To access a Portable Document Format (PDF) file you must have a PDF reader installed. If you do not already have such a reader, there are numerous PDF readers available for free download or for purchase on the Internet.

Strengthening

the Middle ClassInvesting in the middle class, skills training and infrastructure

A strong economy starts with a strong middle class. When you have an economy that works for the middle class, you have a country that works for everyone.

When the middle class thrives, it creates more than just good jobs and opportunity; it can drive real change.

The Middle Class Tax Cut

A strengthened middle class means hard-working Canadians can look forward to a good standard of living and a bright future for their children.

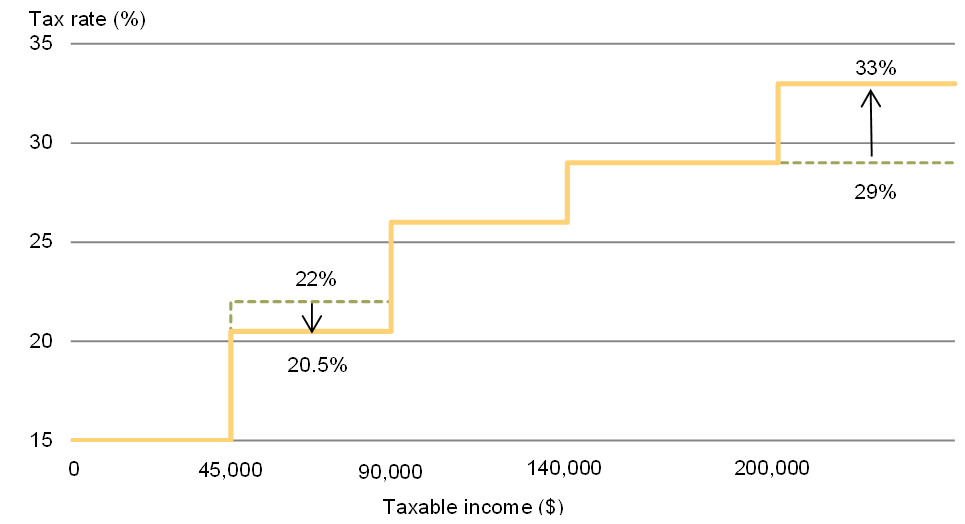

On December 7, 2015, as one of its first actions, the Government cut taxes for nearly 9 million Canadians by reducing the second personal income tax rate to 20.5 per cent from 22 per cent. Single individuals who benefit will see an average tax reduction of $330 every year, and couples who benefit will see an average tax reduction of $540 every year.

To help pay for the tax cut, the Government raised taxes on the wealthiest Canadians by introducing a new top income tax rate of 33 per cent on individual taxable income in excess of $200,000.

Canada Child Benefit

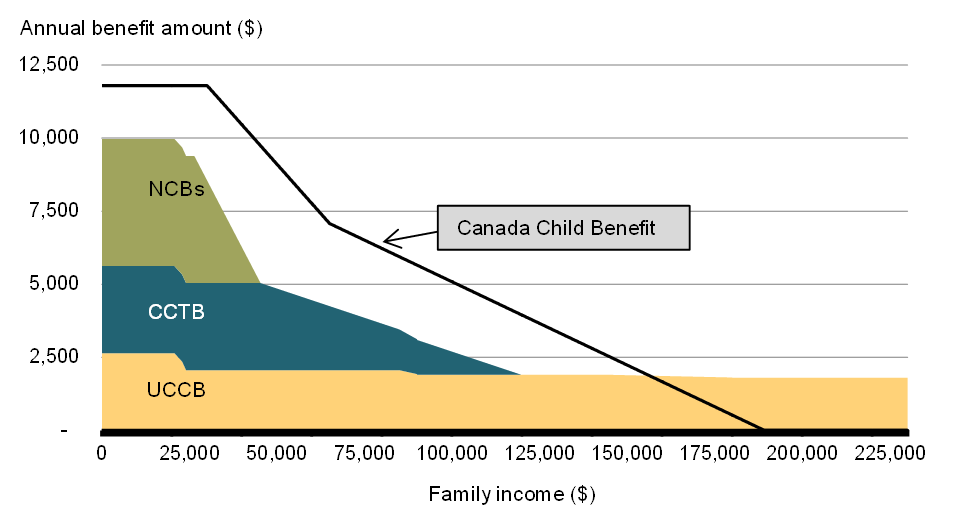

The new Canada Child Benefit (CCB) will put more money in the pockets of middle class families—9 out of 10 families with children will get more—while helping raise hundreds of thousands of children out of poverty. The CCB will provide a maximum annual benefit of up to $6,400 per child under the age of 6, and up to $5,400 per child aged 6 through 17. Payments to families will begin in July 2016.

