Common menu bar links

Aspire to a Stronger, Safer, Better Canada

Slide 1: Budget 2007

Slide 2: Building a Stronger, Safer, Better Canada

Budget 2007 is all about building a stronger, safer and better Canada.

It proposes to do this by:

• Investing in Canadians, the environment, and our health care system;

• Restoring fiscal balance and working with the provinces and territories to deliver results for Canadians and their families;

• Creating competitive advantages for a stronger economy; and

• Making our communities safer and more secure, supporting the men and women of the Canadian Forces, including our veterans, and bringing new hope to people beyond our borders through more effective international aid.

Budget 2007 aims to give Canadians today, and future generations, a quality of life second to none and to make Canada an example to the rest of the world of what a great, prosperous and compassionate country can be.

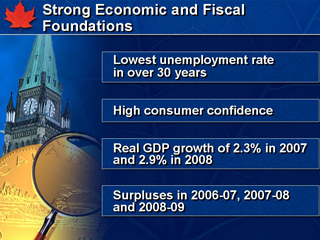

Slide 3: Strong Economic and Fiscal Foundations

The Budget builds on strong economic and fiscal foundations.

The economy is in its 15th year of expansion.

Employment growth has been strong, and the unemployment rate is at its lowest level in over 30 years.

Consumer confidence remains high and business financial positions are healthy.

Though there are risks to the economic outlook, private sector forecasters expect real GDP growth at 2.3 per cent in 2007 and 2.9 per cent in 2008.

After taking account of all the measures proposed in Budget 2007, the Government expects surpluses in 2006-07, 2007-08 and 2008-09.

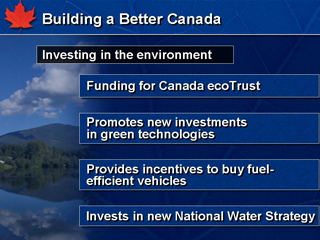

Slide 4: Building a Better Canada: Investing in the environment

Budget 2007 seeks to make Canada better by cleaning up the environment, helping Canadians overcome barriers to a better life, improving health care and celebrating our culture.

Among other things on the environment, it:

• Funds the Canada ecoTrust for Clean Air and Climate Change to support environmental measures by the provinces and territories;

• Re-balances the tax system to promote new investments by the oil sands and other sectors in green technologies, and phases out conventional incentives that are no longer required for oil sands development;

• Provides incentives for Canadians to buy fuel-efficient vehicles and to get gas-guzzlers off the road; and

• Invests in a new National Water Strategy.

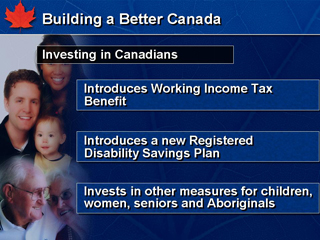

Slide 5: Building a Better Canada: Investing in Canadians

Budget 2007 invests in Canadians. For example:

• It introduces a Working Income Tax Benefit to help people break through the Welfare Wall;

• It provides new funding to support the disabled, including a new Registered Disability Savings Plan; and

• Invests in other measures for children, women, seniors and Aboriginal Canadians.

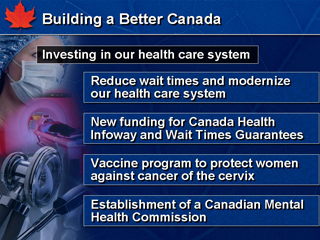

Slide 6: Building a Better Canada: Investing in our health care system

Our health care system goes to the heart of what defines us and is a source of pride for Canadians.

Budget 2007 proposes action that will help to reduce wait times and modernize our health care system. This includes substantial new funding for Canada Health Infoway, as well as funding for provinces that have committed to implement Wait Times Guarantees.

Budget 2007 proposes other health initiatives. For example, a vaccine program to protect women against cancer of the cervix and the establishment of a Canadian Mental Health Commission.

Slide 7: Building a Better Canada: Celebrating our culture

Part of building a better Canada is to celebrate our culture and protect our national treasures.

To that end, Budget 2007 proposes new funding to support local arts and festivals, official languages communities, as well as the creation of a new National Trust, which will operate independently of government and help Canadians protect important lands, buildings and national treasures.

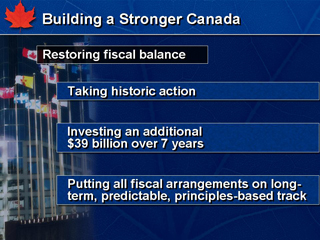

Slide 8: Building a Stronger Canada: Restoring fiscal balance

Budget 2007 takes historic action to restore fiscal balance by providing provinces and territories the means to invest in priorities that matter to Canadians such as health care, post-secondary education, infrastructure, child care and social services.

The Government proposes to invest an additional $39 billion to restore fiscal balance over the next seven years and it is putting all fiscal arrangements on a long-term, predictable and principles-based track.

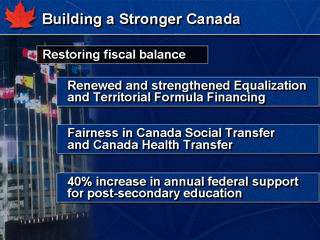

Slide 9: Building a Stronger Canada: Restoring fiscal balance

Specific measures for restoring fiscal balance include:

• Renewed and strengthened Equalization and Territorial Formula Financing programs;

• Fairness through a commitment to equal per capita cash allocation for the Canada Social Transfer and the Canada Health Transfer;

• A 40 per cent increase in annual federal support to the provinces and territories for post-secondary education;

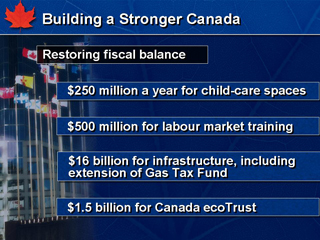

Slide 10: Building a Stronger Canada: Restoring fiscal balance

In addition, Budget 2007 proposes:

• $250 million a year to the provinces and territories for the creation of child-care spaces;

• New funding of $500 million a year for labour market training;

• An additional $16 billion over seven years for infrastructure, including an extension of the Gas Tax Fund, for provinces, territories and municipalities; and

• The $1.5 billion Canada ecoTrust to help provinces and territories meet environmental objectives.

As part of its efforts to restore fiscal balance, the Government also proposes measures in Budget 2007 to clarify roles and responsibilities of governments and to strengthen Canada’s economic union.

These measures will enable the provinces and territories to be full partners in advancing Canada’s economic agenda.

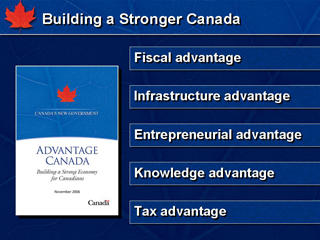

Slide 11: Building a Stronger Canada: Advantage Canada

The Government set out a long-term economic plan in Advantage Canada to restore fiscal balance, create greater opportunities for Canadians to fulfill their dreams of a good job, and provide a world-class education for their children, a home of their own and a retirement they can count on.

We are implementing that Plan.

It focuses on five competitive advantages to strengthen the economy and improve our quality of life—a fiscal advantage, an infrastructure advantage, an entrepreneurial advantage, a knowledge advantage and a tax advantage.

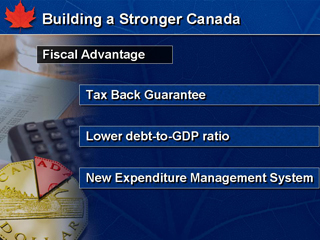

Slide 12: Building a Stronger Canada: Fiscal Advantage

On the Fiscal Advantage, Budget 2007 legislates the Government’s Tax Back Guarantee, which will direct the interest payment savings from debt reduction to personal income tax reductions for all Canadians.

The Government is paying down over $22 billion in debt and remains on target to lower the federal debt-to-GDP ratio to 25 per cent by 2012-13.

The Budget will also put in place a new Expenditure Management System to provide better value for taxpayer dollars by reducing waste and making government programs more efficient.

Slide 13: Building a Stronger Canada: Infrastructure Advantage

This budget also builds Canada, with more than $16 billion in infrastructure funding.

Federal funding for infrastructure over the next seven years will be $33 billion—the largest such investment in Canadian history.

These funds will be devoted to better roads and highways, public transit, bridges, sewers and water systems, community centres and green energy.

This includes increased investment in major gateways for trade such as the Asia-Pacific Gateway and Corridor initiative in Vancouver and the Windsor-Detroit border crossing.

Budget 2007 also proposes to establish a new office to promote public-private partnerships or P3s in infrastructure projects.

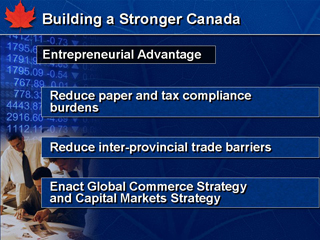

Slide 14: Building a Stronger Canada: Entrepreneurial Advantage

Budget 2007 takes action to create an Entrepreneurial Advantage. The goal is to ensure that our markets remain competitive by reducing barriers and allowing businesses to grow.

This Budget proposes several measures to promote business growth.

For example, it aims to reduce the paper burden by 20 per cent and reduce the tax compliance burden for small businesses, as well as to reduce inter-provincial barriers to trade.

The Government will enact a Global Commerce Strategy to ensure that Canadian businesses can fully participate in global market opportunities. It will also create a Capital Markets Strategy to strengthen capital markets and make Canadian businesses more competitive.

Slide 15: Building a Stronger Canada: Entrepreneurial Advantage

In addition, it will set up a Major Projects Management Office to streamline the review of large natural resource projects, cutting approval times in half.

This Budget also proposes to introduce a simpler and more responsive income stabilization program and to provide substantial new funding for farmers.

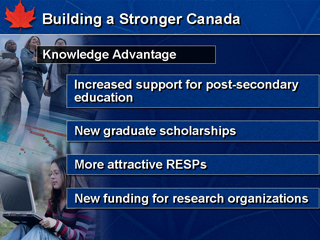

Slide 16: Building a Stronger Canada: Knowledge Advantage

Budget 2007 also takes action to create a Knowledge Advantage. The goal is for Canada to have the best-educated, most highly skilled and flexible labour force in the world, as well as effective support for research in Canada.

Among the measures proposed in Budget 2007 are increased support for post-secondary education for the provinces and territories, new graduate scholarships, improvements to the Temporary Foreign Worker Program, and more attractive Registered Education Savings Plans.

In addition, this Budget proposes new funding for research organizations such as the Canada Foundation for Innovation, Genome Canada, Federal Granting Councils, and Centres of Commercialization and Research Excellence.

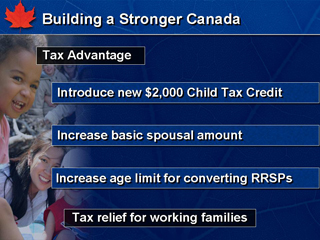

Slide 17: Building a Stronger Canada: Tax relief for families

The Government recognizes that Canadians continue to pay too much tax. Budget 2007 takes steps to create a Tax Advantage. It focuses on tax relief for families and for businesses.

Among the measures for families, Budget 2007 proposes to introduce a new $2,000 Child Tax Credit; end the marriage penalty by increasing the basic spousal and other amounts for a spouse or single taxpayer supporting a child or relative; and increase the age limit for converting RRSPs to make it easier for seniors to remain active in the labour force.

