand access to the travel component of the Northern Residents Deductions. Under the new approach, subject to the other restrictions noted above, a taxpayer would have the option to claim, in respect of each of the taxpayer and each "eligible family member", up to:

- the amount of employer-provided travel benefits the taxpayer received in respect of travel by that individual; or

- a $1,200 standard amount that may be allocated across eligible trips taken by that individual.

After application of the 50-per-cent factor for residents of the Intermediate Zone, the second limit effectively becomes a $600 standard amount.

For these purposes, an eligible family member would be an individual living in the taxpayer's household who is:

- the spouse or common-law partner of the taxpayer;

- a child of the taxpayer (including a child of the taxpayer's spouse or common-law partner) under the age of 18; or

- another individual who is related to the taxpayer and who is wholly dependent on the taxpayer (and/or on the taxpayer's spouse or common-law partner) for support, and who is, except in the case of a parent or grandparent of the taxpayer, so dependent by reason of mental or physical infirmity.

If any taxpayer claims a deduction in respect of an employer-provided benefit for travel by the taxpayer or an eligible family member of the taxpayer in a year, no other taxpayer would be allowed to also claim all or part of the $1,200 standard amount in respect of travel by that first mentioned taxpayer or that eligible family member in that year. If any taxpayer claims all or part of the $1,200 standard amount in respect of travel by an individual, the maximum total amount that could be claimed in respect of that individual by all taxpayers would be $1,200.

Budget 2021 proposes that across all taxpayers in a given individual's household, a maximum of two trips taken by that individual would be allowed to be claimed in total for non-medical personal travel in a year. A taxpayer would continue to be able to claim any number of trips for medical purposes.

In light of the proposed changes described above, claims for a given trip would be limited to the least of:

- the amount of the employer-provided travel benefit received in respect of the trip or the amount allocated to that particular trip by the taxpayer out of the $1,200 standard amount;

- the total travel expenses paid for that trip; and

- the cost of the lowest return airfare to the nearest designated city.

Example:

- Kim and her husband Ryan live in Whitehorse and have a 10-year-old child. Kim has higher income than her husband and claims all travel expenses for the household.

- Kim receives a travel benefit of $1,500 from her employer in respect of each of two non-medical trips she took herself. She also receives a benefit of $1,000 in respect of a non-medical trip that Ryan took. Kim, Ryan, and their child also take one non-medical trip together, but do not receive any travel benefit for this trip.

- Kim may claim up to two trips for non-medical reasons. She decides to claim the two trips for which she received a travel benefit, as the amount of her travel benefit is greater than the $1,200 standard amount. Kim is eligible to claim up to the amount of her travel benefit of $1,500, subject to a limit of her actual expenses and the lowest return airfare, in respect of each trip.

- Kim decides not to claim the amount of the travel benefit she received for Ryan's travel, as the amount she received is less than the $1,200 standard amount. Instead, she allocates the $1,200 standard amount across the two trips that Ryan took, and is eligible to deduct the amount allocated to each trip, subject to the actual expenses and the lowest return airfare for each trip.

- Kim allocates the full $1,200 standard amount to the one trip her child took, and is eligible to deduct up to $1,200 for her child's travel, subject to the actual expenses and the lowest return airfare in respect of that trip.

This measure would apply to the 2021 and subsequent taxation years.

Strategic Environmental Assessment Statement

The proposal would effectively expand access to a rebate on the cost of travel, including carbon-intensive air travel. This may encourage additional travel among northern residents and result in associated greenhouse gas emissions. However, the rules of the deduction allow only two trips to be claimed in respect of any individual for non-medical personal reasons, and further limit the amount that may be claimed in respect of any trip. These rules constrain the circumstances in which an individual may receive a rebate in respect of additional travel taken in response to the proposal. Accordingly, any negative environmental impacts are expected to be negligible.

Postdoctoral Fellowship Income

For income tax purposes, postdoctoral fellows are generally not considered to be students. Thus, postdoctoral fellowship income generally does not qualify for the scholarship exemption from income tax. Although fully included in taxable income, and similar in nature to employment income, postdoctoral fellowship income does not currently qualify as "earned income" for the purpose of determining an individual's contribution limit for a registered retirement savings plan (RRSP).

Budget 2021 proposes to include postdoctoral fellowship income in "earned income" for RRSP purposes. This would provide postdoctoral fellows with additional RRSP room in order to make deductible RRSP contributions.

This measure would apply in respect of postdoctoral fellowship income received in the 2021 and subsequent taxation years. This measure would also apply in respect of postdoctoral fellowship income received in the 2011 to 2020 taxation years, where the taxpayer submits a request in writing to the Canada Revenue Agency for an adjustment to their RRSP room for the relevant years.

Tax Treatment of COVID-19 Benefit Amounts

A range of taxable benefits have been made available to qualified individuals in response to the COVID-19 pandemic. Generally, if a benefit amount is repaid (for example, where an individual determines that they were not eligible for the benefit in question), this amount can only be deducted for income tax purposes in the year the repayment takes place. Therefore, if the repayment does not occur in the same year as the year of receipt of the benefit, an individual may owe tax in respect of the benefit for the year of receipt, while obtaining a deduction for the repayment amount in a future tax year.

Budget 2021 proposes to amend the Income Tax Act to allow individuals the option to claim a deduction in respect of the repayment of a COVID‑19 benefit amount in computing their income for the year in which the benefit amount was received rather than the year in which the repayment was made. This option would be available for benefit amounts repaid at any time before 2023.

For these purposes, COVID-19 benefits would include:

- Canada Emergency Response Benefits/Employment Insurance Emergency Response Benefits;

- Canada Emergency Student Benefits;

- Canada Recovery Benefits;

- Canada Recovery Sickness Benefits; and

- Canada Recovery Caregiving Benefits.

Individuals may only deduct benefit amounts once they have been repaid. An individual who makes a repayment, but who has already filed their income tax return for the year in which the benefit was received, would be able to request an adjustment to the return for that year.

Budget 2021 also proposes to amend the Income Tax Act to ensure that the COVID-19 benefit amounts noted above, and similar provincial or territorial benefit amounts, are included in the taxable income of those individuals who reside in Canada but are considered non-resident persons for income tax purposes. As a result, COVID-19 benefits received by these non-resident persons would be taxable in Canada in a manner generally similar to employment and business income earned in Canada.

