Archived information

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Helping Small Businesses and Entrepreneurs Create Jobs

To access a Portable Document Format (PDF) file you must have a PDF reader installed. If you do not already have such a reader, there are numerous PDF readers available for free download or for purchase on the Internet.

The Harper Government is fulfilling its promise to balance the budget in 2015. Canada's Economic Action Plan has been underpinned by prudent fiscal management and the Government's low-tax plan for jobs, growth and security. Since the depths of the recession, over 1.2 million net new jobs have been created—overwhelmingly full-time, well-paying and in the private sector.

At the same time, the Government has lowered taxes every year since coming into office, and has delivered the lowest overall federal tax burden in over 50 years.

The Government's balanced-budget, low-tax plan for jobs, growth and security is working. But the job is not done. There are new challenges on the horizon, and the Government must stay the course to protect the economic interests of Canadians and the security of Canada.

Economic Action Plan 2015 (EAP 2015) builds a stronger Canada by:

Helping Small Businesses Grow and Fostering Entrepreneurship

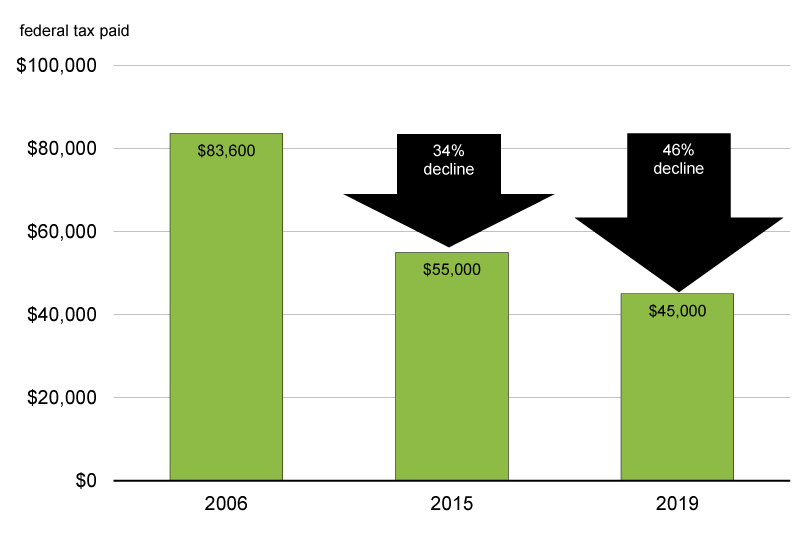

By further reducing the small business tax rate to 9 per cent by 2019, EAP 2015 will lower taxes for small businesses and their owners by $2.7 billion over the 2015–16 to 2019–20 period.

For example, as a result of previous Government actions, the amount of federal income tax paid by a small business with $500,000 of taxable income is already 34 per cent lower in 2015 than in 2006. By 2019, the Harper Government will have decreased taxes for this business by 46 per cent since 2006.

It also takes action to support the growth and success of small businesses by:

- Expanding services offered through the Business Development Bank of Canada and Export Development Canada.

- Cutting red tape and improving the tax services of the Canada Revenue Agency.

- Providing new tools, resources and mentoring support through the Action Plan for Women Entrepreneurs and funding to Futurpreneur Canada.

- Increasing the Lifetime Capital Gains Exemption for qualified farm or fishing property to $1 million.

Growing Trade and Expanding Markets

EAP 2015 will also invest in growing trade and expanding markets to help maximize the tremendous job-creating opportunities that they provide to Canadian businesses.

It proposes the creation of an export market development program to share the financial costs with Canadian businesses as they explore and pursue new export opportunities around the world.

It will increase funding for programs aimed at addressing market access issues and promoting exports for the agriculture and agri-food sector.

And it establishes an Internal Trade Promotion Office to help unleash our trade potential, right here at home.

Lifetime Capital Gains Exemption

The Lifetime Capital Gains Exemption (LCGE) for farm or fishing property provides an incentive to invest in the development of productive farm and fishing businesses, and helps farm and fishing business owners to accumulate capital for retirement.

Budget 2007 increased the LCGE for qualified farm or fishing property to $750,000 from $500,000, the first increase in the exemption since 1988. EAP 2013 further increased the LCGE for qualified farm or fishing property to $800,000 for 2014 and indexed the new limit to inflation, bringing it to $813,600 for 2015.

To allow farm and fishing business owners to maintain more of their capital for retirement, EAP 2015 proposes to increase the LCGE applicable to capital gains realized on the disposition of qualified farm or fishing property to $1 million. This measure will apply to dispositions of qualified farm or fishing property that occur on or after Budget Day, 2015.

Building on a Record of Economic Strength

Since 2006, the Government of Canada has taken action to create jobs, growth and long-term prosperity:

- Reducing taxes for job-creating businesses by $14.7 billion in 2015–16.

- Delivering over $550 million in 2015 and 2016 through the Small Business Job Credit, which will reduce small businesses' Employment Insurance premiums by nearly 15 per cent.

- Expanding trade agreements from 5 countries in 2006 to 43 today. This includes the largest markets in the world: the U.S. and Europe.

With these and other measures, EAP 2015 is creating and protecting jobs for hard-working Canadians by strengthening small businesses.