Slide 18: Building a Stronger Canada: Tax relief for businesses

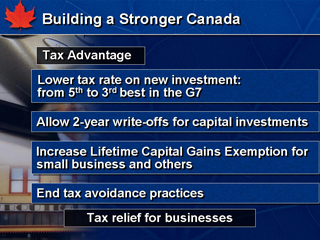

Budget 2007 also proposes tax relief for businesses.

It adjusts the capital cost allowance system to bring timely support to manufacturing businesses, as well as to promote new green technologies such as carbon capture and storage in the oil sands and other industries. These changes will make Canada’s tax rate on new investment 3rd best in the G7, up from 5th best.

This budget helps manufacturers be more competitive by allowing them to write off capital investments using a special two-year, 50 per cent rate.

It increases the Lifetime Capital Gains Exemption to $750,000 from $500,000, which will help farmers, fishermen and fisherwomen and small business owners.

Budget 2007 introduces measures to ensure everyone will pay their fair share of taxes by putting an end to tax avoidance practices, including the use of offshore tax havens.

Slide 19: Building a Safer Canada: Safer Canadian communities

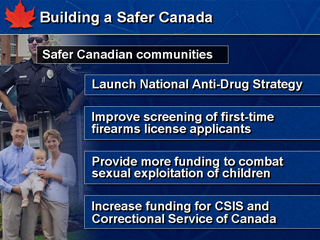

Canadians want to live in safe communities. Budget 2007 proposes steps to prevent crime and ensure Canada’s security, intelligence and corrections systems are as strong as possible.

This includes funding for a new National Anti-Drug Strategy that will crack down on grow-ops, meth labs and gangs.

There will also be improved screening of first-time firearms license applicants.

The Government proposes new measures to protect children from sexual exploitation on the Internet, and human trafficking.

In addition, this Budget earmarks new funding for CSIS and the Correctional Service of Canada.

Slide 20: Building a Safer Canada: Greater support for Canadian Forces

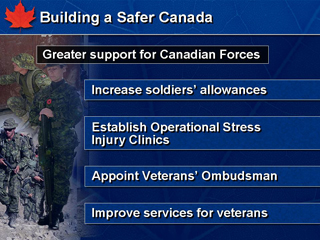

Budget 2007 provides greater support to men and women of the Canadian Forces through enhanced allowances for soldiers in Army field units.

It also proposes to establish several new Operational Stress Injury Clinics for members of the military and their families.

Budget 2007 proposes to establish an Ombudsman to ensure that services for veterans meet the standards set out in a new Veterans’ Bill of Rights.

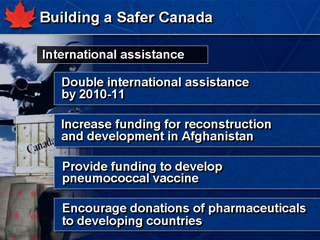

Slide 21: Building a Safer Canada: International assistance

Budget 2007 proposes measures to enhance Canada’s international aid efforts.

The Government will increase foreign aid by nearly $900 million over the next two years, consistent with its commitment to double international assistance by 2010-11.

This includes additional funding for reconstruction and development in Afghanistan, as well as the development of a pneumococcal vaccine and new incentives for donations of pharmaceuticals to save lives in developing countries.

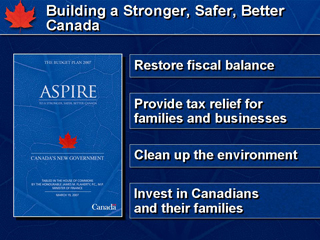

Slide 22: Building a Stronger, Safer, Better Canada

Budget 2007 proposes concrete measures to restore fiscal balance, provide significant tax relief for families and businesses, clean up the environment, and invest in Canadians and their families, so that they can overcome barriers and enjoy better lives than ever.

Slide 23: Budget 2007

In conclusion, Budget 2007 aims to create a Canada that we will be proud to pass on to our children, with a standard of living and quality of life that are second to none.

It’s time to unleash our country’s full potential.

It’s time to aspire to a stronger, safer and better Canada.