Fixing Contribution Errors in Defined Contribution Pension Plans

The rules in the Income Tax Act do not currently permit pension plan administrators to accept retroactive contributions to employee accounts under a defined contribution pension plan in order to correct under-contribution errors in respect of prior years. Although in some circumstances over-contribution errors may be corrected by refunding the excess to the contributor, these rules have been found to be cumbersome.

Budget 2021 proposes to provide more flexibility to plan administrators of defined contribution pension plans to correct for both under-contributions and over-contributions. The proposals would permit certain types of errors to be corrected via additional contributions to an employee's account under a defined contribution pension plan to compensate for an under-contribution error made in any of the preceding five years, subject to a dollar limit. The proposals would also permit plan administrators to correct for pension over-contribution errors in respect of an employee for any of the five years prior to the year in which the excess amount is refunded to the employee or employer, as the case may be, who made the contribution.

To simplify reporting requirements, the proposed rules would require the plan administrator to file a prescribed form in respect of each affected employee, rather than to amend T4 slips for prior years. Additional contributions to correct for under-contributions would reduce the employee's registered retirement savings plan (RRSP) contribution room for the taxation year following the year in which the retroactive contribution is made. To the extent this results in negative RRSP room, it would only impact the employee's contributions in future years. Refunds of over-contributions would generally restore the employee's RRSP contribution room for the taxation year in which the refund is made.

This measure would apply in respect of additional contributions made, and amounts of over-contributions refunded, in the 2021 and subsequent taxation years.

Taxes Applicable to Registered Investments

A trust or corporation that satisfies certain requirements can apply to the Canada Revenue Agency to be a registered investment for registered retirement savings plans (RRSPs), registered retirement income funds or deferred profit sharing plans. The units of a trust, or shares of a corporation, that is a registered investment are qualified investments for the types of plans for which it is registered.

Certain categories of registered investments (e.g., mutual fund trusts and mutual fund corporations) must have a minimum number of investors. A trust or corporation that is a registered investment and is not sufficiently widely held (e.g., a trust that does not have the 150 unit holders required to qualify as a mutual fund trust) is limited to holding investments that would be qualified investments for the types of registered plans for which it is registered. For example, if a trust or corporation is a registered investment for RRSPs, it can hold only investments that are qualified investments for an RRSP.

If a registered investment that is subject to this investment restriction holds property that is not a qualified investment for the type of registered plans for which it is registered, the registered investment is liable to pay a tax under Part X.2 of the Income Tax Act. This tax is equal to one per cent of the property's fair market value, at the time it was acquired, for each month that the registered investment holds the property. However, in some cases the effect of the tax can be disproportionate because the tax applies without regard to the proportion of the shares or units of the registered investment that are held by investors that are themselves subject to the qualified investment rules.

Budget 2021 proposes that the tax imposed under Part X.2 of the Income Tax Act be pro-rated based on the proportion of shares or units of the registered investment that are held by investors that are themselves subject to the qualified investment rules. For example, if a registered investment is registered for RRSPs and 20 per cent of its units are held by RRSPs while 80 per cent of its units are held by individuals via their non-registered accounts, the monthly tax imposed under Part X.2 would now be 20 per cent of 1 per cent of the fair market value of a non-qualified investment at the time it was acquired.

This measure would apply to taxes imposed under Part X.2 of the Income Tax Act in respect of months after 2020. However, the measure would also apply to taxpayers whose tax liability under Part X.2 in respect of months before 2021 has not been finally determined by the Canada Revenue Agency as of Budget Day.

Registration and Revocation Rules Applicable to Charities

In order to further strengthen Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime, Budget 2021 proposes a number of amendments to the Income Tax Act in order to limit opportunities for the abuse of charitable registration status for terrorist financing purposes. Budget 2021 also proposes changes to the rules applicable to all registered charities in respect of certain false statements.

Listed Terrorist Entities

Currently, under the Income Tax Act, the registration of a charity or other qualified donee may be revoked for non-compliance with the rules, but the Canada Revenue Agency must follow a series of steps in order to do so. In certain cases, a registered charity or other qualified donee may be listed as a terrorist entity under the Criminal Code by the Minister of Public Safety and Emergency Preparedness causing it to no longer qualify for registration. There is an administrative process that must be followed for an entity to be listed as a terrorist entity, with appeal rights to the courts.

Budget 2021 proposes to allow the Minister of National Revenue to immediately revoke the registration of a charity or other qualified donee upon its listing as a terrorist entity under the Criminal Code.

Ineligible Individuals

Where a charity or Canadian amateur athletic association has an "ineligible individual" as a director, trustee, officer or like official, or where such an individual controls or manages the charity or association, the Income Tax Act provides the Minister of National Revenue with the discretion to refuse or revoke its registration, or to suspend its authority to issue official donation receipts. Under current rules, an ineligible individual includes, in general terms:

- an individual who has been convicted of a criminal offence involving financial dishonesty; and

- an individual who – during a period in which a registered charity engaged in conduct that constituted a serious breach of the requirements for its registration and for which its registration was revoked within the previous five years – was a director, trustee, officer or like official of the charity, or controlled or managed the charity.

Budget 2021 proposes to amend the "ineligible individual" definition so that it includes an individual who:

- is, or is a member of, a listed terrorist entity; or

- in respect of a listed terrorist entity, was, during a period in which the entity supported or engaged in terrorist activities,

- a director, trustee, officer or like official of the entity; or

- an individual that controlled or managed, directly or indirectly, in any manner whatever, the entity.

The existing rule that requires the Canada Revenue Agency to only consider circumstances occurring within the preceding five-year period would not apply in relation to this measure.

False Statements

The Income Tax Act currently allows for the revocation of the registration of a charity where a false statement amounting to culpable conduct is made for the purpose of obtaining registration.

Budget 2021 proposes to allow the Minister of National Revenue to suspend the authority of a registered charity to issue official donation receipts for one year or to revoke its registration where a false statement amounting to culpable conduct was made for the purpose of maintaining its registration.

All of these amendments would apply on Royal Assent.

Electronic Filing and Certification of Tax and Information Returns

To improve the administration of, and compliance with, the tax system, Budget 2021 proposes various amendments to the Income Tax Act, Income Tax Regulations, Excise Tax Act, Excise Act, 2001, Tax Rebate Discounting Act, Air Travellers Security Charge Act, Part 1 of the Greenhouse Gas Pollution Pricing Act, and Electronic Filing and Provision of Information (GST/HST) Regulations. These proposed measures would improve the Canada Revenue Agency's (CRA) ability to operate digitally, resulting in faster, more convenient and accurate service, while also enhancing security.

Default Method of Correspondence

Notices of Assessment

Budget 2021 proposes to amend the Income Tax Act to provide the CRA with the ability to send certain notices of assessment electronically without the taxpayer having to authorize the CRA to do so. This proposal would apply in respect of individuals who file their income tax return electronically and those who employ the services of a tax preparer that files their income tax return electronically. Taxpayers who continue to file their income tax returns with the CRA in paper format would continue to receive a paper notice of assessment from the CRA.

This measure would come into force on Royal Assent of the enacting legislation.

Correspondence with Businesses

Budget 2021 proposes to change the default method of correspondence for businesses that use the CRA's My Business Account portal to electronic only. However, businesses could still choose to also receive paper correspondence. This measure would apply in respect of the Income Tax Act, Excise Tax Act, Excise Act, 2001, Air Travellers Security Charge Act and Part 1 of theGreenhouse Gas Pollution Pricing Act.

This measure would come into force on Royal Assent of the enacting legislation.

Information Returns

Budget 2021 proposes to amend the Income Tax Regulations to allow issuers of T4A (Statement of Pension, Retirement, Annuity and Other Income) and T5 (Statement of Investment Income) information returns to provide them electronically without having to also issue a paper copy and without the taxpayer having to authorize the issuer to do so.

This measure would apply in respect of information returns sent after 2021.

Electronic Filing Thresholds

Tax Preparers

Budget 2021 proposes to amend the rule in the Income Tax Act that requires, subject to the exception below, professional preparers of income tax returns to file electronically where they prepare more than 10 income tax returns of corporations or 10 income tax returns of individuals (other than trusts) to apply instead where they file more than 5 of either type of return for a calendar year. Furthermore, the exception for trusts would be removed.

Budget 2021 also proposes to amend the exception in the Income Tax Act whereby a tax preparer is allowed to a file a maximum of 10 paper income tax returns of corporations and 10 paper income tax returns of individuals per calendar year to instead allow only a maximum of 5 paper returns of each type per calendar year.

These measures would apply in respect of calendar years after 2021.

Filer of Information Returns

Budget 2021 proposes that the threshold for mandatory electronic filing of income tax information returns for a calendar year under the Income Tax Act be lowered from 50 to 5 returns, in respect of a particular type of information return. As such, persons or partnerships that file more than 5 information returns of a particular type for a calendar year would be required to file them electronically.

This measure would apply in respect of calendar years after 2021.

Corporations and GST/HST Registrants

Budget 2021 proposes to eliminate the mandatory electronic filing thresholds for returns of corporations under the Income Tax Act, and of Goods and Services Tax/Harmonized Sales Tax (GST/HST) registrants (other than for charities or Selected Listed Financial Institutions) under the Excise Tax Act. As such, returns of most corporations and GST/HST registrants under these acts would be required to be filed electronically.

This measure would apply in respect of taxation years that begin after 2021 for the Income Tax Act amendments and in respect of reporting periods that begin after 2021 for the Excise Tax Act.

Electronic Payments

Budget 2021 proposes to clarify that payments required to be made at a financial institution under the Income Tax Act, the GST/HST portion of the Excise Tax Act, the Excise Act, 2001, the Air Travellers Security Charge Act and Part 1 of the Greenhouse Gas Pollution Pricing Act, include online payments made through such an institution. Budget 2021 also proposes that electronic payments be required for remittances over $10,000 under the Income Tax Act and that the threshold for mandatory remittances to be made at a financial institution under the GST/HST portion of the Excise Tax Act, the Excise Act, 2001, the Air Travellers Security Charge Act and Part 1 of the Greenhouse Gas Pollution Pricing Act be lowered from $50,000 to $10,000.

This measure would apply to payments made on or after January 1, 2022.

Handwritten Signatures

Budget 2021 proposes to eliminate the requirement that signatures be in writing on certain prescribed forms, as follows:

- Forms prescribed under the Income Tax Act:

- T183, Information Return for Electronic Filing of an Individual's Income Tax and Benefit Return;

- T183CORP, Information Return for Corporations Filing Electronically; and

- T2200, Declaration of Conditions of Employment.

- Forms prescribed under the Tax Rebate Discounting Act:

- RC71, Statement of Discounting Transaction; and

- RC72, Notice of the Actual Amount of the Refund of Tax.

This measure would come into force on Royal Assent of the enacting legislation.

Business Income Tax Measures

Emergency Business Supports

The government has introduced a number of support measures to help businesses and other organizations affected by the COVID-19 pandemic, including the Canada Emergency Wage Subsidy, the Canada Emergency Rent Subsidy and the Lockdown Support.

Program details in respect of these three measures have been announced through June 5, 2021 and the application of these measures cannot be extended by regulation beyond June 2021.

Budget 2021 proposes to extend the Canada Emergency Wage Subsidy, the Canada Emergency Rent Subsidy and the Lockdown Support until September 2021. The subsidy rates would gradually decline over the July-to-September period. The proposed details of these programs from June 6, 2021 to September 25, 2021 are described below.

Budget 2021 also proposes to provide the government with the legislative authority to add additional qualifying periods for the wage subsidy, the rent subsidy and the Lockdown Support until November 20, 2021, should the economic and public health situation warrant it.

Canada Emergency Wage Subsidy

The government introduced the Canada Emergency Wage Subsidy to prevent further job losses and encourage employers to quickly rehire workers previously laid off as a result of COVID‑19. The measure provides eligible employers that have experienced a decline in revenues with a wage subsidy for eligible remuneration paid to their employees.

Support for Active Employees

The wage subsidy for active employees includes a base subsidy for employers that have experienced a decline in revenues as well as a top-up wage subsidy that is available to employers that have experienced a decline in revenues of at least 50 per cent. The maximum combined base subsidy and top-up wage subsidy rate is set at 75 per cent through the qualifying period ending on June 5, 2021.

