Common menu bar links

Archived - Slideshow - HTML Version

But our economic fundamentals are solid. The economy is in its 16th straight year of expansion. Unemployment is at its lowest rate in 33 years and employment continues to grow.

Business and household finances are strong by historical and international standards, and the Government expects continued surpluses over the next three fiscal years.

In its 2007 Economic Statement, the Government took timely and decisive action with broad-based tax relief of $60 billion over this and the next five years.

When combined with actions taken in Budgets 2006 and 2007 and in the Tax Fairness Plan, $21 billion – equivalent to 1.4 per cent of Canada’s GDP – is being provided to Canadians this year to support our economy.

Budget 2008 builds on this tax relief and implements the Government’s long-term economic plan, Advantage Canada, by:

Maintaining strong fiscal management by continuing to reduce debt and managing spending responsibly;

Strengthening Canada’s tax advantage by promoting savings and extending further support to the manufacturing sector;

Investing in people and knowledge and supporting communities and sectors vulnerable to adjustments in global markets;

Providing leadership at home by improving the lives of Canadians and leadership abroad by re-asserting Canada’s influence in global affairs.

Reducing debt by $10.2 billion this year. By 2012-13, total debt reduction since the Government took office will exceed $50 billion.

Ensuring Canadians continue to benefit from interest savings from reduced debt under the Tax Back Guarantee with $2 billion in personal income tax relief by 2009-10.

Continuing a review of all Government programs to keep spending focused, disciplined and aligned with the priorities of Canadians.

Improving the management and governance of Employment Insurance.

Introducing a new Tax-Free Savings Account to help Canadians save;

Extending temporary tax assistance for Canadian manufacturers and processors;

Supporting small- and medium-sized businesses by improving the scientific research and experimental development (SR&ED) tax incentive program; and

Reducing the tax compliance burden for small business.

The Tax-Free Savings Account is the single most important savings vehicle since the introduction of the RRSP. Under this plan:

Canadians aged 18 and older can contribute up to $5,000 a year.

Investment income, including capital gains, will not be taxed, even when withdrawn.

Unused contribution room can be carried forward to future years and re-contributed later with no loss of contribution room.

Money can be withdrawn tax-free at any time for whatever matters to you.

Modernizing the immigration system to shorten wait times and make Canada’s system more competitive;

Supporting students by streamlining and modernizing the Canada Student Loans Program and expanding the flexibility of Registered Education Savings Plans;

Introducing new grant funding and incentives to encourage research excellence; and

Improving income support for seniors by increasing the Guaranteed Income Supplement exemption to $3,500.

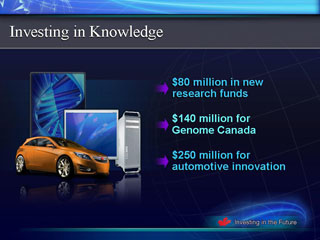

Budget 2008 is investing in the future by supporting knowledge. For example, it is:

Providing $80 million in new funds for university research granting councils and $15 million for indirect costs of research;

Building on Canada’s advantage in genomics research with $140 million in new funding for Genome Canada; and

Supporting new, large-scale automotive research and development projects with $250 million in an Automotive Innovation Fund.

Budget 2008 recognizes the hardships faced by workers and communities arising from international economic volatility.

In January 2008, the Government announced the $1-billion Community Development Trust to create opportunities for workers, help communities and cities adapt to change, and invest in infrastructure.

Budget 2008 goes further by:

Allocating funds to support older workers, farmers, the forestry sector and aquaculture;

Making the Gas Tax Fund a permanent measure to help municipalities plan and fund their infrastructure needs;

Supporting capital investments to improve public transit; and

Establishing a Crown corporation to support public private partnerships.

Budget 2008 supports Canadians in need by:

Providing funds to develop new ways to help Canadians facing mental-health and homelessness challenges through the Mental Health Commission of Canada; and

Dedicating funds to support the survivors of World War Two and Korean War veterans.

