Archived - GBA+: Chapter 4

GBA+: Chapter 4

Support for the Arts, Culture and Diversity

Expanding Support for Artists and Cultural Events

- $60.0 million over two years to enhance support for the Canada Music Fund, Canada Arts Presentation Fund, Building Communities through Arts and Heritage program, and Celebration and Commemoration program.

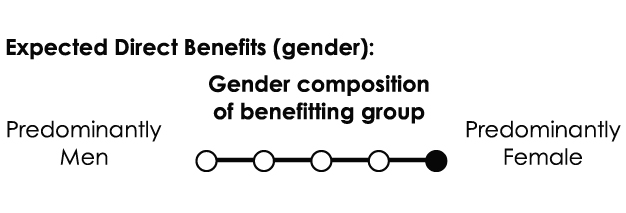

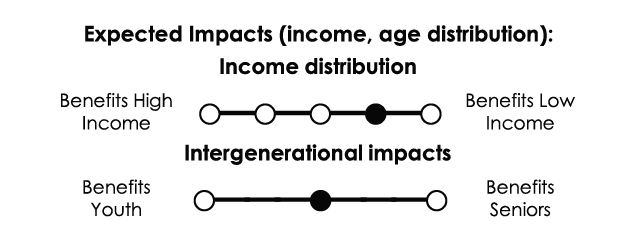

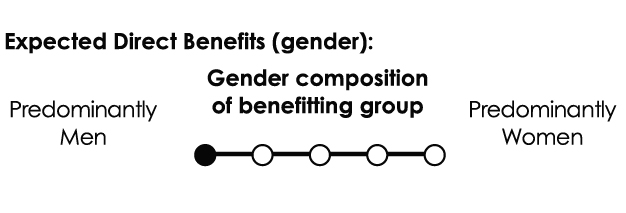

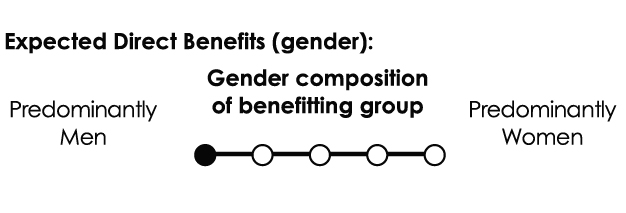

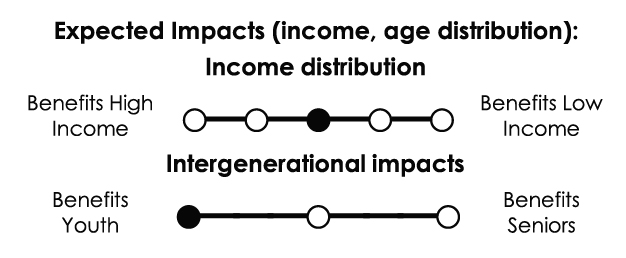

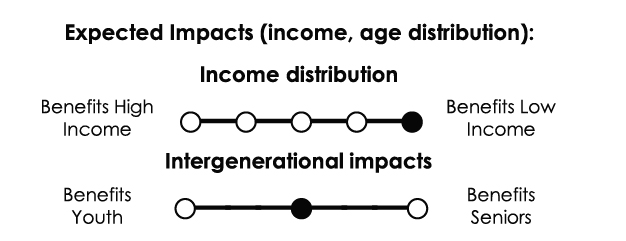

The programs being funded are broadly designed for the benefit of all Canadians.

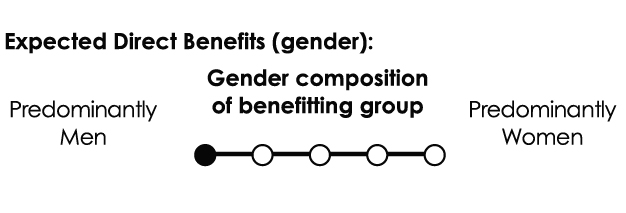

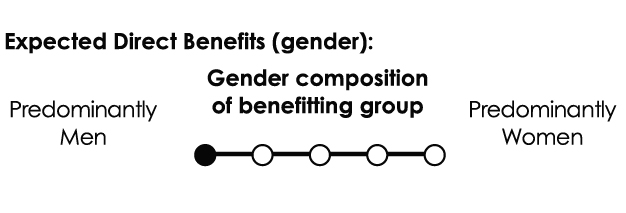

Arts occupations have proportionally high levels of women participation, with women representing 51 per cent of artists and 48 per cent of the workforce in this industry. However, on average women artists earn 31 per cent less than men artists.

Meanwhile, 49 per cent of professional arts presenters serve Indigenous, official language minority and/or culturally diverse audiences as part of their mandate.

The Canada Music Fund and Canada Arts Presentation Fund support culturally diverse artists. The Building Communities and Celebrations and Commemorations initiatives support festivals and celebrations that foster diversity and inclusion, including Canada Day and Multiculturalism Day celebrations as well as festivals for particular cultural groups (e.g. Pride festivals, pow wows).

GBA+ was performed: On the existing program

Target population: All Canadians; arts sector

GBA+ Responsive Approach

This measure will include gender and diversity considerations when determining grants and contribution funding under the various programs, in order to minimize the barriers to funding for artists from particular communities (e.g. Indigenous, ethnic minority). Moreover, funding will aim to bolster support for celebrations and festivals celebrating underserved cultural communities such as French language minority groups outside of Quebec and the LGBTQ2+ community.

In addition, to further support Canadian Heritage’s efforts to integrate GBA+ in program design, Budget 2019 also proposes $1.0 million over two years to improve the collection of disaggregated data and strengthen reporting requirements for the programs being funded.

GBA+: Chapter 4

Support for the Arts, Culture and Diversity

Advancing Gender Equality

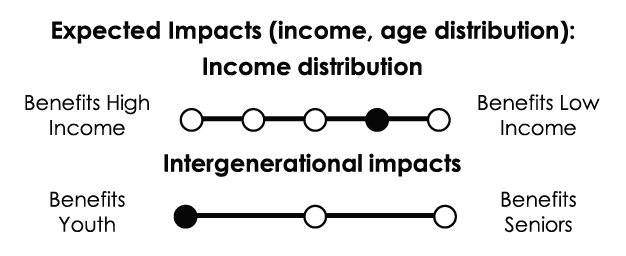

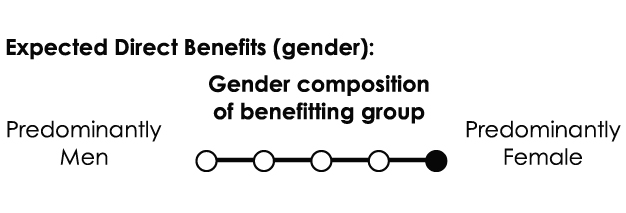

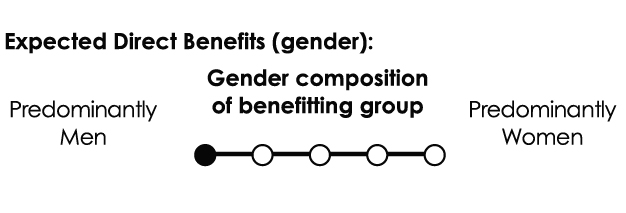

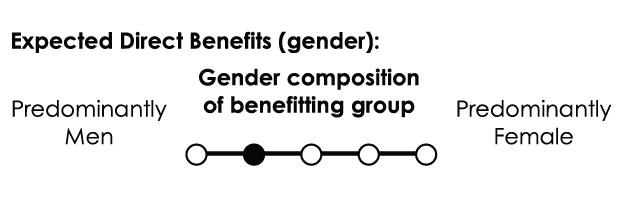

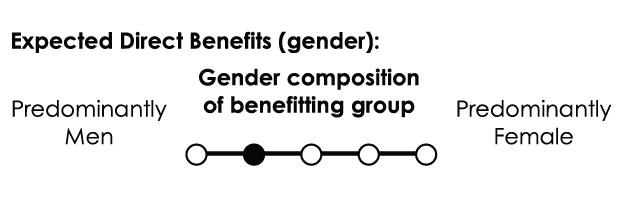

- $160 million over five years to the Department for Women and Gender Equality for the Women’s Program, strengthening support for gender equality.

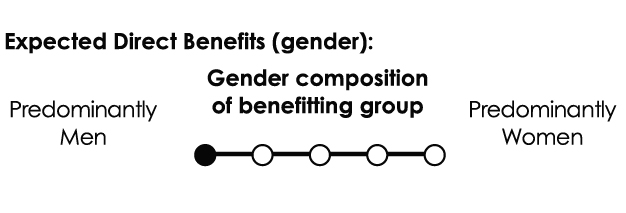

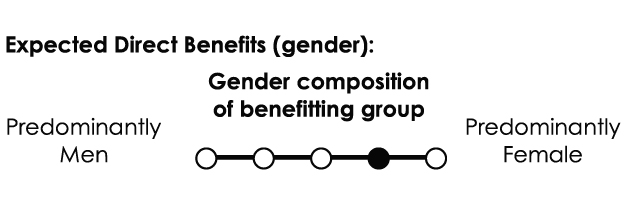

This funding is expected to result in positive long-term impacts for women, girls and gender diverse people in Canada within the three key pillars of the program—ending gender-based violence, improving economic security and encouraging greater leadership.

Statistics in Canada show that women are more likely to be violently victimized than men, have lower labour force participation rates, and are underrepresented in politics and positions of leadership.

While these programs are expected to benefit women in particular, all Canadians will benefit from the greater gender equality that this initiative will promote. The same gender norms that constrain opportunites for women can have negative effects on men, who face gender-specific challenges of their own. For example, men tend to die younger, are more likely to commit suicide, to be incarcerated, to be homeless and to have addiction issues.

Gender norms also have a significant impact on the lives of LGBTQ2+ individuals who often face discrimination and harassment based on gender identity and sexual orientation.

Please see chapter 5: Equality for an overview of the state of gender equality in Canada today, including key statistics.

GBA+ was performed: On the existing program

Target population: Women, girls, gender diverse people; all Canadians through greater gender equality

Equal and full participation in the economy

Encouraging women in leadership positions

Addressing gender-based violence

GBA+: Chapter 4

Support for the Arts, Culture and Diversity

Expanding the Work of the LGBTQ2+ Secretariat

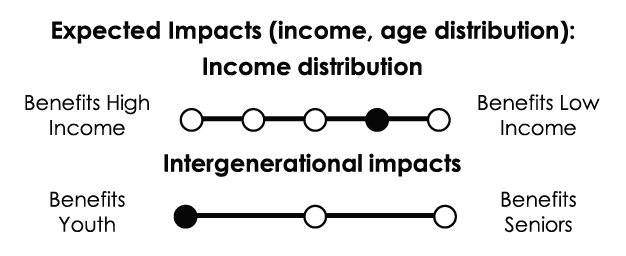

- $20 million over two years to address the unique needs and persisting disparities among LGBTQ2+ Canadians by investing in capacity building and community-level work of Canadian LGBTQ2+ service organizations.

- $1.2 million in 2020-21 to support the ongoing establishment of the LGBTQ2+ Secretariat.

The LGBTQ2+ Secretariat leads ongoing engagement with LGBTQ2+ stakeholders in order to ensure that diverse community and intersectional perspectives and experiences inform the advice that the LGBTQ2+ Secretariat provides. A wide range of engagements and consultations were undertaken and these groups have consistently raised underfunding as a major barrier to their ability to provide services for their communities.

Through capacity building and community-level work, historically marginalized and presently underserved groups can be better represented and supported by Government. This measure will help provide voices to intersectional groups within the LGBTQ2+ populations, especially those who face continued barriers.

According to a recent study by the Centre of Diversity and Inclusion, LGBTQ2+ individuals were more likely to experience discrimination in the workplace (29.1 per cent) than non-LGBTQ2+ individuals (2.9 per cent).

GBA+ was performed: Later stage

Target population: LGBTQ2+ people and communities

GBA+: Chapter 4

Support for the Arts, Culture and Diversity

Introducing A New Anti-Racism Strategy

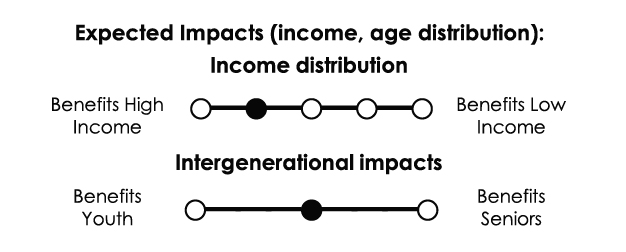

- $45 million over three years to increase funding for the Multiculturalism Program and to develop and implement a new federal Anti-Racism Strategy. In addition, $25 million over five years is provided for projects and capital assistance to celebrate, share knowledge and build capacity in Black Canadian communities.

Approximately 1 in 5 visible minority respondents to the 2014 General Social Survey reported feeling discrimination or unfair treatment in the five years preceding the survey, and 63 per cent believed it was based on their race or skin colour.

It is estimated that men from visible minority groups are 24 per cent more likely to be unemployed than men from non-visible minority groups.

Visible minority women are 48 per cent more likely to be unemployed than and on average earn 55.6 per cent of the income of non-visible minority men.

The establishment of a new Anti-Racism Strategy and related community-based projects and initiatives within the Multiculturalism Program aim to directly address discrimination, particularly against visible minority communities, religious minorities and Indigenous communities.

GBA+ was performed:

Early in the idea development phase

Target population: Visible minority communities; all Canadians

GBA+ Responsive Approach

GBA+: Chapter 4

Support for the Arts, Culture and Diversity

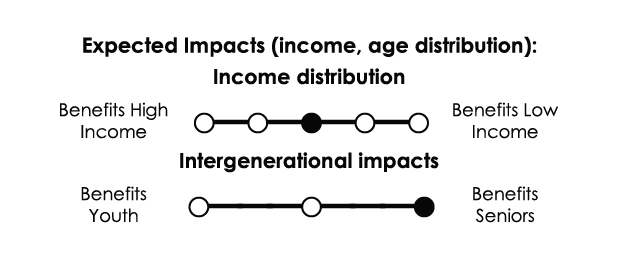

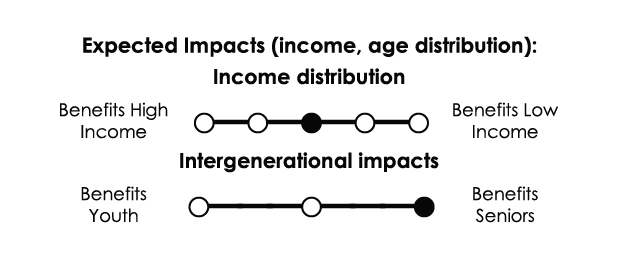

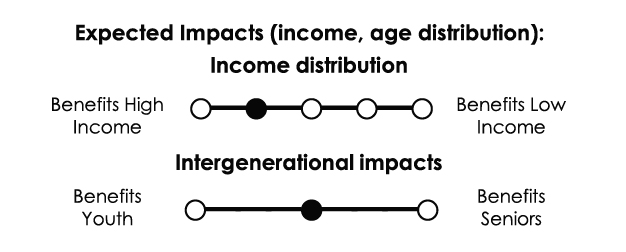

Enhancing Support for Minority-Language Education in Canada

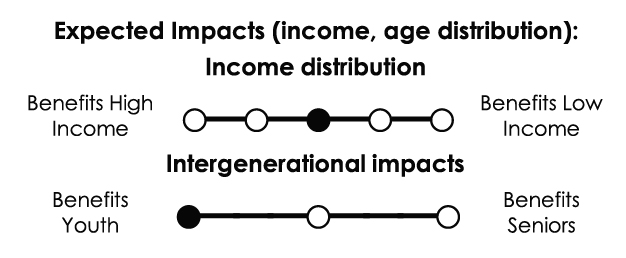

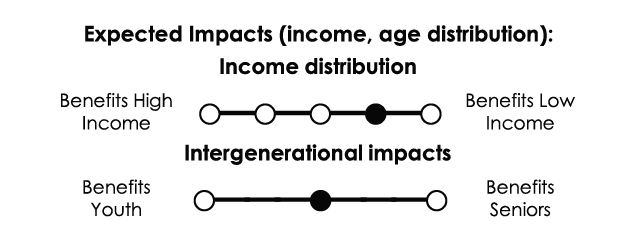

- The Government is committed to enhancing its support for minority-language education, as it works with provinces and territories to finalize the next Protocol for Agreements for Minority-Language Education and Second-Language Instruction.

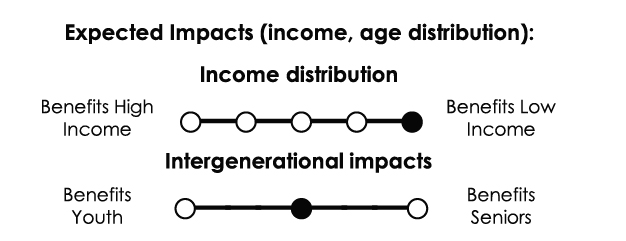

There are more than one million Francophones living outside Quebec and over 1.1 million Anglophones living in Quebec.

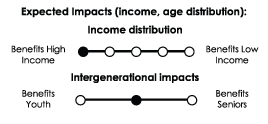

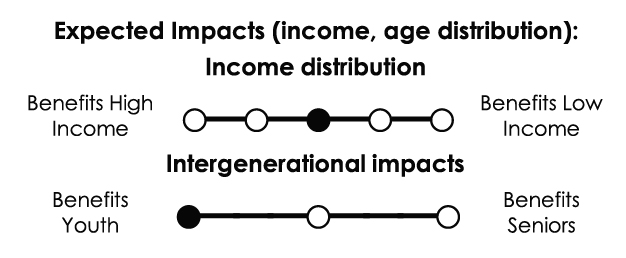

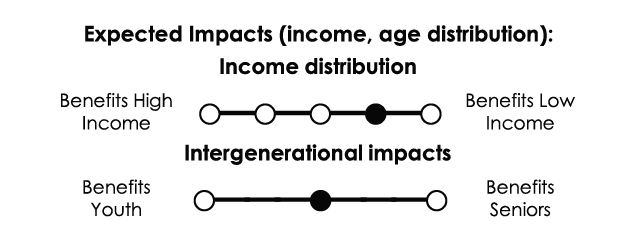

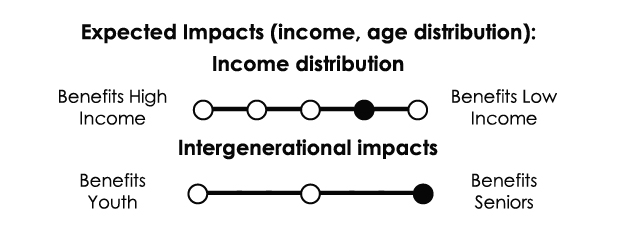

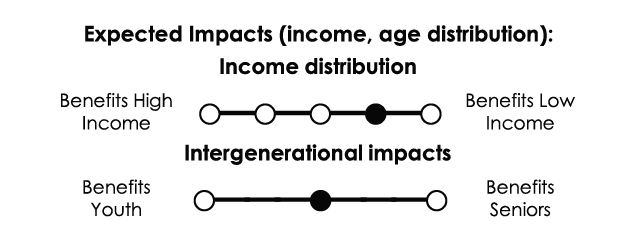

The measure is expected to directly benefit minority-language communities, particularly youth who are in primary or secondary school, and to have broadly gender-balanced impacts. Nationally, there is little difference between the bilingualism rate among women (17.8 per cent) and men (18 per cent).

Francophone minority communities outside of Quebec tend to be in rural areas, comprised older demographics, and tend to be in lower household income categories than the Anglophone majority. As such, this measure may have gradual but positive income distributional impacts by improving the ability of language minority communities to be educated in their official language of choice, through better services and programming.

In addition, women, including those within the minority language education system, represent over 74 per cent of teachers. As such, women may indirectly benefit more from the additional resources for minority language education, such as improved career opportunities, considering that they represent a majority of the teaching profession.

GBA+ was performed: On the existing program

Target population: Official language minority communities, youth

GBA+: Chapter 4

Support for the Arts, Culture and Diversity

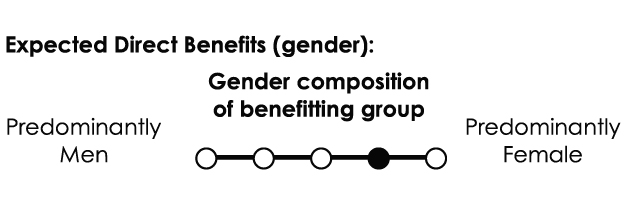

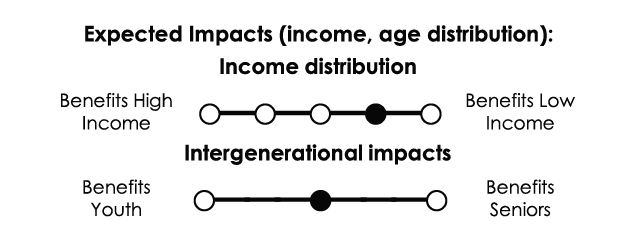

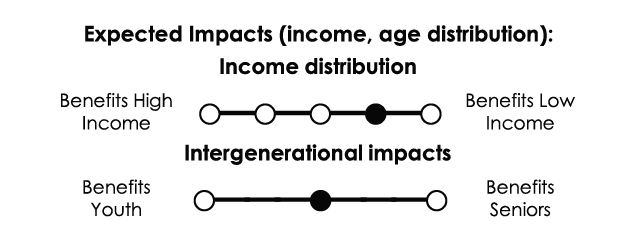

Tax Credit for Journalism Organizations

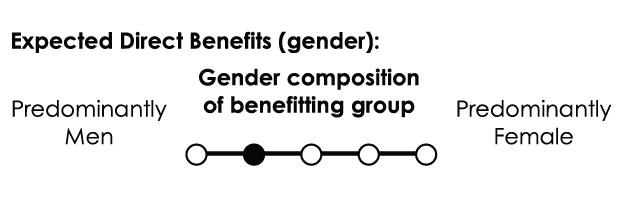

- Budget 2019 proposes a 25-per-cent refundable tax credit on eligible labour costs, available to qualifying Canadian news organizations

Quality, original news content is essential to the proper functioning of a democracy, and helps enable members of Canadian society to make an informed assessment of the issues that may significantly affect their lives and well-being.

To support the production of quality news journalism, Budget 2019 proposes to introduce a 25-per-cent refundable tax credit on eligible labour costs to qualifying Canadian news organizations, starting January 1, 2019.

While this measure is expected to benefit all Canadians by promoting the availability of high quality original news content, it will directly support labour costs associated with eligible workers in the journalism sector. Roughly 48 per cent of journalists in Canada are women, and overall in the information, culture and recreation sector women make up roughly 45 per cent of employees. Roughly 2.2 per cent of employees in this sector are Indigenous people compared to 3 per cent across all industries.

The measure may also benefit the shareholders of eligible Canadian news organizations. Men receive a larger share of overall dividend payments (60 per cent).

GBA+ was performed: Early in the proposal development phase

Target population: All Canadians; journalism sector

GBA+: Chapter 4

Support for the Arts, Culture and Diversity

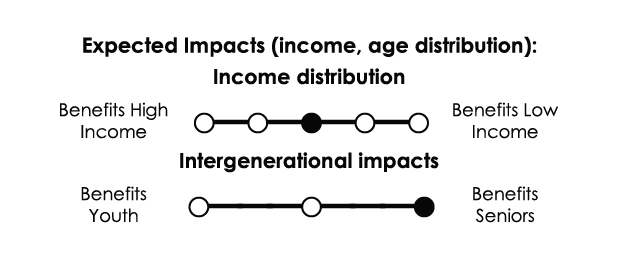

Tax Credit for Digital News Subscriptions

- Budget 2019 proposes to create a new temporary tax credit for subscriptions to digital news produced by certified Canadian journalism organizations. This measure introduces a 15-per-cent non-refundable tax credit for individuals who purchase eligible digital news subscriptions.

Quality, original news content is essential to the proper functioning of a democracy, and helps enable members of Canadian society to make an informed assessment of the issues that may significantly affect their lives and well-being.

To support the accessibility of quality news journalism, this measure introduces a

15-per-cent non-refundable tax credit for individuals who purchase eligible digital news subscriptions.

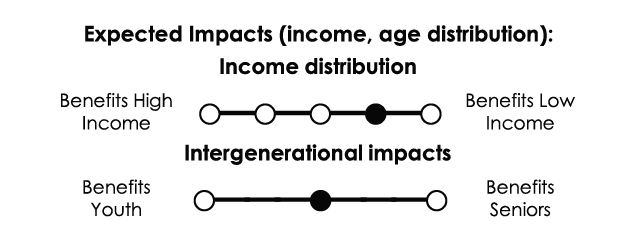

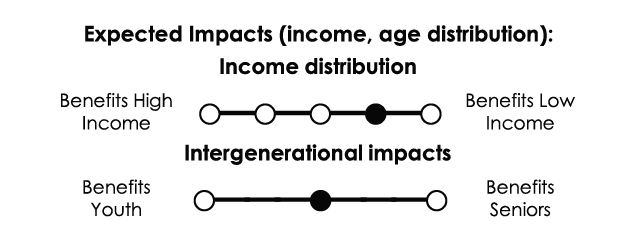

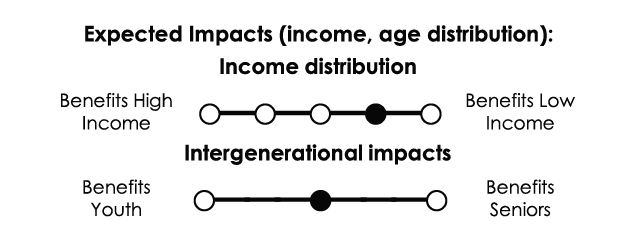

Subscribers to digital news sources are expected to primarily benefit from this measure. Although limited data exist on the characteristics of this beneficiary group, it is anticipated that taxpayers from middle and high-income households will primarily benefit.

Indirectly, the measure is expected to benefit a wide variety of individuals and groups that rely on the Canadian news industry as a regular source of news and information, including, in particular, rural or remote communities. Canadian journalism organizations are also expected to benefit significantly from this measure.

The group consisting of journalists in Canada is broadly gender-balanced. Roughly 48 per cent of journalists in Canada are women, and overall in the information, culture and recreation sector, women make up roughly 45 per cent of employees. Roughly 2.2 per cent of employees in this sector are Indigenous people compared to 3 per cent across all industries.

GBA+ was performed: Mid-point

Target population: All Canadians

GBA+: Chapter 4

Support for the Arts, Culture and Diversity

Access to Charitable Tax Incentives for Not-for-Profit Journalism

- Budget 2019 proposes to create a new category of qualified donees for journalism organizations that produce and disseminate news on a not-for-profit basis.

Quality, original news content is essential to the proper functioning of a democracy, and helps enable members of Canadian society to make an informed assessment of the issues that may significantly affect their lives and well-being.

To support the production of quality news journalism, Budget 2019 proposes to create a new category of qualified donees for journalism organizations that produce and disseminate original news content of public importance to Canadians on a not-for-profit basis.

The measure is intended to support Canadian journalism organizations by enabling them to receive donations and issue official donation receipts and access philanthropic support (i.e., funding from registered charities).

The measure is designed to benefit the journalism industry as a whole. The group consisting of journalists in Canada is broadly gender-balanced. Roughly 48 per cent of journalists in Canada are women, and overall in the information, culture and recreation sector women make up roughly 45 per cent of employees. Roughly 2.2 per cent of employees in this sector are Indigenous people compared to 3 per cent across all industries.

Indirectly, the proposal is expected to benefit a wide variety of individuals and groups that rely on the Canadian news industry as a regular source of news and information, including, in particular, rural or remote communities.

GBA+ was performed: Mid-point

Target population: Journalism sector

GBA+: Chapter 4

Support for the Arts, Culture and Diversity

Supporting Donations of Cultural Property

- Budget 2019 proposes to amend the Income Tax Act in response to a recent Federal Court decision in order to ensure the continued availability of tax incentives for certain donations of cultural property to designated Canadian institutions and public authorities.

Many Canadian cultural institutions lack the resources to purchase cultural property for their collections. Budget 2019 proposes an amendment to ensure tax incentives that will encourage the growth of such collections via donated works.

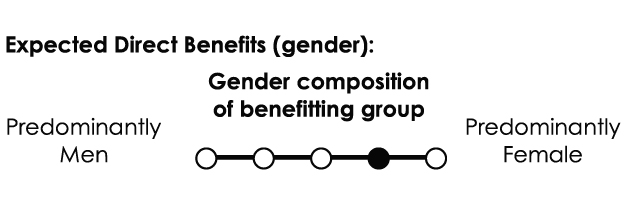

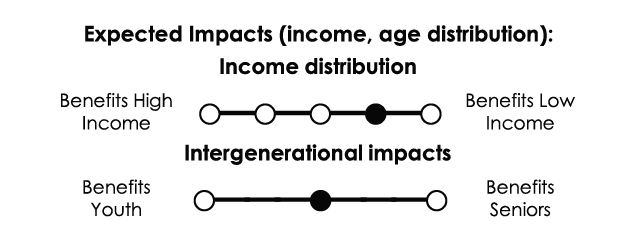

There are currently insufficient data to adequately assess the extent to which the enhanced tax incentives for cultural property impact men and women, however, the benefits are likely to go disproportionately to high-income or wealthy donors.

Canadian cultural institutions and those that visit them would directly benefit from the proposal. The workforce of Canadian museums and galleries tends to be predominantly women: Women hold 70 per cent of director positions in the 80 Canadian art galleries and museums that receive core funding from the Canada Council; and women account for 66 per cent of workers at not-for-profit art galleries across Canada and 67.9 per cent of national museum workers.

In terms of museum visitors, attendance is broadly gender-balanced, with women visiting local museums in slightly higher numbers (50 per cent) than men (46 per cent). Attendance is skewed towards higher income and higher education categories.

GBA+ was performed: Mid-point

Target population: All Canadians; museum sector

GBA+: Chapter 4

Support for the Arts, Culture and Diversity

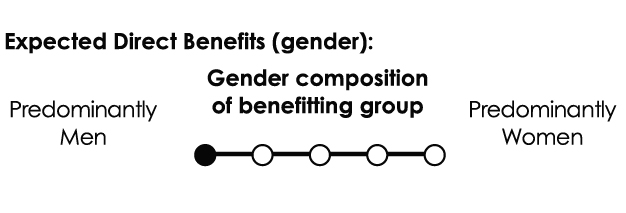

Ensuring a Safe and Healthy Sport System

- $30 million over five years, with $6 million per year ongoing, to Canadian Heritage to support sports organizations in their efforts to foster a fair, safe and healthy competitive sport environment, by addressing key issues such as concussions and doping.

This investment is expected to help remove barriers to sport participation for all Canadians, by ensuring that the Canadian sport system is responsive to emerging social and health-related issues and promotes fair play.

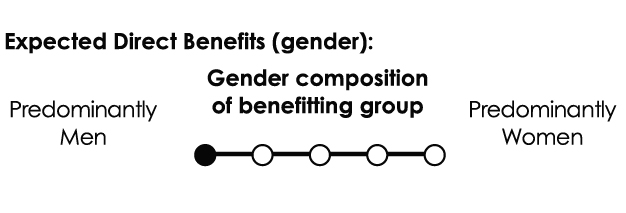

While research shows that 79 per cent of boys and 70 per cent of girls participate in sport, adolescent girls tend to drop out of sport and physical activity at a much higher rate than boys.

Survey data indicate that 37 per cent of children and youth with disabilities never take part in organized physical activities, compared to 10 per cent among those without disabilities.

Only a third of five- to 17-year-olds achieve the level of daily physical activity recommended by the Canadian 24-Hour Movement Guidelines for children and youth. Youth are dropping out of sport and physical activity as they get older.

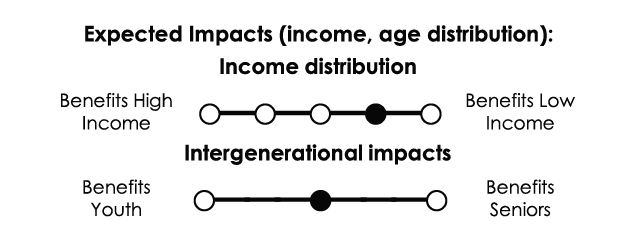

Sport participants are more likely to be found in the higher household income categories than in the lower household income categories. For example, fewer than one in ten individuals with a household income of less than $20,000 per year and 15 per cent of Canadians with a household income in the range of $20,000 to $29,999 participate in sport, compared to 33 per cent of Canadians with a household income greater than $80,000.

GBA+ was performed: Early in idea development phase

Target population: All Canadians

GBA+: Chapter 4

Support for Canada’s Veterans and Their Families

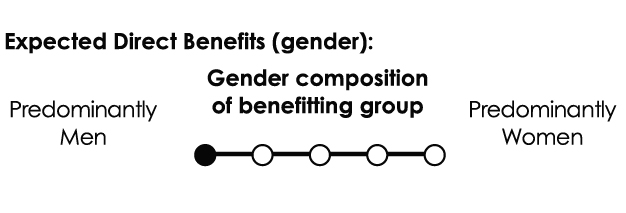

Supporting Veterans as They Transition to Post-Service Life

- $135.1 million over six years, beginning in 2018–19, with $24.4 million ongoing, to Veterans Affairs Canada and the Department of National Defence to make the process simpler and seamless for veterans and members of the Canadian Armed Forces as they transition from service to civilian life.

When adjusting to life after service in the Canadian Armed Forces, 52 per cent of Regular-Force Veterans reported an easy adjustment to life after service, while 32 per cent reported difficulty.

Officers had a lower rate of difficult adjustment: 17 per cent, compared to 29 per cent of Senior Non-Commissioned Members and 39 per cent of Junior Non-Commissioned Members. Veterans who have recently left the military (between 2012 and 2015) had a higher rate of difficult adjustment (42 per cent), compared to those who left between 1998 and 2012 (29 per cent).

Among those seeking services to help with their transition, needs can vary. Veterans Affairs Canada’s 2016 Service Delivery Review identified that there are those who are able to navigate and access information and online tools with little to no assistance; those who occasionally need assistance to navigate the vast array of benefits and programs; and, those who require considerable, ongoing support during their transition.

This measure addresses challenges faced by all of these groups to successfully transition from military to post-military life.

The population of CAF members and veterans who will benefit from this measure is predominantly male given that 86 per cent of Canadian veterans are men. However, spouses, partners and families will also benefit indirectly from improved transition services. Informal caregivers, in particular—who are predominantly women—will face fewer barriers in supporting their veteran family members in accessing benefits and services.

GBA+ was performed: Early in the idea development phase

Target population: Serving members of the Canadian Armed Forces, veterans and their families

GBA+ Responsive Approach

Veterans Affairs Canada and Department of National Defence will monitor the impacts of this measure to ensure equality of access and outcomes in the transition process.

GBA+: Chapter 4

Support for Canada’s Veterans and Their Families

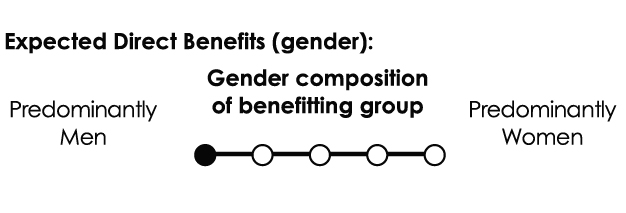

Supporting Research on Military and Veteran Health

- $20.1 million over five years to create a Centre of Excellence on Chronic Pain Research and $25 million over ten years to the Canadian Institute of Military and Veteran Health Research to ensure military members, veterans and their families are supported by research that focuses on their specific needs.

Canadian Armed Forces members and veterans who will benefit from this measure are predominantly men given that most members of the military are men.

Family members also stand to benefit indirectly from this initiative. These measures may help minimize the barriers that informal caregivers—who are predominantly women—must navigate as they support their veteran family members. Military and veteran health researchers also stand to benefit indirectly from this measure. While the representation of women and men varies within specific disciplines, CIMVHR's network of researchers, for example, is gender balanced, which suggests that the benefits of additional research work in this area would accrue equally to men and women researchers.

Veterans report chronic conditions, including arthritis (29 per cent), depression (21per cent), anxiety (15 per cent), and post-traumatic stress disorder (PTSD) (14 per cent), at higher prevalence than Canadians of comparable age and sex.

The prevalence of chronic pain is almost double that of the general Canadian population. Chronic pain is more prevalent in veterans who are women(49 per cent), than in their male counterparts (40 per cent).

GBA+ was performed: Mid-point

Target population: Serving members of the Canadian Armed Forces, veterans and their families

GBA+ Responsive Approach

GBA+: Chapter 4

Support for Canada’s Veterans and Their Families

Supporting Veterans’ Families

- $150 million over five years for a new Veterans’ Survivors Fund.

Eighty-six per cent of Canadian veterans are men. Disaggregated data based on the identity characteristics of survivors of veterans are not available.

The Life After Service Survey (2016) indicated that veterans report higher rates of being married or in a common-law relationship (73 per cent vs. 77 per cent), compared to Canadians of similar age and gender.

Family structure surrounding veterans varies by age group. For example, the most common family composition for veterans aged 55 or older was the veteran living with their partner (74 per cent). For veterans aged 35 to 54, the most common family composition includes children (43 per cent). For veterans under the age of 35, the most common family composition includes children (35 per cent), or living with extended family (25 per cent).

GBA+ was performed: Early in the idea development stage

Target population: Survivors of veterans who married or entered into common law relationships after the age of 60

GBA+: Chapter 4

Support for Canada’s Veterans and Their Families

Commemorating Canada's Veterans: Highway of Heroes

- $2.9 million over three years to Veterans Affairs Canada to support the Highway of Heroes project, which will see 2 million trees being planted between Trenton and Toronto, in commemoration of Canadians who have served in uniform since Confederation.

All Canadians will benefit from this commemorative tree planting initiative, which will serve as a reminder of those who have served in uniform. Members of the Canadian Armed Forces and veterans, who are predominantly men, will benefit in particular from this project.

In addition, those employed to plant trees and prepare the soil will indirectly benefit. Given that 82.5 per cent of workers under the “Harvesting, Landscaping and Natural Resources” occupational classification are men, it is likely that the majority of individuals hired would be men. It is also likely that those hired through this initiative will be predominantly those in Ontario where the project is located.

GBA+ was performed: Later stage

Target population:, All Canadians; veterans

GBA+: Chapter 4

Support for Canada’s Veterans and Their Families

Commemorating Canada’s Veterans: Supporting the Juno Beach Centre

- $2.5 million over five years to support of the operations of the Juno Beach Centre

The Juno Beach Centre is a Second World War museum in Normandy, France, that pays homage to the 45,000 Canadians who lost their lives during the War.

The direct beneficiaries of this measure are all the Centre’s visitors as well as the veterans and families of veterans who are commemorated at the Centre.

The Centre makes an effort to promote diversity and inclusion in its programming. For example, starting in March 2019, the "Great Women During the War: 1939 - 1945" exhibit, developed in partnership with the Canadian War Museum, will be featured at the Centre.

Many youth are hired by the Centre and will indirectly benefit from this initiative. Canadian youth are hired to provide interpretive services and tools are developed to engage educators and youth in remembrance.

GBA was performed: Early stage

Target population: All Canadians

GBA+: Chapter 4

Support for Canada’s Veterans and Their Families

Recognizing Metis Veterans

- $30 million to recognize the contribution of Métis veterans to the Second World War efforts and to commemorate the sacrifices and achievements of all Métis veterans.

Surviving Métis veterans of the Second World War or their estates will benefit directly from the initiative.

All Métis veterans will directly benefit from commemorative activities.

All Canadians will also benefit from this initiative, which will build our country’s knowledge and understanding of the contribution and sacrifices of all Métis Veterans. Young Canadians will benefit in particular as Canada’s commemorative initiatives increasingly focus on engaging Canadian youth in commemorating military history and heritage.