Budget 2021 proposes the wage subsidy rate structures set out in Table 2 for June 6, 2021 to September 25, 2021. As illustrated in the table, the subsidy rates would be gradually phased out starting on July 4, 2021. Furthermore, only employers with a decline in revenues of more than 10 per cent would be eligible for the wage subsidy as of that date.

| Period 17 June 6 – July 3 |

Period 18 July 4 – July 31 |

Period 19 August 1 – August 28 |

Period 20 August 29 – September 25 |

|

|---|---|---|---|---|

| Maximum weekly benefit per employee* | $847 | $677 | $452 | $226 |

| Revenue decline: | ||||

| 70% and over | 75% (i.e., Base: 40% + Top-up: 35%) |

60% (i.e., Base: 35% + Top-up: 25%) |

40% (i.e., Base: 25% + Top-up: 15%) |

20%

(i.e., Base: 10% + Top-up: 10%) |

| 50-69% | Base: 40% + Top-up: (revenue decline - 50%) x 1.75 (e.g., 40% + (60% revenue decline - 50%) x 1.75 = 57.5% subsidy rate) |

Base: 35% + Top-up: (revenue decline - 50%) x 1.25 (e.g., 35% + (60% revenue decline - 50%) x 1.25 = 47.5% subsidy rate) |

Base: 25% + Top-up: (revenue decline - 50%) x 0.75 (e.g., 25% + (60% revenue decline - 50%) x 0.75 = 32.5% subsidy rate) |

Base: 10% + Top-up: (revenue decline - 50%) x 0.5 (e.g., 10% + (60% revenue decline - 50%) x 0.5 = 15% subsidy rate) |

| >10-50% | Base: revenue decline x 0.8 (e.g., 30% revenue decline x 0.8 = 24% subsidy rate) |

Base: (revenue decline - 10%) x 0.875 (e.g., (30% revenue decline - 10%) x 0.875 = 17.5% subsidy rate) |

Base: (revenue decline - 10%) x 0.625 (e.g., (30% revenue decline - 10%) x 0.625 = 12.5% subsidy rate) |

Base: (revenue decline - 10%) x 0.25 (e.g., (30% revenue decline - 10%) x 0.25 = 5% subsidy rate) |

| 0-10% | Base: revenue decline x 0.8 (e.g., 5% revenue decline x 0.8 = 4% subsidy rate) |

0% | 0% | 0% |

| * The maximum weekly benefit per employee is equal to the maximum combined base subsidy and top-up wage subsidy for the qualifying period applied to the amount of eligible remuneration paid to the employee for the qualifying period, on remuneration of up to $1,129 per week. | ||||

Requirement to Repay Wage Subsidy

Budget 2021 proposes to require a publicly listed corporation to repay wage subsidy amounts received for a qualifying period that begins after June 5, 2021 in the event that its aggregate compensation for specified executives during the 2021 calendar year exceeds its aggregate compensation for specified executives during the 2019 calendar year.

For the purpose of this proposed rule, a publicly listed corporation's specified executives will be its Named Executive Officers whose compensation is required to be disclosed under Canadian securities laws in its annual information circular provided to shareholders, or similar executives in the case of a corporation listed in another jurisdiction. This generally includes its chief executive officer, chief financial officer, and three other most highly compensated executives. A corporation's executive compensation for a calendar year will be calculated by prorating the aggregate compensation of its specified executives for each of its taxation years that overlap with the calendar year.

The amount of the wage subsidy required to be repaid would be equal to the lesser of:

- the total of all wage subsidy amounts received in respect of active employees for qualifying periods that begin after June 5, 2021; and

- the amount by which the corporation's aggregate specified executives' compensation for 2021 exceeds its aggregate specified executives' compensation for 2019.

This requirement to repay would be applied at the group level and would apply to wage subsidy amounts paid to any entity in the group.

Support for Furloughed Employees

A separate wage subsidy rate structure applies for furloughed employees. The wage subsidy for furloughed employees is aligned with the benefits provided through Employment Insurance (EI) through June 5, 2021 to ensure equitable treatment of such employees between the two programs.

To ensure that the wage subsidy for furloughed employees remains aligned with benefits available under EI, Budget 2021 proposes that the weekly wage subsidy for a furloughed employee from June 6, 2021 to August 28, 2021 be the lesser of:

- the amount of eligible remuneration paid in respect of the week; and

- the greater of:

- $500; and

- 55 per cent of pre-crisis remuneration for the employee, up to a maximum subsidy amount of $595.

The wage subsidy for furloughed employees would continue to be available to eligible employers that qualify for the wage subsidy for active employees for the relevant period until August 28, 2021. Employers will also continue to be entitled to claim under the wage subsidy their portion of contributions in respect of the Canada Pension Plan, EI, the Quebec Pension Plan and the Quebec Parental Insurance Plan in respect of furloughed employees.

Reference Periods

For the purposes of the wage subsidy, an employer's decline in revenues is generally determined by comparing the employer's revenues in a current calendar month with its revenues in the same calendar month, pre-pandemic. An employer may also elect to use an alternative approach, which compares the employer's monthly revenues relative to the average of its January 2020 and February 2020 revenues. A deeming rule provides that an employer's decline in revenues for any particular qualifying period is the greater of its decline in revenues for the particular qualifying period and the immediately preceding qualifying period.

Budget 2021 proposes the reference periods set out in Table 3 for determining an eligible employer's decline in revenues for the qualifying periods from June 6, 2021 to September 25, 2021.

| Timing | Period 17 June 6 – July 3 |

Period 18 July 4 – July 31 |

Period 19 August 1 – August 28 |

Period 20 August 29 – September 25 |

|---|---|---|---|---|

| General approach | June 2021 over June 2019 or May 2021 over May 2019 | July 2021 over July 2019 or June 2021 over June 2019 | August 2021 over August 2019 or July 2021 over July 2019 | September 2021 over September 2019 or August 2021 over August 2019 |

| Alternative approach | June 2021 or May 2021 over average of January and February 2020 | July 2021 or June 2021 over average of January and February 2020 | August 2021 or July 2021 over average of January and February 2020 | September 2021 or August 2021 over average of January and February 2020 |

Employers that had chosen to use the general approach for prior periods would be required to continue to use that approach. Similarly, employers that had chosen to use the alternative approach would be required to continue to use the alternative approach.

Baseline Remuneration

Under the general rules, an eligible employer's entitlement to the wage subsidy for a furloughed employee, as well as an active employee in certain circumstances, is determined through a calculation that takes into account both the employee's current and baseline (pre-crisis) remuneration.

Baseline remuneration means the average weekly eligible remuneration paid to an eligible employee by an eligible employer during the period beginning January 1, 2020 and ending March 15, 2020. Any period of seven or more consecutive days for which the employee was not remunerated is excluded from the calculation. However, the eligible employer may elect, for each qualifying period in respect of an employee, an alternative baseline period for calculating the average weekly eligible remuneration.

To ensure that the alternative baseline remuneration periods for a particular qualifying period continue to generally reflect the corresponding calendar months covered by the qualifying period, Budget 2021 proposes to allow an eligible employer to elect to use the following alternative baseline remuneration periods:

- March 1 to June 30, 2019 or July 1 to December 31, 2019, for the qualifying period between June 6, 2021 and July 3, 2021; and

- July 1 to December 31, 2019, for qualifying periods beginning after July 3, 2021.

Canada Emergency Rent Subsidy

The government introduced the Canada Emergency Rent Subsidy to provide direct relief to organizations that continue to be economically impacted by the COVID‑19 pandemic. Under the rent subsidy, qualifying organizations that have experienced a decline in revenues are eligible for a subsidy on qualifying expenses.

Rate Structure

The maximum base rent subsidy rate is set at 65 per cent through the qualifying period ending on June 5, 2021.

Budget 2021 proposes the base rent subsidy rate structures set out in Table 4 for June 6, 2021 to September 25, 2021. As illustrated in the table, the subsidy rates would be gradually phased out starting on July 4, 2021. Furthermore, only organizations with a decline in revenues of more than 10 per cent would be eligible for the base rent subsidy and, as discussed below, the Lockdown Support.

| Period 17 June 6 – July 3 |

Period 18 July 4 – July 31 |

Period 19 August 1 – August 28 |

Period 20 August 29 – September 25 |

|

|---|---|---|---|---|

| Revenue decline: | ||||

| 70% and over | 65% | 60% | 40% | 20% |

| 50-69% | 40% + (revenue decline - 50%) x 1.25 (e.g., 40% + (60% revenue decline - 50%) x 1.25 = 52.5% subsidy rate) |

35% + (revenue decline - 50%) x 1.25 (e.g., 35% + (60% revenue decline - 50%) x 1.25 = 47.5% subsidy rate) |

25% + (revenue decline - 50%) x 0.75 (e.g., 25% + (60% revenue decline - 50%) x 0.75 = 32.5% subsidy rate) |

10% + (revenue decline - 50%) x 0.5 (e.g., 10% + (60% revenue decline - 50%) x 0.5 = 15% subsidy rate) |

| >10-50% | Revenue decline x 0.8 (e.g., 30% revenue decline x 0.8 = 24% subsidy rate) |

(Revenue decline - 10%) x 0.875 (e.g., (30% revenue decline - 10%) x 0.875 = 17.5% subsidy rate) |

(Revenue decline - 10%) x 0.625 (e.g., (30% revenue decline - 10%) x 0.625 = 12.5% subsidy rate) |

(Revenue decline - 10%) x 0.25 (e.g., (30% revenue decline - 10%) x 0.25 = 5% subsidy rate) |

| 0-10% | Revenue decline x 0.8 (e.g., 5% revenue decline x 0.8 = 4% subsidy rate) |

0% | 0% | 0% |

| * Expenses for each qualifying period are capped at $75,000 per location and are subject to an overall cap of $300,000 that is shared among affiliated entities. ** Period 17 of the Canada Emergency Wage Subsidy would be the tenth period of the Canada Emergency Rent Subsidy. Period identifiers have been aligned for ease of reference. |

||||

Revenue-Decline Calculation

Both the rent subsidy and the wage subsidy use the same calculation to determine an organization's revenue decline. As a result, the same reference periods are used to calculate an organization's decline in revenues for the wage subsidy and the rent subsidy. Likewise, if an organization elects to use an alternative method for computing its revenue decline under the wage subsidy, it must use that alternative method for the rent subsidy.

Purchase of Business Assets

In order to qualify for the wage subsidy, an applicant must have had a payroll account with the Canada Revenue Agency (or engaged a qualifying payroll service provider). For the purpose of the rent subsidy, an applicant is required to have a business number with the CRA.

If certain conditions are met, the wage subsidy rules provide that an eligible entity that purchases the assets of a seller will be deemed to meet the payroll account requirement if the seller met the requirement.

Budget 2021 proposes to introduce a similar deeming rule that would apply in the context of the rent subsidy, where the seller met the business number requirement. This measure would apply as of the start of the rent subsidy.

Lockdown Support

For locations that must cease operations or significantly limit their activities under a public health order issued under the laws of Canada, a province or territory, the government introduced the Lockdown Support through the Canada Emergency Rent Subsidy program to provide additional help. In order to qualify for the Lockdown Support, an applicant must qualify for the base rent subsidy.

Budget 2021 proposes to extend, for the qualifying periods from June 6, 2021 to September 25, 2021, the current 25-per-cent rate for the Lockdown Support.

Canada Recovery Hiring Program

Budget 2021 proposes to introduce the new Canada Recovery Hiring Program to provide eligible employers with a subsidy of up to 50 per cent on the incremental remuneration paid to eligible employees between June 6, 2021 and November 20, 2021.

An eligible employer would be permitted to claim either the hiring subsidy or the Canada Emergency Wage Subsidy for a particular qualifying period, but not both.

The proposed details of the hiring subsidy are described below.

Eligible Employers

Employers eligible for the Canada Emergency Wage Subsidy would generally be eligible for the hiring subsidy. However, a for-profit corporation would be eligible for the hiring subsidy only if it is a Canadian-controlled private corporation (including a cooperative corporation that is eligible for the small business deduction). Other eligible employers would include individuals, non‑profit organizations, registered charities, and certain partnerships.

Corporations and trusts that are ineligible for the Canada Emergency Wage Subsidy because they are public institutions would not be eligible for the hiring subsidy. Public institutions generally include municipalities and local governments, Crown corporations, wholly owned municipal corporations, public universities, colleges, schools and hospitals.

Eligible employers (or their payroll service provider) would be required to have had a payroll account open with the Canada Revenue Agency on March 15, 2020.

Eligible Employees

An eligible employee must be employed primarily in Canada by an eligible employer throughout a qualifying period (or the portion of the qualifying period throughout which the individual was employed by the eligible employer).

The hiring subsidy would not be available for furloughed employees. A furloughed employee is an employee who is on leave with pay, meaning they are remunerated by the eligible employer but do not perform any work for the employer. An employee would not be considered to be on leave with pay for the purposes of the hiring subsidy if they are on a period of paid absence, such as vacation leave, sick leave, or a sabbatical.

Eligible Remuneration and Incremental Remuneration

The types of remuneration eligible for the Canada Emergency Wage Subsidy would also be eligible for the hiring subsidy. Eligible remuneration generally includes salary, wages, and other remuneration for which employers are required to withhold or deduct amounts on account of the employee's income tax obligations. However, it does not include severance pay, or items such as stock option benefits or the personal use of a corporate vehicle. The amount of remuneration for employees would be based solely on remuneration paid in respect of the qualifying period.

Incremental remuneration for a qualifying period means the difference between an employer's total eligible remuneration paid to eligible employees for the qualifying period and its total eligible remuneration paid to eligible employees for the baseline period. In both the qualifying period and the baseline period, eligible remuneration for each eligible employee would be subject to a maximum of $1,129 per week.

As is currently the case for the Canada Emergency Wage Subsidy, the eligible remuneration for a non-arm's length employee for a week could not exceed their baseline remuneration determined for that week. More information on baseline remuneration is available in the supplementary information on Emergency Business Supports.

The applicable dates for the calculation of the incremental remuneration are shown in Table 5.

| Qualifying period | Period 17 | Period 18 | Period 19 | Period 20 | Period 21 | Period 22 |

|---|---|---|---|---|---|---|

| Qualifying period dates | June 6 to July 3, 2021 | July 4 to July 31, 2021 | August 1 to August 28, 2021 | August 29 to September 25, 2021 | September 26 to October 23, 2021 | October 24 to November 20, 2021 |

| Baseline period | March 14 to April 10, 2021 | |||||

| *Period 17 of the Canada Emergency Wage Subsidy would be the first period of the Canada Recovery Hiring Program. Period identifiers have been aligned for ease of reference. | ||||||

Subsidy Amount

Provided that an eligible employer's decline in revenues exceeds the revenue-decline threshold for a qualifying period (see Revenue-Decline Threshold below), its subsidy in that qualifying period would be equal to its incremental remuneration multiplied by the applicable hiring subsidy rate for that qualifying period. These hiring subsidy rates are shown in Table 6.

| Period 17 June 6 – July 3 |

Period 18 July 4 – July 31 |

Period 19 August 1 – August 28 |

Period 20 August 29 – September 25 |

Period 21 September 26 – October 23 |

Period 22 October 24 – November 20 |

|

|---|---|---|---|---|---|---|

| Hiring subsidy rate | 50% | 50% | 50% | 40% | 30% | 20% |

| *Period 17 of the Canada Emergency Wage Subsidy would be the first period of the Canada Recovery Hiring Program. Period identifiers have been aligned for ease of reference. | ||||||

Revenue-Decline Threshold

To qualify for a hiring subsidy in a qualifying period, an eligible employer would have to have experienced a decline in revenues sufficient to qualify for the Canada Emergency Wage Subsidy in that qualifying period. For qualifying periods where the Canada Emergency Wage Subsidy is no longer in effect, an eligible employer would have to have experienced a decline in revenues of more than 10 per cent. As such, an eligible employer's decline in revenues would have to be more than:

- 0 per cent, for the qualifying period between June 6, 2021 and July 3, 2021; and

- 10 per cent, for qualifying periods between July 4, 2021 and November 20, 2021.

An employer's decline in revenues would be determined in the same manner as under the Canada Emergency Wage Subsidy. This method compares the employer's revenues in a current calendar month with its revenues in the same calendar month, pre-pandemic. An employer can also elect to use an alternative approach, which compares the employer's monthly revenues relative to the average of its January 2020 and February 2020 revenues. A deeming rule provides that an employer's decline in revenues for any particular qualifying period is the greater of its decline in revenues for the particular qualifying period and the immediately preceding qualifying period.

Employers that had chosen to use the general approach for prior periods of the Canada Emergency Wage Subsidy would be required to continue to use that approach for the hiring subsidy. Similarly, employers that had chosen to use the alternative approach would be required to continue to use the alternative approach.

The reference periods set out in Table 7 would be used to determine an eligible employer's decline in revenues for the qualifying periods from June 6, 2021 to November 20, 2021.

| Timing | Period 17 June 6 – July 3 |

Period 18 July 4 – July 31 |

Period 19 August 1 – August 28 |

Period 20 August 29 – September 25 |

Period 21 September 26 – October 23 |

Period 22 October 24 – November 20 |

|---|---|---|---|---|---|---|

| General approach | June 2021 over June 2019 or May 2021 over May 2019 | July 2021 over July 2019 or June 2021 over June 2019 | August 2021 over August 2019 or July 2021 over July 2019 | September 2021 over September 2019 or August 2021 over August 2019 | October 2021 over October 2019 or September 2021 over September 2019 | November 2021 over November 2019 or October 2021 over October 2019 |

| Alternative approach | June 2021 or May 2021 over average of January and February 2020 | July 2021 or June 2021 over average of January and February 2020 | August 2021 or July 2021 over average of January and February 2020 | September 2021 or August 2021 over average of January and February 2020 | October 2021 or September 2021 over average of January and February 2020 | November 2021 or October 2021 over average of January and February 2020 |

| *Period 17 of the Canada Emergency Wage Subsidy would be the first period of the Canada Recovery Hiring Program. Period identifiers have been aligned for ease of reference. | ||||||

An application for the hiring subsidy for a qualifying period would be required to be made no later than 180 days after the end of the qualifying period.

Immediate Expensing

The capital cost allowance (CCA) system determines the deductions that a business may claim each year for income tax purposes in respect of the capital cost of its depreciable property. With some exceptions, depreciable property is divided into CCA classes and a CCA rate for each class of property is prescribed in the Income Tax Regulations.

Prior to November 21, 2018, the CCA allowed in the first year that a property was available for use was generally limited to half the amount that would otherwise be available (the "half-year" rule). On November 21, 2018, the government announced a temporary enhanced first-year allowance, referred to as the Accelerated Investment Incentive, equal to up to three times the previously applicable first-year allowance. In addition, the government announced immediate expensing for investments in machinery and equipment used in manufacturing or processing, as well as for specified clean energy generation equipment.

Budget 2021 proposes to provide temporary immediate expensing in respect of certain property acquired by a Canadian-Controlled Private Corporation (CCPC). This immediate expensing would be available for "eligible property" acquired by a CCPC on or after Budget Day and that becomes available for use before January 1, 2024, up to a maximum amount of $1.5 million per taxation year. The immediate expensing would only be available for the year in which the property becomes available for use. The $1.5 million limit would be shared among associated members of a group of CCPCs. The limit would be prorated for taxation years that are shorter than 365 days. The half-year rule would be suspended for property for which this measure is used. For those CCPCs with less than $1.5 million of eligible capital costs, no carry-forward of excess capacity would be allowed.

Eligible Property

Eligible property under this new measure would be capital property that is subject to the CCA rules, other than property included in CCA classes 1 to 6, 14.1, 17, 47, 49 and 51, which are generally long lived assets.

Interactions of the Immediate Expensing with Other Provisions

CCPCs with capital costs of eligible property in a taxation year that exceed $1.5 million would be allowed to decide to which CCA class the immediate expensing would be attributed and any excess capital cost would be subject to the normal CCA rules. The availability of other enhanced deductions under existing rules – such as the full expensing for manufacturing and processing machinery and equipment and for clean energy equipment, introduced in the 2018 Fall Economic Statement – would not reduce the maximum amount available under this new measure. In other words, a CCPC may expense up to $1.5 million in addition to all other CCA claims under existing provisions of the Income Tax Act, provided the total CCA deduction does not exceed the capital cost of the property.

Immediate expensing under this new rule would not change the total amount that can be deducted over the life of a property – the larger deduction taken in the first year in respect of a property would eventually be offset by a smaller deduction, if any, in respect of the property in future years.

Example of Benefits of Immediate Expensing of $1.5 million

A CCPC invests $2,000,000 in equal amounts for two properties, one falling under CCA Class 7, and the other under Class 10. Under this scenario, the CCPC would be allowed a total first-year deduction of up to $1,725,000 versus $675,000 under the existing rules, as illustrated in the table below. This would represent an additional deduction of $1,050,000 in the first year.

| CCA Class (rate) | Cost of Acquisitions | Immediate Expensing | 1st Year Allowance on Remainder of Class* | Total 1st Year Allowance | Current 1st Year Allowance* |

|---|---|---|---|---|---|

Class 7 (15%) |

1,000,000 | 1,000,000 | 0 | 1,000,000 | 225,000 |

Class 10 (30%) |

1,000,000 | 500,000 | 225,000 | 725,000 | 450,000 |

Total |

2,000,000 | 1,500,000 | 225,000 | 1,725,00 | 675,000 |

| *Assuming eligible for the triple first-year allowance under the Accelerated Investment Incentive | |||||

Restrictions

The Income Tax Act and the Income Tax Regulations include a series of rules designed to protect the integrity of the CCA regime and the tax system more broadly. These include rules related to limited partners, specified leasing properties, specified energy properties and rental properties. In certain circumstances, these rules can restrict a CCA deduction, or a loss in respect of such a deduction, that would otherwise be available. These integrity rules would continue to apply.

Certain additional restrictions would be placed on property eligible for this new measure. Property that has been used, or acquired for use, for any purpose before it was acquired by the taxpayer would be eligible for the immediate expensing only if both of the following conditions are met:

- neither the taxpayer nor a non-arm's length person previously owned the property; and

- the property has not been transferred to the taxpayer on a tax-deferred "rollover" basis.

Coming Into Force

This measure would apply for eligible property that is acquired on or after Budget Day and that becomes available for use before 2024.

Strategic Environmental Assessment Statement

This temporary measure is expected to encourage capital investments across all sectors of the economy and in a variety of assets. It is unclear whether it would result in net positive or negative environmental effects.

The consumption, transportation and fabrication of capital assets can lead to various negative environmental effects. These effects would be unequal across sectors and types of investments. For example, investment in certain capital intensive industries is associated with higher greenhouse gas and air pollutant emissions, water and soil pollution, and faster depletion of natural resources. These activities are subject to applicable federal and provincial environmental regulations. There may be positive offsetting environmental impacts if the measure causes businesses to upgrade to the latest technology, as newer technologies are generally more efficient and greener than older technologies.

Overall, the measure could have both positive and negative impacts on the achievement of some of the Federal Sustainable Development Strategy goals, in particular those of Effective Action on Climate Change, Clean Growth, Pristine Lakes and Rivers, Sustainably Managed Lands and Forests, and Safe and Healthy Communities. Based on available data, it is not possible to assess whether the net environmental impact would be positive or negative in the short run. In the long run, the net environmental impact is not expected to be significant, given that the measure would be temporary.

Rate Reduction for Zero-Emission Technology Manufacturers

Budget 2021 proposes a temporary measure to reduce corporate income tax rates for qualifying zero-emission technology manufacturers. Specifically, taxpayers would be able to apply reduced tax rates on eligible zero-emission technology manufacturing and processing income of:

- 7.5 per cent, where that income would otherwise be taxed at the 15 per cent general corporate tax rate; and

- 4.5 per cent, where that income would otherwise be taxed at the 9 per cent small business tax rate.

Eligible Zero-Emission Technology Manufacturing or Processing Activities

This measure would apply in respect of income from the following zero-emission technology manufacturing or processing activities:

- manufacturing of solar energy conversion equipment, such as solar thermal collectors, photovoltaic solar arrays and bespoke supporting structures or frames, but excluding passive solar heating equipment (e.g., a masonry wall installed to absorb solar energy);

- manufacturing of wind energy conversion equipment, such as wind turbine towers, nacelles and rotor blades;

- manufacturing of water energy conversion equipment, such as hydroelectric, water current, tidal and wave energy conversion equipment;

- manufacturing of geothermal energy equipment;

- manufacturing of equipment for a ground source heat pump system;

- manufacturing of electrical energy storage equipment used for storage of renewable energy or for providing grid-scale storage or other ancillary services (e.g., voltage regulation), including battery, compressed air and flywheel storage systems;

- manufacturing of zero-emission vehicles (i.e., plug-in hybrid vehicles with a battery capacity of at least seven kilowatt-hours, electric vehicles and hydrogen-powered vehicles) and the conversion of vehicles into zero-emission vehicles;

- manufacturing of batteries and fuel cells for zero-emission vehicles;

- manufacturing of electric vehicle charging systems and hydrogen refuelling stations for vehicles;

- manufacturing of equipment used for the production of hydrogen by electrolysis of water;

- production of hydrogen by electrolysis of water; and

- production of solid, liquid or gaseous fuel (e.g., wood pellets, renewable diesel and biogas) from either carbon dioxide or specified waste material (i.e., wood waste, municipal waste, sludge from an eligible sewage treatment facility, plant residue, spent pulping liquor, food and animal waste, manure, pulp and paper by-product and separated organics), but excluding the production of by-products which is a standard part of another industrial or manufacturing process (e.g., the production of wood chips, black liquor or hog fuel as part of another wood transformation process).

For each of the manufacturing activities described above, eligible activities would include the manufacturing of components or sub-assemblies only if such equipment is purpose-built or designed exclusively to form an integral part of the relevant system. For example, manufacturing of wind turbine rotor blades may be an eligible activity, but manufacturing of general use tires, fasteners, wiring, transformers, paint, piping or concrete would not.

Eligible activities would exclude all activities that do not qualify as manufacturing or processing for the purposes of the capital cost allowance rules.

Calculation of Eligible Income

It is proposed that a taxpayer's eligible income generally be equal to its "adjusted business income" multiplied by the proportion of its total labour and capital costs that are used in eligible activities. The definition of "adjusted business income" as well as the method used to determine labour and capital costs would be substantially based on those used in calculating manufacturing and processing profits under current tax rules.

All of a taxpayer's labour and capital costs would be deemed to be labour and capital costs that are used in eligible activities if all or substantially all of its labour and capital costs are related to eligible activities.

The government welcomes feedback from stakeholders on the proposed allocation method for these purposes. Interested parties are invited to send written representations by June 18, 2021 to the Department of Finance Canada, Tax Policy Branch at: ZETM-FTZE@canada.ca.

Minimum Proportion of Eligible Activities

A taxpayer would qualify for the reduced tax rates on its eligible income only if at least 10 per cent of its gross revenue from all active businesses carried on in Canada is derived from eligible activities.

Reduced Rate for Small Businesses

Certain small businesses currently benefit from a reduced federal corporate income tax rate of 9 per cent – a preference relative to the general corporate income tax rate of 15 per cent. This rate reduction is provided through the "small business deduction" and applies on up to $500,000 per year of qualifying active business income (i.e., up to the business limit) of a Canadian-controlled private corporation (CCPC).

For taxpayers with income subject to both the general and the small business corporate tax rates, taxpayers would be able to choose to have their eligible income taxed at either the reduced rate of 4.5 per cent for small businesses or the general reduced rate of 7.5 per cent. The amount of income taxed at the 4.5 per cent rate plus the amount of income taxed at the small business rate of 9 per cent would not be allowed to exceed the business limit.

Treatment of Dividends

The tax system has two dividend tax credit (DTC) rates and gross-up factors to recognize the two different corporate income tax rates that generally apply to corporations. The enhanced DTC and gross-up are applied to dividends distributed to an individual from corporate income taxed at the general corporate tax rate ("eligible dividends"). The ordinary DTC and gross-up are applied to dividends distributed to an individual from corporate income not taxed at the general corporate tax rate ("non-eligible dividends"). At the federal level, the enhanced and ordinary dividend tax credit correspond to 15 per cent and 9 per cent of the grossed-up amount of the dividend, respectively.

Given the targeted application, temporary nature, and gradual phase-out of the proposed measure, no changes to the DTC rates or the allocation of corporate income for the purpose of dividend distributions are proposed. That is, income subject to the general reduced rate would continue to give rise to eligible dividends and the enhanced dividend tax credit, while income subject to the reduced rate for small businesses would continue to give rise to non-eligible dividends and the ordinary dividend tax credit.

Application and Phase-Out

The reduced tax rates would apply to taxation years that begin after 2021. The reduced rates would be gradually phased out starting in taxation years that begin in 2029 and fully phased out for taxation years that begin after 2031 (as shown in Table 8).

| Taxation years that begin in: | 2022 to 2028 | 2029 | 2030 | 2031 | 2032 or later |

|---|---|---|---|---|---|

| Reduced Tax Rate on Income Eligible for the Small Business Deduction | 4.5% | 5.625% | 6.75% | 7.875% | 9% |

| Reduced Tax Rate on Other Eligible Income | 7.5% | 9.375% | 11.25% | 13.125% | 15% |

Strategic Environmental Assessment Statement

Overall, the measure is expected to have positive environmental impacts by lowering emissions of greenhouse gases and air particulates.

The measure could indirectly lower the price of zero-emission technology equipment, which could lead to a greater adoption of zero-emission technology in Canada, helping to reduce emissions of greenhouse gases and air particulates. This would contribute to achieving the Federal Sustainable Development Strategy targets relating to increasing the percentage of Canadians living in areas where air quality standards are achieved to 85 per cent by 2030, and having 90 per cent of electricity generated from renewable and non-emitting sources by 2030. In addition, the proposal would help advance the government's commitment to exceed Canada's target of reducing total greenhouse gas emissions by 30 per cent relative to 2005 levels by 2030, and the government's commitment of net-zero greenhouse gas emissions by 2050.

However, increased manufacturing activities in Canada could directly increase emissions of greenhouse gases and air particulates, as well as increase production of industrial waste. This could partially offset some of the positive environmental impacts of the measure.

Capital Cost Allowance for Clean Energy Equipment

Under the Income Tax Act taxpayers are entitled to deduct a portion of the capital cost of a depreciable property, as capital cost allowance (CCA), in computing their income for each taxation year. With some exceptions, CCA deductions are claimed by class of property and are calculated on a declining-balance basis.