Budget 2008 helps protect the health and safety of Canadians. For example, it is:

Supporting better food safety for Canadians;

Helping ensure greater safety of natural health products and providing more information on the links between pollution and illness; and

Reducing the availability of contraband tobacco products.

Advantage Canada recognized the most effective way to close the gap in socio-economic conditions faced by Aboriginal Canadians is to increase their workforce participation.

Budget 2008 takes action toward this goal by:

Setting aside funds for Aboriginal economic development;

Providing funds to improve First Nations and Inuit health and education outcomes; and

Improving access to safe drinking water in First Nations.

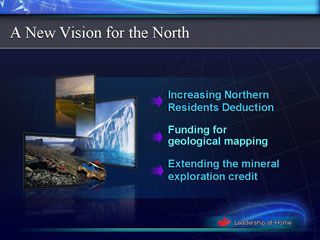

Budget 2008 implements the Government’s vision for a new North with new measures that will protect and secure Canada’s sovereignty and create more economic opportunities in the North. These include:

Increasing the Northern Residents Deduction by 10 per cent to attract skilled workers to Northern Canada.

Providing $34 million over two years for geological mapping of natural resources. A one-year extension of the mineral exploration tax credit.

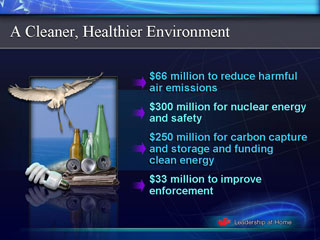

Providing $66 million to set up the regulatory framework to reduce harmful air emissions;

Investing $300 million in nuclear energy and improving nuclear safety;

Allocating $250 million for carbon capture and storage and clean energy options; and

Providing $33 million to law enforcement against polluters and in our National Parks.

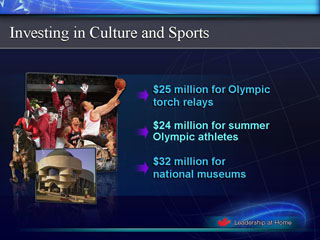

$25 million to make the 2010 Olympic and Paralympic Torch Relays a symbol of national pride.

$24 million over two years to support summer Olympic athletes.

$32 million over five years for investments in Canada’s national museums.

Setting aside funds for the recruitment of 2,500 new police officers;

Committing funds to implement a new vision for federal corrections to achieve better public safety results; and

Providing funds to enhance crime prevention and prosecution.

Providing stable and predictable funding for the Canadian Forces; and

Providing the Communications Security Establishment with funds to keep pace with technological advancement.

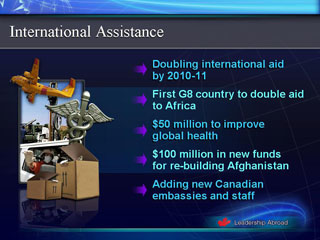

Delivering on our promise to double international assistance by 2010-11;

Meeting our commitment to double aid to Africa, the first G8 country to deliver on this promise;

Providing $50 million to launch a Development Innovation Fund to improve global health;

Providing $100 million in new funds for reconstruction and development in Afghanistan; and

Committing funds to add more staff and new embassies and missions to Canada’s overseas network.

Committing $75 million in new funds to ensure the Canadian Border Services Agency has the resources it needs;

Providing funds to improve the security and efficiency of travel documents, including an electronic passport;

Allocating $29 million to meet priorities under the Security and Prosperity Partnership of North America; and

Enhancing the security of the Great Lakes\St. Lawrence Seaway region.

And in January we announced the Community Development Trust to support workers and communities already feeling the pinch.

Budget 2008:

Prepares for slower growth by further reducing taxes.

Lays stronger economic foundations by reducing debt.

Keeps an eye on spending by managing responsibly.

It builds on broad-based tax relief, delivered since 2006, of almost $200 billion over this and the next five years.

And it demonstrates the kind of responsible leadership, at home and abroad, needed to make Canada the greatest country in the world.