Canada’s Indigenous peoples - Métis, First Nations and Inuit - have a proud tradition of military service. While exact numbers are difficult to determine, the rate of Indigenous participation in Canada’s military has been significant. It is estimated that as many as 12,000 Indigenous people from Canada served in the two World Wars, with at least 500 of them losing their lives.

GBA was performed: Early in the proposal development phase

Target population: Métis veterans and their families

GBA+: Chapter 4

Health and Well-Being

Introducing a National Dementia Strategy

- $50 million over five years to support the implementation of a National Dementia Strategy.

Dementia is having a significant and growing impact on Canadians. As dementia progresses, it becomes highly debilitating for affected individuals, leading to major health impacts and dependency.

By providing funding to support a National Dementia Strategy and working with provinces, territories and other stakeholders, this initiative is intended to optimize the quality of life of all Canadians living with dementia and their caregivers and family members, as well as raise awareness and help prevent the onset of dementia.

Women will benefit more from this measure than men. In 2015–16, more than 419,000 Canadians (6.9 per cent) aged 65 years and older were living with diagnosed dementia, two-thirds of whom are women. Emerging research on genes and sex hormones indicates non-modifiable risk factors disproportionately affect women. Furthermore, the majority of caregivers to persons with dementia are women (80 per cent).

Additionally, Indigenous people, persons with disabilities, and those who identify as LGBTQ2+ will also benefit from this measure, as they are at a greater risk for developing dementia.

GBA+ was performed: On the existing program

Target population: Seniors, people with dementia, their caregivers and family members

More years in good health

GBA+ Responsive Approach

GBA+: Chapter 4

Health and Well-Being

Creating a Pan-Canadian Database for Organ Donation and Transplantation

- $36.5 million over five years with $5 million per year ongoing to support a pan-Canadian data and performance system for organ donation and transplantation.

Every year, approximately 250 individuals die while on the wait list for an organ transplant. Approximately 3,000 organs were donated in 2017, but 4,500 individuals remained on waiting lists.

The pan-Canadian data and performance system for organ donation and transplantation will benefit all Canadians by improving transplant practices and patient outcomes.

While the group benefitting from organ donations is broadly gender-balanced, men are more likely than women to require transplants, and men are also more likely than women to receive an organ transplant (62 per cent).

Moreover, this initiative may improve outcomes for Indigenous patients. Data show that Indigenous kidney patients are less likely to receive kidney transplants than non-Indigenous patients.

While Canadian men and women donate at comparable rates overall, more deceased donors were men (62 per cent) and more living donors were women (63 per cent).

GBA+ was performed: Mid-point

Target population: All Canadians, rural and remote communities

More years in good health

GBA+: Chapter 4

Health and Well-Being

Expanding Health-Related Tax Relief

- Budget 2019 proposes to expand health-related tax relief under the GST/HST system to better meet the health care needs of Canadians.

Providing GST/HST relief for human ova and in vitro embryos will benefit couples experiencing infertility, same-sex couples and single individuals, who require donated human ova and in vitro embryos for use in assisted human reproduction.

According to a 2009–10 Statistics Canada study, 15 per cent of couples that attempted to conceive reported having sought medical help for conception, and 19 per cent of these couples reported using assisted reproduction techniques.

Additionally, this measure will provide GST/HST relief for foot-related medical devices and for multidisiplinary health care services will primarily benefit persons with disabilities and persons with health issues.

GBA+ was performed: Early in the proposal development phase

Target population: Persons with disabilities, persons with health issues, as well as couples experiencing infertility, same-sex couples and single individuals who wish to form a family

GBA+: Chapter 4

Health and Well-Being

Enhancing the Federal Response to the Opioid Crisis in Canada

- $30.5 million over 5 years, with $1 million in ongoing funding, to target key gaps in intervention related to the opioid crisis.

This investment will have positive direct impacts on many sectors of the population that have been particularly affected by the opioid crisis, including men, women, Indigenous peoples, LGBTQ2+ subpopulations, incarcerated populations, and individuals with mental health challenges.

Most apparent opioid-related deaths occurred among men (76 per cent) and among individuals between the ages of 30 and 39 (27 per cent).

Women have also been impacted by the crisis, as they are more likely than men to have a chronic pain condition that is treated with opioids. The effects of long-term opioid use also have specific health risks for women (e.g., infertility, neonatal risks, cardiac risks).

In addition, the overdose death rates for First Nations peoples in Alberta and British Columbia are three and five times higher respectively than non-First Nations people.

Overdose deaths accounted for 30 per cent of non-natural deaths in in federal correctional facilities in 2015-16, with fentanyl identified as a standalone or contributing substance in 69 per cent of overdoses. It should be noted that men also account for 83 per cent of adult admissions to correctional services.

GBA+ was performed: Early in idea development phase

Target population: Individuals affected by the opioid crisis

More years in good health

GBA+ Responsive Approach

GBA+: Chapter 4

Health and Well-Being

Supporting a Pan-Canadian Suicide Prevention Service

- $25 million over five years, and $5 million per year ongoing, to work with experienced and dedicated partners in the space to support a fully operational pan-Canadian suicide prevention service.

In 2016, close to 4,000 people died by suicide. An average of 10 people die by suicide each day in Canada.

A pan-Canadian suicide prevention service will help to ensure that all Canadians have access to suicide prevention support across Canada.

This measure should predominantly benefit men and boys, Indigenous peoples and the LGBTQ2+ community. Men comprise around 75 per cent of all suicide deaths each year, although women are hospitalized for self-harm one and a half times more than men.

Suicide is the second leading cause of death among youth (15–24 years old) and young adults (25–34 years old).

First Nations youth die by suicide about 5 to 6 times more often than non-Indigenous youth. Suicide rates for Inuit youth are among the highest in the world. Thoughts of suicide and suicide-related behaviour are disproportionately prevalent among LGBTQ2+ people; and highest among transgender people; one study reports that more than 10 per cent of transgender people have attempted suicide in the previous year.

GBA+ was performed: Early in idea development phase

Target population: All Canadians; persons with mental health issues

Improved mental health

GBA+: Chapter 4

Health and Well-Being

Supporting Community-Based Housing for People with Complex Health and Social Needs in Prince Edward Island

- $50.8 million over 5 years to support a Public Safety Housing Project in Prince Edward Island (PEI)

The measure will benefit individuals in PEI with complex health and social needs, including those with a mental health disorder, those requiring specialized treatment or those experiencing chronic substance abuse, dependency or housing instability.

For persons 12 years and older in PEI in 2017, 7.2 per cent perceived their mental health to be fair or poor (Statistics Canada).

In 2014-15, 2,606 individuals accessed publicly funded substance use treatment services in PEI, with the majority being men aged 25–34 (Canadian Centre on Substance Use and Addiction).

Alcohol was the substance most commonly reported as the reason for seeking treatment, at 44.3 per cent of treatment events, followed by opioids (31 per cent) and cannabis (15 per cent).

GBA was performed: Later stage

Target population: Prince Edward Island residents with complex health and social needs

Reducing poverty and supporting health and well-being

GBA+: Chapter 4

Health and Well-Being

Supporting a Safe and Non-Discriminatory Approach to Plasma Donation

- $2.4 million over three years to Health Canada for research on plasma donation by men who have sex with men.

Plasma is an antibody-rich liquid found in human blood. Canadians with a wide range of health issues depend on products derived from plasma to treat hematologic, neurologic, rheumatologic and dermatologic illnesses, among others.

Blood and plasma donor screening practices in Canada have been seen as discriminatory, as they can perpetuate harmful myths and stereotypes about the health of men who have sex with men. The evidence generated by Budget 2019’s proposed investment in research on plasma donation by men who have sex with men could help to inform future changes to plasma donation policy.

There are no data available on exactly how many Canadians with health issues use blood plasma, given the wide range of plasma-derived products as well as medical conditions that can be treated with plasma, or the number of Canadians who donate plasma.

GBA+ was performed: On the existing program

Target population: People who identify as LGBTQ2+

GBA+ Responsive Approach

GBA+: Chapter 4

Health and Well-Being

Supporting Employment for Persons with Intellectual Disabilities and Autism Spectrum Disorders

- $12 million over three years for the Ready, Willing and Able program to support employment opportunities for persons with intellectual disabilities and Autism Spectrum Disorders.

Within Canada, there are a growing number of working-age adults with an intellectual disability and Autism Spectrum Disorders (ASD), who face long-standing barriers to fully participating in the labour market. For these individuals, this can result in social exclusion, and poverty. For employers and Canadian society, these individuals represent an untapped source of able workers.

Ready, Willing and Able will benefit individuals with intellectual disabilities and ASD. The prevalence of developmental disabilities is higher among men than among women. Of the 315,470 persons aged 15 and over with a developmental disability, identified in the 2017 Canadian Survey on Disability, 192,160 (61 per cent) were men and 123,310 (39 per cent) were women.

GBA+ was performed: Later stage

Target population: Persons with intellectual disabilities

Equal and full participation in the economy

GBA+: Chapter 4

Health and Well-Being

More Accessible Federal Government Workplaces

- $13.7 million over five years, starting in 2019–20, and $2.9 million per year ongoing to help identify, remove and prevent technological barriers in federal government workplaces.

About 10,000 employees in the federal public service self-identify as having a disability, and the federal government has committed to hiring at least 5,000 people with disabilities over the next five years.

Accessible workplaces with appropriate tools will allow disabled employees to fully participate in an increasingly digital work environment.

GBA+ was performed: On the existing program

Target population: Federal government employees with disabilities

Equal and full participation in the economy

GBA+: Chapter 4

Health and Well-Being

Inclusion of Canadians With Visual Impairments and Other Print Disabilities

- $25.8 million to the Centre for Equitable Library Access and independent Canadian publishers to support the production of accessible materials for people with print disabilities.

Approximately 2.4 million Canadians over the age of 15 have a learning, physical or visual disability that prevents them from reading conventional print. Only a small fraction of published books are made available in accessible formats.

The measure would reduce barriers to literacy, education, and social and economic inclusion.

The incidence of print disabilities increases with age. As a result, increased access to reading material is expected to benefit more current and future seniors.

While fewer younger individuals have print disabilities, those that do are expected to benefit significantly from this initiative as it will help them gain the knowledge and skills needed to participate in the economy and society.

While negative impacts are not expected for any groups, individuals residing in rural or remote communities may not benefit as much given they may not as readily have access to the published materials.

GBA+ was performed: Mid-point

Target population: Persons with disabilities

Equal opportunities and diversified paths in education and skills development

GBA+ Responsive Approach

GBA+: Chapter 4

Health and Well-Being

Inclusion of Canadians With Visual Impairments and Other Print Disabilities—Other

- $1.0 million for the Canadian National Institute for the Blind (CNIB) to improve employment of persons with visual impairments by connecting them to employers.

- $0.5 million to promote innovation in accessible electronic payment terminals so persons with disabilities can make transactions independently.

One in five Canadians over the age of 15, or 6.2 million individuals, have one or more disabilities. Persons with disabilities face lower employment than Canadians without disabilities; only 59 per cent of Canadians with disabilities are employed compared to 80 per cent of Canadians without disabilities.

Funding to CNIB will ensure that more Canadians with visual impairments have employment opportunities.

Women with disabilities stand to benefit slightly more than men from the increased job opportunities the proposal would provide, as there are more women with disabilities than men.

More women reported having disabilities than men (24 per cent and 20 per cent respectively), and 57 per cent of women with disabilities are employed whereas 61 per cent of men with disabilities are employed.

In addition, persons with a wide range of disabilities face barriers to conducting daily activities such as making purchases. The Government is investing in innovative approaches to improve the accessibility of electronic payment terminals to ensure Canadians with disabilities are able to conduct these daily activities independently.

GBA+ was performed: Later stage

- Target population: Persons with disabilities

Equal and full participation

in the economy

GBA+: Chapter 4

Health/Well-Being

Improvements to the Registered Disability Savings Plan

- Budget 2019 proposes to eliminate the requirement to close a Registered Disability Savings Plan (RDSP) when a beneficiary no longer qualifies for the Disability Tax Credit (DTC). Budget 2019 also seeks to exempt RDSPs from seizure in bankruptcy proceedings.

Since becoming available in December 2008, over 180,000 RDSPs have been opened.

Allowing a beneficiary of an RDSP to keep their RDSP open during periods in which they do not qualify for the DTC will primarily benefit Canadians with episodic disabilities, particularly those who are currently in the accumulation phase of saving in an RDSP, by providing access to grants and bonds otherwise required to be repaid to the Government, during a later withdrawal phase of their plan.

All RDSP beneficiaries will benefit from RDSP assets being exempt from seizure in bankruptcy.

Indirect beneficiaries of both measures include families who are helping a person with a disability to save for the long term through an RDSP.

GBA+ was performed: Mid-point

Target population: Canadians with severe and prolonged disabilities and their families

GBA+ Responsive Approach

Through the existing Canada Disability Savings Program, the Government provides Canada Disability Savings Bonds to RDSPs established for low- to modest-income beneficiaries, and supplements private savings at matching rates of up to 300 per cent through Canada Disability Savings Grants. Low- to modest-income beneficiaries are eligible for the highest matching rate.

GBA+: Chapter 4

Health and Well-Being

Introducing a Food Policy for Canada

- $134.4 million over five years, on a cash basis, and $5.2 million per year ongoing in support of a Food Policy for Canada.

- A commitment to invest an additional $100 million from the Strategic Innovation Fund to support agri-food value added production in Canada.

In 2012, 12.5 per cent of Canadian households experienced food insecurity to some degree, including almost 50 per cent of households in Nunavut. Meanwhile, the annual value of wasted food in Canada, as of 2014, has been estimated to be in the range of $31 billion.

A Food Policy for Canada is a comprehensive approach to address these gaps and challenges within four areas of action, including: Food Security for Canadians in the North; Healthy Local Food for Canadians; Canada—Best Quality Food Producer for the World; and Reducing Food Waste. The policy will involve multiple program streams that impact a diverse range of Canadians.

All Canadians are expected to benefit in a uniform way from the majority of program elements. Food Policy initiatives will benefit a wide diversity of Canadians, including Canadian consumers, agriculture and agri-food businesses and farmers. Two programs will seek to address food insecurity, particularly in the North, and as a result are anticipated to have positive income distribution impacts. For example, the Northern and Isolated Community Initiatives Fund and the Local Food Infrastructure Fund are expected to help reduce instances of food insecurity, which disproportionately affect more vulnerable segments of society such as Indigenous households and those living in northern and remote communities.

GBA+ was performed: Early in the idea development phase

Target population: All Canadians

Fewer women and children living in food insecure households

GBA+ Responsive Approach

A number of opportunities to mitigate potential negative impacts and reduce barriers to participation have been identified, such as simplified and streamlined program application processes, partnerships with third-party organizations that can provide additional support to specific segments of the population who may face barriers to participation, and specific program design options to address inclusivity concerns for women and those with physical disabilities. In addition, Agriculture and Agri-Food Canada will, with existing resources, develop a strategy to address gender gaps across the agriculture and agri-food value chain.

GBA+: Chapter 4

Health and Well-Being

Addressing the Challenge of African Swine Fever

- $31 million over five years, with up to $5.8 million per year ongoing, to the Canada Border Services Agency (CBSA) to enhance the capacity of the Detector Dog Service Program in order to further mitigate the risk of African Swine Fever entering Canada.

Hog farm operators and meat processors will be the direct beneficiaries of this initiative, as it is intended to reduce the risk of negative impacts on the Canadian swine herd and lost pork exports expected if African Swine Fever were to enter Canada.

In 2016, 72 per cent of farms in Canada were run by operators who were men, with 54 per cent of the operators over the age of 55.

This initiative will result in enhanced screening of flights arriving in Canada from countries where African Swine Fever exists. Individuals travelling frequently between Canada and these countries may face enhanced screening.

GBA+ was performed: Early in the proposal development phase

Target population: Hog farmers and meat processors

GBA+ Responsive Approach

GBA+: Chapter 4

Public Safety and Justice

Protecting Canada's Critical Infrastructure From Cyber Threats

- $144.9 million over five years to support critical cyber systems in Canada. Funding will also support the Canadian Centre for Cyber Security in providing advice and guidance to critical infrastructure owners and operators on how to better prevent and address cyber attacks.

In its 2018 Global Risks Report, the World Economic Forum rated cyber security issues as the third highest global security risk by perceived likelihood—behind only extreme weather events and natural disasters.

This funding will help to bolster the cyber security of Canada’s most critical cyber systems, including in the banking, transport, telecommunications and energy sectors—sectors that all Canadians rely on each day and, as such, these investments will benefit all Canadians.

Women are underrepresented in science, technology, engineering and mathematics (STEM) disciplines; women are also underrepresented in cyber security professions. A 2017 study of women in cyber security professions found that women are globally underrepresented in the cyber security profession at 11 per cent, much lower than the representation of women in the overall global workforce.

Implementation of this initiative presents an opportunity for the Government to recruit more women and strengthen gender diversity in cyber security and STEM fields, which would align with existing federal human resource efforts to promote a diverse and inclusive workplace.

GBA+ was performed: Mid-point

Target population: All Canadians

GBA+: Chapter 4

Public Safety and Justice

Cyber Security Innovation Network

- $80 million over four years, starting in 2020–21, to support three or more post-secondary affiliated cyber security networks across Canada that will be selected through a competitive process.

Digital technologies are increasingly important to innovation, economic growth and the long-term prosperity of Canadians. As rapid growth in technology continues, the Canadian economy increasingly requires cyber security skills and personnel to build and maintain necessary safeguards to ensure businesses, public institutions and Canadians have confidence in the online infrastructure that underpins the digital economy.

Investments from this proposal will complement the Government’s cyber security efforts by helping to bolster cyber skills development in Canada’s workforce by supporting workers, students and employers, who want to upgrade their skills, gain relevant work experience and hire new talent in the cyber security discipline.

Women are globally underrepresented in the cyber security profession, making up approximately 11 per cent in the overall global workforce. In 2017, 25 per cent of people employed in Canada’s information and communications technology sector were women. According to the Brookfield Institute for Innovation + Entrepreneurship, in Canadian tech jobs, among individuals with a bachelor’s degree or higher, women earn $19,570 less on average than men.

Recognizing these trends, the Government will work to ensure that the opportunities from these investments also accrue to individuals from traditionally underrepresented groups in this sector, including women.

GBA+ was performed: Early in the idea development phase

Target population:All Canadians; cybersecurity and research sector

GBA+ Responsive Approach

As part of the competitive selection process, Innovation, Science and Economic Development Canada will seek to promote equity, diversity and inclusion of groups that are traditionally underrepresented in the relevant fields of study—such as computer sciences—and in cyber security occupations. Equity, diversity and inclusion action plans—with targets, objectives and plans for the tracking of results achieved—will be part of institutions’ applications.

GBA+: Chapter 4

Public Safety and Justice

Protecting Democracy

- $19.4 million over four years to launch a Digital Democracy Project;

- $2.1 million over three years to implement Canada’s commitment regarding the Rapid Response Mechanism, and;

- $4.2 million over thee years to provide cyber security advice and guidance to Canadian political parties and election administrators.

Protecting the integrity of Canada’s democratic system will benefit all Canadians. Because its objective is to combat online disinformation, better understand disinformation’s impact and promote access to reliable sources of information online, the Digital Democracy Project (DDP) is expected to predominantly benefit individuals most susceptible to online disinformation.

There is currently limited knowledge of the groups that are most affected by online disinformation, particularly in the Canadian context, although it is expected that youth, who are high users of social media and digital technologies, and lower-educated Canadians, may be particularly susceptible. One of the objectives of the DDP is to improve that knowledge.

An objective of the Rapid Response Mechanism is to faclilitate coordination and information sharing regarding threats to democracy among G7 countries. This includes investigating and responding to harassment campaigns, which disproportionally target women and other vulnerable groups.

Providing cyber security advice and guidance to Canadian political parties and election administrators is intended to benefit all Canadians by increasing the integrity of the institutions requesting assistance. However, it is anticipated that candidates running for office, which in the 2015 federal elction were 70 per cent men, may also benefit from political parties having more secure systems.

New forms of foreign interference, such as technology-facilitated harassment campaigns (e.g. social media), are expected to have disproportionately adverse impacts on women and other vulnerable groups (e.g. youth).

GBA+ was performed:

Early in the development phase

Target population: All Canadians

GBA+ Responsive Approach

As a partner in the DDP, the Social Sciences and Humanities Research Council (SSHRC) will include GBA+ considerations in the evaluation process to award funding for research on disinformation. Canadian Heritage would also, to the extent possible, ensure that organizations that receive funding from the DDP will take into account GBA+ concerns in their internal operations.

GBA+: Chapter 4

Public Safety and Justice

Protecting Canada’s National Security

- $67.3 million over five years and, $13.8 million per year ongoing to support efforts to assess and respond to economic-based security threats to Canada.

Canada welcomes foreign investment and trade. At the same time, it is critical that the Government have the tools and resources it needs to protect against economic-based security threats.

This funding supports ongoing work to maintain public safety and national security for all Canadians through the assessment and analysis of economic-based security threats related to foreign direct investment, trade, exports and other factors.

GBA+ was performed: On the existing program

Target population: All Canadians

GBA+: Chapter 4

Public Safety and Justice

Enhancing Accountability and Oversight of the Canada Border Services Agency

- $24.42 million over five years and $6.83 million per year ongoing to expand the mandate of the Civilian Review and Complaints Commission (CRCC) so that it acts as an independent review body for the Canada Border Services Agency.

The CBSA is responsible for enforcing laws and regulations that touch nearly every sector of Canadian society, including agriculture, manufacturing and services sectors. In carrying out this role, CBSA officers engage daily with the public at 1,100 ports of entry across Canada, including highway crossings, airports, marine terminals, rail ports, and postal services.

The CBSA has procedures in place to hear comments or complaints about the public’s experience with the Agency.

To further strengthen oversight of the CBSA, this initiative will expand the mandate of the CRCC to provide an independent, fair and impartial examination of issues raised concerning public interactions with the CBSA.

GBA was performed: Early in proposal development phase

Target population: Members of the general public who have interactions with the CBSA

GBA+: Chapter 4

Public Safety and Justice

Strengthening the Royal Canadian Mounted Police

- $508.6 million over five years for the Royal Canadian Mounted Police (RCMP) to support continued policing operations, including to prevent and investigate crimes, enforce laws, and work with other police and law enforcement agencies.

The RCMP is Canada’s national police service and is vital to the safety and security of Canadians. It provides total policing services to all Canadians and policing services under contract to the three territories, eight provinces, more than 150 municipalities, more than 600 Indigenous communities and three international airports.

According to the RCMP’s 2017-18 Departmental Results Report, the Agency employed 29,555 full-time equivalents. Approximately one fifth of the RCMP’s regular members are women, with increasingly more women entering senior ranks.

This initiative will support ongoing policing operations within the RCMP, including the organization’s efforts to become an inclusive, respectful and diverse workforce.

The RCMP is working to ensure its workplace is free from harassment and bullying. To this end, the organization has accepted all 13 recommendations from two external expert reviews carried out by the Civilian Review and Complaints Commission for the RCMP, and by former Auditor-General, Sheila Fraser. The recommendations will be used to address workplace harassment and to create a respectful work environment for all RCMP employees.

GBA was performed: On the existing program

Target population: All Canadians

GBA+: Chapter 4

Public Safety and Justice

Enhancing the Integrity of Canada’s Borders and Asylum System

- $1.18 billion over five years and $55.0 million per year ongoing to strengthen Canada’s asylum system and address the challenges of irregular migration.

By improving the efficiency of the asylum system, asylum seekers will have their claims for asylum heard sooner. Those who are deemed protected persons will be able to start their lives in Canada, and those who are facing persecution in other countries will be able to live without fear of being returned to those countries. A faster determination will allow claimants to settle in Canada, sponsor their families and find meaningful employment sooner.

In 2018, asylum claimants were approximately 70 per cent adults versus 30 per cent minors, and 46 per cent women versus 54 per cent men. A notable minority of asylum claimants have left their country of origin due to persecution on the grounds of sexual identity, for which their government is either complicit or does not offer protection. Asylum claimants tend to be in a lower income strata upon arrival, but achieve average Canadian income within a decade.

Negative differential impacts on particular groups are not expected from the reforms to the asylum system. The efficiency improvements to the system that will make registration and intake processes faster will have some positive impacts on vulnerable claimants, such as women, children and LGBTQ2+. For example, reduced processing times are expected to lower the stress and uncertainty that can be felt while awaiting a decision, which will in turn help to reduce the mental strain experienced by vulnerable groups during the asylum claim process. This is vital especially for individuals being asked to relive traumatic experiences. Shifting the responsibility of scheduling hearings to the Immigration and Refugee Board will also have a positive impact on vulnerable populations who are not only hoping to have their claims for asylum assessed quickly, but who may also face barriers in getting to the hearings.

GBA+ was performed: Early in the idea development phase and at the mid-point

Target population: Asylum claimants and all Canadians

GBA+ Responsive Approach

GBA+: Chapter 4

Public Safety and Justice

Protecting People from Unscrupulous Immigration Consultants

- $51.9 million over five years and $10.1 million per year ongoing to support an improved governance regime for immigration consultants with strengthened compliance and enforcement measures, as well as public awareness activities that will help vulnerable newcomers and applicants protect themselves against fraudulent immigration consultants.

Some foreign nationals are vulnerable to abuse by fraudulent immigration consultants as they navigate Canada’s immigration system. Clients can experience vulnerability for various reasons, including low income, low education and literacy, and lack of knowledge of English or French.

Overall improvements to the regulation of consultants will benefit all clients by creating a robust regime and stronger consumer protection. The new measures will have a greater impact on clients from countries who are more likely to engage the services of a consultant—which are more frequently low- and middle-income countries where prospective applicants may experience more vulnerability due to poverty, religious or ethnic minority status, or other factors.

These measures are not expected to carry differential impacts for men versus women, as data indicates that similar numbers of men and women elect to use authorized consultants for their immigration and citizenship applications. The measures are not expected to pose barriers to participation nor alter behaviour in any way that would impact gender equality.

Individuals from Asian source countries (India, Pakistan, China) are most likely to use immigration consultants. Additionally, usage of immigration consultants is higher among immigrants who apply to come to Canada as permanent residents through the family reunification and economic immigration streams, as compared to usage among those who apply to come to Canada as refugees or asylum seekers.

GBA+ was performed: Early in the idea development phase

Target population: Vulnerable newcomers to Canada and immigration applicants

GBA+: Chapter 4

Public Safety and Justice

Ensuring Better Disaster Management Preparation and Response

- $151.23 million over five years, starting in 2019–20, and $9.28 million per year ongoing to improve emergency management in Canada.

A 2007 Canadian Red Cross report commissioned by Public Safety Canada entitled Integrating Emergency Management and High-Risk Populations: Survey Report and Action Recommendations notes that certain populations are more vulnerable when hazardous events occur. These include seniors, persons with disabilities and medically dependent individuals. As such, it is expected that these groups would be more likely to benefit from improved disaster readiness.

This funding would help enhance Canada’s ability to better understand the nature of the risks posed by floods, wildfires and earthquakes, which will help Canadians be better prepared to prevent, mitigate, plan for and respond to natural disasters. This funding also includes targeted investments to enhance capacity in Indigenous communities to respond to wildfires, which are particularly vulnerable to natural disasters. Approximately 80 per cent of Indigenous communities in Canada are situated in forested areas prone to wildfires.

GBA+ was performed: At each stage of the policy development process

Target population: All Canadians

GBA+ Responsive Approach

GBA+: Chapter 4

Public Safety and Justice

Improving Emergency Medical Response in Western Canada

- $65 million in 2018–19 to support STARS, through Public Safety Canada, in replacing its aging fleet and acquiring new emergency ambulance helicopters.

The Shock Trauma Air Rescue Service (STARS) provides rapid and specialized emergency helicopter ambulance services to patients who are critically ill or injured in communities across Manitoba, Saskatchewan, Alberta and parts of British Columbia.

Given that STARS services the Prairie provinces and some B.C. communities, the benefits of the proposed investments would largely accrue to residents, workers or visitors to those regions. Within this group, those living or working in isolated and rural communities, including Indigenous and northern communities, would likely be more positively impacted by continued STARS services.

Since 1985, STARS has flown over 40,000 missions, and today flies an average of 8 missions per day.

According to the Canadian Institutes of Health Research’s Team in Trauma System Development in Canada, 69 per cent of the Canadian population lives within one-hour driving distance to a trauma centre.

GBA+ was performed: At the later stage

Target population: Critically ill or injured individuals living in or visiting areas serviced by STARS across Manitoba, Saskatchewan, Alberta and parts of British Columbia

GBA+: Chapter 4

Public Safety and Justice

Protecting Children from Sexual Exploitation Online

- $22.24 million over three years for Public Safety Canada to support efforts to combat child sexual exploitation online.

In a review of 153,000 reports of online child sexual exploitation from 2008–15, Cybertip.ca found that 78.3 per cent of children in the images/videos were estimated to be under 12 years old with the majority (63 per cent) of these children appearing to be under 8 years of age.

Certain youth populations are likely more vulnerable to online child sexual exploitation. These can include girls, LGBTQ2+ youth, homeless youth, youth in care, and youth living in unstable family conditions.

These investments would help protect children and youth by aiming to decrease the incidence of child sexual offences online, as well as raising awareness of pathways to disclosure of abuse.

Youth may also be perpetrators of exploitation, for example, when circulating sexually explicit images/videos of their friends/peers and luring other youth. This funding would include targeted awareness activities to help prevent both victimization and offending.

GBA+ was performed: Early in the idea development phase

Target population: Children andyouth

Fewer victims of childhood maltreatment

GBA+: Chapter 4

Public Safety and Justice

Giving Canadians Better Access to Public Legal Education and Information

- $8.1 million over five years, and $1.62 million per year ongoing to the Department of Justice to support the growing demand for Public Legal Education and Information services across Canada.

The main goal of Public Legal Education and Information (PLEI) organizations is to create an informed citizenry that is knowledgeable about the law, able to recognize and exercise their lawful rights, fulfill their legal obligations, and perform their duties as participants in a democratic society.

PLEI organizations are intended to be responsive to the needs of a wide range of Canadians, including those who may face barriers accessing justice. For example, in light of the growing numbers of aging Canadians, PLEI organizations have provided legal information related to power of attorney and guardianship, health and disability, and elder abuse. PLEI organizations also tailor services to reach diverse groups of Canadians, including by publishing legal information in multiple languages.

In general, PLEI organizations offer information about the laws specific to the province or territory in which they operate. In addition, they provide information about federal laws (e.g. cannabis legalization) to help inform the public.

GBA+ was performed:

On the existing program

Target population: All Canadians

Increased accountability and responsiveness of the Canadian justice system

GBA+: Chapter 4

Public Safety and Justice

Supporting Access to Family Justice in the Official Language of One's Choice

- $21.6 million over five years to support legislative amendments that provide for access to family justice—and divorce in particular—in the official language of one’s choice.

Divorce and separation affect Canadians from all walks of life. This initiative will support access to the family justice system, primarily benefitting official language minority communities across Canada. In particular, this initiative will ensure that both official languages can be used in proceedings under the Divorce Act.

This initiative could also help support the sustainability of official language minority communities by enabling greater access to family justice services in both official languages across Canada.

The Department of Justice notes that, according to Census data, five million Canadians separated or divorced between 1991 and 2011.

In 2016, Statistics Canada reported that there were 1,074,985 French-mother-tongue Canadians living outside of Quebec and 718,900 English-mother-tongue Canadians living in Quebec.

GBA+ was performed: Early in the idea development phase

Target population: Official languages minority communities

Increased accountability and responsiveness of the Canadian justice system

GBA+: Chapter 4

Public Safety and Justice

Protecting Community Gathering Places From Hate-Motivated Crimes

- $2.0 million per year ongoing to enhance the Communities at Risk: Security Infrastructure Program.

In November 2018, Statistics Canada reported there were 2,073 police-reported hate crimes in 2017, an increase of 47 per cent over the previous year. This increase was largely the result of a rise in hate-related property crimes, such as graffiti and vandalism.

The Security Infrastructure Program supports the implementation of infrastructure projects to help communities at risk and with a demonstrated history of being victimized by hate-motivated crimes to protect their gathering places (e.g., places of worship, schools, community centres). Program funding will support enhancements to security infrastructure for eligible recipients, and can include installation of lighting, cameras and fencing.

GBA+ was performed: On the existing program

Target population: All Canadians at risk of being targeted by hate crimes

GBA+: Chapter 4

Canada’s International Engagement

International Assistance Envelope Funding Increase

- An additional $700 million in 2023–24 in International Assistance Envelope funding allows Canada to make strategic investments in international assistance and continue Canada’s leadership on the global stage.

The Feminist International Assistance Policy, which will guide the allocation of the additional International Assistance Envelope resources, provides a broad framework of the priority areas within which Canada aims to engage. It is expected there will be an emphasis on the empowerment of women and girls, aiming to make a significant contribution to gender equality and to broader development goals. An assessment of the specific impacts expected as a result of the programming that ensues will be completed following Budget 2019 through the allocation process, informed by additional/separate project and context specific GBA+ and risk analyses.

In 2017, Canada announced its Feminist International Assistance Policy, refocusing Canada’s more than $5 billion in existing international assistance resources on gender equality and the empowerment of women and girls.

By 2021–22, no less than 95 per cent of Canada’s bilateral international development assistance initiatives will target or integrate gender equality and the empowerment of women and girls.

GBA+ was performed: On the existing program

Target population: Individuals in other countries

Increased and meaningful participation of women in peace and security efforts

GBA+ Responsive Approach

The Feminist International Assistance Policy places gender equality at the center of Canada’s international assistance efforts, and recognizes that inequalities exist along intersectional lines. Any mitigation measures required based on the allocation of these additional resources following Budget 2019 will be developed in response to additional/separate context-specific GBA+ and risk analyses at the project and program level.

GBA+: Chapter 4

Canada’s International Engagement

Supporting Farmers in Supply Managed Sectors Following Ratification of New Trade Agreements

- $2.15 billion to be made available to deal with income losses for dairy, poultry, and egg farmers and set aside $1.5 billion for the creation of a demand-driven Quota Value Guarantee Program.

As part of the Canada-European Union Comprehensive and Economic Trade Agreement (CETA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), Canada agreed to market openings to supply-managed sectors.

These measures provide support to affected sectors, and dairy, poultry, and egg farmers are the direct beneficiaries of this programming.

Only 2 per cent of dairy farms and 10 per cent of poultry and egg farms have only women operators, and 35 to 40 per cent of dairy, poultry, and egg farm operators are over the age of 55. As such, the expected direct beneficiaries of this program are predominantly older men.

Dairy, poultry, and egg farmers have relatively higher farm incomes compared to farmers in some other sectors. In 2017, dairy farmers and poultry and egg farmers had an average income of $150,050 and $264,429 respectively.

Some research shows that supply-managed products such as milk, poultry, and eggs have higher consumer prices, which disproportionately affect low-income individuals that necessarily spend a higher proportion of their income on food.

GBA+ was performed: Early in the proposal development phase

Target population: Dairy, poultry, and egg farmers

GBA+: Chapter 4

Canada’s International Engagement

Renewing Canada's Middle East Strategy

- $1.39 billion over two years to renew Canada’s Middle East Strategy.

In February 2016, Canada announced a three-year, whole-of-government Strategy for the Middle East. Over the past three years, with the support of Canada and other partners from the Global Coalition Against Daesh, more than 99 per cent of the territory once held by Daesh in Iraq and Syria, and over 7.7 million people, have been freed from Daesh’s control. Meanwhile, Canadian international assistance has enabled humanitarian partners to provide 8.5 million people with emergency food assistance, and Canada has also helped to bolster the participation of women in the peace process in Syria and the reconciliation processes in Iraq.

Renewing Canada’s engagement will advance our objectives in working towards lasting solutions to help enhance stability and security in the region, reduce the vulnerability of conflict-affected populations and contribute to a more peaceful and prosperous world. Canada’s priorities will remain to confront violent extremism and address other critical security threats; stabilize liberated areas; respond to the basic human needs of conflict-affected populations, particularly women, girls and other vulnerable groups; and build longer-term capacities and resilience at the national and local levels.

GBA+ was performed: On the existing program

Target population: All Canadians

Increased and meaningful participation of women in peace and security efforts

GBA+ Responsive Approach

Canada’s assistance is designed to reduce barriers to equal participation and provide benefits to vulnerable groups. Priorities include targeting the economic empowerment of women and their participation in governance and decision making, as well as addressing the immediate needs of vulnerable women, ethnic and religious minorities, persons with disabilities, and other vulnerable groups affected by the crises in the region.

GBA+: Chapter 4

Canada’s International Engagement

Maintaining Canada’s Support for Ukraine

- $105.6 million over three years to renew Operation UNIFIER, Canada’s contribution to support Ukrainian defence and security forces through training and capacity building.

Canada has been a strong supporter of Ukraine since hostilities with Russia began in 2014.

Maintaining Canada’s support for training and capacity-building activities, through the renewal of Operation UNIFIER, will assist the Security Forces of Ukraine in their efforts to maintain sovereignty, security and stability. Since the beginning of the mission, Canada has trained over 10,000 members of the Security Forces of Ukraine and helped encourage defence reform.

The Canadian Armed Forces will offer training to both men and women in the Ukrainian Security Forces, though the majority are expected to be men. About 8.2 per cent of personnel in the Ukrainian Armed Forces are women, compared to the NATO average of 10.3 per cent. Increased professionalism of Ukraine’s Security Forces is expected to improve their capacity to recruit women candidates at similar rates to NATO allies.

According to Ukraine’s Ministry of Social Policy, the illegal occupation of Crimea has resulted in more than 1.5 million internally displaced persons forced from their homes. Vulnerable populations, including women, children, and economically disadvantaged members, tend to disproportionately bear the costs of conflict and will directly benefit from increased stability in the region.

GBA+ was performed: On the existing program

Target population: All Canadians

GBA+ Responsive Approach

Canada’s training efforts are designed to enhance the participation of women in the Security Forces, protect vulnerable groups and prevent sexual violence. Efforts include the deployment of a Gender Advisor to the mission to provide strategic and operational advice and oversight on the gender perspectives, and the application of lessons learned from a comprehensive assessment of barriers to recruitment and retention of women as part of Canada’s Elsie Initiative for Women in Peace Operations.

GBA+: Chapter 4

Public Safety and Justice

More Affordable International Remittances

- A commitment to lowering remittance prices to an average of 5 per cent by 2022 and to 3 per cent by 2030.

Canadians who transfer money abroad want to be able to do so at low cost. While the cost of remittances in Canada has fallen over the last decade, the Government is committed to further lowering the costs Canadians incur when sending money abroad. To do so, Statistics Canada is undertaking a study on the Canadian remittance market that will inform future policy directions. Additionally, the Government will hold targeted consultations on the remittance market in Canada to explore ways to facilitate payment system access for remittance service providers. International remittance policy is expected to have larger effects on Canadians with family and friends that live outside of Canada.

GBA+ was performed: Early in idea development phase

Target population: Newcomers to Canada, temporary foreign workers, established communities with ties to other countries

GBA+: Chapter 4

Better Government

Investing in Service Canada

- $305.3 million over five years to Employment and Social Development Canada (ESDC) to ensure reliable and responsive Employment Insurance, Old Age Security program and Canada Pension Plan benefits delivery

Improvements and investments to benefit delivery platforms and call centres would make it easier for Canadians to have access to information on their benefits and will make the processing of benefits more efficient.

Investments in the delivery platforms for the OAS program and CPP would benefit more women than men:

- Over half (54 per cent) of recipients of the basic Old Age Security pension are women. Further, under the OAS program, low-income individuals are eligible for the Guaranteed Income Supplement (GIS), and 61 per cent of GIS recipients are women.

- 57 per cent of Canada Pension Plan recipients (covering the retirement pension, disability pension and survivor pension) are women, while 43 per cent are men. For the retirement pension alone, 51 per cent of beneficiaries are women and 49 per cent are men.

For Employment Insurance (EI), in 2016-17, 61 per cent of EI regular claims were established by men, but 65 per cent of special benefit claims were established by women.