The CCB will be:

- Simpler—families will receive a single payment every month;

- Tax-free—families will not have to pay back part of the amount received when they file their tax returns;

- Better targeted to those who need it most—low- and middle-income families will receive more benefits, and those with the highest incomes (generally over $150,000) will receive lower benefits; and

- Much more generous—families benefitting will see an average increase in child benefits of almost $2,300.

Helping Young Canadians Succeed

The Government is committed to supporting opportunities for young Canadians by ensuring that they have the skills and experience they need to succeed.

Student financial assistance must keep up with the rising costs of post-secondary education.

Budget 2016 will ensure that post-secondary education remains affordable for students from low- and middle-income families and that debt loads are manageable.

In addition to doubling the size of the Canada Summer Jobs program, the Government is investing in young Canadians by making it easier for them to join the workforce through enhancements to the Youth Employment Strategy and investments to strengthen co-op and on-the-job learning opportunities.

The Government will also create an Expert Panel on Youth Employment to advise on innovative ways to create good jobs for vulnerable youth.

| Current Program | Proposed Changes1 | Impact | |

|---|---|---|---|

| Enhancing Canada Student Grants |

|

|

These changes will help students cover the costs of their education without increasing student debt. Further enchancements to expand eligibility for Canada Student Grants will be in place for the 2017-2018 academic year. |

| Introducing a Flate-Rate Student Contribution | Students must estimate their financial assets and income earned while studying to determine eligibility for Canada Student Loans and Grants. | Students will be required to contribute a flat amount each year towards the costs of their education, and financial assets and student income will no longer be considered. | This change will allow students to work and gain valuable labour market experience without having to worry about a reduction in their level of financial assistance. It will also benefit adult learners, many of whom may work while studying or have significant financial assets. |

| Making Student Debt More Manageable | Loan repayment threshold under the Repayment Assistance Plan is $20,210. | Loan repayment threshold under the Repayment Assistance Plan will be $25,000. | This change will ensure that no student will have to repay their Canada Student Loan until they are earning at least $25,000 per year. |

Employment Insurance

The Government is taking immediate action to improve the Employment Insurance (EI) system to make sure Canadians get the help they need, when they need it.

This includes eliminating the higher EI eligibility requirements that make it difficult for those who are new entrants, or are re-entering the labour market, to access benefits. Young Canadians, recent immigrants, and those re-entering the job market after an absence will face the same eligibility requirements as other people in the region where they live.

To reduce the period of time that out-of-work Canadians are without income, Budget 2016 proposes to reduce the EI waiting period from two weeks to one week, effective January 1, 2017. Improvements to EI service delivery will also ensure that Canadians get their benefits as quickly as possible.

Certain regions have been particularly hard hit by the falling commodity prices, and unemployment in those areas has increased sharply. Budget 2016 will help workers and their families while they seek new jobs by temporarily extending EI benefits in those regions.

Skills Training

Canadians deserve to have access to the training they need to develop skills demanded by the jobs of tomorrow.

The Government will invest in skills training to improve access to good jobs. The Government’s plans include increased investments in intergovernmental labour market agreements, a new framework to support union-based apprenticeship training, and a pilot program testing new approaches to skills and employment training for Indigenous peoples.

Creating Jobs and Prosperity for the Middle Class

Investing in infrastructure creates good, well-paying jobs that can help the middle class grow and prosper today. In Budget 2016, the Government will implement an historic plan to invest more than $120 billion in infrastructure over 10 years, to better meet the needs of Canadians and better position Canada’s economy for the future.

Phase 1 of the Government’s long-term infrastructure plan provides $11.9 billion over five years to immediately invest in the infrastructure Canadians need—to modernize and rehabilitate public transit, water and wastewater systems, provide affordable housing, and protect infrastructure systems from the effects of climate change.

Phase 2 will deliver on the remaining eight years of the Government’s long-term infrastructure plan. In this phase, the goals will be broader and more ambitious: a more modern, cleaner economy; a more inclusive society; and an economy better positioned to capitalize on the potential of global trade. It will make Canada’s largest cities better places to live through cost-effective, sustainable, integrated transportation networks.

A long-term infrastructure investment plan is an opportunity to make meaningful contributions to Canada’s economic growth and sustainable development by addressing important infrastructure challenges of national significance. Ambitious projects will be supported to reduce urban transportation congestion, improve and expand trade corridors, and reduce the carbon footprint of the national energy system.

- Date modified: